Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JPMORGAN CHASE & CO | jpmc4q17form8k.htm |

F I N A N C I A L R E S U L T S

4Q17

January 12, 2018

1 Significant items include the impact of the enactment of TCJA of $2,446mm after-tax in 4Q17 and a legal benefit of $406 million after-tax in 2Q17. See note 4 on slide 12

2 See note 2 on slide 12

3 Represents estimated common equity Tier 1 (“CET1”) capital and ratio under the Basel III Fully Phased-In capital rules to which the Firm will be subject as of January 1, 2019. See note 7 on slide 12

4 Last twelve months (“LTM”). Net of stock issued to employees

5 See note 1 on slide 12

6 See note 3 on slide 12

7 See note 8 on slide 12

8 Net of stock issued to employees

9 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as further information becomes available. See note 4 on slide 12

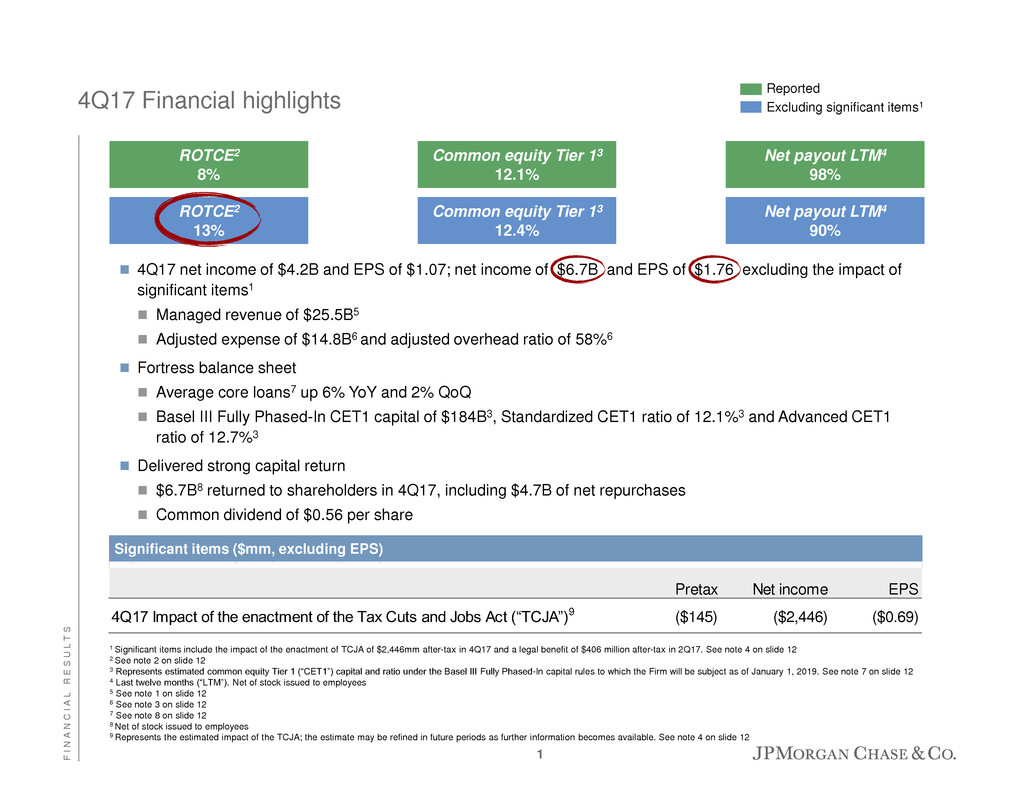

4Q17 net income of $4.2B and EPS of $1.07; net income of $6.7B and EPS of $1.76 excluding the impact of

significant items1

Managed revenue of $25.5B5

Adjusted expense of $14.8B6 and adjusted overhead ratio of 58%6

Fortress balance sheet

Average core loans7 up 6% YoY and 2% QoQ

Basel III Fully Phased-In CET1 capital of $184B3, Standardized CET1 ratio of 12.1%3 and Advanced CET1

ratio of 12.7%3

Delivered strong capital return

$6.7B8 returned to shareholders in 4Q17, including $4.7B of net repurchases

Common dividend of $0.56 per share

ROTCE2

8%

Net payout LTM4

98%

Common equity Tier 13

12.1%

4Q17 Financial highlights

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

Significant items ($mm, excluding EPS)

ROTCE2

13%

Net payout LTM4

90%

Common equity Tier 13

12.4%

Reported

Excluding significant items1

Pretax Net income EPS

4Q17 Impact of the enactment of the Tax Cuts and Jobs Act (“TCJA”)9 ($145) ($2,446) ($0.69)

1

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

2

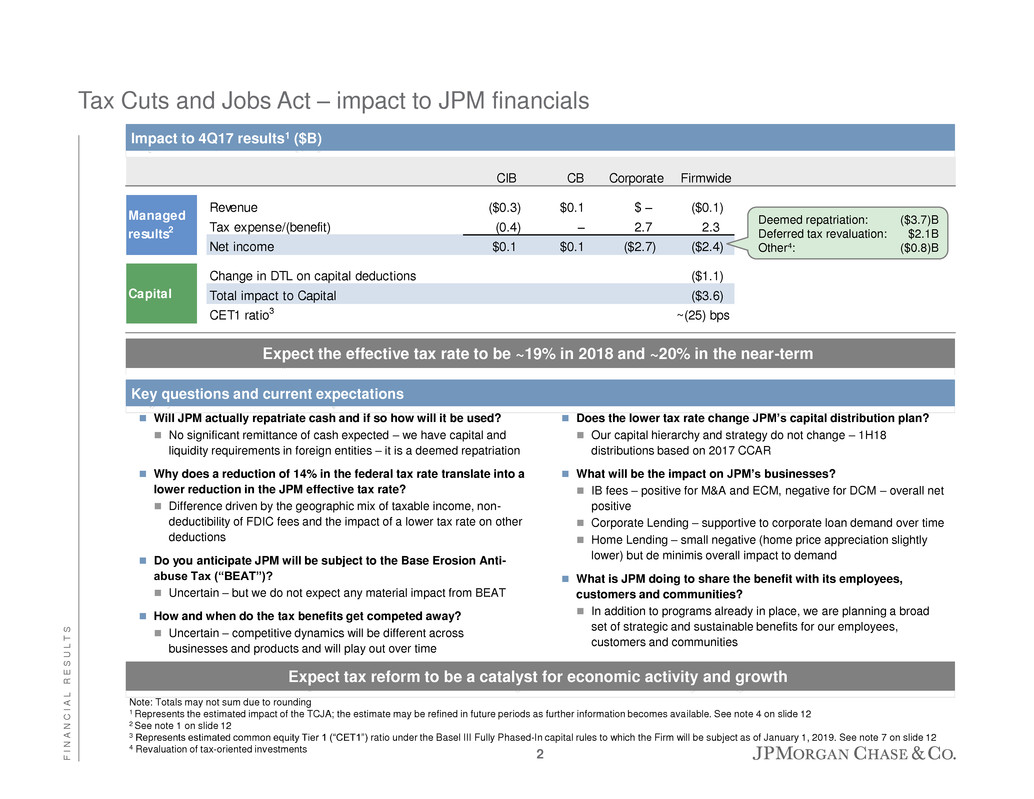

Tax Cuts and Jobs Act – impact to JPM financials

Key questions and current expectations

Impact to 4Q17 results1 ($B)

Will JPM actually repatriate cash and if so how will it be used?

