Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CROWN HOLDINGS INC | d464409d8k.htm |

Exhibit 99.1

Unless the context otherwise requires: (i) “Crown” refers to Crown Holdings, Inc. and its subsidiaries on a consolidated basis, which, after consummation of the Signode Acquisition, will include Signode and its subsidiaries; (ii) “Crown Cork” refers to Crown Cork & Seal Company, Inc. and not its subsidiaries; (iii) “Crown European Holdings” refers to Crown European Holdings S.A. and not its subsidiaries; (iv) “Crown Americas” refers to Crown Americas LLC and not its subsidiaries; (v) “Crown Americas Capital VI” refers to Crown Americas Capital Corp. VI and not its subsidiaries; (vi) “Signode” refers collectively to Signode Industrial Group Holdings (Bermuda) Ltd. and its subsidiaries on a consolidated basis, and (vii) the “Merger Agreement” refers to that certain Agreement and Plan of Merger, dated as of December 19, 2017, as amended and restated on December 26, 2017, by and among Crown, Signode, Cobra Merger Sub, Ltd., and TC Group VI, L.P., solely in its capacity as the shareholders’ representative. Unless otherwise indicated, the information herein relating to Crown and its business does not give pro forma effect to the Signode Acquisition and the financing structure established to fund the Signode Acquisition. The unaudited pro forma condensed combined and consolidated pro forma financial information assumes that Crown acquires entities, properties and assets representing 100% of the net sales generated by Signode and its consolidated subsidiaries for the twelve months ended September 30, 2017.

FORWARD-LOOKING STATEMENTS

Statements included herein that are not historical facts (including any statements concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto) are “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements can be identified by words, such as “believes,” “estimates,” “anticipates,” “expects” and other words of similar meaning in connection with a discussion of future operating or financial performance. These may include, among others, statements relating to:

| • | the new senior notes offerings and the use of proceeds therefrom described herein, and Crown’s ability to implement the offerings on the terms described herein; |

| • | Crown’s plans or objectives for future operations, products or financial performance; |

| • | Crown’s indebtedness and other contractual obligations; |

| • | the impact of an economic downturn or growth in particular regions; |

| • | anticipated uses of cash; |

| • | cost reduction efforts and expected savings; |

| • | Crown’s policies with respect to executive compensation; and |

| • | the expected outcome of contingencies, including with respect to asbestos-related litigation and Crown’s and Signode’s pension and postretirement liabilities. |

These forward-looking statements are made based upon Crown’s expectations and beliefs concerning future events impacting Crown and, therefore, involve a number of risks and uncertainties. Crown cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

Important factors that could cause the actual results of operations or financial condition of Crown to differ include, but are not necessarily limited to:

| • | the ability of Crown to expand successfully in international and emerging markets; |

| • | whether the Signode Acquisition is consummated; |

| • | whether the acquisition of Signode will be accretive to Crown’s earnings; |

| • | whether the sales and profits of Signode will continue to grow; |

| • | whether the combination of Crown and Signode will provide benefits to customers and shareholders; |

| • | whether the operations of Signode can be successfully integrated into Crown’s operations; |

1

| • | the ability of Crown to repay, refinance or restructure its short and long-term indebtedness on adequate terms and to comply with the terms of its agreements relating to debt; |

| • | the impact of the recent European Sovereign debt crisis; |

| • | the impact of the United Kingdom’s expected withdrawal from the European Union; |

| • | Crown’s ability to generate significant cash to meet its obligations and invest in its business and to maintain appropriate debt levels; |

| • | restrictions on Crown’s use of available cash under its debt agreements; |

| • | changes or differences in U.S. or international economic or political conditions, such as inflation or fluctuations in interest or foreign exchange rates (and the effectiveness of any currency or interest rate hedges), tax rates and tax laws (including with respect to taxation of unrepatriated non-U.S. earnings or as a result of the depletion of net loss or foreign tax credit carryforwards); |

| • | the impact of health care reform in the United States; |

| • | the impact of the Tax Act (as defined below) on Crown and Signode; |

| • | the impact of foreign trade laws and practices; |

| • | the collectability of receivables; |

| • | war or acts of terrorism that may disrupt Crown’s production or the supply or pricing of raw materials, including in Crown’s Middle East operations, impact the financial condition of customers or adversely affect Crown’s ability to refinance or restructure its remaining indebtedness; |

| • | changes in the availability and pricing of raw materials (including aluminum can sheet, steel tinplate, energy, water, inks and coatings) and Crown’s ability to pass raw material, energy and freight price increases and surcharges through to its customers or to otherwise manage these commodity pricing risks; |

| • | Crown’s ability to obtain and maintain adequate pricing for its products, including the impact on Crown’s revenue, margins and market share and the ongoing impact of price increases; |

| • | energy and natural resource costs; |

| • | the cost and other effects of legal and administrative cases and proceedings, settlements and investigations; |

| • | the outcome of asbestos-related litigation (including the number and size of future claims and the terms of settlements, and the impact of bankruptcy filings by other companies with asbestos-related liabilities, any of which could increase the asbestos-related costs of Crown Cork & Seal Company, Inc., a subsidiary of Crown (“Crown Cork”) over time, the adequacy of reserves established for asbestos-related liabilities, Crown Cork’s ability to obtain resolution without payment of asbestos-related claims by persons alleging first exposure to asbestos after 1964, and the impact of state legislation dealing with asbestos liabilities and any litigation challenging that legislation and any future state or federal legislation dealing with asbestos liabilities); |

| • | Crown’s ability to realize deferred tax benefits; |

| • | changes in Crown’s critical or other accounting policies or the assumptions underlying those policies; |

| • | labor relations and workforce and social costs, including Crown’s and Signode’s pension and postretirement obligations and other employee or retiree costs; |

| • | investment performance of Crown’s pension plans; |

| • | costs and difficulties related to the acquisition of a business and integration of acquired businesses, including the integration of Signode; |

| • | the impact of any potential dispositions, acquisitions or other strategic realignments, which may impact Crown’s operations, financial profile, investments or levels of indebtedness; |

| • | Crown’s ability to realize efficient capacity utilization and inventory levels and to innovate new designs and technologies for its products in a cost-effective manner; |

2

| • | competitive pressures, including new product developments, industry overcapacity, or changes in competitors’ pricing for products; |

| • | Crown’s ability to achieve high capacity utilization rates for its equipment; |

| • | Crown’s ability to maintain, develop and capitalize on competitive technologies for the design and manufacture of products and to withstand competitive and legal challenges to the proprietary nature of such technology; |

| • | Crown’s ability to protect its information technology systems from attacks or catastrophic failure; |

| • | the strength of Crown’s cyber-security; |

| • | Crown’s ability to generate sufficient production capacity; |

| • | Crown’s ability to improve and expand its existing product and product lines; |

| • | the impact of overcapacity on the end-markets Crown serves; |

| • | loss of customers, including the loss of any significant customers; |

| • | changes in consumer preferences for different packaging products; |

| • | the financial condition of Crown’s vendors and customers; |

| • | weather conditions, including their effect on demand for beverages and on crop yields for fruits and vegetables stored in food containers; |

| • | the impact of natural disasters, including in emerging markets; |

| • | changes in governmental regulations or enforcement practices, including with respect to environmental, health and safety matters and restrictions as to foreign investment or operation; |

| • | the impact of increased governmental regulation on Crown and its products, including the regulation or restriction of the use of bisphenol-A; |

| • | the impact of Crown’s recent initiatives to generate additional cash, including the reduction of working capital levels and capital spending; |

| • | the ability of Crown to realize cost savings from its restructuring programs; |

| • | Crown’s ability to maintain adequate sources of capital and liquidity; |

| • | costs and payments to certain of Crown’s executive officers in connection with any termination of such executive officers or a change in control of Crown; |

| • | the impact of existing and future legislation regarding refundable mandatory deposit laws in Europe for non-refillable beverage containers and the implementation of an effective return system; and |

| • | changes in Crown’s strategic areas of focus, which may impact Crown’s operations, financial profile or levels of indebtedness. |

While Crown periodically reassesses material trends and uncertainties affecting Crown’s results of operations and financial condition, Crown does not intend to review or revise any particular forward-looking statement in light of future events.

