Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | form8-kjanuary11x122018inv.htm |

Powering Growth, Delivering Value

Investor Meetings l January 11-12, 2018

POWERING GROWTH

DELIVERING VALUE

Powering Growth, Delivering Value 2

FORWARD LOOKING STATEMENTS

This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings

guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,”

“predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project” and similar words. Because actual results may

differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause

future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS.

These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while

maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather

seasonality, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and

distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power

markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballet initiatives and regulation, including

those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric

markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on

and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related

costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic

conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or

delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and

other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased

power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement

benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of

derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations

of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to

meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or

ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend

the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC

orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on

Form 10-K for the fiscal year ended December 31, 2016 and in Part II, Item 1A of the Pinnacle West/APS Quarterly Report on Form

10-Q for the quarter ended June 30, 2017, which you should review carefully before placing any reliance on our financial statements,

disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our

internal estimates change, except as required by law.

Powering Growth, Delivering Value 3

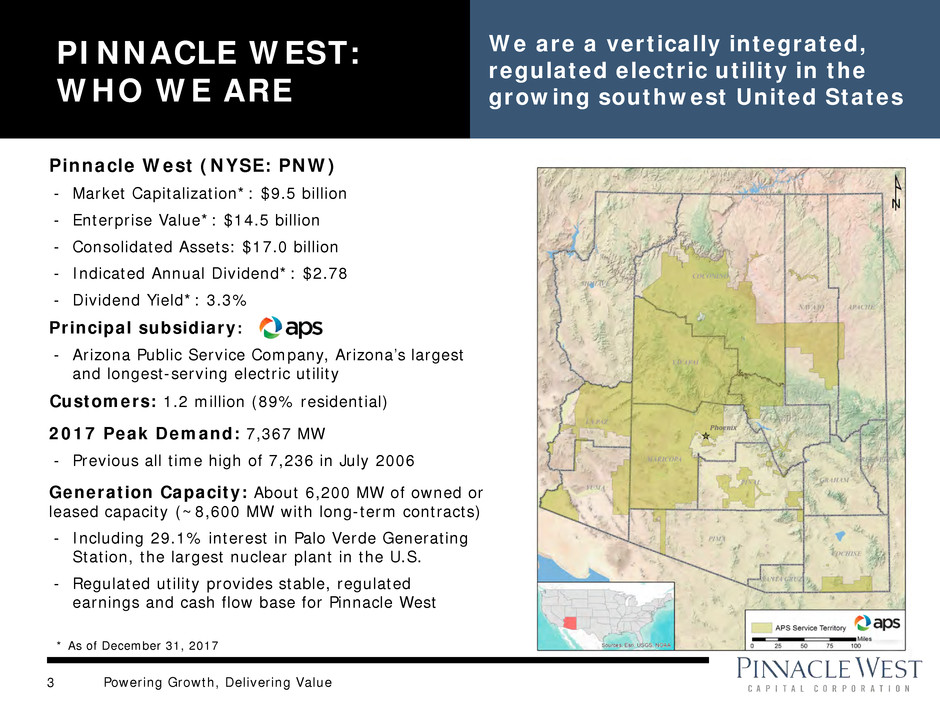

PINNACLE WEST:

WHO WE ARE

We are a vertically integrated,

regulated electric utility in the

growing southwest United States

Pinnacle West (NYSE: PNW)

- Market Capitalization*: $9.5 billion

- Enterprise Value*: $14.5 billion

- Consolidated Assets: $17.0 billion

- Indicated Annual Dividend*: $2.78

- Dividend Yield*: 3.3%

Principal subsidiary:

- Arizona Public Service Company, Arizona’s largest

and longest-serving electric utility

Customers: 1.2 million (89% residential)

2017 Peak Demand: 7,367 MW

- Previous all time high of 7,236 in July 2006

Generation Capacity: About 6,200 MW of owned or

leased capacity (~8,600 MW with long-term contracts)

- Including 29.1% interest in Palo Verde Generating

Station, the largest nuclear plant in the U.S.

- Regulated utility provides stable, regulated

earnings and cash flow base for Pinnacle West

* As of December 31, 2017

Powering Growth, Delivering Value 4

VALUE PROPOSITION

We are executing on our financial and operational objectives …

Operational Excellence

Top decile safety performance

among peers

APS operates the Palo Verde

Generating Station

Disciplined cost management

Financial Strength

Annual dividend growth target of

6%, subject to declaration at

Board of Directors’ discretion

Strong credit ratings and balance

sheet

Rate base growth of 6-7%

(2015-2019)

