Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NOVANTA INC | novt-8k_20180109.htm |

A Trusted Technology Partner to Medical and Advanced Technology Equipment Manufacturers NASDAQ: NOVT January 2018 Matthijs Glastra, Chief Executive Officer Exhibit 99.1

Safe Harbor Statement The statements in this presentation that relate to guidance, pro forma presentations, future plans, goals, business opportunities, events or performance are forward-looking statements that involve risks and uncertainties, including risks associated with business and economic conditions, failure to achieve expected benefits of acquisitions, failure to comply with Food and Drug Administration regulations, customer and/or supplier contract cancellations, manufacturing risks, competitive factors, ability to successfully introduce new products, uncertainties pertaining to customer orders, demand for products and services, growth and development of markets for the Company's products and services, and other risks identified in our filings made with the Securities and Exchange Commission. Actual results, events and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company disclaims any obligation to update these forward-looking statements as a result of developments occurring after the date of this presentation. Readers are encouraged to refer to the risk disclosures described in the Company’s Form 10-K for the year ended December 31, 2016 and subsequent filings with the SEC, as applicable. Please see “Safe Harbor and Forward-Looking Information” in the Form 8-K for more information. In this presentation, we present the non-GAAP financial measures of Adjusted Revenue, Adjusted EPS, Adjusted EBITDA , free cash flow and net debt. Please see “Use of Non-GAAP Financial Measures” in the accompany appendix and our third quarter 2017 earnings press release for the reasons we use these measures, a reconciliation of these measures to the most directly comparable GAAP measures and other information relating to these measures. The Company neither updates nor confirms any guidance regarding the 2017 full year operating results of the Company which may have been given prior to this presentation.

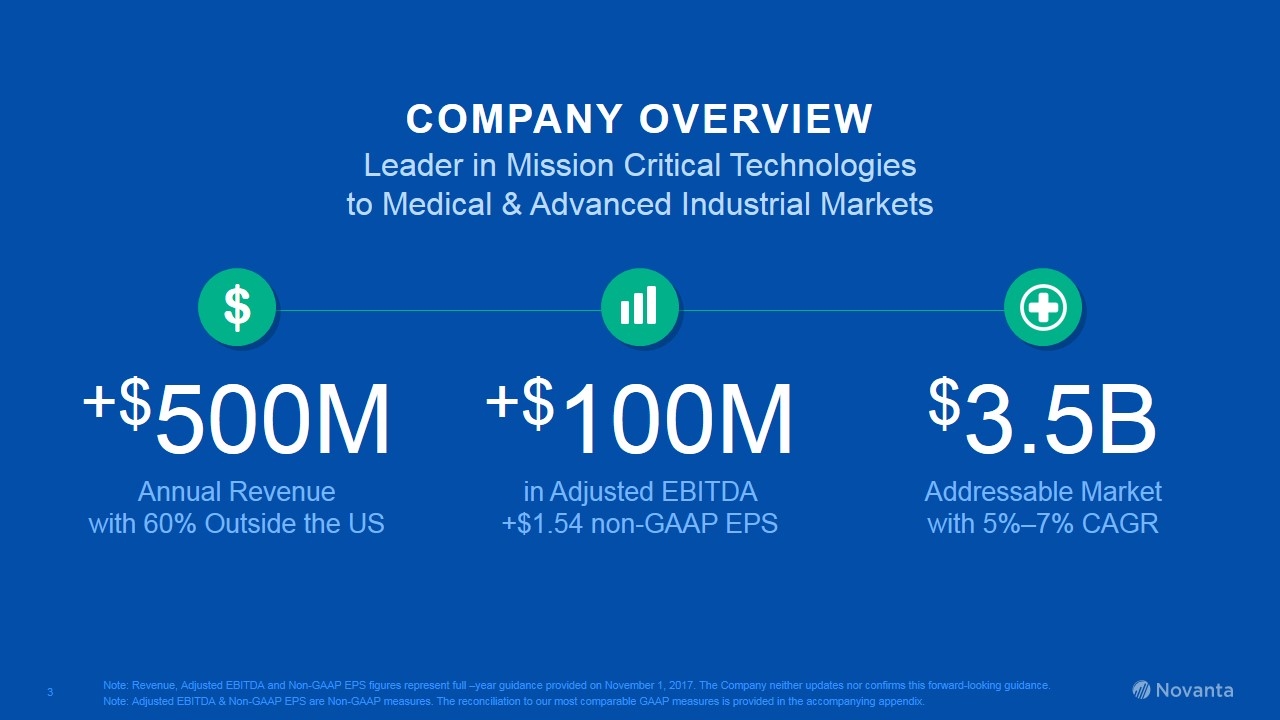

+$100M in Adjusted EBITDA +$1.54 non-GAAP EPS +$500M Annual Revenue with 60% Outside the US $3.5B Addressable Market with 5%–7% CAGR COMPANY OVERVIEW $ Note: Revenue, Adjusted EBITDA and Non-GAAP EPS figures represent full –year guidance provided on November 1, 2017. The Company neither updates nor confirms this forward-looking guidance. Note: Adjusted EBITDA & Non-GAAP EPS are Non-GAAP measures. The reconciliation to our most comparable GAAP measures is provided in the accompanying appendix. Leader in Mission Critical Technologies to Medical & Advanced Industrial Markets

