Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | mdrx-8k_20180109.htm |

Allscripts Healthcare Solutions Investor Presentation J.P. Morgan 2018 Healthcare Conference | January 9, 2018 Exhibit 99.1

Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including the statements under “Affirming 2017 Outlook”. These forward-looking statements are based on the current beliefs and expectations of Allscripts management, only speak as of the date that they are made (or any other specified date), and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Actual results could differ significantly from those set forth in the forward-looking statements and reported results should not be considered an indication of future performance. Certain factors that could cause Allscripts actual results to differ materially from those described in the forward-looking statements include, but are not limited to: the expected financial contribution and results of the Netsmart joint business entity (including consolidation for financial reporting purposes), the provider/patient solutions business acquired from NantHealth, and the hospital and health systems business acquired from McKesson Corporation (the “Enterprise Information Solutions Business”); the timing and ultimate closing of the Practice Fusion acquisition; the successful integration of businesses acquired by Allscripts; the anticipated and unanticipated expenses and liabilities related to the businesses acquired by Allscripts; Allscripts failure to compete successfully; consolidation in Allscripts industry; current and future laws, regulations and industry initiatives; increased government involvement in Allscripts industry; the failure of markets in which Allscripts operates to develop as quickly as expected; Allscripts or its customers’ failure to see the benefits of government programs; changes in interoperability or other regulatory standards; the effects of the realignment of Allscripts sales, services and support organizations; market acceptance of Allscripts products and services; the unpredictability of the sales and implementation cycles for Allscripts products and services; Allscripts ability to manage future growth; Allscripts ability to introduce new products and services; Allscripts ability to establish and maintain strategic relationships; risks related to the acquisition of new companies or technologies; the performance of Allscripts products; Allscripts ability to protect its intellectual property rights; the outcome of legal proceedings involving Allscripts; Allscripts ability to hire, retain and motivate key personnel; performance by Allscripts content and service providers; liability for use of content; security breaches; price reductions; Allscripts ability to license and integrate third party technologies; Allscripts ability to maintain or expand its business with existing customers; risks related to international operations; changes in tax rates or laws; business disruptions; Allscripts ability to maintain proper and effective internal controls; and asset and long-term investment impairment charges. Additional information about these and other risks, uncertainties, and factors affecting Allscripts business is contained in Allscripts filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in the most recent Allscripts Annual Report on Form 10-K and subsequent Form 10-Qs. Allscripts does not undertake to update forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes in its business, financial condition or operating results over time.

