Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANALOGIC CORP | d518915d8k.htm |

50 years of imaging innovation 36th Annual JP Morgan Healthcare conference Fred parks, president and CEO January 11, 2018 Exhibit 99.1

Safe Harbor Any statements about future expectations, plans, and prospects for the Company, including statements containing the words “believes,” “anticipates,” “plans,” “expects,” and similar expressions, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including risks relating to product development and commercialization, limited demand for the Company’s products, risks associated with competition, uncertainties associated with regulatory agency approvals, competitive pricing pressures, downturns in the economy, the risk of potential intellectual property litigation, acquisition related risks, and other factors discussed in our most recent quarterly or annual report filed with the Securities and Exchange Commission. In addition, the forward-looking statements included in this presentation represent the Company’s views as of the date of this document. While the Company anticipates that subsequent events and developments will cause the Company’s views to change, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s views as of any later date.

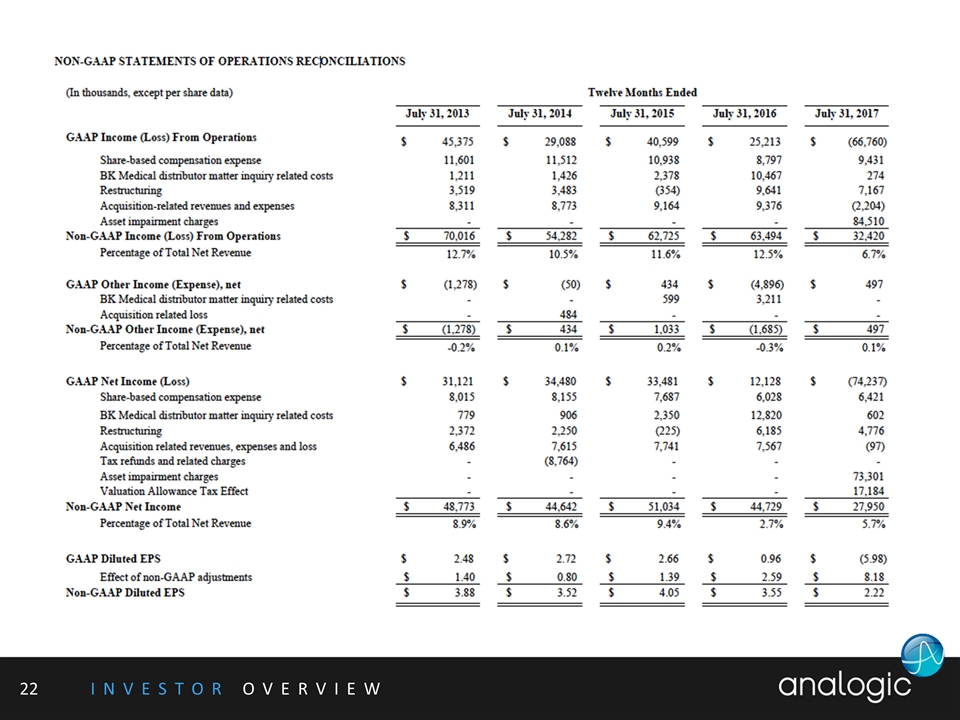

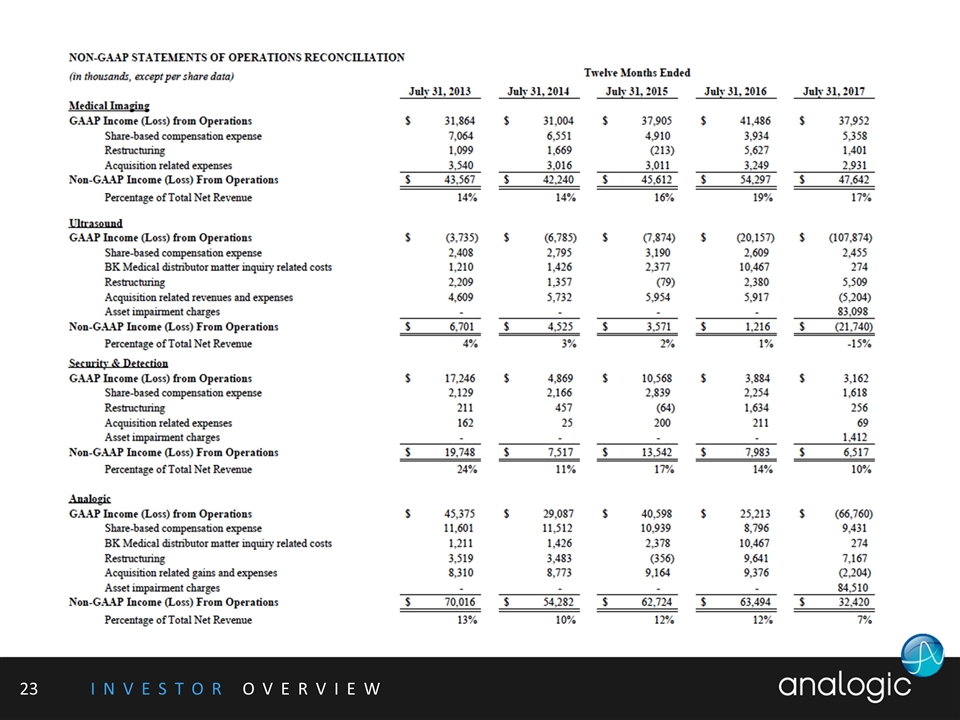

This presentation includes non-GAAP financial measures that are not in accordance with, nor an alternative to, generally accepted accounting principles and may be different from such non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Management uses non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income and non-GAAP diluted earnings per share to evaluate the Company's operating performance against past periods and to budget and allocate resources in future periods. These non-GAAP measures also assist management in understanding and evaluating the underlying baseline operating results and trends in the Company’s business. With respect to forwarding looking measures, we provide an outlook for our non-GAAP operating margins and earnings. We do