Attached files

Exhibit 99.2

MMAC – Hunt Transaction Nasdaq: MMAC www.MMACapitalManagement.com 3600 O’Donnell Street, Suite 600, Baltimore, MD 21224 (443) 263 - 2900 Exhibit 99.2

• This presentation contains forward - looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward - looking statements often include words such as “may,” “will,” “should,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “seek,” “would,” “could,” and similar words or expressions and are made in connection with discussions of future operating or financial performance. • Forward - looking statements reflect our management’s expectations at the date of this presentation regarding future conditions, events or results. They are not guarantees of future performance. By their nature, forward - looking statements are subject to risks and uncertainties. Our actual results and financial condition may differ materially from what is anticipated by the forward - looking statements. There are many factors that could cause actual conditions, events or results to differ from those anticipated by the forward - looking statements contained in this presentation. They include the factors discussed in “Item 1A. Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31, 2016, which was filed with the Securities and Exchange Commission (“SEC”) on March 16, 2017, and our Quarterly Report filed on Form 10 - Q for the quarter ended September 30, 2017, which was filed with the SEC on November 9, 2017. • Readers are cautioned not to place undue reliance on forward - looking statements in this presentation. We do not undertake to update any forward - looking statements included in this presentation. The statements in this presentation are for the convenience of our shareholders, capital partners and other stakeholders and are qualified in their entirety by reports that we file with the SEC. 2 MMA Capital Management, LLC Disclaimer

• Executive Summary • MMAC Pre - Transaction • Strategic Rationale • MMAC Post - Transaction • MMAC Manager Post - Transaction 3 MMA Capital Management, LLC Table of Contents

• MMA Capital Management, LLC (“MMAC”), affiliates of the Hunt Companies, Inc. (“Hunt”) and Morrison Grove Management, LLC (“MGM”) have entered into a series of agreements designed to enhance MMAC shareholder value and position it for future growth. • The transaction has three interrelated parts: 1. Business and Asset Sales . We have sold to Hunt the assets and liabilities related to our Low Income Housing Tax Credit (“LIHTC”) and International Housing Solutions (“IHS”) business lines, our energy capital origination platform, and various non - core investments for $57 million plus a contingent purchase price based on the performance of the LIHTC business. Furthermore, we have entered into a definitive agreement to purchase MGM, and Hunt has an option to purchase MGM. ▪ If Hunt purchases MGM, MMAC would recognize a total increase in GAAP common shareholders’ equity of $55 million: ▪ $32 million was recognized in the first quarter of 2018 upon closing on the sale of LIHTC, IHS and non - core investments to Hunt; ▪ $9 million was recognized in the first quarter of 2018 related to the LIHTC business and the adoption of revenue recognition rules effective January 1, 2018; and ▪ $14 million would be recognized if Hunt closes on the purchase of MGM. ▪ The contingent purchase price opportunity allows MMAC to participate in the gross cash flows of the combined LIHTC business (MMAC’s plus MGM’s). ▪ After Hunt receives gross cash flows of 158% of its purchase price for the combined LIHTC business, MMAC will receive 30% of the gross cash flows. ▪ Any payments will be received over a number of years and will depend on the performance of the combined LIHTC business. ▪ Hunt will pay for the net assets via a seven - year fully amortizing note with an interest rate of 5%, with the first two years being interest only. ▪ The note will be from a private Hunt entity with a GAAP net worth in excess of $500 million . 4 MMA Capital Management, LLC Executive Summary

• The transaction has three interrelated parts (continued): 2. Equity Investment and Board Membership . To ensure the alignment of interests between Hunt and MMAC, Hunt will purchase MMAC shares and will have a MMAC board seat. ▪ Hunt will purchase 250,000 newly issued MMAC shares in two equal tranches at an average price of $33.50/share. ▪ James C. (“Chris”) Hunt will have observer status on our Board effective immediately and a board seat upon completion of the share acquisition. 3. Management Agreement . Hunt will become the external manager of MMAC. ▪ MMAC has transferred all of its employees and operations to Hunt Investment Management, LLC. ▪ MMAC will be an externally advised entity focused on fixed income investments in affordable housing and clean energy. ▪ Hunt Investment Management, LLC (“HIM”) will receive a quarterly fee plus usual and customary reimbursements and incentives. ▪ HIM will receive a quarterly fee of 0.50% of the GAAP equity value of MMAC up to $500 million, subject to certain adjustments, and 0.25% of the GAAP equity value of MMAC in excess of $500 million; ▪ HIM will be entitled to reimbursement of certain operating and personnel expenses directly attributable to managing MMAC; and ▪ HIM will receive incentive compensation equal to 20% of the amount by which the year - over - year change in MMAC GAAP equity per share exceeds 7%. 5 MMA Capital Management, LLC Executive Summary, cont.

