Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ENERGIZER HOLDINGS, INC. | d466448dex991.htm |

| EX-10.1 - EX-10.1 - ENERGIZER HOLDINGS, INC. | d466448dex101.htm |

| EX-2.1 - EX-2.1 - ENERGIZER HOLDINGS, INC. | d466448dex21.htm |

| 8-K - 8-K - ENERGIZER HOLDINGS, INC. | d466448d8k.htm |

Energizer to Acquire Spectrum Brands’ Global Battery and Portable Lighting Business January 16, 2018 Exhibit 99.2

1 Safe Harbor Statement Unless the context otherwise requires, references in this presentation to “Energizer,” “we,” “our,” and “the Company” refer to Energizer Holdings, Inc., and its subsidiaries. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, statements about the expected benefits of the proposed transaction, including, without limitation, future business, financial and operating results, the manner in which the proposed transaction is expected to be financed, and the anticipated timing of the completion of the proposed transaction. These forward-looking statements generally are identified by the words “will,” “opportunity,” “offers,” “expected,” “intends,” “anticipated” and similar words and expressions. Any statements that are not statements of historical fact should be considered to be forward-looking statements. Any such forward looking statements are made based on information currently known and are subject to various risks and uncertainties. Risks and uncertainties to which these forward-looking statements are subject include, without limitation: (1) the proposed transaction may not be completed on the anticipated terms and timing or at all, (2) required regulatory approvals, including antitrust approvals, are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transaction or cause the parties to abandon the proposed transaction, (3) a condition to closing of the proposed transaction may not be satisfied, (4) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transactions, (5) the ability to obtain or consummate financing or refinancing related to the transaction upon acceptable terms or at all, (6) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (7) negative effects of the announcement or the consummation of the transaction on the market price of Energizer’s common stock, (8) the potential impact of unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of Energizer’s operations after the consummation of the transaction and on the other conditions to the completion of the proposed transaction, (9) the risks and costs associated with, and the ability of Energizer to, integrate the businesses successfully and to achieve anticipated synergies, (10) the risk that disruptions from the proposed transaction will harm Energizer’s business, including current plans and operations, (11) risks related to changes and developments in external competitive market factors, such as introduction of new product features or technological developments, development of new competitors or competitive brands or competitive promotional activity or spending, (12) the ability of Energizer to retain and hire key personnel, (13) adverse legal and regulatory developments or determinations or adverse changes in, or interpretations of, U.S. or other foreign laws, rules or regulations, including tax laws, rules and regulations, that could delay or prevent completion of the proposed transactions or cause the terms of the proposed transactions to be modified, and (14) management’s response to any of the aforementioned factors. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to Energizer’s most recent 10-K, 10-Q and 8-K reports. Energizer does not assume any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

