Attached files

| file | filename |

|---|---|

| 8-K - POWIN ENERGY CORP | p1111828k.htm |

Exhibit 99.1

Growth Equity Capital Raise Investor Presentation January 2018

Executive Summary Powin Energy Corp (“Powin” or the “Company”) is a producer of commercially proven, cost-competitive, bankable lithium-ion battery technology which will capture meaningful market share in the rapidly growing (35% CAGR over next ten years1) energy storage marketOver the past 8 years Powin applied their competitive advantages to the nascent energy storage sector and is currently among the market leaders in providing utility-scale, turnkey battery energy storage solutions Powin has engaged Swift Current Advisors to raise $10 to $15 million of growth equity to: (1) accelerate sales pipeline to build on existing revenue base, (2) contribute to ongoing R&D, and (3) strengthen their balance sheet in order to provide additional comfort to customersPowin is currently a publicly listed but closely held company; the Company is flexible on investment structures (including a PIPE or going private) and will entertain offers beyond the growth equity structure above (including secondary share sales or an acquisition) Powin’s Business Model Powin has a 26 year history as a global manufacturer supplying design, engineering, manufacturing, and logistics services In 2009, Powin formed the energy storage product division and in 2016 divested all non-energy related businesses to become a pure-play stationary energy storage company; in December 2017 Powin exited its project development activities to focus on product salesPowin is SEC registered and publicly traded (“PWON”) on the US over-the-counter marketPowin is headquartered outside Portland, Oregon with its dedicated assembly facility in Yangzhou, China and additional engineering, programming, and procurement professionals at its Qingdao, China officePowin has 36 employees across the U.S. and China Powin generated $~25M of gross proceeds in 2017; a portion was received in 2017 and the remainder will be received in 2018 Opportunity Overview Company Background Design Innovative Battery Control TechnologyPowin’s core innovation is software and hardware to provide granular monitoring and control of their utility-scale battery systems Assemble Fully Turnkey Energy Storage SystemsPowin has an advanced Asian supply chain to source commercialized, low-cost, third-party lithium-ion batteries and other electrical components for assembly in their China-based manufacturing facility, allowing the Company to deliver a fully turnkey, modular system to customers globally Direct Energy Storage System SalesAs a product company, Powin focuses on developing deep relationships with targeted energy developers and utilities that procure utility-scale energy storage equipment; the current focus is on North America with the goal of expanding into other fast growing international markets On-going Operations and Warranty ManagementAfter the customer installs Powin equipment, the Company provides on-going operational support for the life of the asset as well as administers the battery cell warranty on behalf of the customer Sources: 1. Navigant 2017

Investment Highlights Cell agnostic approach allows Powin to benefit from the projected massive expansion of the lithium-ion battery manufacturing base and the resulting cost reductions Distinct competitive advantage with a path to a long-term, sustained advantage Largely driven by demand for the global electric vehicle market, the manufacturing capacity of lithium-ion cells is expected to nearly triple by 2021; this scale should drive down the cost of quality battery cellsPowin is cell agnostic, allowing them to seek out commercialized battery cell manufacturers that can provide the most cost competitive productWhereas several other integrators rely on specialist battery cell providers such as Samsung, LG Chem, or Panasonic to provide fully integrated battery packs, Powin leverages their proprietary battery management system to optimize cell vendors with specific customer needs, such as lower cost or higher performanceThe Company identifies quality cost-efficient battery cell suppliers, performs robust product testing and on-site audits, and implements quality control on all battery cells that are delivered to Powin’s assembly facility Forecasted Global Lithium-ion Manufacturing Capacity (GWh)1 Powin currently has an early mover advantage to provide proven, fully turnkey storage systems consistently priced at a low cost pointAssembly of the product at their China-based facility allows Powin to manage quality assurance and dramatically reduce their balance of system costsOver the next 24 months, Powin will continue to use their competitive battery cell procurement process and the internal assembly capability to maintain their price advantage relative to competitorsPowin also plans to continue to develop their application and services layers to differentiate themselves and expand revenue streams beyond hardware sales Competitive Advantage Over Time Low cost turnkey system based on competitive procurement of battery cells, control of assembly and software control layers Continually dropping cell prices and value engineering to lower Powin system costs Sources: 1. Bloomberg New Energy Finance Current Next 24 Months Develop value add software applications and services Future 1 2

Investment Highlights (cont’d) Market validation of commercialized, bankable technology Revenue generation with a substantial near-term pipeline In 2016 and 2017 Powin demonstrated bankability of their technology by directly developing and contracting 111 MWh of stand alone storage projectsIn December 2017, Powin sold their operating assets and contracted development pipeline to third parties, generating ~$25M in gross proceedsThe sale of the self-developed assets was a key milestone that shifts Powin’s business model to a pure-play product company selling product and services to asset owners globallyIn 2017 Powin built a robust product sales pipeline of 200+ MWh which is forecasted to generate revenue in access of $50M in 2018 Powin does not take battery technology risk, rather they commit to only use commercial, proven lithium ion technologiesThe Company performs deep audits on each battery cell manufacturer before integrating their technology into the Powin modular system to ensure quality of their systemsIn 2017 Powin achieved important market validation for their technology by receiving non-recourse project debt from Brookfield Renewables, an established project finance investorBrookfield conducted extensive diligence on Powin’s technology and commissioned a thorough third party independent engineering report from DNV GLA further market validation point was an equity investment in the Millikan and Stratford projects by the Australian real asset investor BlueSky Alternatives 49 MWh of Operating or In-Construction Projects Institutional Investors that Own or Finance Powin Equipment Source for market size: 1. GTM Research 2017 3 4

