Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LABORATORY CORP OF AMERICA HOLDINGS | form8-k1918jpmppt.htm |

J.P. MORGAN

HEALTHCARE CONFERENCE

JANUARY 9, 2018 | SAN FRANCISCO, CA

1

FORWARD LOOKING STATEMENT

Cautionary Statement Regarding Forward Looking Statements

This presentation contains forward-looking statements, including statements about the Company’s performance

against strategic objectives and the impact of various factors on operating and financial results. Each of these

forward-looking statements is subject to change based on various risks and uncertainties, including without

limitation, competitive actions and other unforeseen changes and uncertainties in the marketplace, changes in

government regulations, including healthcare reform, changes in payer regulations or policies, other adverse actions

of governmental and third-party payers, failure to maintain or develop customer relationships, changes in testing

guidelines or recommendations, adverse results in material litigation matters, the impact of changes in tax laws and

regulations, and failures in information technology systems or data security.

2

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

3

WHO WE ARE

Our Mission

is to

improve health

and improve lives

LabCorp is

a leading global

life sciences company

that is deeply integrated

in guiding patient care

Our Strategic Objectives are to:

Deliver World-Class Diagnostics

Bring Innovative Medicines to Patients Faster

Use Technology to Improve the Delivery of Care

4

LABCORP OVERVIEW

• Provides diagnostic, drug development

and technology-enabled products and solutions

for ~120 million patient encounters per year

• Operates in two segments – Diagnostics and

Drug Development

• >57,000 mission-driven employees worldwide

• Proprietary data sets with >30 billion lab test results

and >175,000 unique investigators

• Leading scientific and therapeutic expertise, including

>1,800 employed MDs and PhDs

A Leading Global Life Sciences Company

Consolidated Financial Summary(1)

Year Ended

Implied

Growth 2017E(2) 2016

Revenue $10,216 $9,437 8.3%

Adj. EPS $9.50 $8.83 7.6%

Free Cash Flow $990 $897 10.4%

1. Adjusted operating income, margin and earnings per share exclude amortization, restructuring charges

and other special items; dollars in millions, except per share data.

2. Based on the midpoint of guidance issued on October 25, 2017.

5

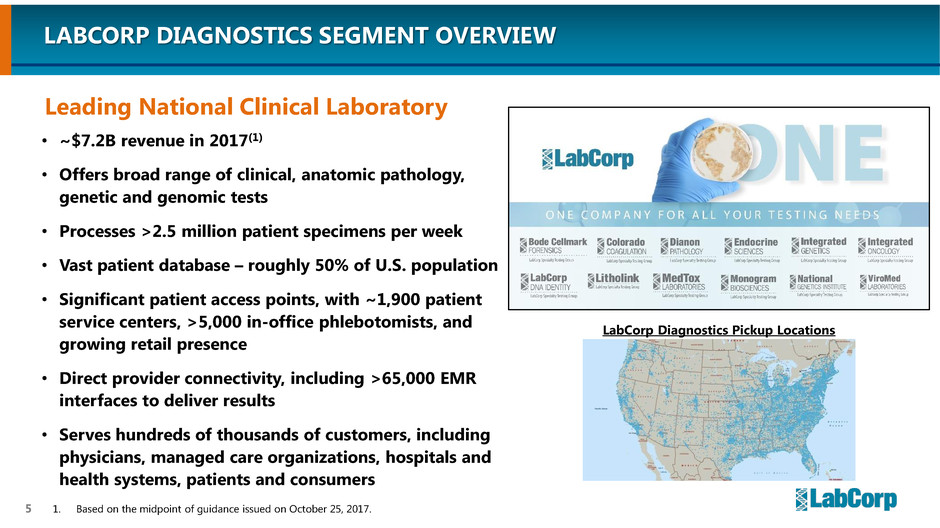

LABCORP DIAGNOSTICS SEGMENT OVERVIEW

• ~$7.2B revenue in 2017(1)

• Offers broad range of clinical, anatomic pathology,

genetic and genomic tests

• Processes >2.5 million patient specimens per week

• Vast patient database – roughly 50% of U.S. population

• Significant patient access points, with ~1,900 patient

service centers, >5,000 in-office phlebotomists, and

growing retail presence

• Direct provider connectivity, including >65,000 EMR

interfaces to deliver results

• Serves hundreds of thousands of customers, including

physicians, managed care organizations, hospitals and

health systems, patients and consumers

1. Based on the midpoint of guidance issued on October 25, 2017.

Leading National Clinical Laboratory

LabCorp Diagnostics Pickup Locations

6

COVANCE DRUG DEVELOPMENT OVERVIEW

• ~$3.0B revenue in 2017(1)

