Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIRST PRIORITY FINANCIAL CORP. | d689550dex991.htm |

| EX-2.1 - EX-2.1 - FIRST PRIORITY FINANCIAL CORP. | d689550dex21.htm |

| 8-K - 8-K - FIRST PRIORITY FINANCIAL CORP. | d689550d8k.htm |

Exhibit 99.2

Mid Penn Bancorp, Inc. (NASDAQ: MPB) Announces Acquisition of First Priority Financial Corp. January 16, 2018 NASDAQ: MPB OTCQX: FPBK

Disclaimer Regarding Forward Looking Statements This presentation contains forward-looking statements that are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “project,” “plan,” “seek,”“target,” “intend” or “anticipate” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections and estimates and their underlying assumptions, statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of Mid Penn Bancorp, Inc. (“MidPenn”), First Priority Financial Corp. (“FirstPriority”) and our respective subsidiaries. These forward-looking statements are subject to various assumptions, risks, uncertainties and other factors. These risks are detailed in documents filed by Mid Penn and First Priority with the Securities and Exchange Commission, including Mid Penn’s and First Priority’s Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, and other required filings. Because of these uncertainties, risks and the possibility of changes in these assumptions, actual results could differ materially from those expressed in any forward-looking statements. Investors are cautioned not to place undue reliance on these statements. Neither Mid Penn nor First Priority assume any duty or obligation to update any forward-looking statements made in this presentation. The proposed transaction will be submitted to the shareholders of First Priority and Mid Penn for their consideration and approval. In connection with the proposed transaction, Mid Penn will be filing with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 which will include a joint proxy statement/prospectus and other relevant documents to be distributed to the shareholders of Mid Penn and First Priority. Investors are urged to read the registration statement and the joint proxy statement/prospectus regarding the proposed transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Investors will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about Mid Penn and First Priority, free of charge from the SEC’s Internet site (www.sec.gov), by contacting Mid Penn Bancorp, Inc., 349 Union Street, Millersburg, Pennsylvania 17061, attention: Investor Relations (telephone (717) 692-7105); or First Priority Financial Corp., 2 West Liberty Boulevard, Suite 104, Malvern, Pennsylvania 19355, attention: Investor Relations (telephone (610) 280-7100). INVESTORS SHOULD READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TRANSACTION. Mid Penn, First Priority and their respective directors, executive officers, and certain other members of management and employees may be soliciting proxies from Mid Penn and First Priority shareholders in favor of the transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Mid Penn and First Priority shareholders in connection with the proposed transaction will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about Mid Penn’s executive officers and directors in its most recent proxy statement filed with the SEC, which is available at the SEC’s Internet site (www.sec.gov). Information about First Priority’s executive officers and directors is set forth in its most recent annual report on Form 10-K filed with the SEC, which is available at the SEC’s Internet site. You can also obtain free copies of these documents from Mid Penn or First Priority, as appropriate, using the contact information above. 2

