Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - REGENCY CENTERS CORP | d523966dex991.htm |

| 8-K - 8-K - REGENCY CENTERS CORP | d523966d8k.htm |

Exhibit 99.2

|

January 11, 2018

2018 EARNINGS & VALUATION GUIDANCE

|

Forward-Looking Statements

Forward-looking statements involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking

statements. Please refer to the documents filed by Regency Centers Corporation (“Regency” or the “Company”) with the Securities and Exchange Commission (“SEC”), specifically the most recent reports on Forms 10-K and 10-Q, which identify important risk factors which could cause actual results to differ from those contained in the forward-looking statements.

Regency Centers 2018 Earnings and Valuation Guidance 1

|

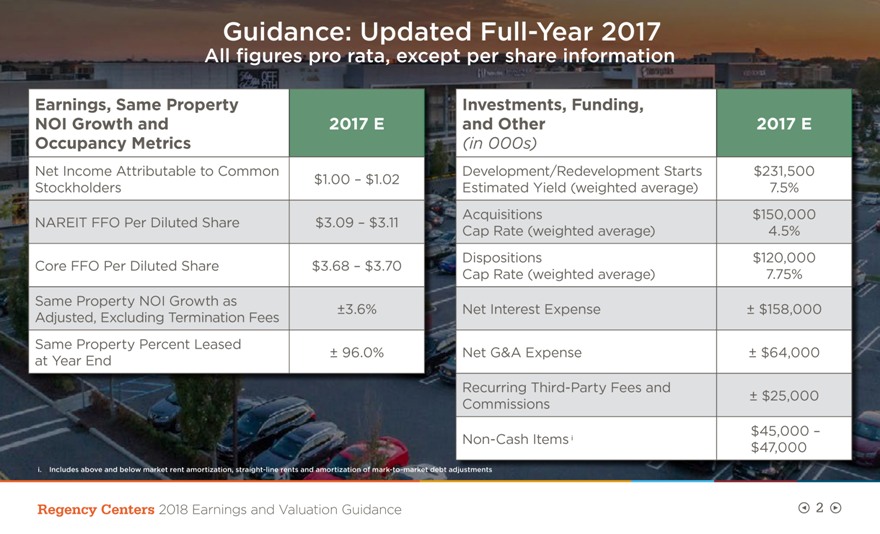

Guidance: Updated Full-Year 2017

All figures pro rata, except per share information

Earnings, Same Property Investments,

Funding,

NOI Growth and 2017 E and Other 2017 E Occupancy Metrics (in 000s)

Net Income Attributable to Common Development/Redevelopment Starts $231,500 $1.00 – $1.02 Stockholders Estimated Yield (weighted average) 7.5% Acquisitions

$150,000 NAREIT FFO Per Diluted Share $3.09 – $3.11 Cap Rate (weighted average) 4.5% Dispositions $120,000 Core FFO Per Diluted Share $3.68 – $3.70 Cap Rate (weighted average) 7.75% Same Property NOI Growth as ±3.6% Net Interest

Expense ± $158,000 Adjusted, Excluding Termination Fees Same Property Percent Leased

± 96.0% Net G&A Expense ± $64,000 at Year End

Recurring Third-Party Fees and

± $25,000 Commissions $45,000 – Non-Cash Itemsi $47,000

i. Includes above and below market rent amortization, straight-line rents and amortization of

mark-to-market debt adjustments

Regency Centers 2018 Earnings and Valuation

Guidance 2

|

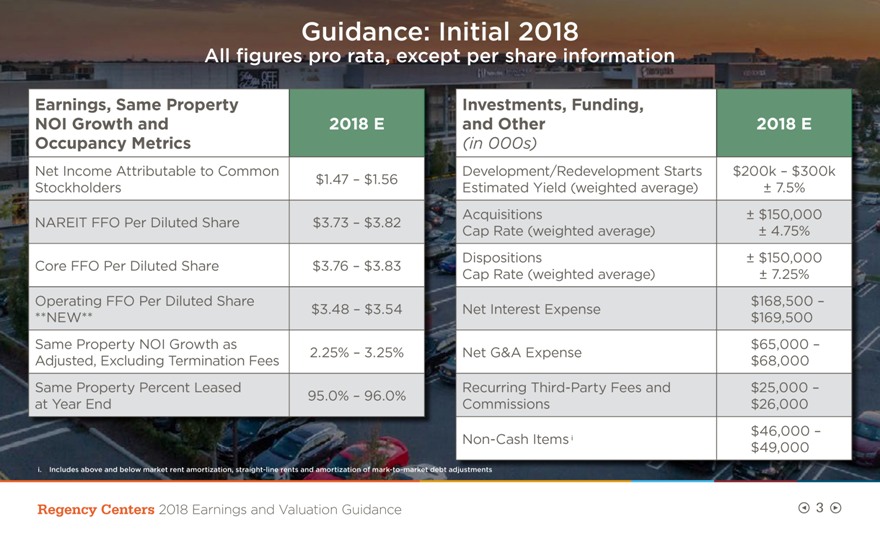

Guidance: Initial 2018

All figures pro rata, except per share information

Earnings, Same Property Investments,

Funding,

NOI Growth and 2018 E and Other 2018 E Occupancy Metrics (in 000s)