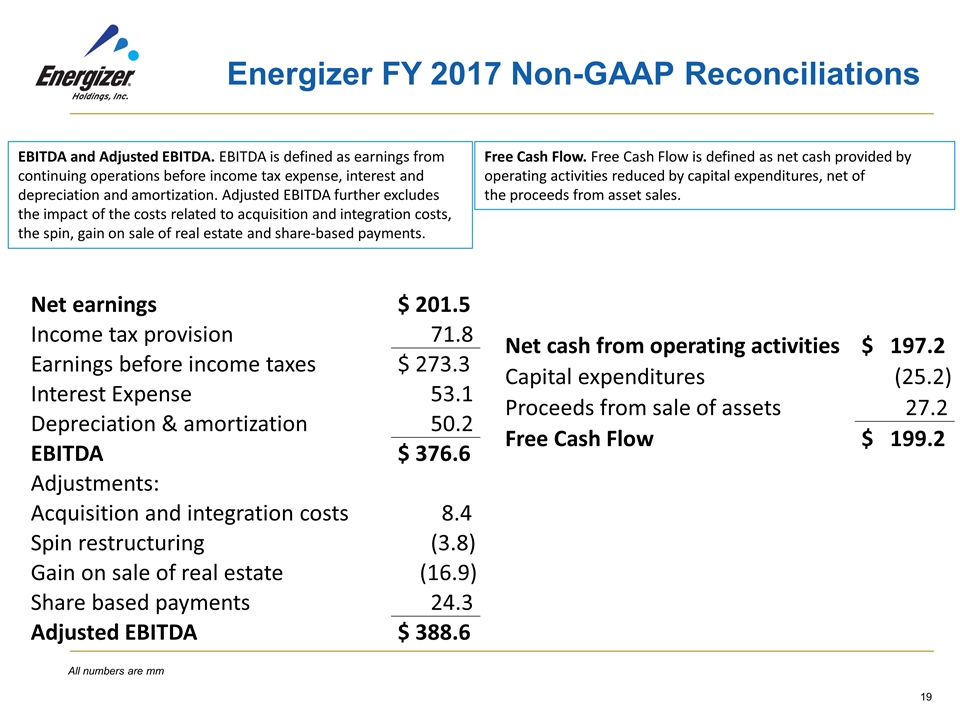

2 Non-GAAP Financial Measures Non-GAAP financial measures While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), this presentation includes non-GAAP measures, including, without limitation, free cash flow, EBITDA and Adjusted EBITDA. We believe these non-GAAP measures provide a meaningful comparison to the corresponding historical or future period, assist investors in performing their analysis, and provide investors with visibility into the underlying financial performance of the Company’s business. The Company believes that these non-GAAP measures are presented in such a way as to allow investors to more clearly understand the nature and amount of the adjustments to arrive at the non-GAAP measure. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. Additionally, these non-GAAP measures may differ from similarly titled measures presented by other companies. We are unable to provide a reconciliation of non-GAAP measures of the acquired business due to the carve-out nature of the proposed transaction. A reconciliation of these non-GAAP measures for Energizer to the nearest comparable GAAP measure is available at the end of this presentation.

Spectrum Brands’ Battery and Portable Lighting Business Represents a Compelling Opportunity Spectrum Brands’ portfolio complements Energizer’s business Operational Benefits Financial Benefits Broadens product portfolio Expands global presence and international brand portfolio Amplifies both companies’ strong innovation capabilities Positions us better to win in growing channels like eCommerce Cost synergies; enabling reinvestment in the business including innovation Immediate Adjusted EPS accretion Free cash flow growth through synergies Long-term shareholder value Expanded manufacturing footprint Expanded R&D capabilities and technology platforms will accelerate innovation Joint supply chain will provide efficiencies and cost synergies Sharing of best practice approaches

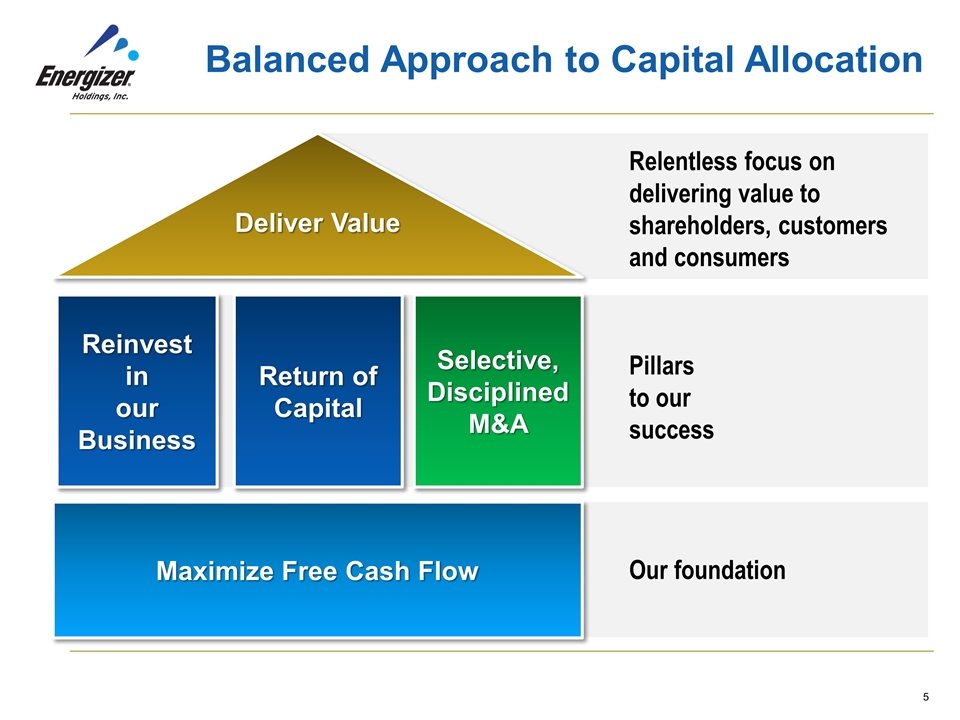

Balanced Approach to Capital Allocation Maximize Free Cash Flow Reinvest in our Business Return of Capital Selective, Disciplined M&A Deliver Value Our foundation Pillars to our success Relentless focus on delivering value to shareholders, customers and consumers

Spectrum Brands’ Business Meets Energizer’s Strategic Acquisition Criteria Branded household products Complementary business models due to technology and global distribution Leverages Energizer’s core competencies Similar financial profile Customer, channel and geographic alignment Leverage existing global battery platform and integrated supply chain Ability to derive cost and operational synergies through scale, operations and enhanced distribution 6 ü ü ü ü ü ü ü Spectrum Brands’ Battery and Portable Lighting Business

