United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15[d] of the Securities Exchange Act of 1934

January 4, 2018

Date of Report [Date of Earliest Event Reported]

NORTHSIGHT CAPITAL, INC.

(Exact name of Registrant as specified in its Charter)

Nevada |

| 000-53661 |

| 26-2727362 |

(State or Other Jurisdiction of Incorporation |

| (Commission File Number) |

| (I.R.S. Employer Identification No.) |

7580 East Gray Rd., St. 103

Scottsdale, AZ 85260

(Address of Principal Executive Offices)

(480) 385-3893

(Registrant’s Telephone Number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see general instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement

Item 1.02. Termination of a Material Definitive Agreement

Item 2.01. Completion of Acquisition or Disposition of Assets

Item 3.02. Unregistered Sales of Equity Securities

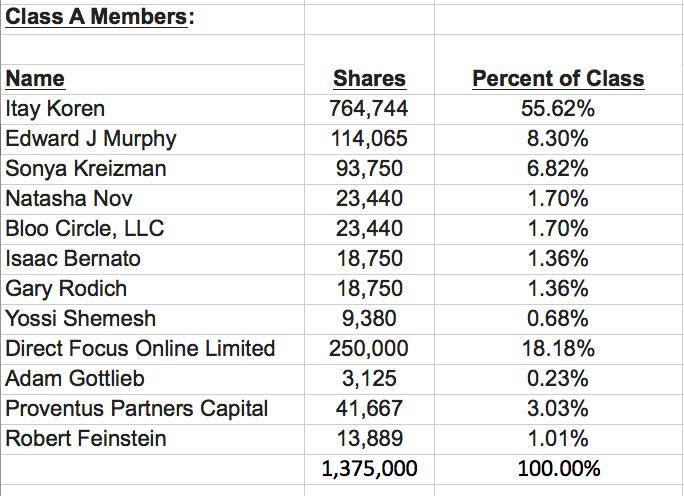

On January 8, 2018, the Registrant (the “Company”) completed the acquisition of Crush Mobile, LLC (“Crush Mobile”) from its members, who owned the percentage of Crush Mobile indicated opposite their respective names:

Crush Mobile’s assets consist primarily of trademarks, domain names, mobile dating applications and related software and intellectual property. In connection with the closing of the acquisition, the Registrant is issuing an aggregate of 7,904,000 shares of common stock as follows: (i) 4,904,000 shares to the Crush Mobile members and (ii) 3,000,000 shares to certain Crush Mobile creditors (who are also members) in full satisfaction of $300,000 of indebtedness owed to them by Crush Mobile.

As previously disclosed in the Registrant’s quarterly Report on Form 10-Q filed August 21, 2017, on August 8, 2017, the Company entered into a definitive agreement to acquire all the outstanding membership interests of Crush Mobile (“Purchase Agreement”). Under the terms of the Purchase Agreement, the Company agreed to acquire all the outstanding membership interests of Crush Mobile, in exchange for an aggregate of 4,904,000 shares of common stock, plus an aggregate 3,000,000 shares issuable to two creditors, $85,000 in cash payable to 17 Media Group, LLC, a Crush Mobile creditor and about $5,000 in cash payable to members who are not accredited investors. The Company also agreed to piggy-back registration rights with respect to the shares of common stock issuable to the sellers in connection with the acquisition. The agreement provided that the current management of Crush would take over management of the Company following the closing. Under the terms of the Agreement, consummation of the Crush Mobile acquisition was subject to the Company completing a funding of at least $500,000.

On or about January 4, 2018, the Company, Crush Mobile, LLC and the other parties to the Purchase Agreement entered into the first amendment thereto, under which, among other things, Crush Mobile agreed to waive the Company’s fulfillment of the $500,000 funding condition, 17 Media Group, LLC (an affiliate of Itay Koren) agreed to defer for one year the $85,000 cash payment, three members agreed to defer their aggregate $5,000 cash payment for one year, and the parties agreed that the management of Crush Mobile would not take over management of the Company at the closing, but would instead act as consultants to the Company.

As reported under Part II, Item 5. “Other Information” in the Company’s 10Q for the quarter ended September 30, 2017, on November 11, 2017, the Company entered into a preliminary agreement ("Preliminary Agreement") to acquire (i) 80% of Westcliff Technologies ("Westcliff"), a company engaged in the business of operating ATM's that dispense Bitcoins, and (ii) 49% of a company to be formed by Westcliff which will is developing its own cryptocurrency (collectively, the "Business").

2

The Preliminary Agreement contemplated that the Company would acquire the Business in exchange for (i) 18 million shares of Company restricted stock at closing, with a guaranteed value of $36 million on the first anniversary of the closing (as described below), (ii) $3 million to be paid in 36 equal monthly installments of $83,333, commencing on the closing date, and (iii) $3 million of funding at closing, as part of the purchase price, of which half will be invested into each of the companies being acquired.

The Company had also agreed, subject to the Business' attainment of milestones to be negotiated, that if the Company's common stock were quoted at less than $2 per share on the twelve-month anniversary of the closing, the Company would issue the sellers of the Business that number of additional shares of company common stock, such that the aggregate value of the shares issued to the sellers of the Business will be $36 million (the guaranteed value).

The foregoing transactions were subject to board approval and the negotiation, execution and delivery of definitive agreements. Due to regulatory considerations, the Company has determined not to proceed with the acquisition of the Business. The Company is having discussions with Westcliff regarding possible business collaborations going forward, but no agreement has been reached.

The registrant believes that the foregoing transactions were exempt from the registration requirements of the Securities Act of 1933, as amended, because there was no general solicitation, the persons to whom shares were issued are accredited investors, within the meaning of Regulation D, and are sophisticated about business and financial matters.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

NORTHSIGHT CAPITAL, INC.

Date: | 01/10/2018 |

| By: | /s/ John P. Venners |

|

|

|

| John P. Venners |

|

|

|

| EVP, Operations |

3