Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - APPLIED INDUSTRIAL TECHNOLOGIES INC | d521385dex991.htm |

| EX-10.1 - EX-10.1 - APPLIED INDUSTRIAL TECHNOLOGIES INC | d521385dex101.htm |

| 8-K - 8-K - APPLIED INDUSTRIAL TECHNOLOGIES INC | d521385d8k.htm |

January 9, 2018 Investor Presentation FCX Performance Acquisition Overview Exhibit 99.2

Safe Harbor This presentation contains statements that are forward-looking concerning the agreement entered into by Applied to acquire FCX, including expectations regarding the financial and operational impact of the acquisition on Applied. The term “forward-looking” is defined by the Securities and Exchange Commission in its rules, regulations and releases, and Applied intends that such forward-looking statements be subject to the safe harbors created thereby. Forward-looking statements are often identified by qualifiers such as "expect," “anticipate," "will," “projection," and similar expressions. All forward-looking statements are based on current expectations regarding important risk factors, including the following: the consummation of the proposed transaction on the proposed terms and schedule; Applied’s financial and operational performance following the completion of the proposed transaction; the ability of Applied and the seller to satisfy closing conditions; Applied's ability to close the transaction, successfully integrate the business, and realize the strategic and other benefits of the acquisition; the timing of when the acquisition will become accretive to earnings; trends in the industrial sector of the economy; and other risk factors identified in Applied's most recent periodic report and other filings made with the Securities and Exchange Commission. Accordingly, actual results may differ materially from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by Applied or any other person that the results expressed therein will be achieved. Applied assumes no obligation to update publicly or revise any forward-looking statements, whether due to new information, or events, or otherwise.

Non-GAAP Financial Measures This presentation includes certain forward-looking financial measures that are not presented in accordance with generally accepted accounting principles (“GAAP”). These non-GAAP financial measures are numerical measures of financial performance that exclude or include amounts so as to be different than the most directly comparable measure that would be presented in accordance with GAAP in Applied’s consolidated balance sheets and related consolidated statements of operations, comprehensive income, changes in stockholders’ equity and cash flows. Non-GAAP financial measures should not be considered in isolation or as a substitute for the most directly comparable GAAP measures. Applied’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. These forward-looking non-GAAP financial measures are intended to provide additional information to investors regarding Applied’s current expectations surrounding the pending FCX acquisition. We do not attempt to reconcile these measures with the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments identified below, the amounts of which could be material. One non-GAAP measure, estimated EBITDA, represents a current estimate of FCX’s forward 12-month post-acquisition net income adjusted to exclude interest expense, income taxes, depreciation and amortization, as well as other adjustments described below. In addition, this presentation includes a non-GAAP reference to the expected accretive impact of the proposed transaction to Applied’s earnings per share, based on projections for the acquired business in the first 12 months post-acquisition, excluding first-year transaction-related costs. Forward EBITDA projections were developed based on FCX’s trailing 12-month actual results for the period ended September 30, 2017, as adjusted to conform accounting policies with Applied and normalized to exclude certain one-time items and approximate results under Applied’s ownership, based on quality of earnings reviews prepared by third parties. The adjusted historical base was then further adjusted for a non-material acquisition made by FCX in December 2017 and for additional financial performance information presented by FCX for the two months ended November 30, 2017. Estimated forward 12-month post-acquisition EBITDA assumes market sales growth, modest improvement in gross margins based on current FCX initiatives and estimated synergies, including both synergies from the integration of acquisitions completed by FCX prior to the proposed closing date as well as synergies available as a result of Applied’s ownership.