Option 2: Trade SaleLikely acquirers include:Industrial private equity fundsElectrical equipment OEMsInverter OEMsEnergy storage integrators Investment Highlights (cont’d) Favorable payment terms with battery suppliers provides Powin with a highly efficient working capital positionThe lithium-ion batteries the largest portion of Powin’s system cost, so during a period of rapidly growing sales, Powin will require a high volume of physical battery cells for work-in-progress inventoryPowin currently has highly favorable payment terms with key battery cell suppliers, allowing the Company to execute purchase orders, assemble / deliver a system to the customer, and receive customer revenue in advance of paying their battery suppliersBattery cell suppliers’ main customers are electric vehicle manufacturers that demand multiple year payment terms, so 12 month payment terms with Powin are relatively favorable to these suppliersPowin uses the favorable payment terms as a form of vendor financing so that working capital requirements do not impede growth 6 Month 0 1 2 3 4 5 6 7 8 9 10 11 12 Purchase order executed Initial customer payment Equipment assembly complete Final customer payment Equipment delivery to site Second customer payment Payment to battery supplier Several paths to a meaningful exit for new investorsAn alternative to a control trade sale is an uplisting to the NASDAQ, providing investors with liquidity, potentially a higher valuation, and it could represent one of the only pure play publicly traded energy storage companiesPowin’s strong momentum and differentiated position will begin to attract attention from a range of potential acquirers including industrial-focused PE fundsLarge, diversified electrical equipment manufacturers could see Powin’s patent portfolio, fully integrated product, and established brand as an attractive “buy instead of build” addition to an existing suite of products Inverter manufacturers could see Powin’s platform as an attractive means to improve sales of their product and to capture more of the energy storage value chainEnergy storage integrators that focus on project installation could see Powin as an opportunity to provide a differentiated, cost competitive solution to market Option 1: UplistingWhen revenue growth and EBITDA justify, Powin may choose to uplist to the NASDAQ 5

Emergence of the Energy Storage Market In Front of the Meter ApplicationsEnergy storage allows utilities to offset costs to upgrade their system and provides for improved operations Behind the Meter ApplicationsEnergy storage provides commercial and industrial (“C&I”) facilities with back-up power and the ability to lower their electricity bills through peak shaving Renewable IntegrationEnergy storage allows renewable energy projects to smooth out the intermittency of generation, furthering their market penetration / acceptance Grid ServicesEnergy storage provides grid operators the ability to improve frequency regulation, voltage support, and reserves to increase system efficiency Energy Storage Use Cases Energy storage technology fundamentally solves multiple problems for utilities, grid operators, energy generators, and building owners - key market trends are driving rapid adoption Falling Battery Costs Make More Use Cases EconomicalThe global supply chain of lithium-ion is set to nearly triple in the next 6 years1 driving down costs and making more energy storage use cases economicalPowin’s cell agnostic approach allows rapidly falling battery cell prices to provide highly competitive pricing for their storage solutions Market Framework FormationMost the value of energy storage accrues to grid operators and utilities; these parties are beginning to create market incentives to catalyze third party development of energy storage projects The evolving market framework requires successful developers to be; Powin’s flexibility in design, cost, and delivery timelines provide an advantage in selling to these developers Key Trends Driving Market Growth Source: 1. Navigant 2017

Energy Storage Market Overview Powin’s core market is lithium-ion, in front of the meter (utility scale) projects, for use by utilities and developers of renewable-energy-plus-storage and storage-only projectsNavigant Consulting forecasts the global market for these projects to expand more than 9x from the current size of ~2.5 GWh to 25.5 GWh in 2022, which represents a $3.9 billion market opportunityPowin currently focuses on North America and China where it has deep relationships Sources: 1. Navigant 2017, GTM Research; 2. Bloomberg New Energy Finance 2017 The global energy storage market is rapidly developing from niche and experimental projects into an exponentially growing asset class, brought about by scaling of production and growing renewables capacity Lithium Ion Storage Market Size and Growth Lithium Ion Battery Prices The price of lithium-ion batteries has declined more than 73% since 20102 and is forecasted to continue to decline rapidlyFactors include increased manufacturing capacity to meet demand from electric cars, especially in China, and competition from new market entrantsBloomberg has forecasted that the pipeline of commissioned, under construction, and announced battery storage plants will increase global lithium ion battery manufacturing capacity by 154 GWh by 2021 (more than doubling total capacity today)2Forecasts point to battery pack prices dropping below $200/kWh within the next 5 years and below $100/kWh by 20302 Global Lithium-Ion Energy Storage Market Forecast1 Lithium-ion Battery Pack Cost Curve ($/kWh)2