3

Crown Holdings, Inc.

Crown is a worldwide leader in the design, manufacture and sale of packaging products for consumer goods. Crown’s primary products include steel and aluminum cans for food, beverage, household and other consumer products, glass bottles for beverage products and metal vacuum closures and caps. These products are manufactured in Crown’s plants both within and outside the United States and are sold through Crown’s sales organization to the soft drink, food, citrus, brewing, household products, personal care and various other industries. At December 31, 2016, Crown operated 146 plants along with sales and service facilities throughout 36 countries and had approximately 24,000 employees.

For the fiscal year ended December 31, 2016 and the nine months ended September 30, 2017, Crown had net sales of approximately $8,284 million and $6,530 million, respectively, and Adjusted EBITDA (a non-GAAP measure that is defined in “—Summary Historical Financial Data for Crown”) of $1,325 million and $1,066 million, respectively, without giving effect to the Signode Acquisition. Approximately 77% of such net sales were derived from operations outside the United States, of which 55% of these non-U.S. revenues were derived from operations in the European Division, in the fiscal year ended December 31, 2016. Approximately 78% of such net sales were derived from operations outside the United States in the nine months ended September 30, 2017.

The following chart demonstrates the breadth of Crown’s product portfolio and its geographic presence by division:

| Americas | Europe | Asia-Pacific | ||||||||||

| Food cans |

* | * | * | |||||||||

| Beverage cans |

* | * | * | |||||||||

| Aerosol cans |

* | * | * | |||||||||

| Specialty cans |

* | * | * | |||||||||

| Glass bottles |

* | |||||||||||

| Closures and caps |

* | * | * | |||||||||

| Can-making equipment |

* | |||||||||||

Divisions and Operating Segments

Crown’s business is organized geographically within three divisions: Americas, Europe and Asia Pacific. Within each division, Crown is generally organized along product lines. Crown’s reportable segments within the Americas Division are Americas Beverage and North America Food. Crown’s reportable segments within the European Division are European Beverage and European Food. Crown’s Asia Pacific Division is a reportable segment which primarily consists of beverage can operations and also includes Crown’s non-beverage can operations, primarily food cans and specialty packaging. Crown’s non-reportable segments include its European specialty packaging business, its aerosol can businesses in North America and Europe and its tooling and equipment operations in the United States and United Kingdom.

4

Business Strengths

Crown’s principal strength lies in its ability to meet the changing needs of its global customer base with products and processes from a broad range of well-established packaging businesses. Crown believes that it is well-positioned within the packaging industry because of its:

| • | Global leadership positions. Crown is a leading producer of food, beverage and aerosol cans and of closures in North America, Europe and Asia. Crown maintains its leadership through an extensive geographic presence, with 146 plants located throughout the world as of December 31, 2016. Its large manufacturing base allows Crown to service its customers locally while achieving significant economies of scale. |

| • | Strong customer base. Crown provides packaging to many of the world’s leading consumer products companies. Major customers include Anheuser-Busch InBev, Coca-Cola, Cott Beverages, Heineken, Molson Coors and Pepsi-Cola, among others. These consumer products companies represent generally stable businesses that provide consumer staples such as soft drinks, alcoholic beverages, foods and household products. In addition, Crown has long-standing relationships with many of its largest customers. |

| • | Broad and diversified product base. Crown produces a wide array of products differentiated by type, purpose, size, shape and benefit to customers. Crown is not dependent on any specific product market since no product in any one geographical region represents a substantial share of total revenues. |

| • | Business and industry fundamentals. Fundamental changes in its business, including price increases, cost reduction initiatives and working capital reductions, have improved Crown’s business outlook. |

| • | Technological leadership resulting in superior new product and process development. Crown believes that it possesses the technology, processes and research, development and engineering capabilities to allow it to provide innovative and value-added packaging solutions to its customers, as well as to design cost-efficient manufacturing systems and materials. |

| • | Financially disciplined management team. Crown’s current executive leadership is focused on improving profit and increasing free cash flow. |

| • | All levels of Crown’s management are committed to minimizing capital employed in their respective businesses. |

| • | Crown is prudent about its capital spending, attempting to pursue projects that provide an adequate return. In place of high capital spending, Crown attempts to maximize the usefulness of all assets currently employed. |

Business Strategy

Crown has several key business strategies:

| • | Grow in targeted markets. Crown plans to capitalize on its leading food, beverage and aerosol can positions by targeting geographic areas with strong growth potential. Crown believes that it is well-positioned to take advantage of the growth potential in Southern and Eastern Europe with numerous food and beverage can plants already established in those markets. In addition, as a leading packaging supplier to the Middle Eastern, Southeast Asian and Latin American markets, Crown will work to benefit from the anticipated growth in the consumption of consumer goods in these regions. Crown may consider acquisitions to grow its business (within developed or developing markets). |

| • | Increase margins through ongoing cost reductions. Crown plans to continue to reduce manufacturing costs, enhance efficiencies and drive return on invested capital through investments in equipment and technology and through improvements in productivity and material usage and by maintaining a disciplined approach to managing supplier contracts. |

| • | Maximize cash flow generation. Crown has established performance-based incentives to increase its free cash flow and operating income. In recent years Crown has used available cash flow to complete acquisitions, invest in emerging markets and repurchase Crown common stock, and Crown may in the future use free cash flow to reduce indebtedness, complete acquisitions, invest in emerging or developed markets, repurchase stock or to fund regular dividend payments on Crown common stock. |

| • | Crown uses the economic profit concept in connection with its executive compensation program, which requires each business unit to exceed prior year’s returns on the capital that it employs. |

| • | Crown will continue to attempt to focus its capital expenditures on projects that provide an adequate return. |

5

| • | Serve the changing needs of the world’s leading consumer products companies through technological innovation. Crown intends to capitalize on the demand of its customers for higher value-added packaging products. By continuing to improve the physical attributes of its products, such as strength of materials and graphics, Crown plans to further improve its existing customer relationships, as well as attract new customers. |

Recent Developments

Signode Acquisition

In December 2017, Crown signed the Merger Agreement, which provides for the acquisition (subject to the satisfaction or waiver of the closing conditions in the Merger Agreement) by Crown of Signode (the “Signode Acquisition”), a leading global provider of transit packaging systems and solutions, from an affiliate of the Carlyle Group, in a cash transaction valued at $3.91 billion subject to customary closing adjustments. The Signode Acquisition is expected to close in the first quarter of 2018. However, given the number of jurisdictions in which antitrust approval is required, there is no assurance that the acquisition can be completed on that timeframe. The net proceeds from the new senior notes offerings, borrowings under Crown’s credit agreement and available cash on hand will be used to pay the cash consideration for the Signode Acquisition, refinance Signode’s existing indebtedness and pay costs and expenses related to the foregoing.

Signode Industrial Group

Signode is a leading global provider of industrial systems and solutions, including both consumables and equipment. It was formed through the combination of various businesses as a division of Illinois Tool Works, prior to being divested to The Carlyle Group in May 2014. Signode’s products are used to contain, unitize, and protect goods during manufacturing, transport, and warehousing and are sold around the world under various brand names, such as Signode, Strapex, Orgapack, Shippers Airbags, Angleboard, and Mima. Signode serves diverse end markets that include metals, food and beverage, construction, agricultural, corrugated and general industrial.

