Attached files

| file | filename |

|---|---|

| EX-10.9 - EX-10.9 - ONE STOP SYSTEMS, INC. | d447171dex109.htm |

| EX-23.2 - EX-23.2 - ONE STOP SYSTEMS, INC. | d447171dex232.htm |

| EX-23.1 - EX-23.1 - ONE STOP SYSTEMS, INC. | d447171dex231.htm |

| EX-10.13 - EX-10.13 - ONE STOP SYSTEMS, INC. | d447171dex1013.htm |

| EX-10.12 - EX-10.12 - ONE STOP SYSTEMS, INC. | d447171dex1012.htm |

| EX-10.11 - EX-10.11 - ONE STOP SYSTEMS, INC. | d447171dex1011.htm |

| EX-10.8 - EX-10.8 - ONE STOP SYSTEMS, INC. | d447171dex108.htm |

| EX-10.1 - EX-10.1 - ONE STOP SYSTEMS, INC. | d447171dex101.htm |

| EX-5.1 - EX-5.1 - ONE STOP SYSTEMS, INC. | d447171dex51.htm |

| EX-4.4 - EX-4.4 - ONE STOP SYSTEMS, INC. | d447171dex44.htm |

| EX-4.1 - EX-4.1 - ONE STOP SYSTEMS, INC. | d447171dex41.htm |

| EX-3.4 - EX-3.4 - ONE STOP SYSTEMS, INC. | d447171dex34.htm |

| EX-3.3 - EX-3.3 - ONE STOP SYSTEMS, INC. | d447171dex33.htm |

| EX-3.2 - EX-3.2 - ONE STOP SYSTEMS, INC. | d447171dex32.htm |

| EX-1.1 - EX-1.1 - ONE STOP SYSTEMS, INC. | d447171dex11.htm |

| S-1/A - S-1/A - ONE STOP SYSTEMS, INC. | d447171ds1a.htm |

Exhibit 2.1

MERGER AGREEMENT

AND

PLAN OF REORGANIZATION

by and among

ONE STOP SYSTEMS, INC.,

a California corporation

(“Buyer”)

and

MISSION TECHNOLOGY GROUP, INC.,

a California corporation

(“Target”)

and

RANDY JONES

(“Target Shareholder”)