No significant remittance of cash expected – we have capital and

liquidity requirements in foreign entities – it is a deemed repatriation

Why does a reduction of 14% in the federal tax rate translate into a

lower reduction in the JPM effective tax rate?

Difference driven by the geographic mix of taxable income, non-

deductibility of FDIC fees and the impact of a lower tax rate on other

deductions

Do you anticipate JPM will be subject to the Base Erosion Anti-

abuse Tax (“BEAT”)?

Uncertain – but we do not expect any material impact from BEAT

How and when do the tax benefits get competed away?

Uncertain – competitive dynamics will be different across

businesses and products and will play out over time

Does the lower tax rate change JPM’s capital distribution plan?

Our capital hierarchy and strategy do not change – 1H18

distributions based on 2017 CCAR

What will be the impact on JPM’s businesses?

IB fees – positive for M&A and ECM, negative for DCM – overall net

positive

Corporate Lending – supportive to corporate loan demand over time

Home Lending – small negative (home price appreciation slightly

lower) but de minimis overall impact to demand

What is JPM doing to share the benefit with its employees,

customers and communities?

In addition to programs already in place, we are planning a broad

set of strategic and sustainable benefits for our employees,

customers and communities

Expect the effective tax rate to be ~19% in 2018 and ~20% in the near-term

Expect tax reform to be a catalyst for economic activity and growth

Note: Totals may not sum due to rounding

1 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as further information becomes available. See note 4 on slide 12

2 See note 1 on slide 12

3 Represents estimated common equity Tier 1 (“CET1”) ratio under the Basel III Fully Phased-In capital rules to which the Firm will be subject as of January 1, 2019. See note 7 on slide 12

4 Revaluation of tax-oriented investments

CIB CB Corporate Firmwide

Revenue ($0.3) $0.1 $ – ($0.1)

Tax expense/(benefit) (0.4) – 2.7 2.3

Net income $0.1 $0.1 ($2.7) ($2.4)

Change in DTL on capital deductions ($1.1)

Total impact to Capital ($3.6)

CET1 ratio3 ~(25) bps

Capital

Man ged

re ults2

Deemed repatriation:

Deferred tax revaluation:

Other4:

($3.7)B

$2.1B

($0.8)B

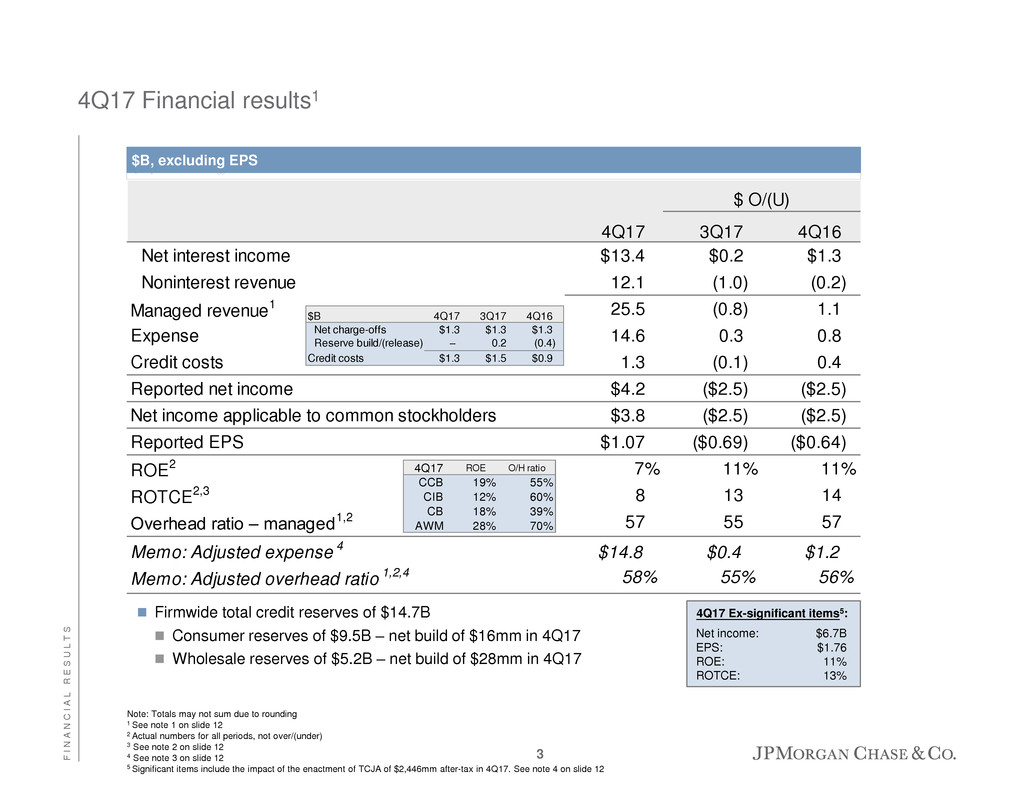

$ O/(U)

4Q17 3Q17 4Q16

Net interest income $13.4 $0.2 $1.3

Noninterest revenue 12.1 (1.0) (0.2)

Managed revenue1 25.5 (0.8) 1.1

Expense 14.6 0.3 0.8

Credit costs 1.3 (0.1) 0.4

Reported net income $4.2 ($2.5) ($2.5)

Net income applicable to common stockholders $3.8 ($2.5) ($2.5)

Reported EPS $1.07 ($0.69) ($0.64)

ROE2 7% 11% 11%

ROTCE2,3 8 13 14

Overhead ratio – managed1,2 57 55 57

Memo: Adjusted expense 4 $14.8 $0.4 $1.2

Memo: Adjusted overhead ratio 1,2,4 58% 55% 56%

Note: Totals may not sum due to rounding

1 See note 1 on slide 12

2 Actual numbers for all periods, not over/(under)

3 See note 2 on slide 12

4 See note 3 on slide 12

5 Significant items include the impact of the enactment of TCJA of $2,446mm after-tax in 4Q17. See note 4 on slide 12

$B, excluding EPS

4Q17 Financial results1

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

Firmwide total credit reserves of $14.7B

Consumer reserves of $9.5B – net build of $16mm in 4Q17

Wholesale reserves of $5.2B – net build of $28mm in 4Q17

4Q17 ROE O/H ratio

CCB 19% 55%

CIB 12% 60%

CB 18% 39%

AWM 28% 70%

$B 4Q17 3Q17 4Q16

Net charge-offs $1.3 $1.3 $1.3

Reserve build/(release) – 0.2 (0.4)