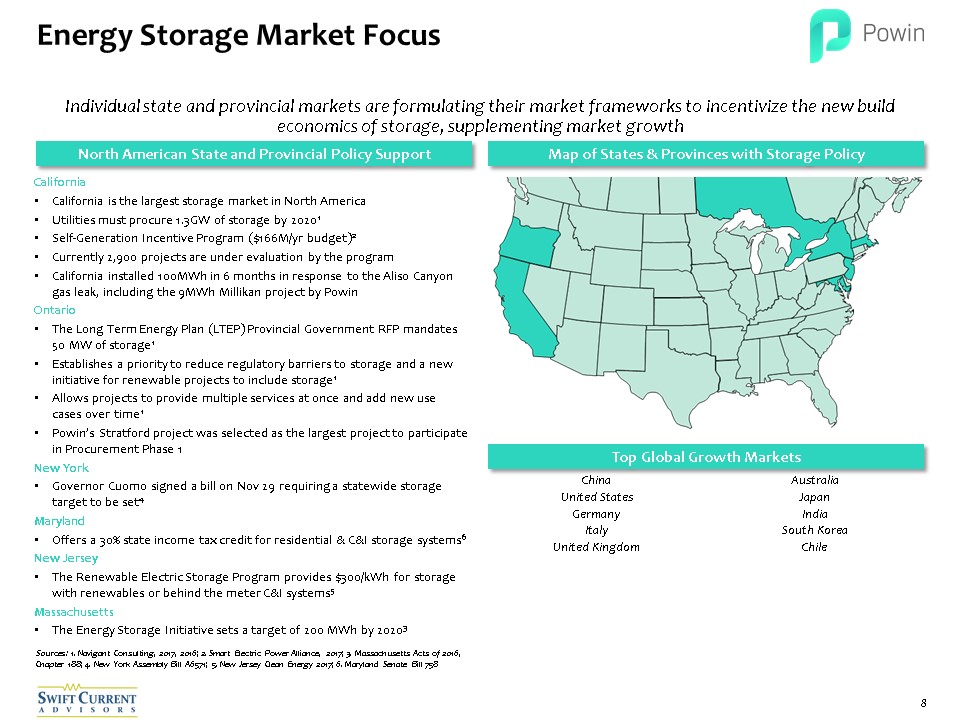

Energy Storage Market Focus CaliforniaCalifornia is the largest storage market in North AmericaUtilities must procure 1.3GW of storage by 20201Self-Generation Incentive Program ($166M/yr budget)2Currently 2,900 projects are under evaluation by the programCalifornia installed 100MWh in 6 months in response to the Aliso Canyon gas leak, including the 9MWh Millikan project by PowinOntarioThe Long Term Energy Plan (LTEP) Provincial Government RFP mandates 50 MW of storage1 Establishes a priority to reduce regulatory barriers to storage and a new initiative for renewable projects to include storage1Allows projects to provide multiple services at once and add new use cases over time1Powin’s Stratford project was selected as the largest project to participate in Procurement Phase 1New YorkGovernor Cuomo signed a bill on Nov 29 requiring a statewide storage target to be set4MarylandOffers a 30% state income tax credit for residential & C&I storage systems6New JerseyThe Renewable Electric Storage Program provides $300/kWh for storage with renewables or behind the meter C&I systems5MassachusettsThe Energy Storage Initiative sets a target of 200 MWh by 20203 Sources: 1. Navigant Consulting, 2017, 2016; 2. Smart Electric Power Alliance, 2017; 3. Massachusetts Acts of 2016, Chapter 188; 4. New York Assembly Bill A6571; 5. New Jersey Clean Energy 2017; 6. Maryland Senate Bill 758 Individual state and provincial markets are formulating their market frameworks to incentivize the new build economics of storage, supplementing market growth China Australia United States Japan Germany India Italy South Korea United Kingdom Chile North American State and Provincial Policy Support Map of States & Provinces with Storage Policy Top Global Growth Markets

Energy Storage Competitor Landscape The energy storage market has seen several distinct business models and competitors arise, however, Powin is uniquely positioned to provide the most cost competitive energy storage system Battery Cell Manufacturing Battery Pack Assembly Battery Management System System Assembly and Integration Energy Management System Project Installation Operation & Monitoring Business Models in the Energy Storage Value Chain Integrators Large Cell Suppliers Integrated Cell Suppliers Powin Powin’s Competitive Advantage Competitive Business Model Examples Powin’s Competitive Advantage Large Cell Suppliers Large cell suppliers can deliver battery packs along with a battery management system, however, these packs will need to be assembled on-site by the customer increasing the system cost; Powin delivers fully assembled units decreasing the customer’s installation cost Integrators Integrators procure separate system components and assemble them on-site, increasing the time of integration and the cost; Powin’s modular systems can be installed more quickly and with a lower cost Integrated Cell Suppliers Tesla is the likely closest competitor to Powin, directly controlling the entire value chainTesla is captive to their own battery cell supply, meaning that if a material in their chemistry rises in value or if a more efficient chemistry is introduced, Tesla’s price will have to go up or their margins will have to go down; Powin is cell agnostic to evolve with the market, keep prices low, and maintain marginsTesla sells equipment to third party developers and while also self-developing projects, whereas Powin purposefully does not compete with customers