Signode’s key products fall in the following categories:

Steel and Plastic Strap Consumables: Steel and plastic strapping consumables are predominantly used to contain, unitize, and protect goods during manufacturing, transport, and warehousing. Steel and plastic packaging consumables can vary by width, thickness, and grade, which collectively impact strapping strength. Steel strap is typically stronger than plastic strap and is therefore used in more heavy duty applications that could potentially rip and tear plastic strapping. However, Signode has recently begun offering a stronger polyester (“PET”) strap that has allowed customers to substitute PET strap for steel strap even in certain heavy-duty applications. Signode’s strap platforms sell its strapping consumables across end markets, often addressing specific needs on a customer-by-customer basis.

Stretch Consumables: Signode manufactures conventional, oriented and silage stretch film. These products are designed for hand-wrapping and machine use.

Protective Packaging Consumables: Signode’s Protective Packaging business units sell a variety of goods that are used to secure goods during transport. These goods range from paper and re-usable polypropylene airbags to friction slip mats that are used by transporters to protect cargo. Airbags products fit in voids between goods during transportation. Corrugated and kraft paper honeycomb products are used as void-fillers, panels and pads. Edge protection products are focused on corner protection, stacking strength, and unitization of palletized and bundled goods during warehousing and transport.

Strap and Stretch Equipment and Tools: Strap packaging equipment is used to apply steel and plastic strapping consumables to boxes, pallets, raw materials, and other goods. This equipment can be broken down into three categories: hand tools, general purpose machines and special application machines. Hand tools are used throughout manufacturing, logistics operations, and job sites to secure strapping around goods. Medium-sized machines are typically located at the end of a stage within a manufacturing or logistics operation, where items are strapped together in an automated process. Special application equipment is typically large, automatic strapping machines that are developed with specific customer needs in mind and integrated into a complex production line. Signode designs and manufactures stretch wrap application equipment and other end-of-line packaging systems for a variety of end uses globally. Stretch wrap application equipment varies by application technique and speed and includes ring, stretch hood, turntable and rotary arm designs. Signode provides onsite initial installation and maintenance services for its tools and equipment and has a team of service technicians to address spare part sales, rebuilds, general machine services and other support. In addition, Signode offers monitoring systems on its installed base of equipment that provides real time productivity and efficiency analysis.

6

Signode’s products are essential to its customers’ manufacturing, protection and product transportation operations. Although the cost of Signode’s consumable products typically represent a small percentage of the value of goods they protect, they are critical to customer operations since product failure could lead to damaged goods, manufacturing line disruptions, or personal safety concerns in certain applications. Signode’s equipment, which in many cases is directly integrated into customers’ manufacturing lines, facilitates efficient application of strap and film products. Signode’s full systems offering, comprised of consumables, equipment and related services, provides an advantage to customers in terms of greater productivity, reliability, uptime and aftermarket support. Signode’s long operational history has resulted in a large installed base of our equipment, which drives recurring revenue through the sale of consumables, parts and service offerings and future equipment replacement sales.

For the fiscal year ended December 31, 2016 and the nine months ended September 30, 2017, Signode had net sales of approximately $2,134.2 million and $1,666.0 million, respectively.

Signode serves customers in approximately 60 countries on six continents, and generated approximately 52% of 2016 net sales in North and South America, 33% in Europe, and 15% in Asia Pacific. No single customer represents more than 1.3% of Signode’s 2016 revenue and the top ten customer represent less than 10% of 2016 revenue. In addition, as of September 30, 2017, Signode operated 93 manufacturing facilities in 23 countries and maintained a global network of sales, distribution, research and development and corporate offices. As of January 2018, Signode had approximately 7,000 employees worldwide.

Signode’s primary raw material purchases consist of plastic resins, polyester, polypropylene, steel, recycled products, and paper/paperboard. Signode maintains a broad supplier network across its platforms to ensure adequate diversity of raw materials needed to create our reliable products.

Despite historical volatility in primary raw material prices, Signode has maintained stable margins. Signode actively manages the spread between sales price and raw material costs to maintain spread over time and have shown an ability to pass through raw material fluctuations. In the case of steel strap, Signode maintains a reciprocal buy-sell relationship with several steel mills, whereby Signode purchases large coils of hot roll steel and sells manufactured steel strap back to the mills. These relationships benefit Signode by ensuring that each side of the value chain understands the impact of changes in commodity prices.

As of December 31, 2016, Signode’s patent portfolio consisted of approximately 335 United States issued patents or pending patent applications and over 1,300 foreign issued patents or pending patent applications. The portfolio broadly covers about 400 customized technologies and spans approximately 38 countries in which Signode operates.

Concurrent Credit Facilities Financing

In December 2017, Crown amended its credit agreement to provide for incremental “term B” senior secured credit facilities and to permit the Signode Acquisition. Simultaneous with the offering of the new senior notes, Crown intends to enter into an incremental amendment to its credit agreement to provide for incremental senior secured credit facilities consisting of a U.S. dollar denominated “term B” loan in an amount equal to $1,250 million, maturing seven years after the closing date of the Signode Acquisition, and a Euro denominated “term B” loan in an amount equal to €750 million, maturing seven years after the closing date of the Signode Acquisition (together, the “Incremental Term Facilities”). Such incremental amendment will not become effective until the closing date of the Signode Acquisition, at which time Crown intends to borrow under the Incremental Term Loan Facilities to partially finance the Signode Acquisition.

In December 2017, the credit agreement was also amended, among other things, to (i) amend the restrictive covenants regarding indebtedness and liens to permit the incurrence of debt to fund the Signode Acquisition, including the Incremental Term Facilities, the new senior notes, (ii) include a customary excess cash flow mandatory prepayment provision and (iii) modify the total leverage ratio financial maintenance covenant.

Additionally, Crown has obtained commitments to increase its (i) U.S. dollar revolving credit facility from $650 million to $670 million and (ii) multicurrency revolving credit facility from $700 million to $930 million.

7

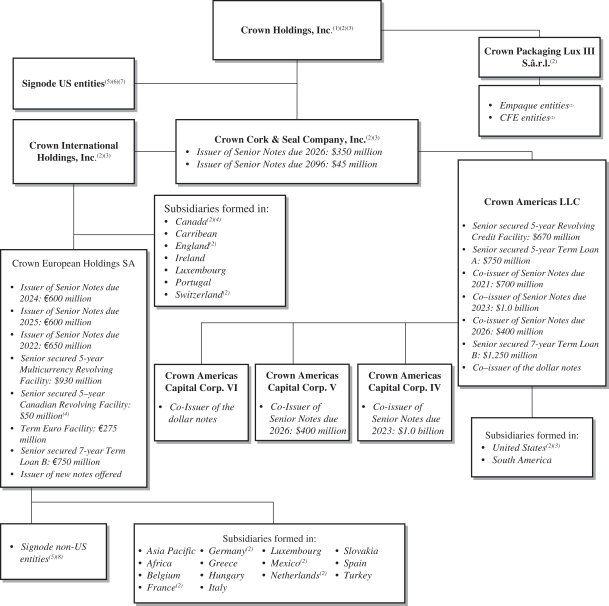

Organizational Structure

The following chart shows a summary of Crown’s current organizational structure, as well as the applicable obligors under the new senior notes, other outstanding notes, and Crown’s senior secured credit facilities as of the date hereof after giving pro forma effect to the dollar new senior notes offerings and the Signode Acquisition. Crown may modify this proposed corporate structure in the future, subject to the covenants in the indenture governing the notes and compliance with the agreements governing Crown’s other outstanding indebtedness. The new senior notes will be guaranteed on an unsecured basis by (i) Crown and, subject to applicable law and exceptions described herein, each of Crown’s subsidiaries in the United States, Canada, England, Luxembourg, Mexico, the Netherlands, Switzerland and Spain that is an obligor under Crown’s senior secured credit facilities or that guarantees or otherwise becomes liable with respect to any other indebtedness of Crown, the issuer or another guarantor and (ii) subject to applicable law and exceptions described herein, each of the issuer’s subsidiaries that guarantees or otherwise becomes liable with respect to any indebtedness of Crown, the issuer or another guarantor or is otherwise an obligor under Crown’s senior secured credit facilities which as of the issue date of the notes is expected to include certain subsidiaries organized under the laws of France, Germany, Mexico and the Netherlands. The guarantees will rank equal in right of payment to all existing and future senior debt of Crown and such guarantors. After consummation of the Signode Acquisition and subject to certain exceptions, the Signode entities organized under the laws of the United States, England, Germany, Mexico, Canada, Luxembourg, Switzerland, Spain and the Netherlands are expected (i) to become guarantors of the outstanding senior secured credit facilities of Crown European Holdings and (ii) if such guarantees are provided, to guarantee the notes on an unsecured basis.