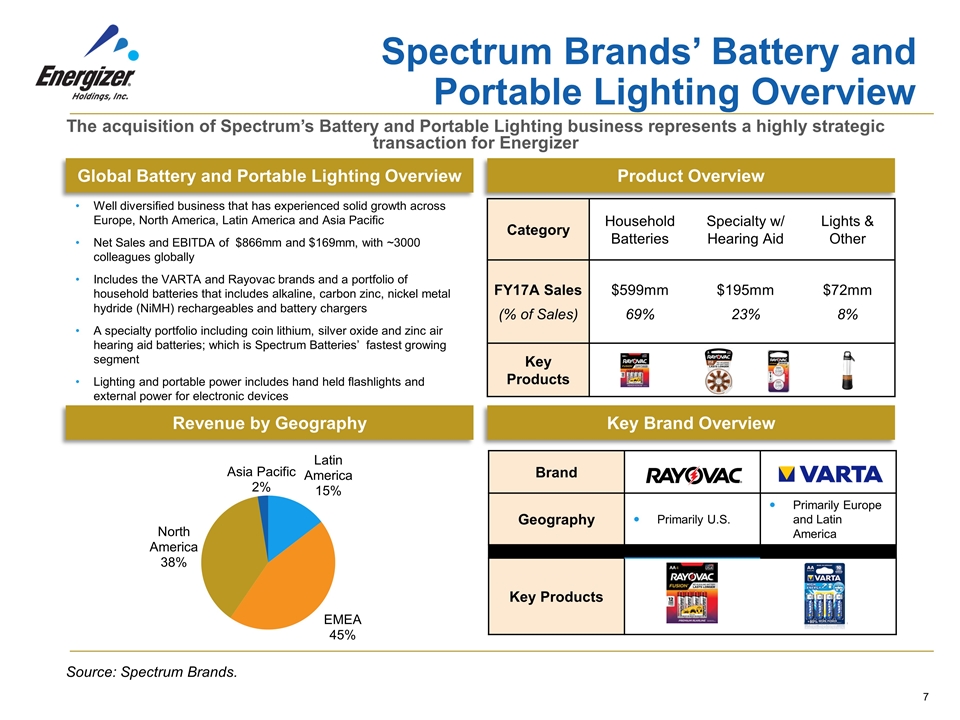

Category Household Batteries Specialty w/ Hearing Aid Lights & Other FY17A Sales (% of Sales) $599mm 69% $195mm 23% $72mm 8% Key Products Brand Geography Primarily U.S. Primarily Europe and Latin America Key Products Spectrum Brands’ Battery and Portable Lighting Overview The acquisition of Spectrum’s Battery and Portable Lighting business represents a highly strategic transaction for Energizer Well diversified business that has experienced solid growth across Europe, North America, Latin America and Asia Pacific Net Sales and EBITDA of $866mm and $169mm, with ~3000 colleagues globally Includes the VARTA and Rayovac brands and a portfolio of household batteries that includes alkaline, carbon zinc, nickel metal hydride (NiMH) rechargeables and battery chargers A specialty portfolio including coin lithium, silver oxide and zinc air hearing aid batteries; which is Spectrum Batteries’ fastest growing segment Lighting and portable power includes hand held flashlights and external power for electronic devices 8 Revenue by Geography Global Battery and Portable Lighting Overview Key Brand Overview Product Overview Source: Spectrum Brands.