• Market leader in early development, central laboratory,

and Phase I-IV clinical trial management services

• Xcellerate® includes one of the world’s most

comprehensive investigator performance databases

• Collaborated on 86% of the 22 novel drugs approved by

FDA in 2016, including all 4 approved oncology drugs,

and 8 of 9 drugs treating rare and orphan diseases

• Involved in the development of all of the top 50

best-selling drugs on the market(2)

• Acquired Chiltern in 2017, a leading global CRO to

expand scale in Asia-Pacific, expand FSP offering and

strengthen emerging-to-mid biopharma capabilities

Leading CRO / Drug Development Services Provider

1. Based on the midpoint of guidance issued on October 25, 2017, which includes results

from Chiltern as of September 1, 2017.

2. Ranking based on 2016 net sales.

Region

Approximate Number

of Unique Sites

Africa 1,500+

Asia-Pacific 24,000+

Central/Eastern Europe 12,000+

Latin America 9,500+

Middle East 350+

North America 28,000+

Western Europe 21,000+

7

29%

23% 11%

32%

3% 3%

(2)

29%

23% 11%

32%

3%3%

Pharma & Biotech

Other Payers

Medicare & Medicaid

Managed Care (Fee for Service)

Patient

Managed Care (Capitated)

(2)

Attractive Customer Mix and Geographic Presence(1)

EXPANDED REVENUE BASE

1. Based on nine months ended September 30, 2017, which includes results from Chiltern as of September 1, 2017. Does not tie due to rounding.

2. Includes physicians and hospitals, occupational testing services, non-U.S. clinical diagnostic laboratory operations, nutritional chemistry and

food safety operations, and Beacon LBS.

29%

23% 11%

32%

3%3%

Pharma & Biotech

Other Payers

Medicare & Medicaid

Managed Care (Fee for Service)

Patient

Managed Care (Capit ted)

(2)

USA Rest of World

81%

19%

Managed Care (Fee for Service)

Patient

Managed Care (Capitated)

Pharma & Biotech

Other Payers (2)

edicare & Medicaid

8

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

9

OUR 2018 PRIORITIES

Drive Profitable

Growth

Optimize

Enterprise

Margins

Integrate Key

Acquisitions

10

1. Based on nine months ended September 30.

2. Includes $1.0 billion from acquisition of Chiltern.

DRIVING PROFITABLE GROWTH

Diagnostics: Capitalize on Growth Opportunities

• Health systems, large physician

groups and managed care

partnerships

• Expand 23andMe collaboration

• Mitigate pricing impact of PAMA

Drug Development: Build on Existing Momentum

to Exceed Historical Growth Rates

• Convert backlog into profitable revenue growth

• Maintain broad-based strength in net orders

• Capitalize on strategic investments in leadership,

sales force and technology

• Women’s health, genetics and

medical drug monitoring

portfolio and capabilities

• Pursue accretive acquisitions

• Continue focus on quality,

service and innovation

2.0%

1.2%

3.2%

Year Over Year

Organic Volume Growth

2015 2016 2017(1)

(2)

11

• Generates approximately

$500 million in profitable revenue

growth in 2018

• Successful “Best of the Best”

approach to selecting and

retaining talent

• Dedicated and experienced

integration teams, focused on

customer retention and synergies

Maximize Value Through Flawless Integration

INTEGRATING KEY ACQUISITIONS

Mount Sinai

Clinical Outreach

Lab Assets

12

OPTIMIZING ENTERPRISE MARGINS

Continue Value Creation Through the

LaunchPad Business Process Improvement Initiative

Covance LaunchPad

• Applying LaunchPad principles to

Drug Development

• Rightsizing implemented in mid-2017;