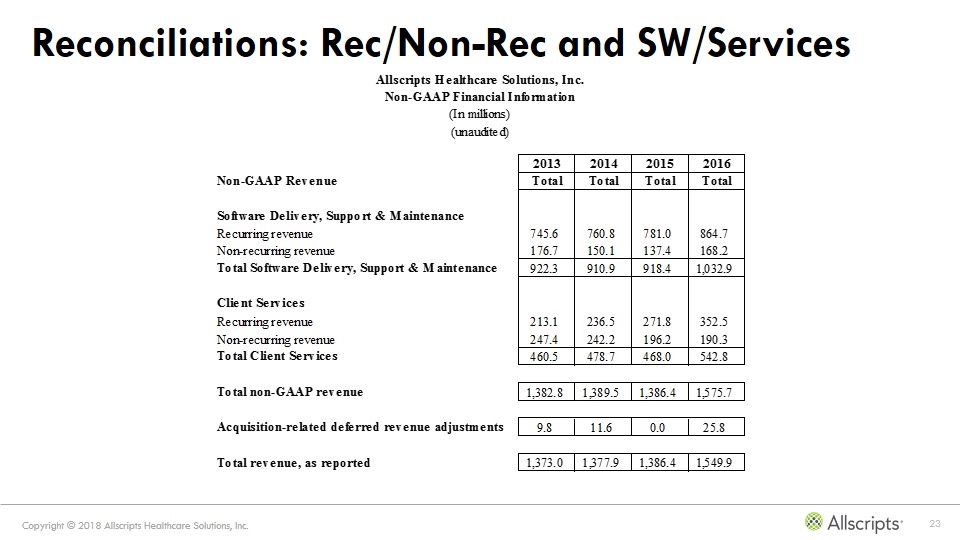

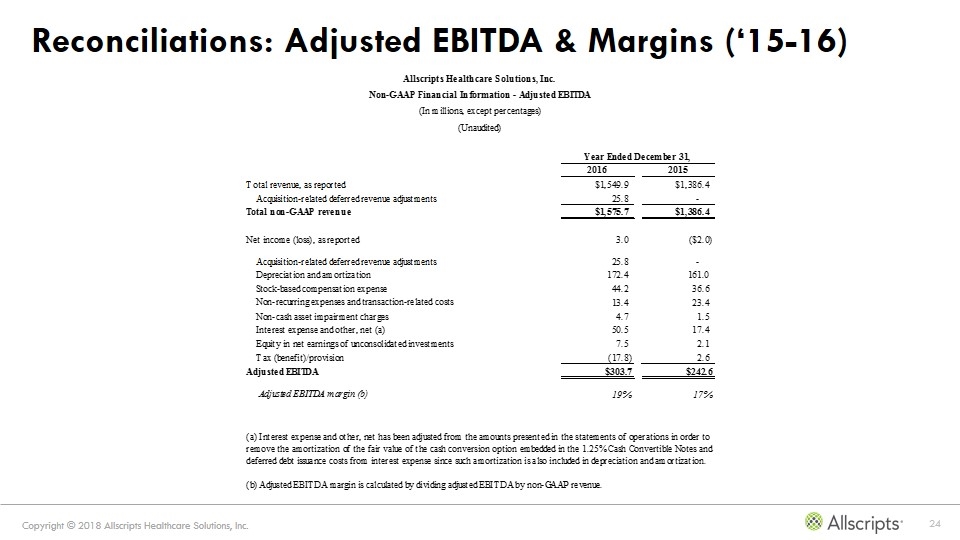

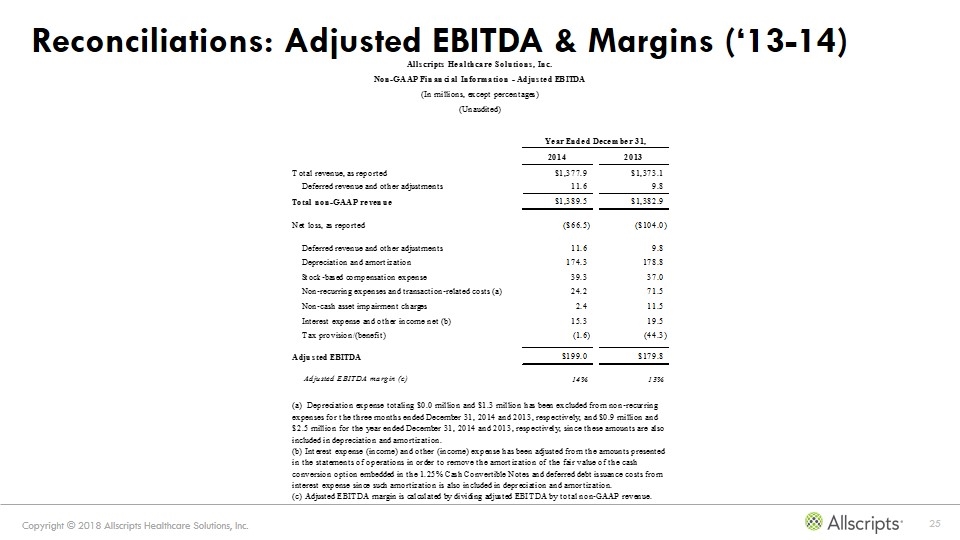

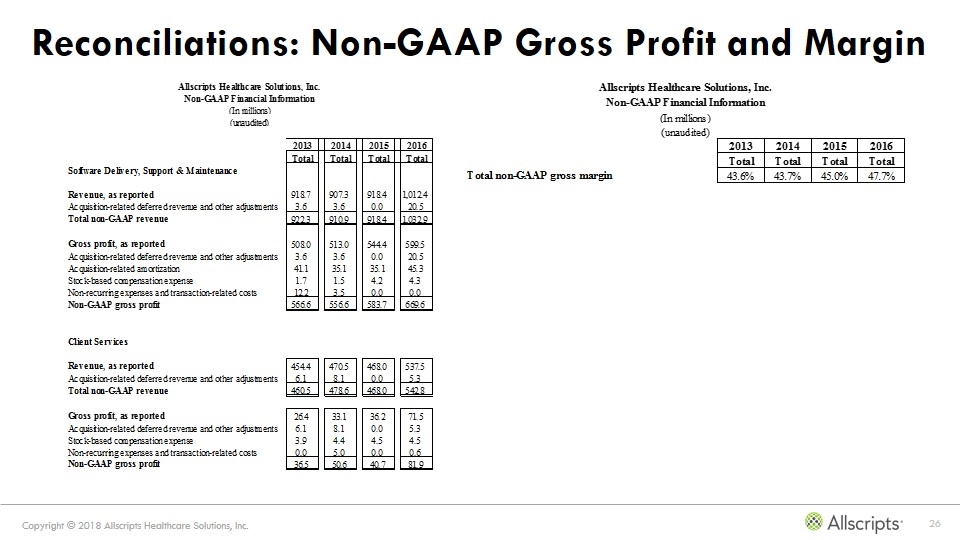

Non-GAAP Financial Measures This presentation includes references to non-GAAP revenue, gross profit, gross margin, and Adjusted EBITDA, which are considered non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. Each of these measures adjusts for certain items and are not considered financial measures under generally accepted accounting principles in the United States (“GAAP”). Non-GAAP revenue consists of GAAP revenue and adds back deferred revenue from the Netsmart transaction that is eliminated for GAAP purposes due to purchase accounting adjustments. Non-GAAP gross profit consists of GAAP gross profit, as reported, and excludes acquisition-related deferred revenue adjustments, acquisition-related amortization, stock-based compensation expense and transaction-related and other costs. Non-GAAP gross margin consists of non-GAAP gross profit as a percentage of GAAP revenue in the applicable period, as defined above. Adjusted EBITDA is a non-GAAP measure and consists of GAAP net income (loss) as reported and adjusts for: acquisition-related deferred revenue adjustments; depreciation and amortization; stock-based compensation expense; transaction-related and other costs; non-cash asset impairment charges; interest expense and other, net; equity in net earnings of unconsolidated investments; and tax provision (benefit). Management also believes that non-GAAP measures provide useful supplemental information to management and investors regarding the underlying performance of Allscripts business operations. Acquisition accounting adjustments made in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments provided and discussed herein. Management also uses this information internally for forecasting and budgeting, as it believes that these measures are indicative of core operating results. In addition, management may use non-GAAP measures to measure achievement under Allscripts stock and cash incentive compensation plans. Note, however, that non-GAAP revenue, gross profit, and gross margin are performance measures only, and they do not provide