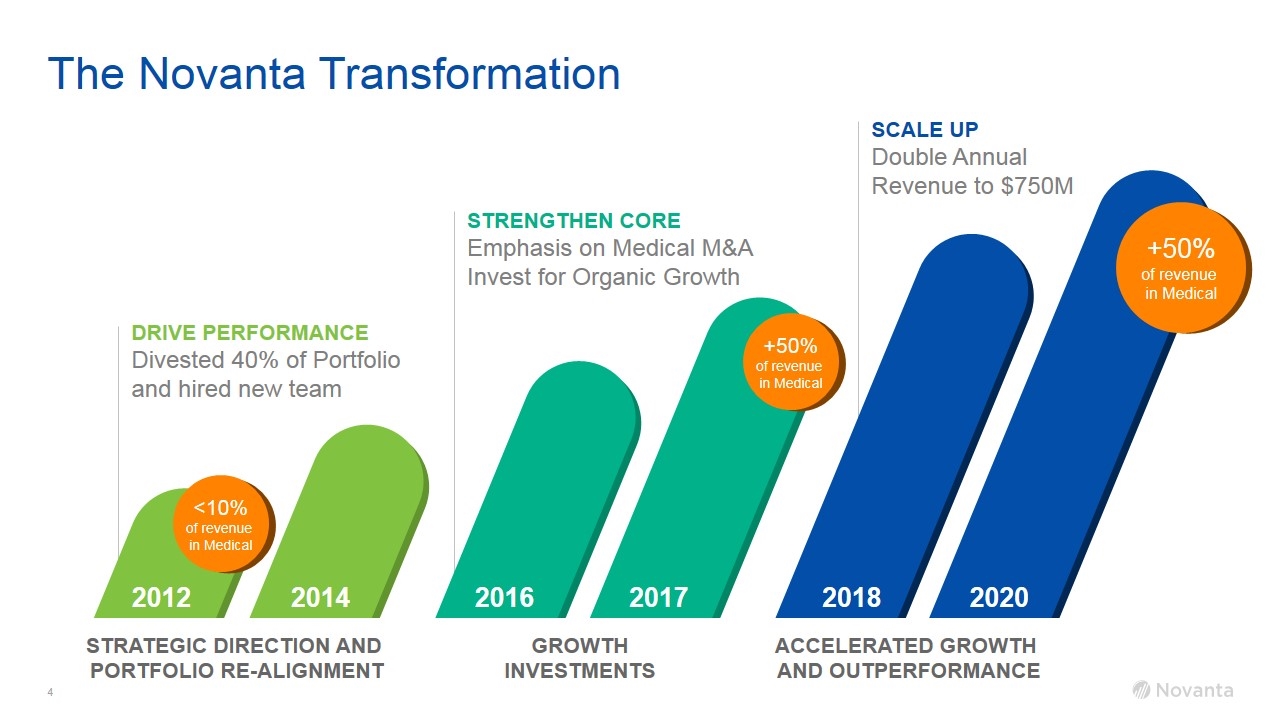

SCALE UP Double Annual Revenue to $750M STRENGTHEN CORE Emphasis on Medical M&A Invest for Organic Growth DRIVE PERFORMANCE Divested 40% of Portfolio and hired new team The Novanta Transformation Source: STRATEGIC DIRECTION AND PORTFOLIO RE-ALIGNMENT GROWTH INVESTMENTS ACCELERATED GROWTH AND OUTPERFORMANCE 2012 2014 2016 2018 2020 2017 +50% of revenue in Medical <10% of revenue in Medical +50% of revenue in Medical

Leader in Intelligent Mission Critical and Enabling Technologies 2020 STRATEGIC DIRECTION Breakthrough Scale Double Annual Revenue to $750M Consistent Growth 5–7% Organic Growth and +50% of Revenue in Medical Markets Global Market Leadership “Top 2” Share Position Globally Superior Profitability Deliver 20% Adj. EBITDA, with Diversified Businesses Reputation for Excellence Widely Recognized as a World Class Operating Company 1 2 3 4 5

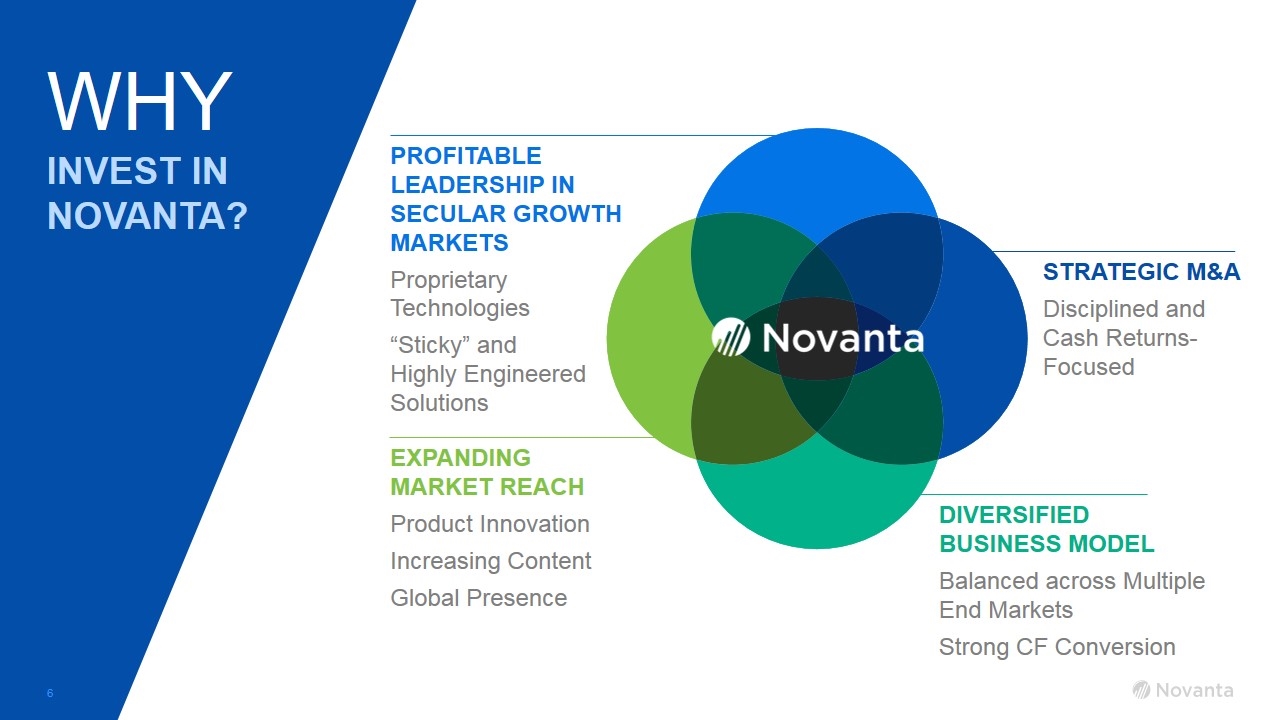

WHY INVEST IN NOVANTA? EXPANDING MARKET REACH Product Innovation Increasing Content Global Presence PROFITABLE LEADERSHIP IN SECULAR GROWTH MARKETS Proprietary Technologies “Sticky” and Highly Engineered Solutions STRATEGIC M&A Disciplined and Cash Returns-Focused DIVERSIFIED BUSINESS MODEL Balanced across Multiple End Markets Strong CF Conversion