Leverage

Economic Growth

Arizona’s long-term growth

fundamentals remain largely

intact, including population

growth, job growth and economic

development

By 2032 we expect to add

550,000 new customers1

… while also advocating to ensure Pinnacle West and

Arizona have a sustainable energy future

Integrating Technology to

Modernize the Grid

At the forefront of utilities

studying and deploying advanced

infrastructure to enable reliable

and cost-efficient integration of

emerging technologies into the

grid and with customers

Taking Steps to Address

Rate Design

Worked with Arizona Corporation

Commission and key stakeholders

to modernize rates

Comprehensive rate review

agreement approved in August

2017, enabling investment in

smarter, cleaner energy

infrastructure

Pinnacle West combines

a solid foundation and a

clear strategy to build

shareholder value through

our core utility business

1 Based on the 2017 Integrated Resource Plan filed April 10, 2017.

Powering Growth, Delivering Value 5

THE GRID IS EVOLVING – DRIVING NEW

INVESTMENTS IN TECHNOLOGY

Drivers for

Change

– Traditional grid built for

one-way flow

– Technology advancements

(storage, home energy

management)

– Changing customer needs and

demands

– Proliferation of distributed

solar energy, which does not

align with peak

The Modern

Grid

– New technologies to enable

two-way flow

– Proactive vs. reactive

operations and maintenance

– Modern rate structure

– New ways to interact with

customer

– Mobility for our field personnel

– Smarter, more flexible real-

time system operations

– Support consumer products

and services

– Addresses cybersecurity

APS Laying

Foundation for

the Future

– Solar R&D initiatives

• Solar Partner Program

• Solar Innovation Study

– Smart meters fully deployed

– Investing in peaking capacity upgrades

(Ocotillo)

– Evaluating storage/customer-cited

technology

• Battery pilot investments

• Microgrids

– Software upgrades for distribution

operations and customer service

– Ensuring our people have the relevant

skill sets

Grid stability, power quality and reliability remain the core of a sustainable electrical system.

APS is at the forefront of utilities designing and planning for the next generation electric grid.

New technology advances and changing customer needs are transforming the way we use the grid.

Powering Growth, Delivering Value 6

GRID INVESTMENTS

Modernizing the distribution grid

with advanced technology

investments – resulting in

improved reliability for customers

and more efficient operations

Integrated Volt/VAR Control (IVVC)

Smart Meters

Advanced Distribution Management System

Strategic Fiber

Supervisory Controlled Switches

Substation Health Monitoring

Controls regulators and

capacity banks to manage

power quality such as power

factor and voltage.

New technologies such as

APS’s Transformer Oil

Analysis & Notification

(TOAN) system leverage

advances in

communications and

sensing to remotely monitor

heath of transformers,

enabling proactive

maintenance actions to

prevent critical failures.

Automated switches that

can be controlled from

Distribution Operations

Center (DOC). Allows

operations to manage

load without sending

field personnel to

manually operate the

switch.

Integrated operational

platform. Increases

efficiency and life of

distribution system;

improves safety and

communication; increases

ability to manage overall

reliability; and enables

Distributed Energy

Resources (DER).

Grid Operations & Investment

$1.3 Billion from 2017-2019

Powering Growth, Delivering Value 7

APS MICROGRID PROJECTS COMPLETED

Data Center – North Phoenix

• Phase 1=11MW Tier 4 diesel generation

• In service December 2016

• 17 Autonomous Frequency Response events since

April 2017; 1 ECC call for power event (7/19/2017)

• 50% cost share

• Customer has requested to begin Phase 2 planning

• Add 22MW; full build out will be ~60MW

Military Base – Arizona

• 22MW Tier 4 Final diesel generation

• In service December 2016

• 26 Autonomous Frequency Response events since

February 2017

• One ECC call for power event (7/19/2017)

• 80% APS funded; 20% in kind consideration from

customer

• Capable of adding energy storage and solar PV in

future

Powering Growth, Delivering Value 8

RENEWABLE

RESOURCES

APS is a leader in solar

Aragonne Mesa

Wind

90 MW

Snowflake

Biomass

14 MW

Glendale Landfill

Biogas

2.8 MW

Salton Sea

Geothermal

10 MW

• Solar* 1,230 MW

• Wind 289 MW

• Biomass 14 MW

• Geothermal 10 MW

• Biogas 6 MW

Owned solar includes 170 MW AZ Sun Program, 4 MW of other APS

owned utility scale solar and 40 MW Red Rock Solar Plant;

Distributed Generation (DG) includes 25 MW of APS owned;

PPA is primarily 250 MW Solana Concentrated Solar Facility.

PPA

310 MW

DG

706 MW

Owned

214 MW

APS Solar Portfolio*

Yuma Foothills

Solar

35 MW

* As of Third Quarter 2017 Form 10-Q – with additional 96 MW under development

APS currently has 1,549 MW

of renewable resources:

Powering Growth, Delivering Value 9

BATTERY STORAGE

Energy storage is important but

will only be cost effective in niche

circumstances for the next several

years

APS Projects

– Punkin Center, Arizona: 2 X 4MWh Li-ion battery storage systems in place of

rebuilding 20 miles of transmission lines

– Solar Innovation Study: Residential battery installations for purpose of

studying ability of solar-coupled systems to lower peak energy demand

– Solar Partner Program: 2 X 2MWh Li-ion battery storage systems – 1 at

substation, 1 mid-feeder, for purposes of researching battery effects on grid

and learning most efficient manner to operate

APS Solar Partner battery system

Distribution

Substation

Substation

Storage (Feeder 1)