$25 million in incremental savings in 2018

• Multi-year initiative, details to be provided

on Q4 earnings call

• Aided by Chiltern capabilities and expertise

Diagnostics LaunchPad

• Ongoing benefit from reengineering projects

• Additional opportunities, including

streamlining delivery of services

Opportunities for Productivity Gains

Automation

Global Service

Delivery Model

Procurement

New Tools

and Technology

13

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

14

Transition to

Value-Based Care

Enhance

Drug Development

Process

Role of the

Consumer

HEALTHCARE IS UNDERGOING A PERIOD OF UNPRECEDENTED CHANGE

• Improving efficiency in care

delivery

• Reducing the overall cost of

patient care

• Utilizing advanced tools and

analytics to deliver better

outcomes via personalized

medicine and population

health

• Dealing with increased trial

complexity, and competition

for patients and investigators

• Greater need for scalable tools

and processes to initiate and

manage trials

• Increased sponsor demand for

data-driven study design and

execution, as well as access to

relevant analytes, biomarkers

and tests

• Increased interest in and

influence over healthcare

decision-making

• Technology advances driving

expectation of convenience

• Consumer satisfaction

increasingly important to

other healthcare stakeholders

15

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

• National access

• Comprehensive test menu

• Extensive sales and service organization

• Scientific innovation

• Cost advantages through

economies of scale

Clinical Decision Support

• Programs for key disease states

• Lab reports incorporate care

guidelines

• Developed by physicians

• Data monitoring drives

optimal care management

Leading Laboratory Services

Payer and Provider Collaboration

• Help stakeholders achieve total cost of care

metrics in value-based care contracts

• Actionable lab results

• Global patient results data

• MACRA, HEDIS, and ACO quality metrics

• Care Intelligence® population health

Drug Development Solutions

Value-Based Care Solutions

• Companion diagnostics leadership

• Potential provider revenue stream

from increased participation in

clinical trials

• Cost savings to patients and payers

• “Real World” data

16

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

• Xcellerate® suite of informatics

• Companion diagnostics leadership

• Differentiated and growing patient and

investigator database

• Insight through patient engagement

• Dedicated biotech offering through

combination of Covance and Chiltern

• Extended Lab Management Services

• Early Phase Development Solutions

Streamlining Clinical Studies

High quality

data

Proactive risk-based

monitoring

Optimal site

selection

Transparency and

secure collaboration

Efficient product

supply management

Proactive safety

monitoring

17

On pace to

significantly exceed $100 million

in cumulative new CDx-related revenue from

the acquisition of Covance through 2018

• Dedicated CDx organization with capabilities

across development, validation, testing,

regulatory support, commercialization and

market access

• Opened purpose built, state of the art CDx

laboratory, with focus on genomics and

molecular pathology

• Supported ~70% of CDx on the market(1)

• Customizable offering -- in vitro diagnostic

(IVD) partnerships and single site pathway

• Collaborated with over 35 clients on more

than 150 CDx projects in 2017(2)

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Increasing Our Leadership in

Companion and Complementary Diagnostics (CDx)

1. As of January 1, 2018.

2. Based on results through November 2017.

3. As of September 30, 2017.

$114

$153

$276

2015 2016 2017

CDx-Related Backlog

(Dollars in millions)

(3)

18

LabCorp Data is a Key Competitive Advantage for

Patient Recruitment, Site Selection and Protocol Design

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

LabCorp Diagnostics Patient Data

• Our patient data is identifiable

• Represents the “real world”

• Billions of data points

• Lab values essential for

inclusion/exclusion criteria

Covance Drug Development

Investigator Data

• Our investigator data is global

• Filter at therapeutic and protocol level

• 175,000+ investigators across

~100,000 sites

• Insight into site location,

performance and study saturation

19

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Incorporating Patient Intelligence

into Clinical Research and Drug Development • Powered by survey responses from

patients that want to be contacted

about clinical trials

• Supported by LabCorp patient

flow and increased emphasis on

scaling opt-in database

20

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

Developing a Broad Consumer Platform to Create Deep Relationships

• Organizing around the empowered

consumer

• Creating a convenient, seamless

experience

• Providing easy access to lab test results

and personalized content

• Offering price transparency to highlight

access to highest quality, low-cost

diagnostics

21

EXPANDING LABCORP’S ROLE

IN THE HEALTHCARE SYSTEM OF THE FUTURE

• Patient Service Centers opened inside Walgreens stores

• Strong patient volume, net promoter scores, and patient

feedback

• Start to roll out to new markets in 2018

• Launch new at-home, self-collection offering built on LabCorp’s

10 years of experience with dried blood spot testing

• Invest in expanded capacity and enhanced automation to

support 23andMe strategic collaboration

• Collaborate on new delivery models, such as telehealth and

on-demand phlebotomy

Bringing our High-Quality Offering to Consumers

22

2016

>$200 million

2017

~$500 million

OUR DIFFERENTIATED SOLUTIONS ARE RESONATING WITH CUSTOMERS

Value-Based Care

Solutions

Streamlining

Clinical Studies

Consumer Platform

Completed

3 marquee transactions

in 2017

Cumulative new orders won through

the combination of LabCorp patient

data and Covance capabilities:

