Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION JANUARY 2018 - GREAT PLAINS ENERGY INC | investorpresentation8-kjan.htm |

MERGER TO FORM

LEADING ENERGY

COMPANY

January 2018

Investor Update

Exhibit 99.1

January 2018 Investor Update

Forward-Looking Statements

2

Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date

when made. Forward-looking statements include, but are not limited to, statements relating to the anticipated merger transaction of Great Plains Energy Incorporated (Great

Plains Energy) and Westar Energy, Inc. (Westar Energy), including those that relate to the expected financial and operational benefits of the merger to the companies and

their shareholders (including cost savings, operational efficiencies and the impact of the anticipated merger on earnings per share), the expected timing of closing, the

outcome of regulatory proceedings, cost estimates of capital projects, dividend growth, share repurchases, balance sheet and credit ratings, rebates to customers, employee

issues and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy

and Westar Energy are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking information. These

important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of

electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy, KCP&L, and Westar Energy; changes in business

strategy, operations or development plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and

regulatory actions or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding

rates that the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and

environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates

and credit spreads and in availability and cost of capital and the effects on derivatives and hedges, nuclear decommissioning trust and pension plan assets and costs;

impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy

their contractual commitments; impact of terrorist acts, including, but not limited to, cyber terrorism; ability to carry out marketing and sales plans; weather conditions

including, but not limited to, weather-related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties

in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the

occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of generation, transmission, distribution

or other projects; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental, health, safety, regulatory and

financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; the ability of Great Plains Energy and Westar Energy

to obtain the regulatory approvals necessary to complete the anticipated merger or the imposition of adverse conditions or costs in connection with obtaining regulatory

approvals; the risk that a condition to the closing of the anticipated merger may not be satisfied or that the anticipated merger may fail to close; the outcome of any legal

proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the anticipated merger; the costs incurred to consummate the anticipated

merger; the possibility that the expected value creation from the anticipated merger will not be realized, or will not be realized within the expected time period; difficulties

related to the integration of the two companies; the credit ratings of the combined company following the anticipated merger; disruption from the anticipated merger making it

more difficult to maintain relationships with customers, employees, regulators or suppliers; the anticipated diversion of management time and attention on the anticipated

merger; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. Additional risks and uncertainties are discussed in the joint proxy statement/prospectus

and other materials that Great Plains Energy, Westar Energy and Monarch Energy Holding, Inc. (Monarch Energy) file with the Securities and Exchange Commission (SEC)

in connection with the anticipated merger. Other risk factors are detailed from time to time in quarterly reports on Form 10-Q and annual reports on Form 10-K filed by Great

Plains Energy, KCP&L and Westar Energy with the SEC. Each forward-looking statement speaks only as of the date of the particular statement. Monarch Energy, Great

Plains Energy, KCP&L and Westar Energy undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

January 2018 Investor Update

Recent Focus

• Merger Approval Update

Shareholder Approval – overwhelming support with more than 90 percent of shares voted in favor at each

company – November 2017

Received HSR antitrust clearance – December 2017

• Ryan A. Silvey confirmed as Missouri Public Service Commissioner – January 2018

• Tax Reform

Continuing to evaluate the overall impact of recently passed federal tax legislation

Initial review is not expected to change previously disclosed pro forma EPS and Dividend growth targets

Continue to expect repurchase of ~60 million shares over first two years after closing

Expect to maintain strong investment grade credit profile

Projections subject to further evaluation of tax reform legislation, guidance from various regulatory

agencies, and the outcome from various state regulatory proceedings, including those focused on tax

reform

3

Merger Overview

January 2018 Investor Update

Creating A Leading Energy Company

5

Merger Drives

Value For All

Stakeholders

Expect to deliver exceptional

value through attractive

earnings and dividend growth

Serving customers and

communities with reliable

service, clean energy, and

fewer and lower rate increases

Maintaining a rewarding and

challenging work environment for

valued employees

Shareholders

Customers &

Communities

Employees

January 2018 Investor Update

Merger Of Equals

• Creates a leading energy company with a combined

equity value of ~$14.5 billion1 – a more valuable

company for shareholders and a stronger company

for customers

• 100% stock-for-stock, tax-free exchange of shares

with no transaction debt and no exchange of cash

• Exchange Ratio

WR: 1:1 (52.5% ownership)