Feeder-level

Storage (Feeder 2)

Powering Growth, Delivering Value 10

RESIDENTIAL SOLAR

VS. APS CUSTOMER

LOAD

Performance at system peak

304

100

5

6,136

7,367

6,918

0

2,000

4,000

6,000

8,000

0

100

200

300

400

500

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

M

W

Hour Ending

Residential Rooftop

APS Customer Load

1-2 PM: Customer demand still increasing; rooftop solar peaks and begins to decline

5-6 PM: Between 5-6 pm, when customer demand reaches peak, rooftop solar producing at

approximately 30% of total capacity

8 PM: Rooftop output near zero, but customer demand still above 6,900 MW of power

On June 20th, APS customers hit “peak demand” for 2017 using more than 7,300 MW of electricity

Powering Growth, Delivering Value 11

249 357 339

442 610

710 641

783

871

939

523

836

484

680 832 715

1,157 1,158

1,349

1,141 1,002

1,189

1,077

1,168

1,154

759

1,267

1,002

1,291 1,413 1,364

2,033

1,605

1,447

1,287

1,440 1,468

1,591

1,860 1,988

2,522

3,865

2,254

3,749

415

675 786

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2014 Applications 2015 Applications 2016 Applications 2017 Applications

* Monthly data equals applications received minus cancelled applications. As of November 30, 2017, approximately 70,000

residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately

548 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems.

Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found

on the site, but are not included in the chart above.

RESIDENTIAL PV

APPLICATIONS* 10 18 22 44 51

57

74

133 135

2009 2011 2013 2015 2017

Residential DG (MWdc) Annual Additions

YTD -Nov

Powering Growth, Delivering Value 12

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

1 3 5 7 9 11 13 15 17 19 21 23

Over-

Generation

Generation

Minimum Output

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

1 3 5 7 9 11 13 15 17 19 21 23

Generation Minimum

Output

Over-

Generation

THE “DUCK CURVE” Distributed generation is changing the load shape of the grid

Excess renewables creates over-generation

challenges …

Hour Hour

… and potentially for nuclear generation in

the future

Current Spring Day Spring Day 2022

Nuclear Output Nuclear Output

Powering Growth, Delivering Value 13

School Bus Electrification

– Pilot program to electrify school buses that can charge in the middle of the day

Managed EV Charging Program

– Fleet, workplace and multifamily charging infrastructure

– Utility controlled providing additional demand response

Reverse Demand Response Pilot

– Customers take advantage of negative pricing events

Energy Storage Initiative Expansion

– Focus on C&I energy storage and control

DEMAND SIDE

MANAGEMENT (DSM)

2018 DSM Plan shifts the focus to

align with APS’s changing

resource needs

2018 DSM Plan introduces new high value pilot programs to utilize the mid-day

overproduction of energy

Powering Growth, Delivering Value 14

Other Eligible

Participants

Secondary

Customer

Target

Primary

Customer

Target

Limited-Income Residential Customers

and Multi-Family Dwellings

Moderate-Income Residential Customers

Commercial Customers Serving Limited

& Moderate-Income Customers

Title 1

Schools Non-Profits

Rural

Government

APS Solar Partner Program (Installations Complete)

– Installed 10 MW of APS-owned residential PV systems with advanced controllable

inverters that can vary power output

– 4 MWh of grid-tied battery storage on 2 of the participating feeders

APS Solar Communities (Construction begins in early 2018)

– Deploy utility owned photovoltaic

solar generation connected

directly to the distribution system

– All installations will include advanced

inverters, as well as full

communications and control

– Program spend of $10-$15 million in

direct capital costs each year for the

three-year program period

– Program costs recovered annually through

the Renewable Energy Surcharge

APS SOLAR Providing more renewable energy and technology to all customers

Powering Growth, Delivering Value 15

Peak** 8,405 MW 9,835 MW 11,410 MW

Resource Reductions

(Retirements, Expirations)

2017-2022

-487 MW

Ocotillo steam unit retirements and

Navajo contract expiration

-509 MW

PPA expirations

2017-2027

-872 MW

Ocotillo steam unit retirements,

Navajo contract expiration and

Cholla coal retirement

-1,120 MW

PPA expirations

2017-2032

-872 MW

Ocotillo steam unit retirements,

Navajo contract expiration and

Cholla coal retirement

-1,133 MW

PPA expirations

Resource Additions

2017-2022

2,704 MW

Natural gas generating units, short-term

market purchases, DSM, microgrids,

rooftop solar and storage

2017-2027

5,206 MW

Natural gas generating units, short-term

market purchases, DSM, microgrids,

rooftop solar and storage

2017-2032

6,923 MW

Natural gas generating units, short-term

market purchases, DSM, microgrids,

rooftop solar, storage and wind

Peak Load Growth 2022

3.4%

2017-2022

20%

2027

3.1%

2017-2027

40%

2032

3.0%

2017-2032

62%

RESOURCE PLANNING*

**Normal weather peak, includes planning reserves

2022

Nuclear Coal Natural Gas DSM Utility-Scale Renewable Energy Rooftop Solar

Short-Term Market

Purchases Storage

* Data shown is based on the 2017 Integrated Resource Plan filed

April 10, 2017.