Description Why it is Important Cell Level Powin has the flexibility to integrate a wide array of lithium based battery cells into the system based on customer demand, end use case, needed parameters, and costThe Powin engineering team can quickly adapt the Powin battery management system to a new cell technology Flexibility and Low Cost: Based on market dynamics and customer preferences, Powin competitively procures most cost effective cells Pack Level The pack consists of roughly 7.8 kWh to 9.8 kWh of cells assembled into an efficient form factorWithin the pack, each cell is connected to a module controller that measures cell voltage and temperature to provide detailed granularity, and discharges the cells for passive balancingEach pack has both a balancing charger and battery pack controller provide active balancing an charging of cells Lower Degradation: Most pack level designs do not balance to the cell level, causing increased cell degradation; Powin’s pack controller reduces degradation and extends lifeWider SOC Operating Range: Tightly targeted active and passive balancing allows for safely charging higher and discharging more deeplyMore Granular Data: Cell level data from the module controller allows for deeper operational insights System Level 17 packs form Powin’s ‘Stack140’, the modular, purpose-built 140 kWh battery systemThe modularity of Stack140 eases installation, simplifies maintenance, reduces downtime, and lowers operation costsStack140 can scale easily to multiple MW systems for indoor and outdoor environmentsPowin partners with leading power conversion providers ensure that the system delivered to a customer is turnkey Full Turnkey Solution: Powin’s fully integrated solution saves customers time and money during installationQuicker Delivery Time: The modular nature of Powin’s technology allows for rapid design and delivery to customers Software and Control Level Powin has detailed IP around the Battery Pack Operating System (“bP-OS”) that was designed specifically for stationary storage systems as opposed to EVsThe bp-OS functions unlike most competitors’ battery management systems by evenly synchronizing charge and discharge cycles and provides visibility and predictability into every level of the battery systemPowin’s EMS software manages the entire system Extends Cell Lives: The balancing manager of bp-OS lowers the degradation of the cells, maintaining higher performance and residual value for the end customersFoundation for Applications: bP-OS acts as a foundation for a suite of current and future value-add applications for customers Technology Overview Powin’s IP combined with their thorough approach to engineering and integrating the energy storage system from the bottom up allows them to deliver a low cost, turnkey, and differentiated product to customers EMS & bp-Os

Cell Level Pack Level System Level Software and Control Level Powin Technology Differentiation Current Differentiation of Powin’s Patented Applications Patented applications that run on Powin’s bP-OS provide customers with the ability to strictly enforce battery warranties, optimize operations, and extend a system’s useful life relative to competitors’ BMS Battery OdometerWhat it is: An application that leverages the bP-OS cell level data, including current factor, voltage factor, and temperature factor, to calculate a cell-level ‘odometer value’, which is a single time-series data set that measures the capacity degradation and remaining life of each cellWhy it is Important: Provides the operator with a real-time, single data set to monitor the performance, optimize operations, and quickly identify issues of the energy storage systemWhy it is Different: Competitors’ systems provide disparate data streams that focus on historical data and do not provide real-time insight to optimize operations Warranty TrackerWhat it is: An application that closely tracks when a battery storage system is not operating in the warranty parametersWhy it is Important: Battery warranties are crucial to the financeablility of Powin’s systems; the warranty tracker allows an operator to enforce battery warranties with hard data and removes subjectivity and dispute from the warranty claim processWhy it is Different: Battery cell manufacturers do not have an incentive to closely track the warranty to provide flexibility in warranty fulfillment; Powin’s system allows the operator to enforce the warranty with battery OEMs Balancing ManagerWhat it is: An application that optimizes active and passive balancing to keep a consistent charge across all cellsWhy it is Important: Inconsistent charging causes uneven degradation, harming operations and increasing the degradation of the whole system; Powin’s Balancing Manager reduces cell degradation over the useful life. More granular active and passive balancing allows a wider operating SOC range, make more energy storage available using the same cells, at the same costWhy it is Different: Most competitors’ battery managers were made for EVs and not larger stationary systems and cause uneven degradation of the cells causing shorter useful life of batteries, and making less of the cell capacity available for use EMS & bp-Os