GXP: 0.5981:1 (47.5% ownership)

• Transaction structure directly responsive to earlier

regulatory concerns

• Closing expected second quarter 2018

6

Great Plains

Energy

Westar

Energy

Pro Forma

Combined

Rate Base ($billion)4 $6.6 $6.5 $13.1

Electric Customers 864,400 707,000 1,571,400

Owned Generation

Capacity (MW)

6,524 6,573 13,097

Renewables5 (MW) 1,455 1,661 3,116

Transmission Miles 3,600 6,400 10,000

Distribution Miles 22,700 29,000 51,700

1. Great Plains Energy and Westar Energy combined market cap as of 12/29/17.

2. Excludes Great Plains Energy’s Crossroad Energy Center in the Mississippi Delta and Westar’s Spring Creek Energy Center in Logan County, OK.

3. Operating metrics as of 9/30/17.

4. Estimated rate base based on ordered and settled rate cases.

5. Renewables both owned and purchase power agreements as of 12/31/17.

Energy Centers Westar Energy Great Plains Energy

Combined Service Area2 Key Operating Metrics3

January 2018 Investor Update

Stronger Platform For Earnings Growth

7

$3.25

[VALUE]

[VALUE]

2016A Pro Forma 2021E

Targeted Pro Forma EPS Growth1

6%-8%

CAGR

1. EPS growth based on Westar Energy 2016 actual EPS of $2.43.

Driven by the Following Assumptions:

• Merger savings

• FERC regulated transmission growth

• Share repurchases over first two years after closing

• Anticipated 2018 general rate reviews to reduce regulatory lag

January 2018 Investor Update

Stronger Platform For Dividend Growth

8

$2.19

[VALUE]

[VALUE]

Pro Forma 2018E Pro Forma 2021E

Targeted Pro Forma Dividend Growth

6%-8%

CAGR

• Initial dividend results in 15% increase for Westar’s shareholders

• Initial dividend maintains Great Plains Energy’s current dividend policy

• Targeted annual dividend growth in line with EPS growth while targeting payout

ratio of 60% to 70%

1. Based on most recent Great Plains Energy quarterly dividend payment annualized of $1.10 per share divided by the 0.5981 exchange ratio.

1

January 2018 Investor Update

Strong Platform For Merger Savings

9

2018E 2019E 2020E 2021E

$110.3

$143.5 $149.4

$27.8

Targeted Merger Savings ($mm)1

2016A 2021E

Great Plains Energy Westar Pro Forma

$1,367

~$1,100 – $1,200

Targeted O&M Cost Reductions ($mm)2

~(15%)

• Combination provides maximum opportunities for efficiencies, cost savings for customers, and

better ability to earn allowed returns

• Cost savings and ongoing management of O&M expected to drive total cost reductions of

approximately 15% from 2016 to 2021

• Detailed integration plans expected to result in merger savings of $160 million in 2022 and beyond

In addition to targeted merger savings, we expect over $200 million of potential cost savings

related to Great Plains Energy plant retirements

1. Excludes Great Plains Energy plant retirements announced June 2017 and potential capital expenditure savings. Planned merger savings include non-fuel O&M and Other shown net of costs to

achieve. See appendix slide for projected merger savings by type and year.

2. Inclusive of targeted O&M merger savings and expected O&M cost savings of Great Plains Energy announced plant retirements.

