Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PHOTRONICS INC | form8k.htm |

Exhibit 99.1

Photronics, Inc.Merchant Photomask Leader 20th Annual Needham Growth ConferenceJanuary 17, 2018

Safe Harbor Statement This presentation and some of our comments may contain projections or other forward-looking statements regarding future events, our future financial performance, and/or the future performance of the industry. These statements are predictions, and contain risks and uncertainties. Actual events or results may differ materially from those presented. These statements include words like “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “may”, “should” or the negative thereto. We cannot guarantee the accuracy of any forecasts or estimates, and we are not obligated to update any forward-looking statements if our expectations change. If you would like more information on the risks involved in forward-looking statements, please see the documents we file from time to time with the Securities and Exchange Commission, specifically our most recent Form 10K and Form 10Q.Non-GAAP Financial MeasuresThis presentation and some of our comments may reference non-GAAP financial measures. These non-GAAP financial measures exclude certain income or expense items, and are consistent with another way management internally analyzes our results of operations. Non-GAAP information should be considered to be a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. Please see the “Reconciliation of GAAP to Non-GAAP Financial Information” in this presentation. 2

Global merchant photomask market and technology leader#1 merchant market share positionDelivering high-end growth through technology leadershipInvestment strategy aligned with secular growth trendsChina industry expansionTechnology inflection from LCD to AMOLEDExpect +40% organic revenue growth over next 3 yearsStrategic investments bring top-line growthOperating leverage creates margin expansion A Compelling Investment Thesis 3

BackgroundGrowth DriversFinancial Summary Agenda 4

BackgroundGrowth DriversFinancial Summary Agenda 5

Largest merchant photomask manufacturerExpanding global footprint to supply increasingly global customer baseInvesting to extend high end leadershipStrong and flexible balance sheet to fund growth Photronics at a Glance 6 Key StatsMarket Symbol: PLABStock Exchange: NASDAQHeadquarters: Brookfield, CTFounded: 1969Employees: 1,475

All Electronic Devices Need Photomasks 7 Design End User Photomask Manufacturing Process SmartphoneTabletPCVirtual Reality Automotive TVIoTIndustrialAppliance Transports component design to manufacturing process Device manufacturing and end product assembly Component Design Unique, proprietary IC & FPD circuit design

BackgroundGrowth DriversFinancial Summary Agenda 8

Extending Leadership ThroughHigh-End Investments 9 High-End30% Mainstream70% High-End68% Mainstream32% Growth Investment Cycle