On track to deliver

$150 million

in cumulative new revenue

from the acquisition of Covance

through 2018

41%

28%

Patients Seen in Denver

LabCorp at Walgreens

Patients not

seen in past

12 months

Patients

new to

LabCorp

LabCorp PSCs in

Walgreens stores are

attracting new patients

23

AGENDA

Company Overview

2018 Priorities

Long-term Strategic Initiatives

Financial Strength

24

$4.1

$4.5 $4.7

$5.0

$5.5 $5.7

$5.8

$6.0

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

$8.5

$9.4

$10.2

$6.2

$6.6

$7.2

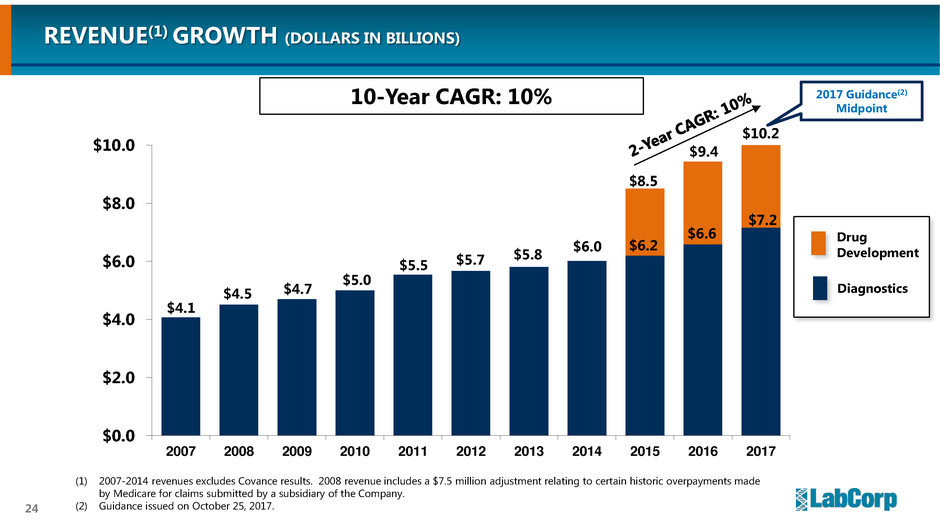

REVENUE(1) GROWTH (DOLLARS IN BILLIONS)

(1) 2007-2014 revenues excludes Covance results. 2008 revenue includes a $7.5 million adjustment relating to certain historic overpayments made

by Medicare for claims submitted by a subsidiary of the Company.

(2) Guidance issued on October 25, 2017.

2017 Guidance(2)

Midpoint

Drug

Development

Diagnostics

10-Year CAGR: 10%

25

ADJUSTED EPS(1)(2) GROWTH

(1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges). Diluted EPS, as

reported in the Company’s Annual Report were: $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25 in 2013;

$5.91 in 2014; $4.35 in 2015; and $7.02 in 2016.

(2) 2007-2014 figures exclude Covance results, and other items discussed in the Appendix.

(3) Guidance issued on October 25, 2017.

2017 Guidance(3)

Midpoint

$4.45

$4.91

$5.24

$5.98

$6.37

$6.82 $6.95 $6.80

$7.91

$8.83

$9.50

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

10-Year CAGR: 8%

26

STRONG FREE CASH FLOW(1) (DOLLARS IN MILLIONS)

(1) Free Cash Flow represents Operating Cash Flow less Capital Expenditures in each of the years presented.

2008-2014 figures exclude Covance results, and other items discussed in the Appendix.

(2) Guidance issued on October 25, 2017.

10 Year Average Free Cash Flow: $732 million

2017 Guidance(2)

Midpoint

$624

$748 $758

$759

$668

$617

$536

$727

$897

$990

$0

$200

$400

$600

$800

$1,000

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

27

TRACK RECORD OF EFFECTIVE AND BALANCED

CAPITAL DEPLOYMENT TO BUILD SHAREHOLDER VALUE

Approximately $2.3 Billion in

Capital Deployment in 2017(1)

Chiltern Acquisition

$1.2 Billion (52%)

LabCorp

Diagnostics

Acquisitions

$0.6 Billion (26%)