3. Represents Great Plains Energy utility O&M and Westar’s O&M and SG&A as reported in GAAP financials.

3

January 2018 Investor Update

• Projected significant earnings accretion to Great Plains Energy and Westar Energy

• Expect to offer top quartile total shareholder return amongst electric utilities:

Target EPS growth of 6% to 8%, 2016 to 20211

Target dividend growth in line with EPS growth, 60% to 70% target payout ratio

• Initial 15% dividend increase for Westar Energy

• Diversifies and enhances earnings stream

• Opportunity to improve earned returns relative to authorized

• Target rate base growth of 3 to 4% through 20222

Over $6 billion in investment from 2018 through 2022

Including, over $1 billion in FERC regulated transmission investment

• Capital structure rebalancing post-closing

Expect to repurchase ~60 million, or ~22% of pro forma shares outstanding, in the first two years after closing3

Rebalancing supported by strong balance sheet with expected $1.25 billion of cash at closing

Combined company expected to maintain strong investment-grade credit ratings

10

1. Targeted EPS growth based on Westar Energy 2016 actual EPS of $2.43.

2. Based on 2016 pro forma rate base currently reflected in rates of $13.1 billion.

3. Anticipated initial pro forma shares of approximately 272 million at merger closing.

Financial Benefits

10

January 2018 Investor Update

Strong Credit with Capacity for Share

Repurchases

• Great Plains Energy completed unwind of prior debt and mandatory convertible preferred equity acquisition financing

following July 2017 merger of equals announcement

• Merger of equals structure with no merger debt results in a strengthened credit profile and positive rating agency action

Credit metrics for combined company expected to be in-line with those of Great Plains Energy pre-merger

• Expect to repurchase ~60 million shares (~22% of pro forma shares outstanding) in the first two years after closing1

• Projected consolidated FFO / Total Debt of ~18% to 20% in 2019 – 20212

• Projected consolidated Debt / Capitalization of ~48 to 50% in 2019 – 20212

11

Ratings / Outlook3

Westar

Energy

Great Plains

Energy KCP&L GMO

S

&

P

Issuer Rating BBB+ BBB+ BBB+ BBB+

Senior Secured Debt A - A -

Senior Unsecured Debt - BBB BBB+ BBB+

Outlook Positive Positive Positive Positive

M

o

o

d

y

’s

Issuer Rating Baa1 - - -

Senior Secured Debt A2 - A2 -

Senior Unsecured Debt - Baa2 Baa1 Baa2

Outlook Stable Stable Stable Stable

1. Anticipated initial pro forma shares of approximately 272 million at merger closing.

2. Projected FFO/Debt and Debt/Capitalization could be impacted by recently passed tax legislation.

3. Credit ratings as of 11/1/2017.

January 2018 Investor Update

Merger Expected To Close Second

Quarter of 2018

12

Stakeholder Filed

Approval

Anticipated Additional Information

GXP and WR shareholders Approved November 21, 2017

KCC 2Q18 Docket: 18-KCPE-095-MER

MPSC 2Q18 Docket: EM-208-0012

FERC 1Q18 – 2Q18 Docket: EC-171-000

NRC 1Q18 – 2Q18 Docket: 50-482

U.S. DOJ/FTC (HSR) Received December 12, 2017

FCC 1Q18 – 2Q18 1Q18 – 2Q18

January 2018 Investor Update

State Merger Procedural Schedules

13

Key Dates (2018) Kansas Corporation Commission Missouri Public Service Commission1

January 16 Rebuttal Testimony Due

January 22 Public Hearing

January 29 Staff/Intervenor Direct Testimony Due

February 19 Rebuttal Testimony Due

February 21 Surrebuttal Testimony Due

Week of February 26 Settlement Conferences

March 7 Deadline to Submit Settlement Agreement

March 12-16 Evidentiary Hearings

March 19-27 Evidentiary Hearings

March 30 Initial Briefs Due

April 10 Initial Brief Due

April 13 Reply Briefs Due

April 20 Staff/Intervenor Responsive Brief Due

April 28 Reply Brief Due

June 5 Commission Order Due

1. The Missouri Public Service Commission’s procedural schedule was silent on an expected order date but is supportive of an end of May, 2018 order effective date.