Leading Engineered Fluid Power & Flow Control Systems Provider Compelling Strategic Acquisition Brings Together Leading Fluid Power & Specialty Flow Control Businesses in the North American Markets Establishes Comprehensive Technical MRO & OEM Solutions Offering, Including High-Touch Lifecycle Services Provides Unique Value Proposition with Significant Cross-Selling & Cost Savings / Efficiency Improvement Opportunities Includes Scale Advantages & Inventory Stocking Capabilities SM

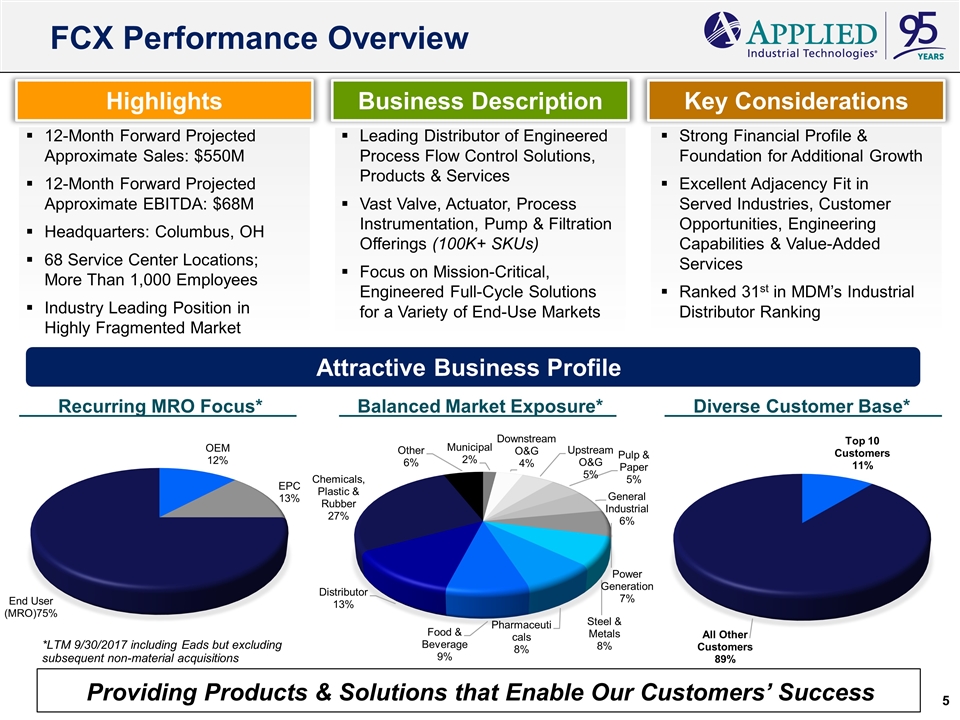

12-Month Forward Projected Approximate Sales: $550M 12-Month Forward Projected Approximate EBITDA: $68M Headquarters: Columbus, OH 68 Service Center Locations; More Than 1,000 Employees Industry Leading Position in Highly Fragmented Market Unique Technical Capabilities Providing Products & Solutions that Enable Our Customers’ Success FCX Performance Overview Recurring MRO Focus* Balanced Market Exposure* Diverse Customer Base* Business Description Key Considerations Highlights Leading Distributor of Engineered Process Flow Control Solutions, Products & Services Vast Valve, Actuator, Process Instrumentation, Pump & Filtration Offerings (100K+ SKUs) Focus on Mission-Critical, Engineered Full-Cycle Solutions for a Variety of End-Use Markets Strong Financial Profile & Foundation for Additional Growth Excellent Adjacency Fit in Served Industries, Customer Opportunities, Engineering Capabilities & Value-Added Services Ranked 31st in MDM’s Industrial Distributor Ranking Attractive Business Profile *LTM 9/30/2017 including Eads but excluding subsequent non-material acquisitions