any measure of cash flow or liquidity. Non-GAAP financial measures are not in accordance with, or an alternative for, measures of financial performance prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Allscripts results of operations as determined in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures with GAAP financial measures contained in the Appendix to this presentation. For the purpose of providing financial guidance, the company does not reconcile non-GAAP revenue, non-GAAP earnings, Adjusted net EBITDA or non-GAAP earnings per share guidance to the corresponding GAAP financial measures. Allscripts does not provide guidance for the various reconciling items since certain items that impact GAAP revenue and net income are either outside of its control and/or cannot be reasonably predicted. These are available on Allscripts investor relations website (http://www.investor.Allscripts.com).

Investment Considerations Allscripts offers a robust and diversified solutions portfolio Supported by a high recurring revenue model Significant operating leverage Double digit non-GAAP earnings growth and strong free cash flow Secular shift to value-based care drives global investment in IT We enable providers to optimize value at the point of care

A Global Leader in Healthcare Technology NASDAQ: MDRX Public since 1999 Global HQ: Chicago, IL Non-GAAP Revenue1: ~$2.2B ~77% recurring Our Team ~8,900 team associates globally Veteran executive leadership Clients, team members in 13 countries incl. Australia, Canada, Israel & UK Our Company 1Annualized 2017 non-GAAP revenue based on mid-point of calculated Q4 2017 guidance, multiplied by four, to arrive at full year revenue (to be inclusive of the Enterprise Information Solutions business) plus pro forma Practice Fusion

Electronic Health Record The power of Allscripts EHRs extends across the continuum, connecting healthcare communities. Precision Medicine & Consumer Solutions Integrated, actionable genomic information delivered directly into clinical workflow. Financial Management Management and operational efficiency. Population Health Management CareInMotion™ addresses every element of the population health equation. A Complete and Diverse Portfolio