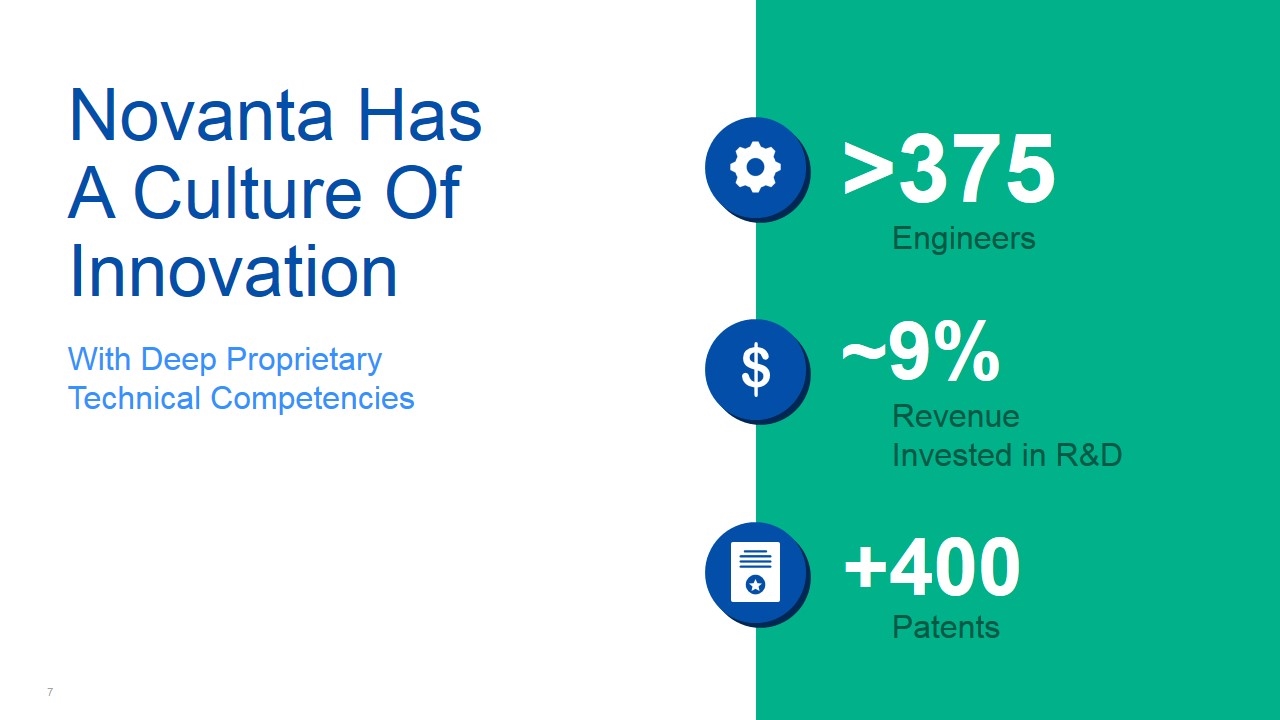

Novanta Has A Culture Of Innovation With Deep Proprietary Technical Competencies >375 Engineers ~9% Revenue Invested in R&D +400 Patents

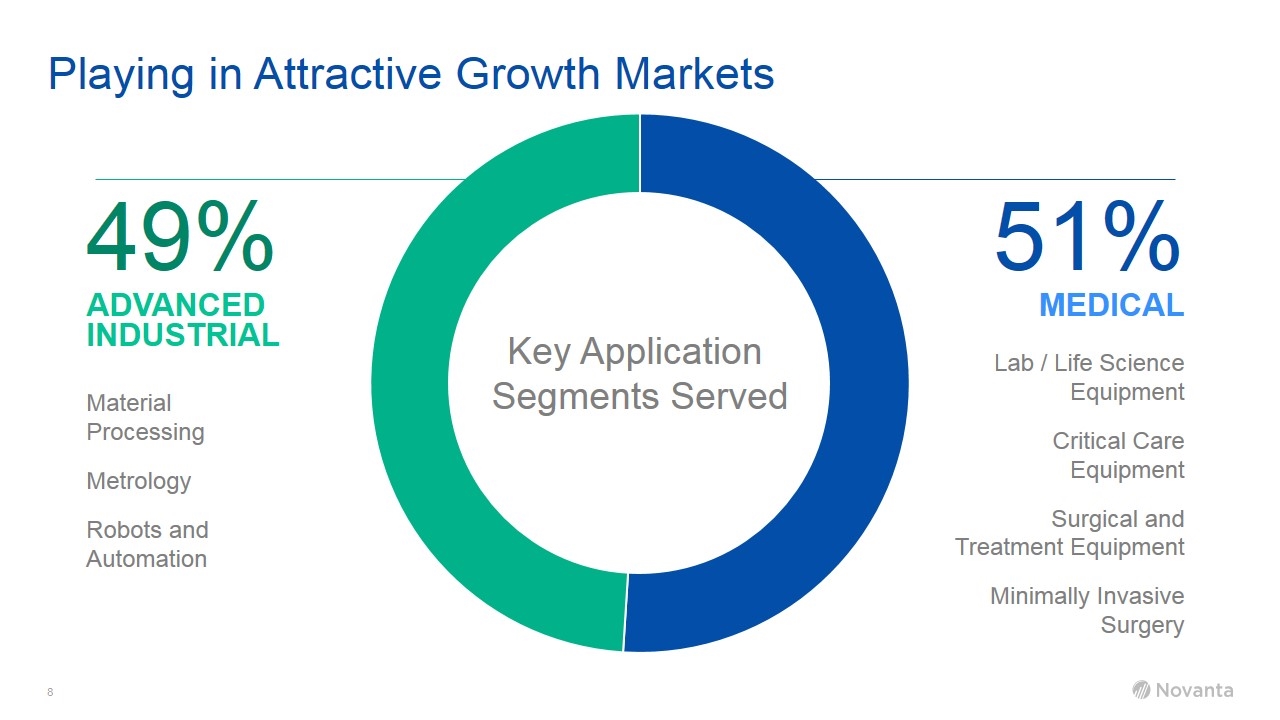

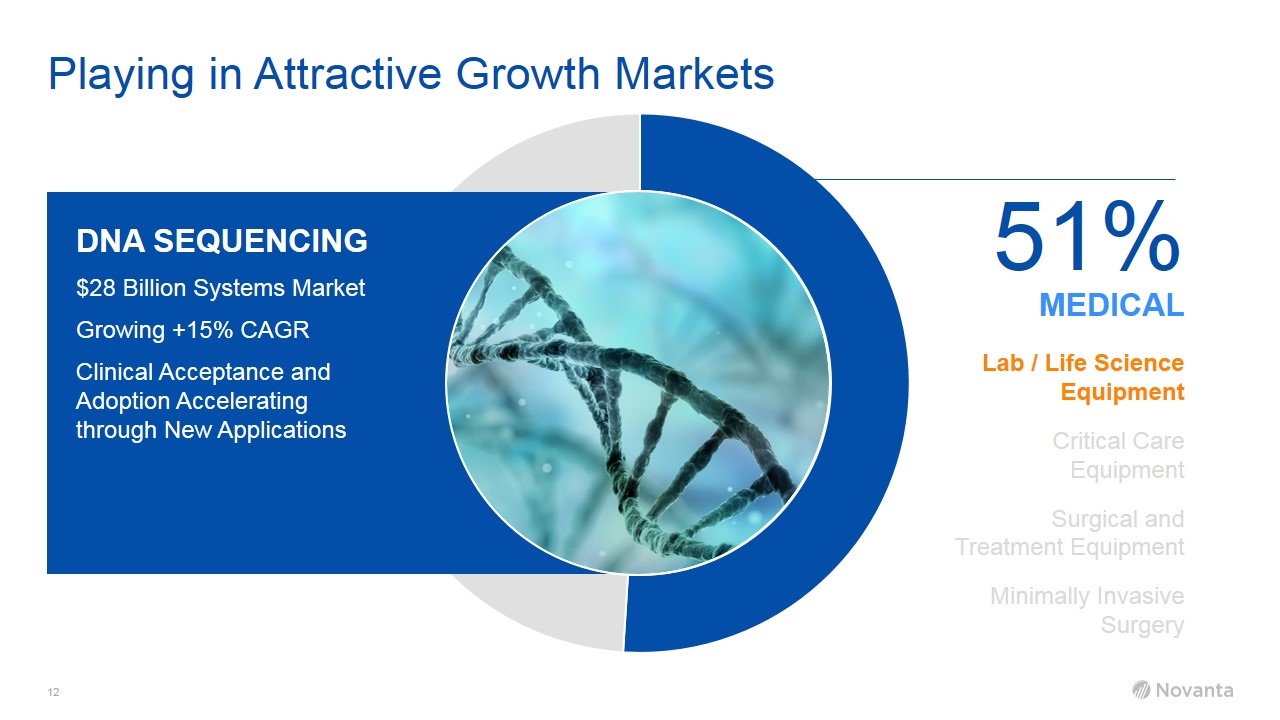

51% MEDICAL 49% ADVANCED INDUSTRIAL Material Processing Metrology Robots and Automation Lab / Life Science Equipment Critical Care Equipment Surgical and Treatment Equipment Minimally Invasive Surgery Key Application Segments Served Playing in Attractive Growth Markets

