Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 JPM PRESS RELEASE - HALOZYME THERAPEUTICS, INC. | ex991jpm1918pressrelease.htm |

| 8-K - 8-K JPM 2018 - HALOZYME THERAPEUTICS, INC. | a8-kjpm2018.htm |

Building a Premier Oncology

Biotech

Dr. Helen Torley, President & CEO

January 9, 2018

JP Morgan 36th Annual Healthcare Conference

Forward-Looking Statements

All of the statements in this presentation that are not statements of historical

facts constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Examples of such statements include

possible activity, benefits and attributes of PEGPH20, future product

development and regulatory events and goals, anticipated clinical trial

results and strategies, product collaborations, our business intentions and

financial estimates and results, including projected revenue amounts. These

statements are based upon management’s current plans and expectations

and are subject to a number of risks and uncertainties which could cause

actual results to differ materially from such statements. A discussion of the risks

and uncertainties that can affect these statements is set forth in the

Company’s annual and quarterly reports filed from time to time with the

Securities and Exchange Commission under the heading “Risk Factors.” The

Company disclaims any intention or obligation to revise or update any

forward-looking statements, whether as a result of new information, future

events, or otherwise.

1

Halozyme Two Pillar Strategy

2

Removing Biological Barriers to Treatment

Enhancing Delivery

of Treatments

Late Stage Investigational

New Product

ENHANZE® PEGPH20

ENHANZE image from “The 5 Steps to Infuse HYQVIA.” http://www.hyqvia.com/resources/videos/

Significant Value Creation in 2017

ENHANZE®

• 2 new partners: BMS, Alexion

• Roche adds new target

• $175M upfront milestones

• Phase 3 starts: Janssen’s

Darzalex®

3

PEGPH20 - Pancreatic

• Supportive Phase 2

• Companion Diagnostic

• Strong progress in Phase 3

trial: HALO-301

PEGPH20 - Pan-Tumor

• > 20 patients enrolled:

Keytruda®/PEGPH20

• 2 studies in 4 tumors:

Tecentriq®/PEGPH20

Financial

• Cash balance exiting

2017 of $460M-$470M

Capabilities

• Initiating > 200 centers in 22 countries in Phase 3 Pancreas Cancer Trial

• Agreements and onboarding of 2 new partners

• Record number of API lots delivered

ENHANZE® Pillar

2017: Transformative Year for ENHANZE®

Pipeline

June 2017: RITUXAN HYCELA™ U.S. FDA Approval

Aug 2017: Initiate Phase 1 trial

Sept 2017: Landmark 11-target I-O deal

Sept 2017: Expanded collaboration, 1 new target

Nov 2017: Initiate Phase 3 trials, daratumumab SC

Dec 2017: Four-target collaboration

5

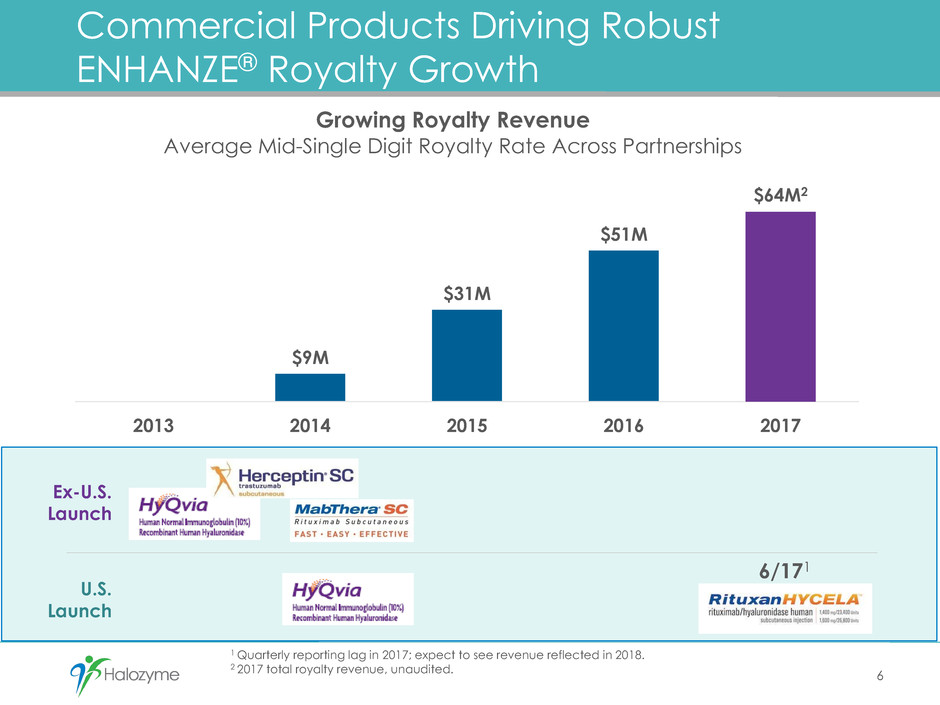

1 Quarterly reporting lag in 2017; expect to see revenue reflected in 2018.

2 2017 total royalty revenue, unaudited.

Commercial Products Driving Robust

ENHANZE® Royalty Growth

$9M

$31M

$51M

$64M2

2013 2014 2015 2016 2017

Growing Royalty Revenue

Average Mid-Single Digit Royalty Rate Across Partnerships

Ex-U.S.

Launch

U.S.

Launch

6

6/171

Approved Products Potential Future Products1,2

Assumes 7 additional products,

including Darzalex® and Opdivo®, are

globally approved and launched in

multiple indications

ENHANZE®: ~$1 Billion Royalty Revenue

Potential in 2027

1 Includes projections for subcutaneous versions of 7 targets not approved or commercially available. Innovator

revenues based on Bloomberg analyst projections. Conversion rates based on Halozyme internal projections.

2 Royalty revenue projection includes targets selected but not yet disclosed.

$1B

$500M

~$1 Billion

2017 2027

7

Approved and Commercialized

Phase 1

Phase 3

ENHANZE® Progress and Value Acceleration

in 2018

2018 2017

1

Darzalex®

2

Perjeta ®/Herceptin®

Anti-IL23

3

4

6 Products 9 products

8

2

3

Potential for Competitive

Differentiation

New Intellectual Property

and Exclusivity

Changing US Reimbursement and

Care Landscape

Reduced Treatment Burden and

Healthcare Costs

ENHANZE® Offers Four Paths for Differentiation

and Value Creation for Partners

9

1

2

3

4

Phase 3 Oncology Asset:

PEGPH20

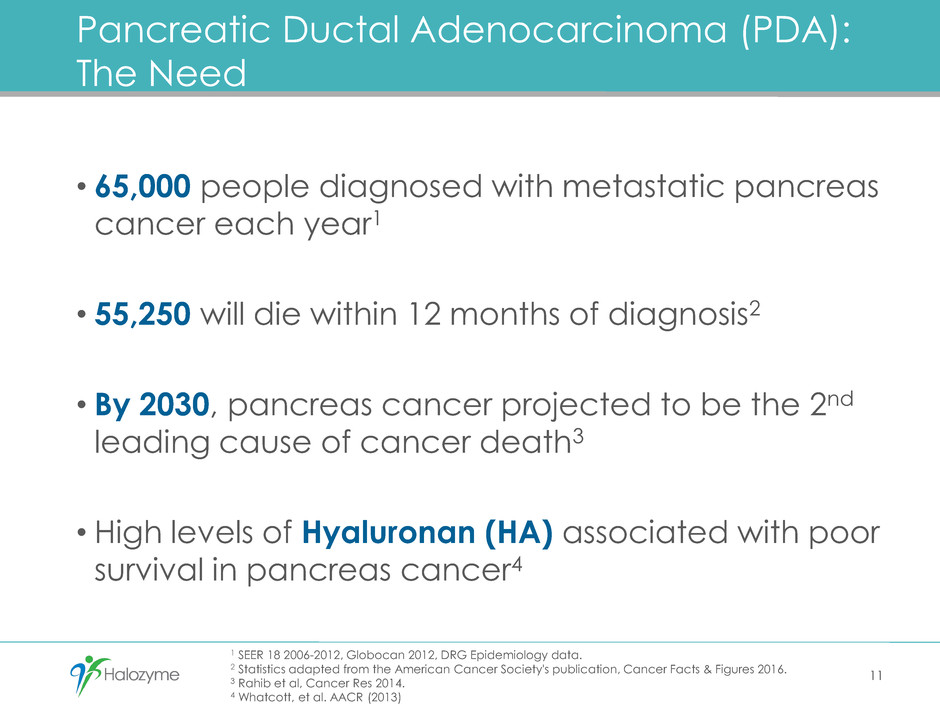

1 SEER 18 2006-2012, Globocan 2012, DRG Epidemiology data.

2 Statistics adapted from the American Cancer Society's publication, Cancer Facts & Figures 2016.

3 Rahib et al, Cancer Res 2014.

4 Whatcott, et al. AACR (2013)

Pancreatic Ductal Adenocarcinoma (PDA):

The Need

• 65,000 people diagnosed with metastatic pancreas

cancer each year1

• 55,250 will die within 12 months of diagnosis2

• By 2030, pancreas cancer projected to be the 2nd

leading cause of cancer death3

• High levels of Hyaluronan (HA) associated with poor

survival in pancreas cancer4

11

1 Provenzano, et al. Cancer Cell. 2012,21(3):418.

PEGPH20 Targets and Degrades Hyaluronan

Before PEGPH201

• Hard

• Fibrotic

• Hypovascular

MPA#1 + Gemcitabine fter PEGPH201

• Soft

• Cellular

• Hypervascular

12

1 SEER 18 2006-2012, Globocan 2012, DRG Epidemiology data.

2 Halozyme estimates for HA-High %.

3 DRG Epidemiology data, Halozyme internal estimates.

~$1B Potential Sales Opportunity in HA-High Metastatic

Pancreatic Ductal Adenocarcinoma (PDA)