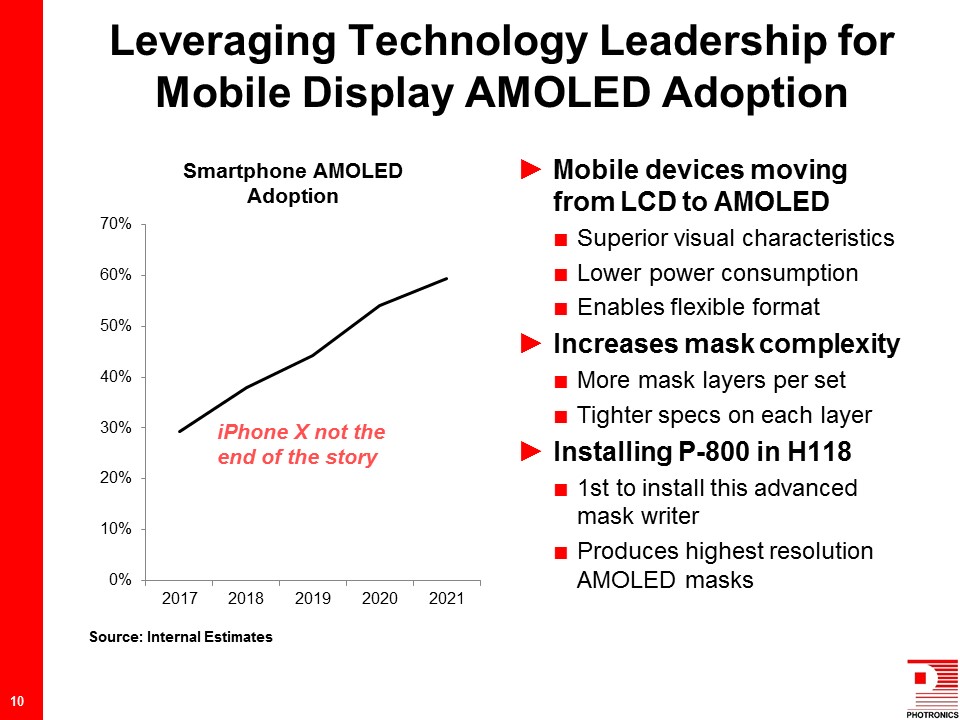

Mobile devices moving from LCD to AMOLEDSuperior visual characteristicsLower power consumptionEnables flexible formatIncreases mask complexityMore mask layers per setTighter specs on each layerInstalling P-800 in H1181st to install this advanced mask writerProduces highest resolution AMOLED masks Leveraging Technology Leadership for Mobile Display AMOLED Adoption 10 Source: Internal Estimates iPhone X not the end of the story

G10.5+ Delivers Greater Glass Efficiency 11 65” 65” 75” 75” 65” 65” 65” 75” 75” 75” 75” 75” 75” 65” 65” 65” 65” 65” 65” 65” 65” 3370 mm x 2940 mm 2200 mm x 2500 mm 1950 mm x 2250 mm 1500 mm x 1850 mm 73% 88% 64% 94% 95%

China represents fastest growing display region~40 fabs in production, under construction or being plannedExpected to be largest display producer within next few yearsPhotomask opportunities in China are attractiveWide range of technology, including AMOLED & G10.5+No strong merchant producer “Made in China 2025” Driving Growth in FPD Market… 12 +17% CAGR Source: Internal Estimates G10.5+ CAGR +62%

China represents fastest growing semiconductor regionAccommodative government policy (Made in China 2025)Growing domestic producersInvestments by multi-nationalsPhotomask opportunities in China are attractiveWide range of nodes in logic and memoryNo strong domestic merchant mask producer …and IC Market 13 18% CAGR Source: IC Insights, May 2017

We already have meaningful business in ChinaStrong 5-year growth (IC +28% CAGR; FPD +73% CAGR)10% of 2017 revenue (8% of IC; 19% of FPD)Manufacturing presence in China should accelerate growthCustomer contracts will help quickly ramp facilitiesInvestment incentives reduce risk and improve returnsIC JV enables us to compete more effectively Successfully Developing China Business 14 +39% CAGR

IC FPD Announced August 2016 August 2017 Location Xiamen Hefei Investment ($M) $160M $160M Structure Majority-owned JV Wholly-owned Investment time period 5 years 5 years Technology High-end, mainstream, logic, memory Up to G10.5+, AMOLED Production start Early 2019 Spring 2019 Projected sales $150M (total for both operations) Investing in China Operations 15 PLAB well positioned for these investmentsGlobal merchant market and technology leaderStrong footprint in AsiaBalance sheet to support investment

Expanding Global Network to Serve Global Customers 16 ICFPD China plants under construction; plan to begin production in 2019

BackgroundGrowth DriversFinancial Summary Agenda 17

Q4 best quarter of yearImproving customer demand trendsSequential growth in all high-end sectorsHigh-End IC +49%High-End FPD +2%Strong operating cash flow each quarterAnticipate trends to continue in 2018 Finished 2017 with Momentum 18

Tremendous operating leverage: 50% targetPositive Free Cash Flow since 2009Strong balance sheetSignificant net cash positionFinancial flexibility enables growth investments Solid Financial Fundamentals 19

Generating Cash to Fund Investments 20 2018 capex:China IC & FPD expansionFPD P-800 mask writer~50% planned for Q418

Strong and Flexible Balance Sheet 21 Clear capital deployment prioritiesFund organic growthExplore strategic M&AReduce debt (converts become due in 2019)Anticipate minimum $75M net cash throughout China investment periodExcellent liquidity positionOperating cash generatorMay use credit facilities to borrow locally in China *Net cash defined as cash and cash equivalents less long-term borrowings (including current portion)

Global merchant photomask market and technology leader#1 merchant market share positionDelivering high-end growth through technology leadershipInvestment strategy aligned with secular growth trendsChina industry expansionTechnology inflection from LCD to AMOLEDExpect +40% organic revenue growth over next 3 yearsStrategic investments bring top-line growthOperating leverage creates margin expansion A Compelling Investment Thesis 22

Thank you for your interest! For Additional Information:R. Troy Dewar, CFADirector, Investor Relations203.740.5610tdewar@photronics.com

24