July 6, 2016

TABLE OF CONTENTS

| RECITALS |

1 | |||||

| ARTICLE 1. EFFECT OF THE TRANSACTION |

1 | |||||

| 1.1 |

AGREEMENT TO MERGE | 1 | ||||

| 1.2 |

CLOSING DATE; EFFECTIVE TIME | 2 | ||||

| 1.3 |

GOVERNANCE OF SURVIVING CORPORATION | 2 | ||||

| ARTICLE 2. CONVERSION OF SHARES |

2 | |||||

| 2.1 |

CONVERSION OF TARGET’S SHARES | 2 | ||||

| 2.2 |

CLOSING OF STOCK TRANSFER BOOKS | 3 | ||||

| 2.3 |

DISSENTERS’ RIGHTS | 3 | ||||

| 2.4 |

EXCHANGE OF SHARES; DELIVERIES | 3 | ||||

| ARTICLE 3. TARGET’S REPRESENTATIONS AND WARRANTIES |

5 | |||||

| 3.1 |

ORGANIZATION, STANDING, QUALIFICATION; CORPORATE POWER AND ACTION | 5 | ||||

| 3.2 |

CAPITAL STRUCTURE OF TARGET | 5 | ||||

| 3.3 |

SUBSIDIARIES | 6 | ||||

| 3.4 |

TARGET FINANCIAL STATEMENTS; TARGET BALANCE SHEET DATE | 6 | ||||

| 3.5 |

TITLE TO ASSETS | 7 | ||||

| 3.6 |

INVENTORY | 7 | ||||

| 3.7 |

INTELLECTUAL PROPERTY | 7 | ||||

| 3.8 |

ACCOUNTS RECEIVABLE | 9 | ||||

| 3.9 |

INTERESTS IN TARGET’S PROPERTY | 9 | ||||

| 3.10 |

ABSENCE OF UNDISCLOSED LIABILITIES | 10 | ||||

| 3.11 |

ABSENCE OF SPECIFIED CHANGES | 10 | ||||

| 3.12 |

PERMITS, LICENSES, AND FRANCHISES | 11 | ||||

| 3.13 |

JUDGMENTS, DECREES, OR ORDERS RESTRAINING BUSINESS | 11 | ||||

| 3.14 |

INSURANCE | 11 | ||||

| 3.15 |

LABOR DISPUTES | 11 | ||||

| 3.16 |

ENVIRONMENTAL COMPLIANCE; HAZARDOUS MATERIALS | 11 | ||||

| 3.17 |

REAL PROPERTY | 12 | ||||

| 3.18 |

POWERS OF ATTORNEY | 13 | ||||

| 3.19 |

No VIOLATION OF OTHER INSTRUMENTS | 13 | ||||

| 3.20 |

LITIGATION | 13 | ||||

| 3.21 |

CONTRACTS | 13 | ||||

| 3.22 |

TAXES | 15 | ||||

| 3.23 |

PRIVACY AND DATA SECURITY | 15 | ||||

| 3.24 |

CUSTOMERS AND SUPPLIERS | 16 | ||||

| 3.25 |

AFFILIATED BUSINESSES | 17 | ||||

| 3.26 |

GOVERNMENT REPORTS | 17 | ||||

| 3.27 |

CLAIMS, INQUIRIES AND CITATIONS AFFECTING TARGET | 17 | ||||

| 3.28 |

CORPORATE DOCUMENTS | 18 | ||||

| 3.29 |

PERSONNEL | 18 | ||||

| 3.30 |

CONTINUITY OF BUSINESS ENTERPRISE | 19 | ||||

| 3.31 |

No BROKERS | 19 | ||||

| 3.32 |

DISCLOSURE | 19 | ||||

| 3.33 |

CERTAIN DEFINITIONS | 19 | ||||

| 3.34 |

No OTHER REPRESENTATIONS OR WARRANTIES | 19 | ||||

-i-

| ARTICLE 4. BUYER’S REPRESENTATIONS AND WARRANTIES |

20 | |||||

| 4.1 |

ORGANIZATION, STANDING, QUALIFICATION; CORPORATE POWER AND ACTION | 20 | ||||

| 4.2 |

No VIOLATION OF OTHER INSTRUMENTS | 20 | ||||

| 4.3 |

No BROKERS | 21 | ||||

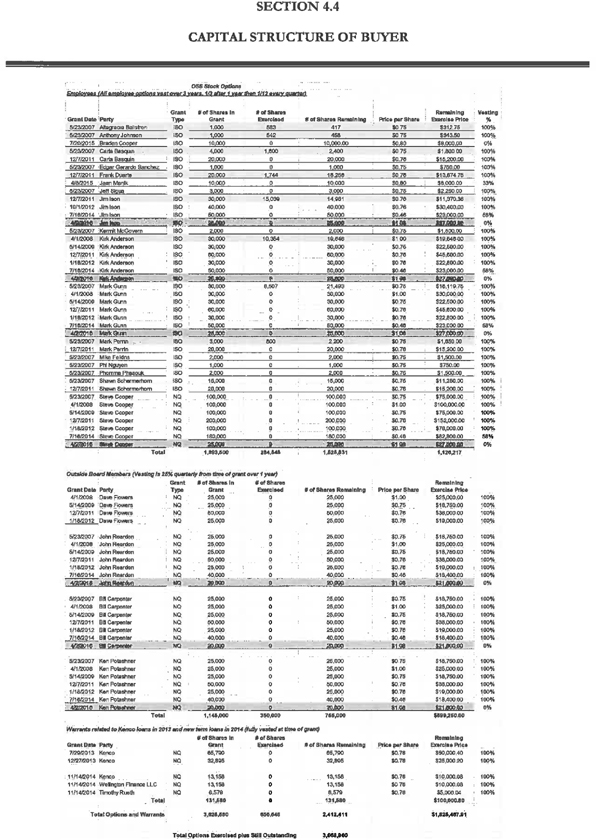

| 4.4 |

CAPITAL STRUCTURE OF BUYER | 21 | ||||

| 4.5 |

BUYER FINANCIAL STATEMENTS; BUYER BALANCE SHEET DATE | 21 | ||||

| 4.6 |

INSURANCE | 22 | ||||

| 4.7 |

CONTINUITY OF BUSINESS ENTERPRISE | 22 | ||||

| 4.8 |

TITLE TO ASSETS | 22 | ||||

| 4.9 |

INTERESTS IN BUYER’S PROPERTY | 22 | ||||

| 4.10 |

ABSENCE OF UNDISCLOSED LIABILITIES | 22 | ||||

| 4.11 |

ABSENCE OF SPECIFIED CHANGES | 23 | ||||

| 4.12 |

PERMITS, LICENSES, AND FRANCHISES | 24 | ||||

| 4.13 |

JUDGMENTS, DECREES, OR ORDERS RESTRAINING BUSINESS | 24 | ||||

| 4.14 |

LABOR DISPUTES | 24 | ||||

| 4.15 |

ENVIRONMENTAL COMPLIANCE; HAZARDOUS MATERIALS | 24 | ||||

| 4.16 |

LITIGATION | 25 | ||||

| 4.17 |

CLAIMS, INQUIRIES AND CITATIONS AFFECTING BUYER | 25 | ||||

| 4.18 |

DISCLOSURE | 25 | ||||

| 4.19 |

CERTAIN DEFINITIONS | 25 | ||||

| 4.20 |

No OTHER REPRESENTATIONS OR WARRANTIES | 26 | ||||

| ARTICLE 5. CONDITIONS PRECEDENT TO BUYER’S OBLIGATION TO CLOSE |

26 | |||||

| 5.1 |

PERFORMANCE OF ACTS AND UNDERTAKINGS OF TARGET | 26 | ||||

| 5.2 |

CERTIFIED RESOLUTIONS | 26 | ||||

| 5.3 |

CONTINUED ACCURACY OF TARGET’S WARRANTIES | 26 | ||||

| 5.4 |

APPROVALS FROM AUTHORITIES | 27 | ||||

| 5.5 |

CONSENTS | 27 | ||||

| 5.6 |

BUYER SHAREHOLDER APPROVAL | 27 | ||||

| 5.7 |

TARGET SHAREHOLDER APPROVAL | 27 | ||||

| 5.8 |

DISSENTING SHARES | 27 | ||||

| 5.9 |

EMPLOYMENT AGREEMENTS | 27 | ||||

| 5.10 |

FILING OF MERGER AGREEMENT | 27 | ||||

| 5.11 |

TARGET’S DELIVERY OF UPDATED TARGET DISCLOSURE SCHEDULES | 27 | ||||

| 5.12 |

BUYER’S APPROVAL OF UPDATED TARGET DISCLOSURE SCHEDULES | 27 | ||||

| 5.13 |

EXEMPTIONS FROM FEDERAL AND CALIFORNIA SECURITIES LAW REQUIREMENTS | 28 | ||||

| 5.14 |

TERMINATION OF OUTSTANDING CONVERTIBLE SECURITIES | 28 | ||||

| 5.15 |

No ORDER, INJUNCTION, RESTRAINT, OR PROCEEDINGS | 28 | ||||

| 5.16 |

FINANCING, ETC | 28 | ||||

| 5.17 |

CLOSING CONDITION TARGET’S WORKING CAPITAL DEFICIT | 28 | ||||

| ARTICLE 6. CONDITIONS PRECEDENT TO TARGET’S OBLIGATION TO CLOSE |

29 | |||||

| 6.1 |

PERFORMANCE OF ACTS AND UNDERTAKINGS BY BUYER | 29 | ||||

| 6.2 |

CERTIFIED RESOLUTIONS | 29 | ||||

| 6.3 |

CONTINUED ACCURACY OF BUYER’S WARRANTIES | 29 | ||||

| 6.4 |

BUYER’S DELIVERY OF UPDATED BUYER DISCLOSURE SCHEDULES | 29 | ||||

| 6.5 |

TARGET’S APPROVAL OF UPDATED BUYER DISCLOSURE SCHEDULES | 29 | ||||

| ARTICLE 7. COVENANTS |

29 | |||||

| 7.1 |

BUYER’S INVESTIGATION | 29 | ||||

-ii-

| 7.2 |

CONDUCT OF BUSINESS IN NORMAL COURSE | 30 | ||||

| 7.3 |

WORKING CAPITAL ADJUSTMENT | 30 | ||||

| 7.4 |

TARGET SHAREHOLDER’S NONCOMPETITION, ETC | 31 | ||||

| 7.5 |

AUDITS | 32 | ||||

| 7.6 |

FURTHER ASSURANCES | 32 | ||||

| ARTICLE 8. SURVIVAL OF REPRESENTATIONS AND WARRANTIES; INDEMNIFICATION |

33 | |||||

| 8.1 |

SURVIVAL OF REPRESENTATIONS, WARRANTIES, AND INDEMNITIES | 33 | ||||

| 8.2 |

INDEMNIFICATION | 33 | ||||

| ARTICLE 9. TERMINATION OF AGREEMENT |

35 | |||||

| 9.1 |

GROUNDS FOR TERMINATION | 35 | ||||

| 9.2 |

RIGHT TO PROCEED | 36 | ||||

| 9.3 |

RETURN OF TARGET’S DOCUMENTS IN EVENT OF TERMINATION | 36 | ||||

| 9.4 |

ATTORNEYS’ FEES AND COSTS IN EVENT OF TERMINATION | 36 | ||||

| ARTICLE 10. PUBLIC ANNOUNCEMENT |

36 | |||||

| ARTICLE 11. MEETING OF TARGET’S SHAREHOLDERS |

36 | |||||

| ARTICLE 12. GOVERNING LAW; SUCCESSORS AND ASSIGNS; COUNTERPARTS; ENTIRE AGREEMENT |

37 | |||||

| ARTICLE 13. NOTICES |

37 | |||||

| ARTICLE 14. DISPUTE RESOLUTION |

38 | |||||

| 14.1 |

EXCLUSIVE DISPUTE RESOLUTION MECHANISM | 38 | ||||

| 14.2 |

NEGOTIATIONS | 38 | ||||

| 14.3 |

MEDIATION | 38 | ||||

| 14.4 |

ARBITRATION AS A FINAL RESORT | 39 | ||||

| ARTICLE 15. AMENDMENTS |

39 | |||||

| ARTICLE 16. MISCELLANEOUS |

39 | |||||

| 16.1 |

WORD USAGE | 39 | ||||

| 16.2 |

INCORPORATION OF RECITALS | 39 | ||||

| 16.3 |

RECOVERY OF LITIGATION COSTS | 39 | ||||

| 16.4 |

ATTORNEY-CLIENT MATTERS | 40 | ||||

| 16.5 |

SEVERABILITY | 40 | ||||

| 16.6 |

EFFECT OF HEADINGS | 40 | ||||

| EXHIBIT A: CERTIFICATE OF AMENDMENT OF ARTICLES OF INCORPORATION |

42 | |||||

| EXHIBIT B: LETTER OF TRANSMITTAL |

43 | |||||

| EXHIBIT C: TARGET DISCLOSURE SCHEDULE |

44 | |||||

| EXHIBIT D: BUYER DISCLOSURE SCHEDULE |

45 | |||||

-iii-

MERGER AGREEMENT

AND

PLAN OF REORGANIZATION

This Merger Agreement and Plan of Reorganization (“Agreement”) is made as of July 6, 2016 by and among One Stop Systems, Inc., a California corporation (“Buyer”); Mission Technology Group, Inc., a California corporation (“Target”); and Randy Jones, an individual and the sole shareholder of Target (“Target Shareholder”). Target and Target Shareholder are collectively referred to in this Agreement as “Target Parties.” Buyer and Target Parties are collectively referred to in this Agreement as the “Parties.”

RECITALS

WHEREAS, this Agreement contemplates a tax-free merger of Target with and into Buyer in a reorganization pursuant to Internal Revenue Code Section 368(a)(1)(A) and the Parties intend to treat this Agreement as a Plan of Reorganization within the meaning of Treasury Regulations Section 1.368-2(g);

WHEREAS, Target Shareholder will receive shares of Buyer’s common stock in exchange for his Target common stock; and

WHEREAS, the Parties expect the Merger will further certain of their business objectives.

NOW THEREFORE, in consideration of the mutual covenants, agreements, representations, and warranties contained in this Agreement, the Parties agree as follows:

AGREEMENT

ARTICLE 1. EFFECT OF THE TRANSACTION

1.1 AGREEMENT TO MERGE. At the Effective Time (as defined in this Agreement), a merger will take place (“Merger”) whereby Target will be merged with and into Buyer, and Buyer will be the Surviving Corporation. (The term “Surviving Corporation” in this Agreement denotes Buyer after consummation of the Merger.) Buyer’s corporate name, existence, and all its purposes, powers, and objectives will continue unaffected and unimpaired by the Merger, and as the Surviving Corporation it will be governed by the laws of the State of California and succeed to all of Target’s rights, assets, liabilities, and obligations in accordance with the California General Corporation Law (“California Corporations Code”).