13

Diagnosed Metastatic

PDA Annually US and EU 51

Estimated number of

HA-High patients

35-40% of population2

65,000

25,000

~$1B

Projected potential global

sales opportunity for successful

therapy in metastatic PDA3

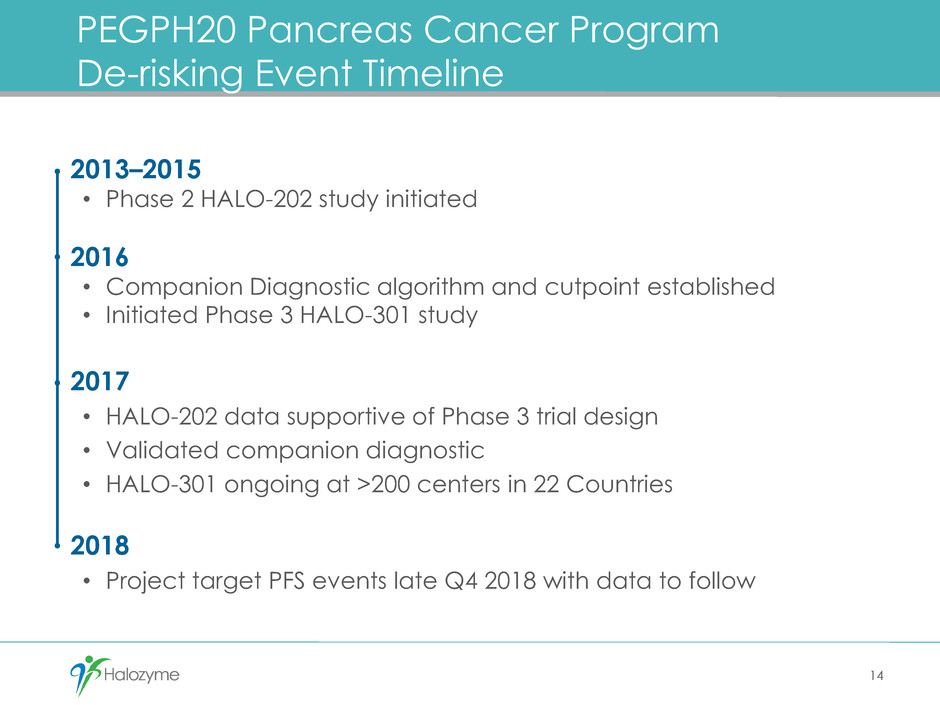

PEGPH20 Pancreas Cancer Program

De-risking Event Timeline

14

2013–2015

• Phase 2 HALO-202 study initiated

2016

• Companion Diagnostic algorithm and cutpoint established

• Initiated Phase 3 HALO-301 study

2017

• HALO-202 data supportive of Phase 3 trial design

• Validated companion diagnostic

• HALO-301 ongoing at >200 centers in 22 Countries

2018

• Project target PFS events late Q4 2018 with data to follow

HALO-301|Pancreatic: Global Phase 3 Trial

Enrolling in 22 Countries

• Randomized (2:1 PAG:AG), double-blind, placebo-controlled, global

• Project to achieve target number of PFS events late Q4 2018,

triggering final data collection, cleaning and interim analysis

PEGPH20 + ABRAXANE®

+ gemcitabine (PAG)

ABRAXANE® +

gemcitabine (AG) +

placebo

1L Metastatic

PDA

High-HA

patients

N=420-570

Primary Endpoints:

• Progression-Free

Survival (PFS)

• Overall Survival (OS)

15

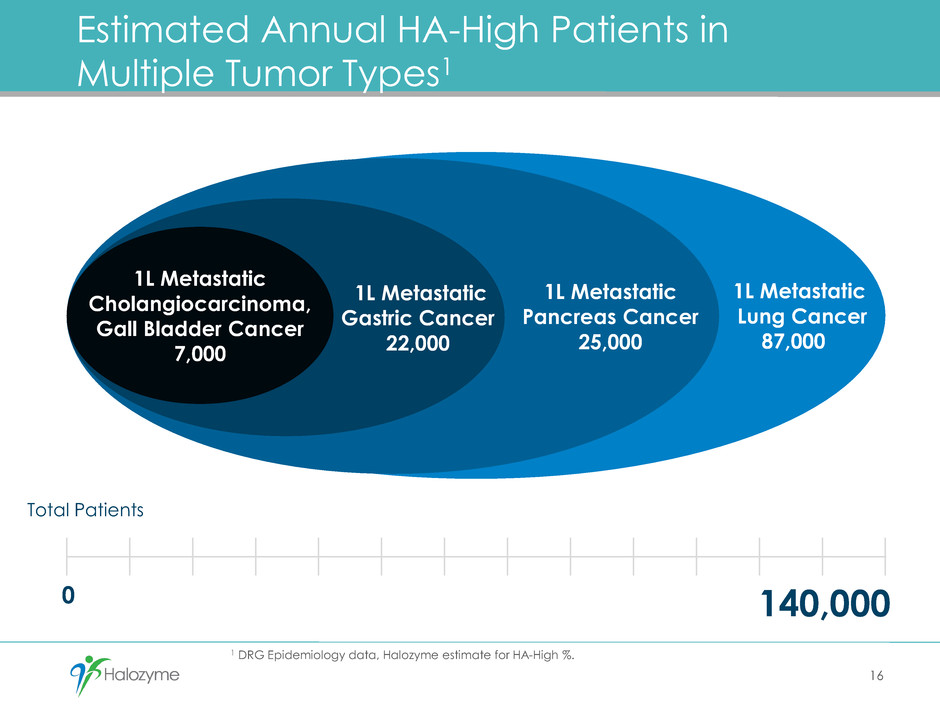

1 DRG Epidemiology data, Halozyme estimate for HA-High %.

1L Metastatic

Lung Cancer

87,000

1L Metastatic

Pancreas Cancer

25,000

1L Metastatic

Gastric Cancer

22,000

Estimated Annual HA-High Patients in

Multiple Tumor Types1

1L Metastatic

Cholangiocarcinoma,

Gall Bladder Cancer

7,000

140,000

Total Patients

0

16

ISTs: SWOG study enrollment closed in March 2017 following futility analysis

in all-comer population. Data collection and analysis ongoing.