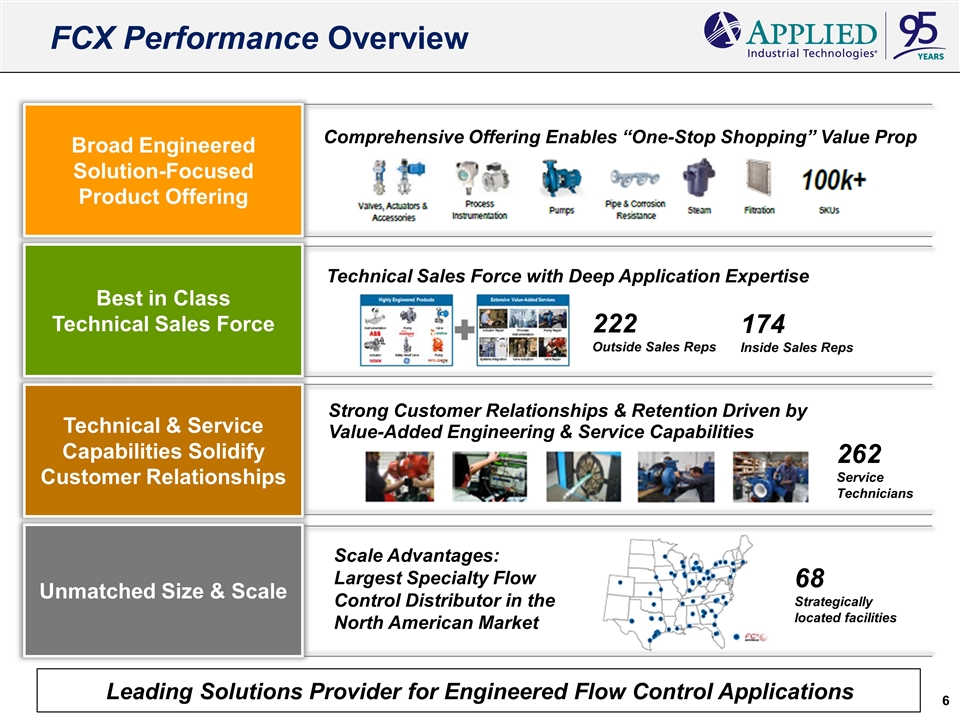

FCX Performance Overview Best in Class Technical Sales Force Technical & Service Capabilities Solidify Customer Relationships Broad Engineered Solution-Focused Product Offering Unmatched Size & Scale Comprehensive Offering Enables “One-Stop Shopping” Value Prop Technical Sales Force with Deep Application Expertise 222 Outside Sales Reps 174 Inside Sales Reps Strong Customer Relationships & Retention Driven by Value-Added Engineering & Service Capabilities 262 Service Technicians Scale Advantages: Largest Specialty Flow Control Distributor in the North American Market Leading Solutions Provider for Engineered Flow Control Applications 68 Strategically located facilities