1.2 CLOSING DATE; EFFECTIVE TIME. Unless this Agreement is earlier terminated in accordance with its terms, the Merger will be effected as soon as practicable after all the conditions established in Articles 5 and 6 of this Agreement have been satisfied or waived. Closing of the Merger (“Closing”) will be held at 10:00 a.m. pacific time, on July 15, 2016, by the electronic exchange

MERGER AGREEMENT AND PLAN OF REORGANIZATION

of documents, or at such other time and place as the Parties may agree. The time and date of Closing are called the “Closing Date,” and will be the same day as the effective date of the Merger. On the Closing Date, the Parties will cause the Merger to be consummated by filing an agreement of merger (“Agreement of Merger”) with the Secretary of State of California in accordance with the provisions of the California Corporations Code (the time of acceptance by the Secretary of State of California of such filing, or such later time as specified in the Agreement of Merger, will be referred to in this Agreement as the “Effective Time”).

1.3 GOVERNANCE OF SURVIVING CORPORATION.

1.3.1 Articles of Incorporation. The articles of incorporation of Buyer in effect at the Effective Time will become the articles of incorporation of the Surviving Corporation, and upon the consummation of the Merger, will be amended to provide Surviving Corporation’s shareholders preemptive rights as more particularly described in the Certificate of Amendment of Articles of Incorporation, substantially in the form attached hereto as Exhibit A (the “Certificate of Amendment”). From and after the Effective Time, said articles of incorporation, as they may be duly amended from time to time, will be, and may be separately certified as, the articles of incorporation of the Surviving Corporation.

1.3.2 Bylaws. The bylaws of Buyer in effect at the Effective Time will be the bylaws of the Surviving Corporation until they are thereafter duly altered, amended, or repealed.

1.3.3 Directors and Officers.

(a) The directors of Buyer at the Effective Time will be the directors of the Surviving Corporation, each to hold office in accordance with the provisions of applicable law and the articles of incorporation and bylaws of the Surviving Corporation, until their successors have been duly elected and qualified. Immediately after the Effective Time, the Surviving Corporation will appoint Randy Jones as a director, as Vice-Chairman.

(b) The officers of Buyer at the Effective Time will be the officers of Surviving Corporation, each to hold office subject to the bylaws of the Surviving Corporation. Immediately after the Effective Time, the Surviving Corporation will appoint (i) Tim Miller as President- Magma Business Group and (ii) Julia Elbert as Vice-President- Engineering.

ARTICLE 2. CONVERSION OF SHARES

2.1 CONVERSION OF TARGET’S SHARES. At the Effective Time, each share of Target’s common stock, no par value, issued and outstanding immediately before the Effective Time (“Target Common Stock”), other than “dissenting shares” as defined in the California Corporations Code Section 1300, will by virtue of the Merger and without action on the part of any Target shareholder be converted into the right to receive .3095652 of one share of Buyer’s common stock (the ratio of .3095652 shares of Buyer’s common stock to one share of Target’s common stock is referred to herein as the “Conversion Ratio”), up to a maximum of 1,424,000 shares of Buyer’s common stock.

-2-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

2.2 CLOSING OF STOCK TRANSFER BOOKS. At the Effective Time, the stock transfer books of Target will be closed, and thereafter no transfers of shares of Target common stock will be made or consummated.

2.3 DISSENTERS’ RIGHTS. Despite anything in this Agreement to the contrary, a “dissenting shareholder” who holds any of Target’s “dissenting shares” (as those terms are defined in California Corporations Code Section 1300) outstanding immediately before the Effective Time and who has made and perfected a demand for payment of the value of the shares (“Payment”) in accordance with California Corporations Code Sections 1300-1312 (“Dissenters’ Rights Statute”) and who has not effectively withdrawn or lost the right to such Payment will have, by virtue of the Merger and without further action on the dissenting shareholder’s part, the right to receive and be paid the Payment and no further rights other than those provided by the Dissenters’ Rights Statute. Target will give Buyer prompt written notice of all written demands for Payment, withdrawals of demand, and other written communications received by Target pursuant to the Dissenters’ Rights Statute. After the amount of the Payment has been agreed on or finally determined pursuant to the Dissenters’ Rights Statute, all dissenting shareholders entitled to the Payment pursuant to the Dissenters’ Rights Statute will receive such payment from Target Parties, and the dissenting shares will thereupon be canceled.

2.4 EXCHANGE OF SHARES; DELIVERIES.

2.4.1 Exchange of Shares.

(a) On or before the Closing Date:

(i) Buyer will mail a letter of transmittal to each person who is a shareholder of record of Target Common Stock. The letter of transmittal will be substantially in the form of Exhibit B to this Agreement; and

(i) Target will cause each shareholder of Target Common Stock to deliver and surrender to the Surviving Corporation the shareholder’s executed letter of transmittal and certificate(s) evidencing ownership of Target Common Stock.

(b) Provided the shareholder of Target Common Stock has delivered and surrendered to the Surviving Corporation the shareholder’s executed letter of transmittal and certificate(s) evidencing ownership of Target Common Stock, immediately after the Effective Time, such shareholder of Target Common Stock will be entitled to receive in exchange therefor that number of shares of Buyer’s common stock equal to the product of (a) the number of shares of Target Common Stock represented by such surrendered certificate(s) multiplied by (b) the Conversion Ratio.

(c) All such certificates evidencing ownership of Target Common Stock will be canceled. No Target Common Stock will be deemed to be outstanding or to have any rights other than those set forth above in this Subsection 2.4.1 after the Effective Time.

-3-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

2.4.2 Deliveries by Target.

(a) On or before the Closing Date, Target will provide Buyer written evidence (satisfactory to Buyer in its sole discretion) that each of the then outstanding option to purchase shares of Target Common Stock (each an “Option”) has be canceled.

(b) Immediately after the Effective Time, Target shall deliver to Buyer:

(i) Target Shareholder’s letter of transmittal and certificate(s) evidencing ownership of 100% of the Target Common Stock (“Surrendered Certificates”).

(ii) Deliver to Buyer a copy of a registration rights agreement granting Buyer’s common shareholders (including Target Shareholder) substantially similar “piggy-back” registration rights that Buyer’s preferred shareholders enjoy (“Piggyback Registration Rights Agreement”), duly executed by Target Shareholder;

(iii) Deliver to Buyer a voting agreement, in a form reasonably acceptable to Target Shareholder and Stephen Cooper, providing that Stephen Cooper will vote his shares of Buyer stock to elect and maintain Target Shareholder as director on the board of directors of Buyer, until the annual shareholders meeting occurring after the second anniversary of the Closing Date (“Voting Agreement”), duly executed by Target Shareholder; and

(iv) Deliver to Buyer a management agreement, in a form reasonably acceptable to Target Shareholder and Buyer; containing terms no less favorable to Target Shareholder than the terms set forth in that certain term sheet, dated as of June 16, 2016, between Target and Buyer, providing that Target Shareholder will continue as an independent contractor to the Surviving Company (“Management Agreement”), duly executed by Target Shareholder.

2.4.3 Deliveries by Buyer. Immediately after the Effective Time, Buyer shall:

(a) Issue and deliver to Target Shareholder that number of shares of Buyer’s common stock equal to the product of (a) the number of shares of Target Common Stock represented by the Surrendered Certificates multiplied by (b) the Conversion Ratio (the “Merger Consideration Shares”);

(b) Pay to Comerica Bank by wire transfer of immediately available funds an amount not exceeding Nine Hundred Fifty Thousand Dollars ($950,000) to fully repay Target’s credit line and term loan indebtedness, as reflected on a payoff and lien release letter delivered to Buyer and Target by Comerica Bank, dated on or about the Closing Date (“Comerica Payoff Letter”);

(c) Pay to Miller Capital Corporation by wire transfer of immediately available funds an amount not exceeding One Hundred Thousand Dollars ($100,000) to pay all amounts due to Miller Capital Corporation under that certain Lender Bank Work Out Related Services Agreement, dated February 26, 2016 between Target and Miller Capital Corporation;

(d) Deliver to Target Shareholder the Piggyback Registration Rights Agreement, duly executed by Buyer;

-4-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(e) Deliver to Target Shareholder (i) resolutions, duly authorized by the shareholders or board of directors, as applicable, of Buyer in accordance with the Bylaws of Buyer, appointing Target Shareholder as a director of the board of directors of Buyer, as Vice-Chairman and independent board member, receiving Buyer’s customary and standard board fees plus Buyer’s customary and standard annual board member stock options and (ii) the Voting Agreement, duly executed by Stephen Cooper; and

(f) Deliver to Target Shareholder the Management Agreement, duly executed by the Buyer.

ARTICLE 3. TARGET’S REPRESENTATIONS AND WARRANTIES

Except as set forth in the Target Disclosure Schedule attached as Exhibit C, as may be updated through the Closing Date (the “Target Disclosure Schedule”), Target Parties, jointly and severally, represent and warrant to Buyer as of the date hereof and as of the Closing as follows.