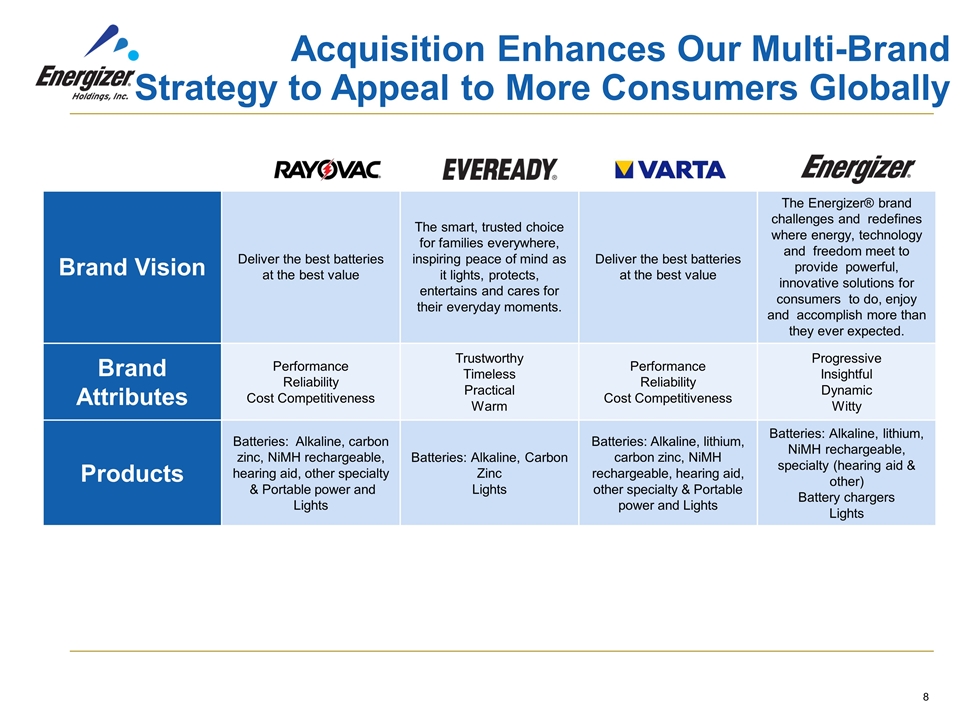

Brand Vision Deliver the best batteries at the best value The smart, trusted choice for families everywhere, inspiring peace of mind as it lights, protects, entertains and cares for their everyday moments. Deliver the best batteries at the best value The Energizer® brand challenges and redefines where energy, technology and freedom meet to provide powerful, innovative solutions for consumers to do, enjoy and accomplish more than they ever expected. Brand Attributes Performance Reliability Cost Competitiveness Trustworthy Timeless Practical Warm Performance Reliability Cost Competitiveness Progressive Insightful Dynamic Witty Products Batteries: Alkaline, carbon zinc, NiMH rechargeable, hearing aid, other specialty & Portable power and Lights Batteries: Alkaline, Carbon Zinc Lights Batteries: Alkaline, lithium, carbon zinc, NiMH rechargeable, hearing aid, other specialty & Portable power and Lights Batteries: Alkaline, lithium, NiMH rechargeable, specialty (hearing aid & other) Battery chargers Lights Acquisition Enhances Our Multi-Brand Strategy to Appeal to More Consumers Globally

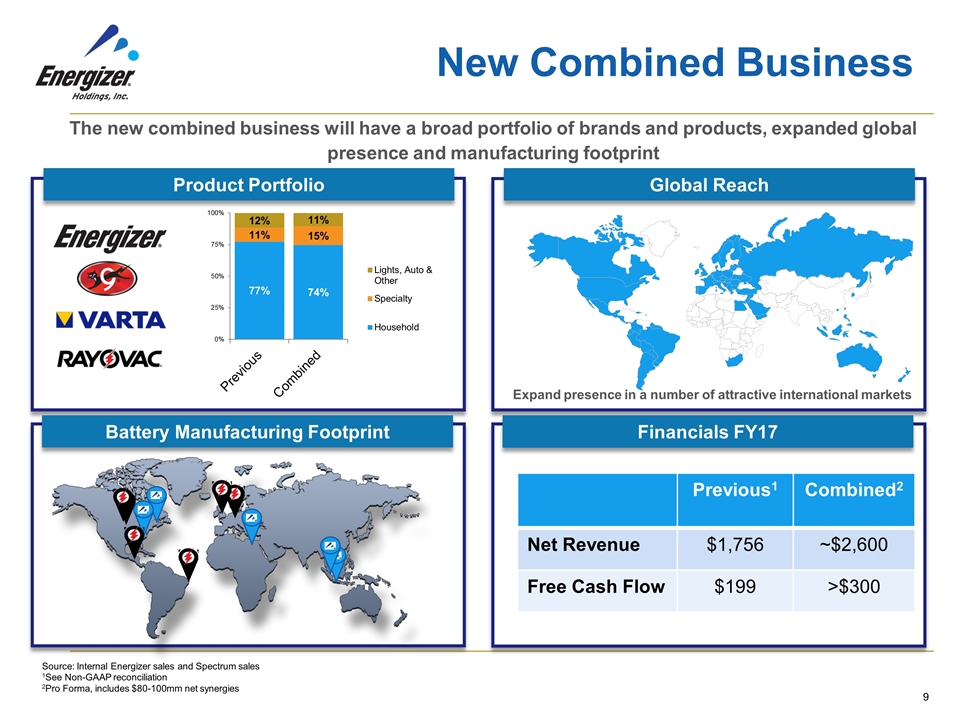

New Combined Business Product Portfolio Battery Manufacturing Footprint Financials FY17 The new combined business will have a broad portfolio of brands and products, expanded global presence and manufacturing footprint Global Reach Expand presence in a number of attractive international markets Source: Internal Energizer sales and Spectrum sales 1See Non-GAAP reconciliation 2Pro Forma, includes $80-100mm net synergies Previous1 Combined2 Net Revenue $1,756 ~$2,600 Free Cash Flow $199 >$300