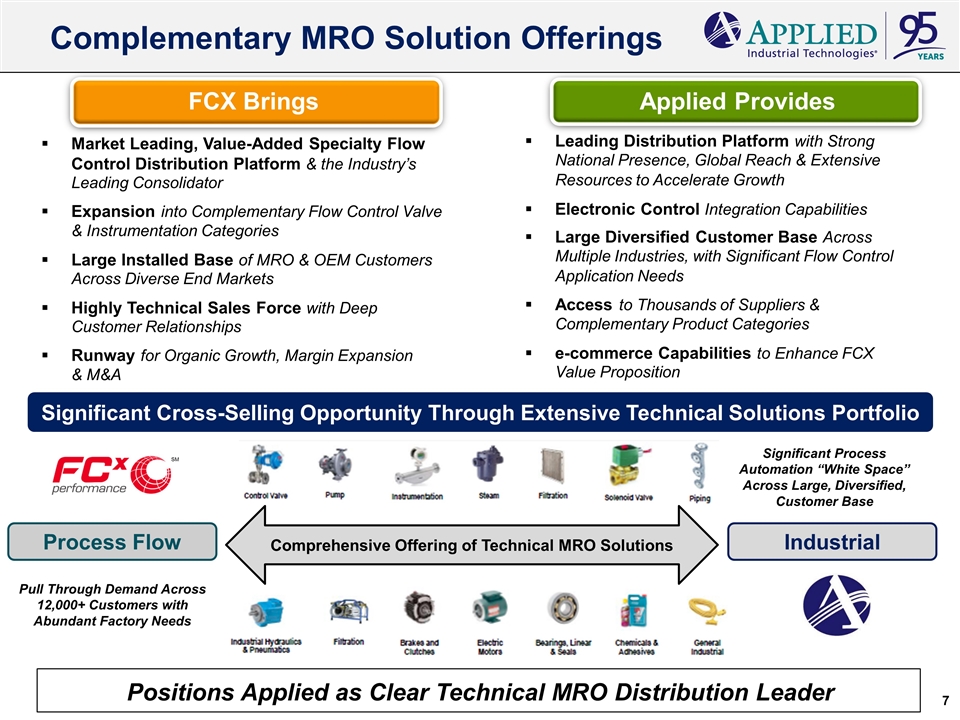

Market Leading, Value-Added Specialty Flow Control Distribution Platform & the Industry’s Leading Consolidator Expansion into Complementary Flow Control Valve & Instrumentation Categories Large Installed Base of MRO & OEM Customers Across Diverse End Markets Highly Technical Sales Force with Deep Customer Relationships Runway for Organic Growth, Margin Expansion & M&A Complementary MRO Solution Offerings Positions Applied as Clear Technical MRO Distribution Leader Leading Distribution Platform with Strong National Presence, Global Reach & Extensive Resources to Accelerate Growth Electronic Control Integration Capabilities Large Diversified Customer Base Across Multiple Industries, with Significant Flow Control Application Needs Access to Thousands of Suppliers & Complementary Product Categories e-commerce Capabilities to Enhance FCX Value Proposition Industrial Comprehensive Offering of Technical MRO Solutions Pull Through Demand Across 12,000+ Customers with Abundant Factory Needs Significant Process Automation “White Space” Across Large, Diversified, Customer Base Process Flow Significant Cross-Selling Opportunity Through Extensive Technical Solutions Portfolio FCX Brings Applied Provides SM