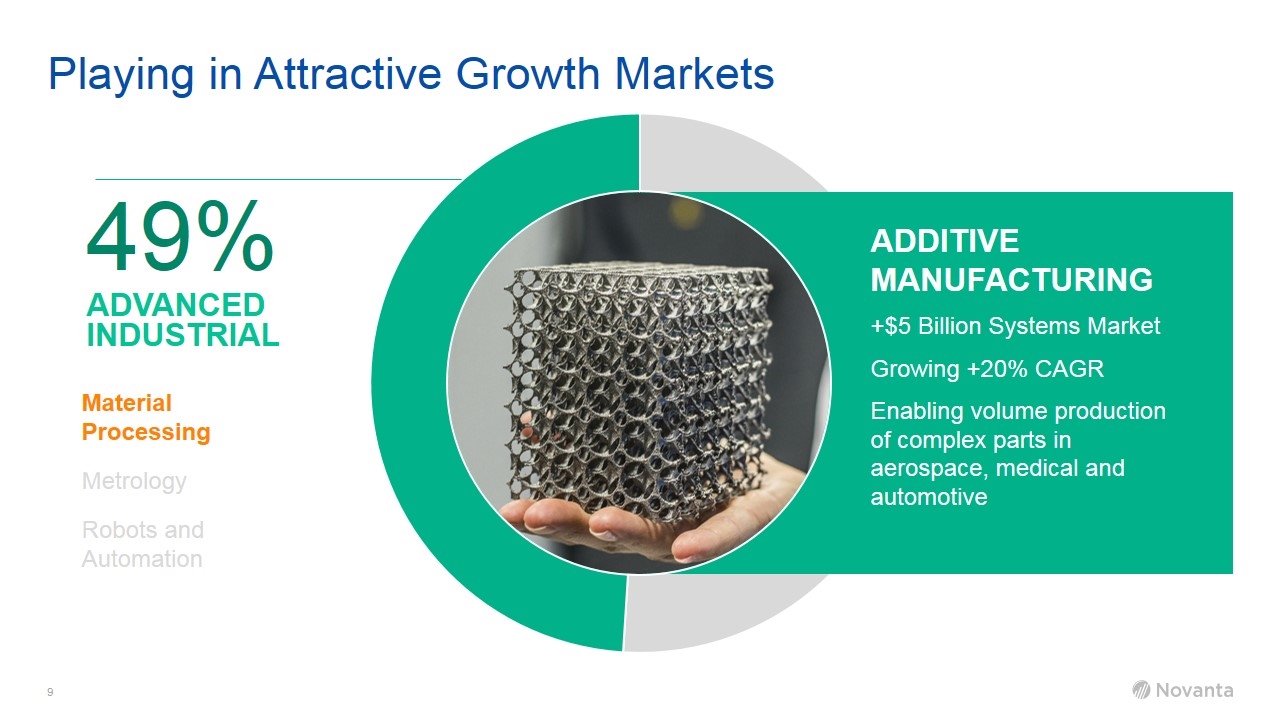

49% ADVANCED INDUSTRIAL Playing in Attractive Growth Markets ADDITIVE MANUFACTURING +$5 Billion Systems Market Growing +20% CAGR Enabling volume production of complex parts in aerospace, medical and automotive Material Processing Metrology Robots and Automation

49% ADVANCED INDUSTRIAL Material Processing Metrology Robots and Automation Playing in Attractive Growth Markets PRECISION ROBOTICS Rising and harmonized labor costs driving productivity pressures solved through robotics Robots already an economically viable alternative to human labor in many industries1) The share of manufacturing tasks performed by robots to rise from 10% to 25% by 20251) 1) BCG, The Robotics Revolution, Sept 2016

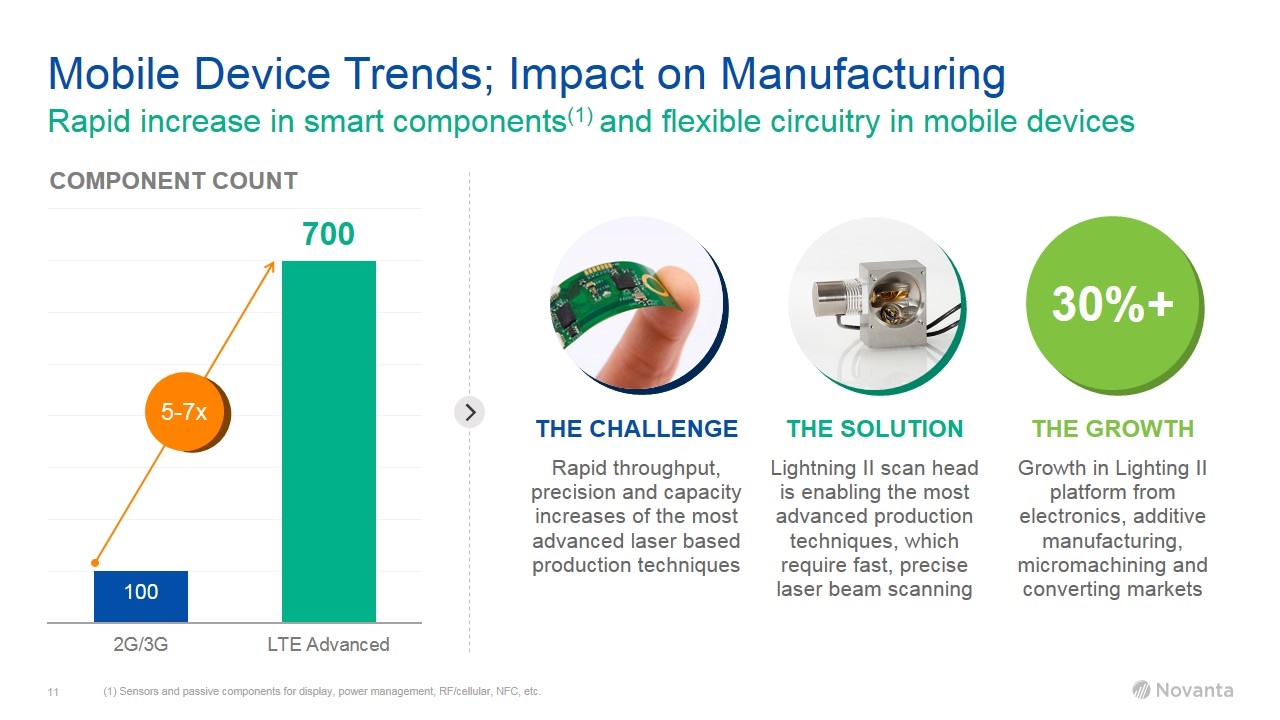

Mobile Device Trends; Impact on Manufacturing Component Count 100 5-7x 700 (1) Sensors and passive components for display, power management, RF/cellular, NFC, etc. Rapid increase in smart components(1) and flexible circuitry in mobile devices 30%+ The Challenge Rapid throughput, precision and capacity increases of the most advanced laser based production techniques The Growth Growth in Lighting II platform from electronics, additive manufacturing, micromachining and converting markets The Solution Lightning II scan head is enabling the most advanced production techniques, which require fast, precise laser beam scanning