• Once all of the elements of the transaction are complete: • MMAC will retain its existing Leveraged Bonds and Energy Capital assets along with its tax net operating losses (“NOLs”) and long - term subordinated debt; • The key to MMAC’s long - term success will continue to be our commitment to performance built on our core values of integrity, innovation and service; and • MMAC’s performance will be measured based on the long - term growth in both GAAP diluted shareholders’ common equity per share and share price. • Hunt is dedicated to fostering long - term partnerships through the development, investment, management, and financing of real assets. • Hunt was founded in 1947 and is privately owned. • Hunt’s core competencies are real estate investments, military communities, public infrastructure, financial services, and asset services • Hunt has more than $12 billion 1 of assets under management in real estate and infrastructure and has a $12.3 billion 1 mortgage servicing portfolio. • Current employees and leadership of MMAC will become employees of Hunt Investment Management, LLC. Note 1 - Based on information published on the Hunt Companies, Inc. public website, www.huntcompanies.com. 6 MMA Capital Management, LLC Executive Summary, cont.

Prior to the Hunt Transaction: • MMAC partnered with institutional capital to create and manage investments in affordable housing and clean energy; • MMAC was organized around four business lines: • Leveraged Bonds – we owned a leveraged tax - exempt bond portfolio; • LIHTC – we owned a wide range of interests directly and indirectly in affordable housing investments as well as the guarantees associated with these investments; • Energy Capital – we invested in and managed ventures focused on development, construction and permanent lending for commercial solar projects; • IHS – we invested in and managed funds focused on affordable housing in South Africa and Sub - Sahara Africa; and • MMAC had valuable NOL carry forwards and attractive long - term subordinated debt. 7 MMA Capital Management, LLC MMAC Pre - Transaction

• We believe that the completion of all of the elements of the transaction will strategically reposition MMAC: • We will have achieved significant value realization from our tax credit and international businesses; • Our balance sheet will be simpler and more transparent; ▪ Our balance sheet will be further simplified as we dispose of certain equity investments; • We will have reduced overhead, which helps right - size our costs associated with operating a public company of our size. • We preserve our NOLs and our attractively priced long - term subordinated debt. • Our simplified and transparent balance sheet should increase our access to accretive shareholder capital which will allow us to grow our business and utilize our NOLs. • Accelerating the utilization of some of our NOLs is projected to significantly increase their net present value. • Over the long - term, we plan to continue to execute on our strategy to invest both new and recycled capital primarily in the debt of real assets to generate attractive risk adjusted returns. • We expect to benefit from the extensive Hunt origination network as we source new investment opportunities. • We plan to employ moderate leverage of approximately 50% against our total assets. • We will target total returns of approximately 8 - 12%. • We will focus on real assets with positive social and environmental impacts. • From time to time, we also expect that we will invest in the equity of real assets. • We anticipate issuing new shares when market and investment conditions are favorable, while taking steps to preserve our NOLs. • We will target generating a high single/low double digit shareholder ROE based on our investment returns, NOL utilization and reduced operating costs. 8 MMA Capital Management, LLC Strategic Rationale