not provide operating margin or earnings outlook on a GAAP basis. Many of the items that we exclude from our Non-GAAP operating margin and earnings calculations, such as amortization of intangibles, acquisition related costs, restructuring expenses, and one-time tax adjustments, are less capable of being controlled or reliably predicted by management. These items could cause our GAAP operating margins and earnings to vary materially from the corresponding Non-GAAP figures presented in our outlook statements. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. They are limited in value because they exclude charges that have a material effect on our reported results and, therefore, should not be relied upon as the sole financial measures to evaluate our financial results. The non-GAAP financial measures are meant to supplement, and to be viewed in conjunction with, GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures can be found in the appendix to this presentation and our First Quarter FY2018 press release issued December 6, 2018 available at our website http://investor.analogic.com. Use of Non-GAAP Financial Measures

50 Years of Imaging Innovation Founded on advanced CT imaging technology in 1967 Innovative healthcare and security solutions with extensive patent portfolio and know how Strategic redirection and lean operating structure yielding improved profitability in FY18

Investment Thesis Imaging Technologies in Medical, Ultrasound and Security Markets Create Opportunities Expanding into New and Existing Markets Focusing on Execution will Drive Value Improving Operating Leverage on Lower Cost Structure Exploring Strategic Alternatives for Accelerated Value Creation

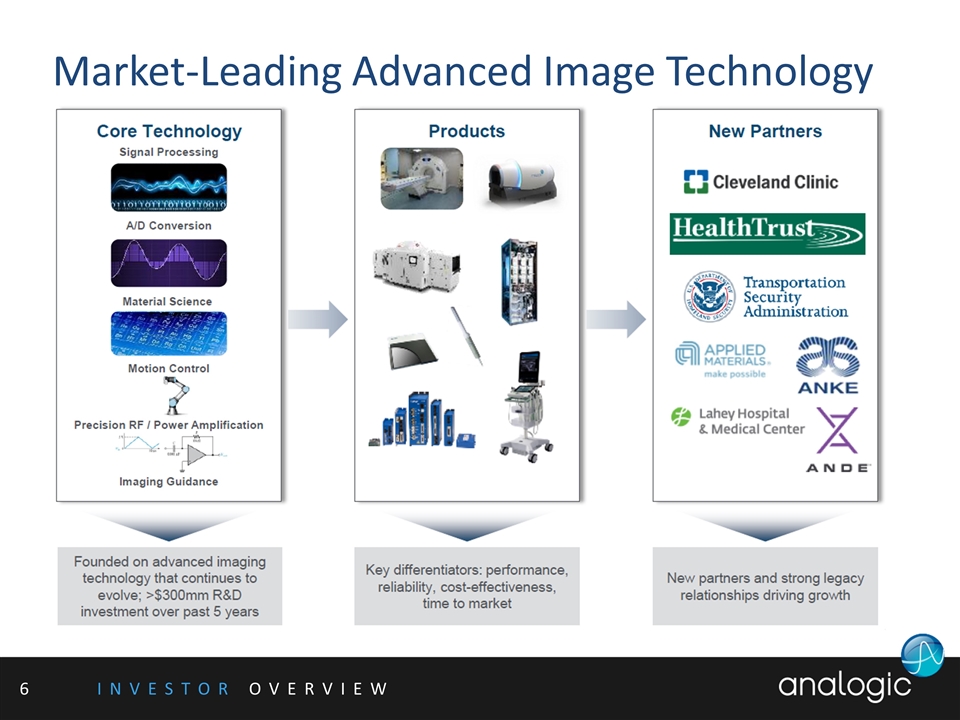

Market-Leading Advanced Image Technology

Organic Strategic Focus Businesses Returning to Growth Medical Imaging Returning to historical levels with high margins Security is in Build mode with new opportunities Ultrasound is Refocused for above-market growth Commitment to productive cost structure Accelerates earnings growth More than $24 million operating cost reduction from FY17