2027 2032 Reference Year 2017**

Peak**

7,023 MW

Powering Growth, Delivering Value 16

$221 $211 $273 $227

$79

$245 $121

$8

$220

$199

$90

$22

$102

$3

$16

$16

$127

$182

$178

$175

$388

$420

$421

$437

$87

$77

$82

$124

2016 2017 2018 2019

APS CAPITAL

EXPENDITURES

Capital expenditures are funded

primarily through internally

generated cash flow

($ Millions)

$1,224

$1,337

Other

Distribution

Transmission

Renewable

Generation

Environmental(1)

Traditional

Generation

Projected

$1,181

New Gas

Generation(2)

• The table does not include capital expenditures related to 4CA’s 7% interest in the Four Corners Power Plant Units 4 and 5 of

$30 million in 2016, $27 million in 2017, $15 million in 2018 and $6 million in 2019.

• 2017 – 2019 as disclosed in Third Quarter 2017 Form 10-Q.

(1) Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q4 2017 (Unit 5) and Q1 2018 (Unit 4)

(2) Ocotillo Modernization Project: 2 units scheduled for completion in Q4 2018, 3 units scheduled for completion in Q1 2019

$1,009

Powering Growth, Delivering Value 17

OPERATIONS &

MAINTENANCE

Goal is to keep O&M per kWh flat,

adjusted for planned outages

751 753 734 756

775 - 785 785 - 795

37 52 38

72 55 - 65

75 - 85 $788 $805 $772

$828 $830 - $850

$860 - $880

2013 2014 2015 2016 2017E 2018E*

PNW Consolidated ex RES/DSM** Planned Fleet Outages

* 2018 excludes impacts related to the adoption of the new accounting standard regarding the presentation of pension and postretirement

benefit costs. See Notes 4 and 12 in the Third Quarter 2017 Form 10-Q for additional information.

** Excludes RES/DSM of $137 million in 2013, $103 million in 2014, $96 million in 2015, $83 million in 2016, $80 million in 2017E and

$90 million in 2018E.

($ Millions)

Powering Growth, Delivering Value 18

Palo Verde Generating Station

− Palo Verde will continue to have two refueling outages each year (18 months cycles

for each of the three units)

− APS’s share of the annual planned outage expense at Palo Verde has been between

$18 - $22 million per year since 2013

− Equipment testing, inspections, and plant modifications are performed during the

outages that cannot be done while the unit is online

−Outage duration and cost are driven by scope of planned work as well as emergent

work identified during the outage

Gas/Oil Plants

−No planned cycles; major maintenance outages are based on run hours and/or the

number of starts and overall plant condition

− Increasing levels of solar generation, participation in Energy Imbalance Market,

and low gas prices have resulted in increased starts

Coal Plants

−Major maintenance outage cycles are typically between 6 to 8 years

PLANNED OUTAGE

CYCLES

The length of time between

outages varies from plant to plant

Powering Growth, Delivering Value 19

SUSTAINABILITY

APS’s vision is to create a

sustainable energy future for

Arizona

Pinnacle West and APS have

adopted a strategic framework that

supports our operating foundation

Five critical areas of our sustainability efforts

• 50% of our diverse energy mix is carbon-free

• 4.9M metric tons of CO2 avoided in 2016 vs. goal of 3.5M

• More than 1,000 MW of installed solar capacity

• $20M saved as a result of Advanced Metering Infrastructure

• Lowest OSHA recordable injuries on Company record in 2016

• $8.7M invested in security at substations to ensure reliability

• 28% reduction in groundwater use in 2016

• 20B gallons of water recycled each year to cool Palo Verde

• Avg. employee tenure of 13 yrs due to strong talent strategy

• Almost $370M spent with diverse suppliers in 2016

Carbon Management

Energy Innovation

Safety & Security

Water Resources

People

Powering Growth, Delivering Value 20

Excess Deferred Taxes

− Approximately $1.1B in excess deferred taxes passed through to ratepayers over remaining life of

plant

Interest Deductibility Limitation

− Majority of Pinnacle West and APS debt is likely allocable to regulated operations and excluded from

any limitation

Rate Base Impacts

− Higher incremental rate base growth beginning in 2018

Exclusion of Regulated Utility Property from New Expensing Rules

− Some uncertainty around applicability of bonus depreciation for property under construction as of

September 27, 2017

Regulatory

− Lower tax rate benefits flow through to customers via the Tax Expense Adjustor Mechanism likely

beginning in Q1 2018

− FERC guidance on the rate reduction and return of excess deferred taxes to transmission customers

expected in early 2018

Cash Taxes

– Minimal cash tax payments through 2019 due to existing Pinnacle West Investment Tax Credit

carryforwards of approximately $100M (as of September 30, 2017)

TAX REFORM

Tax Cuts and Jobs Act provides

benefits to both our customers

and shareholders

Powering Growth, Delivering Value

APPENDIX

Powering Growth, Delivering Value 22

Jim Hatfield

Executive Vice President and

Chief Financial Officer, Pinnacle West & APS

• Joined as SVP and CFO in

2008 from OGE Energy

Corp.