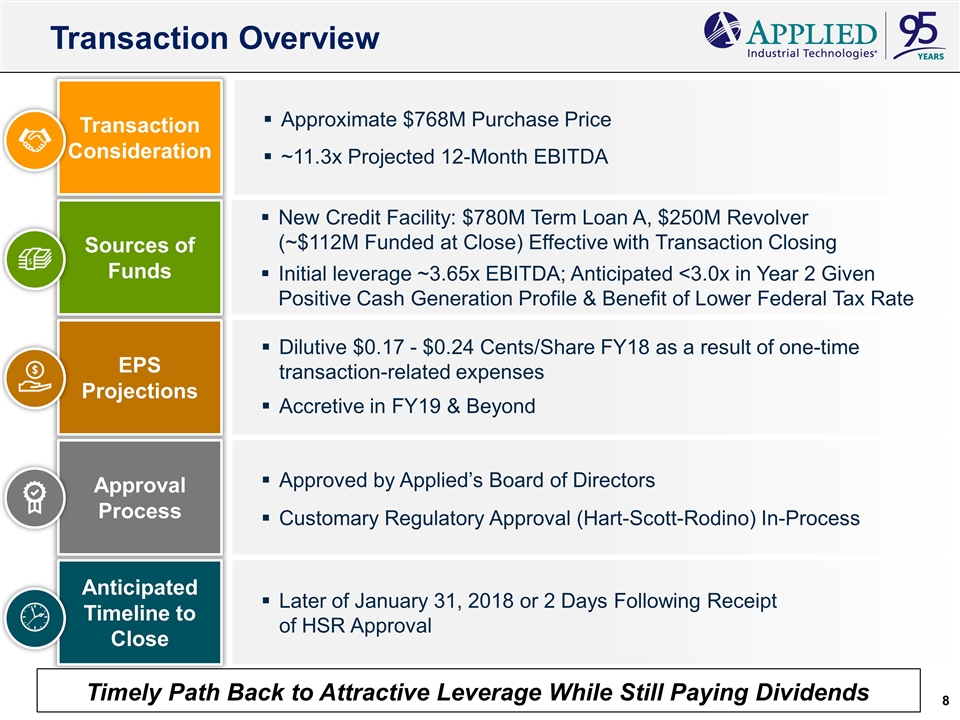

Timely Path Back to Attractive Leverage While Still Paying Dividends Transaction Overview Anticipated Timeline to Close Sources of Funds EPS Projections Transaction Consideration Approval Process Approximate $768M Purchase Price ~11.3x Projected 12-Month EBITDA New Credit Facility: $780M Term Loan A, $250M Revolver (~$112M Funded at Close) Effective with Transaction Closing Initial leverage ~3.65x EBITDA; Anticipated <3.0x in Year 2 Given Positive Cash Generation Profile & Benefit of Lower Federal Tax Rate Dilutive $0.17 - $0.24 Cents/Share FY18 as a result of one-time transaction-related expenses Accretive in FY19 & Beyond Approved by Applied’s Board of Directors Customary Regulatory Approval (Hart-Scott-Rodino) In-Process Later of January 31, 2018 or 2 Days Following Receipt of HSR Approval

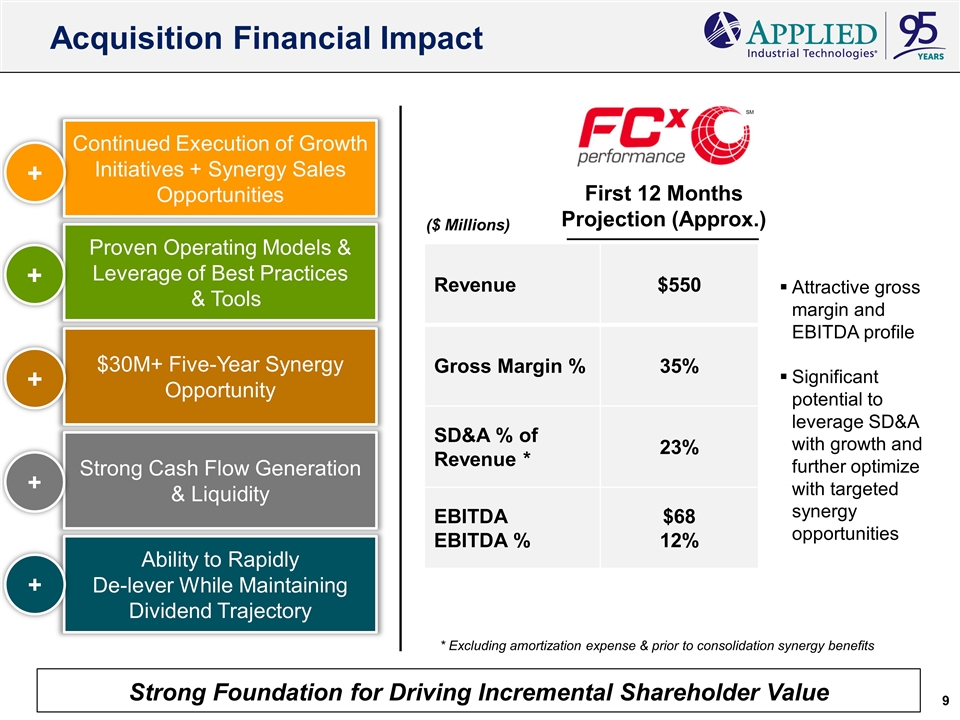

Acquisition Financial Impact Strong Foundation for Driving Incremental Shareholder Value Ability to Rapidly De-lever While Maintaining Dividend Trajectory Proven Operating Models & Leverage of Best Practices & Tools $30M+ Five-Year Synergy Opportunity Continued Execution of Growth Initiatives + Synergy Sales Opportunities Strong Cash Flow Generation & Liquidity + + + + + First 12 Months Projection (Approx.) Revenue $550 Gross Margin % 35% SD&A % of Revenue * 23% EBITDA EBITDA % $68 12% ($ Millions) * Excluding amortization expense & prior to consolidation synergy benefits Attractive gross margin and EBITDA profile Significant potential to leverage SD&A with growth and further optimize with targeted synergy opportunities SM