Credit costs $1.3 $1.5 $0.9

4Q17 Ex-significant items5:

Net income:

EPS:

ROE:

ROTCE:

$6.7B

$1.76

11%

13%

3

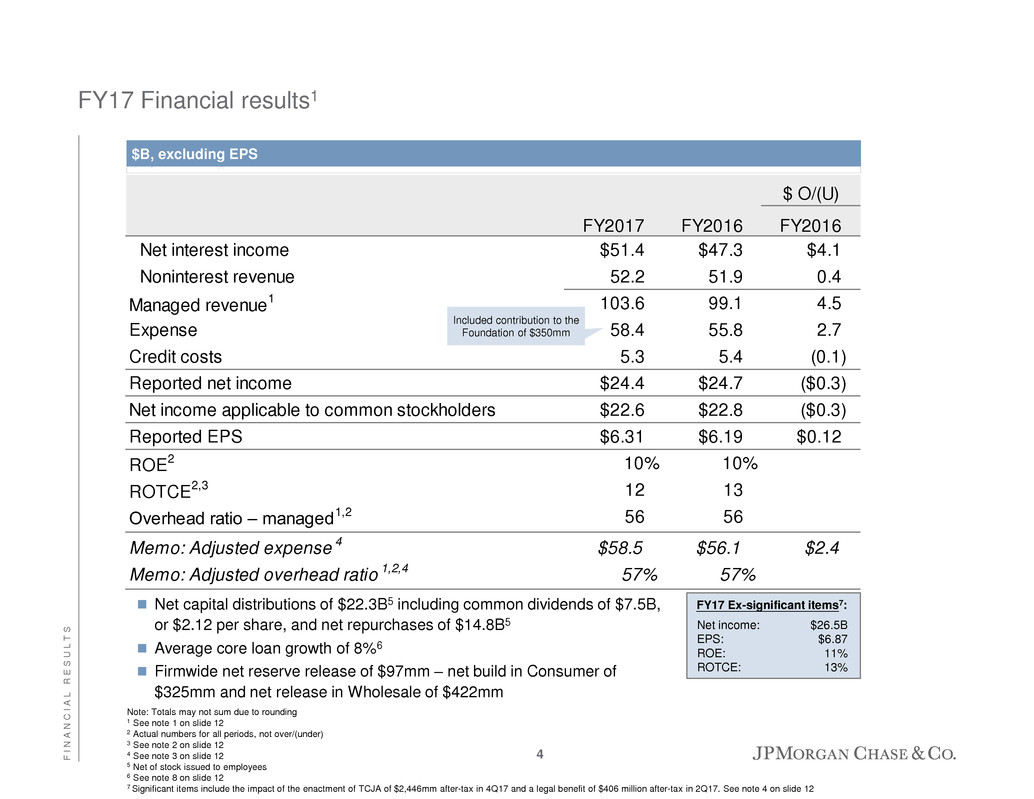

FY17 Financial results1

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

$B, excluding EPS

$ O/(U)

FY2017 FY2016 FY2016

Net interest income $51.4 $47.3 $4.1

Noninterest revenue 52.2 51.9 0.4

Managed revenue1 103.6 99.1 4.5

Expense 58.4 55.8 2.7

Credit costs 5.3 5.4 (0.1)

Reported net income $24.4 $24.7 ($0.3)

Net income applicable to common stockholders $22.6 $22.8 ($0.3)

Reported EPS $6.31 $6.19 $0.12

ROE2 10% 10%

ROTCE2,3 12 13

Overhead ratio – managed1,2 56 56

Memo: Adjusted expense 4 $58.5 $56.1 $2.4

Memo: Adjusted overhead ratio 1,2,4 57% 57%

Net capital distributions of $22.3B5 including common dividends of $7.5B,

or $2.12 per share, and net repurchases of $14.8B5

Average core loan growth of 8%6

Firmwide net reserve release of $97mm – net build in Consumer of

$325mm and net release in Wholesale of $422mm

Note: Totals may not sum due to rounding

1 See note 1 on slide 12

2 Actual numbers for all periods, not over/(under)

3 See note 2 on slide 12

4 See note 3 on slide 12

5 Net of stock issued to employees

6 See note 8 on slide 12

7 Significant items include the impact of the enactment of TCJA of $2,446mm after-tax in 4Q17 and a legal benefit of $406 million after-tax in 2Q17. See note 4 on slide 12

Included contribution to the

Foundation of $350mm

FY17 Ex-significant items7:

Net income:

EPS:

ROE:

ROTCE:

$26.5B

$6.87

11%

13%

4

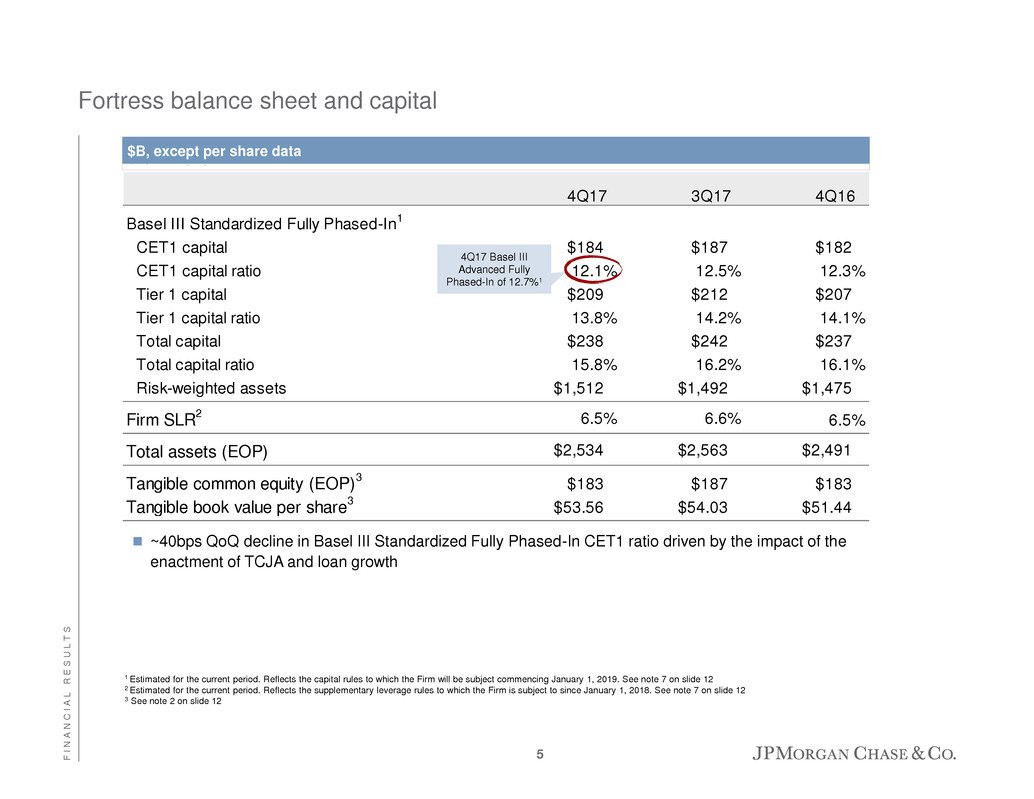

$B, except per share data

1 Estimated for the current period. Reflects the capital rules to which the Firm will be subject commencing January 1, 2019. See note 7 on slide 12