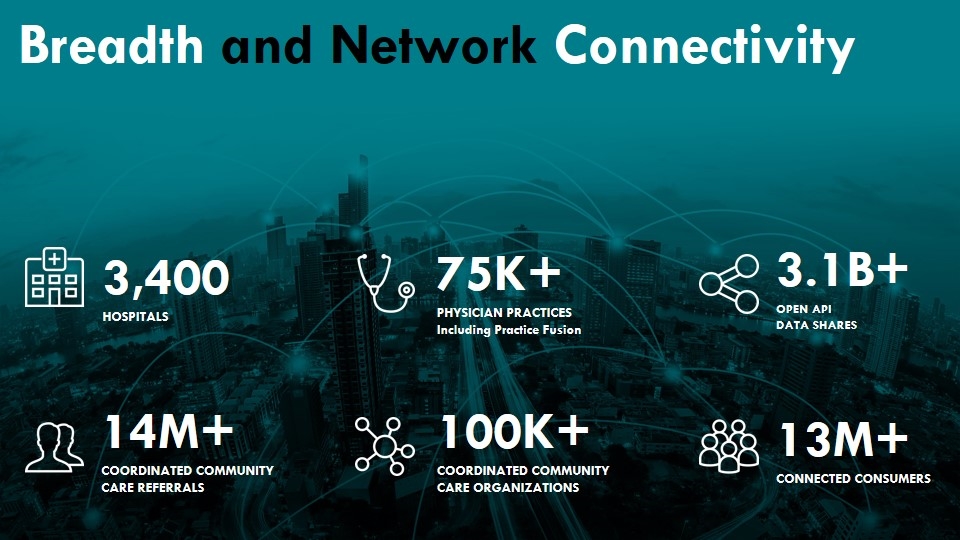

Breadth and Network Connectivity 75K+ PHYSICIAN PRACTICES Including Practice Fusion 3,400 HOSPITALS 13M+ CONNECTED CONSUMERS 100K+ COORDINATED COMMUNITY CARE ORGANIZATIONS 14M+ COORDINATED COMMUNITY CARE REFERRALS 3.1B+ OPEN API DATA SHARES

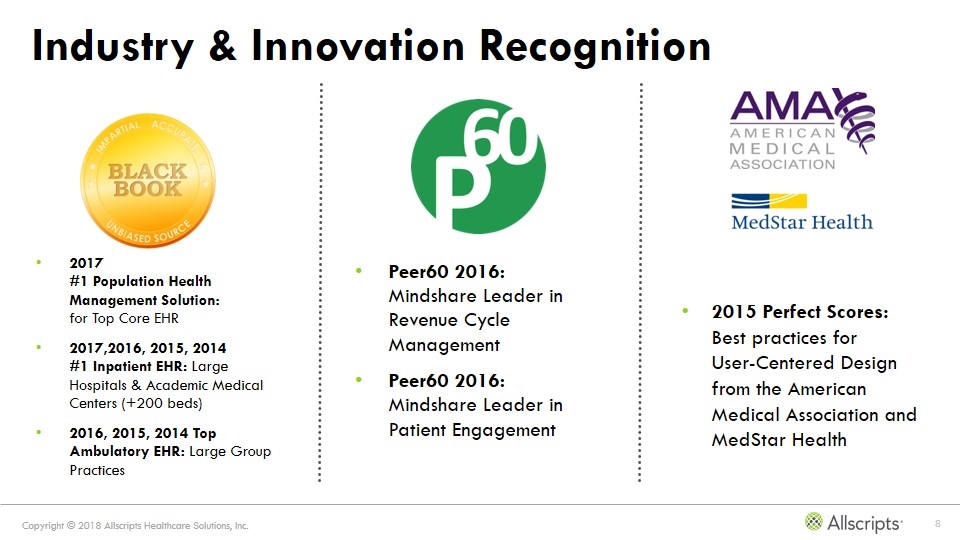

Industry & Innovation Recognition 2017 #1 Population Health Management Solution: for Top Core EHR 2017,2016, 2015, 2014 #1 Inpatient EHR: Large Hospitals & Academic Medical Centers (+200 beds) 2016, 2015, 2014 Top Ambulatory EHR: Large Group Practices 2015 Perfect Scores: Best practices for User-Centered Design from the American Medical Association and MedStar Health Peer60 2016: Mindshare Leader in Revenue Cycle Management Peer60 2016: Mindshare Leader in Patient Engagement