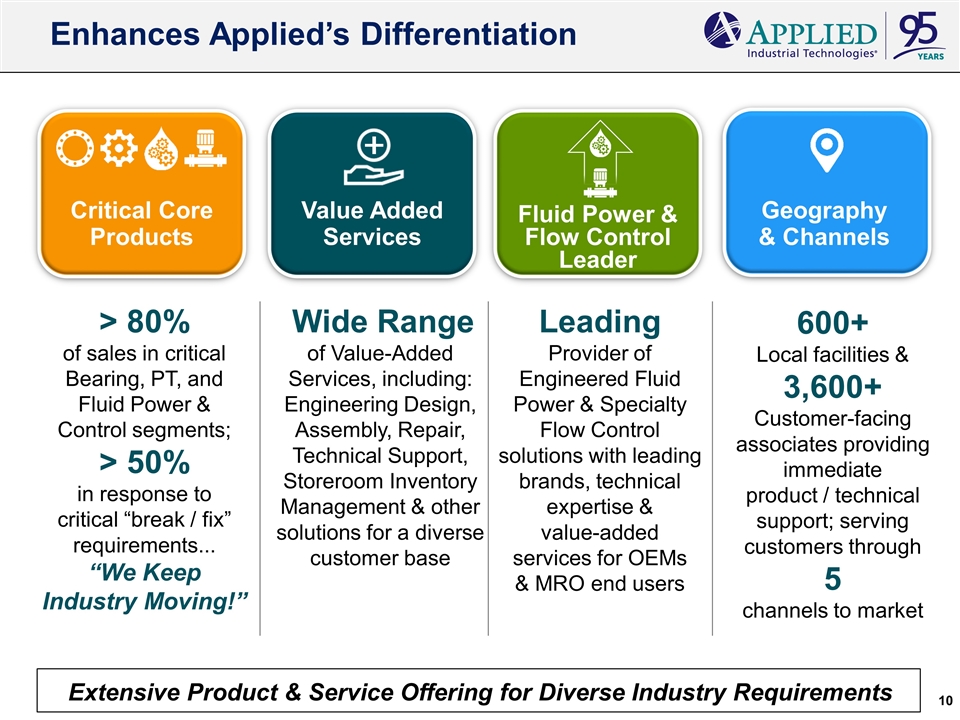

Extensive Product & Service Offering for Diverse Industry Requirements > 80% of sales in critical Bearing, PT, and Fluid Power & Control segments; > 50% in response to critical “break / fix” requirements... “We Keep Industry Moving!” 600+ Local facilities & 3,600+ Customer-facing associates providing immediate product / technical support; serving customers through 5 channels to market Leading Provider of Engineered Fluid Power & Specialty Flow Control solutions with leading brands, technical expertise & value-added services for OEMs & MRO end users Critical Core Products Geography & Channels Value Added Services Fluid Power & Flow Control Leader Wide Range of Value-Added Services, including: Engineering Design, Assembly, Repair, Technical Support, Storeroom Inventory Management & other solutions for a diverse customer base Enhances Applied’s Differentiation