2 Estimated for the current period. Reflects the supplementary leverage rules to which the Firm is subject to since January 1, 2018. See note 7 on slide 12

3 See note 2 on slide 12

Fortress balance sheet and capital

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

4Q17 3Q17 4Q16

Basel III Standardized Fully Phased-In1

CET1 capital $184 $187 $182

CET1 capital ratio 12.1% 12.5% 12.3%

Tier 1 capital $209 $212 $207

Tier 1 capital ratio 13.8% 14.2% 14.1%

Total capital $238 $242 $237

Total capital ratio 15.8% 16.2% 16.1%

Risk-weighted assets $1,512 $1,492 $1,475

Firm SLR

2 6.5% 6.6% 6.5%

Total assets (EOP) $2,534 $2,563 $2,491

Tangible common equity (EOP)

3

$183 $187 $183

Tangible book value per share

3

$53.56 $54.03 $51.44

4Q17 Basel III

Advanced Fully

Phased-In of 12.7%1

~40bps QoQ decline in Basel III Standardized Fully Phased-In CET1 ratio driven by the impact of the

enactment of TCJA and loan growth

5

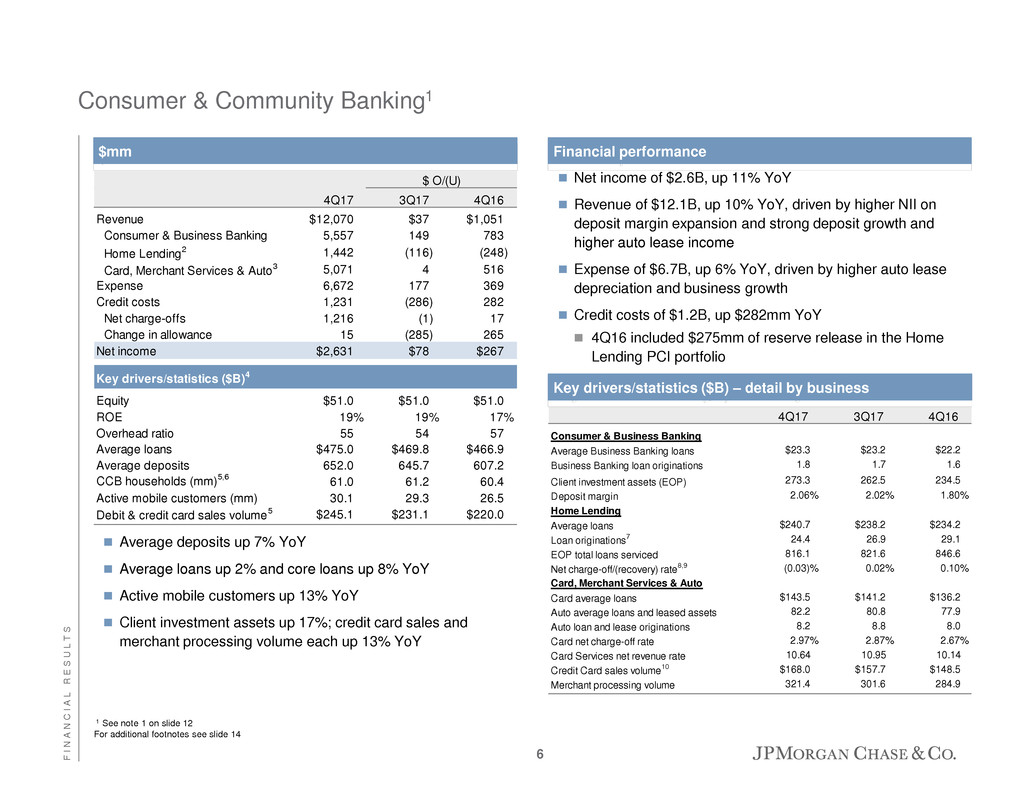

4Q17 3Q17 4Q16

Consumer & Business Banking

Average Business Banking loans $23.3 $23.2 $22.2

Business Banking loan originations 1.8 1.7 1.6

Client investment assets (EOP) 273.3 262.5 234.5

Deposit margin 2.06% 2.02% 1.80%

Home Lending

Average loans $240.7 $238.2 $234.2

Loan originations

7 24.4 26.9 29.1

EOP total loans serviced 816.1 821.6 846.6

Net charge-off/(recovery) rate

8,9 (0.03)% 0.02% 0.10%

Card, Merchant Services & Auto

Card average loans $143.5 $141.2 $136.2

Auto average loans and leased assets 82.2 80.8 77.9

Auto loan and lease originations 8.2 8.8 8.0

Card net charge-off rate 2.97% 2.87% 2.67%

Card Services net revenue rate 10.64 10.95 10.14

Credit Card sales volume

10 $168.0 $157.7 $148.5

Merchant processing volume 321.4 301.6 284.9

Key drivers/statistics ($B) – detail by business

Consumer & Community Banking1

$mm

Net income of $2.6B, up 11% YoY

Revenue of $12.1B, up 10% YoY, driven by higher NII on

deposit margin expansion and strong deposit growth and

higher uto lease income

Expense of $6.7B, up 6% YoY, driven by higher auto lease

depreciation and business growth

Credit costs of $1.2B, up $282mm YoY

4Q16 included $275mm of reserve release in the Home

Lending PCI portfolio

Financial performance

1 See note 1 on slide 12

For additional footnotes see slide 14

Average deposits up 7% YoY

Average loans up 2% and core loans up 8% YoY

Active mobile customers up 13% YoY

Client investment assets up 17%; credit card sales and

merchant processing volume each up 13% YoY

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

6

$ O/(U)

4Q17 3Q17 4Q16

Revenue $12,070 $37 $1,051

Consumer & Business Banking 5,557 149 783

Home Lending2 1,442 (116) (248)