Regulatory and Legislative

Priorities

January 2018 Investor Update

Regulatory Initiatives

Westar General Rate Review Considerations:

• Western Plains Wind Farm

• Expiration of wholesale contracts currently reflected in rates as offsets to retail cost of service

• Expiring production tax credits from initial wind investments

• Federal income tax reform

• Updated depreciation study

KCP&L/GMO General Rate Review Considerations:

• Drivers include new customer information system and other infrastructure investments since rates were last set

• Federal income tax reform

Energy Legislative Priorities:

• Supporting comprehensive regulatory reform in Missouri in 20181

• Not expecting major Kansas legislative activities in 2018

15

Regulatory Timing 1Q18 2Q18 3Q18 4Q18

Merger Approval

Westar General Rate Review

KCP&L – KS General Rate Review

KCP&L – MO General Rate Review

GMO General Rate Review

Missouri & Kansas Legislative Session

1. Missouri Senate Bill 564 filed December 1, 2017 and House Bill 1575 filed December 11, 2017.

January 2018 Investor Update

Constructive Ratemaking

16

Cost Recovery Mechanisms

Westar

Kansas

KCP&L

Kansas

KCP&L

Missouri

GMO

Missouri

Energy Cost Adj. Rider (KS) / Fuel Adj. Clause Rider (MO) √ √ √ √

Pension and OPEB Tracker √ √ √ √

Property Tax Surcharge Rider √ √

Energy Efficiency Cost Recovery Rider √ √

Missouri Energy Efficiency Investment Act Program Rider √ √

Renewable Energy Standards Tracker √ √

Renewable Energy Standard Rate Adj. Mechanism Rider √

Transmission Delivery Charge Rider √ √

Critical Infrastructure Protection Standards / Cybersecurity

Tracker √ √

Abbreviated Rate Case √ √

January 2018 Investor Update

State Commissioners

17

Missouri Public Service Commission (MPSC) Kansas Corporation Commission (KCC)

Mr. Daniel Y. Hall (D)

Chair (since August 2015)

Term began: September 2013

Term expires: September 2019

Mr. Pat Apple (R)

Chair (since January 2017)

Term began: March 2014

Term expires: March 20181

Mr. William P. Kenney (R)

Commissioner

Term began: January 2013

Term expires: January 2019

Ms. Shari Feist Albrecht (I)

Commissioner

Term began: June 2012

Reappointed: January 2017

Term expires: March 2020

Mr. Scott T. Rupp (R)

Commissioner

Term began: March 2014

Term expires: March 2020

Mr. Jay S. Emler (R)

Commissioner

Term began: January 2014

Reappointed: May 2015

Term expires: March 2019

Ms. Maida J. Coleman (D)

Commissioner

Term began: August 2015

Term expires: August 2021

Mr. Ryan A. Silvey (R)

Commissioner

Term began: January 2018

Term expires: January 2024

MPSC consists of five (5) members, including the Chairman, who are

appointed by the Governor and confirmed by the Senate.

Members serve six-year terms (may continue to serve after term expires

until reappointed or replaced)

Governor appoints one member to serve as Chairman

KCC consists of three (3) members, including the Chairman, who are appointed

by the Governor and confirmed by the Senate.

Members serve four-year terms (may continue to serve after term expires

until reappointed or replaced)

Commissioners elect one member to serve as Chairman

1. Chair Pat Apple has indicated he will not serve past his term.

Clean Energy Leader

January 2018 Investor Update

Sustainable Energy Portfolio

• Combined wind portfolio will be one of the largest in the United

States: ~3,200 MW1

• Renewable energy ~30% of retail sales

Emission-free energy (renewable and nuclear) nearly half

of retail sales

• Well ahead of renewable portfolio standards in Missouri and

voluntary goals in Kansas3

19

1. Includes owned generation and power purchase agreements based on nameplate capacity of the facility.

2. Source: American Wind Energy Association.

3. Missouri RPS requires 15% of electricity sales to customers with renewable sources by 2021. Kansas has voluntary goal of 20% of utility’s peak by 2020.