Growth Opportunity

Future Growth Streams Our unique growth opportunities—unmatched by any HIT provider Growth as an industry consolidator Post-acute growth Organic growth in traditional markets

Organic growth in traditional healthcare Recurring Services Professional Services Hosting Managed Services Revenue Cycle Management Services Value-based Care Tools Connects & aggregates community data to create harmonized view of patient Care coordination sets clinical interventions into action Financial performance management & decision support Precision Medicine Comprehensive solutions including risk analytics, content and service offerings Global Markets Outstanding reputation and presence in English speaking countries Leverage single Sunrise™ platform Complete solution: clinical/financial + value-based care U.K., Australia, others lag in healthcare digital automation

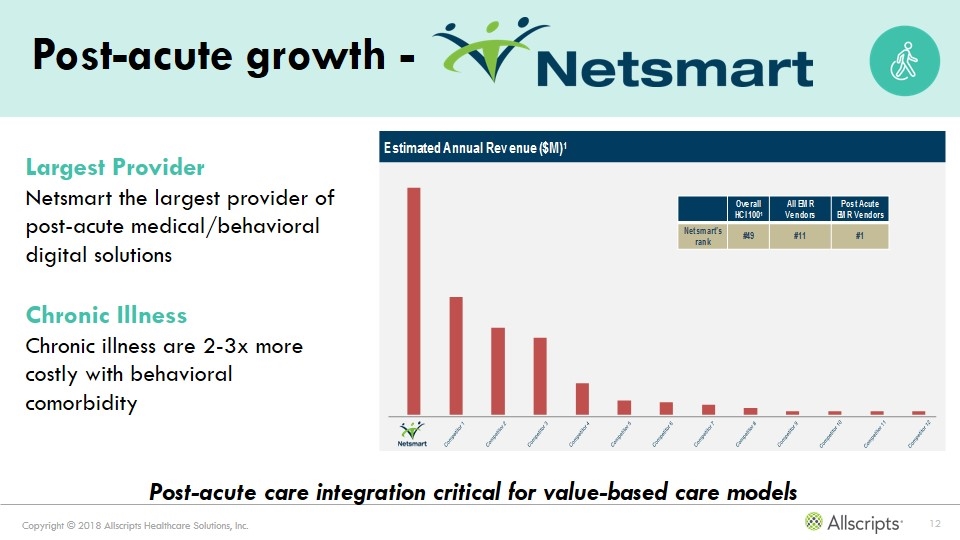

Post-acute growth - Largest Provider Netsmart the largest provider of post-acute medical/behavioral digital solutions Chronic Illness Chronic illness are 2-3x more costly with behavioral comorbidity Post-acute care integration critical for value-based care models