Card, Merchant Services & Auto3 5,071 4 516

Expense 6,672 177 369

Credit costs 1,231 (286) 282

Net charge-offs 1,216 (1) 17

Change in allowance 15 (285) 265

Net income $2,631 $78 $267

Key drivers/sta stics ($B)4

Equity $51.0 $51.0 $51.0

ROE 19% 19% 17%

Overhead ratio 55 54 57

Average loans $475.0 $469.8 $466.9

Average deposits 652.0 645.7 607.2

CCB household (mm)5,6 61.0 61.2 60.4

Active mobil cus omers (mm) 30.1 29.3 26.5

Debit & credit card sales volume5 $245.1 $231.1 $220.0

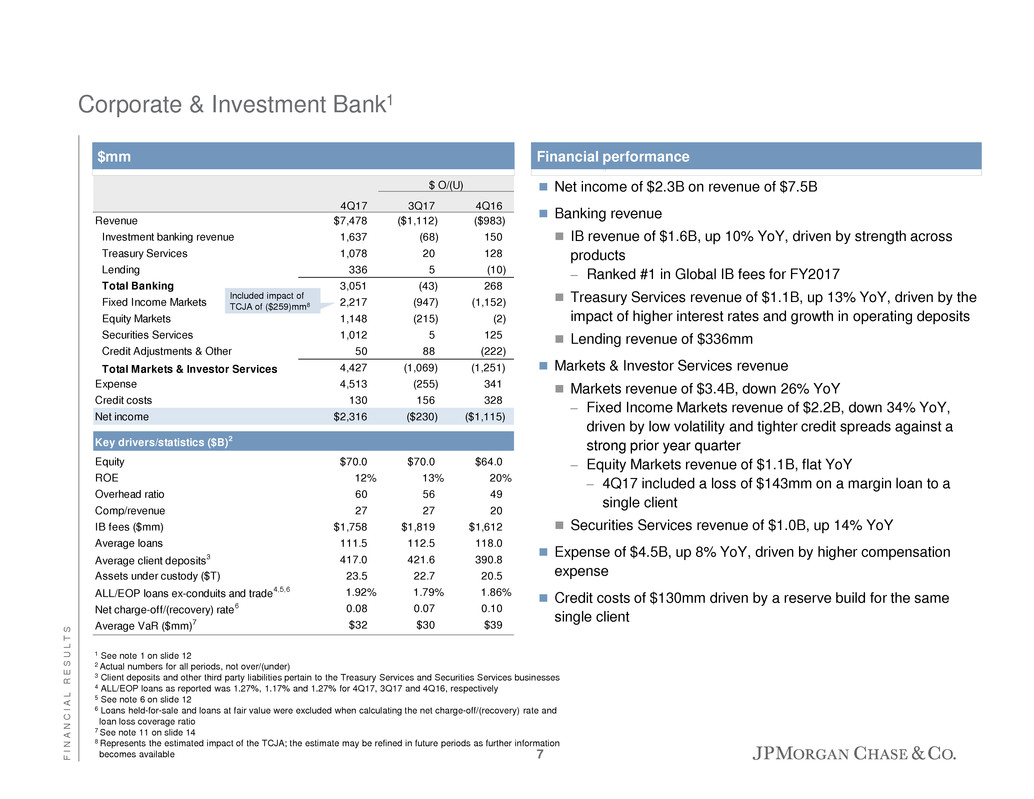

$ O/(U)

4Q17 3Q17 4Q16

Revenue $7,478 ($1,112) ($983)

Investment banking revenue 1,637 (68) 150

Treasury Services 1,078 20 128

Lending 336 5 (10)

Total Banking 3,051 (43) 268

Fixed Income Markets 2,217 (947) (1,152)

Equity Markets 1,148 (215) (2)

Securities Services 1,012 5 125

Credit Adjustments & Other 50 88 (222)

Total Markets & Investor Services 4,427 (1,069) (1,251)

Expense 4,513 (255) 341

Credit costs 130 156 328

Net income $2,316 ($230) ($1,115)