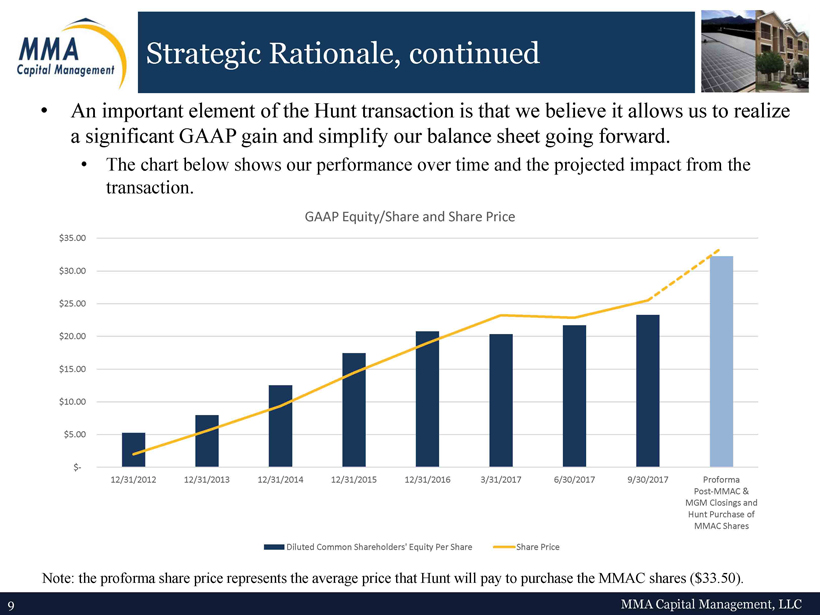

• An important element of the Hunt transaction is that we believe it allows us to realize a significant GAAP gain and simplify our balance sheet going forward. • The chart below shows our performance over time and the projected impact from the transaction. 9 MMA Capital Management, LLC Strategic Rationale, continued $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 12/31/2012 12/31/2013 12/31/2014 12/31/2015 12/31/2016 3/31/2017 6/30/2017 9/30/2017 Proforma Post-MMAC & MGM Closings and Hunt Purchase of MMAC Shares GAAP Equity/Share and Share Price Diluted Common Shareholders' Equity Per Share Share Price Note: the proforma share price represents the average price that Hunt will pay to purchase the MMAC shares ($33.50).

• Once all of the elements of the Hunt transaction are complete, MMAC will have two business lines and certain unique balance sheet attributes. • MMAC business lines: • Leveraged Bonds – We will invest primarily in tax - exempt mortgage revenue bonds that are leveraged to generate attractive risk adjusted returns. • Energy Capital – We will invest along side our institutional capital partners in loans financing clean energy projects. • In both business lines, we will earn interest income, fees, realized gains and unrealized gains. • We believe that post - transaction, MMAC will have several unique and attractive balance sheet attributes including: • NOLs – Approximately $400 million of federal NOLs which at the new tax rates could offset approximately $84 million of future taxes; • Subordinated Debt – Approximately $92 million of subordinated debt with an interest rate of 3 - month LIBOR plus 200bps, partially amortizing by maturity in 2035; • Hunt Note – A $57 million, seven - year fully amortizing note with an interest rate of 5%; and • Additional real estate investments – These include: (1) an equity investment in a mixed - use development project; (2) an equity investment in a land development project and (3) a limited partnership interest in a South African housing fund. ▪ All of these assets are non - core and subject to disposition or run - off. 10 MMA Capital Management, LLC MMAC Post - Transaction – Business Lines

• Through its Leveraged Bonds business line, MMAC will continue to invest primarily in tax - exempt mortgage revenue bonds that are leveraged to generate attractive risk adjusted returns. • Our bonds are primarily collateralized by affordable multifamily rental properties. • We execute total return swaps (“TRS”) in this portfolio to achieve a target return in the mid - teens. • We hedge a portion of the floating interest rate exposure created by the TRS positions. • As of September 30, 2017, our bond portfolio consisted of 30 bonds that were owned directly or through TRS positions. • The fair value of these bonds was $248 million, or 105% of their unpaid principal balance (“UPB”) of $237 million. • The weighted - average interest rate we collected on the bond portfolio was 6.14%. • On a fair value basis, 91% of the bond portfolio was secured by multifamily rental properties and 9% by sales tax revenues generated from retail. • The underlying multifamily bonds had a weighted - average debt service coverage ratio of 1.17x. • As of September 30, 2017, the notional balance of our TRS positions was $174 million. • The weighted - average interest rate we paid on our TRS positions was 2.29%, which for most of our TRS agreements was based on SIFMA (the Securities Industry and Financial Markets Association seven - day municipal swap rate) plus a spread. • We have hedged 60% of the variable interest rate risk associated with the TRS positions with SIFMA pay fixed interest rates swaps with a notional balance of $105 million. $70 million of the hedges mature in 2019 and the remaining $35 million mature in 2023. • An additional 26% of the variable interest rate risk was hedged with a 2.50% SIFMA interest rate cap with a notional balance of $45 million that matures in 2019. 11 MMA Capital Management, LLC MMAC Post - Transaction – Leveraged Bonds