3.1 ORGANIZATION, STANDING, QUALIFICATION; CORPORATE POWER AND ACTION.

3.1.1 Target is duly organized, validly existing, and in good standing under the laws of California and has the corporate power to own all of its properties and assets and to carry on its business as it is now being conducted. Target is duly qualified or licensed to do business as a foreign corporation and is in good standing in the jurisdictions listed in Section 3.1.1 of the Target Disclosure Schedule, and, except as set forth in Section 3.1.1 of the Target Disclosure Schedule, neither the ownership of its property nor the conduct of its business requires it to be qualified to do business in any other jurisdiction, except where the failure to so qualify would not result in a Material Adverse Effect.

3.1.2 Target’s board of directors has duly authorized the execution of this Agreement, and Target has the corporate power and is duly authorized, subject only to the approval of this Agreement by the Target Shareholder and the filing of the Agreement of Merger with the Secretary of State of California, to merge Target into Buyer pursuant to this Agreement. This Agreement has been duly executed and delivered by Target and, assuming the due authorization, execution, and delivery by Buyer, constitutes the valid and binding obligation of Target, enforceable against Target in accordance with its terms, except as such enforceability may be subject to laws of general application related to bankruptcy, insolvency, and the relief of debtors now or hereafter in effect and rules of law governing specific performance, injunctive relief, or other equitable remedies.

3.1.3 The approval of the Target Shareholder is the only approval of holders of Target capital securities required to approve the Merger.

3.2 CAPITAL STRUCTURE OF TARGET. Target’s authorized capital stock consists of ten million (10,000,000) shares of Target common stock, of which four million six hundred thousand (4,600,000) shares are issued and outstanding. All of Target’s capital stock is held by the Target Shareholder, and no shares of Target capital stock are held in treasury. There are one million one hundred thirty-six thousand one hundred and seventy-six (1,136,176) shares of Target common stock reserved for issuance pursuant to Mission Technology Group, Inc. Stock Option Plan Adopted October 1, 2009 and four hundred sixty nine thousand two hundred and fifty (469,250)

-5-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

shares of Target common stock subject to outstanding Options. Section 3.2 of the Target Disclosure Schedule sets forth the following information with respect to outstanding Options: (a) the name and most recent address of each option holder, (b) the number of shares of Target common stock to be issued on exercise of Options held by each such holder, (c) the exercise price of such Options, (d) the vesting schedule for such Options, including the extent vested to date, and (e) whether such Options are intended to qualify as incentive stock options as defined in Internal Revenue Code Section 422, as amended. All issued and outstanding shares have been, and all shares to be issued pursuant to outstanding Options will be, validly issued in full compliance with all federal and state securities laws, fully paid and nonassessable, not subject to preemptive rights created by statute, the articles of incorporation, or the bylaws of Target and issued free and clear of any similar rights under any agreement to which Target is a party or by which it is bound, and do or will have one voting right per share. Other than as set forth in Section 3.2 of the Target Disclosure Schedule, there are no outstanding subscriptions, options, rights, warrants, convertible securities, or other agreements or commitments obligating Target to issue or to transfer from treasury any additional shares of its capital stock of any class.

3.3 SUBSIDIARIES. Each subsidiary of Target (each a “Target Subsidiary” and collectively “Target Subsidiaries”) is listed in Section 3.3 of the Target Disclosure Schedule, which correctly sets forth for each Target Subsidiary (a) its jurisdiction of organization, (b) the jurisdictions in which it is qualified or licensed to do business as a foreign entity, (c) the number of equity interests authorized, (d) the number of equity interests issued and outstanding, and (e) if the Target Subsidiary is not wholly owned by Target, the number of outstanding equity interests held by Target and the number of outstanding equity interests held by, and the names of, other equity holders. Except as specified in Section 3.3 of the Target Disclosure Schedule, Target or a Target Subsidiary owns all the outstanding equity interests of each Target Subsidiary and neither Target nor any Target Subsidiary has any outstanding investment in or advance of cash to any company other than a Target Subsidiary. There are no outstanding rights or options to acquire, or any outstanding securities convertible into, equity interests of any class of any Target Subsidiary. Each Target Subsidiary (a) is an entity duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization; (b) is duly qualified to do business as a foreign entity and is in good standing in each jurisdiction listed with respect to it in Section 3.3 of the Target Disclosure Schedule; (c) has the entity power to own all of its property and assets and carry on its business as it is now being conducted; and (d) except as set forth in Section 3.3 of the Target Disclosure Schedule, is not required by its ownership of property, by the conduct of its business, or otherwise to be qualified to do business in any other jurisdictions.

3.4 TARGET FINANCIAL STATEMENTS; TARGET BALANCE SHEET DATE.

3.4.1 Target has delivered to Buyer (a) unaudited consolidated balance sheets of Target as of December 31, 2015, December 31, 2014, and December 31, 2013, and the related unaudited consolidated statements of income, changes in shareholders’ equity and cash flows for the three years ending on those dates, reviewed by Target’s independent public accountants and (b) unaudited consolidated balance sheets of Target as of June 30, 2016, together with related unaudited consolidated statements of income, changes in shareholders’ equity and cash flows for the six (6) month period ending on this date, certified by Target’s chief financial officer as accurately reflecting Target’s financial condition for this period and accurately reflecting all information normally reported to Target’s independent public accountants for the preparation of Target’s financial

-6-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

statements (other than footnotes thereto). The above financial statements delivered to Buyer are referred to as the “Target Financial Statements.”

3.4.2 The Target Financial Statements (a) have been prepared in accordance with the books and records of Target, (b) have been prepared in accordance with United States generally accepted accounting principles (“GAAP”) consistently applied by target throughout the periods indicated, and (c) fairly present the financial position of Target as of the respective dates of the balance sheets included and the results of its operations for the respective periods indicated, in accordance with GAAP and subject to normal and recurring year-end adjustments and the lack of footnote disclosure.

3.4.3 June 30, 2016 is referred to in this Agreement as the “Target Balance Sheet Date.”

3.5 TITLE TO ASSETS. Target and each Target Subsidiary has good and marketable title to all their respective assets and interests in assets, whether real, personal, mixed, tangible, or intangible, that constitute all the assets and interests in assets that are used in the businesses of Target and each Target Subsidiary. All these assets are free and clear of restrictions on or conditions to transfer or assignment and free and clear of mortgages, liens, pledges, charges, encumbrances, equities, claims, easements, rights of way, covenants, conditions, or restrictions, except for (a) those disclosed in Section 3.5 of the Target Disclosure Schedule or (b) the lien of current taxes not yet due and payable.

3.6 INVENTORY. The inventories of Target and each Target Subsidiary reflected on Target’s June 30, 2016 Balance Sheet, as well as all inventory items acquired since the Target Balance Sheet Date that are now the property of Target or a Target Subsidiary, consist of raw materials, supplies, work in process, and finished goods of such quality and in such quantities as are being used and will be usable or are being sold and will be salable in the ordinary course of the business of Target and Target Subsidiaries. These inventories exclude scrap, slow-moving items, and obsolete items and are valued at the lower of cost or market value, determined in accordance with GAAP consistently applied. Since the Target Balance Sheet Date, Target and each Target Subsidiary have continued to replenish these inventories in a normal and customary manner consistent with prudent practice prevailing in the business, and there have not been any write-downs of the value of, or establishment of any reserves against, the inventory, except for write-downs and reserves in the ordinary course of business consistent with past practice.

3.7 INTELLECTUAL PROPERTY.

3.7.1 Section 3.7.1 of the Target Disclosure Schedule contains a complete and accurate list of (a) all Registered Intellectual Property, together with identification of the owner of record of each listed item of Intellectual Property; (b) except for contracts for off-the-shelf software, all agreements, together with identification of all parties to such agreements, under which Target or any Target Subsidiary either obtains or grants the right to use any item of Intellectual Property (the “License Agreements”) together with identification of the Intellectual Property licensed thereunder; and (c) all opinions of counsel (whether in house or outside) on the validity, infringement, or enforceability of any patent owned or controlled by a party other than Target or any Target Subsidiary that relates to any aspect of Target or any Target Subsidiary’s business. For purposes of this Agreement, “Intellectual Property” means any and all inventions, invention studies (whether

-7-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

patentable or unpatentable), designs, patents, patent applications, copyrights, copyright registrations, copyright registration applications, trademarks, trademark registrations, trademark registration applications, service marks, service mark registrations, service mark registration applications, trade dress, trade names, trade secrets, secret processes, secret formulas, and technical information and know-how; and “Registered Intellectual Property” means applications, registrations and filings for Intellectual Property owned by the Target or any Target Subsidiary that have been registered, filed, or otherwise perfected or recorded with or by any state, government or other legal authority.