Key drivers/statistics ($B)2

Equity $70.0 $70.0 $64.0

ROE 12% 13% 20%

Overhead ratio 60 56 49

Comp/revenue 27 27 20

IB fees ($mm) $1,758 $1,819 $1,612

Average loans 111.5 112.5 118.0

Average client deposits3 417.0 421.6 390.8

Assets under custody ($T) 23.5 22.7 20.5

ALL/EOP loans ex-conduits and trade4,5,6 1.92% 1.79% 1.86%

Net charge-off/(recovery) rate6 0.08 0.07 0.10

Average VaR ($mm)7 $32 $30 $39

$mm Financial performance

1 See note 1 on slide 12

2 Actual numbers for all periods, not over/(under)

3 Client deposits and other third party liabilities pertain to the Treasury Services and Securities Services businesses

4 ALL/EOP loans as reported was 1.27%, 1.17% and 1.27% for 4Q17, 3Q17 and 4Q16, respectively

5 See note 6 on slide 12

6 Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and

loan loss coverage ratio

7 See note 11 on slide 14

8 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as further information

becomes available

Net income of $2.3B on revenue of $7.5B

Banking revenue

IB revenue of $1.6B, up 10% YoY, driven by strength across

products

– Ranked #1 in Global IB fees for FY2017

Treasury Services revenue of $1.1B, up 13% YoY, driven by the

impact of higher interest rates and growth in operating deposits

Lending revenue of $336mm

Markets & Investor Services revenue

Markets revenue of $3.4B, down 26% YoY

– Fixed Income Markets revenue of $2.2B, down 34% YoY,

driven by low volatility and tighter credit spreads against a

strong prior year quarter

– Equity Markets revenue of $1.1B, flat YoY

– 4Q17 included a loss of $143mm on a margin loan to a

single client

Securities Services revenue of $1.0B, up 14% YoY

Expense of $4.5B, up 8% YoY, driven by higher compensation

expense

Credit costs of $130mm driven by a reserve build for the same

single client

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

Corporate & Investment Bank1

Included impact of

TCJA of ($259)mm8

7

$mm

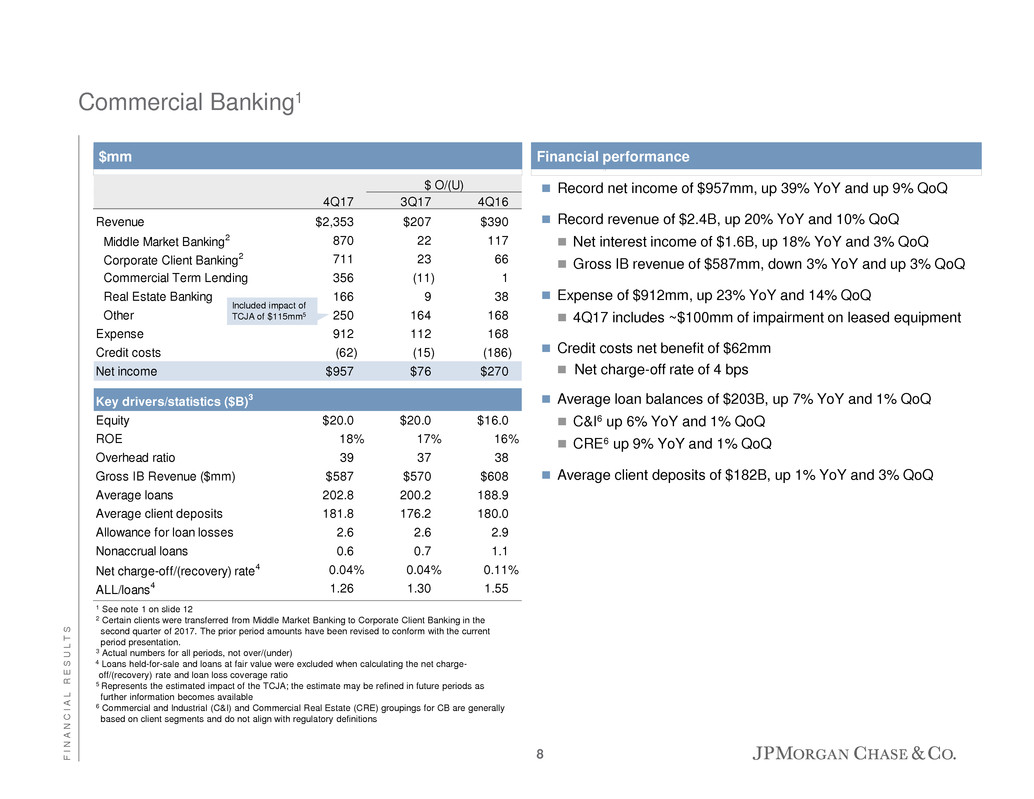

Commercial Banking1

Record net income of $957mm, up 39% YoY and up 9% QoQ

Record revenue of $2.4B, up 20% YoY and 10% QoQ

Net interest income of $1.6B, up 18% YoY and 3% QoQ

Gross IB revenue of $587mm, down 3% YoY and up 3% QoQ

Expense of $912mm, up 23% YoY and 14% QoQ

4Q17 includes ~$100mm of impairment on leased equipment

Credit costs net benefit of $62mm

Net charge-off rate of 4 bps

Average loan balances of $203B, up 7% YoY and 1% QoQ

C&I6 up 6% YoY and 1% QoQ

CRE6 up 9% YoY and 1% QoQ

Average client deposits of $182B, up 1% YoY and 3% QoQ

1 See note 1 on slide 12

2 Certain clients were transferred from Middle Market Banking to Corporate Client Banking in the

second quarter of 2017. The prior period amounts have been revised to conform with the current

period presentation.

3 Actual numbers for all periods, not over/(under)

4 Loans held-for-sale and loans at fair value were excluded when calculating the net charge-

off/(recovery) rate and loan loss coverage ratio

5 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as

further information becomes available

6 Commercial and Industrial (C&I) and Commercial Real Estate (CRE) groupings for CB are generally

based on client segments and do not align with regulatory definitions

Financial performance

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

4Q17 3Q17 4Q16

Revenue $2,353 $207 $390

Middle Market Banking2 870 22 117

Corporate Client Banking2 711 23 66

Commercial Term Lending 356 (11) 1

Real Estate Banking 166 9 38

Other 250 164 168

Expense 912 112 168

Credit costs (62) (15) (186)

Net income $957 $76 $270

Key drivers/statistics ($B)3

Equity $20.0 $20.0 $16.0

ROE 18% 17% 16%

Overhead ratio 39 37 38

Gross IB Revenue ($mm) $587 $570 $608

Average loans 202.8 200.2 188.9

Average client deposits 181.8 176.2 180.0

Allowance for loan losses 2.6 2.6 2.9

Nonaccrual loa s 0.6 0.7 1.1

Net charge-off/(recovery) rate4 0.04% 0.04% 0.11%

ALL/loans4 1.26 1.30 1.55

$ O/(U)

Included impact of

TCJA of $115mm5

8

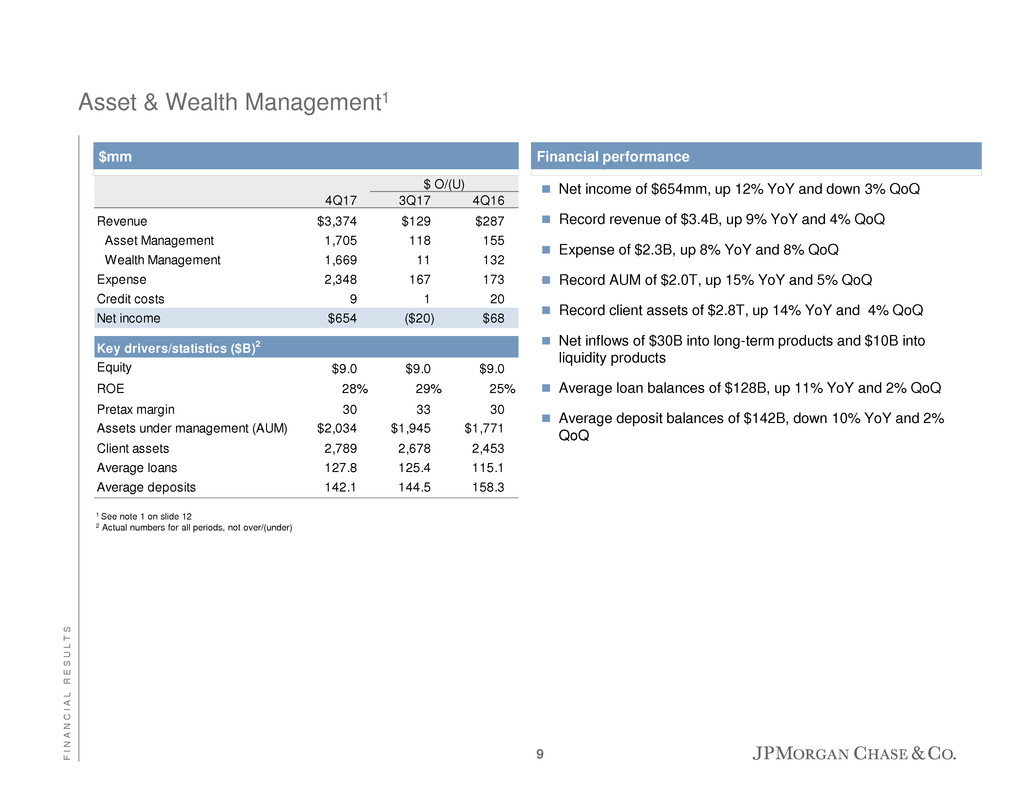

4Q17 3Q17 4Q16

Revenue $3,374 $129 $287

Asset Management 1,705 118 155

Wealth Management 1,669 11 132

Expense 2,348 167 173

Credit costs 9 1 20

Net income $654 ($20) $68

Key drivers/statistics ($B)2

Equity $9.0 $9.0 $9.0

ROE 28% 29% 25%

Pretax margin 30 33 30

Assets under management (AUM) $2,034 $1,945 $1,771

Client assets 2,789 2,678 2,453

Average loans 127.8 125.4 115.1

Average deposits 142.1 144.5 158.3

$ O/(U)