• Focused on growing renewables while retiring end-of-life

fossil plants

• Strong platform to grow renewables and take advantage

of abundant local natural resources

Kansas ranks 5th in the nation for installed wind

capacity2

2005 2018

0%

10%

20%

30%

40%

Combined Company Projections

Anticipated Emission Reduction 2005 - 2020 Renewables as Percent of Retail Sales

0%

25%

50%

75%

100%

2005 2008 2011 2014 2017E 2020E

SO2

98%

85%

~30%

NOx

85%

SO2

38%

Appendix

January 2018 Investor Update

Projected Merger Savings

21

2016- 2017 2018E 2019E 2020E 2021E 2022E Total

NFOM

Labor

- $38.3 $66.6 $78.1 $83.2 $85.3 $351.5

NFOM Non-

Labor

- $8.6 $41.4 $55.1 $54.3 $61.1 $220.5

Fuel - $0.7 $1.0 $1.1 $1.3 $2.3 $6.4

Other - $2.2 $7.9 $12.3 $13.3 $13.4 $49.0

Gross

Efficiencies

- $49.7 $116.9 $146.5 $151.9 $162.0 $627.0

Transition

Costs

($35.6) ($21.9) ($6.6) ($3.0) ($2.5) ($2.2) ($71.8)

Net

Savings

($35.6) $27.8 $110.3 $143.5 $149.4 $159.8 $555.2

Merger Savings by Type and Year ($mm)1,2

1. Some numbers may not add due to rounding.

2. Source: Steven Busser, Kansas direct testimony filed August 25, 2017; page 15 (Docket: 18-KCPE-095-MER).

Steven Busser, Missouri direct testimony filed August 31, 2017; page 14 (Docket: EM-2018-0012).

January 2018 Investor Update

Creating a Leading Midwest Energy

Utility

22

Source: Company filings, investor presentations, Bloomberg market data as of 12/29/2017.

$14.3 $14.3 $12.2

$8.6 $9.9 $9.5 $9.5 $8.1 $5.7 $7.5 $6.6 $6.9

$22.6

$21.1 $19.6

$17.3

$14.9 $14.5 $13.1 $12.7 $12.5 $11.4

$9.8 $9.8

Combined

Company

WR GXP

Market Cap EV

17.3

15.0 15.0 14.2 13.4 13.1

11.0

9.4 9.2

8.2 7.6

6.6 6.5

GXP WR

1.6 1.6

1.2

1.0 0.9 0.9 0.8 0.8 0.7 0.7

0.5 0.5

GXP WRCombined Company

SELECTED MID-CAP UTILITIES BY ENTERPRISE VALUE ($BN)

SELECTED MID-CAP UTILITIES BY CUSTOMERS (MILLIONS) SELECTED MID-CAP UTILITIES BY RATE BASE ($BN)

Combined

Company

January 2018 Investor Update

Compelling Strategic and

Geographic Fit

23

• Better positioned to meet customer’s energy needs, provide clean energy and optimize investments to achieve improved

long-term financial returns

• Increased scale and jurisdictional diversity with enhanced platform to drive value for shareholders and customers

• Strong geographic fit, complementary operations with contiguous territories and existing shared assets produce economies of

scale and significant savings and efficiencies

Great Plains Energy Westar Energy Combined Company

G

e

o

graph

y

b

y

Cu

s

to

m

e

r1

Rat

e

B

a

s

e

b

y

J

uri

s

d

ic

ti

o

n

2

Cap

a

c

it

y

(M

W

)3

KS

100%

KS

60%

MO

40%

MO

64%

KS

31%

FERC

5%

KS

81%

FERC

19%

KS

56%

MO

32%

FERC

12%

Coal

44% Natural

Gas & …

Nuclear

7%

Renewable

19%

Coal

43% Natural

Gas & …

Nuclear

7%

Renewable

20%

Coal

42% Natural

Gas …

Nuclear

7%

Renewabl

e …

MO

72%

KS

28%

1. Customer breakdown by jurisdiction based on retail sales generation.

2. KCP&L,GMO, Westar and KG&E are also subject to regulation by The Federal Energy Regulatory Commission (FERC) with respect to transmission, wholesale sales and rates, and

other matters.

