Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEDIFAST INC | tv482937_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION January 2018

SAFE HARBOR S TATEMENT ▪ Certain information included in this presentation may constitute “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology. Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements. Medifast believes this presentation should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward - looking statements are subject to certain events, risks, uncertainties, and other factors. Some of these factors include, among others, Medifast's inability to attract and retain independent OPTA VIA Coaches TM and Members, stability in the pricing of print, TV and Direct Mail marketing initiatives affecting the cost to acquire customers, increases in competition, litigation, regulatory changes, and its planned growth into new domestic and international markets and new channels of distribution. Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its latest Annual Report on Form 10 - K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K. All of the forward - looking statements contained herein speak only as of the date of this presentation. 2

TODAY’S PRESENTERS & AGENDA Dan Chard Chief Executive Officer Tim Robinson Chief Financial Officer Agenda ▪ Medifast Today ▪ New Brand: OPTA VIA ® ▪ Growth Strategy ▪ Financials 3

MEDIFAST ® TODAY

MEDIFAST ® VISION & MISSION To Offer the World LIFELONG TRANSFORMATION One Healthy Habit at a Time ™ 5

COMPANY PROFILE ▪ Leading Health & Wellness company ▪ $274.5M Net Sales in 2016 ▪ Recommended by over 20,000 doctors since 1980 ▪ Unique direct - to - consumer model with over 14,000 OPTA VIA Coaches ™ ▪ Our Coaches teach habits that lead to Optimal Wellbeing TM and Lifelong Transformation ▪ Achieving a healthy weight is the catalyst for leading a bigger life 6

KEY INVESTMENT HIGHLIGHTS ▪ Health and wellness company with differentiated, science - based products & programs ▪ Large and growing market opportunity addressing a global need ▪ Scalable Coach - based distribution model – products, technology, support ▪ Ideally positioned for an acceleration of growth in the U.S. and abroad ▪ Attractive, highly predictable financial model ▪ Significant cash flow generation and strong balance sheet to support growth ▪ Strong dividend @ $0.48/ qtr , a 2.75% yield as of December 31, 2017 7

LARGE AND GROWING MARKET OPPORTUNITY Obesity at Critical Levels ▪ Nearly 70% of U.S. Adults are Overweight or Obese (1) ▪ International levels now 2X from 30 years ago (3) Current & Growth Markets ▪ A ddressable U.S. Weight Loss Products & Services market expected to grow 5% per year through 2022 (4) ▪ Broader Health and Wellness markets are adjacent and a strong fit for our model and mission 8 SOURCES: (1) CDC; (2) www.stateofobesity.org ; (3) www.who.int/mediacentre/factsheets/fs311/en/ (4) Marketdata LLC: Represents our addressable weight loss market, excluding diet soft drinks, artificial sweeteners, and health club revenu e. (5) MarketdataLLC , Euromonitor, IBIS World U.S Health and Wellness $194 Billion+ (5) U.S. Weight Loss $17 Billion (4) Maps (2 )

PROVEN & EFFECTIVE PRODUCTS & PROGRAMS 9 ▪ The Plan: Eat 6 small meals every day ▪ 5 of our meal replacements (“Fuelings”) ▪ Plus 1 meal we teach you to make yourself ▪ Scientifically Formulated: ▪ The Plan is designed to put you in a gentle fat - burning state which is essential for losing weight ▪ Helps retain lean muscle mass ▪ Promotes gut health ▪ Trustworthy: ▪ Weight Loss results supported by randomized, controlled clinical trials ▪ Scientific Advisory Board of leading physicians and researchers from U.S., Canada, and Mexico Flavors & variety for every taste Highly adaptable to individual needs

LIFE - CHANGING RESULTS 10 * Average weight loss for Clients on the Optimal Weight 5&1 Plan ® with support is 20 pounds

84% 11% 5% OPTAVIA Medifast Direct Medifast Business Partners MULTIPLE SUPPORT MODELS Self - directed E - commerce Net Sales Breakdown YTD 2017 (3) 14,200 (1) Independent Coaches OPTA VIA ® Medifast Direct ® Weight Loss Control Centers 35 (2) Franchise locations 2 (2) Reseller locations 11 (1) Active earning Coaches during quarter ending September 30,2017 (2) As of September 30,2017 (3) Year - to - date ending September 30,2017

DIRECT - TO - CONSUMER IS THE BEST APPROACH The Right Sales & Support ▪ Personal selling is optimal for helping consumers understand complex products ▪ Studies have consistently shown that weight loss works best with personal support ▪ Leverages consumer trends to personal recommendations ▪ Medifast’s OPTA VIA ® division has over 14,000 independent Coaches around the U.S. Compelling Business Model ▪ Clients become Coaches, who attract more Clients ▪ Minimal company advertising costs ▪ Direct Selling products traditionally earn premium pricing ▪ Wellness is largest, fastest growing segment of the industry 1 ▪ Fits trends to “gig” economy 2 and social selling with “sticky” relationships 1 World Association of DSAs market data 2 Direct selling Industry publication, 2016 State of the Industry Report, September 2016 and https://blog.dsa.org/direct - selling - in - 2016 - an - overview / 12

