Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Alkermes plc. | alks-20180109x8k.htm |

Exhibit 99.1

Relevant slides from Alkermes plc's presentation at the J.P. Morgan Healthcare Conference in San Francisco, California on January 9, 2018:

|

|

Great Science Deep Compassion Real Impact JANUARY 9, 2018 Richard Pops Chief Executive Officer 36th Annual J.P. Morgan Healthcare Conference © 2018 Alkermes. All rights reserved. Alkermes* Patient inspired* |

|

|

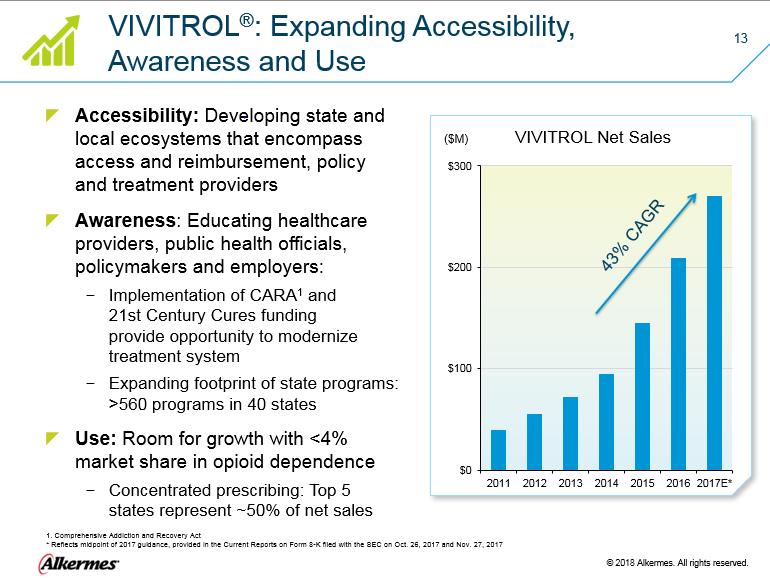

VIVITROL®: Expanding Accessibility, Awareness and Use 13 Accessibility: Developing state and local ecosystems that encompass access and reimbursement, policy and treatment providers Awareness: Educating healthcare providers, public health officials, policymakers and employers: Implementation of CARA1 and 21st Century Cures funding provide opportunity to modernize treatment system Expanding footprint of state programs: >560 programs in 40 states Use: Room for growth with <4% market share in opioid dependence Concentrated prescribing: Top 5 states represent ~50% of net sales VIVITROL Net Sales ($M) 43% CAGR 1. Comprehensive Addiction and Recovery Act * Reflects midpoint of 2017 guidance, provided in the Current Reports on Form 8-K filed with the SEC on Oct. 26, 2017 and Nov. 27, 2017 $0 $100 $200 $300 2011 2012 2013 2014 2015 2016 2017E* © 2018 Alkermes. All rights reserved. Alkermes* |