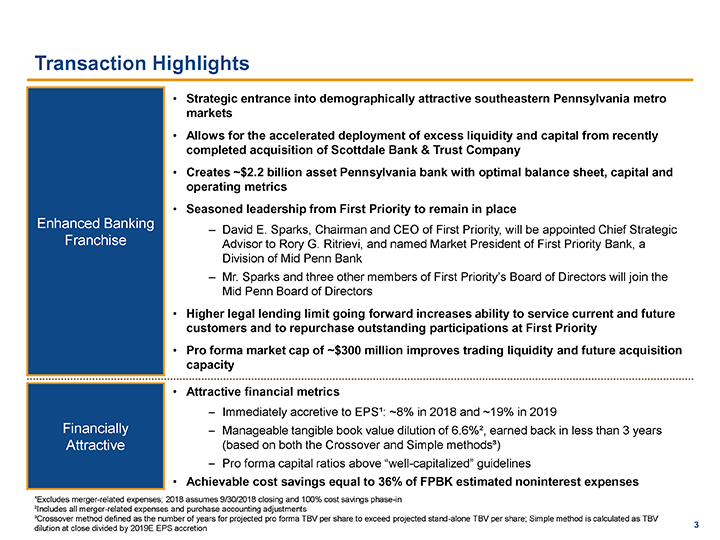

Transaction Highlights • Strategic entrance into demographically attractive southeastern Pennsylvania metro markets • Allows for the accelerated deployment of excess liquidity and capital from recently completed acquisition of Scottdale Bank & Trust Company • Creates ~$2.2 billion asset Pennsylvania bank with optimal balance sheet, capital and operating metrics • Seasoned leadership from First Priority to remain in place Enhanced Banking — David E. Sparks, Chairman and CEO of First Priority, will be appointed Chief Strategic Franchise Advisor to Rory G. Ritrievi, and named Market President of First Priority Bank, a Division of Mid Penn Bank — Mr. Sparks and three other members of First Priority’s Board of Directors will join the Mid Penn Board of Directors • Higher legal lending limit going forward increases ability to service current and future customers and to repurchase outstanding participations at First Priority • Pro forma market cap of ~$300 million improves trading liquidity and future acquisition capacity • Attractive financial metrics – Immediately accretive to EPS¹: ~8% in 2018 and ~19% in 2019 Financially – Manageable tangible book value dilution of 6.6%², earned back in less than 3 years Attractive (based on both the Crossover and Simple methods³) – Pro forma capital ratios above “well-capitalized” guidelines • Achievable cost savings equal to 36% of FPBK estimated noninterest expenses ¹Excludes merger-related expenses; 2018 assumes 9/30/2018 closing and 100% cost savings phase-in ²Includes all merger-related expenses and purchase accounting adjustments ³Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share; Simple method is calculated as TBV dilution at close divided by 2019E EPS accretion 3

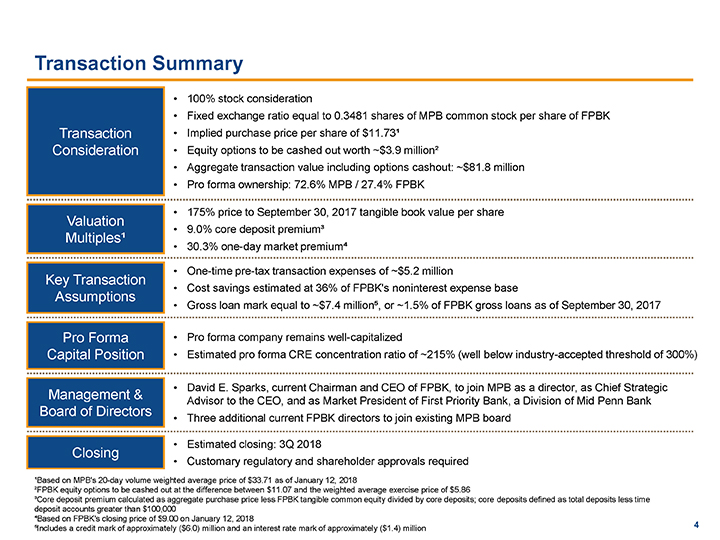

Transaction Summary • 100% stock consideration • Fixed exchange ratio equal to 0.3481 shares of MPB common stock per share of FPBK Transaction • Implied purchase price per share of $11.73¹ Consideration • Equity options to be cashed out worth ~$3.9 million² • Aggregate transaction value including options cashout: ~$81.8 million • Pro forma ownership: 72.6% MPB / 27.4% FPBK • 175% price to September 30, 2017 tangible book value per share Valuation • 9.0% core deposit premium³ Multiples¹ • 30.3% one-day market premiumâ´ • One-time pre-tax transaction expenses of ~$5.2 million Key Transaction • Cost savings estimated at 36% of FPBK’s noninterest expense base Assumptions • Gross loan mark equal to ~$7.4 millionâµ, or ~1.5% of FPBK gross loans as of September 30, 2017 Pro Forma • Pro forma company remains well-capitalized Capital Position • Estimated pro forma CRE concentration ratio of ~215% (well below industry-accepted threshold of 300%) • David E. Sparks, current Chairman and CEO of FPBK, to join MPB as a director, as Chief Strategic Management & Advisor to the CEO, and as Market President of First Priority Bank, a Division of Mid Penn Bank Board of Directors • Three additional current FPBK directors to join existing MPB board • Estimated closing: 3Q 2018 Closing • Customary regulatory and shareholder approvals required ¹Based on MPB’s 20-day volume weighted average price of $33.71 as of January 12, 2018 ²FPBK equity options to be cashed out at the difference between $11.07 and the weighted average exercise price of $5.86 ³Core deposit premium calculated as aggregate purchase price less FPBK tangible common equity divided by core deposits; core deposits defined as total deposits less time deposit accounts greater than $100,000 â´Based on FPBK’s closing price of $9.00 on January 12, 2018 âµIncludes a credit mark of approximately ($6.0) million and an interest rate mark of approximately ($1.4) million 4