Roadmap to a Sustained Advantage As the energy storage market matures, Powin’s cost advantage may begin to erode; the Company plans to shift the strategy towards software and services as a differentiator to create new revenue streams Market Dynamics:Given the current disaggregated nature and nascence of the energy storage market, few parties can execute quickly on a full turnkey energy storage solution at a cost competitive pricePowin Product Strategy:Provide proven, low cost, and fully turnkey energy storage systemsExecution PlanLeverage the unique Asian supply chain relationships to provide a low cost, fully turnkey solutionUse the internal bp-Os to get customers and the market comfortable with lower cost battery chemistriesDevelop value-add applications for customers 2017 2018 2019 2020 2021 2022 Current Strategy Market Dynamics:Competitors will begin to price more aggressively to gain market sharePowin Product Strategy:Continue to drive incremental costs out of the systemRamp up the value of Powin’s service, analytics, monitoring, SCADA integration, and applications layers to customersExecution PlanContinue to leverage Asian supply chain to decrease battery costs; 2018 and 2019 already have quoted prices with 15% and 9% annual reductions in COGS Explore the integration of inexpensive second life batteries into the system Continue to develop the services layer, which include customer applications and integrations to expand the system use cases and diversify revenue streams 2018 to 2019 Strategy Market Dynamics:Margins will begin to compress on hardware as energy storage market maturesNew use cases will require more sophisticated applications and integrationsPowin Product Strategy:As the hardware commoditizes, Powin will focus developing a sophisticated services layer to drive product differentiation and future revenueExecution Plan:The R&D team will work closely to work with customers to build applications Expand the integrations with third party software to maximize the potential use cases for Powin’s systems 2020 and Beyond Strategy Powin’s Focus Shifts from Hardware to a Software and Services Focus Over Time % of Powin R&D time focused on hardware development % of Powin R&D time focused on software and services

Powin dedicates resources to identify and closely track all commercialized battery OEMs and other component manufacturers to chose the best technology When Powin identifies a potential supplier, the Company will perform detailed analyses on sample products and perform an on-site audit of the facility When placing an order, Powin will run a competitive RFP process to procure low cost components that meet performance specs Powin has the purchasing power to further drive down component costs, lock in pricing for two years forward, and achieve favorable payment terms Once an order is placed, Powin manages on-site quality control audits and tests all components when they arrive at the Powin assembly facility Sophisticated Supply Chain – Procurement One of the core differentiators of Powin is its advanced Asian supply chain, where the Company has developed deep supplier relationships over the past 8 yearsThe procurement efforts are led out of the U.S. office while a Qingdao, China based team ensures the goal of identifying commercialized product manufacturers, negotiating favorable terms, and performing routine supplier auditsThe Company currently has relationships with several suppliers across China, Japan, and Korea; the Company has several qualified lithium iron phosphate cell suppliers in ChinaPowin’s supply chain flexibility on battery chemistries and other electrical components provide customers with choice to match specific/customized applications at low costs, and avoiding exposure to a single technology risk Powin’s advance procurement capabilities in Asia provides a continued price advantage and delivery times relative to competitors First Mover Advantage in Developing an Advanced Asian Supply Chain Market DynamicCobalt is an element included in Panasonic, Samsung, and other battery OEM chemistryIn the second half of 2017, the price of cobalt spiked, rising the prices of batteries with cobalt in their chemistryPowin’s Advantage Powin was able to quickly incorporate battery chemistries without exposure to cobalt, allowing them to further lower their cost relative to competitors Powin Office / Facility Qingdao Procurement Office Yangzhou Assembly Facility Case Study on the Value of Powin’s Flexible Supply Chain Supplier Identification Pre Qualify Suppliers Supplier RFP Negotiation and Purchase Order Quality Control Detailed Supply Chain Procurement Process

Sophisticated Supply Chain – Assembly and Integration Background: The Yangzhou, China assembly facility is the focal point of Powin’s supply chain, where all components are assembled and tested into a fully integrated, modular energy storage system750 MWh Facility Capacity: The assembly facility has the capacity to produce 750 MWh of energy storage systems per year with ability to expand further as neededMinimal Inventory: Powin administers a ‘just-in-time’ methodology with suppliers to ensure minimal inventory on their balance sheetRobust Quality Control: Powin has an exhaustive quality control program, testing suppliers’ shipments upon arrival, monitoring the voltage level of cells, closely monitoring the process, and performing operational tests on all systems before shipmentsLogistics: The Company has a dedicated person, with 20+ years of Asia to North America logistics experience, to directly manage shipping, customers, and delivery of the productFast Turn Around: The fully integrated supply chain allows Powin the unique ability to go from purchase order to delivery in 3 to 5 months Powin’s dedicated assembly facility creates a unique competitive advantage, as Powin controls the full integration of their systems to manage assembly cost, control quality, and increase certainty of supply Potential Powin Acquisition of the Assembly Facility The assembly facility is operated by Finway Energy, currently jointly owned by two of Powin’s board members, and exclusively manufacturers Powin’s systemsPowin is currently evaluating the acquisition of Finway Energy for further supply chain control and improve access to the Chinese energy storage market Dedicated Assembly Plant Provides Powin with Speed and Control