3.7.2 To the Knowledge of Target, the assets of Target and each Target Subsidiary reflected on Target’s June 30, 2016 Balance Sheet include all material Intellectual Property rights necessary for the business of Target and each Target Subsidiary without the need for any license or consent from any Person.

3.7.3 Appropriate filings, registrations, or issuances have been made with or by the appropriate governmental agencies of the United States, any of the states, and all applicable foreign countries with respect to the Registered Intellectual Property on Section 3.7.1 of the Target Disclosure Schedule, except where the failure to so file, register or issue would not result in a Material Adverse Effect.

3.7.4 Except as set forth in Section 3.7.4 of the Target Disclosure Schedule:

(a) Target or Target Subsidiaries are the sole and exclusive owner or licensee of all of Target’s and Target Subsidiaries’ Intellectual Property, including, but not limited to, the Registered Intellectual Property listed in Section 3.7.1(a) of the Target Disclosure Schedule, and has the sole and exclusive right to use all of the same.

(b) All of Target and Target Subsidiaries Intellectual Property is free and clear of any attachments, liens, or encumbrances, and none is subject to any outstanding order, decree, judgment, stipulation, or agreement restricting the scope of the use to the same.

(c) There are no claims or demands of any other person, firm, or corporation (other than attorneys’ charges for services rendered to or expenses incurred on behalf of Target or Target Subsidiaries, and except for registration proceedings pending before a registration office) pertaining to the Target’s and Target Subsidiaries’ Intellectual Property or License Agreements, and no proceedings have been instituted, are pending, or, to the Knowledge of Target, are threatened in writing (except for registration proceedings pending before a registration office) that challenge the rights of Target or Target Subsidiaries in respect to the same.

(d) To the Knowledge of Target, none of Target’s and Target Subsidiaries’ Intellectual Property infringes on the rights of others and none of the rights pertaining to Target’s and Target Subsidiaries’ Intellectual Property are being infringed by others.

(e) During the last seven (7) years neither Target nor Target Subsidiaries or any predecessor has been charged with or has charged others with infringement, unfair competition, or violation of rights with respect to any patent, trademark, service mark, trade dress, trade name, or copyright, or with wrongful use of confidential information, trade secrets, or secret processes.

-8-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(f) To the Knowledge of Target, there are no unexpired patents necessary for the manufacture of the products of Target or any Target Subsidiary or necessary to the apparatus or methods employed by Target or any Target Subsidiary in manufacturing or producing their products, other than unexpired patents held by Target or Target Subsidiaries or unexpired patents under which Target or Target Subsidiaries is licensed.

(g) To the Knowledge of Target, Target and Target Subsidiaries are not using any patentable inventions, confidential information, trade secrets, or secret processes of others.

(h) Each License Agreement in Section 3.7.1 of the Target Disclosure Schedule is valid and binding in accordance with its terms and is in full force and effect. Neither Target nor Target Subsidiaries nor, to the Knowledge of Target, any other party, to any such agreement has breached any material provision or is in default in any material respect under the terms of that agreement; and the Merger will not result in termination of any such agreement, require the consent of any party to any such agreement, or bring into operation any provision of any such agreement.

(i) All employees, contractors, and consultants of Target and each Target Subsidiary and any other third parties who have been involved in the development of any Intellectual Property rights owned by Target or any Target Subsidiary have executed invention assignment agreements in the form(s) delivered to Buyer, and all such employees and consultants who have access to confidential information or trade secrets of Target’s or ant Target Subsidiary’s business or that relate to Intellectual Property rights have executed appropriate nondisclosure agreements in the form(s) delivered to Buyer. Target and each Target Subsidiary have taken reasonable steps, consistent with industry standards, to protect the secrecy and confidentiality of their trade secret and know how rights.

(j) Except as set forth in Section 3.7.1(b) of the Target Disclosure Schedule, neither Target nor any Target Subsidiary is liable for, nor has made any contract or arrangement by which it may become liable to any Person for, any royalty, fee, or other compensation for the ownership, use, license, sale, offer of sale, distribution, manufacture, import, export, reproduction, distribution, public display, public performance of, creation of derivative works based on, or disposition of any of the Intellectual Property rights.

3.8 ACCOUNTS RECEIVABLE. Within three (3) months after the Effective Time, Target Parties reasonably believe that Surviving Corporation will have collected ninety percent (90%), and within six (6) months after the Effective Time, Target Parties reasonably believe that Surviving Corporation will have collected one hundred percent (100%), of the amounts shown as accounts receivable (less the amount of the reserve in respect of such accounts receivable shown on the balance sheet, which reserve has been established and calculated consistent with past practice) on the books of Target and Target Subsidiaries at the close of business on the day before the effective date of the Merger.

3.9 INTERESTS IN TARGET’S PROPERTY. No officer, director, or shareholder of Target or any Target Subsidiary has any interest in any property, real or personal, tangible or intangible, including copyrights, trademarks, or trade names, used in or pertaining to the business of Target or any Target Subsidiary.

-9-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

3.10 ABSENCE OF UNDISCLOSED LIABILITIES. There are no liabilities of Target or any Target Subsidiary other than the following:

(a) Liabilities disclosed or provided for in Target’s June 30, 2016 Balance Sheet, including the notes to such Balance Sheet;

(b) Liabilities disclosed in Section 3.10 of the Target Disclosure Schedule; or

(c) Liabilities incurred in the ordinary course of business consistent with past practice since the Target Balance Sheet Date, none of which has been adverse to the business of Target or any Target Subsidiary, and none of which is attributable to any period before the Target Balance Sheet Date.

3.11 ABSENCE OF SPECIFIED CHANGES. Since December 31, 2015 there has not been:

(a) Any material change in the business, results of operations, assets, financial condition, or manner of conducting the business of Target or any Target Subsidiary other than changes in the ordinary course of business consistent with past practice, none of which has had a Material Adverse Effect;

(b) Any material damage, destruction, or loss (whether or not covered by insurance) adversely affecting any aspect of the business or operations of Target or any Target Subsidiary;

(c) Any direct or indirect redemption or other acquisition by Target of any of Target’s shares of capital stock of any class, or any declaration, setting aside, or payment of any dividend or other distribution of Target’s capital stock of any class;

(d) Any increase in the compensation, incentive payments, or severance payable or to become payable by Target or any Target Subsidiary to any of its officers, employees, or agents, other than compensation increases granted in the ordinary course of business;

(e) Any option to purchase, or other right to acquire, stock of any class of Target or any Target Subsidiary granted by Target or any Target Subsidiary to any person;

(f) Any employment, bonus, severance, change of control, or deferred compensation agreement or arrangement entered into between Target or any Target Subsidiary and any of its directors, officers, or other employees or consultants;

(g) Any issuance of capital stock of any class by Target or any Target Subsidiary;

(h) Any sale or disposition of a material amount of assets or material interests owned or possessed by Target, other than sales occurring in the ordinary course of business consistent with past practices and prior periods;

(i) Any indebtedness incurred by Target or any Target Subsidiary for borrowed money or any commitment to borrow money entered into by Target or any guaranty given by Target;

-10-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(j) Any cancellation by Target of any material indebtedness owing to Target, or any cancellation or settlement by Target of any material claims against others;

(k) Any change in accounting practices by Target;

(1) Any change in method of accounting with respect to taxes, any change to a tax election, any filing of an amended tax return, any settlement or compromise of any proceeding with respect to any material tax liability;

(m) Any amendment to Target’s articles of incorporation or bylaws; or

(n) Any agreement or commitment by or on behalf of Target to do or take any of the actions referred to in (a) through (m) above.

3.12 PERMITS, LICENSES, AND FRANCHISES. Target and each Target Subsidiary have obtained all necessary permits, licenses, franchises, and other authorizations and have complied with all laws applicable to the conduct of their business in the manner and in the areas in which business is presently being conducted; and all such permits, licenses, franchises, and authorizations are valid and in full force and effect. To the Knowledge of Target, neither Target nor any Target Subsidiary has engaged in any activity that would cause revocation or suspension of any such permits, licenses, franchises, or authorizations; no action or proceeding contemplating the revocation or suspension of any of them is pending or, to the Knowledge of Target, threatened; and no approvals or authorizations will be required after the consummation of the Merger to permit Surviving Corporation to continue Target’s business as presently conducted.

3.13 JUDGMENTS, DECREES, OR ORDERS RESTRAINING BUSINESS. Neither Target nor any Target Subsidiary is a party to or subject to any judgment, decree, or order entered in any suit or proceeding brought by any governmental agency or by any other person, enjoining Target or any Target Subsidiary with respect to any business practice, the acquisition of any property, or the conduct of business in any area.