8

| 1) | Guarantor of outstanding debentures of Crown Cork. |

| 2) | Guarantors of outstanding senior notes and senior secured credit facilities of Crown European Holdings and its subsidiaries and guarantors of Crown European Holdings’ obligations under the notes offered hereby, with the exception of: (i) the U.S. subsidiaries Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV and Crown Americas Capital Corp. V, which guarantee the senior secured credit facilities but not the outstanding senior notes of Crown European Holdings, the notes offered hereby or the dollar notes, and Crown Americas Capital Corp. VI, which will guarantee the senior secured credit facilities but not the outstanding senior notes of Crown European Holdings or the notes offered hereby, (ii) the U.S. subsidiaries Crownway Insurance Company and Crown, Cork & Seal Receivables (DE) Corporation, who do not guarantee the senior secured credit facilities, the outstanding senior notes of Crown European Holdings, the notes offered hereby or the dollar |

| 3) | Guarantors of the outstanding notes of Crown Americas LLC, Crown Americas Capital Corp. IV, Crown Americas Capital Corp. V and certain of the new senior notes, with the exception of the following U.S. subsidiaries: Crown Americas Capital Corp., Crown Americas Capital Corp. II, Crown Americas Capital Corp. III, Crown Americas Capital Corp. IV, Crown Americas Capital Corp. V, Crownway Insurance Company and Crown, Cork & Seal Receivables (DE) Corporation. |

| 4) | Crown Metal Packaging Canada LP serves as the Canadian borrower. |

| 5) | After the consummation of the Signode Acquisition, certain of Signode’s subsidiaries organized in the United States, England, Germany, Mexico, Canada, France, Luxembourg, Switzerland, Spain and the Netherlands are expected (i) to become guarantors of the outstanding senior secured credit facilities of Crown European Holdings and (ii) if such guarantees are provided, to guarantee the outstanding senior notes of Crown European Holdings and certain of the new senior notes on an unsecured senior basis. |

| 6) | Assumes Signode’s subsidiaries organized in the United States are either purchased separately by Crown immediately prior to the Signode Acquisition, as provided at Crown’s option pursuant to the Merger Agreement, or transferred to Crown Holdings, Inc. (or one of its direct or indirect subsidiaries) subsequent thereto. |

| 7) | After the consummation of the Signode Acquisition, certain of Signode’s subsidiaries organized in the United States are expected (i) to become guarantors of the outstanding senior secured credit facilities of Crown Americas and (ii) if such guarantees are provided, to guarantee the outstanding senior notes of Crown Americas, Crown Americas Capital Corp. IV, Crown Americas Capital Corp. V and the new senior notes on an unsecured senior basis. |

| 8) | Assumes that the Signode Acquisition is consummated through a merger of Signode with a wholly-owned direct or indirect subsidiary of Crown European Holdings. |

Crown is a Pennsylvania corporation. Crown’s principal executive offices are located at One Crown Way, Philadelphia, Pennsylvania 19154, and its telephone number is (215) 698-5100. Crown Cork is a Pennsylvania corporation. Crown Americas (formerly known as Crown Americas, Inc.) is a Pennsylvania limited liability company. Crown Americas Capital VI is a Delaware corporation and Crown European Holdings (formerly known as CarnaudMetalbox SA) is a société anonyme organized under the laws of France. Each of Crown Americas, Crown Americas Capital VI and Crown European Holdings is an indirect, wholly-owned subsidiary of Crown, and Crown Cork is a direct, wholly-owned subsidiary of Crown.

9

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION AND OTHER INFORMATION

($ in millions)

The following table presents summary unaudited pro forma condensed combined consolidated financial information and has been prepared to reflect the effects of the Signode Acquisition, the new senior notes offerings and borrowings under the Term Loan B Facilities and revolving credit facility on Crown’s financial statements. Such information is based on certain assumptions that management currently believes are directly attributable to these transactions, factually supportable and, with respect to the statements of operations, expected to have a continuing impact on Crown’s consolidated results. The unaudited pro forma condensed combined and consolidated pro forma financial information assumes that Crown acquires entities, properties and assets representing 100% of the net sales generated by Signode and its consolidated subsidiaries for the twelve months ended September 30, 2017.

The unaudited pro forma condensed consolidated balance sheet data as of September 30, 2017 presents the condensed consolidated balance sheet of Crown and gives effect to the consummation of Signode Acquisition, the new senior notes offerings and borrowings under the Term Loan B Facilities and revolving credit facility as if they had occurred on September 30, 2017. The unaudited pro forma condensed combined and consolidated statement of operations data for the twelve months ended December 31, 2016 and September 30, 2017 present the condensed combined and consolidated statements of operations of Crown, giving effect to the consummation of the Signode Acquisition, the new senior notes offerings and borrowings under the Term Loan B Facilities and revolving credit facility as if they had occurred on January 1, 2016.

The pro forma financial data for the twelve months ended September 30, 2017 was derived by adding our unaudited pro forma financial data for the year ended December 31, 2016 to our unaudited financial data for the nine months ended September 30, 2017, and subtracting our unaudited pro forma financial data for the nine months ended September 30, 2016.

The unaudited pro forma condensed combined and consolidated financial information is provided for informational purposes only. The unaudited pro forma condensed combined and consolidated financial information does not purport to represent what Crown’s results of operations or financial condition would have been had the Signode Acquisition and the new senior notes offerings actually occurred on the dates indicated and does not purport to project Crown’s results of operations or financial condition for any future period or as of any future date. In addition, the unaudited pro forma condensed combined and consolidated financial information has not been adjusted to reflect any matters not directly attributable to implementing the Signode Acquisition and the new senior notes offerings. No adjustment, therefore, has been made for actions that may be taken once the transactions close, such as any of Crown’s integration plans related to Signode. As a result, the actual amounts recorded in the consolidated financial statements of Crown may differ from the amounts reflected in the unaudited pro forma condensed combined and consolidated financial information, and the differences may be material.