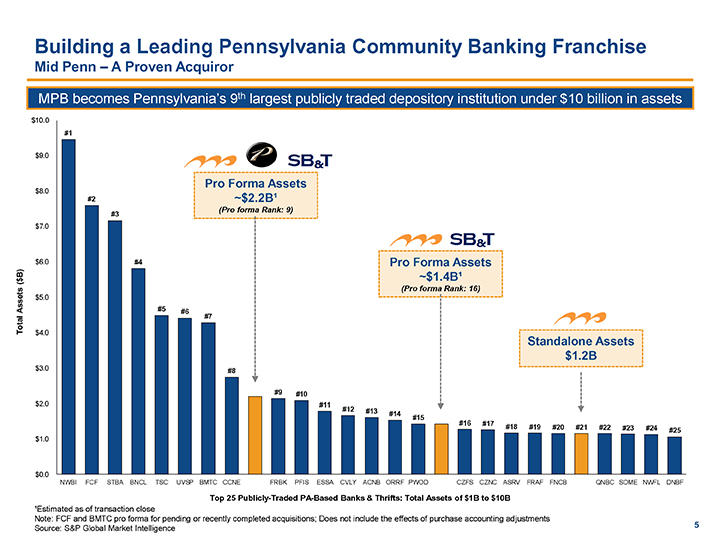

Building a Leading Pennsylvania Community Banking Franchise Mid Penn – A Proven Acquiror MPB becomes Pennsylvania’s 9th largest publicly traded depository institution under $10 billion in assets $10.0 #1 $9.0 $8.0 Pro Forma Assets #2 ~$2.2B¹ (Pro forma Rank: 9) #3 $7.0 $6.0 #4 Pro Forma Assets ($B) ~$1.4B¹ Assets (Pro forma Rank: 16) $5.0 #5 #6 Total #7 $4.0 Standalone Assets $1.2B $3.0 #8 #9 #10 $2.0 #11 #12 #13 #14 #15 #16 #17 #18 #19 #20 #21 #22 #23 #24 #25 $1.0 $0.0 NWBI FCF STBA BNCL TSC UVSP BMTC CCNE FRBK PFIS ESSA CVLY ACNB ORRF PWOD CZFS CZNC ASRV FRAF FNCB QNBC SOME NWFL DNBF Top 25 Publicly-Traded PA-Based Banks & Thrifts: Total Assets of $1B to $10B ¹Estimated as of transaction close Note: FCF and BMTC pro forma for pending or recently completed acquisitions; Does not include the effects of purchase accounting adjustments Source: S&P Global Market Intelligence 5

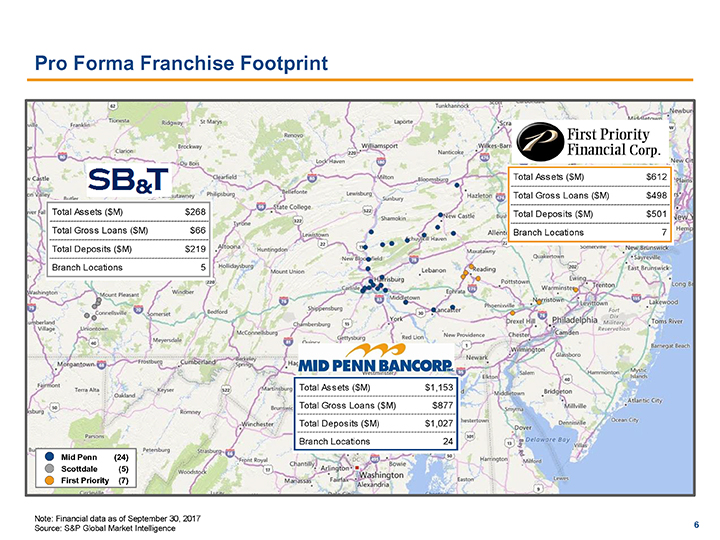

Pro Forma Franchise Footprint Total Assets ($M) $612 Total Gross Loans ($M) $498 Total Assets ($M) $268 Total Deposits ($M) $501 Total Gross Loans ($M) $66 Branch Locations 7 Total Deposits ($M) $219 Branch Locations 5 Total Assets ($M) $1,153 Total Gross Loans ($M) $877 Total Deposits ($M) $1,027 Branch Locations 24 Mid Penn (24) Scottdale (5) First Priority (7) Note: Financial data as of September 30, 2017 Source: S&P Global Market Intelligence 6