Our Business Segments Medical Imaging Ultrasound Security & Detection 57% of revenues* 30% of revenues* 13% of revenues* Migrating from CT components to CT systems Growing OEM base with differentiated offerings Drive growth in emerging markets Re-focusing in Urology (#1) and Surgery (#2) Revitalizing differentiated probe business Drive share in checked baggage Adoption of ConneCT for checkpoint First mover advantage in RapidDNA market * Percent revenues as of the end of fiscal 2017

Medical Imaging

CT Mammo MRI Medical Imaging Business Update CT gantry growth in China progressing; 200+ systems Growing OEM customer base with new gantry offerings OEM sourcing decision impacts FY18 revenue Long-term contracts with major OEMs Growth opportunities at 1.5T and 3.0T with existing OEMs Longer-term growth in Semi applications Stable business with Siemens and other OEMs Stable service revenue, >5,000 unit installed base Growth opportunities with OEMs in China

ULTRASOUND

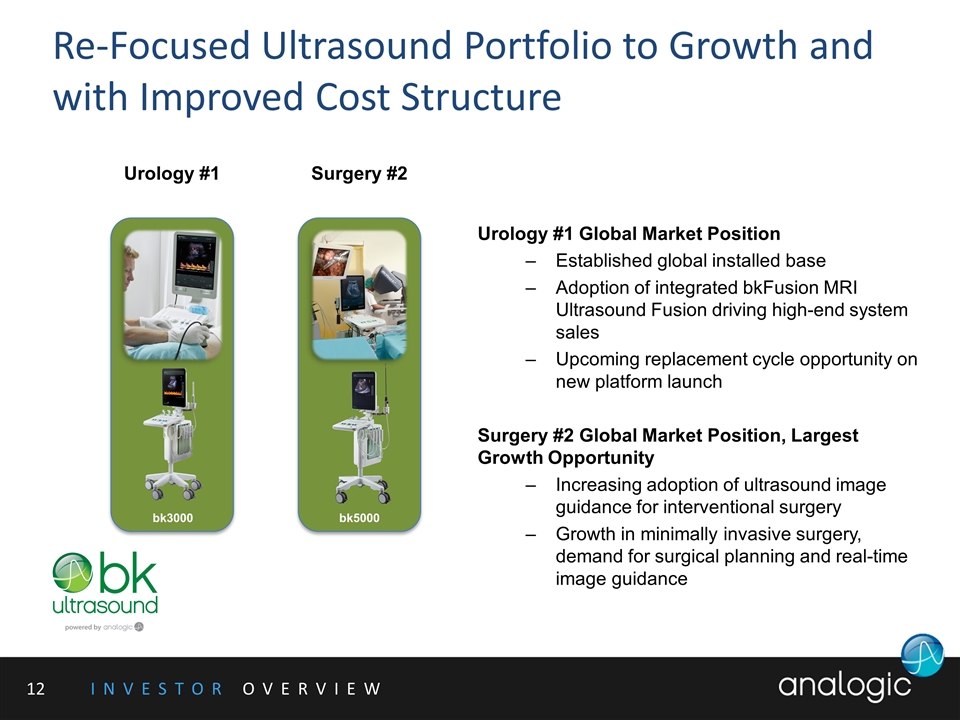

Re-Focused Ultrasound Portfolio to Growth and with Improved Cost Structure Surgery #2 bk5000 Urology #1 bk3000 Urology #1 Global Market Position Established global installed base Adoption of integrated bkFusion MRI Ultrasound Fusion driving high-end system sales Upcoming replacement cycle opportunity on new platform launch Surgery #2 Global Market Position, Largest Growth Opportunity Increasing adoption of ultrasound image guidance for interventional surgery Growth in minimally invasive surgery, demand for surgical planning and real-time image guidance

Probes Sales Channel Surgery Urology Ultrasound Business Update Solidifying #1 position in urology with bk3000 Differentiated probe offering New opportunities in Fusion with partner MIM Solid #2 player in surgery market New bk5000 gaining traction; driving growth in Q1 FY18 Small cavity, sterilizable probes with integrated accessories Revitalized probe offerings Consolidated U.S. sales teams Expanding OUS opportunity, especially China