• MMAC will continue to invest in loans financing clean energy projects that are originated by MMA Energy Capital, LLC (“MEC”). • Post - Transaction, MEC’s employees will become employees of HIM and remain responsible for originating and managing our solar investments . • MEC is focused on short - and medium - term renewable energy project lending . • MEC provides late - stage development, construction, and term loans to renewable energy projects, primarily solar. • MEC typically looks to originate loans that range in size from $2 million to over $50 million, and from 3 months to 5 years in term. • From its inception through September 30, 2017, MEC has originated approximately $750 million of debt investments that will enable the completion of over 1.45 gigawatts of renewable energy. • MEC originates loans through joint ventures with two partners and for MMAC’s own account. • The joint ventures, which are administered by MEC, are with TSSP, the global credit and specialty lending platform of TPG Capital, and Fundamental Advisors, a leading alternative asset manager. • As of September 30, 2017, the carrying value of our investment in these joint ventures was $89 million. 12 MMA Capital Management, LLC MMAC Post - Transaction – Energy Capital

Today we have NOL carry forwards and long - term subordinated debt which we consider unique balance sheet attributes. Post - Transaction these will be joined by the “Hunt Note” described below. NOL Carry Forwards • We have approximately $400 million of federal NOLs which expire between 2027 and 2035. • At current tax rates (35% for 2017 and 21% and afterwards), these NOLs will enable the Company to offset up to $84 million of future taxes. • The Hunt transaction is projected to accelerate the utilization of some of these NOLs, significantly increasing their net present value. • We currently value these NOLs at zero for financial reporting purposes because of our history of losses and inability to adequately project future uses. We believe this transaction will better position us to project future uses. LIBOR Based Long - term Subordinated Debt • We owe an unpaid principal balance of $92 million as of 9/30/17 on our LIBOR - based subordinated debt. • Interest rate on the debt is 3 - month LIBOR plus 2%. • The debt amortizes 200bps annually until balloon payment at maturity in 2035. Hunt Note • The Hunt Note will be $57 million of fully amortizing debt with a 5% interest rate. • It will be interest only for the first two years, then fully amortizing over the following five years. • It will be issued by a Hunt entity with GAAP net worth in excess of $500 million. • The note will be secured by all of the equity interests of the issuing Hunt entity. Additional Real Estate Investments • An equity investment in Spanish Fort Town Center, a mixed - use development located near Mobile, Alabama. • An equity investment in a land development project in Winchester, VA. • A limited partnership interest in the South Africa Workforce Housing Fund (“SAWHF”). • All of these assets are non - core and subject to disposition or run - off. 13 MMA Capital Management, LLC MMAC Post - Transaction – Unique Balance Sheet Attributes

Moving forward we expect to grow our common shareholders’ GAAP equity per share by: • Staying true to our mission and values; • Retaining and reinvesting our earnings; • Prudently leveraging our investments; • Offering additional equity when accretive; • Investing in attractive risk adjusted opportunities; • Lowering our overhead; and • Exploring opportunities in related investment spaces. 14 MMA Capital Management, LLC MMAC Post - Transaction – Future Growth

• HIM, a wholly owned subsidiary of Hunt, will employ the current leadership team and employees of MMAC post - transaction. • MMAC’s senior management team averages over 22 years experience in either the real estate or renewable energy business and 16 years with MMAC. • The MMAC team includes approximately 30 employees focused on investment, capital management, asset management, and accounting. • HIM will receive a quarterly fee plus usual and customary reimbursements and incentives. • HIM will receive a quarterly fee of 0.50% of the GAAP equity value of MMAC up to $500 million, subject to certain adjustments, and 0.25% of the GAAP equity value of MMAC in excess of $500 million; • HIM will be entitled to reimbursement of certain operating and personnel expenses directly attributable to managing MMAC; and • HIM will receive incentive compensation equal to 20% of the amount by which the year - over - year change in MMAC GAAP equity per share exceeds 7%. • Hunt Investment Management will asset manage and originate new investments in MMAC’s Leveraged Bond and Energy Capital business lines. • Separately, Hunt Investment Management also will manage the assets sold to Hunt that were previously part of MMAC’s LIHTC and IHS business lines. 15 MMA Capital Management, LLC MMAC Manager Post - Transaction