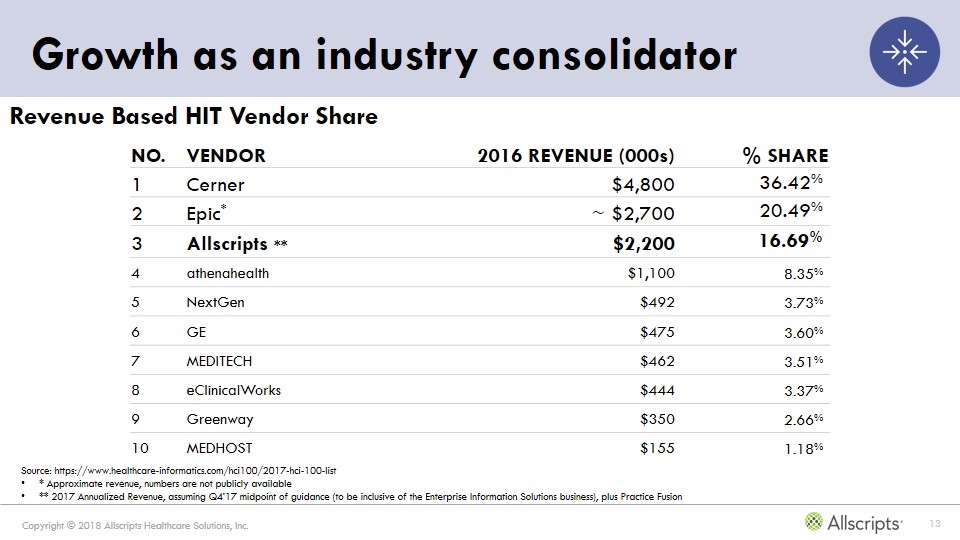

Growth as an industry consolidator Revenue Based HIT Vendor Share Source: https://www.healthcare-informatics.com/hci100/2017-hci-100-list * Approximate revenue, numbers are not publicly available ** 2017 Annualized Revenue, assuming Q4’17 midpoint of guidance (to be inclusive of the Enterprise Information Solutions business), plus Practice Fusion NO. VENDOR 2016 REVENUE (000s) % SHARE 1 Cerner $4,800 36.42% 2 Epic* ~ $2,700 20.49% 3 Allscripts ** $2,200 16.69% 4 athenahealth $1,100 8.35% 5 NextGen $492 3.73% 6 GE $475 3.60% 7 MEDITECH $462 3.51% 8 eClinicalWorks $444 3.37% 9 Greenway $350 2.66% 10 MEDHOST $155 1.18%

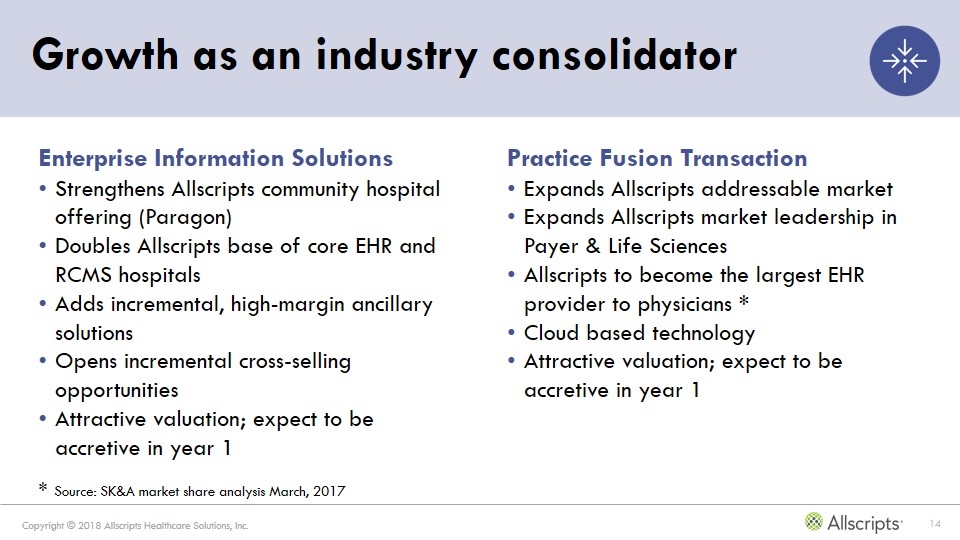

Growth as an industry consolidator Enterprise Information Solutions Strengthens Allscripts community hospital offering (Paragon) Doubles Allscripts base of core EHR and RCMS hospitals Adds incremental, high-margin ancillary solutions Opens incremental cross-selling opportunities Attractive valuation; expect to be accretive in year 1 Practice Fusion Transaction Expands Allscripts addressable market Expands Allscripts market leadership in Payer & Life Sciences Allscripts to become the largest EHR provider to physicians * Cloud based technology Attractive valuation; expect to be accretive in year 1 * Source: SK&A market share analysis March, 2017