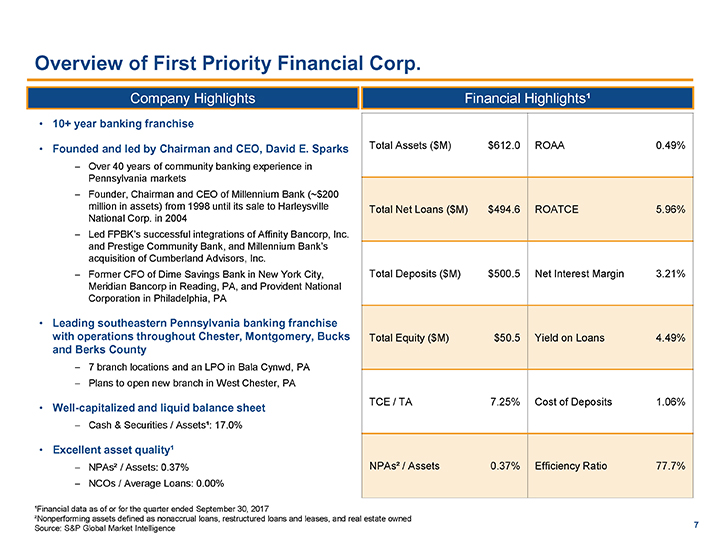

Overview of First Priority Financial Corp. Company Highlights Financial Highlights¹ • 10+ year banking franchise • Founded and led by Chairman and CEO, David E. Sparks Total Assets ($M) $612.0 ROAA 0.49% – Over 40 years of community banking experience in Pennsylvania markets – Founder, Chairman and CEO of Millennium Bank (~$200 million in assets) from 1998 until its sale to Harleysville Total Net Loans ($M) $494.6 ROATCE 5.96% National Corp. in 2004 – Led FPBK’s successful integrations of Affinity Bancorp, Inc. and Prestige Community Bank, and Millennium Bank’s acquisition of Cumberland Advisors, Inc. – Former CFO of Dime Savings Bank in New York City, Total Deposits ($M) $500.5 Net Interest Margin 3.21% Meridian Bancorp in Reading, PA, and Provident National Corporation in Philadelphia, PA • Leading southeastern Pennsylvania banking franchise with operations throughout Chester, Montgomery, Bucks Total Equity ($M) $50.5 Yield on Loans 4.49% and Berks County – 7 branch locations and an LPO in Bala Cynwd, PA – Plans to open new branch in West Chester, PA TCE / TA 7.25% Cost of Deposits 1.06% • Well-capitalized and liquid balance sheet – Cash & Securities / Assets¹: 17.0% • Excellent asset quality¹ – NPAs² / Assets: 0.37% NPAs² / Assets 0.37% Efficiency Ratio 77.7% – NCOs / Average Loans: 0.00% ¹Financial data as of or for the quarter ended September 30, 2017 ²Nonperforming assets defined as nonaccrual loans, restructured loans and leases, and real estate owned Source: S&P Global Market Intelligence 7

