Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOLLY ENERGY PARTNERS LP | hep_formx8-kxirpresentatio.htm |

INVESTOR PRESENTATION

JANUARY 2018

Dark Blue:

24,49,116

Title Blue:

23,55,94

Orange:

230,175,10

9

Grey:

127,127,12

7

Light Blue:

114,164,18

3

Brown:

148,126,10

3

Blue Grey:

53,66,82

Light Blue:

91,152,197

Green:

101,164,49

Holly Energy Partners (NYSE: HEP) 2

Safe Harbor Disclosure Statement

Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the

meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and

necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy

Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties

include but are not limited to risks and uncertainties with respect to the actions of actual or potential competitive suppliers and

transporters of refined petroleum products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude

oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of

constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines,

effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the

effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing strategies, HollyFrontier's and Holly

Energy Partners’ efficiency in carrying out construction projects, HollyFrontier's ability to acquire refined product operations or

pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of

terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and

uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is provided in the

most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All forward-

looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The

forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy

Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Holly Energy Partners (NYSE: HEP) 3

Holly Energy Partners

A system of petroleum product and crude

pipelines, storage tanks, distribution

terminals, loading racks and processing

units located at or near HFC’s refining

assets in high growth markets

• Revenues are nearly 100% fee-based with

limited commodity risk

• Major refiner customers have entered into

long-term contracts

• Contracts require minimum payment

obligations for volume and/or revenue

commitments

• Over 80% of revenues tied to long term

contracts and minimum commitments

• Earliest contract up for renewal in 2019

(approx. 17% of total commitments)

• 52 consecutive quarterly distribution

increases since IPO in 2004

• Target 1.0-1.2x distribution coverage

1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split.

$0

$20

$40

$60

$80

$100

$120

$140

$160

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

Q

4

2

0

0

4

Q

2

2

0

0

5

Q

4

2

0

0

5

Q

2

2

0

0

6

Q

4

2

0

0

6

Q

2

2

0

0

7

Q

4

2

0

0

7

Q

2

2

0

0

8

Q

4

2

0

0

8

Q

2

2

0

0

9

Q

4

2

0

0

9

Q

2

2

0

1

0

Q

4

2

0

1

0

Q

2

2

0

1

1

Q

4

2

0

1

1

Q

2

2

0

1

2

Q

4

2

0

1

2

Q

2

2

0

1

3

Q

4

2

0

1

3

Q

2

2

0

1

4

Q

4

2

0

1

4

Q

2

2

0

1

5

Q

4

2

0

1

5

Q

2

2

0

1

6

Q

4

2

0

1

6

Q

2

2

0

1

7

W

T

I Pri

ce

Di

s

trib

u

ti

o

n

Consistent Distribution Growth Despite Crude Price

Volatility

DPU*

WTI

Holly Energy Partners (NYSE: HEP) 4

HollyFrontier and Holly Energy Partners Footprint

Holly Energy Partners (NYSE: HEP) 5

HollyFrontier Business Segment Highlights

REFINING MIDSTREAM SPECIALTY LUBRICANTS

Inland merchant refiner

5 refineries in the Mid Continent,

Southwest and Rockies regions

Flexible refining system with fleet wide

discount to WTI

Premium niche product markets versus

Gulf Coast

Organic initiatives to drive growth and

enhance returns

Disciplined capital structure &

allocation

Operate Crude and Product Pipelines,

loading racks, terminals and tanks in and

around HFC’s refining assets

HFC owns 59% of the LP Interest in HEP

and the non-economic GP interest

IDR simplification transaction lowers

HEP’s cost of capital

Over 80% of revenues tied to long term

contracts and minimum volume

commitments

Integrated specialty lubricants

producer

Sells finished lubricants & specialty

products in over 80 countries under

the Petro-Canada & HF LSP brands

Lubricant production facilities in

Mississauga, Ontario & Tulsa,

Oklahoma

Combined, fourth largest North

American base oil producer with

28,000 barrels per day of lubricants

production

HollyFrontier Lubricants & Specialty

Products is the largest North American

group III base oil producer

Holly Energy Partners (NYSE: HEP)

1. Unit Count as of 12/1/17

2. Based on HEP unit closing price on December 29, 2017

100%

Interest

41.9mm HEP units1

41% LP Interest

$1.4B Value2

59.6mm HEP units1

59% LP Interest

$1.9B Value2

HOLLYFRONTIER

CORPORATION (HFC)