Financial Model

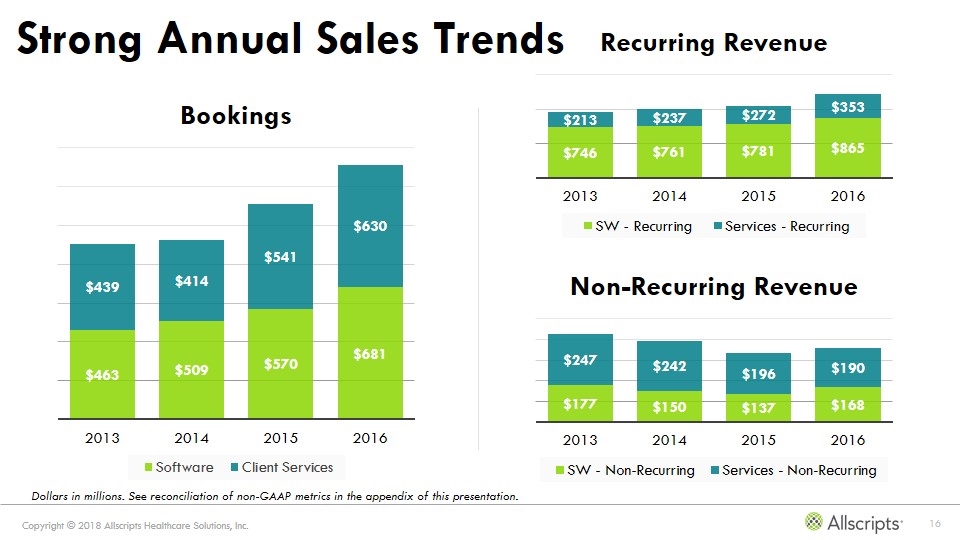

Strong Annual Sales Trends Dollars in millions. See reconciliation of non-GAAP metrics in the appendix of this presentation.

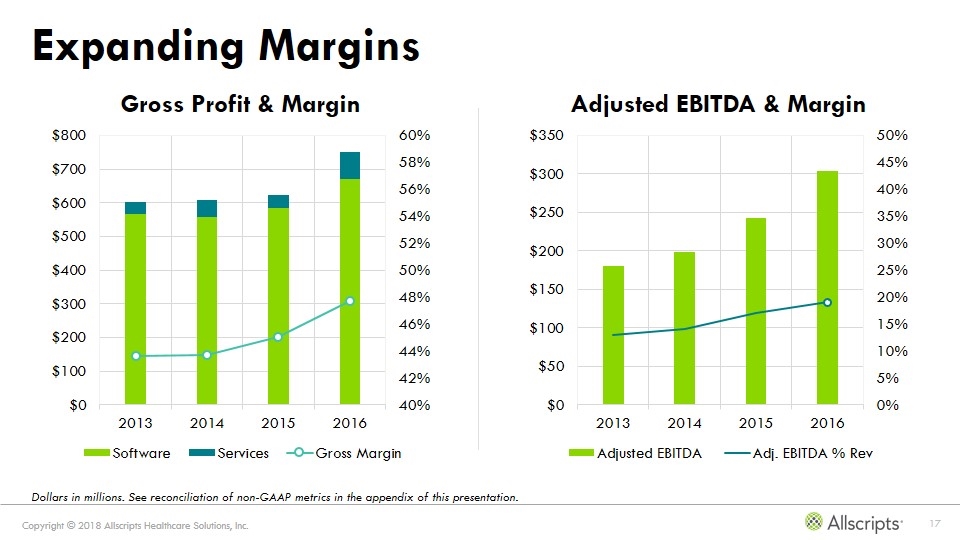

Expanding Margins Dollars in millions. See reconciliation of non-GAAP metrics in the appendix of this presentation.