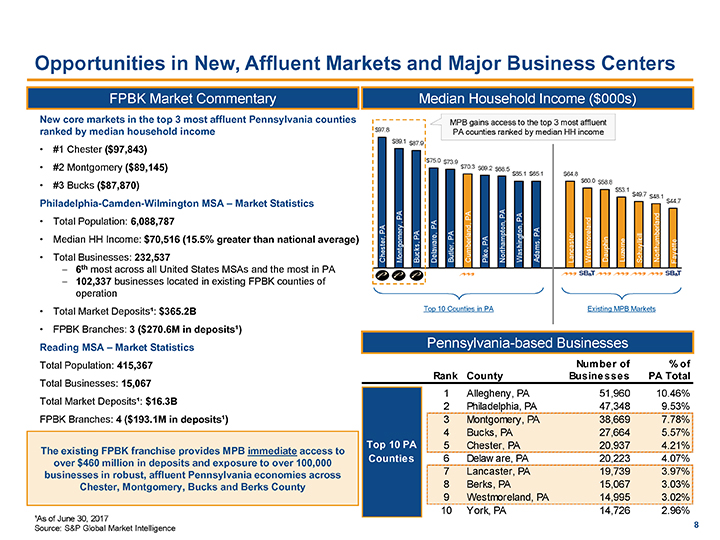

Opportunities in New, Affluent Markets and Major Business Centers FPBK Market Commentary Median Household Income ($000s) New core markets in the top 3 most affluent Pennsylvania counties MPB gains access to the top 3 most affluent ranked by median household income $97.8 PA counties ranked by median HH income • #1 Chester ($97,843) $89.1 $87.9 $75.0 $73.9 • #2 Montgomery ($89,145) $70.3 $69.2 $68.5 $65.1 $65.1 $64.8 • #3 Bucks ($87,870) $60.0 $58.8 $53.1 $49.7 $48.1 Philadelphia-Camden-Wilmington MSA – Market Statistics $44.7 PA PA A PA nd P • Total Population: 6,088,787 , rla y PA PA er Washington, A eland be pton, P ill PA PA or n m • Median HH Income: $70,516 (15.5% greater than national average) PA m hi lk gom s, berland, t hum ette ck e, tha ams, erne t hester, ont um es y • Total Businesses: 232,537 C C A d Daup Luz Nor a M Bu Delaware, Butler, Pik Nor Lancaster W Schuy F – 6th most across all United States MSAs and the most in PA – 102,337 businesses located in existing FPBK counties of Delaware,PA Butler, PA Cumberland, PA Pike,PA Nort ampton,PA h Washi gt n o n, PA Adams, PA Lancast e r Westmoreland Dauphin Luzerne Schuylkil Nort h umberland Fayet e operation • Total Market Deposits¹: $365.2B Top 10 Counties in PA Existing MPB Markets • FPBK Branches: 3 ($270.6M in deposits¹) Reading MSA – Market Statistics Pennsylvania-based Businesses Total Population: 415,367 Number of % of Rank County Businesses PA Total Total Businesses: 15,067 1 Allegheny, PA 51,960 10.46% Total Market Deposits¹: $16.3B 2 Philadelphia, PA 47,348 9.53% FPBK Branches: 4 ($193.1M in deposits¹) 3 Montgomery, PA 38,669 7.78% 4 Bucks, PA 27,664 5.57% Top 10 PA 5 Chester, PA 20,937 4.21% The existing FPBK franchise provides MPB immediate access to Counties 6 Delaware, PA 20,223 4.07% over $460 million in deposits and exposure to over 100,000 7 Lancaster, PA 19,739 3.97% businesses in robust, affluent Pennsylvania economies across Chester, Montgomery, Bucks and Berks County 8 Berks, PA 15,067 3.03% 9 Westmoreland, PA 14,995 3.02% 10 York, PA 14,726 2.96% ¹As of June 30, 2017 Source: S&P Global Market Intelligence 8