• Responsible for corporate

functions including finance,

investor relations, and risk

management

• 37+ years of financial

experience in the utility and

energy business

SENIOR

MANAGEMENT

TEAM

Our management team has more

than 100 combined years of

creating shareholder value in the

energy industry

Mark Schiavoni

Executive Vice President and

Chief Operating Officer, APS

• Joined APS in 2009 from

Exelon Corp.

• Appointed COO in 2014

• Oversees operations for non-

nuclear activities

• Significant leadership

experience in the energy

industry

Bob Bement

Executive Vice President and

Chief Nuclear Officer, APS

• Joined APS in 2007 from

Arkansas Nuclear One

• Promoted from SVP of Site

Operations to EVP and Chief

Nuclear Officer in 2016

• Responsible for all nuclear-

related activities associated

with Palo Verde

• Seasoned nuclear industry

expert serving on several

industry committees

Jeff Guldner

Executive Vice President, Public Policy &

General Counsel, Pinnacle West & APS

• Joined APS in 2004 from

Snell & Wilmer

• Appointed EVP and GC, April

2017

• Responsible for overseeing

regulatory and government

affairs and legal activities

• Significant experience in

public utility and energy law

and regulation

Don Brandt

Chairman of the Board, President and

Chief Executive Officer, Pinnacle West & APS

• Joined Pinnacle West in 2002

• Elected to Pinnacle West

Board and named Chairman,

CEO in 2009

• Recognized industry leader

with 30+ years in the nuclear

and energy industries

• Vice Chairman of the

Institute of Nuclear Power

Operations and Chairman of

the Nuclear Energy Institute

We maintain a robust

pipeline of talent to serve

our complex operations

and facilitate effective

succession planning in a

highly competitive talent

environment

Bob Bement succeeded

Randy Edington as Chief Nuclear

Officer in October 2016

Powering Growth, Delivering Value 23

ECONOMIC

INDICATORS

Arizona and Metro Phoenix remain

attractive places to live and do

business

E

0%

5%

10%

15%

20%

25%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17

Nonresidential Building Vacancy – Metro Phoenix

Vacancy Rate

Office

Retail

Industrial

Q3

Above-average job growth in tourism,

health care, manufacturing, financial

services, and construction

Maricopa County ranked #1 in U.S. for population growth in 2016

- U.S. Census Bureau March 2017

Scottsdale ranked best place in the U.S. to find a new job in 2017;