10

There can be no assurance that the issuer will consummate the Signode Acquisition. In the event that the Signode Acquisition is not consummated for any reason, we would be forced to redeem the notes pursuant to the special mandatory redemption and the below pro forma information would no longer be relevant.

| Pro Forma Year Ended December 31, 2016 |

Pro Forma Twelve Months Ended September 30, 2017 |

|||||||

| Summary of Operations Data: |

||||||||

| Net sales |

$ | 10,418 | $ | 10,646 | ||||

| Cost of products sold, excluding depreciation and amortization |

8,089 | 8,294 | ||||||

| Depreciation and amortization |

431 | 424 | ||||||

| Selling and administrative expense |

639 | 638 | ||||||

| Provision for asbestos |

21 | 21 | ||||||

| Restructuring and other |

78 | 73 | ||||||

|

|

|

|

|

|||||

| Income from operations |

1,160 | 1,196 | ||||||

| Loss from early extinguishments of debt |

37 | 7 | ||||||

| Interest expense |

379 | 385 | ||||||

| Interest income |

(13 | ) | (15 | ) | ||||

| Foreign exchange |

(21 | ) | 30 | |||||

|

|

|

|

|

|||||

| Income before income taxes |

778 | 789 | ||||||

| Provision for income taxes |

188 | 219 | ||||||

|

|

|

|

|

|||||

| Net income |

590 | 570 | ||||||

| Net income attributable to noncontrolling interests |

(87 | ) | (105 | ) | ||||

|

|

|

|

|

|||||

| Net income attributable to Crown Holdings |

$ | 503 | $ | 465 | ||||

|

|

|

|

|

|||||

| Balance Sheet Data (at end of period): |

||||||||

| Cash and cash equivalents |

$ | 365 | ||||||

| Working capital |

416 | |||||||

| Total assets |

15,192 | |||||||

| Total liabilities |

14,105 | |||||||

| Total equity |

1,087 | |||||||

| Pro Forma Financial Data: |

||||||||

| EBITDA(1) |

$ | 1,575 | $ | 1,583 | ||||

| Adjusted EBITDA(2) |

1,692 | 1,725 | ||||||

| Total secured debt(3) |

— | 3,270 | ||||||

| Total debt(4) |

— | 9,271 | ||||||

| Total net debt(5) |

— | 8,906 | ||||||

| Net interest expense(6) |

366 | 370 | ||||||

| Ratio of total secured debt to Adjusted EBITDA |

— | 1.90x | ||||||

| Ratio of total debt to Adjusted EBITDA |

— | 5.37x | ||||||

| Ratio of total net debt to Adjusted EBITDA |

— | 5.16x | ||||||

11

| (1) | EBITDA is a non-GAAP measurement that consists of net income plus the sum of income taxes, interest expense (net of interest income) and depreciation and amortization. The reconciliation from income from continuing operations to EBITDA is as follows: |

| Year Ended December 31, 2016 | Twelve months ended September 30, 2017 | |||||||||||||||||||||||||||||||

| Pro Forma | Pro Forma | Pro Forma | Pro Forma | |||||||||||||||||||||||||||||

| Crown | Signode | Adjustments | Combined | Crown | Signode | Adjustments | Combined | |||||||||||||||||||||||||

| Net income |

$ | 583 | $ | 23 | $ | (16 | ) | $ | 590 | $ | 582 | $ | 8 | $ | (20 | ) | $ | 570 | ||||||||||||||

| Provision for income taxes |

186 | 7 | (5 | ) | 188 | 213 | 12 | (6 | ) | 219 | ||||||||||||||||||||||

| Interest expense |

243 | 116 | 20 | 379 | 249 | 127 | 9 | 385 | ||||||||||||||||||||||||

| Interest income |

(12 | ) | (1 | ) | — | (13 | ) | (14 | ) | (1 | ) | — | (15 | ) | ||||||||||||||||||

| Depreciation and amortization |

247 | 183 | 1 | 431 | 242 | 165 | 17 | 424 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| EBITDA |

$ | 1,247 | $ | 328 | $ | — | $ | 1,575 | $ | 1,272 | $ | 311 | $ | — | $ | 1,583 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (2) | Adjusted EBITDA is a non-GAAP measure that (i) Crown calculates as EBITDA plus the sum of provision for asbestos, restructuring and other, including asset impairments, loss from early extinguishments of debt, fair value adjustment to inventory, timing impact of hedge ineffectiveness and foreign exchange and (ii) Signode’s Adjusted EBITDA is calculated as EBITDA plus the sum of net gain or loss on foreign exchange transactions, non-recurring expenses, sponsor management fee, other adjustments and impairment charges. |

| Year Ended December 31, 2016 | Twelve months ended September 30, 2017 | |||||||||||||||||||||||||||||||

| Crown | Signode | Pro Forma Adjustments |

Pro Forma Combined |

Crown | Signode | Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||||||||||||||

| EBITDA |

$ | 1,247 | $ | 328 | $ | — | $ | 1,575 | $ | 1,272 | $ | 311 | $ | — | $ | 1,583 | ||||||||||||||||

| Foreign exchange(a) |

(16 | ) | (6 | ) | (22 | ) | 10 | 20 | 30 | |||||||||||||||||||||||

| Loss from early extinguishments of debt |

37 | 37 | 7 | 7 | ||||||||||||||||||||||||||||

| Restructuring and other |

44 | 44 | 51 | 51 | ||||||||||||||||||||||||||||

| Other adjustments(b) |

26 | 26 | 13 | 13 | ||||||||||||||||||||||||||||

| Impairment charges(c) |

17 | 17 | 17 | 17 | ||||||||||||||||||||||||||||

| Non-recurring expenses |

(1 | ) | (1 | ) | — | |||||||||||||||||||||||||||

| Hedge ineffectiveness |

(8 | ) | (8 | ) | — | |||||||||||||||||||||||||||

| Provision for asbestos |

21 | 21 | 21 | 21 | ||||||||||||||||||||||||||||

| Sponsor management fee(d) |

3 | 3 | 3 | 3 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Adjusted EBITDA(e) |

$ | 1,325 | $ | 367 | $ | — | $ | 1,692 | $ | 1,361 | $ | 364 | $ | — | $ | 1,725 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Signode’s foreign exchange adjustment excludes the net gain or loss from both the foreign currency translation recognized on it’s €300 million Euro Term Loan and intercompany loans. |

| (b) | Signode’s other adjustments eliminate non-recurring charges including long-live asset impairment charges, inventory write-offs, losses from exiting a business, losses from Hurricane Harvey and other costs. |

| (c) | Signode’s impairment charge represents the non-cash costs associated with the impairment of certain goodwill and intangible assets. |

| (d) | Signode’s sponsor management fee represents the quarterly consulting fee paid to Carlyle Investment Management, LLC for consulting services and other expenses. |

| (e) | EBITDA and Adjusted EBITDA are provided for illustrative and informational purposes only and do not purport to represent, and should not be viewed as indicative of, actual or future financial condition or results of operations. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to net income, operating income, net cash provided by operating activities or any other measure of operating performance or liquidity that is calculated in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA information is unaudited and has been included herein because Crown believes that certain analysts, rating agencies and investors may use it as supplemental information to evaluate a company’s ability to service its indebtedness and overall performance over time. However, EBITDA and Adjusted EBITDA have material limitations as analytical tools and should not be considered in isolation, or as substitutes for analysis of results as reported under U.S. GAAP. A limitation associated with EBITDA and Adjusted EBITDA is that they do not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues. Any measure that eliminates components of the capital structure and costs associated with carrying significant amounts of assets on the balance sheet has material limitations as a performance measure. Management evaluates the costs of such tangible and intangible assets through other financial measures such as capital expenditures. In addition, in evaluating EBITDA and Adjusted EBITDA, you should be aware that the adjustments may vary from period to period and in the future Crown will incur expenses such as those used in calculating these measures. Furthermore, |