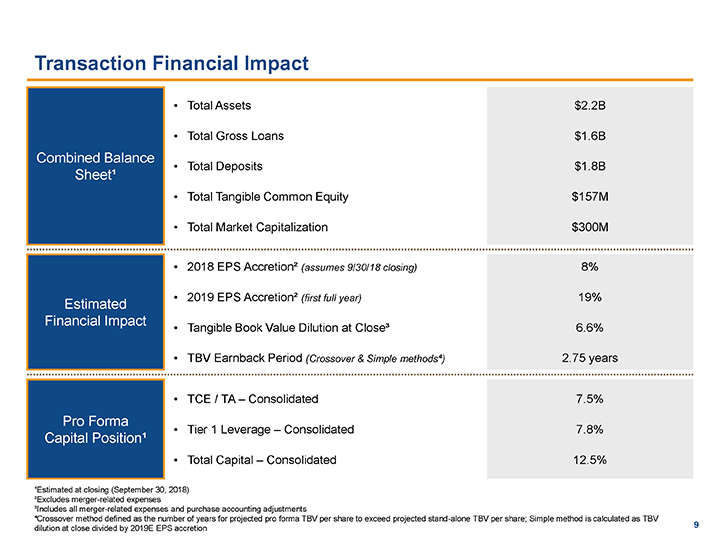

Transaction Financial Impact • Total Assets $2.2B • Total Gross Loans $1.6B Combined Balance • Total Deposits $1.8B Sheet¹ • Total Tangible Common Equity $157M • Total Market Capitalization $300M • 2018 EPS Accretion² (assumes 9/30/18 closing) 8% • 2019 EPS Accretion² (first full year) 19% Estimated Financial Impact • Tangible Book Value Dilution at Close³ 6.6% • TBV Earnback Period (Crossover & Simple methodsâ´) 2.75 years • TCE / TA – Consolidated 7.5% Pro Forma • Tier 1 Leverage – Consolidated 7.8% Capital Position¹ • Total Capital – Consolidated 12.5% ¹Estimated at closing (September 30, 2018) ²Excludes merger-related expenses ³Includes all merger-related expenses and purchase accounting adjustments â´Crossover method defined as the number of years for projected pro forma TBV per share to exceed projected stand-alone TBV per share; Simple method is calculated as TBV dilution at close divided by 2019E EPS accretion 9

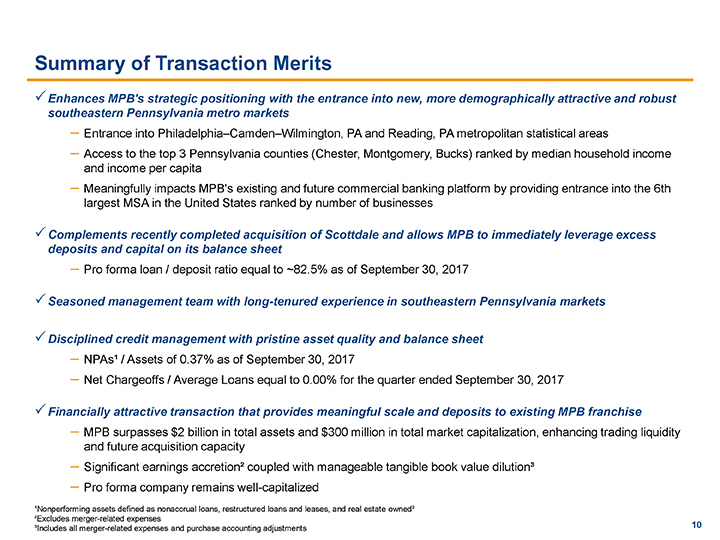

Summary of Transaction Merits ïEnhances MPB’s strategic positioning with the entrance into new, more demographically attractive and robust southeastern Pennsylvania metro markets – Entrance into Philadelphia–Camden–Wilmington, PA and Reading, PA metropolitan statistical areas – Access to the top 3 Pennsylvania counties (Chester, Montgomery, Bucks) ranked by median household income and income per capita – Meaningfully impacts MPB’s existing and future commercial banking platform by providing entrance into the 6th largest MSA in the United States ranked by number of businesses ïComplements recently completed acquisition of Scottdale and allows MPB to immediately leverage excess deposits and capital on its balance sheet – Pro forma loan / deposit ratio equal to ~82.5% as of September 30, 2017 ïSeasoned management team with long-tenured experience in southeastern Pennsylvania markets ïDisciplined credit management with pristine asset quality and balance sheet – NPAs¹ / Assets of 0.37% as of September 30, 2017 – Net Chargeoffs / Average Loans equal to 0.00% for the quarter ended September 30, 2017 ïFinancially attractive transaction that provides meaningful scale and deposits to existing MPB franchise – MPB surpasses $2 billion in total assets and $300 million in total market capitalization, enhancing trading liquidity and future acquisition capacity – Significant earnings accretion² coupled with manageable tangible book value dilution³ – Pro forma company remains well-capitalized ¹Nonperforming assets defined as nonaccrual loans, restructured loans and leases, and real estate owned² ²Excludes merger-related expenses ³Includes all merger-related expenses and purchase accounting adjustments 10