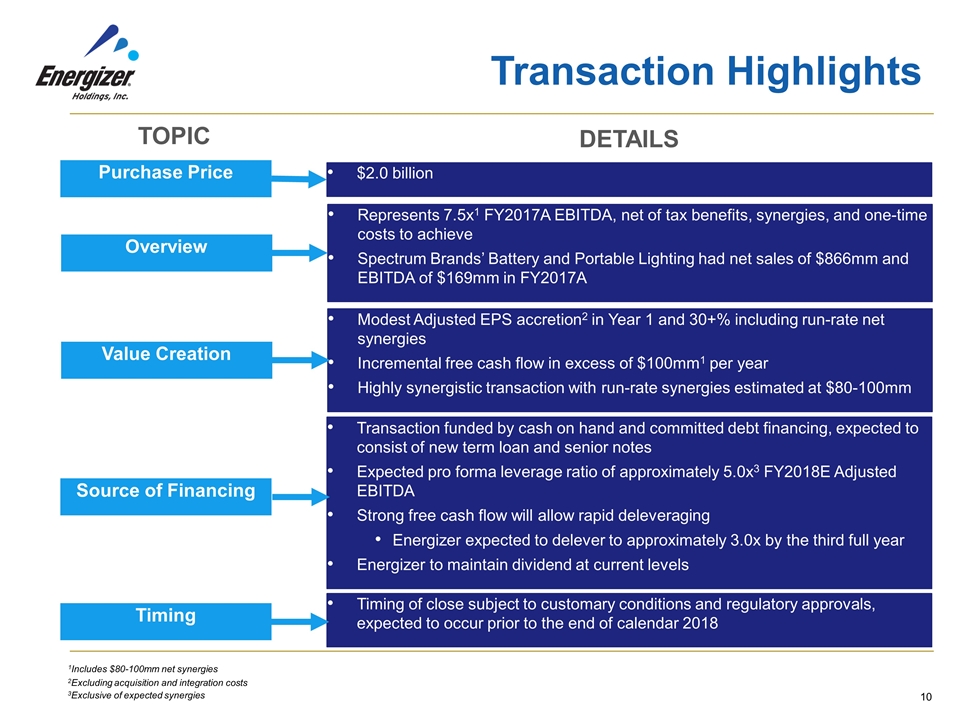

Transaction Highlights Purchase Price $2.0 billion Source of Financing Transaction funded by cash on hand and committed debt financing, expected to consist of new term loan and senior notes Expected pro forma leverage ratio of approximately 5.0x3 FY2018E Adjusted EBITDA Strong free cash flow will allow rapid deleveraging Energizer expected to delever to approximately 3.0x by the third full year Energizer to maintain dividend at current levels TOPIC DETAILS Overview Represents 7.5x1 FY2017A EBITDA, net of tax benefits, synergies, and one-time costs to achieve Spectrum Brands’ Battery and Portable Lighting had net sales of $866mm and EBITDA of $169mm in FY2017A Value Creation Modest Adjusted EPS accretion2 in Year 1 and 30+% including run-rate net synergies Incremental free cash flow in excess of $100mm1 per year Highly synergistic transaction with run-rate synergies estimated at $80-100mm Timing Timing of close subject to customary conditions and regulatory approvals, expected to occur prior to the end of calendar 2018 1Includes $80-100mm net synergies 2Excluding acquisition and integration costs 3Exclusive of expected synergies