Sales Strategy Powin has a focused sales strategy to drive near-term pipeline growth with plans to expand into new customer segments and fast growing international markets Current, Focused Sales StrategyGeography Focus: North AmericaCustomer Segment Focus: Energy DevelopersSales Origination Strategy:Remain actively engaged with key North American developers, providing light touch support to stay top of mindLeverage an internal CRM to closely track the status of developers’ pipeline to focus attention on nearest term opportunitiesA company-wide focus on excellent delivery with the goal of repeat orders Energy DevelopersDescription: Independent storage developers that typically focus on regional markets bring storage projects through initial design and development cycle, then finance their projects’ capital costKey Characteristics:Product availability, equipment design support, and supply chain responsiveness is importantFinancially driven decision makers40 to 50 active energy developers currently in the U.S. energy storage space UtilitiesDescription: Owners and operators of transmission and distribution lines; beginning to use storage to offset major system upgradesKey Characteristics:Conservative buyers of energy and transmission equipment with established OEM relationshipsRun purchases through an RFPRequire strong balance sheet suppliersRecurring customer after they make the first sale with a supplier Commercial and Industrial FacilitiesDescription: Commercial and Industrial (“C&I”) building owners have the ability to install smaller storage systems to lower their electricity costs Key Characteristics:Storage lowers their cost, but is typically not a top prioritySmall system sizes and high customer acquisition cost makes scale difficultLarge opportunity but currently a disaggregated customer segment Customer Segmentation Planned Progression of Powin’s Sales Strategy Expansion into New SegmentsGeography Focus: North AmericaCustomer Segment Focus: Energy Developers, Utilities, C&ISales Origination Strategy:Leverage partnerships with large balance sheet players to bid into utility RFPs that have high balance sheet requirementsIdentify quality C&I storage developers that can aggregate smaller customers into a large, single equipment order Expansion InternationallyGeography Focus: North America, China, Australia, Southeast AsiaCustomer Segment Focus: Energy Developers, Utilities, C&ISales Origination Strategy:Identify local partners as the key channel to expand into high growth international marketsCurrently in discussions with a joint venture for select global markets

Sales Pipeline Opportunity Status Categories Probability Weighting Total Pipeline (MWh) Probability Adjusted Pipeline (MWh) 06 - Product Delivered 100% 49 49 05 - Purchase Order Completed 90% 76 69 04 - Negotiating Proposal 50% 247 124 03 - Proposal in Process 20% 2,908 582 02 - Conversation Initiated 10% 1,645 165 01 - Opportunity Identified 5% 2,470 123 Total 7,396 1,112 Powin has a robust 2018 pipeline of 200+ probability adjusted MWh, representing more than $50M in revenue Five Year Pipeline Summary

esVolta / BlueSky Exclusive Sales Relationship Powin’s internally developed projects were sold to an independent energy developer called esVolta; esVolta will continue to develop storage projects using Powin equipment BlueSky Transaction esVolta Strategy In December 2017, Powin sold the 9 MWh Millikan operating project, the 40 MWh Stratford project, and its internally developed project pipeline of 2+ GWh to a newly formed entity called esVoltaBlueSky Alternative Investments, an multi-billion AUM Australian private equity, real estate, and infrastructure investor, is the sponsor of esVoltaPowin will receive ~$25M of gross proceeds in 2017 and 2018 from the transaction with BlueSkyPowin received a 10% interest in esVolta as part of the asset salePowin has a ROFR to sell technology to all esVolta projects going forward The esVolta strategy is to develop, construct, own, and operate utility-scale storage projectsBlueSky will fund both the development platform and the construction of the projectsThe team is led by Randy Mann, an experienced energy development executive previously with NRG Energy and Edison Mission EnergyThe current development pipeline is a combination of projects acquired from BlueSky and self developed projectsThe esVolta contracted pipeline is 66 MWh with a line of site to another 2.1 GWh of pipeline Increased Product Sales: Powin has a ROFR to provide equipment for all projects esVolta develops, providing the Company with access to hundreds of MWh of captive sales pipeline Value to Powin Product Focus: As Powin fully divested out of direct project development, they now focus exclusively on product enhancements and sales Improves Positioning in Market: Exiting the direct project development alleviates concerns from energy developers that Powin is a competitor 1 2 3

Management Team Joseph Lu – Founder, CEO and ChairmanMr. Lu has over 30 years of management and international business experience, including serving as president of multiple successful companies in Taiwan. He has proven expertise in international trade, marketing, manufacturing, and supply chain management. Lu founded Powin Corporation (Powin Energy’s parent company) in 1989 and still serves as its Chairman of the Board. Geoffrey Brown – PresidentGeoffrey Brown is an engineer and businessman with over 10 years of cleantech experience with companies like NRG Renew, Beacon Power, Element Power, and Garrad Hassan America. Brown led renewable and energy storage sales efforts to utility and industrial customers across North America and played a key role in the development of more than 10 gigawatts of utility scale wind projects. Virgil Beaston – Chief Technology OfficerVirgil is the Senior Vice President and Chief Technology Officer (CTO) for Powin and has been with the Company since 2011. He has over 10 years of experience in the battery and energy storage industry and is often asked to speak publicly as a subject matter expert. He was the co-founder and CTO of Greensmith Energy Management Solutions. Beaston is an inventor, lawyer, and engineer with a Doctorate of Law, Masters in Electrical Engineering, and a Bachelor of Science in Applied Physics and Electrical Engineering. Jan Jacobson – VP of Business DevelopmentJan has extensive experience across the renewable and distributed energy resources industries. Prior to Powin, Jan led project deployment and technical business development for energy storage leader Stem, overseeing the majority of their current capacity. He also led project development for fuel cell startup Bloom Energy in the Western U.S. and Asia. Jan’s distributed energy expertise was built on a strong foundation of utility scale project development in his previous stints at Pacific Gas & Electric and Acciona. Mike Wietecki – General CounselMike oversees the legal needs of the organization, develops strategy, manages business issues and supports the fast evolving needs of this dynamic organization. His background covers securities, litigation and risk management, M&A, sustainability, regulatory compliance and operations. Danny Lu – VP of Global ProcurementDanny has been with Powin Energy from the beginning and has had diverse responsibilities including marketing, financial structuring, pricing, and negotiation experience in the energy storage industry. He was previously VP of Business Development before taking over Global Procurement. Danny is responsible for managing the global supply chain and has strong relationships with battery suppliers and component vendors. Powin’s strategy and execution is driven by an executive team with battery management system expertise, long standing battery supply chain relationships in Asia, and deep customer connections The management team’s experience includes leading roles at the forefront of energy storage and renewables Stu Statman– Head of Product and EngineeringStu is responsible for overseeing Powin’s product development and engineering teams. With seven startups and over 20 years of experience in engineering leadership at companies such as Boeing, RealNetworks and Viacom. In his last role as Senior VP of Technology for Sunverge, Stu initiated and led the development of its industry leading hardware and software platform.