Asset & Wealth Management1

1 See note 1 on slide 12

2 Actual numbers for all periods, not over/(under)

Net income of $654mm, up 12% YoY and down 3% QoQ

Record revenue of $3.4B, up 9% YoY and 4% QoQ

Expense of $2.3B, up 8% YoY and 8% QoQ

Record AUM of $2.0T, up 15% YoY and 5% QoQ

Record client assets of $2.8T, up 14% YoY and 4% QoQ

Net inflows of $30B into long-term products and $10B into

liquidity products

Average loan balances of $128B, up 11% YoY and 2% QoQ

Average deposit balances of $142B, down 10% YoY and 2%

QoQ

$mm Financial performance

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

9

4Q17 3Q17 4Q16

Treasury and CIO $66 ($9) $263

Other Corporate (2,392) (2,395) (2,248)

Net income ($2,326) ($2,404) ($1,985)

$ O/(U)

Corporate1

Treasury and CIO

Net income of $66mm, up $263mm YoY, primarily due to the

benefit of higher rates

Other Corporate

Net loss of $2.4B, compared with a net loss of $0.1B in the prior

year 1 See note 1 on slide 12

2 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as further

information becomes available

$mm Financial performance

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

Included impact of

TCJA of ($2.7)B2

10

Outlook

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

Firmwide

As a result of the change in tax rate due to TCJA, expect a reduction in tax-equivalent adjustments,

decreasing both managed revenue and managed tax expense by ~$1.2B on an annual run-rate basis

New revenue recognition accounting rule expected to increase both FY2018 revenue and expense by

~$1.2B, with the vast majority of the impact in AWM

Expect FY2018 effective tax rate to be ~19%

Expect 1Q18 net interest income to be modestly lower QoQ due to the impact of TCJA and day count

11

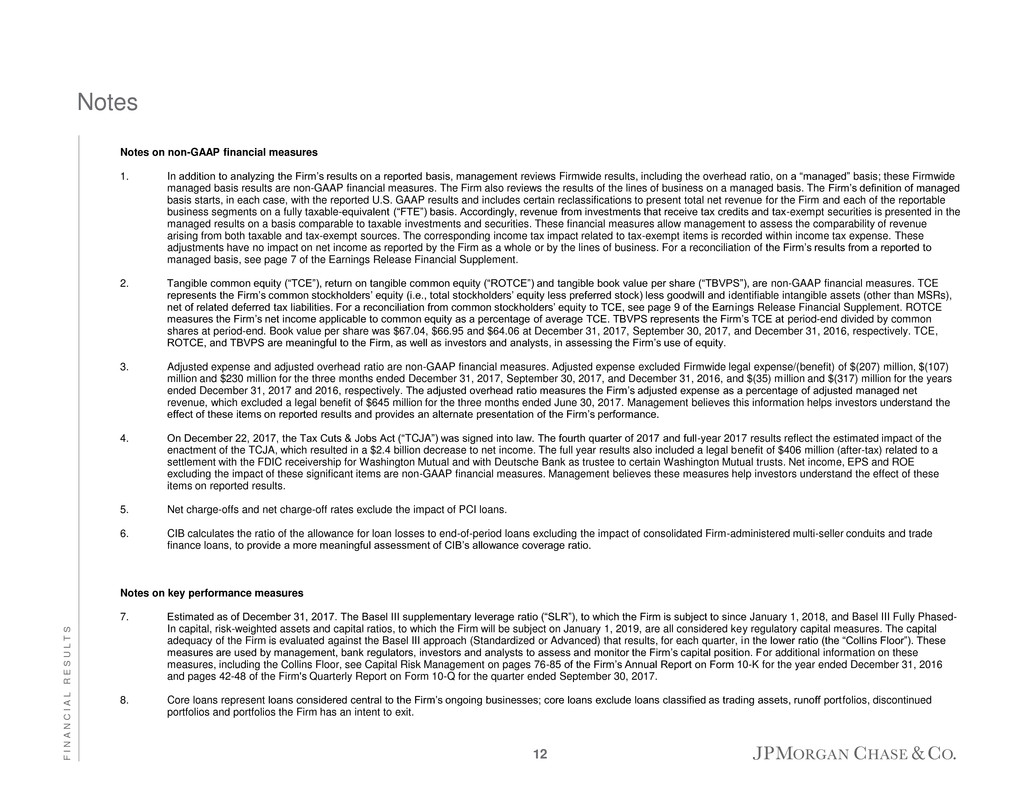

Notes on non-GAAP financial measures

1. In addition to analyzing the Firm’s results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a “managed” basis; these Firmwide

managed basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. The Firm’s definition of managed

basis starts, in each case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm and each of the reportable

business segments on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the

managed results on a basis comparable to taxable investments and securities. These financial measures allow management to assess the comparability of revenue

arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These

adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. For a reconciliation of the Firm’s results from a reported to

managed basis, see page 7 of the Earnings Release Financial Supplement.

2. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are non-GAAP financial measures. TCE

represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs),

net of related deferred tax liabilities. For a reconciliation from common stockholders’ equity to TCE, see page 9 of the Earnings Release Financial Supplement. ROTCE

measures the Firm’s net income applicable to common equity as a percentage of average TCE. TBVPS represents the Firm’s TCE at period-end divided by common

shares at period-end. Book value per share was $67.04, $66.95 and $64.06 at December 31, 2017, September 30, 2017, and December 31, 2016, respectively. TCE,

ROTCE, and TBVPS are meaningful to the Firm, as well as investors and analysts, in assessing the Firm’s use of equity.

3. Adjusted expense and adjusted overhead ratio are non-GAAP financial measures. Adjusted expense excluded Firmwide legal expense/(benefit) of $(207) million, $(107)

million and $230 million for the three months ended December 31, 2017, September 30, 2017, and December 31, 2016, and $(35) million and $(317) million for the years

ended December 31, 2017 and 2016, respectively. The adjusted overhead ratio measures the Firm’s adjusted expense as a percentage of adjusted managed net

revenue, which excluded a legal benefit of $645 million for the three months ended June 30, 2017. Management believes this information helps investors understand the

effect of these items on reported results and provides an alternate presentation of the Firm’s performance.

4. On December 22, 2017, the Tax Cuts & Jobs Act (“TCJA”) was signed into law. The fourth quarter of 2017 and full-year 2017 results reflect the estimated impact of the

enactment of the TCJA, which resulted in a $2.4 billion decrease to net income. The full year results also included a legal benefit of $406 million (after-tax) related to a

settlement with the FDIC receivership for Washington Mutual and with Deutsche Bank as trustee to certain Washington Mutual trusts. Net income, EPS and ROE

excluding the impact of these significant items are non-GAAP financial measures. Management believes these measures help investors understand the effect of these

items on reported results.