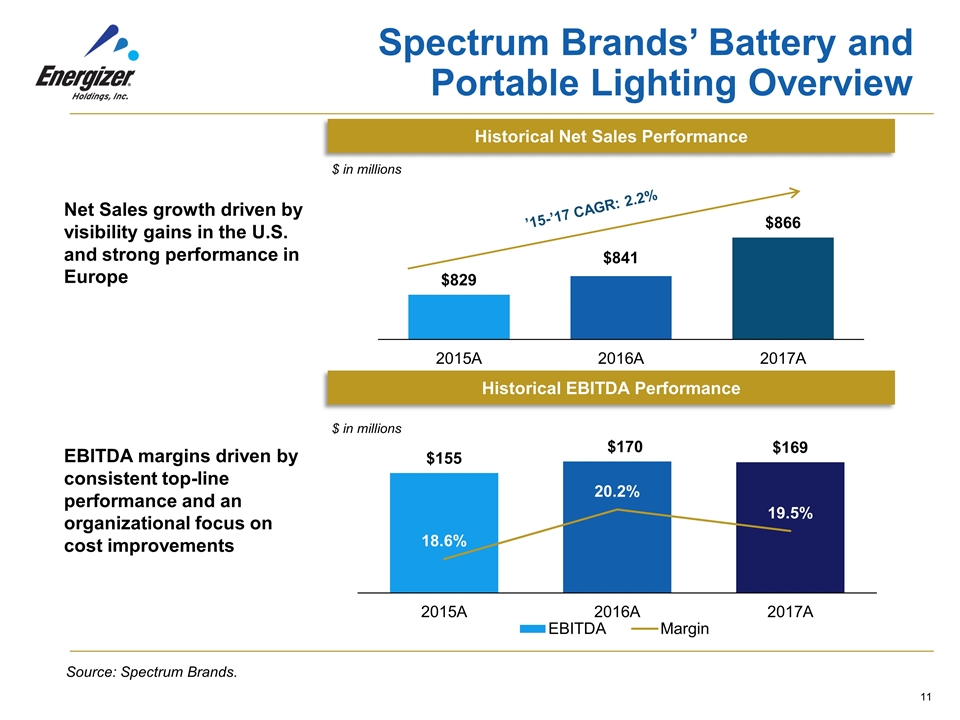

Spectrum Brands’ Battery and Portable Lighting Overview Net Sales growth driven by visibility gains in the U.S. and strong performance in Europe EBITDA margins driven by consistent top-line performance and an organizational focus on cost improvements 12 Historical Net Sales Performance Historical EBITDA Performance ’15-’17 CAGR: 2.2% Source: Spectrum Brands.

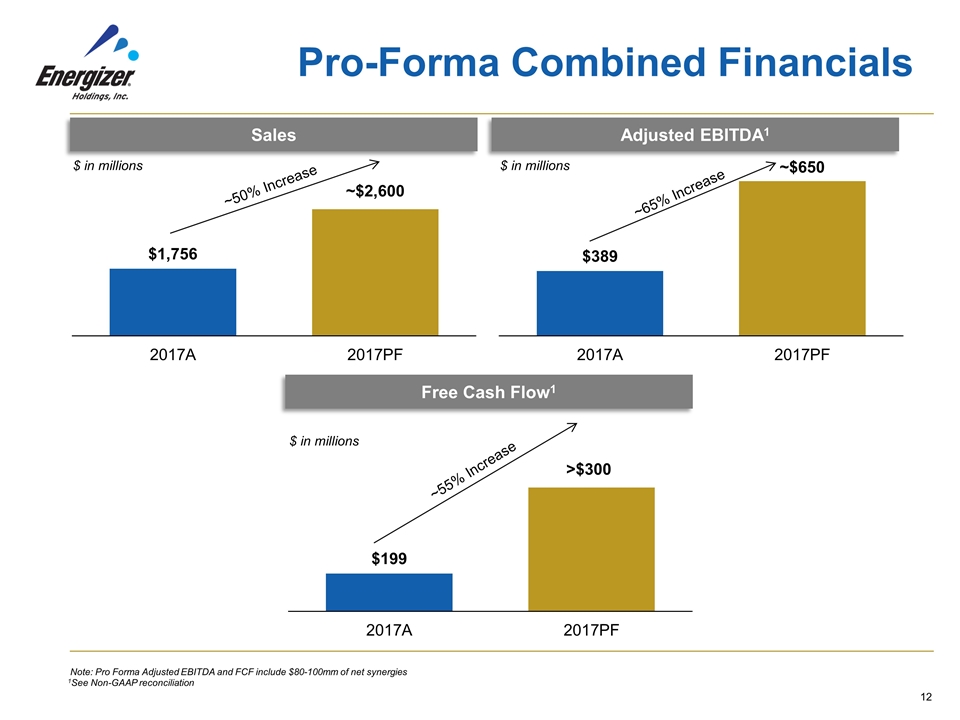

Pro-Forma Combined Financials 13 Sales Adjusted EBITDA1 Free Cash Flow1 Note: Pro Forma Adjusted EBITDA and FCF include $80-100mm of net synergies ~50% Increase ~65% Increase ~55% Increase 1See Non-GAAP reconciliation