Net Income Attributable to Common Development/Redevelopment Starts $200k – $300k $1.47 – $1.56 Stockholders Estimated Yield (weighted average) ±

7.5% Acquisitions ± $150,000 NAREIT FFO Per Diluted Share $3.73 – $3.82 Cap Rate (weighted average) ± 4.75% Dispositions ± $150,000 Core FFO Per Diluted Share $3.76 – $3.83 Cap Rate (weighted average) ± 7.25%

Operating FFO Per Diluted Share $168,500 – $3.48 – $3.54 Net Interest Expense **NEW** $169,500 Same Property NOI Growth as $65,000 – 2.25% – 3.25% Net G&A Expense Adjusted, Excluding Termination Fees $68,000 Same Property

Percent Leased Recurring Third-Party Fees and $25,000 – 95.0% – 96.0% at Year End Commissions $26,000 $46,000 – Non-Cash Itemsi $49,000

i. Includes above and below market rent amortization, straight-line rents and amortization of

mark-to-market debt adjustments

Regency Centers 2018 Earnings and Valuation

Guidance 3

|

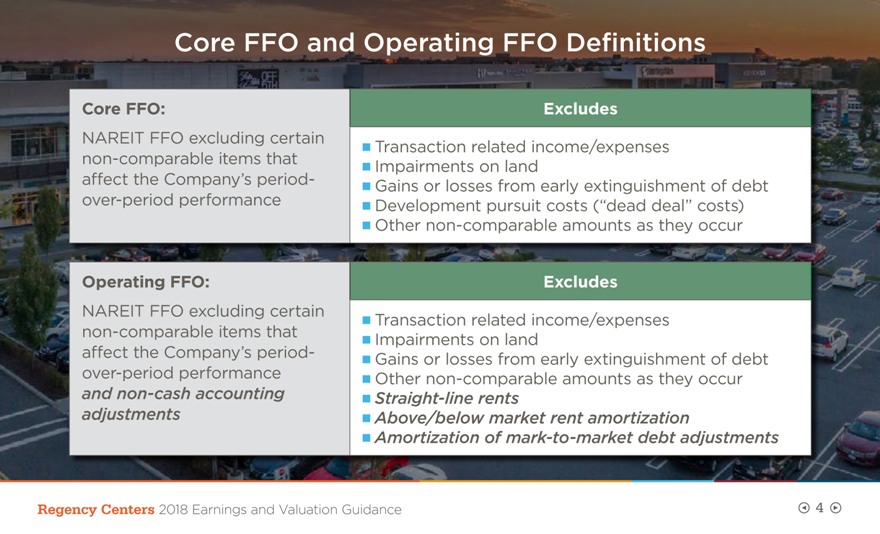

Core FFO and Operating FFO Definitions

Core FFO: Excludes

NAREIT FFO excluding certain

Transaction related income/expenses non-comparable items that Impairments on land affect the Company’s period-

Gains or losses from early extinguishment of debt over-period performance Development pursuit costs (“dead deal” costs) Other

non-comparable amounts as they occur

Operating FFO: Excludes

NAREIT FFO excluding certain

Transaction related income/expenses non-comparable items that Impairments on land affect the Company’s period-

Gains or losses from early extinguishment of debt

over-period performance Other non-comparable amounts as they occur and non-cash accounting Straight-line rents adjustments Above/below market rent amortization