GENERAL PARTNER (GP)

HOLLY LOGISTIC

SERVICES, L.L.C

HOLLY ENERGY

PARTNERS, L.P. (HEP)

PUBLIC

Non-economic

GP Interest

HEP Ownership Structure

IDR Simplification Provides Lower Cost of Capital for HEP

6

Holly Energy Partners (NYSE: HEP) 7

Limited Partner Distributions Since Inception

Distribution has been increased every quarter since IPO – 52 consecutive quarters

$1.11

$1.29

$1.42

$1.50

$1.58

$1.66

$1.74

$1.84

$1.96

$2.08

$2.20

$2.36

$2.58

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017E

LP Distribution ($/Unit)1

1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split. Amounts based on

distributions earned during the period.

Holly Energy Partners (NYSE: HEP) 8

HEP Growth Since Inception

$80

2005 2016

Revenue, 16% CAGR*

$50

2005 2016

EBITDA, 17% CAGR*

$41

$219

2005 2016

DCF, 16% CAGR*

*See page 17 for definitions

Holly Energy Partners (NYSE: HEP) 9

HEP Historical Growth

2004 2005 2006 2007 2008 2009

MLP IPO

(July 2004)

Holly intermediate

feedstock pipeline

dropdown

(July 2005)

25% JV with

Plains for

SLC pipeline

(Mar 2009)

Holly Tulsa

dropdown of

loading rack

(Tulsa West)

(Aug 2009)

Holly crude oil

and tankage

assets

dropdown

(Feb 2008)

Alon pipeline

and terminal

asset

acquisition

(Feb 2005)

Holly 16”

intermediate

pipeline

facilities

acquisition

(June 2009)

Tulsa East

acquisition &

Roadrunner /

Beeson

dropdown

(Dec 2009)

Sale of 70%

interest in Rio

Grande to

Enterprise

(Dec 2009)

2010

Purchase of

additional

Tulsa tanks

& racks and

Lovington rack

(Mar 2010)

2011

HFC

dropdown of

El Dorado &

Cheyenne

assets

(Nov 2011)

Holly South

Line expansion

project

(2007-2008)

Holly Corporation

and Frontier Oil

Corporation

complete merger

(July 2011)

2012

HEP purchases

75% interest in

UNEV from HFC

(July 2012)

Tulsa

interconnect

pipelines

(Aug 2011)

2013

Crude gathering

system expansion

(2014)

2014 2015 2016 2017

Acquired remaining

interests in SLC /

Frontier pipelines

(Oct 2017)

IDR

Simplification

(Oct 2017)

Purchase of

Tulsa West

Tanks

(March 2016)

HFC dropdown

of El Dorado

processing

units

(Nov 2015)

50% JV with

Plains for

Frontier

pipeline

(Aug 2015)

50% JV with

Plains for

Cheyenne

pipeline

(June 2016)

HFC

dropdown of

Woods Cross

processing

units

(Oct 2016)

Acquisition of

El Dorado

tank farm

(Mar 2015)

HEP purchases

50% interest in

Osage from HFC

(Feb 2016)