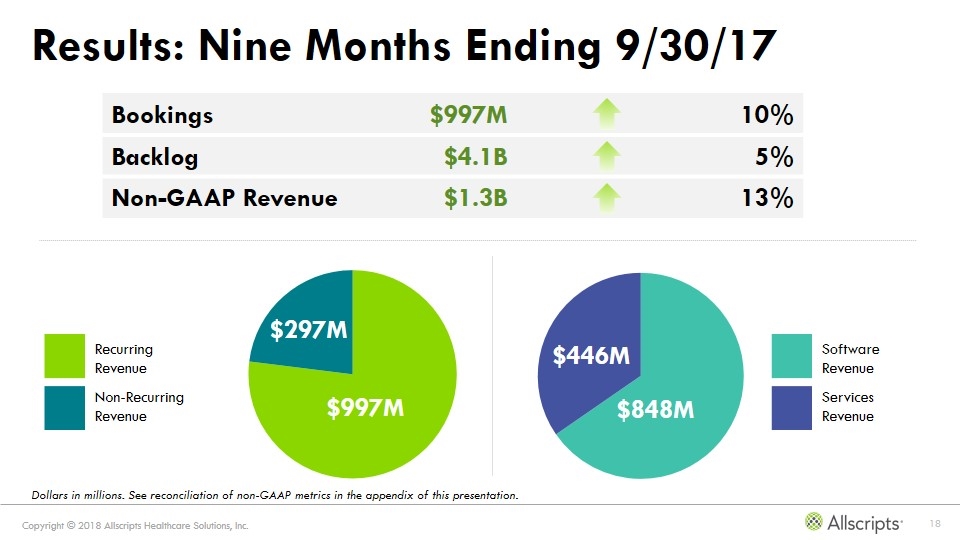

Results: Nine Months Ending 9/30/17 Bookings $997M 10% Backlog $4.1B 5% Non-GAAP Revenue $1.3B 13% $997M $297M Recurring Revenue Non-Recurring Revenue Software Revenue Services Revenue $446M $848M Dollars in millions. See reconciliation of non-GAAP metrics in the appendix of this presentation.

Strong Cash Generation Enabling Balanced Approach to Value Creation Invest to accelerate growth Continue to innovate across our growth pillars Gross R&D spend +15% 9.30.17 YTD 2017 ~16% of non-GAAP revenue1 M&A Broaden portfolio with opportunistic M&A Enterprise Information Solutions (new core segment – small hospitals) Practice Fusion (expand addressable market) Core Medical Solutions (global – new geography) Careport (value-based care innovation) Share repurchase $176M remaining under current authorization through 2019 In 2016, repurchases totaled $121M 2017 YTD (through 9.30.17) repurchased 1.0 million shares for $12.1 million Maintain balance sheet flexibility 1Annualized 2017 non-GAAP revenue based on mid-point of calculated Q4 2017 guidance, multiplied by four, to arrive at full year revenue (to be inclusive of the Enterprise Information Solutions business) plus pro forma Practice Fusion

Affirming 2017 Outlook: Non-GAAP revenue at high end of $1.79 billion and $1.82 billion Adjusted EBITDA at high end of $345 million and $365 million, consisting of: Non-GAAP earnings per share growth of between 10 to 15 percent ($0.61-$0.63) Note: Based on original disclosure of November 2, 2017.

Allscripts Healthcare Solutions Investor Presentation J.P. Morgan 2018 Healthcare Conference | January 9, 2018

Appendix: Non-GAAP Reconciliations

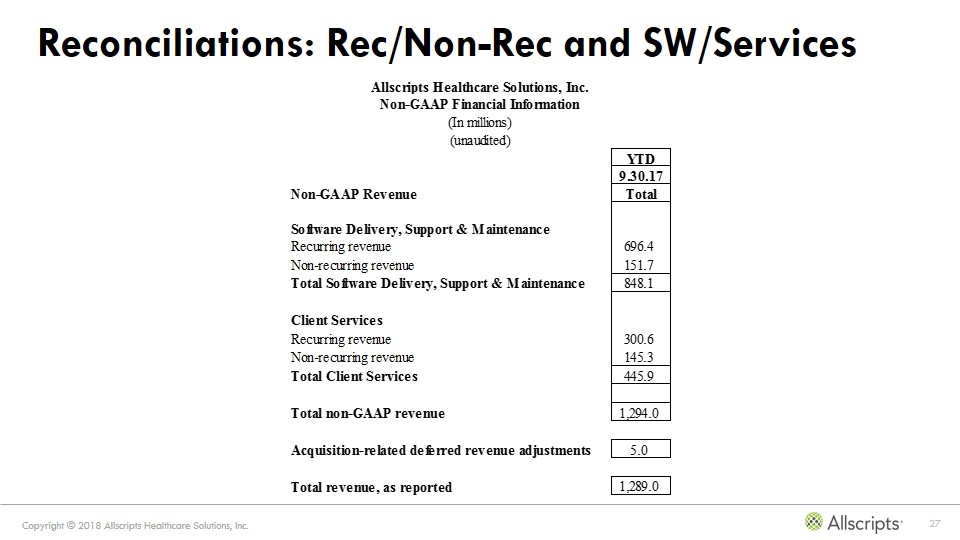

Reconciliations: Rec/Non-Rec and SW/Services

Reconciliations: Adjusted EBITDA & Margins (‘15-16)

Reconciliations: Adjusted EBITDA & Margins (‘13-14)

Reconciliations: Non-GAAP Gross Profit and Margin

Reconciliations: Rec/Non-Rec and SW/Services