Playing in Attractive Growth Markets DNA SEQUENCING $28 Billion Systems Market Growing +15% CAGR Clinical Acceptance and Adoption Accelerating through New Applications 51% MEDICAL Lab / Life Science Equipment Critical Care Equipment Surgical and Treatment Equipment Minimally Invasive Surgery

Playing in Attractive Growth Markets ENDOSCOPY & ROBOTIC SURGERY $20B system market, growing at mid to high single digit rates Conversion from open to minimally invasive procedures Long term 8-10% annual procedure growth 51% MEDICAL Lab / Life Science Equipment Critical Care Equipment Surgical and Treatment Equipment Minimally Invasive Surgery

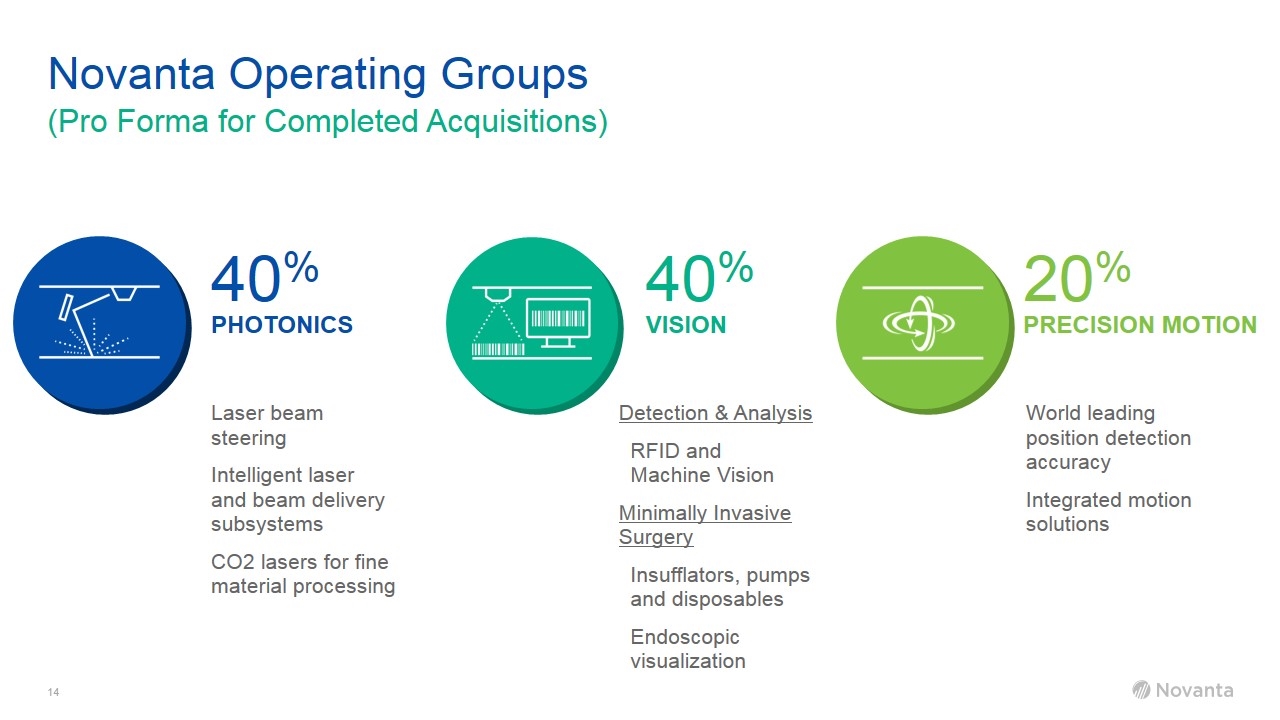

Novanta Operating Groups 40% Vision 40% PHOTONICS 20% Precision Motion (Pro Forma for Completed Acquisitions) Laser beam steering Intelligent laser and beam delivery subsystems CO2 lasers for fine material processing Detection & Analysis RFID and Machine Vision Minimally Invasive Surgery Insufflators, pumps and disposables Endoscopic visualization World leading position detection accuracy Integrated motion solutions

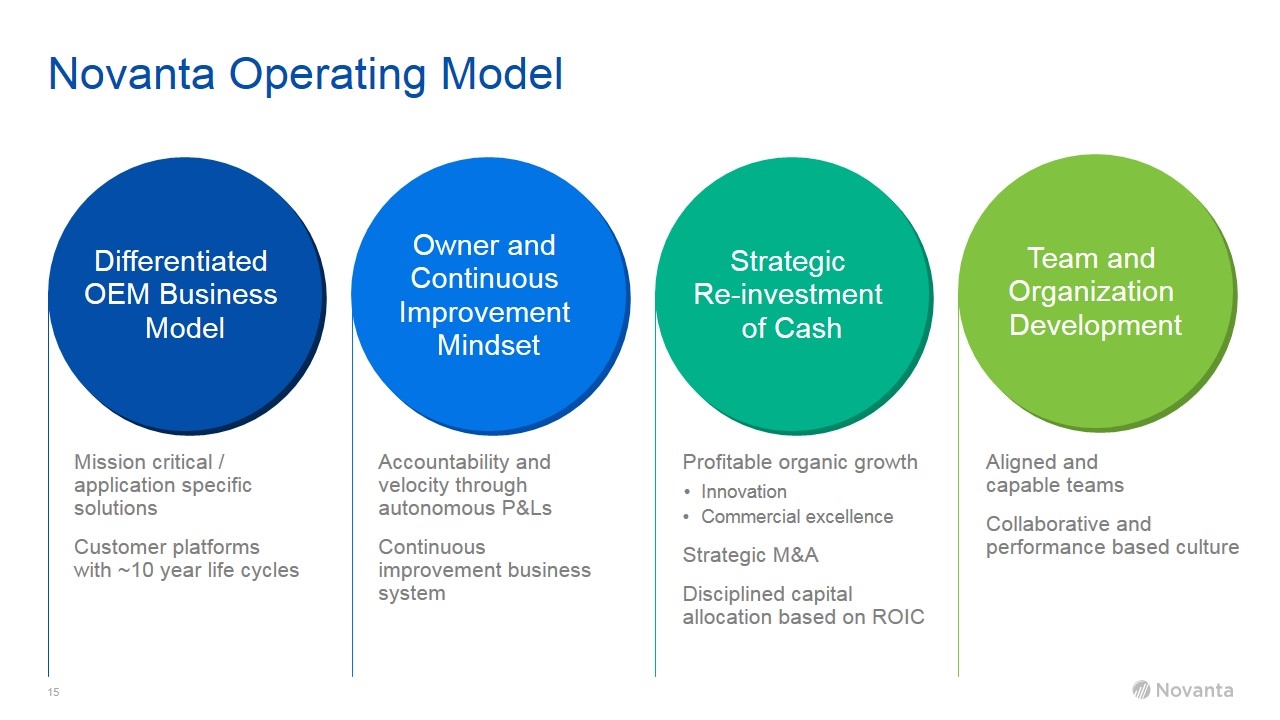

Novanta Operating Model Strategic Re-investment of Cash Team and Organization Development Owner and Continuous Improvement Mindset Differentiated OEM Business Model Mission critical / application specific solutions Customer platforms with ~10 year life cycles Accountability and velocity through autonomous P&Ls Continuous improvement business system Profitable organic growth Innovation Commercial excellence Strategic M&A Disciplined capital allocation based on ROIC Aligned and capable teams Collaborative and performance based culture