3.14 INSURANCE. During each of the past five (5) fiscal years, Target and each Target Subsidiary have been adequately insured by financially sound and reputable insurers with respect to risks normally insured against and in amounts normally carried by companies similarly situated. All such insurance policies are in full force and effect; all premiums due on such policies have been fully paid; and no notice of cancellation or termination has been received with respect to any policy.

3.15 LABOR DISPUTES. Target is not a party to any collective bargaining agreement or other contract with a labor union. No work stoppage, strike, lockout, or other labor dispute in respect to Target or any Target Subsidiary is pending or, to the Knowledge of Target, threatened, and no application for certification of a collective bargaining agent is pending or, to the Knowledge of Target, threatened.

3.16 ENVIRONMENTAL COMPLIANCE; HAZARDOUS MATERIALS.

3.16.1 As used in this Section “Environmental Laws” means any federal, state, local, or foreign laws, statutes, regulations, ordinances, decrees, judgments, or orders and all common law concerning

-11-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

public health or safety, worker health or safety, or pollution or protection of the environment, as the foregoing are enacted or in effect before the Closing Date. As used in this Section, “Hazardous Material” means any hazardous or toxic substance, material, or waste that is regulated by any federal authority or by any state or local authority where the substance, material, or waste is located. “Hazardous Material” includes, but is not limited to, petroleum base products, paints and solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonium compounds, asbestos, PCBs, and other chemical products.

3.16.2 Target and each Target Subsidiary have complied in all material respects with, and have not been cited for any violation of, Environmental Laws; and no material capital expenditures will be required for compliance with any Environmental Laws. None of Target or any Target Subsidiary has received any written notice, claim, report, or other information regarding any violation or alleged violation of any Environmental Laws. None of Target or any Target Subsidiary has retained or assumed by contract or operation of law any material liability or obligation of another person under any Environmental Law. To the Knowledge of Target, there are no underground storage tanks located on the real property described in Section 3.17.1 of the Target Disclosure Schedule in which any Hazardous Material has been or is being stored, nor has there been any spill, disposal, discharge, or release of any Hazardous Material into, upon, or over that real property or into or upon ground or surface water on that real property. To the Knowledge of Target, there are no asbestos-containing materials incorporated into the buildings or interior improvements that are part of that real property or into other assets of Target or any Target Subsidiary, nor is there any electrical transformer, fluorescent light fixture with ballasts, or other equipment containing PCBs on that real property. All reports, audits, assessments, and other similar documents in possession of Target or any Target Subsidiary relating to any material liability or potential material liability of Target or any Target Subsidiary under any Environmental Law or to any Hazardous Material have been provided to Buyer.

3.17 REAL PROPERTY.

3.17.1 The real property described in Section 3.17.1 of the Target Disclosure Schedule constitutes all of the real property and interests in real property owned or leased by the Company as of the Target Balance Sheet Date, except for properties that have been disposed of as specified in Section 3.17.1 of the Target Disclosure Schedule.

3.17.2 Except as set forth in Section 3.17.2 of the Target Disclosure Schedule:

(a) Target and each Target Subsidiary have not purchased, sold, contracted to purchase or sell, taken or given any options on, or entered into any leases of any real property or interests in real property since the Target Balance Sheet Date.

(b) To the Knowledge of Target, the buildings and operations of Target and each Target Subsidiary do not encroach on the property of others. All such buildings and the machinery and equipment therein that are in regular use are in good working order and in good state of repair; and all such buildings and operations conform in all material respects with all applicable ordinances, regulations, and zoning laws.

-12-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(c) All parcels of land included in such real property purporting to be contiguous to other parcels are contiguous and not separated by strips or gores.

(d) Target and each Target Subsidiary have good and marketable title to all real property and interests in real property listed as owned by it free and clear of all liens, claims, options, or other encumbrances.

(e) Each lease described in Section 3.17.1 of the Target Disclosure Schedule is a valid and binding agreement in accordance with its terms; no default exists under any provision of any such lease, and the Merger will not result in the termination of any such lease, require the consent of any other party to the lease, or bring into operation any other provision of the lease.

(f) No real property or interests in real property owned or controlled directly or indirectly by any of the directors or officers of Target or any Target Subsidiary adjoins or abuts in any degree any real property owned or leased by Target or any Target Subsidiary.

3.18 POWERS OF ATTORNEY. Target has no powers of attorney outstanding, except for powers of attorney granted to Hara CPA Services for tax filings and IRS enquiries.

3.19 NO VIOLATION OF OTHER INSTRUMENTS. The execution and delivery of this Agreement by Target do not, and the consummation of the Merger by Target will not, (a) violate any provision of Target’s articles of incorporation or bylaws; (b) violate any provision of, result in the acceleration of any obligation under, result in a right of termination in another party to, or result in the imposition of any lien or encumbrance on any asset of Target pursuant to the terms of, any mortgage, note, lien, lease, franchise, license, permit, agreement, instrument, order, arbitration award, judgment, or decree; (c) result in the termination of any agreement, license, franchise, lease, or permit to which Target is a party or by which Target is bound; or (d) violate or conflict with any other restriction of any kind or character to which Target is subject. After Target Shareholder has approved the plan of merger as set forth in this Agreement, Target will take, or will have taken, all actions required by law or by Target’s articles of incorporation or bylaws or otherwise required or necessary to authorize the execution and delivery of this Agreement and to authorize the Merger of Target with Buyer pursuant to this Agreement.

3.20 LITIGATION. Except as set forth in Section 3.20 of the Target Disclosure Schedule: (a) there are no claims, actions, suits, or proceedings pending or, to the Knowledge of Target, threatened (i) against or affecting Target or any Target Subsidiary or the properties or business of Target or any Target Subsidiary or (ii) that would prevent or hinder the consummation of the Merger; and (b) Target and Target Subsidiaries are not charged with violation of, or threatened with charges of violation of, or under investigation with respect to a possible violation of any provision of any federal, state, or local law or administrative ruling or regulation relating to any aspect of its business.

3.21 CONTRACTS.

3.21.1 Except for the contracts, agreements, plans, leases, and licenses described in Section 3.21.1 of the Target Disclosure Schedule, Target or any Target Subsidiary are not parties to or subject to:

-13-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(a) Any oral or written employment contract or agreement with any officer, consultant, director, or employee;

(b) Any plan or oral or written contract or agreement, providing for bonuses, pensions, options, deferred compensation, retirement payments, profit sharing, severance or the like;

(c) Any contract or agreement with any labor union;

(d) Any lease of machinery, equipment, or other personal property involving payment by it of annual rental in excess of Five Thousand Dollars ($5,000);

(e) Any contract or agreement for the purchase of any materials or supplies except individual purchase orders for less than Five Thousand Dollars ($5,000) incurred in the ordinary course of business;

(f) Any contract for the purchase of equipment or any construction or other agreement not otherwise covered by this schedule and involving any expenditure by the Company of more than Five Thousand Dollars ($5,000);

(g) Any instrument evidencing or related to indebtedness for borrowed money, or pursuant to which the Company is obligated or entitled to borrow money, or any instrument of guaranty;

(h) Any license or franchise agreement either as licenser or licensee or as franchisor or franchisee (other than agreements covered by the schedule of intellectual property to be delivered pursuant to the agreement);

(i) Any joint venture contract or arrangement or any other agreement involving a sharing of profits;

(j) Any contract or agreement for the sale or lease of its products or the furnishings of its services, or any sales agency contract, brokerage contract, distribution contract, or similar contract other than contracts made in the ordinary course of business on standard forms (copies of which standard forms are attached);

(k) Any contract containing covenants limiting the freedom of the Company to compete in any line of business or with any person;

(l) Any contract or agreement for or relating to the purchase or acquisition by merger or otherwise of the business, assets, or shares of any other corporation or of any partnership or sole proprietorship (regardless of whether the purchase or acquisition has been consummated), which contract or agreement imposes continuing obligations on or grants continuing rights or benefits to the Company;

(m) Any insurance policy (i) held by Target or any Target Subsidiary during the last three (3) years or (ii) under which any claim could be made; or

-14-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

(n) Any material contract or agreement not covered by any of the other items of this Section 3.21 that is not either (i) to be performed by Target or any Target Subsidiary within three (3) months from the date of the Agreement or (ii) by its terms terminable by and without penalty to Target or any Target Subsidiary or any successor or assign within three (3) months from the date of the Agreement.

3.21.2 Except as set forth in Section 3.21.2 of the Target Disclosure Schedule:

(a) All contracts, agreements, plans, leases, and licenses (including, but not limited to, those described in Section 3.21.1 of the Target Disclosure Schedule) are valid and binding in all material respects in accordance with their terms and are in full force and effect.