Security and Detection

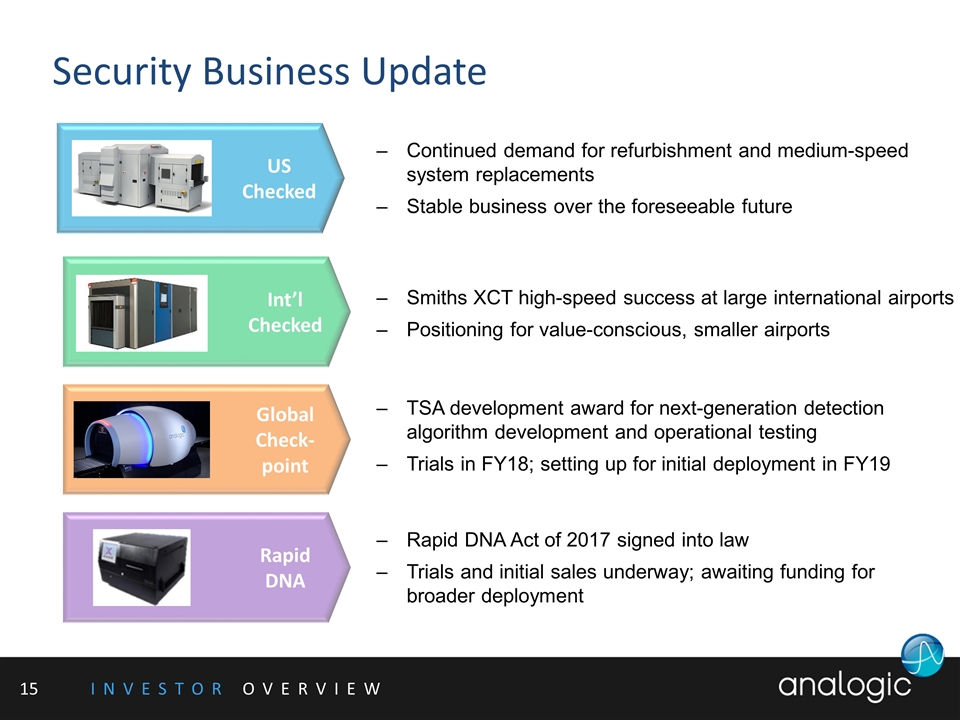

Global Check-point Rapid DNA Int’l Checked US Checked Security Business Update Continued demand for refurbishment and medium-speed system replacements Stable business over the foreseeable future Smiths XCT high-speed success at large international airports Positioning for value-conscious, smaller airports TSA development award for next-generation detection algorithm development and operational testing Trials in FY18; setting up for initial deployment in FY19 Rapid DNA Act of 2017 signed into law Trials and initial sales underway; awaiting funding for broader deployment

Outlook

Q1 FY18 Business Summary Encouraged by Q1 Ultrasound performance Re-focused strategy on core business driving positive results led by strength in surgical ultrasound sales Benefits of prior year cost reductions yielding improved profitability Security gaining traction with high speed and ConneCT Strong second half in FY18 driven by high-speed, international checked baggage systems $4 million TSA contract granted for continued checkpoint algorithm development Medical Imaging results as expected on lower CT and MRI Encouraging Q1 results increasing confidence in FY18 FY17 cost reductions benefitting bottom line in FY18

FY 2018 Outlook* Optimistic after Q1 FY18 performance, FY17 cost reductions continue to drive profitability Ultrasound: Low-single-digit non-GAAP operating margin on low-single-digit revenue decline Core growth in optimized Urology / Surgery portfolio Lower annual operating expenses by $20 million Medical Imaging: Low-double-digit revenue decline with mid-teens non-GAAP operating margins CT OEM customer sourcing decisions partially offset by private label CT system growth in China MRI and Mammo down for the year with Motion Controls up Investment year for CT growth, and for MRI and Mammo technology refresh Security and Detection: Double-digit revenue growth with mid-teens non-GAAP operating margin Continued demand for medium-speed and strong back-log for high-speed systems TSA and EU certification complete; ConneCT enters early phase of deployment Growth in Rapid DNA *Prior to impact of tax reform (update to be provided during Q2 Earnings Call) For FY 2018 we expect revenue between $450 and $460 million with non-GAAP operating margins of 10% to 11% delivering non-GAAP diluted EPS of between $2.75 to $2.90. Sequential improvement throughout the fiscal year.

Strategic Alternatives for Value Creation As previously announced, our Board of Directors has initiated a process for the sale of the whole Company to maximize value for shareholders on an accelerated timeline Engaged Citi as financial advisor Continuing to focus on strategic sale process while driving value through improved operating results Will provide updates as appropriate

Thank You

Non-Gaap Reconciliation