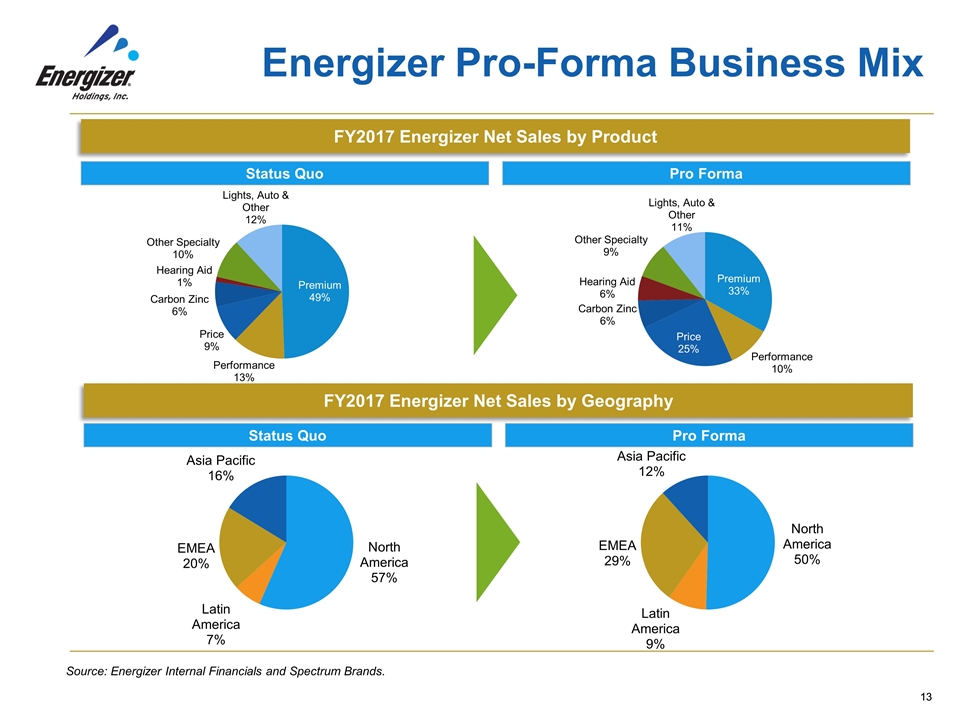

Energizer Pro-Forma Business Mix 10 FY2017 Energizer Net Sales by Geography Status Quo Pro Forma FY2017 Energizer Net Sales by Product Status Quo Pro Forma Source: Energizer Internal Financials and Spectrum Brands.