(b) Neither Target nor any Target Subsidiary or, to the Knowledge of Target, any other party to any such contract, agreement, plan, lease, or license is in default in any material respect under the terms of any such contract, agreement, plan, lease, or license.

(c) Each of Target and each Target Subsidiary as party to an evidence of indebtedness for borrowed money has received from the holder of such indebtedness cash equal to the principal amount of such indebtedness.

(d) The Merger will not result in the termination of any material contract, agreement, plan, lease, or license; will not require the consent of any other party to the contract, agreement, plan, lease, or license; and will not bring into operation any other provision of the contract, agreement, plan, lease, or license.

3.22 TAXES.

3.22.1 Target has delivered or made available to Buyer all federal, state and local tax returns of Target and Target Subsidiaries filed within the past three (3) years.

3.22.2 Within the times and in the manner prescribed by law, Target and each Target Subsidiary have filed all federal, state, and local tax returns required by law and have paid all taxes, assessments, and penalties shown to be due and payable on such returns. There have been no audits of Target or Target Subsidiary by the Internal Revenue Service or the California Franchise Tax Board other than the audits previously disclosed by Target to Buyer, and the results of such audits are accurately reflected in Target’s Financial Statements. The provisions for taxes reflected in Target’s consolidated June 30, 2016 Balance Sheet are adequate for federal, state, county, and local taxes for the period ending on the date of that Balance Sheet and for all prior periods, whether disputed or undisputed. There are no present disputes about taxes of any nature payable by Target or any Target Subsidiary.

3.23 PRIVACY AND DATA SECURITY. Target and each Target Subsidiary have (a) complied in all material respects with all privacy and data protection laws applicable to them or to their respective businesses in all pertinent jurisdictions worldwide, and Target and each Target Subsidiary have not received any notice or information that any violation of any such law is being or may be alleged. Target and each Target Subsidiary have processed personal information and data (“Personal Data”) fairly, lawfully, and for specified, explicit, and legitimate purposes; (b) obtained all necessary

-15-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

consents of the data subjects from whom Target or any Target Subsidiary collects Personal Data (the “Data Subjects”) in forms appropriate for each jurisdiction that requires such consent; (c) implemented technical and organizational security measures ensuring a level of security appropriate to the risks represented by the data processing activities and the nature of the data to be protected; (d) implemented appropriate technical and organizational measures sufficient to protect Personal Data against accidental or unlawful destruction or accidental loss, alteration, unauthorized disclosure or access, or any unlawful forms of processing; and (e) ensured that any third parties responsible for processing its Personal Data have implemented technical and organizational measures. Target and each Target Subsidiary collect, store, process, and use information in accordance with all applicable laws. Target and each Target Subsidiary have adopted a written information security program (“WISP”) to govern the protection of all Personal Data that Target or any Target Subsidiary, as applicable, maintains. Target and each Target Subsidiary have provided to Buyer for Buyer’s review Target’s and each Target Subsidiary’s WISP and other applicable security program documents, including the Target’s and each Target Subsidiary’s incident response policies, encryption standards, and other computer security protection policies or procedures, that constitute compliance with applicable U.S. federal and state and foreign privacy laws. Target and each Target Subsidiary will provide Buyer with any amendments to such policies or programs adopted or implemented prior to the Closing Date, and with any new policies or programs related to information privacy and security as may be adopted by Target and each Target Subsidiary prior to the Closing Date. For the past thirty-six (36) months, neither Target nor any Target Subsidiary has had an information security breach, data breach, or loss of or unauthorized access to the Personal Information of any customers of Target or any Target Subsidiary.

3.24 CUSTOMERS AND SUPPLIERS.

3.24.1 Section 3.24.1 of the Target Disclosure Schedule sets forth each of Target and Target Subsidiaries’ ten (10) largest customers (based on the dollar amount of sales to such customers) for the year ended December 31, 2015 and the five-month period ended June 30, 2016 (“Material Customers”). Except as set forth in Section 3.24.1 of the Target Disclosure Schedule, (a) no Material Customer has provided written or oral notice it will not continue to be a customer after the consummation of the Merger, and to the Knowledge of Target, all Material Customers continue to be customers of Target and Target Subsidiaries and; (b) since December 31, 2015, no Material Customer has modified or indicated that it intends to modify the terms of its relationship with Target or any Target Subsidiary in any material respect; (c) since December 31, 2015, no Material Customer has cancelled or otherwise terminated its relationship with Target or any Target Subsidiary or threatened to do so; and (e) Target and Target Subsidiaries are not involved in any material claim, dispute or controversy with any Material Customer.

3.24.2 Section 3.24.2 of the Target Disclosure Schedule sets forth each of Target and Target Subsidiaries’ ten (10) largest suppliers (based on the dollar amount of purchases from such suppliers) for the year ended December 31, 2015 and the five-month period ended June 30, 2016 (“Material Suppliers”). Except as set forth in Section 3.24 of the Target Disclosure Schedule, (i) all Material Suppliers continue to be suppliers of Target and Target Subsidiaries, and no Material Supplier has given written or oral notice it will not continue to be a supplier of Target or any Target Subsidiary after the consummation of the Merger; (ii) none of the Material Suppliers has reduced materially its sales to Target or any Target Subsidiary from the levels achieved during the calendar year ended December 31, 2015, or indicated it intends to do so; (iii) since December 31, 2015, no Material

-16-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

Supplier has modified or indicated it intends to modify the terms of its relationship with Target or any Target Subsidiary in any material respect; (iv) since December 31, 2015, no Material Supplier has cancelled or otherwise terminated its relationship with Target or any Target Subsidiary or threatened to do so; (v) Target and Target Subsidiaries are not involved in any material claim, dispute or controversy with any Material Supplier; and (vi) no supplier to Target or any Target Subsidiary represents a sole source of supply for any goods and services used in the conduct of their business.

3.25 AFFILIATED BUSINESSES.

3.25.1 Section 3.25.1 of the Target Disclosure Schedule contains a complete and accurate list of all corporations, partnerships, limited liability companies, and sole proprietorships, directly or indirectly owned or controlled by any of the officers or directors of Target or any Target Subsidiary, which during the past three (3) years (a) have engaged in any business similar to any of Target’s or any Target Subsidiary’s businesses or (b) have conducted business with Target or any Target Subsidiary as a supplier, customer, lessor, lessee, or otherwise.

3.25.2 The list contained in Section 3.25.1 of the Target Disclosure Schedule specifies (a) the business engaged in by each such corporation, partnership, or sole proprietorship during the past three (3) years, and (b) the nature and volume of the business of each such corporation, partnership, or sole proprietorship conducted with Target or any Target Subsidiary and the period during which it has been conducted.

3.26 GOVERNMENT REPORTS. Section 3.26 of the Target Disclosure Schedule contains a complete and accurate list of all reports filed or required to be filed by Target or any Target Subsidiary during the last three (3) years (a) with the United States government reflecting production capacity, actual production, inventories, or shipments (including the Bureau of Census “Annual Survey of Manufacturers” on Form MA10000), and (b) with the Securities and Exchange Commission, Federal Trade Commission, Equal Employment Opportunity Commission, Environmental Protection Agency, and the Departments of Justice, Treasury, Labor, Interior, Commerce, and Defense.

3.27 CLAIMS, INQUIRIES AND CITATIONS AFFECTING TARGET.

3.27.1 Section 3.27.1 of the Target Disclosure Schedule contains a complete and accurate list of all claims, inquiries, citations, penalties assessed, and other proceedings of federal, state, or local governmental agencies and of others in respect of Target or any Target Subsidiary during the past three (3) years that relate to any provision of federal, state, or local laws or regulations, including those relating to occupational safety and health, equal employment opportunity, and environmental pollution.

3.27.2 Except to the extent indicated in Section 3.27.2 of the Target Disclosure Schedule, all such claims, inquiries, citations, or proceedings have been terminated or will be terminated at a cost to Target and Target Subsidiaries of not more than Five Thousand Dollars ($5,000) in any one instance and not more than Five Thousand Dollars ($5,000) in the aggregate.

-17-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

3.27.3 Except as set forth in Section 3.27.3 of the Target Disclosure Schedule, the buildings and operations of Target and Target Subsidiaries comply in all material respects with all applicable federal, state, and local laws.

3.28 CORPORATE DOCUMENTS. Target has furnished to Buyer for examination (a) copies of the articles of incorporation and bylaws of Target and each Target Subsidiary; (b) the minute books of Target and each Target Subsidiary containing all records required to be set forth of all proceedings, consents, actions, and meetings of the shareholders, members, boards of directors and managers of Target and each Target Subsidiary; (c) all permits, orders, and consents issued by the California Commissioner of Corporations with respect to Target or any Target Subsidiary, or any security of either of them, and all applications for such permits, orders, and consents; and (d) the stock transfer books of Target and each Target Subsidiary setting forth all transfers of any equity interests.