4 other valley cities ranked in Top 20

- WalletHub January 2017

Housing construction on pace to have its best year since 2007

Vacancy rates in office and retail space have fallen to pre-recessionary levels

0

10,000

20,000

30,000

40,000

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17

Single Family Multifamily

Single Family & Multifamily Housing Permits

Maricopa County

Powering Growth, Delivering Value 24

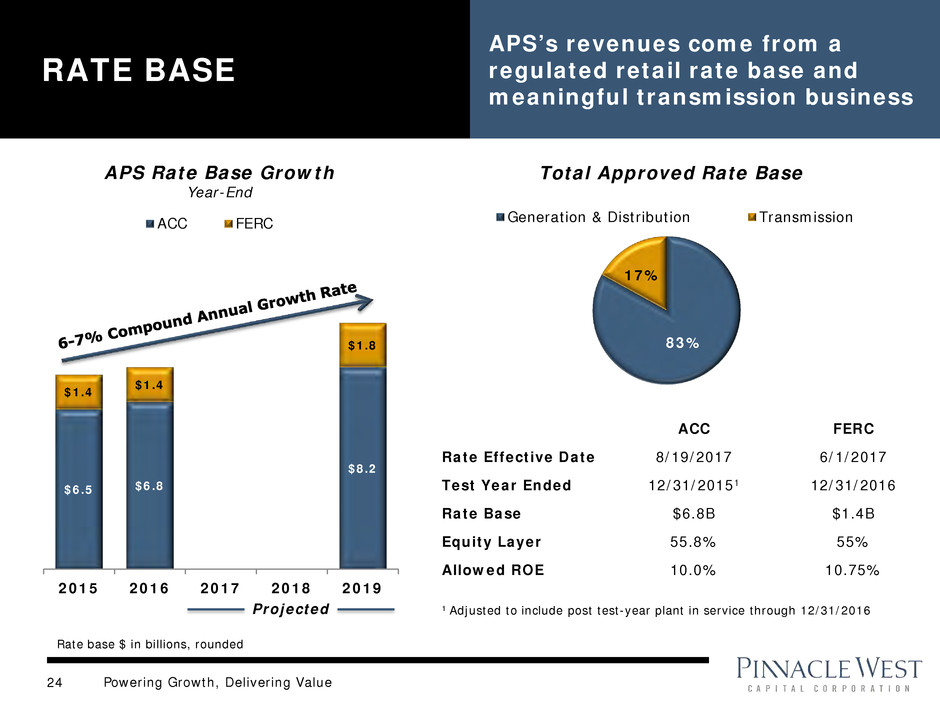

RATE BASE

APS’s revenues come from a

regulated retail rate base and

meaningful transmission business

$6.5 $6.8

$8.2

$1.4 $1.4

$1.8

2015 2016 2017 2018 2019

APS Rate Base Growth

Year-End

ACC FERC

Total Approved Rate Base

Projected

ACC FERC

Rate Effective Date 8/19/2017 6/1/2017

Test Year Ended 12/31/20151 12/31/2016

Rate Base $6.8B $1.4B

Equity Layer 55.8% 55%

Allowed ROE 10.0% 10.75%

1 Adjusted to include post test-year plant in service through 12/31/2016

83%

17%

Generation & Distribution Transmission

Rate base $ in billions, rounded

Powering Growth, Delivering Value 25

Credit Ratings

• A- or equivalent ratings or better at S&P, Moody’s

and Fitch

2017 Major Financing Activities

• $300 million 10-year 2.95% APS senior unsecured

notes issued September 2017

• $250 million re-opening in March of APS’s

outstanding 4.35% senior unsecured notes due

November 2045

• $300 million 3-year 2.25% PNW senior unsecured

notes issued November 2017

2018 Major Financing Activities

• Currently expect up to $400 million of long-term

debt issuance at APS

We are disclosing credit ratings to enhance understanding of

our sources of liquidity and the effects of our ratings on our

costs of funds.

BALANCE SHEET STRENGTH

$50

$600

$250

$125

$-

$100

$200

$300

$400

$500

$600

2017 2018 2019 2020

APS PNW

($Millions)

Debt Maturity Schedule

Powering Growth, Delivering Value 26

2017 RATE REVIEW ORDER*

EFFECTIVE AUGUST 19, 2017

Key Financial Proposals – Base Rate Changes

Annualized Base Rate Revenue Changes ($ millions)

Non-fuel, Non-depreciation Base Rate Increase $ 87.2

Decrease fuel and Purchased Power over Base Rates (53.6)

Increase due to Changes in Depreciation Schedules 61.0

Total Base Rate Increase $ 94.6

Key Financial Assumptions

Allowed Return on Equity 10.0%

Capital Structure

Long-term debt 44.2%

Common equity 55.8%

Base Fuel Rate (¢/kWh) 3.0168

Post-test year plant period 12 months

*The ACC’s decision is subject to appeals.

Powering Growth, Delivering Value 27

Key Proposals – Revenue Requirement

Four Corners • Cost deferral order from in-service dates to incorporation of SCRs in rates using a step-increase no later than January 1, 2019

Ocotillo Modernization

Project • Cost deferral order from in-service dates to effective date in next rate case

Power Supply Adjustor (PSA) • Modified to include certain environmental chemical costs and third-party battery storage

Property Tax Deferral • Defer for future recovery the Arizona property tax expense above or below the test year rate

Key Proposals – Rate Design

Lost Fixed Cost Recovery

(LFCR)

• Modified to be applied as a capacity (demand) charge per kW for customer with a demand rate and

as a kWh charge for customers with a two-part rate without demand

Environmental Improvement

Surcharge (EIS)

• Increased cumulative per kWh cap rate from $0.00016 to a new rate of $0.00050 and include a

balancing account

Time-of-Use Rates (TOU)

• Modified on-peak period for residential, and extra small through large general service to

3:00 pm – 8:00 pm weekdays

• After September 1, 2018, a new TOU rate will be the standard rate for all new customers (except

small use)

Distributed Generation

• New DG customers eligible for TOU rate with Grid Access Charge or Demand rates

• Resource Comparison Proxy (RCP) for exported energy of $0.129/kWh in year one

APS Solar Communities

• New program for utility-owned solar distributed generation, recoverable through the Renewable

Energy Adjustment Clause (RES), to be no less than $10 million per year, and not more than $15

million per year

Other Considerations

Rate Case Moratorium • No new general rate case application before June 1, 2019 (3-year stay-out)

Self-Build Moratorium

• APS will not pursue any new self-build generation (with exceptions) having an in-service date prior

to January 1, 2022 (extended to December 31, 2027 for combined-cycle generating units) unless

expressly authorized by the ACC

2017 RATE REVIEW ORDER*

EFFECTIVE AUGUST 19, 2017

*The ACC’s decision is subject to appeals.