5. Net charge-offs and net charge-off rates exclude the impact of PCI loans.

6. CIB calculates the ratio of the allowance for loan losses to end-of-period loans excluding the impact of consolidated Firm-administered multi-seller conduits and trade

finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio.

Notes on key performance measures

7. Estimated as of December 31, 2017. The Basel III supplementary leverage ratio (“SLR”), to which the Firm is subject to since January 1, 2018, and Basel III Fully Phased-

In capital, risk-weighted assets and capital ratios, to which the Firm will be subject on January 1, 2019, are all considered key regulatory capital measures. The capital

adequacy of the Firm is evaluated against the Basel III approach (Standardized or Advanced) that results, for each quarter, in the lower ratio (the “Collins Floor”). These

measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position. For additional information on these

measures, including the Collins Floor, see Capital Risk Management on pages 76-85 of the Firm’s Annual Report on Form 10-K for the year ended December 31, 2016

and pages 42-48 of the Firm's Quarterly Report on Form 10-Q for the quarter ended September 30, 2017.

8. Core loans represent loans considered central to the Firm’s ongoing businesses; core loans exclude loans classified as trading assets, runoff portfolios, discontinued

portfolios and portfolios the Firm has an intent to exit.

Notes

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

12

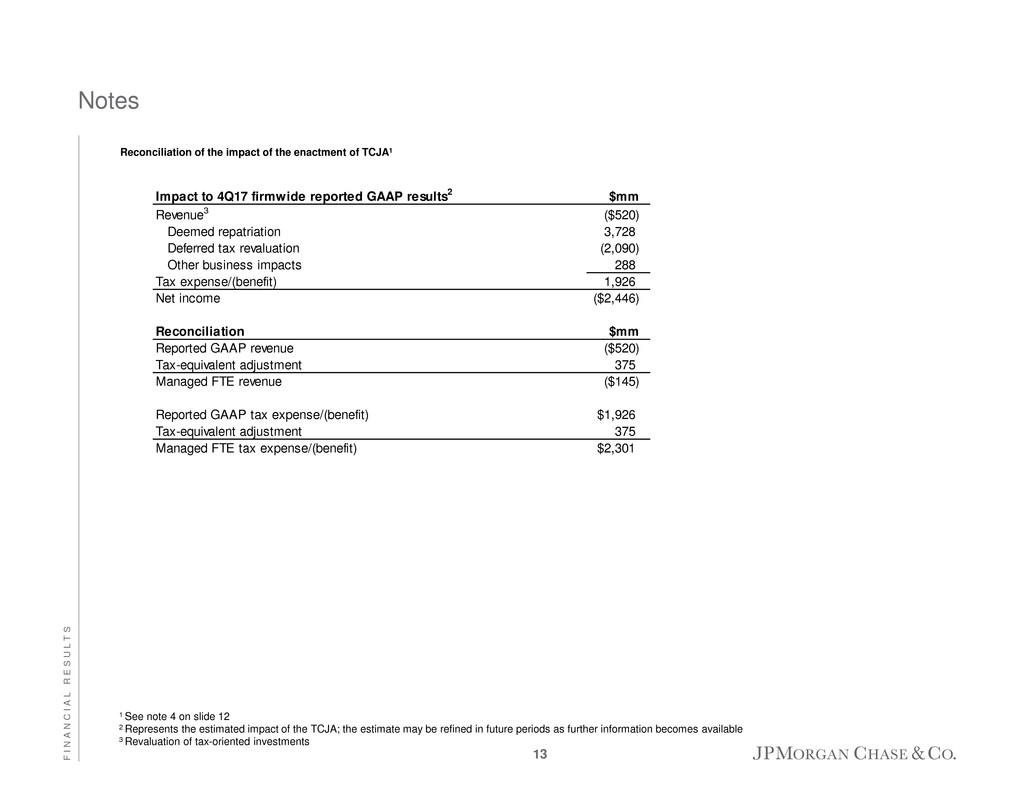

Notes

Reconciliation of the impact of the enactment of TCJA1

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

1 See note 4 on slide 12

2 Represents the estimated impact of the TCJA; the estimate may be refined in future periods as further information becomes available

3 Revaluation of tax-oriented investments

Impact to 4Q17 firmwide reported GAAP results2 $mm

Revenue3 ($520)

Deemed repatriation 3,728

Deferred tax revaluation (2,090)

Other business impacts 288

Tax expense/(benefit) 1,926

Net income ($2,446)

Reconciliation $mm

Repor ed GAAP revenue ($520)

Tax-equivalent adjustment 375

Managed FTE revenue ($145)

Reported GAAP tax expense/(benefit) $1,926

Tax-equivalent adjustment 375

Managed FTE tax expense/(benefit) $2,301

13

Additional Notes on slide 6 – Consumer & Community Banking

2. Formerly Mortgage Banking

3. Formerly Card, Commerce Solutions & Auto

4. Actual numbers for all periods, not over/(under)

5. The prior period amounts have been revised to conform with the current period presentation

6. During 3Q17, Card refined its inactive credit card account policy, resulting in more frequent reviews and closures of certain inactive accounts. The impact of this refinement

was a cumulative decrease of 0.3mm CCB households in 2H17 (0.2mm in 4Q17 and 0.1mm in 3Q17)

7. Firmwide mortgage origination volume was $26.6B, $29.2B and $33.5B, for 4Q17, 3Q17 and 4Q16, respectively

8. Excludes purchased credit-impaired (PCI) write-offs of $20mm, $20mm and $32mm for 4Q17, 3Q17 and 4Q16, respectively. See note 5 on slide 12

9. Excludes the impact of PCI loans. See note 5 on slide 12

10. Excludes Commercial Card

Additional Note on slide 7 – Corporate & Investment Bank

11. The Firm refined the historical proxy time series inputs to certain VaR models during the first quarter of 2017. This refinement was intended to more appropriately reflect

the risk exposure from certain asset-backed products. In the absence of this refinement, the average CIB VaR would have been higher by $2 million and $5 million for the

three months ended December 31, 2017 and September 30, 2017, respectively.

Notes

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

14

Forward-looking statements

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations

of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties.

Actual results may differ from those set forth in the forward-looking statements. Factors that could

cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the

forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K

for the year ended December 31, 2016 and Quarterly Reports on Form 10-Q for the quarters ended

September 30, 2017, June 30, 2017 and March 31, 2017, which have been filed with the Securities

and Exchange Commission and are available on JPMorgan Chase & Co.’s website

(http://investor.shareholder.com/jpmorganchase/sec.cfm), and on the Securities and Exchange

Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the

forward-looking statements to reflect the impact of circumstances or events that may arise after the

date of the forward-looking statements.

F

I

N

A

N

C

I

A

L

R

E

S

U

L

T

S

15