INTRODUCING OPTA VIA ®

TAKE SHAPE FOR LIFE ® BECAME OPTA VIA ® JULY 2017 1/8/2018 14 ▪ Lifestyle - focused brand of our Coach community ▪ Designed to be relevant across international markets ▪ Developed around a motivating mission and compelling story ▪ Equipped with uniquely formulated, exclusive products ™

15 PROVEN NUTRITION gets you where you want to go. OPTA VIA COACHES ; make sure you never go it alone. People are More Successful in their Transformation Journey when they; ; Have a Support System (Coach and Community) ; Learn and i ncorporate Healthy Habits into Their Lives (Habits of Health System) ® A shared vision for success

UNIQUE AND TRANSPARENT DISTRIBUTION MODEL ▪ Perfect balance between the power of a personal selling channel and a retail model ▪ 91% of all OPTA VIA ® product sales go directly to Clients; 9 % are consumed by Coaches ▪ All commissions based on product sales ▪ Coaches do not buy or carry inventory, don’t handle cash, and don’t buy at a discount to clients 16

▪ When you succeed, your transformation will be an inspiration to others ▪ OPTA VIA offers a compelling financial opportunity ▪ LOW - RISK: Registering as a Coach costs under $200 ▪ ATTRACTIVE COMPENSATION: High AOV(~$230) and commission rates (Commissions are ~42 % of OPTA VIA Revenues) ▪ FLEXIBILITY: Work as much as you want. Perfect for the “gig” economy ▪ SKILL BUILDING: An emphasis on business training & personal development ▪ MISSION - DRIVEN: Doing good by doing well ▪ RECOGNITION : From cheers of fellow Coaches to earning the trip of a lifetime 17 OPTA VIA ® OPPORTUNITY: THE COACHED BECOMES THE COACH

STRATEGY FOR GROWTH

STRATEGY FOR GROWTH 19 Grow Our Coach Community Drive Innovation Expand Segments & Geographies Accelerate Coach Success Develop Digital Tools

ACCELERATING COACH SUCCESS 20 ▪ Capitalizing on a new brand and compelling message ▪ Offering new, exclusive products based on Medifast ® proven science ▪ Delivering an easy to share, compelling story about a complex problem facing the world ▪ Teaching a simple growth model ▪ Streamlining all aspects of the Coach experience

NEW DIGITAL & SOCIAL TOOLS ▪ New Coach Business Suite Improves Coach productivity ▪ Deep visibility into Coach team activities ▪ Work flow enabled ▪ Real time updates ▪ New e - commerce platform Improves Client experience ▪ New s ocial t ools Makes sharing their story easy ▪ Scalable to support expansion plans 21

OPTA VIA ® PRODUCT INNOVATION ON - TREND OPTAVIA TM Select OPTAVIA TM Essential MEDIFAST Classic Proven Clinically - proven weight loss programs that include our unique Fueling formulation x x x Interchangeable Each Fueling can be eaten for any meal occasion, making it easy to follow the program x x x Fat - burning Scientifically designed Plan to put your body into a gentle, efficient fat - burning state x x x Fortified 24 Vitamins and minerals x x x Variety Wide range of bars, shakes, hot items, desserts & more x x x Clean No colors, flavors, or sweeteners from artificial sources x no preservatives x Gut Health 250 million+ CFU of probiotic cultures per Fueling to help support digestive health x x GMO - free No genetically modified organisms x World Ingredients Premium ingredients from around the world including Morocco, Bolivia, and Indonesia x $ per Box of 7: $22.95 $20.95 $18.95 22

INNOVATION PATH - FORWARD BASED ON HEALTHY HABITS 23 NUTRITION SLEEP MOVEMENT HYDRATION

SIGNIFICANT U.S. EXPANSION OPPORTUNITIES 24 1 Regional Many U.S markets under - represented; All under - penetrated 2 Generationa l 3 Diversity 4 Lifestyle Younger demographics can drive faster Coach development Penetrate important U.S. communities and build synergies for International Serve clients in different stages of their journey to Optimal Wellbeing TM

INTERNATIONAL POTENTIAL 25 Peer Direct Selling companies generate majority of their revenue in $185Bn Global Market Nu Skin $2.2Bn - Global $245M – US / Canada US / Canada All Other USANA $1.0Bn – Global $252M – Americas / Europe Americas / Europe All Other Public Company Examples: ▪ Largest Markets ▪ U.S. $36Bn ▪ China $35Bn ▪ Korea $17Bn ▪ Germany $15Bn ▪ Japan $ 15Bn ▪ Fastest Growing (3 - yr CAGR) ▪ China 22.5% ▪ Indonesia 11.9% ▪ U.K. 9.8% ▪ Philippines 9.8% ▪ Malaysia 9.4% Global Direct Selling Market * Source: 2016 10 - K *2013 - 2015 data, World Federation of Direct Selling Associations Medifast has larger U.S. revenue base than many U.S. - based peers, but no international presence today

STRONG FINANCIAL FOUNDATION

ATTRACTIVE FINANCIAL CHARACTERISTICS ▪ Significant opportunity to accelerate revenue growth ▪ Highly predictable financial model ▪ High gross margins and variable cost structure ▪ Asset - light with minimal working capital and capex requirements ▪ Significant cash flow generation ▪ Strong balance sheet with no debt ▪ Attractive capital allocation policy ▪ Executive compensation entirely aligned with creating shareholder value 27

ACCELERATING REVENUE TRAJECTORY 28 $200 $225 $250 $275 $300 $325 2014 2015 2016 2017 Guidance $285 $273 $275 $ 295 - $298 ($ millions) - Revenue from continuing operations .