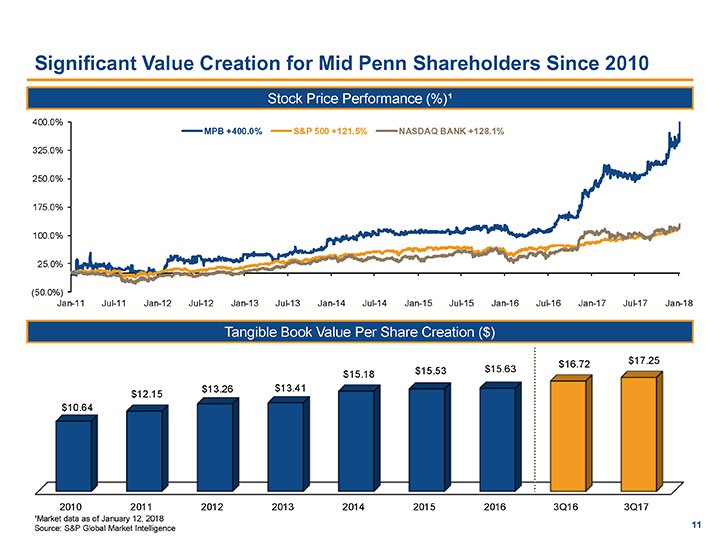

Significant Value Creation for Mid Penn Shareholders Since 2010 Stock Price Performance (%)¹ 400.0% MPB +400.0% S&P 500 +121.5% NASDAQ BANK +128.1% 325.0% 250.0% 175.0% 100.0% 25.0% (50.0%) Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Tangible Book Value Per Share Creation ($) $15.63 $16.72 $17.25 $15.18 $15.53 $13.26 $13.41 $12.15 $10.64 2010 2011 2012 2013 2014 2015 2016 3Q16 3Q17 ¹M Source: S&P Global Market Intelligence 11

Appendix

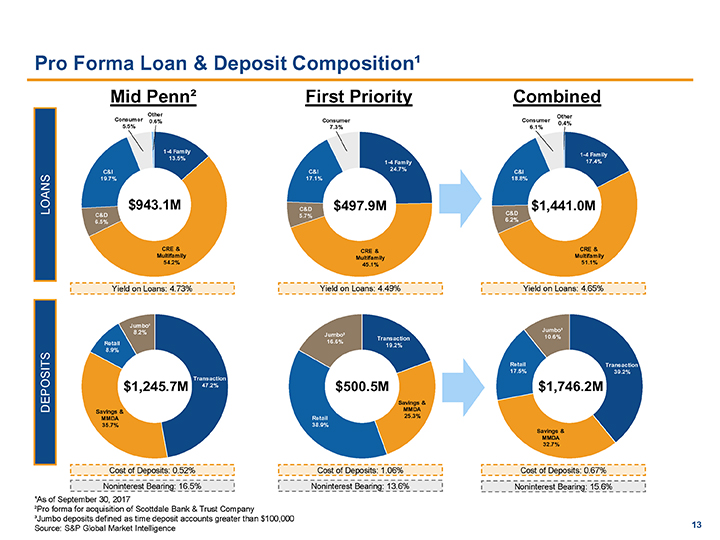

Pro Forma Loan & Deposit Composition¹ Mid Penn² First Priority Combined Consumer Other Other 0.6% Consumer Consumer 0.4% 5.5% 7.3% 6.1% 1-4 Family 1-4 Family 13.5% 1-4 Family 17.4% 24.7% C&I C&I C&I ANS 19.7% 17.1% 18.8% LO $943.1M C&D $497.9M $1,441.0M C&D C&D 5.7% 6.5% 6.2% CRE & CRE & CRE & Multifamily Multifamily Multifamily 54.2% 45.1% 51.1% Yield on Loans: 4.73% Yield on Loans: 4.49% Yield on Loans: 4.65% Jumbo³ 8.2% Jumbo³ Jumbo³ 16.6% Transaction 10.6% Retail 19.2% POSITS 8.9% Retail Transaction 17.5% 39.2% Transaction $1,245.7M 47.2% $500.5M $1,746.2M Savings & DE Savings & MMDA MMDA Retail 25.3% 35.7% 38.9% Savings & MMDA 32.7% Cost of Deposits: 0.52% Cost of Deposits: 1.06% Cost of Deposits: 0.67% Noninterest Bearing: 16.5% Noninterest Bearing: 13.6% Noninterest Bearing: 15.6% ¹As of September 30, 2017 ²Pro forma for acquisition of Scottdale Bank & Trust Company ³Jumbo deposits defined as time deposit accounts greater than $100,000 Source: S&P Global Market Intelligence 13