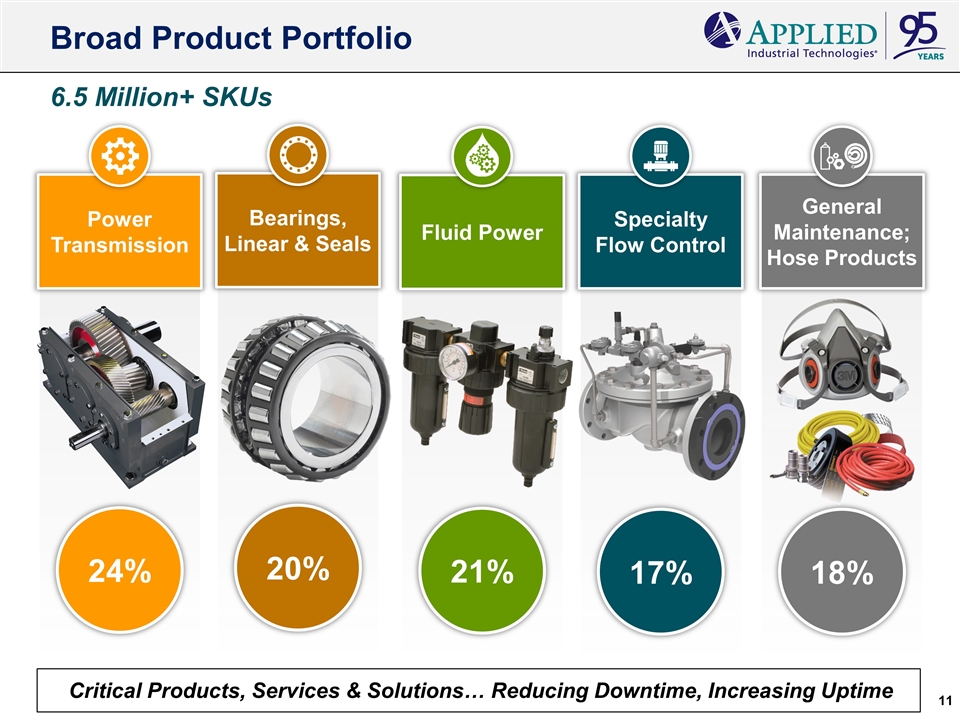

General Maintenance; Hose Products 18% Fluid Power 21% Power Transmission 24% Bearings, Linear & Seals 20% Broad Product Portfolio 6.5 Million+ SKUs Critical Products, Services & Solutions… Reducing Downtime, Increasing Uptime Specialty Flow Control 17%