3. As of year-end 2017.

January 2018 Investor Update

Pro Forma Corporate Structure

24

NewCo1

Kansas City Power &

Light

KCP&L Greater

Missouri Operations

Great Plains Energy

Other Subsidiaries

Westar Energy

Westar Subsidiaries,

notably, KG&E

1. NewCo and operating utilities will be rebranded, with study underway.

January 2018 Investor Update

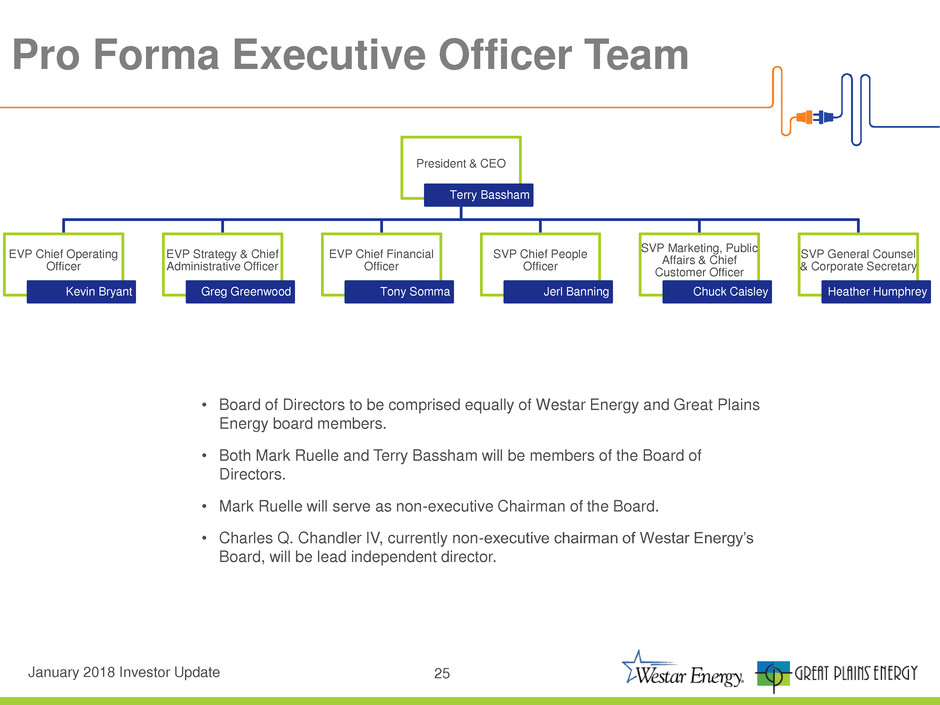

Pro Forma Executive Officer Team

President & CEO

Terry Bassham

EVP Chief Operating

Officer

Kevin Bryant

EVP Strategy & Chief

Administrative Officer

Greg Greenwood

EVP Chief Financial

Officer

Tony Somma

SVP Chief People

Officer

Jerl Banning

SVP Marketing, Public

Affairs & Chief

Customer Officer

Chuck Caisley

SVP General Counsel

& Corporate Secretary

Heather Humphrey

25

• Board of Directors to be comprised equally of Westar Energy and Great Plains

Energy board members.

• Both Mark Ruelle and Terry Bassham will be members of the Board of

Directors.

• Mark Ruelle will serve as non-executive Chairman of the Board.

• Charles Q. Chandler IV, currently non-executive chairman of Westar Energy’s

Board, will be lead independent director.