12

| EBITDA and Adjusted EBITDA, as calculated by Crown, may not be comparable to calculations of similarly titled measures by other companies. In light of the foregoing limitations, Crown does not rely solely on EBITDA and Adjusted EBITDA as performance measures and also considers its results as calculated in accordance with U.S. GAAP. |

| (3) | Total secured debt as of September 30, 2017 is presented as the principal outstanding after giving effect to the Signode Acquisition and the expected issuance of the notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds,” and the issuance of certain of the new senior notes and the expected application of the net proceeds therefrom, and consists of $745 million of U.S. dollar Term Loan, $321 million (€272 million) of Euro Term Loan, $1,250 million of U.S. dollar Term Loan B, $886 million (€750 million) of Euro Term Loan B, $49 million under the revolving credit facilities and $19 million of other secured indebtedness. |

| (4) | Total debt as of September 30, 2017 is presented as the principal outstanding after giving effect to the Signode Acquisition and the expected issuance of the notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds” and the issuance of certain of the new senior notes and the expected application of the net proceeds therefrom. Adjusted total debt of $9,158 million consists of $3,270 million of secured indebtedness, $5,836 million of senior notes, including the new senior notes and debentures and $165 million of other indebtedness. |

| (5) | Total net debt as of September 30, 2017 is presented as the principal outstanding after giving effect to the Signode Acquisition and the expected issuance of the notes and the expected application of the net proceeds therefrom described under the caption “Use of Proceeds” and the issuance of certain of the new senior notes and the expected application of the net proceeds therefrom less cash and cash equivalents as of September 30, 2017. |

| (6) | Net interest expense reflects the use of proceeds from the new senior notes offerings, together with other available funds, to consummate the Signode Acquisition, and was calculated using a blended interest rate of 3.40% on the new senior notes and the related Term Loan borrowings. |

13

An investment in the notes involves a high degree of risk. You should consider carefully the following risks involved in investing in the notes, as well as the other information contained herein, before deciding whether to purchase the notes.

Risks Related to the Signode Acquisition

The Signode Acquisition is subject to the satisfaction or waiver of a number of closing conditions, which could delay or materially adversely affect the timing of its completion, or prevent it from occurring.

The closing of the Signode Acquisition is dependent upon the satisfaction or waiver of conditions (some of which may not be waivable), including obtaining the approval of various competition authorities. In the event that these regulatory conditions are not satisfied or the satisfaction thereof is significantly delayed, it may prevent the Signode Acquisition from being consummated on the anticipated timeline, or at all.

In addition to the required regulatory clearances, the Signode Acquisition is subject to a number of other conditions beyond Crown’s and Signode’s control that may prevent, delay or otherwise materially adversely affect its completion. We cannot predict whether and when these other conditions will be satisfied.

Crown expects to incur substantial expenses related to the Signode Acquisition and the integration of Signode’s business into Crown’s if the Signode Acquisition is consummated.

Crown expects to incur substantial expenses in connection with the Signode Acquisition and the integration of Signode’s business with Crown’s. There are a large number of processes, policies, procedures, operations, technologies and systems that must be integrated, including purchasing, accounting and finance, sales, payroll, pricing, marketing and benefits. While Crown has assumed that a certain level of expenses will be incurred, there are many factors beyond its control that could affect the total amount or the timing of the integration expenses. Moreover, many of the expenses that will be incurred are, by their nature, difficult to estimate accurately. These integration expenses may result in Crown taking significant charges against earnings following the consummation of the Signode Acquisition, and the amount and timing of such charges are uncertain at present. As a result of the Signode Acquisition, Crown’s results of operations may be adversely affected.

Following the Signode Acquisition, if consummated, Crown may face integration difficulties and may be unable to integrate the business of Signode into its business successfully or realize the anticipated benefits of the Signode Acquisition.

Crown and Signode entered into the Merger Agreement with the expectation that the Signode Acquisition will result in various benefits for the combined company. Achieving the anticipated benefits of the Signode Acquisition is subject to a number of uncertainties, including whether the respective businesses and assets of both companies can be integrated in an efficient and effective manner. Crown will be required to devote significant management attention and resources to integrating the business practices and operations of Signode with those of Crown. Potential difficulties Crown may encounter as part of the integration process include the following:

| • | the inability to successfully combine the business of Signode with Crown in a manner that permits the parties to achieve the full revenue and other benefits anticipated to result from the Signode Acquisition; |

| • | complexities associated with managing the combined businesses, including difficulty addressing possible differences in corporate cultures and management philosophies and the challenge of integrating complex systems, technology, networks and other assets of each of the companies in a seamless manner that minimizes any adverse impact on customers, suppliers, employees and other constituencies; and |

| • | potential unknown liabilities and unforeseen increased expenses or delays associated with the Signode Acquisition. |

Even if Crown is able to integrate Signode’s businesses successfully, this integration may not result in the realization of the full benefits of the opportunities that it currently expects from this integration or that these

14

benefits will be achieved within the anticipated timeframe or at all. Moreover, Crown may incur substantial expenses in connection with the integration of Signode’s businesses. While Crown anticipates that certain expenses will be incurred, such expenses are difficult to estimate accurately, and may exceed current estimates. Accordingly, the benefits from the Signode Acquisition may be offset by costs incurred or delays in integrating the businesses. Moreover, failure to achieve these anticipated benefits could result in increased costs or decreases in the amount of expected revenues and could adversely affect the combined company’s future business, financial condition, operating results and prospects.

In addition, it is possible that the integration process could result in:

| • | diversion of the attention of management; and |

| • | the disruption of, or the loss of momentum in, each company’s ongoing businesses or inconsistencies in standards, controls, procedures and policies, |

any of which could adversely affect Crown’s ability to maintain relationships with customers, suppliers, employees and other constituencies or its ability to achieve the anticipated benefits of the Signode Acquisition or could reduce Crown’s earnings or otherwise adversely affect Crown’s business and financial results following the Signode Acquisition.

Moreover, uncertainty about the effect of the Signode Acquisition on employees, suppliers, vendors and customers may have an adverse effect on Crown. These uncertainties may impair Crown’s ability to attract, retain and motivate key personnel until the Signode Acquisition is completed and for a period of time thereafter, and could cause customers, suppliers, vendors and others who deal with Crown to seek to change existing business relationships with Crown. Employee retention and recruitment may be particularly challenging prior to completion of the Signode Acquisition, as employees and prospective employees may experience uncertainty about their future roles with the post-Acquisition company.

The combined company may experience an impairment of goodwill which could adversely affect its financial condition and results of operations.

Crown expects to recognize a substantial amount of goodwill in connection with the consummation of the Signode Acquisition and the allocation of the purchase price thereto. Crown tests goodwill for impairment annually during the fourth quarter, or more frequently if events or circumstances indicate that the carrying value may not be recoverable. A significant amount of judgment is involved in performing fair value estimates for goodwill since the results are based on estimated future cash flows and assumptions related thereto. Significant assumptions include estimates of future sales and expense trends, liquidity and capitalization, among other factors. Crown bases its fair value estimates on projected financial information, which it believes to be reasonable. However, actual results may differ from those projections. Further, it may need to recognize an impairment of some of the goodwill recognized in the Signode Acquisition, which would adversely affect its financial condition and results of operations in the future.

Crown’s future results could suffer if Crown cannot effectively manage the expanded operations following the Signode Acquisition.

Following the Signode Acquisition, the size of the combined business will be significantly larger than the current size of either Crown’s or Signode’s business. Crown’s future success depends, in part, upon Crown’s ability to manage this expanded business, which will pose substantial challenges for management, including challenges related to the management and monitoring of new operations and associated increased costs and complexity. There can be no assurances that Crown will be successful or that Crown will realize any operating efficiencies, cost savings, revenue enhancements or other benefits currently anticipated from the Signode Acquisition.

Moreover, if Crown consummates the Signode Acquisition then Crown will be subject to additional risks, including, without limitation, all of the business, financial, operational, environmental, competitive, regulatory, economic and other risks related to Signode and its properties and operations that are included in Signode’s financial statements. In addition, the risks that Crown’s current operations face may increase or intensify.

15

The unaudited pro forma financial information herein may not be indicative of Crown’s actual financial position or results of operations.