Committed to Continuing Successful Track Record of Growth

Holly Energy Partners (NYSE: HEP) 10

HEP Avenues for Growth

ORGANIC ACQUISITIONS DROPDOWNS FROM HFC

Leverage HEP’s existing

footprint, specifically in

Permian Basin

Contractual PPI/FERC

Escalators

SLC / Frontier Expansion

Pursue logistics assets in HEP’s current

geographic region

Replace incumbent HFC service

providers with HEP

Leverage HFC refining and commercial

footprint

Participate in expected MLP sector

consolidation

Partnering with HFC to build

and/or acquire new assets /

businesses

Target high tax basis assets with

durable cash flow characteristics

that also add to HFC EBITDA

Holly Energy Partners (NYSE: HEP) 11

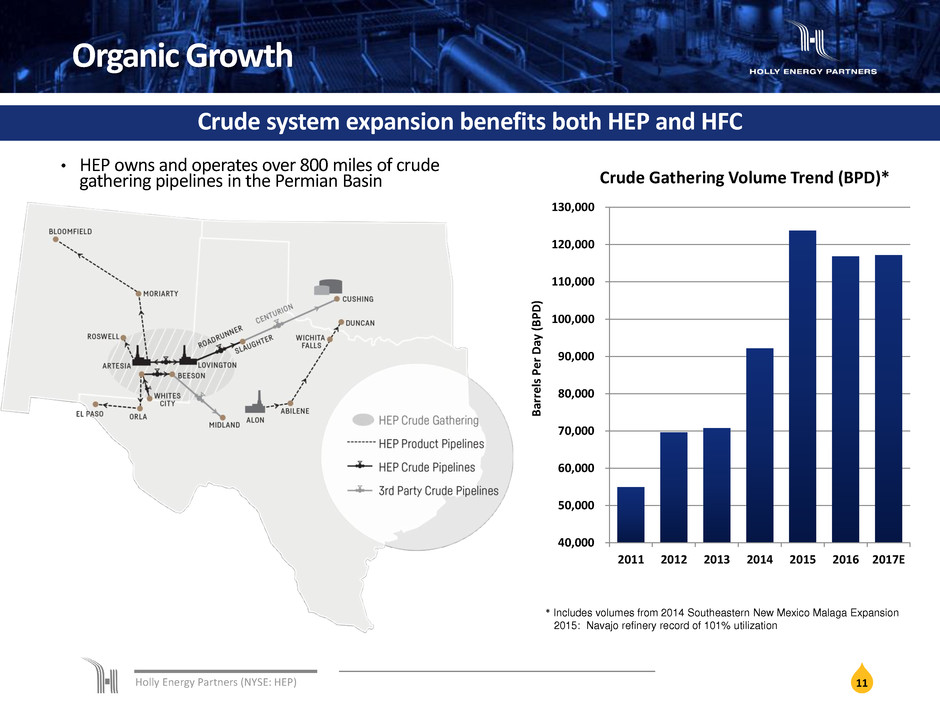

Organic Growth

* Includes volumes from 2014 Southeastern New Mexico Malaga Expansion

2015: Navajo refinery record of 101% utilization

Crude system expansion benefits both HEP and HFC

• HEP owns and operates over 800 miles of crude

gathering pipelines in the Permian Basin

40,000

50,000

60,000

70,000

80,000

90,000

100,000

110,000

120,000

130,000

2011 2012 2013 2014 2015 2016 2017E

B

ar

re

ls Pe

r

D

ay

(

B

P

D

)

Crude Gathering Volume Trend (BPD)*

Holly Energy Partners (NYSE: HEP) 12

Asset Description

• Acquired remaining 50% interest in Frontier

pipeline, and remaining 75% interest in SLC

pipeline in October 2017

• Frontier: 289-mile, 72,000 BPD capacity crude

pipeline from Casper, WY to Frontier Station, UT

• SLC: 95-mile, 90,000 BPD capacity crude pipeline

from Frontier Station, UT into Salt Lake City

• Both pipelines deliver Canadian and Rocky

Mountain Crudes to SLC refineries

• Evaluating expansion opportunities to increase

capacity by ~10%

Deal Highlights

• Interests acquired from Plains All American (PAA)

• HEP now operates both pipelines

• Acquired interests expected to generate $23

million in annual EBITDA

Acquisition of Interests in Frontier and SLC Pipelines

Holly Energy Partners (NYSE: HEP) 13

Dropdowns From HFC

Newly constructed crude, catalytic cracking, and

polymerization units at HFC’s Woods Cross refinery

for a total cash consideration of $278.0 MM,

effective October 1, 2016

• HEP and HFC entered into 15-year tolling

agreements featuring minimum volume

commitments for each respective unit

• 2017 EBITDA from these tolling agreements

expected to be at least $32.7 MM*

• HFC owns all commodity inputs and outputs; HEP

takes no commodity risk

El Dorado Dropdown Woods Cross Dropdown

Newly constructed naphtha fractionation and

hydrogen generation units at HFC’s El Dorado

refinery for total cash consideration of

approximately $62.0 MM, effective November 1,

2015

• HEP and HFC entered into 15-year tolling

agreements featuring minimum volume

commitments for each respective unit

• 2017 EBITDA from these tolling agreements

expected to be at least $8.2 MM*

• HFC owns all commodity inputs and outputs; HEP

takes no commodity risk

Dropdown Approach

• HEP positioned to benefit through HFC partnership:

• Growth capital projects

• Potential HFC M&A

• Target new HFC growth capital projects:

• High tax basis

• Durable cash flow streams

* For historical reconciliation of EBITDA, please see the Holly Energy Partners 2016 10-K

Holly Energy Partners (NYSE: HEP)

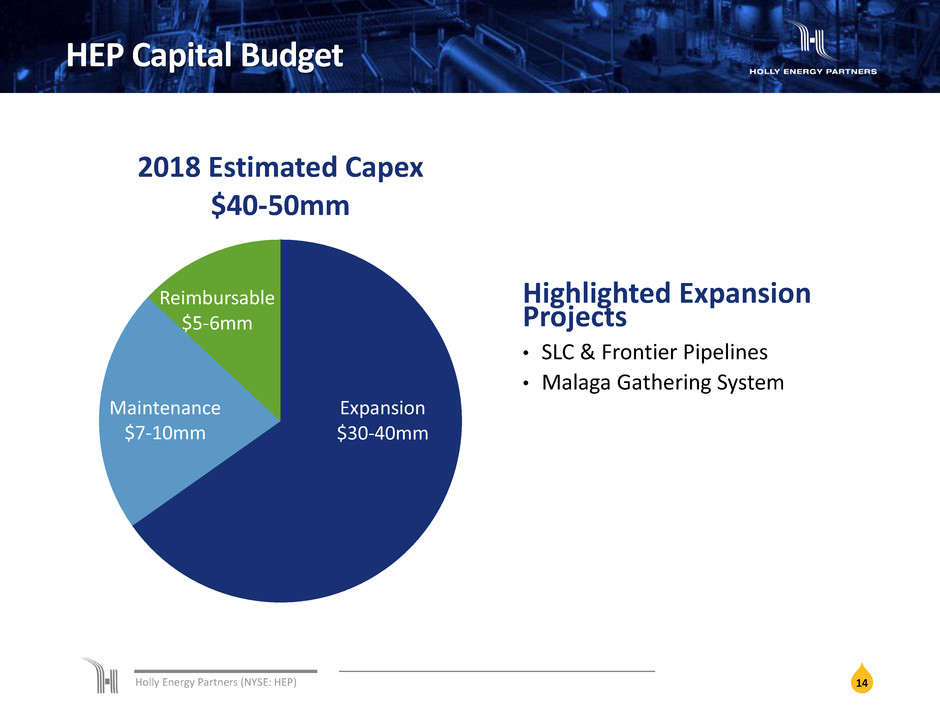

HEP Capital Budget

2018 Estimated Capex

$40-50mm

Reimbursable

$5-6mm

Maintenance

$7-10mm

Expansion

$30-40mm

Highlighted Expansion

Projects

• SLC & Frontier Pipelines

• Malaga Gathering System

14

Holly Energy Partners (NYSE: HEP)

HEP Financial Strength

Reimbursable

$15-20mm

Maintenance

$10-15mm

Expansion

$40-50mm

Capital Markets Activity in 2017

• Upsized Revolver from $1.2 billion to $1.4

billion

• Redeemed $300 million of 6.5% Senior Notes

due 2020

• Completed $100 million tack-on offering of 6%

Senior Notes due 2024

• Raised $53.6 million in net proceeds through At-

The-Market (“ATM”) equity issuance program

HEP Capital Structure ($ millions) 9/30/2017

Revolver Capacity $ 1,400

Revolver Borrowings $ (750)

Revolver Availability $ 650

Cash & Marketable Securities $ 7

Total Liquidity $ 657

6.00% Senior Notes due 2024 $ 500

Revolver Borrowings $ 750

Total HEP Debt $ 1,250

TTM EBITDA $ 297

Debt/TTM EBITDA 4.2x

15

Holly Energy Partners (NYSE: HEP) 16

Appendix-HEP Assets

Holly Energy Partners owns and operates substantially all of the refined product pipeline and

terminaling assets that support HollyFrontier’s refining and marketing operations in the Mid-Continent,

Southwest and Rocky Mountain regions of the United States.