1. Based on nine months ended September 30, 2017.

2018 Free Cash Flow

M&A Priorities

• Diagnostics “tuck-in” transactions

Return of Capital to Shareholders

• Continue share repurchases

Debt Reduction

• Pay down debt to reduce leverage

28

KEY TAKEAWAYS

Global leader in life sciences with leading

diagnostics and drug development businesses

strategically positioned to improve health and lives

Relentless focus on execution in 2018

Driving long-term growth through innovation

in value-based care, the drug development process,

and our consumer platform

J.P. MORGAN

HEALTHCARE CONFERENCE

JANUARY 9, 2018 | SAN FRANCISCO, CA

30

Appendix

31

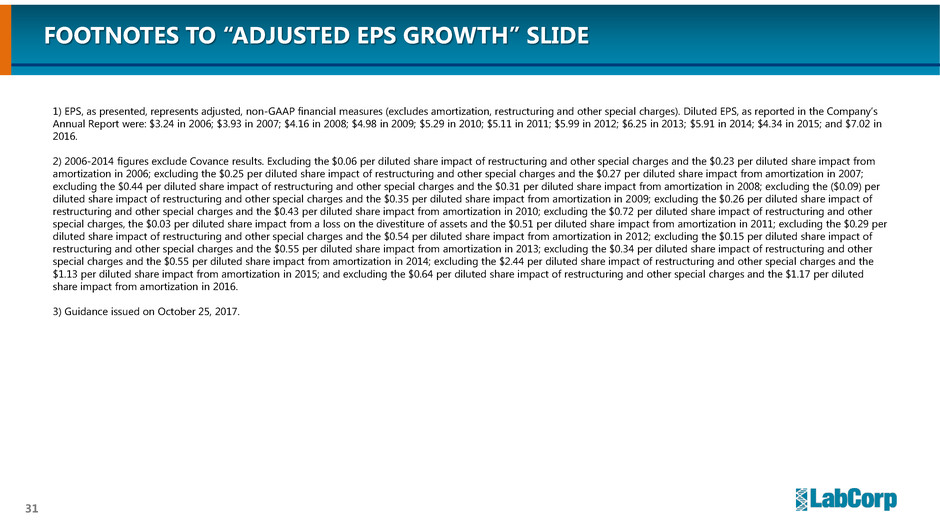

FOOTNOTES TO “ADJUSTED EPS GROWTH” SLIDE

1) EPS, as presented, represents adjusted, non-GAAP financial measures (excludes amortization, restructuring and other special charges). Diluted EPS, as reported in the Company’s

Annual Report were: $3.24 in 2006; $3.93 in 2007; $4.16 in 2008; $4.98 in 2009; $5.29 in 2010; $5.11 in 2011; $5.99 in 2012; $6.25 in 2013; $5.91 in 2014; $4.34 in 2015; and $7.02 in

2016.

2) 2006-2014 figures exclude Covance results. Excluding the $0.06 per diluted share impact of restructuring and other special charges and the $0.23 per diluted share impact from

amortization in 2006; excluding the $0.25 per diluted share impact of restructuring and other special charges and the $0.27 per diluted share impact from amortization in 2007;

excluding the $0.44 per diluted share impact of restructuring and other special charges and the $0.31 per diluted share impact from amortization in 2008; excluding the ($0.09) per

diluted share impact of restructuring and other special charges and the $0.35 per diluted share impact from amortization in 2009; excluding the $0.26 per diluted share impact of

restructuring and other special charges and the $0.43 per diluted share impact from amortization in 2010; excluding the $0.72 per diluted share impact of restructuring and other

special charges, the $0.03 per diluted share impact from a loss on the divestiture of assets and the $0.51 per diluted share impact from amortization in 2011; excluding the $0.29 per

diluted share impact of restructuring and other special charges and the $0.54 per diluted share impact from amortization in 2012; excluding the $0.15 per diluted share impact of

restructuring and other special charges and the $0.55 per diluted share impact from amortization in 2013; excluding the $0.34 per diluted share impact of restructuring and other

special charges and the $0.55 per diluted share impact from amortization in 2014; excluding the $2.44 per diluted share impact of restructuring and other special charges and the

$1.13 per diluted share impact from amortization in 2015; and excluding the $0.64 per diluted share impact of restructuring and other special charges and the $1.17 per diluted

share impact from amortization in 2016.

3) Guidance issued on October 25, 2017.

32

FOOTNOTES TO “STRONG FREE CASH FLOW” SLIDE(1)

(1) 2007-2014 figures exclude Covance results.

(2) Operating Cash Flow and Free Cash Flow in 2011 exclude the $49.5 million Hunter Labs settlement.

LABORATORY CORPORATION OF AMERICA HOLDINGS

Reconciliation of Non-GAAP Financial Measures

(in millions)

Free Cash Flow: 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Operating Cash Flow 710$ 781$ 862$ 884$ 905$ 841$ 819$ 739$ 982$ 1,176$

Less: Capital Expenditures (143) (157) (115) (126) (146) (174) (202) (204) (256) (279)

Free Cash Flow 567$ 624$ 748$ 758$ 759$ 668$ 617$ 536$ 727$ 897$

(2)

(2)