The unaudited pro forma financial information contained herein is presented for illustrative purposes only and is not necessarily indicative of what Crown’s actual financial position or results of operations would have been had the Signode Acquisition and related financing been completed as of the date indicated. Additionally, the unaudited pro forma financial information assumes that 100% of the Signode Acquisition is consummated. The unaudited pro forma financial information reflects adjustments, which are based upon assumptions and preliminary estimates that Crown believes to be reasonable, including an estimate relating to the financing of the Signode Acquisition, but it can provide no assurance that any or all of such assumptions or estimates are correct.

Risks Related to Crown’s Business

Crown’s international operations, which generated approximately 77% of its consolidated net sales in 2016, and Signode’s international operations are subject to various risks that may lead to decreases in its financial results.

Crown is an international company, and the risks associated with operating in foreign countries may have a negative impact on Crown’s liquidity and net income. Crown’s international operations generated approximately 77% of its consolidated net sales in the years ended 2016 and 2015, 76% of its consolidated net sales in the year ended 2014, and 78% of its consolidated net sales in the nine months ended September 30, 2017, respectively, without giving effect to the Signode Acquisition. In addition, Crown’s business strategy includes continued expansion of international activities, including within developing markets and areas, such as the Middle East, South America, and Asia, that may pose greater risk of political or economic instability. Approximately 38%, 37%, 32% and 37% of Crown’s consolidated net sales in the years ended 2016, 2015 and 2014 and the nine months ended September 30, 2017, respectively, without giving effect to the Signode Acquisition, were generated outside of the developed markets in Western Europe, the United States and Canada. Furthermore, if economic conditions in Europe deteriorate, there will likely be a negative effect on Crown’s European business, as well as the businesses of Crown’s European customers and suppliers. If a further downturn in European economic conditions ultimately leads to a significant devaluation of the euro, the value of Crown’s financial assets that are denominated in euros would be significantly reduced when translated to U.S. dollars for financial reporting purposes. Any of these conditions could ultimately harm Crown’s overall business, prospects, operating results, financial condition and cash flows.

Emerging markets are a focus of Crown’s international growth strategy. The developing nature of these markets and the nature of Crown’s international operations generally are subject to various risks, including:

| • | foreign government’s restrictive trade policies; |

| • | inconsistent product regulation or policy changes by foreign agencies or governments; |

| • | duties, taxes or government royalties, including the imposition or increase of withholding and other taxes on remittances and other payments by non-U.S. subsidiaries; |

| • | customs, import/export and other trade compliance regulations; |

| • | foreign exchange rate risks; |

| • | difficulty in collecting international accounts receivable and potentially longer payment cycles; |

| • | increased costs in maintaining international manufacturing and marketing efforts; |

| • | non-tariff barriers and higher duty rates; |

| • | difficulties associated with expatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; |

| • | difficulties in enforcement of contractual obligations and intellectual property rights and difficulties in protecting intellectual property or sensitive commercial and operations data or information technology systems generally; |

16

| • | exchange controls; |

| • | national and regional labor strikes; |

| • | geographic, language and cultural differences between personnel in different areas of the world; |

| • | high social benefit costs for labor, including costs associated with restructurings; |

| • | civil unrest or political, social, legal and economic instability, such as recent political turmoil in the Middle East; |

| • | product boycotts, including with respect to the products of Crown’s multi-national customers; |

| • | customer, supplier, and investor concerns regarding operations in areas such as the Middle East; |

| • | taking of property by nationalization or expropriation without fair compensation; |

| • | imposition of limitations on conversions of foreign currencies into dollars or payment of dividends and other payments by non-U.S. subsidiaries; |

| • | hyperinflation and currency devaluation in certain foreign countries where such currency devaluation could affect the amount of cash generated by operations in those countries and thereby affect Crown’s ability to satisfy its obligations; |

| • | war, civil disturbance, global or regional catastrophic events, natural disasters, including in emerging markets, and acts of terrorism; |

| • | geographical concentration of Crown’s factories and operations and regional shifts in its customer base; |

| • | periodic health epidemic concerns; |

| • | the complexity of managing global operations; and |

| • | compliance with applicable anti-corruption or anti-bribery laws. |

There can be no guarantee that a deterioration of economic conditions in countries in which Crown operates or may seek to operate in the future would not have a material impact on Crown’s results of operations.

As Crown seeks to expand its business globally, growth opportunities may be impacted by greater political, economic and social uncertainty and the continuing and accelerating globalization of businesses could significantly change the dynamics of Crown’s competition, customer base and product offerings.

Crown’s efforts to grow its businesses depend to a large extent upon access to, and its success in developing market share and operating profitably in, geographic markets including but not limited to the Middle East, South America, Eastern Europe and Asia, including, after the Signode Acquisition, India. In some cases, countries in these regions have greater political and economic volatility, greater vulnerability to infrastructure and labor disruptions and differing local customer product preferences and requirements than Crown’s other markets. Operating and seeking to expand business in a number of different regions and countries exposes Crown to multiple and potentially conflicting cultural practices, business practices and legal and regulatory requirements that are subject to change, including those related to tariffs and trade barriers, investments, property ownership rights, taxation, repatriation of earnings and regulation of advanced technologies. Such expansion efforts may also use capital and other resources of Crown that could be invested in other areas. Expanding business operations globally also increases exposure to currency fluctuations which can materially affect Crown’s financial results. As these emerging geographic markets become more important to Crown, its competitors are also seeking to expand their production capacities and sales in these same markets, which may lead to industry overcapacity that could adversely affect pricing, volumes and financial results in such markets. Although Crown is taking measures to adapt to these changing circumstances, Crown’s reputation and/or business results could be negatively affected should these efforts prove unsuccessful.

17

Crown may not be able to manage its anticipated growth, and it may experience constraints or inefficiencies caused by unanticipated acceleration and deceleration of customer demand.

Unanticipated acceleration and deceleration of customer demand for Crown’s products may result in constraints or inefficiencies related to Crown’s manufacturing, sales force, implementation resources and administrative infrastructure, particularly in emerging markets where Crown is seeking to expand production. Such constraints or inefficiencies may adversely affect Crown as a result of delays, lost potential product sales or loss of current or potential customers due to their dissatisfaction. Similarly, over-expansion, including as a result of overcapacity due to expansion by Crown’s competitors, or investments in anticipation of growth that does not materialize, or develops more slowly than Crown expects, could harm Crown’s financial results and result in overcapacity.

To manage Crown’s anticipated future growth effectively, Crown must continue to enhance its manufacturing capabilities and operations, information technology infrastructure, and financial and accounting systems and controls. Organizational growth and scale-up of operations could strain its existing managerial, operational, financial and other resources. Crown’s growth requires significant capital expenditures and may divert financial resources from other projects, such as the development of new products or enhancements of existing products or reduction of Crown’s outstanding indebtedness. If Crown’s management is unable to effectively manage Crown’s growth, its expenses may increase more than expected, its revenue could grow more slowly than expected and it may not be able to achieve its research and development and production goals. Crown’s failure to manage its anticipated growth effectively could have a material effect on its business, operating results or financial condition.

Crown’s profits will decline if the price of raw materials or energy rises and it cannot increase the price of its products, and Crown’s financial results could be adversely affected if Crown was not able to obtain sufficient quantities of raw materials.

Crown uses various raw materials, such as steel, aluminum, tin, water, natural gas, electricity and other processed energy, in its manufacturing operations, and Signode uses raw materials including steel and materials derived from crude oil and natural gas, such as polyethylene and polypropylene resins. Sufficient quantities of these raw materials may not be available in the future or may be available only at increased prices. Crown’s raw material supply contracts vary as to terms and duration, with steel contracts typically one year in duration with fixed prices and aluminum contracts typically multi-year in duration with fluctuating prices based on aluminum ingot costs. The availability of various raw materials and their prices depends on global and local supply and demand forces, governmental regulations (including tariffs), level of production, resource availability, transportation, and other factors, including natural disasters such as floods and earthquakes. In particular, in recent years the consolidation of steel suppliers, shortage of raw materials affecting the production of steel and the increased global demand for steel, including in China and other developing countries, have contributed to an overall tighter supply for steel, resulting in increased steel prices and, in some cases, special surcharges and allocated cut backs of products by steel suppliers. In addition, future steel supply contracts may provide for prices that fluctuate or adjust rather than provide a fixed price during a one-year period. As a result of continuing global supply and demand pressures, other commodity-related costs affecting Crown’s business may increase as well, including natural gas, electricity and freight-related costs.