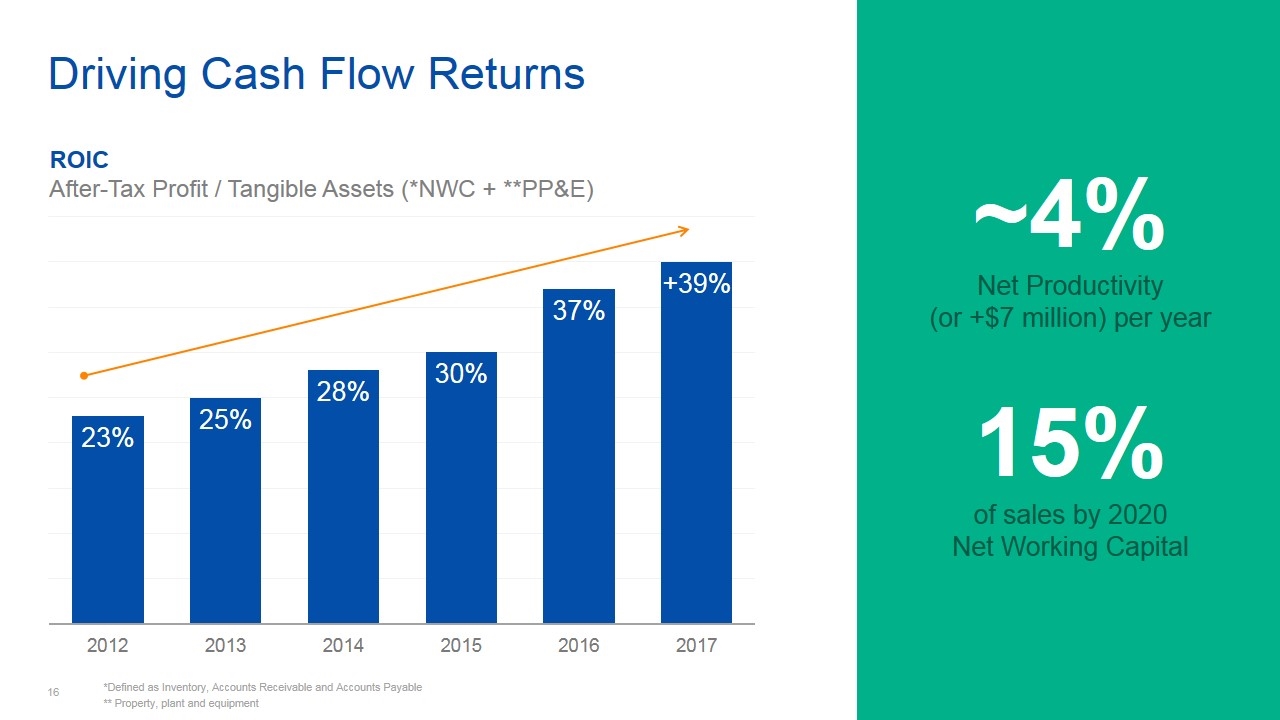

Driving Cash Flow Returns *Defined as Inventory, Accounts Receivable and Accounts Payable ** Property, plant and equipment ROIC After-Tax Profit / Tangible Assets (*NWC + **PP&E) ~4% Net Productivity (or +$7 million) per year 15% of sales by 2020 Net Working Capital

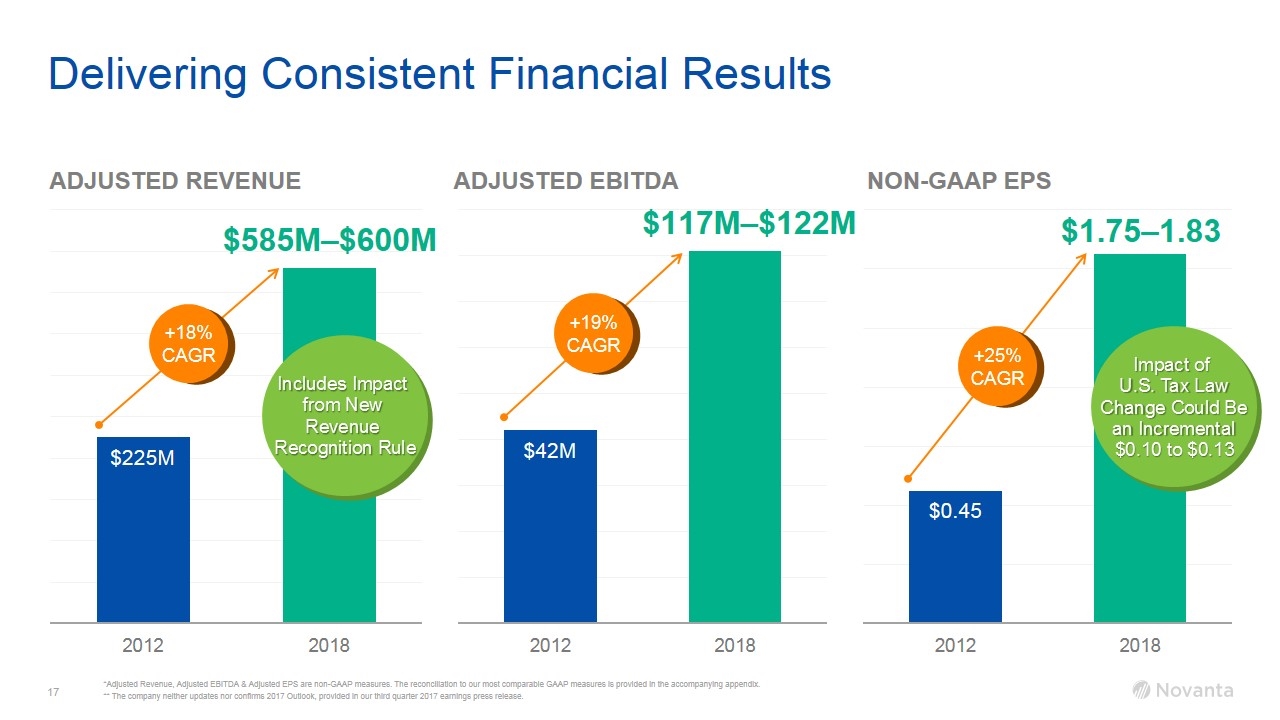

Delivering Consistent Financial Results Adjusted EBITDA Adjusted Revenue *Adjusted Revenue, Adjusted EBITDA & Adjusted EPS are non-GAAP measures. The reconciliation to our most comparable GAAP measures is provided in the accompanying appendix. ** The company neither updates nor confirms 2017 Outlook, provided in our third quarter 2017 earnings press release. $42M +18% CAGR $117M–$122M $225M $585M–$600M +19% CAGR $1.75–1.83 +25% CAGR $0.45 NON-GAAP EPS Impact of U.S. Tax Law Change Could Be an Incremental $0.10 to $0.13 Includes Impact from New Revenue Recognition Rule

About Novanta Novanta is a leading global supplier of core technology solutions that give healthcare and advanced industrial original equipment manufacturers (“OEMs”) a competitive advantage. We combine deep proprietary expertise in photonics, vision, and precision motion technologies with a proven ability to solve complex technical challenges. This enables Novanta to engineer mission-critical core components and sub-systems that deliver extreme precision and performance, tailored to our customers' demanding applications. The driving force behind our growth is the team of innovative professionals who share a commitment to innovation and customer success. Novanta's common shares are quoted on NASDAQ under the ticker symbol “NOVT.”