• Approximately 3,400 miles of crude oil and petroleum product pipelines

• 14 million barrels of refined product and crude oil storage

• 8 terminals and 7 loading rack facilities in 10 western and mid-

continent states

• Refinery processing units in Woods Cross, Utah and El Dorado, Kansas

• 75% joint venture interest in UNEV Pipeline, LLC – the owner of a 400-

mile refined products pipeline system connecting Salt Lake area refiners

to the Las Vegas product market

• 50% joint venture interest in Cheyenne Pipeline LLC – the owner of an

87-mile crude oil pipeline from Fort Laramie, Wyoming to Cheyenne,

Wyoming.

• 50% joint venture interest in Osage Pipe Line Company, LLC – the owner

of a 135-mile crude oil pipeline from Cushing, Oklahoma to El Dorado,

Kansas

Holly Energy Partners (NYSE: HEP) 17

Definitions

BPD: Barrels per day

CAGR: The compound annual growth rate is calculated by dividing the ending value by

the beginning value, raise the result to the power of one divided by the period length,

and subtract one from the subsequent result. CAGR is the mean annual growth rate of

an investment over a specified period of time longer than one year.

DISTRIBUTABLE CASH FLOW: Distributable cash flow (DCF) is not a calculation based

upon GAAP. However, the amounts included in the calculation are derived from

amounts separately presented in our consolidated financial statements, with the

exception of excess cash flows over earnings of SLC Pipeline, maintenance capital

expenditures and distributable cash flow from discontinued operations. Distributable

cash flow should not be considered in isolation or as an alternative to net income or

operating income as an indication of our operating performance or as an alternative to

operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily

comparable to similarly titled measures of other companies. Distributable cash flow is

presented here because it is a widely accepted financial indicator used by investors to

compare partnership performance. We believe that this measure provides investors an

enhanced perspective of the operating performance of our assets and the cash our

business is generating. Our historical distributable cash flow for the past five years is

reconciled to net income in footnote 4 to the table in "Item 6. Selected Financial Data"

of HEP's 2016 10-K.

DPU: Cash distribution per unit.

EBITDA: Earnings before interest, taxes, depreciation and amortization which is

calculated as net income plus (i) interest expense net of interest income and (ii)

depreciation and amortization. EBITDA is not a calculation based upon U.S. generally

accepted accounting principles (“U.S. GAAP”). However, the amounts included in the

EBITDA calculation are derived from amounts included in our consolidated financial

statements. EBITDA should not be considered as an alternative to net income or

operating income, as an indication of our operating performance or as an alternative to

operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to

similarly titled measures of other companies. EBITDA is presented here because it is a

widely used financial indicator used by investors and analysts to measure performance.

EBITDA is also used by our management for internal analysis and as a basis for

compliance with financial covenants. Our historical EBITDA for the past five years is

reconciled to net income in footnote 3 to the table in “Item 6. Selected Financial Data”

of HEP’s 2016 10-K.

Forecasted EBITDA for SLC and Frontier: Forecasted EBITDA is based on Holly

Energy's projections for the acquired interests in SLC and Frontier. Forecasted

EBITDA is included to help facilitate comparisons of operating performance

of Holly Energy with other companies in its industry, as well as help facilitate an

assessment of the projected ability of the acquired interests in SLC and Frontier to

generate sufficient cash flow to make distributions to Holly Energy's partners.

Forecasted EBITDA is not presented as an alternative to the nearest GAAP

financial measure, net income, and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with GAAP. Holly

Energy is unable to present a reconciliation of forecasted EBITDA to net income

because certain elements of net income for future periods, including interest,

depreciation and taxes, are not available without unreasonable efforts. Together,

these items generally would result in EBITDA being significantly greater than net

income.

KBPD: Thousand barrels per day

Non GAAP measurements: We report certain financial measures that are not

prescribed or authorized by U. S. generally accepted accounting principles

("GAAP"). We discuss management's reasons for reporting these non-GAAP

measures below. Although management evaluates and presents these non-GAAP

measures for the reasons described below, please be aware that these non-GAAP

measures are not alternatives to revenue, operating income, income from

continuing operations, net income, or any other comparable operating measure

prescribed by GAAP. In addition, these non-GAAP financial measures may be

calculated and/or presented differently than measures with the same or similar

names that are reported by other companies, and as a result, the non-GAAP

measures we report may not be comparable to those reported by others.

Rack Backward: business segment of HF LSP that captures the value between

feedstock