Amortization of mark-to-market debt adjustments

Regency Centers 2018 Earnings and

Valuation Guidance 4

|

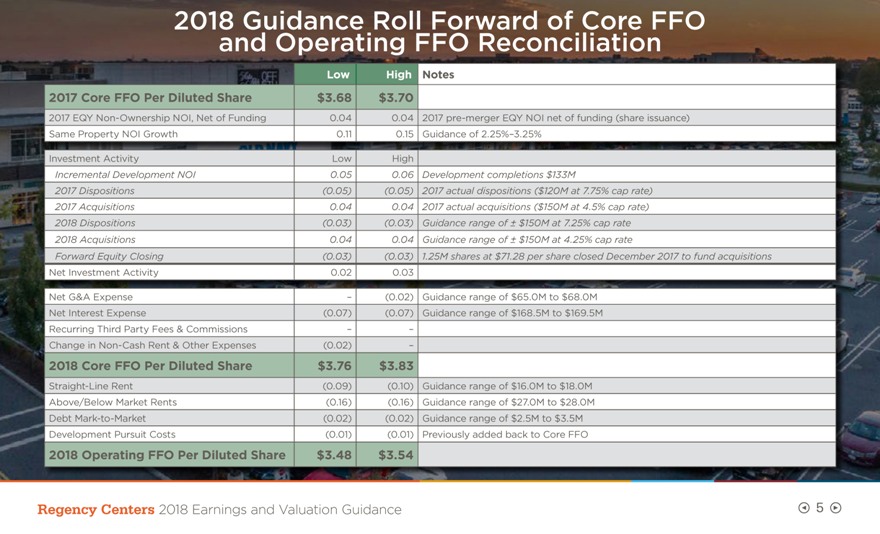

2018 Guidance Roll Forward of Core FFO and Operating

FFO Reconciliation

Low High Notes

2017 Core FFO Per Diluted Share $3.68 $3.70

2017 EQY Non-Ownership NOI, Net of Funding 0.04 0.04 2017 pre-merger EQY NOI net of

funding (share issuance) Same Property NOI Growth 0.11 0.15 Guidance of 2.25%–3.25%

Investment Activity Low High

Incremental Development NOI 0.05 0.06 Development completions $133M

2017 Dispositions (0.05)

(0.05) 2017 actual dispositions ($120M at 7.75% cap rate) 2017 Acquisitions 0.04 0.04 2017 actual acquisitions ($150M at 4.5% cap rate) 2018 Dispositions (0.03) (0.03) Guidance range of ± $150M at 7.25% cap rate 2018 Acquisitions 0.04 0.04

Guidance range of ± $150M at 4.25% cap rate

Forward Equity Closing (0.03) (0.03) 1.25M shares at $71.28 per share closed December 2017 to fund acquisitions

Net Investment Activity 0.02 0.03

Net G&A Expense – (0.02) Guidance

range of $65.0M to $68.0M Net Interest Expense (0.07) (0.07) Guidance range of $168.5M to $169.5M Recurring Third Party Fees & Commissions – –Change in Non-Cash Rent & Other

Expenses (0.02) –

2018 Core FFO Per Diluted Share $3.76 $3.83

Straight-Line Rent (0.09) (0.10) Guidance range of $16.0M to $18.0M Above/Below Market Rents (0.16) (0.16) Guidance range of $27.0M to $28.0M Debt Mark-to-Market (0.02) (0.02) Guidance range of $2.5M to $3.5M Development Pursuit Costs (0.01) (0.01) Previously added back to Core FFO

2018 Operating FFO Per Diluted Share $3.48 $3.54

Regency Centers 2018 Earnings and Valuation

Guidance 5

|

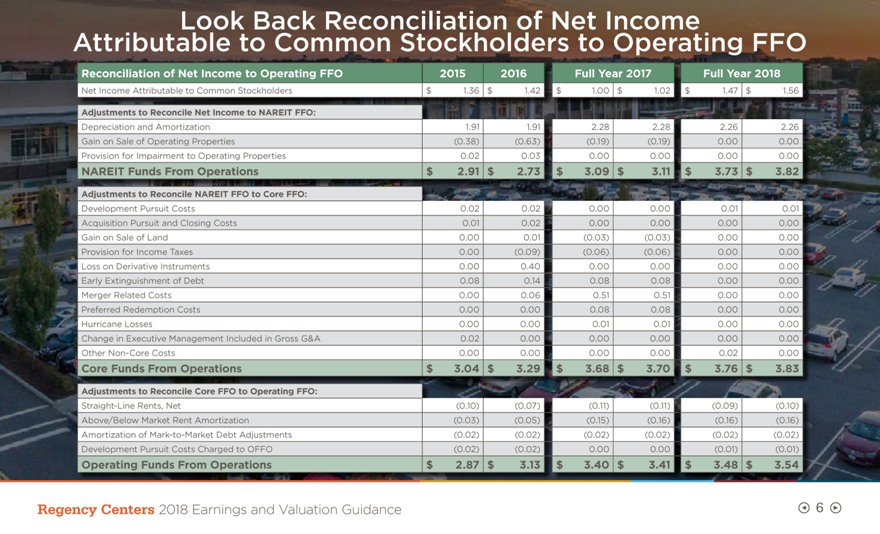

Look Back Reconciliation of Net Income Attributable

to Common Stockholders to Operating FFO

Reconciliation of Net Income to Operating FFO 2015 2016 Full Year 2017 Full Year 2018

Net Income Attributable to Common Stockholders $ 1.36 $ 1.42 $ 1.00 $ 1.02 $ 1.47 $ 1.56

Adjustments to Reconcile Net Income to NAREIT FFO:

Depreciation and

Amortization 1.91 1.91 2.28 2.28 2.26 2.26 Gain on Sale of Operating Properties (0.38) (0.63) (0.19) (0.19) 0.00 0.00 Provision for Impairment to Operating Properties 0.02 0.03 0.00 0.00 0.00 0.00

NAREIT Funds From Operations $ 2.91 $ 2.73 $ 3.09 $ 3.11 $ 3.73 $ 3.82

Adjustments to

Reconcile NAREIT FFO to Core FFO:

Development Pursuit Costs 0.02 0.02 0.00 0.00 0.01 0.01 Acquisition Pursuit and Closing Costs 0.01 0.02 0.00 0.00 0.00 0.00 Gain

on Sale of Land 0.00 0.01 (0.03) (0.03) 0.00 0.00 Provision for Income Taxes 0.00 (0.09) (0.06) (0.06) 0.00 0.00 Loss on Derivative Instruments 0.00 0.40 0.00 0.00 0.00 0.00 Early Extinguishment of Debt 0.08 0.14 0.08 0.08 0.00 0.00 Merger Related

Costs 0.00 0.06 0.51 0.51 0.00 0.00 Preferred Redemption Costs 0.00 0.00 0.08 0.08 0.00 0.00 Hurricane Losses 0.00 0.00 0.01 0.01 0.00 0.00 Change in Executive Management Included in Gross G&A 0.02 0.00 0.00 0.00 0.00 0.00 Other Non-Core Costs 0.00 0.00 0.00 0.00 0.02 0.00

Core Funds From Operations $ 3.04 $ 3.29 $ 3.68 $ 3.70 $ 3.76 $ 3.83

Adjustments to Reconcile Core FFO to Operating FFO:

Straight-Line Rents, Net (0.10) (0.07)

(0.11) (0.11) (0.09) (0.10) Above/Below Market Rent Amortization (0.03) (0.05) (0.15) (0.16) (0.16) (0.16) Amortization of Mark-to-Market Debt Adjustments (0.02) (0.02)

(0.02) (0.02) (0.02) (0.02) Development Pursuit Costs Charged to OFFO (0.02) (0.02) 0.00 0.00 (0.01) (0.01)

Operating Funds From Operations $ 2.87 $ 3.13 $ 3.40 $

3.41 $ 3.48 $ 3.54

Regency Centers 2018 Earnings and Valuation Guidance 6

|

Non-GAAP

Disclosure

The Company uses certain non-GAAP performance measures, in addition to the required GAAP presentations, as it

believes these measures improve the understanding of the Company’s operational results. Regency manages its entire real estate portfolio without regard to ownership structure, although certain decisions impacting properties owned through

partnerships require partner approval. Therefore, the Company believes presenting its pro-rata share of operating results regardless of ownership structure, along with other

non-GAAP measures, makes comparisons of other REITs’ operating results to the Company’s more meaningful. Management continually evaluates the usefulness, relevance, limitations, and calculation of

the Company’s reported non-GAAP performance measures to determine how best to provide relevant information to the public, and thus such reported measures could change. NAREIT FFO is a commonly used

measure of REIT performance, which the National Association of Real Estate Investment Trusts (“NAREIT”) defines as net income, computed in accordance with GAAP, excluding gains and losses from dispositions of depreciable property, net of

tax, excluding operating real estate impairments, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Regency computes NAREIT FFO for all periods presented in accordance with NAREIT’s

definition. Many companies use different depreciable lives and methods, and real estate values historically fluctuate with market conditions. Since NAREIT FFO excludes depreciation and amortization and gains and losses from depreciable property

dispositions, and impairments, it can provide a performance measure that, when compared year over year, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs, acquisition and development activities, and

financing costs. This provides a perspective of the Company’s financial performance not immediately apparent from net income determined in accordance with GAAP. Thus, NAREIT FFO is a supplemental non-GAAP

financial measure of the Company’s operating performance, which does not represent cash generated from operating activities in accordance with GAAP and therefore, should not be considered a substitute measure of cash flows from operations. Core

FFO and Operating FFO are additional performance measures used by Regency as the computation of NAREIT FFO includes certain non-cash and non-comparable items that affect

the Company’s period-over-period performance. Core FFO excludes from NAREIT FFO: (a) transaction related income or expenses; (b) impairments on land; (c) gains or losses from the early extinguishment of debt; (d) development

pursuit costs; and (e) other non-comparable amounts as they occur. Operating FFO excludes from Core FFO: (a) non-cash components of earnings derived from above

and below market rent amortization, straight-line rents, and amortization of mark-to-market of debt adjustments; and includes (b) development pursuit costs. The

Company provides a reconciliation of Net Income to NAREIT FFO to Core FFO to Operating FFO.

Regency Centers 2018 Earnings and Valuation Guidance 7