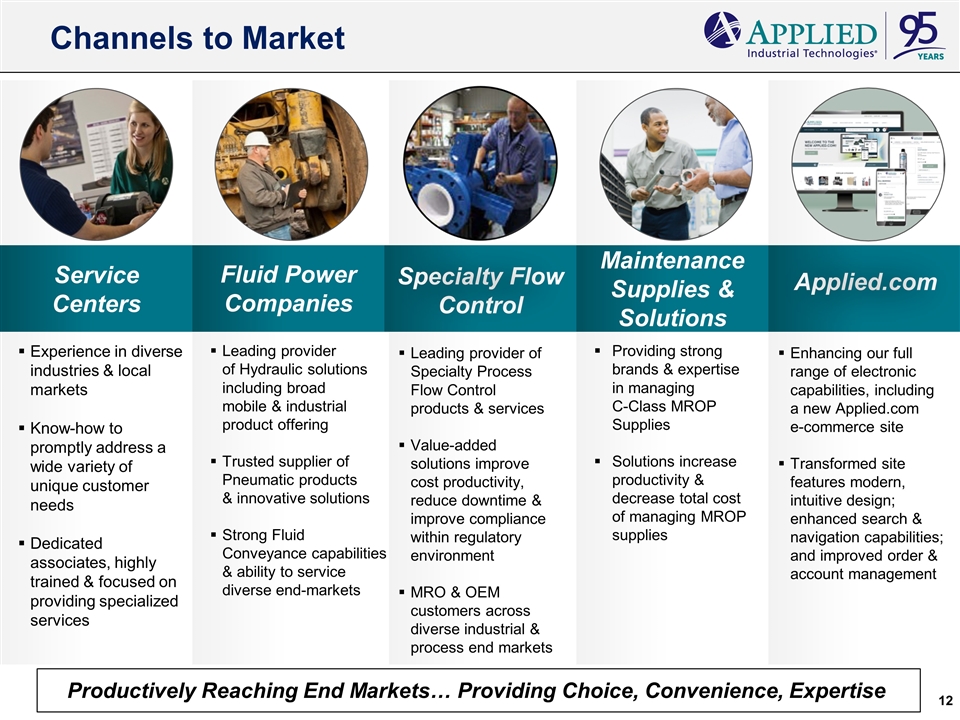

Leading provider of Specialty Process Flow Control products & services Value-added solutions improve cost productivity, reduce downtime & improve compliance within regulatory environment MRO & OEM customers across diverse industrial & process end markets Channels to Market Service Centers Fluid Power Companies Specialty Flow Control Applied.com Maintenance Supplies & Solutions Leading provider of Hydraulic solutions including broad mobile & industrial product offering Trusted supplier of Pneumatic products & innovative solutions Strong Fluid Conveyance capabilities & ability to service diverse end-markets Providing strong brands & expertise in managing C-Class MROP Supplies Solutions increase productivity & decrease total cost of managing MROP supplies Enhancing our full range of electronic capabilities, including a new Applied.com e-commerce site Transformed site features modern, intuitive design; enhanced search & navigation capabilities; and improved order & account management Productively Reaching End Markets… Providing Choice, Convenience, Expertise Experience in diverse industries & local markets Know-how to promptly address a wide variety of unique customer needs Dedicated associates, highly trained & focused on providing specialized services

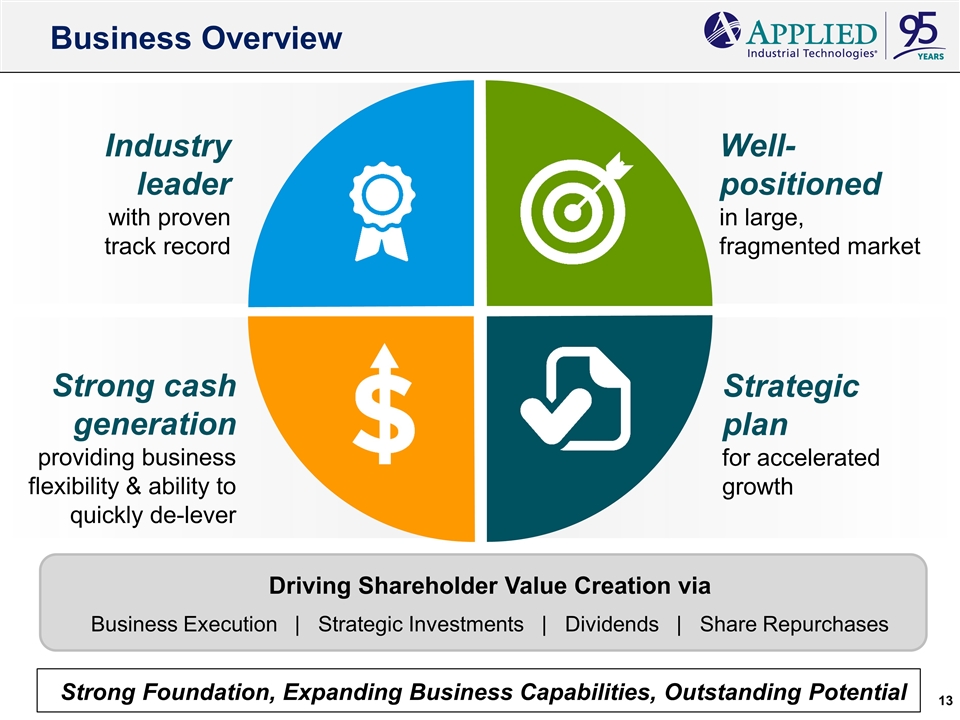

Business Overview Industry leader with proven track record Well-positioned in large, fragmented market Strong cash generation providing business flexibility & ability to quickly de-lever Strategic plan for accelerated growth Driving Shareholder Value Creation via Business Execution | Strategic Investments | Dividends | Share Repurchases Strong Foundation, Expanding Business Capabilities, Outstanding Potential