Breast Cancer

Gastric Cancer,

NSCLC

Pancreas Cancer,

Gastric Cancer

Gall Bladder Cancer,

Cholangiocarcinoma

Robust Pan-Tumor Testing of PEGPH20

17

1 Pending continued enrollment rate.

Financial Update

Record 2017 Financial Performance

Jan 2017 2017 FY Estimate

Net Revenue $115M to $130M $310M to $320M

New ENHANZE®

agreements: $172M

Operating

Expenses

$240M to $250M $230M to $240M

Disciplined expense

control, flat spending to

2016

Operating Cash

(Burn) / Flow

($75M to $85M) $125M to $135M

Excludes impact of

financing, repayment of

debt principal

Year-end Cash $100M to $110M $460M to $470M

New ENHANZE revenue,

$135M equity raise

19

2018 Financial Guidance

2018

Net Revenue

• Royalty Growth

• Product Sales

$115M to $125M

25% - 30%

API product orders lower as a

result of planned partner

manufacturing transition

• Does not include potential

new ENHANZE® agreements

Operating Expenses $230M to $240M

• Disciplined expense control,

flat to 2017

Operating Cash Burn ($75M) to ($85M)

• Excludes impact of financing,

repayment of debt principal

Debt Repayment ~($95M)

• Includes royalty-backed and

Oxford/SVB loans

Year-end Cash $305M to $315M • Cash runway into 2020

20

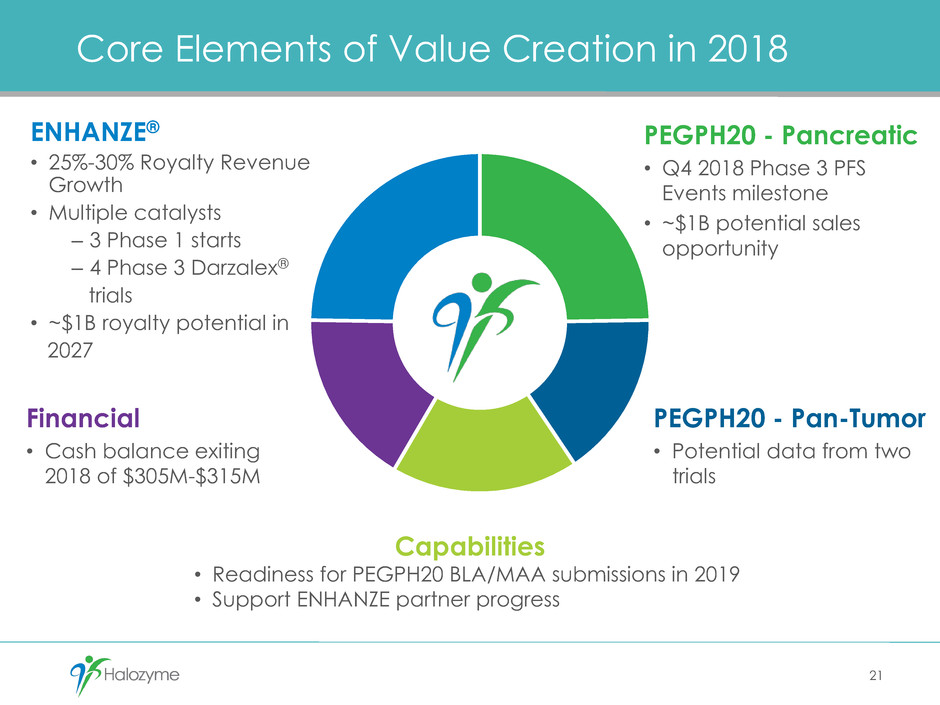

Core Elements of Value Creation in 2018

ENHANZE®

• 25%-30% Royalty Revenue

Growth

• Multiple catalysts

– 3 Phase 1 starts

– 4 Phase 3 Darzalex®

trials

• ~$1B royalty potential in

2027

21

PEGPH20 - Pancreatic

• Q4 2018 Phase 3 PFS

Events milestone

• ~$1B potential sales

opportunity

PEGPH20 - Pan-Tumor

• Potential data from two

trials

Financial

• Cash balance exiting

2018 of $305M-$315M

Capabilities

• Readiness for PEGPH20 BLA/MAA submissions in 2019

• Support ENHANZE partner progress

Building a Premier Oncology

Biotech

Dr. Helen Torley, President & CEO

January 9, 2018

JP Morgan 36th Annual Healthcare Conference