SCALABLE BUSINESS MODEL DRIVES EARNINGS GROWTH $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 2014 2015 2016 2017 Guidance $1.65 $1.62 $1.49 $2.15 - $2.18 $1.89 $1.73 $1.89 Adj. GAAP 29 - EPS from continuing operations . - 2014 Non - GAAP EPS excludes the net of tax items of $ 1 . 3 million accrual for franchise loan default guaranteed by Medifast and the $ 1 . 8 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 65 . - 2015 Non - GAAP EPS excludes $ 1 . 4 million in extraordinary legal and advisory expenses resulting from 13 D filings . Reported EPS $ 1 . 62 - 2016 Non - GAAP EPS excludes $ 1 . 2 million of restructuring costs associated with separation agreements with several senior executives and a $ 6 . 1 million noncash asset impairment expense . Reported EPS $ 1 . 49

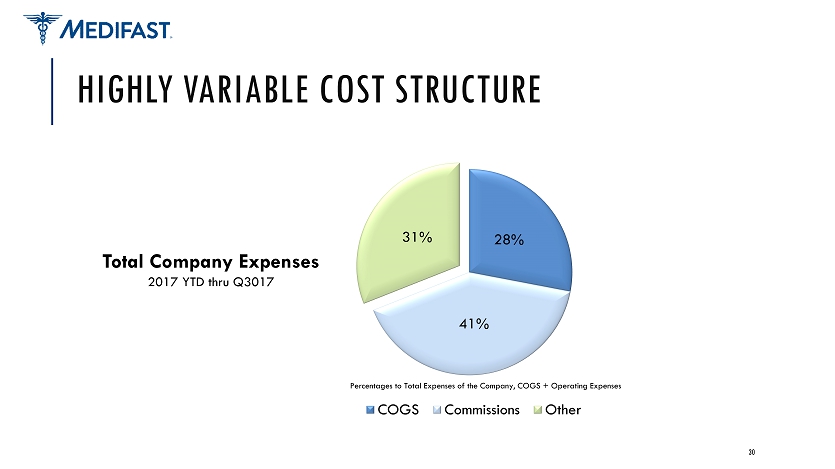

28% 41% 31% COGS Commissions Other HIGHLY VARIABLE COST STRUCTURE 30 Total Company Expenses 2017 YTD thru Q3017 Percentages to Total Expenses of the Company, COGS + Operating Expenses

HIGHLY PREDICTABLE OPTA VIA ® FINANCIAL MODEL ▪ Direct - To - Consumer Model ; Majority of new Coaches come from Client base ▪ Consistent patterns create strong visibility into future results ; Coaches acquiring new Clients ; Client retention ▪ Significant % of Clients on continuity shipments (~85%) ▪ High lifetime value: ~2x higher than self - directed channel ▪ Variable cost model 31

- 20.0 40.0 60.0 80.0 100.0 120.0 2014 2015 2016 YTD 2017 Stock Repurchase Dividend Other Financing Activities Cash & Investments Retained STRONG CASH FLOW GENERATION 32 ($ millions) Share Repurchase + Dividend ($67.8M (62% of Cumulative Cash Flow) $109.3 Note: YTD 2017 represents cumulative cash flows since January 1, 2014 (1) YTD Through September 30, 2017 (2) Includes $5.2M of Cash & Investments used to fund financing activities $78.6 $56.0 $29.8 (2) (1)

STRONG CASH & BALANCE SHEET ▪ $95.7M Cash & Investments ▪ No debt ▪ Low working c apital Levels ▪ Minimal CAPEX r equirements ▪ Strong cash flow generation ▪ Existing stock r epurchase p rogram ▪ Increased quarterly cash dividend in December 2017 by 50% to $0.48 per share Note: Cash and Investments as well as debt position as of 9 /30/2017 33

KEY INVESTMENT HIGHLIGHTS ▪ Health and wellness company with differentiated, science - based products & programs ▪ Large and growing market opportunity addressing a global need ▪ Scalable Coach - based distribution model – products, technology, support ▪ Ideally positioned for an acceleration of growth in the U.S. and abroad ▪ Attractive, highly predictable financial model ▪ Significant cash flow generation and strong balance sheet to support growth ▪ Strong dividend @ $0.48/ qtr – 2.75% yield as of December 31, 2017 34

35