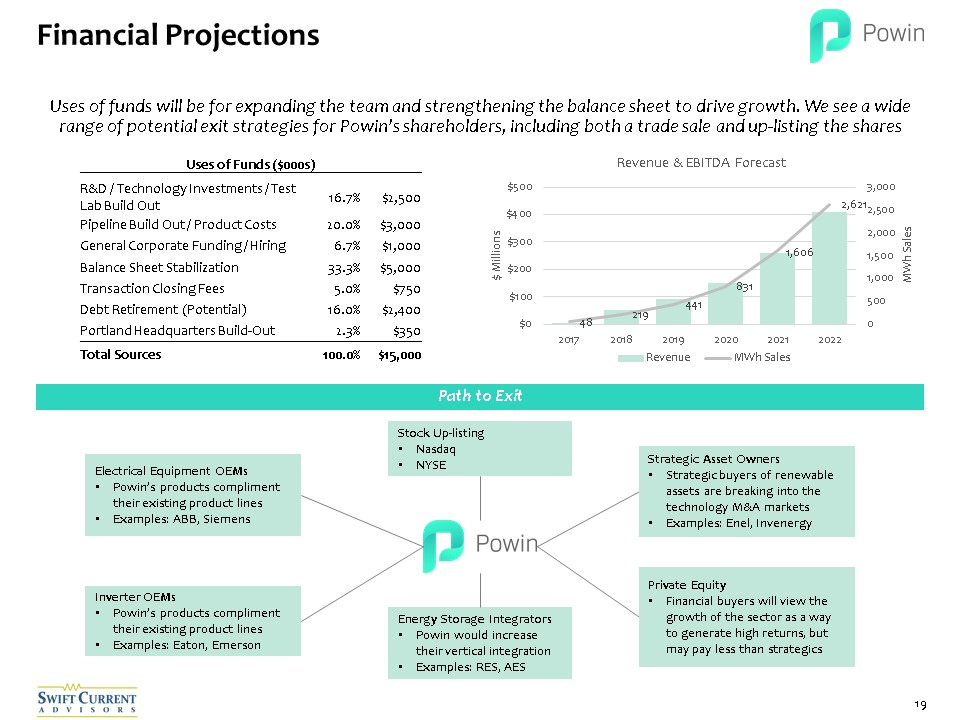

Financial Projections Path to Exit Uses of Funds ($000s) R&D / Technology Investments / Test Lab Build Out 16.7% $2,500 Pipeline Build Out / Product Costs 20.0% $3,000 General Corporate Funding / Hiring 6.7% $1,000 Balance Sheet Stabilization 33.3% $5,000 Transaction Closing Fees 5.0% $750 Debt Retirement (Potential) 16.0% $2,400 Portland Headquarters Build-Out 2.3% $350 Total Sources 100.0% $15,000 Uses of funds will be for expanding the team and strengthening the balance sheet to drive growth. We see a wide range of potential exit strategies for Powin’s shareholders, including both a trade sale and up-listing the shares Electrical Equipment OEMsPowin’s products compliment their existing product linesExamples: ABB, Siemens Inverter OEMsPowin’s products compliment their existing product linesExamples: Eaton, Emerson Energy Storage IntegratorsPowin would increase their vertical integrationExamples: RES, AES Private EquityFinancial buyers will view the growth of the sector as a way to generate high returns, but may pay less than strategics Strategic Asset OwnersStrategic buyers of renewable assets are breaking into the technology M&A marketsExamples: Enel, Invenergy Stock Up-listingNasdaqNYSE