January 2018 Investor Update

Key Terms

26

Transaction

Structure

• All stock merger of equals (100% stock-for-stock tax-free exchange); combined equity value of

~$14.51 billion

• New company to be jointly named prior to close

Exchange Ratio

• Westar Energy: 1:1

• Great Plains Energy: 0.5981:1

Approximate Pro

Forma Ownership

• Westar Energy 52.5%

• Great Plains Energy 47.5%

Pro Forma Dividend

• Adjust to maintain current Great Plains Energy dividend

• Results in 15% dividend uplift for Westar Energy

Termination Fees

• Reverse break-up fee of $190 million in favor of Westar Energy

• Mutual fiduciary out break-up fees of $190 million in favor of the other

Governance

• Mark Ruelle (Westar Energy CEO) to be non-executive chairman

• Terry Bassham (Great Plains Energy Chairman, President & CEO) to be President & CEO

• Tony Somma (Westar Energy CFO) to be CFO; Kevin Bryant (Great Plains Energy CFO) to be COO

• Equal board representation from each company, including Bassham and Ruelle

Headquarters

• Corporate Headquarters – Kansas City, Missouri

• Operating Headquarters – Topeka, Kansas; Kansas City, Missouri

Timing / Approvals

• Expected to close second quarter 2018

• Shareholders, federal and state regulators

1. Great Plains Energy and Westar Energy combined market cap as of 12/29/17.

January 2018 Investor Update

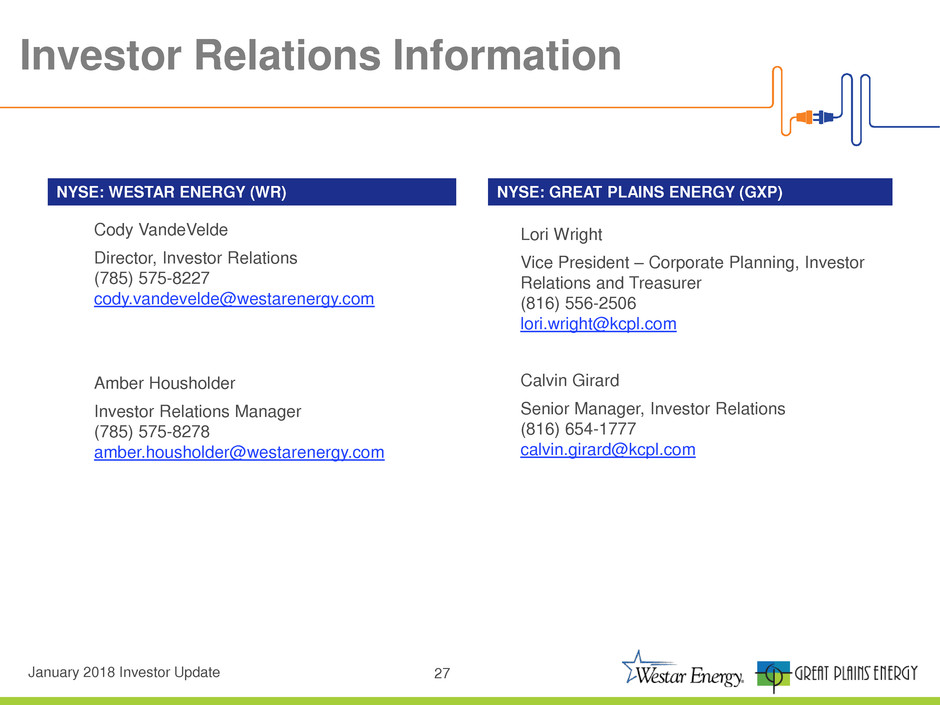

Investor Relations Information

27

Lori Wright

Vice President – Corporate Planning, Investor

Relations and Treasurer

(816) 556-2506

lori.wright@kcpl.com

Calvin Girard

Senior Manager, Investor Relations

(816) 654-1777

calvin.girard@kcpl.com

NYSE: GREAT PLAINS ENERGY (GXP)

Cody VandeVelde

Director, Investor Relations

(785) 575-8227

cody.vandevelde@westarenergy.com

Amber Housholder

Investor Relations Manager

(785) 575-8278

amber.housholder@westarenergy.com

NYSE: WESTAR ENERGY (WR)