Powering Growth, Delivering Value 28

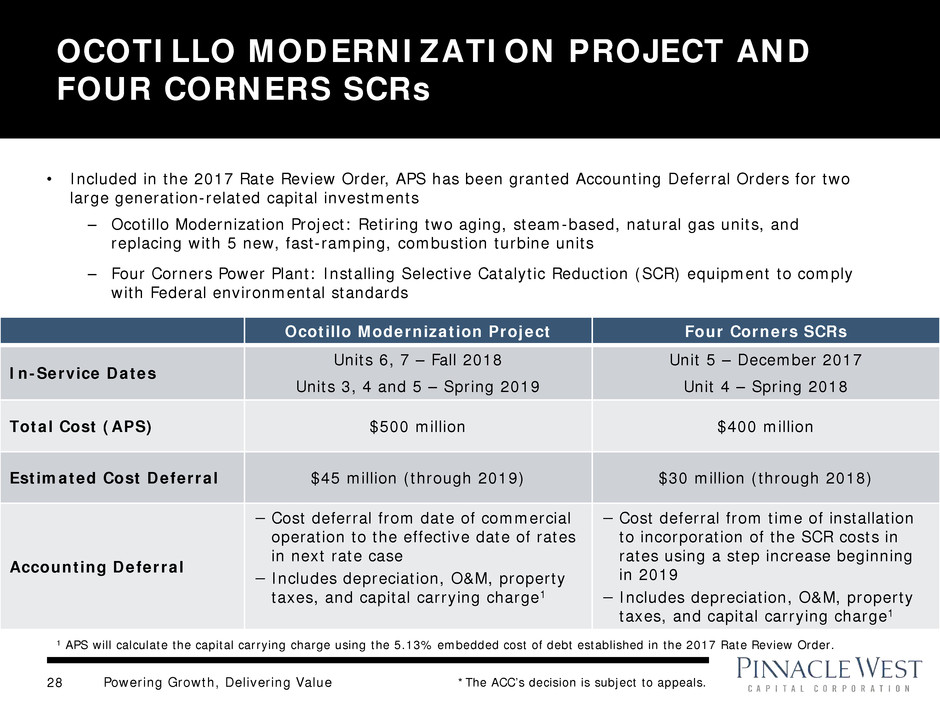

OCOTILLO MODERNIZATION PROJECT AND

FOUR CORNERS SCRs

Ocotillo Modernization Project Four Corners SCRs

In-Service Dates

Units 6, 7 – Fall 2018

Units 3, 4 and 5 – Spring 2019

Unit 5 – December 2017

Unit 4 – Spring 2018

Total Cost (APS) $500 million $400 million

Estimated Cost Deferral $45 million (through 2019) $30 million (through 2018)

Accounting Deferral

− Cost deferral from date of commercial

operation to the effective date of rates

in next rate case

− Includes depreciation, O&M, property

taxes, and capital carrying charge1

− Cost deferral from time of installation

to incorporation of the SCR costs in

rates using a step increase beginning

in 2019

− Includes depreciation, O&M, property

taxes, and capital carrying charge1

• Included in the 2017 Rate Review Order, APS has been granted Accounting Deferral Orders for two

large generation-related capital investments

– Ocotillo Modernization Project: Retiring two aging, steam-based, natural gas units, and

replacing with 5 new, fast-ramping, combustion turbine units

– Four Corners Power Plant: Installing Selective Catalytic Reduction (SCR) equipment to comply

with Federal environmental standards

1 APS will calculate the capital carrying charge using the 5.13% embedded cost of debt established in the 2017 Rate Review Order.

*The ACC’s decision is subject to appeals.

Powering Growth, Delivering Value 29

Term to January 2019

Other State Officials

ARIZONA CORPORATION COMMISSION

* Term limited - elected to four-year terms (limited to two consecutive)

**Governor Doug Ducey appointed Justin Olson to fill the remainder of former Commissioner Doug Little’s term.

ACC Executive Director – Ted Vogt

RUCO Director – David Tenney

Terms to January 2020

Justin

Olson (R)**

Bob

Burns (R)*

Andy

Tobin (R)

Tom

Forese (R)

Chairman

Boyd

Dunn (R)

Powering Growth, Delivering Value 30

• 10-Year Transmission Plan filed January

2017 (115 kV and above)

– 52 miles of new lines

– 5 bulk transformer additions

• Also includes:

– Sun Valley-Morgan 500kV (2018)

– North Gila-Orchard 230kV (2021)

• 2 of 3 Projects to deliver renewable energy

approved by ACC have been completed

• Transmission investment diversifies

regulatory risk

– Constructive regulatory treatment

– FERC formula rates and retail adjustor

APS TRANSMISSION

Strategic transmission investment

is essential to maintain reliability

and deliver diversified resources

to customers

Legend

Planned lines

Existing lines

Solar potential area

Wind potential area

Phoenix

Flagstaff

Tucson

Powering Growth, Delivering Value 31

GENERATION PORTFOLIO*

Plant Location No. of Units Dispatch COD Ownership Interest1 Net Capacity (MW)