Contact Information This overview is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer will be made only pursuant to a Private Placement Memorandum that will be provided in connection with any such offering. The information contained herein includes (or is based in part on) projections, valuations, estimates and other financial data. This information has not been verified or substantiated by any third party sources. This information should not be relied upon for the purpose of making an investment. Any information regarding projected or estimated values, investment returns or distributions are estimates only and should not be considered indicative of the actual results that may be realized or predictive of any investment. This presentation is preliminary in nature. This document is a confidential document that is not to be made available to third parties and in particular must not be made available to the public nor be made available in jurisdictions where this would be contrary to local laws and regulations. Recipients of this document are required to inform themselves of and to comply with all applicable local laws and regulations in any jurisdiction in which they receive or use this document. Disclaimer Securities Offered Through Alternative Investment Services LLC, Member FINRA/SIPC Jason Segal, CFACo-Founder and Co-Managing Partner+1 646.693.9449jsegal@swiftcurrentadv.com Alex MiadeletsManaging Director+1 646.693.9444amiadelets@swiftcurrentadv.com Patrick NortonVice President+1 312.257.4961pnorton@swiftcurrentadv.com Ashton WhitcombAssociate+1 646.693.9454awhitcomb@swiftcurrentadv.com All communications and inquiries relating to the materials and the process or requests for additional information should be addressed to the Swift Current Advisors team members listed below. Under no circumstances should Powin or any of its respective officers, directors, employees, suppliers, or partners be contacted directly.

Project Case Studies Appendix

Case Study 1: Millikan Project (9 MWh) Project OverviewReached commercial operations in January 2017 using Lixin lithium iron phosphate cellsAwarded an off-take contract with Southern California Edison in July 2016 as part of the Aliso Canyon RFPThe independent engineering firm DNV GL prepared a detailed and rigorous report on Powin’s technologyPowin is providing on-going operational services and warranty managementPowin sold the project to esVolta, an independent storage developer, who also purchased the Stratford Ontario project. BlueSky Alternative Investments, an Australian private equity, real estate, and infrastructure investor, is the sponsor of esVoltaFrom January to November 2017, the project generated $300k of contracted revenue and $50k of merchant revenueCommercial FrameworkThe primary function of the Millikan project is to support SoCal Edison’s grid in the wake of the Aliso Canyon gas leak and provide frequency regulation Partners

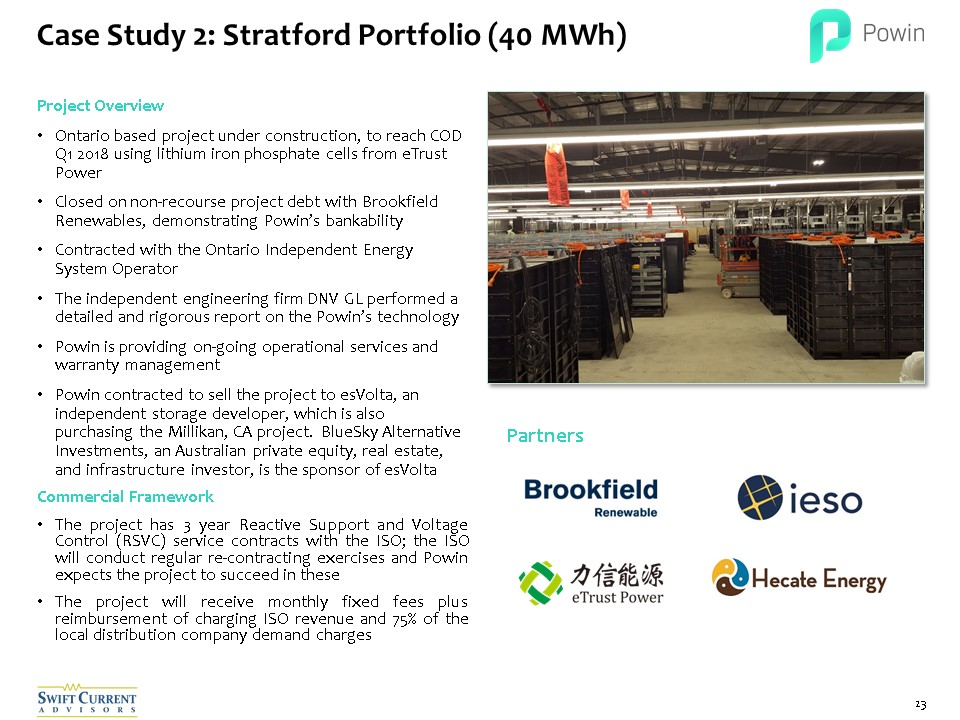

Case Study 2: Stratford Portfolio (40 MWh) Project OverviewOntario based project under construction, to reach COD Q1 2018 using lithium iron phosphate cells from eTrust PowerClosed on non-recourse project debt with Brookfield Renewables, demonstrating Powin’s bankabilityContracted with the Ontario Independent Energy System OperatorThe independent engineering firm DNV GL performed a detailed and rigorous report on the Powin’s technologyPowin is providing on-going operational services and warranty managementPowin contracted to sell the project to esVolta, an independent storage developer, which is also purchasing the Millikan, CA project. BlueSky Alternative Investments, an Australian private equity, real estate, and infrastructure investor, is the sponsor of esVoltaCommercial FrameworkThe project has 3 year Reactive Support and Voltage Control (RSVC) service contracts with the ISO; the ISO will conduct regular re-contracting exercises and Powin expects the project to succeed in theseThe project will receive monthly fixed fees plus reimbursement of charging ISO revenue and 75% of the local distribution company demand charges Partners