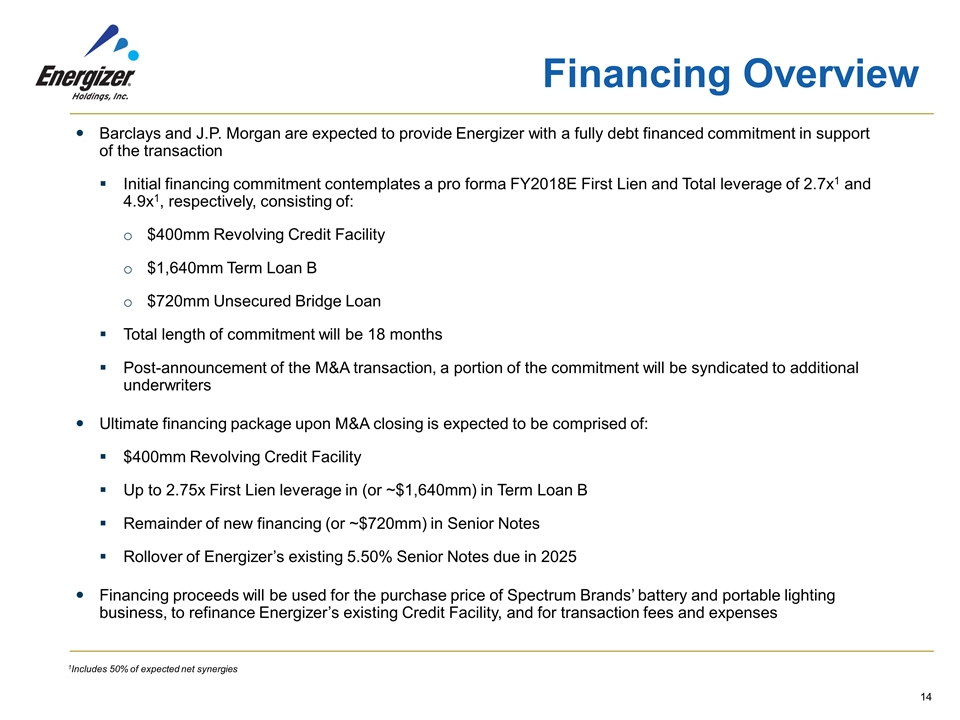

Barclays and J.P. Morgan are expected to provide Energizer with a fully debt financed commitment in support of the transaction Initial financing commitment contemplates a pro forma FY2018E First Lien and Total leverage of 2.7x1 and 4.9x1, respectively, consisting of: $400mm Revolving Credit Facility $1,640mm Term Loan B $720mm Unsecured Bridge Loan Total length of commitment will be 18 months Post-announcement of the M&A transaction, a portion of the commitment will be syndicated to additional underwriters Ultimate financing package upon M&A closing is expected to be comprised of: $400mm Revolving Credit Facility Up to 2.75x First Lien leverage in (or ~$1,640mm) in Term Loan B Remainder of new financing (or ~$720mm) in Senior Notes Rollover of Energizer’s existing 5.50% Senior Notes due in 2025 Financing proceeds will be used for the purchase price of Spectrum Brands’ battery and portable lighting business, to refinance Energizer’s existing Credit Facility, and for transaction fees and expenses Financing Overview 1Includes 50% of expected net synergies

We expect to file for regulatory clearance in the necessary jurisdictions, including the U.S. Subject to these regulatory approvals, we expect to be able to complete the transaction by the end of calendar 2018. Next Steps

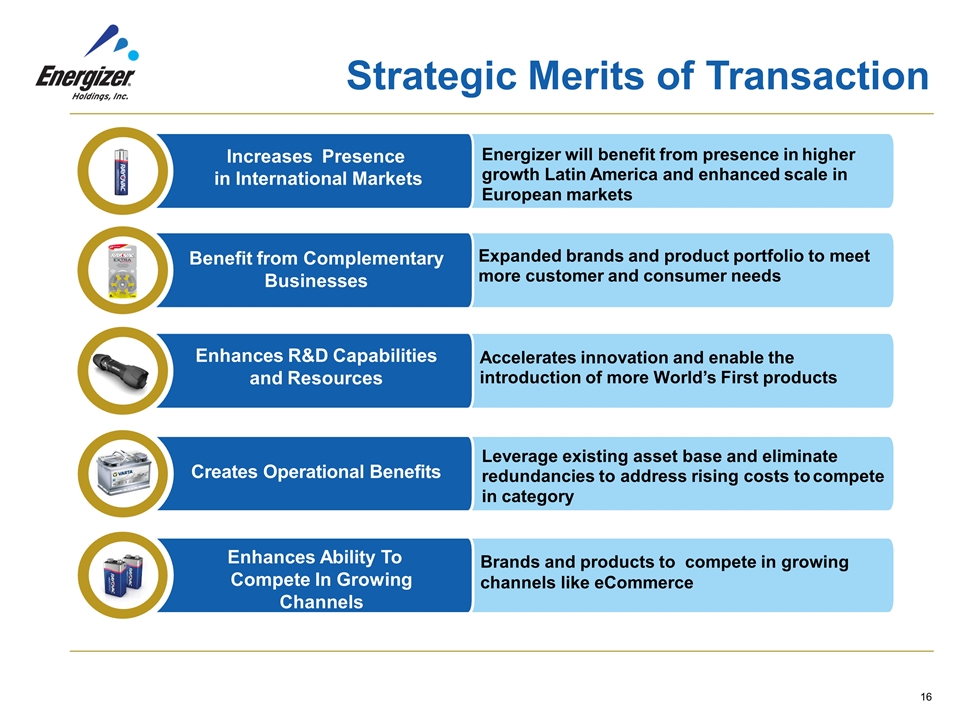

Strategic Merits of Transaction Brands and products to compete in growing channels like eCommerce Expanded brands and product portfolio to meet more customer and consumer needs Energizer will benefit from presence in higher growth Latin America and enhanced scale in European markets Increases Presence in International Markets Enhances Ability To Compete In Growing Channels Leverage existing asset base and eliminate redundancies to address rising costs to compete in category Accelerates innovation and enable the introduction of more World’s First products Benefit from Complementary Businesses Enhances R&D Capabilities and Resources Creates Operational Benefits

Q&A

APPENDIX

Energizer FY 2017 Non-GAAP Reconciliations 6 Net cash from operating activities $ 197.2 Capital expenditures (25.2) Proceeds from sale of assets 27.2 Free Cash Flow $ 199.2 Net earnings $ 201.5 Income tax provision 71.8 Earnings before income taxes $ 273.3 Interest Expense 53.1 Depreciation & amortization 50.2 EBITDA $ 376.6 Adjustments: Acquisition and integration costs 8.4 Spin restructuring (3.8) Gain on sale of real estate (16.9) Share based payments 24.3 Adjusted EBITDA $ 388.6 EBITDA and Adjusted EBITDA. EBITDA is defined as earnings from continuing operations before income tax expense, interest and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to acquisition and integration costs, the spin, gain on sale of real estate and share-based payments. Free Cash Flow. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales. All numbers are mm