|

|

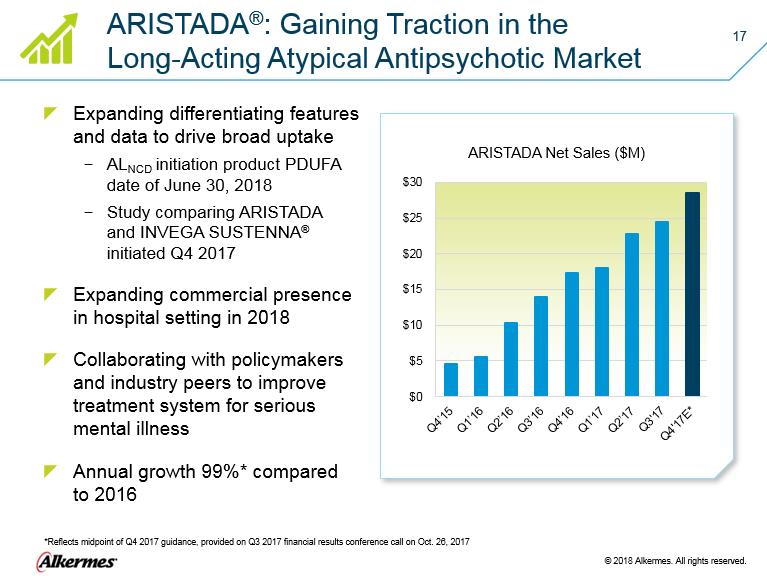

Expanding differentiating features and data to drive broad uptake ALNCD initiation product PDUFA date of June 30, 2018 Study comparing ARISTADA and INVEGA SUSTENNA® initiated Q4 2017 Expanding commercial presence in hospital setting in 2018 Collaborating with policymakers and industry peers to improve treatment system for serious mental illness Annual growth 99%* compared to 2016 17 ARISTADA®: Gaining Traction in the Long-Acting Atypical Antipsychotic Market *Reflects midpoint of Q4 2017 guidance, provided on Q3 2017 financial results conference call on Oct. 26, 2017 $0 $5 $10 $15 $20 $25 $30 ARISTADA Net Sales ($M) Q4’15 Q1’16 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17 Q3’17 Q4’17E* © 2018 Alkermes. All rights reserved. Alkermes* |

|

|

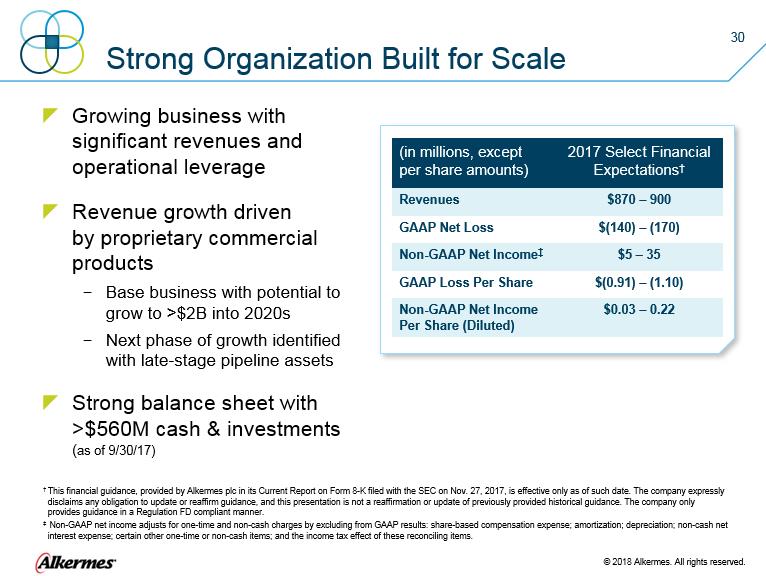

Growing business with significant revenues and operational leverage Revenue growth driven by proprietary commercial products Base business with potential to grow to >$2B into 2020s Next phase of growth identified with late-stage pipeline assets Strong balance sheet with >$560M cash & investments (as of 9/30/17) 30 Strong Organization Built for Scale (in millions, except per share amounts) 2017 Select Financial Expectations† Revenues $870 – 900 GAAP Net Loss $(140) – (170) Non-GAAP Net Income‡ $5 – 35 GAAP Loss Per Share $(0.91) – (1.10) Non-GAAP Net Income Per Share (Diluted) $0.03 – 0.22 † This financial guidance, provided by Alkermes plc in its Current Report on Form 8-K filed with the SEC on Nov. 27, 2017, is effective only as of such date. The company expressly disclaims any obligation to update or reaffirm guidance, and this presentation is not a reaffirmation or update of previously provided historical guidance. The company only provides guidance in a Regulation FD compliant manner. ‡ Non-GAAP net income adjusts for one-time and non-cash charges by excluding from GAAP results: share-based compensation expense; amortization; depreciation; non-cash net interest expense; certain other one-time or non-cash items; and the income tax effect of these reconciling items. © 2018 Alkermes. All rights reserved. Alkermes* |