3.29 PERSONNEL.

3.29.1 Identification and Compensation. Section 3.29.1 of the Target Disclosure Schedule contains a complete and accurate list of the names and addresses of all officers, directors, employees, agents, and manufacturer’s representatives of Target and each Target Subsidiary, stating the rates of compensation payable to each.

3.29.2 Employment Contracts and Benefits. Section 3.29.2 of the Target Disclosure Schedule contains a complete and accurate list of all employment contracts and collective bargaining agreements, and all pension, bonus, profit-sharing, stock option, or other agreements or arrangements providing for employee remuneration or benefits to which Target or any Target Subsidiary is a party or by which Target or any Target Subsidiary is bound. All these contracts and arrangements are in full force and effect, and neither Target nor any Target Subsidiary, nor, to the Knowledge of Target, any other party is in default under them. There have been no claims of defaults and, to the Knowledge of Target, there are no facts or conditions that if continued, or on notice, will result in a default under these contracts or arrangements. There is no pending or, to the Knowledge of Target, threatened labor dispute, strike, or work stoppage affecting Target’s or any Target Subsidiary’s business. Target and each Target Subsidiary have complied with all applicable laws for each of their respective employee benefit plans, including the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended, if and to the extent applicable. There are no pending or, to the Knowledge of Target, threatened claims by or on behalf of any such benefit plan, by or on behalf of any employee covered under any such plan, or otherwise involving any such benefit plan, that allege a breach of fiduciary duties or violation of other applicable state or federal law; nor is there, to the Knowledge of Target, any basis for such a claim. Except as set forth in Section 3.29.2 of the Target Disclosure Schedule, neither Target nor any Target Subsidiary has entered into any severance or similar arrangement with any present or former employee that will result in any obligation, absolute or contingent, of Buyer, Target, or any Target Subsidiary, to make any payment to any present or former employee following termination of employment.

3.29.3 Banks and Financial Institutions. Section 3.29.3 of the Target Disclosure Schedule contains a complete and accurate list of the names and addresses of all banks or other financial institutions in which Target or any Target Subsidiary has an account, deposit, or safe deposit box, with the names of all persons authorized to draw on these accounts or deposits or to have access to these boxes.

-18-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

3.30 CONTINUITY OF BUSINESS ENTERPRISE. Target operates at least one significant historic business line, or owns at least a significant portion of its historic business assets, in each case within the meaning of Internal Revenue Code Reg. Section 1.368-l(d).

3.31 NO BROKERS. Target has not incurred, nor will it incur, directly or indirectly, any liability for brokerage or finders’ fees or agents’ commissions or charges or any similar charges in connection with this Agreement or any transactions contemplated hereby.

3.32 DISCLOSURE. No representation or warranty by Target Parties in this Agreement and no statement by Target Parties or any Target Subsidiary by any executive officer or other person or contained in any document, certificate, or other writing furnished by or on behalf of Target Parties or any Target Subsidiary to Buyer in connection with this transaction contains or will contain any untrue statement of material fact, or omits or will omit to state any material fact necessary to make it not misleading or to fully provide the information required to be provided in the document, certificate, or other writing.

3.33 CERTAIN DEFINITIONS.

3.33.1 As used in this Article 3, “Material Adverse Effect” means any change, condition, occurrence, development, event or effect that, individually or in the aggregate with other changes, conditions, occurrences, developments, events or effects, (i) is materially adverse to the assets, business, condition (financial or otherwise), operations or prospects of Target, taken as a whole, (ii) materially impairs the ability of Target to perform its obligations under this Agreement or (iii) prevents or delays the consummation of the transactions contemplated herein; provided, however, that none of the following shall constitute, or shall be considered in determining whether there has occurred, and no event, circumstance, change or effect resulting from or arising out of any of the following shall constitute, a Material Adverse Effect: (A) changes in the national or world economy or financial markets as a whole or changes in general economic conditions that affect the industries in which Target conducts its business, so long as such changes or conditions do not adversely affect Target, taken as a whole, in a materially disproportionate manner relative to other similarly situated participants in the industries or markets in which they operate; (B) any change in applicable legal requirements, rule or regulation or interpretation thereof after the date hereof, so long as such changes do not adversely affect Target, taken as a whole, in a materially disproportionate manner relative to other similarly situated participants in the industries or markets in which they operate; (C) the failure, in and of itself, of Target to meet any internally prepared estimates of revenues, earnings or other financial projections, performance measures or operating statistics; provided, however, that the facts and circumstances underlying any such failure may, except as may be provided in subsections (A), (B), and (D), of this definition, be considered in determining whether a Material Adverse Effect has occurred; and (D) acts or omissions of Buyer after the date of this Agreement (other than actions or omissions specifically contemplated by this Agreement).

3.33.2 As used in this Article 3, “Knowledge of Target” means the actual knowledge of Randy Jones and Tim Miller.

3.34 NO OTHER REPRESENTATIONS OR WARRANTIES. Except for the representations and warranties contained in Article 3 (including the related Parts of the Target Disclosure Schedule), neither Target Party nor any other person has made or makes any other express or implied

-19-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

representation or warranty, either written or oral, on behalf of Target, including any representation or warranty as to the accuracy or completeness of any information furnished or made available to Buyer and its representatives or as to the future revenue, profitability or success of Target’s business, or any representation or warranty arising from statute or other legal requirement, and Buyer specifically disclaims that it is relying upon or has relied upon any other representations or warranties that may have been made by a Target Party or any other person, and acknowledges and agrees that Target Parties have specifically disclaimed and do hereby specifically disclaim any such other representation or warranty made by Target Parties or any other person.

ARTICLE 4. BUYER’S REPRESENTATIONS AND WARRANTIES

Except as set forth in the Buyer Disclosure Schedule attached as Exhibit D, as updated through the Closing Date (the “Buyer Disclosure Schedule”), Buyer represents and warrants to Target as of the date hereof and as of the Closing as follows.

4.1 ORGANIZATION, STANDING, QUALIFICATION; CORPORATE POWER AND ACTION.

4.1.1 Buyer is duly organized, validly existing, and in good standing under the laws of the State of California and has the corporate power to own all of its properties and assets and to carry on its business as it is now being conducted. Buyer is duly qualified or licensed to do business as a foreign corporation and is in good standing in the jurisdictions listed in Section 4.1.1 of the Buyer Disclosure Schedule, and, except as set forth in Section 4.1.1 of the Buyer Disclosure Schedule, neither the ownership of its property nor the conduct of its business requires it to be qualified to do business in any other jurisdiction, except where the failure to so qualify would not result in a Material Adverse Effect.

4.1.2 Buyer’s board of directors has duly authorized the execution of this Agreement, and Buyer has the corporate power to execute and deliver this Agreement and is duly authorized, subject only to (a) the approval of Buyer’s shareholders and (b) the filing of the Agreement of Merger with the Secretary of State of California, to merge Target into Buyer pursuant to this Agreement. This Agreement has been duly executed and delivered by Buyer and, assuming the approval of Buyer’s shareholders and the due authorization, execution, and delivery by Target, constitutes the valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as such enforceability may be subject to laws of general application related to bankruptcy, insolvency, and the relief of debtors now or hereafter in effect and rules of law governing specific performance, injunctive relief, or other equitable remedies.

4.1.3 The approvals of Buyer’s common and preferred shareholders are the only approvals of holders of Buyer’s capital securities required to approve the Merger.

4.2 NO VIOLATION OF OTHER INSTRUMENTS. The execution and delivery of this Agreement by Buyer does not, and the consummation of the Merger will not, (a) violate any provision of the articles of incorporation or bylaws of Buyer; (b) violate any provision of, result in the acceleration of any obligation under, result in a right of termination in another party to, or result in the imposition of any lien or encumbrance on any asset of Buyer under, any mortgage, note, lien, lease, franchise, license, permit, agreement, instrument, order, arbitration award, judgment, or decree to which Buyer is a party or by which Buyer is bound; (c) result in the termination of any agreement, license,

-20-

MERGER AGREEMENT AND PLAN OF REORGANIZATION

franchise, lease, or permit to which Buyer is a party or by which Buyer is bound; or (d) violate or conflict with any other restriction of any kind or character to which Buyer is subject. After the shareholder(s) of Buyer have approved the Merger, Buyer will take, or will have taken, all actions required by law, Buyer’s articles of incorporation or bylaws, or otherwise required or necessary to authorize the execution and delivery of this Agreement and to authorize the Merger.

4.3 NO BROKERS. Buyer has not incurred, nor will Buyer incur, directly or indirectly, any liability for brokerage or finders’ fees or agents’ commissions or charges or any similar charges in connection with this Agreement or any transactions contemplated hereby.