The prices of certain raw materials used by Crown, such as steel, aluminum and processed energy, have historically been subject to volatility. In 2016, consumption of steel and aluminum represented 21% and 41%, respectively, of Crown’s consolidated cost of products sold, excluding depreciation and amortization and without giving effect to the Signode Acquisition. While certain, but not all, of Crown’s contracts pass through raw material costs to customers, Crown may be unable to increase its prices to offset increases in raw material costs without suffering reductions in unit volume, revenue and operating income. In addition, any price increases may take effect after related cost increases, reducing operating income in the near term. Significant increases in raw material costs may increase Crown’s working capital requirements, which may increase Crown’s average outstanding indebtedness and interest expense and may exceed the amounts available under Crown’s senior secured credit facilities and other sources of liquidity. In addition, Crown hedges raw material costs on behalf of certain customers and may suffer losses if such customers are unable to satisfy their purchase obligations.

18

If Crown is unable to purchase steel, aluminum or other raw materials for a significant period of time, Crown’s operations would be disrupted and any such disruption may adversely affect Crown’s financial results. If customers believe that Crown’s competitors have greater access to raw materials, perceived certainty of supply at Crown’s competitors may put Crown at a competitive disadvantage regarding pricing and product volumes.

Crown is subject to the effects of fluctuations in foreign exchange rates, which may reduce its net sales and cash flow.

Crown is exposed to fluctuations in foreign currencies as a significant portion of its consolidated net sales, costs, assets and liabilities, are denominated in currencies other than the U.S. dollar. For the years ended December 31, 2016 and 2015, without giving effect to the Signode Acquisition, Crown derived approximately 77% of its consolidated net sales from its international operations. For the year ended December 31, 2014, without giving effect to the Signode Acquisition, Crown derived approximately 76% of its consolidated net sales from its international operations. For the nine-month period ended September 30, 2017, Crown derived approximately 78% of its consolidated net sales from its international operations, without giving effect to the Signode Acquisition. In its consolidated financial statements, Crown translates local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period. During times of a strengthening U.S. dollar, its reported international revenue and earnings will be reduced because the local currency will translate into fewer U.S. dollars. Conversely, a weakening U.S. dollar will effectively increase the dollar-equivalent of Crown’s expenses and liabilities denominated in foreign currencies. Although Crown may use financial instruments such as foreign currency forwards from time to time to reduce its exposure to currency exchange rate fluctuations in some cases, it may not elect or have the ability to implement hedges or, if it does implement them, there can be no assurance that such agreements will achieve the desired effect.

For the year-ended December 31, 2016, without giving effect to the Signode Acquisition, a 0.10 movement in the average euro rate would have reduced net income by $14 million.

Pending and future asbestos litigation and payments to settle asbestos-related claims could reduce Crown’s cash flow and negatively impact its financial condition.

Crown Cork, a wholly-owned subsidiary of Crown, is one of many defendants in a substantial number of lawsuits filed throughout the United States by persons alleging bodily injury as a result of exposure to asbestos. In 1963, Crown Cork acquired a subsidiary that had two operating businesses, one of which is alleged to have manufactured asbestos-containing insulation products. Crown Cork believes that the business ceased manufacturing such products in 1963.

Crown recorded pre-tax charges of $21 million, $26 million and $40 million to increase its accrual for asbestos-related liabilities in 2016, 2015 and 2014, respectively. As of September 30, 2017, Crown Cork’s accrual for pending and future asbestos-related claims and related legal costs was $327 million, including $270 million for unasserted claims. Crown determines its accrual without limitation to a specific time period. Assumptions underlying the accrual include that claims for exposure to asbestos that occurred after the sale of the subsidiary’s insulation business in 1964 would not be entitled to settlement payouts and that state statutes described under Note L to the consolidated financial statements, including Texas and Pennsylvania statutes, are expected to have a highly favorable impact on Crown Cork’s ability to settle or defend against asbestos-related claims in those states and other states where Pennsylvania law may apply.

Crown Cork had approximately 55,500 asbestos-related claims outstanding at December 31, 2016. Of these claims, approximately 16,000 claims relate to claimants alleging first exposure to asbestos after 1964 and approximately 39,500 relate to claimants alleging first exposure to asbestos before or during 1964, of which approximately 13,000 were filed in Texas, 2,000 were filed in Pennsylvania, 6,000 were filed in other states that have enacted asbestos legislation and 18,500 were filed in other states. The outstanding claims at December 31, 2016 also exclude approximately 19,000 inactive claims. Due to the passage of time, Crown considers it unlikely that the plaintiffs in these cases will pursue further action. The exclusion of these inactive claims had no effect on the calculation of Crown’s accrual as the claims were filed in states where Crown’s liability is limited by statute. Crown devotes significant time and expense to defend against these various claims, complaints and proceedings, and there can be no assurance that the expenses or distractions from operating Crown’s businesses arising from these defenses will not increase materially.

19

During the year ended December 31, 2016, Crown Cork received approximately 2,500 new claims, settled or dismissed approximately 1,500 claims, and had approximately 55,500 claims outstanding at the end of the period.

On October 22, 2010, the Texas Supreme Court, in a 6-2 decision, reversed a lower court decision, Barbara Robinson v. Crown Cork & Seal Company, Inc., No. 14-04-00658-CV, Fourteenth Court of Appeals, Texas, which had upheld the dismissal of an asbestos-related case against Crown Cork. The Texas Supreme Court held that the Texas legislation was unconstitutional under the Texas Constitution when applied to asbestos-related claims pending against Crown Cork when the legislation was enacted in June of 2003. Crown believes that the decision of the Texas Supreme Court is limited to retroactive application of the Texas legislation to asbestos-related cases that were pending against Crown Cork in Texas on June 11, 2003 and therefore continues to assign no value to claims filed after June 11, 2003.

Crown Cork made cash payments of $30 million in each of the years 2016, 2015 and 2014 for asbestos-related claims including settlement payments and legal fees. These payments have reduced and any such future payments will reduce the cash flow available to Crown Cork for its business operations and debt payments.

Asbestos-related payments including defense costs may be significantly higher than those estimated by Crown Cork because the outcome of this type of litigation (and, therefore, Crown Cork’s reserve) is subject to a number of assumptions and uncertainties, such as the number or size of asbestos-related claims or settlements, the number of financially viable responsible parties, the extent to which state statutes relating to asbestos liability are upheld and/or applied by the courts, Crown Cork’s ability to obtain resolution without payment of asbestos-related claims by persons alleging first exposure to asbestos after 1964, and the potential impact of any pending or future asbestos-related legislation. Accordingly, Crown Cork may be required to make payments for claims substantially in excess of its accrual, which could reduce Crown’s cash flow and impair its ability to satisfy its obligations.

As a result of the uncertainties regarding its asbestos-related liabilities and its reduced cash flow, the ability of Crown to raise new money in the capital markets is more difficult and more costly, and Crown may not be able to access the capital markets in the future. Further information regarding Crown Cork’s asbestos-related liabilities is presented within “Crown Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the headings, “Provision for Asbestos” and “Critical Accounting Policies” and under Note L to the consolidated financial statements.

Crown and Signode have significant pension plan obligations worldwide and significant unfunded postretirement obligations, which could reduce Crown’s cash flow and negatively impact its results of operations and its financial condition.