NUCLEAR

1,146 MW Palo Verde Wintersburg, AZ 3 Base 1986-1989 29.1% 1,146

COAL

1,672 MW

Cholla Joseph City, AZ 2 Base 1962-1980 100 387

Four Corners Farmington, NM 2 Base 1969-1970 63 970

Navajo Page, AZ 3 Base 1974-1976 14 315

GAS - COMBINED CYCLE

1,871 MW

Redhawk Arlington, AZ 2 Intermediate 2002 100 984

West Phoenix Phoenix, AZ 5 Intermediate 1976-2003 100 887

GAS - STEAM TURBINE

220 MW Ocotillo Tempe, AZ 2 Peaking 1960 100 220

GAS / OIL

COMBUSTION TURBINE

1,088 MW

Sundance Casa Grande, AZ 10 Peaking 2002 100 420

Yucca Yuma, AZ 6 Peaking 1971-2008 100 243

Saguaro Red Rock, AZ 3 Peaking 1972-2002 100 189

West Phoenix Phoenix, AZ 2 Peaking 1972-1973 100 110

Ocotillo Tempe, AZ 2 Peaking 1972-1973 100 110

Douglas Douglas, AZ 1 Peaking 1972 100 16

SOLAR

239 MW

Hyder & Hyder II Hyder, AZ - As Available 2011-2013 100 30

Paloma Gila Bend, AZ - As Available 2011 100 17

Cotton Center Gila Bend, AZ - As Available 2011 100 17

Chino Valley Chino Valley, AZ - As Available 2012 100 19

Foothills Yuma, AZ - As Available 2013 100 35

Distributed Energy Multiple AZ Facilities - As Available Various 100 25

Gila Bend Gila Bend, AZ - As Available 2015 100 32

Luke Air Force Base Glendale, AZ - As Available 2015 100 10

Desert Star Buckeye, AZ - As Available 2015 100 10

Red Rock Red Rock, AZ - As Available 2016 100 40

Various Multiple AZ Facilities - As Available 1996-2006 100 4

Total Generation Capacity 6,236 MW

1 Includes leased generation plants * As disclosed in 2016 Form 10-K.

Powering Growth, Delivering Value 32

PURCHASED POWER CONTRACTS*

Contract Location Owner/Developer Status1 PPA Signed COD Term (Years) Net Capacity (MW)

SOLAR

310 MW

Solana Gila Bend, AZ Abengoa IO Feb-2008 2013 30 250

RE Ajo Ajo, AZ Duke Energy Gen Svcs IO Jan-2010 2011 25 5

Sun E AZ 1 Prescott, AZ SunEdison IO Feb-2010 2011 30 10

Saddle Mountain Tonopah, AZ SunEdison IO Jan - 2011 2012 30 15

Badger Tonopah, AZ PSEG IO Jan-2012 2013 30 15

Gillespie Maricopa County, AZ Recurrent Energy IO Jan-2012 2013 30 15

WIND

289 MW

Aragonne Mesa Santa Rosa, NM Ingifen Asset Mgmt IO Dec-2005 2006 20 90

High Lonesome Mountainair, NM Foresight / EME IO Feb-2008 2009 30 100

Perrin Ranch Wind Williams, AZ NextEra Energy IO Jul-2010 2012 25 99

GEOTHERMAL

10 MW Salton Sea Imperial County, CA Cal Energy IO Jan-2006 2006 23 10

BIOMASS

14 MW Snowflake Snowflake, AZ Novo Power IO Sep-2005 2008 15 14

BIOGAS

6 MW

Glendale Landfill Glendale, AZ Glendale Energy LLC IO Jul-2008 2010 20 3

NW Regional Landfill Surprise, AZ Waste Management IO Dec-2010 2012 20 3

INTER-UTILITY

540 MW

PacifiCorp Seasonal

Power Exchange - PacifiCorp IO Sep-1990 1991 30 480

Not Disclosed Not Disclosed Not Disclosed IO May-2009 2010 10 60

CONVENTIONAL

TOLLING

1,639 MW

CC Tolling Not Disclosed Not Disclosed IO Mar-2006 2007 10 514

CC Tolling Not Disclosed Not Disclosed IO Aug-2007 2010 10 560

CC Tolling Arlington, AZ Arlington Valley IO Dec-2016 2020 6 565

DEMAND RESPONSE

25 MW Demand Response Not Disclosed Not Disclosed IO Sep-2008 2010 15 25

Total Contracted Capacity 2,833 MW

1 UD = Under Development; UC = Under Construction; IO = In Operation * As disclosed in 2016 Form 10-K.

Powering Growth, Delivering Value 33

INVESTOR RELATIONS CONTACTS

Stefanie Layton

Director, Investor Relations

(602) 250-4541

stefanie.layton@pinnaclewest.com

Chalese Haraldsen

(602) 250-5643

chalese.haraldsen@pinnaclewest.com

Michelle Clemente

(602) 250-3752

michelle.clemente@pinnaclewest.com

Pinnacle West Capital Corporation

P.O. Box 53999, Mail Station 9998

Phoenix, Arizona 85072-3999

Visit us online at: www.pinnaclewest.com