APPENDIX NASDAQ: NOVT

Use of Non-GAAP The non-GAAP financial measures used in this presentation are non-GAAP Adjusted Revenue, Adjusted EBITDA, and Adjusted Diluted EPS from continuing operations. The Company believes that these non-GAAP financial measures provide useful and supplementary information to investors regarding the Company’s operating performance. It is management’s belief that these non-GAAP financial measures would be particularly useful to investors because of the significant changes that have occurred outside of the Company’s day-to-day business in accordance with the execution of the Company’s strategy. This strategy includes streamlining the Company’s existing operations through site and functional consolidations, strategic divestitures and product line closures, expanding the Company’s business through significant internal investments, and broadening the Company’s product and service offerings through acquisition of innovative and complementary technologies and solutions. The financial impact of certain elements of these activities, particularly acquisitions, divestitures, and site and functional restructurings, is often large relative to the Company’s overall financial performance, which can adversely affect the comparability of its operating results and investors’ ability to analyze the business from period to period. Adjusted Revenue excludes the JK Lasers business to only show the results of ongoing operations of the Company as the JK Lasers business was sold in April 2015. We excluded JK Lasers sales from Adjusted Revenue because divestiture activities can vary between reporting periods and between us and our peers, which we believe make comparisons of long-term performance trends difficult for management and investors, and could result in overstating or understating to our investors the performance of our operations. Additionally, we include estimated revenue from contracts acquired with business acquisitions that will not be fully recognized due to business combination rules. Because GAAP accounting rules require the elimination of this revenue, GAAP results alone do not fully capture all of our economic activities. These non-GAAP adjustments are intended to reflect the full amount of such revenue. The Company defines Adjusted EBITDA as Operating Income (loss) from Continuing Operations before deducting depreciation, amortization, non-cash share-based compensation, restructuring, acquisition, divestiture and other costs, impairment of goodwill and intangible assets, acquisition fair value adjustments, CEO transition costs and inventory related charges associated with product line closures. The Company’s Adjusted EBITDA is used by management to evaluate operating performance internally, communicate financial results to the Board of Directors, benchmark results against historical performance and the performance of peers, and evaluate investment opportunities including acquisitions and divestitures. In addition, Adjusted EBITDA is used to determine bonus payments for senior management and employees. Accordingly, the Company believes that this non-GAAP measure provides greater transparency and insight into management’s method of analysis. Adjusted Diluted EPS from Continuing Operations excludes amortization of acquired intangible assets and revenue fair value adjustments related to business acquisitions, restructuring, acquisition, divestiture, and other costs, inventory related charges associated with product line closures, CEO transition costs, the gain on sale of JK Lasers and the related unrealized foreign exchange loss on the U.S. dollar sales proceeds held by our U.K. subsidiary, impairment of goodwill and intangible assets, gain on acquisition of business, significant non-recurring income tax expenses (benefits) related to releases of valuation allowance, effects of changes in tax laws, income tax audit settlements, effects of acquisition related tax planning actions on our effective tax rate, and the income tax effect of non-GAAP adjustments. In addition, the Company excluded the adjustment of redeemable noncontrolling interest to estimated redemption value as (1) the adjustment is unusual; (2) the amount is noncash; (3) the amount is excluded from the determination of net income attributable to Novanta Inc.; and (4) the Company believes that it may not be indicative of future adjustments and that investors may benefit from an understanding of the Company's results without giving effect to this adjustment. The Company also uses Adjusted Diluted EPS as a measurement for performance shares issued to certain executives. Non-GAAP financial measures should not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP. They are limited in value because they exclude charges that have a material effect on the Company’s reported results and, therefore, should not be relied upon as the sole financial measures to evaluate the Company’s financial results. The non-GAAP financial measures are meant to supplement, and to be viewed in conjunction with, GAAP financial measures. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this document.

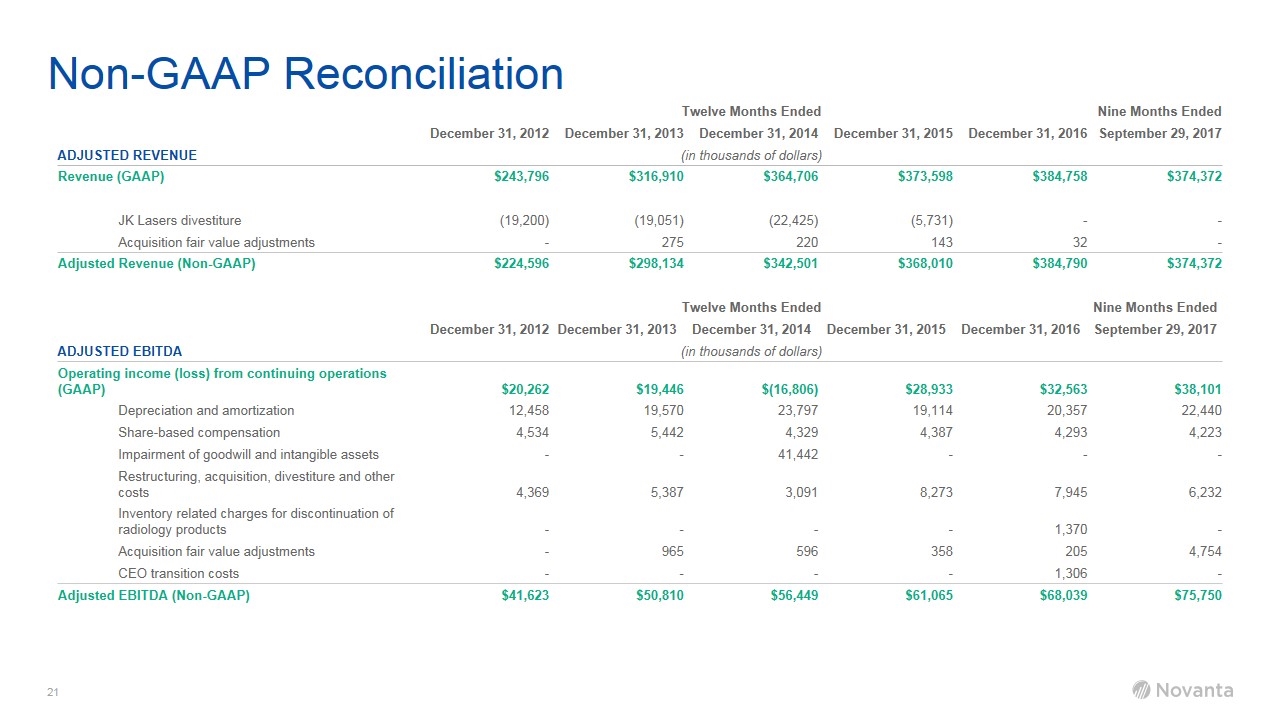

Non-GAAP Reconciliation Twelve Months Ended Nine Months Ended December 31, 2012 December 31, 2013 December 31, 2014 December 31, 2015 December 31, 2016 September 29, 2017 ADJUSTED REVENUE (in thousands of dollars) Revenue (GAAP) $243,796 $316,910 $364,706 $373,598 $384,758 $374,372 JK Lasers divestiture (19,200) (19,051) (22,425) (5,731) - - Acquisition fair value adjustments - 275 220 143 32 - Adjusted Revenue (Non-GAAP) $224,596 $298,134 $342,501 $368,010 $384,790 $374,372 Twelve Months Ended Nine Months Ended December 31, 2012 December 31, 2013 December 31, 2014 December 31, 2015 December 31, 2016 September 29, 2017 ADJUSTED EBITDA (in thousands of dollars) Operating income (loss) from continuing operations (GAAP) $20,262 $19,446 $(16,806) $28,933 $32,563 $38,101 Depreciation and amortization 12,458 19,570 23,797 19,114 20,357 22,440 Share-based compensation 4,534 5,442 4,329 4,387 4,293 4,223 Impairment of goodwill and intangible assets - - 41,442 - - - Restructuring, acquisition, divestiture and other costs 4,369 5,387 3,091 8,273 7,945 6,232 Inventory related charges for discontinuation of radiology products - - - - 1,370 - Acquisition fair value adjustments - 965 596 358 205 4,754 CEO transition costs - - - - 1,306 - Adjusted EBITDA (Non-GAAP) $41,623 $50,810 $56,449 $61,065 $68,039 $75,750

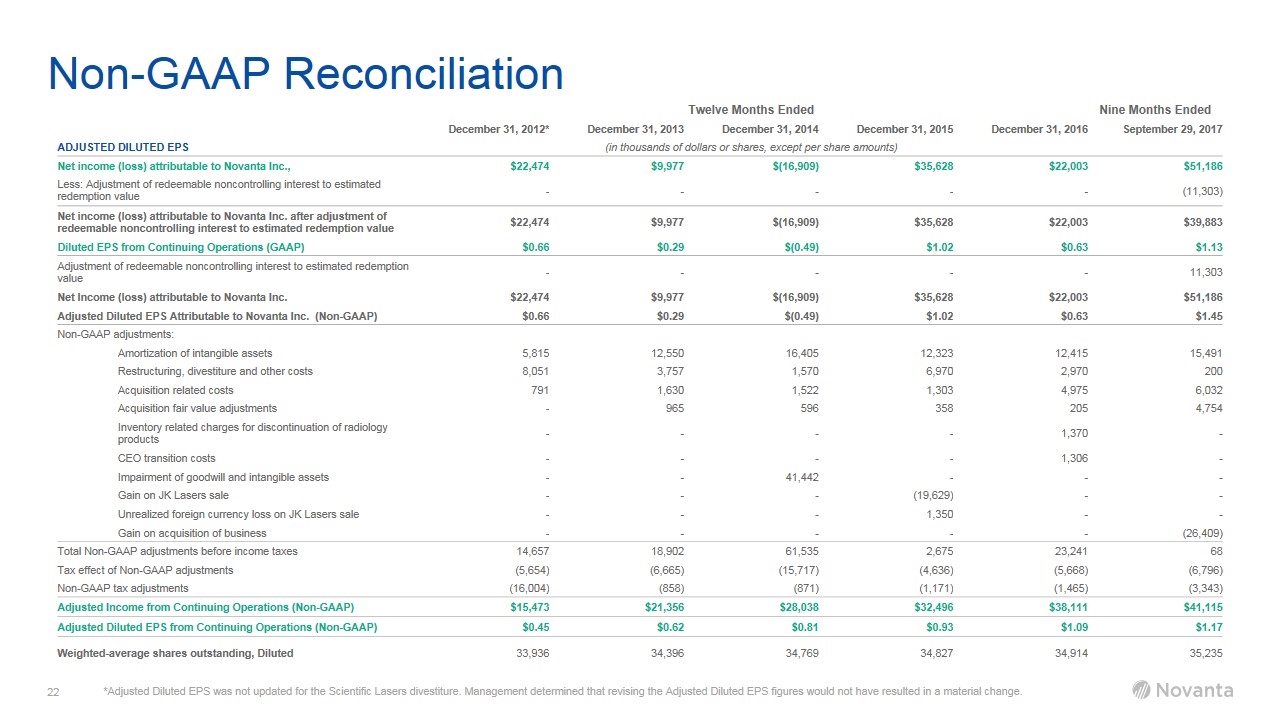

ADJUSTED DILUTED EPS Twelve Months Ended Nine Months Ended December 31, 2012* December 31, 2013 December 31, 2014 December 31, 2015 December 31, 2016 September 29, 2017 (in thousands of dollars or shares, except per share amounts) Net income (loss) attributable to Novanta Inc., $22,474 $9,977 $(16,909) $35,628 $22,003 $51,186 Less: Adjustment of redeemable noncontrolling interest to estimated redemption value - - - - - (11,303) Net income (loss) attributable to Novanta Inc. after adjustment of redeemable noncontrolling interest to estimated redemption value $22,474 $9,977 $(16,909) $35,628 $22,003 $39,883 Diluted EPS from Continuing Operations (GAAP) $0.66 $0.29 $(0.49) $1.02 $0.63 $1.13 Adjustment of redeemable noncontrolling interest to estimated redemption value - - - - - 11,303 Net Income (loss) attributable to Novanta Inc. $22,474 $9,977 $(16,909) $35,628 $22,003 $51,186 Adjusted Diluted EPS Attributable to Novanta Inc. (Non-GAAP) $0.66 $0.29 $(0.49) $1.02 $0.63 $1.45 Non-GAAP adjustments: Amortization of intangible assets 5,815 12,550 16,405 12,323 12,415 15,491 Restructuring, divestiture and other costs 8,051 3,757 1,570 6,970 2,970 200 Acquisition related costs 791 1,630 1,522 1,303 4,975 6,032 Acquisition fair value adjustments - 965 596 358 205 4,754 Inventory related charges for discontinuation of radiology products - - - - 1,370 - CEO transition costs - - - - 1,306 - Impairment of goodwill and intangible assets - - 41,442 - - - Gain on JK Lasers sale - - - (19,629) - - Unrealized foreign currency loss on JK Lasers sale - - - 1,350 - - Gain on acquisition of business - - - - - (26,409) Total Non-GAAP adjustments before income taxes 14,657 18,902 61,535 2,675 23,241 68 Tax effect of Non-GAAP adjustments (5,654) (6,665) (15,717) (4,636) (5,668) (6,796) Non-GAAP tax adjustments (16,004) (858) (871) (1,171) (1,465) (3,343) Adjusted Income from Continuing Operations (Non-GAAP) $15,473 $21,356 $28,038 $32,496 $38,111 $41,115 Adjusted Diluted EPS from Continuing Operations (Non-GAAP) $0.45 $0.62 $0.81 $0.93 $1.09 $1.17 Weighted-average shares outstanding, Diluted 33,936 34,396 34,769 34,827 34,914 35,235 Non-GAAP Reconciliation *Adjusted Diluted EPS was not updated for the Scientific Lasers divestiture. Management determined that revising the Adjusted Diluted EPS figures would not have resulted in a material change.