Attached files

| file | filename |

|---|---|

| 8-K - 8-K JPM INVESTOR MEETINGS - REVA Medical, Inc. | rva-8k_20180108.htm |

REVA Medical Corporate Presentation January 2018 ©2017 REVA Medical CC100021 Rev. D Exhibit 99.1

Important Notice Not an Offer for Securities This presentation does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in the Company nor does it constitute financial product advice nor take into account your investment objectives, taxation situation, financial situation or needs. An investor must not act on the basis of any matter contained in this presentation but must make its own assessment of the Company and conduct its own investigations and analysis. Information is a Synopsis Only This presentation only contains a synopsis of information on the Company and, accordingly, no reliance may be placed for any purpose whatsoever on the sufficiency or completeness of such information. Information presented in this presentation is subject to change without notice and REVA does not have any responsibility or obligation to inform you of any matter arising or coming to their notice after the date of this presentation, which may affect any matter in the presentation. Forward-Looking Statements This presentation contains or may contain forward-looking statements that are based on management's beliefs, assumptions and expectations and on information currently available to management. All statements that are not statements of historical fact, including those statements that address future operating performance and events or developments that we expect or anticipate will occur in the future, are forward-looking statements, such as those statements regarding the projections and timing surrounding our plans to commence commercial operations and sell products, conduct clinical trials, develop pipeline products, incur losses from operations, list our securities for sale on a U.S. stock exchange, and assess and obtain future financings for operating and capital requirements. Readers should not place undue reliance on forward-looking statements. Although management believes forward-looking statements are reasonable as and when made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to vary materially from those expressed in forward-looking statements, including the risks and uncertainties that are described in the "Risk Factors" section of our Annual Report on Form 10-K filed with the US Securities and Exchange Commission (the “SEC”) on February 28, 2017, and as may be updated in our periodic reports thereafter. Any forward-looking statements in this presentation speak only as of the date when made. REVA does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Disclaimer This presentation and any supplemental materials have been prepared by the Company based on available information. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of such information and opinions and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of the Company, or any of its members, directors, officers, employees, or agents or advisers, nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of the Company or any of its directors, officers, employees, or agents. Fantom, Fantom Encore, and Tyrocore are trademarks of REVA Medical, Inc.

REVA Medical is a leader in bioresorbable polymer technologies for vascular applications Launching a proprietary product for Coronary Artery Disease and pursuing Peripheral Artery Disease therapies

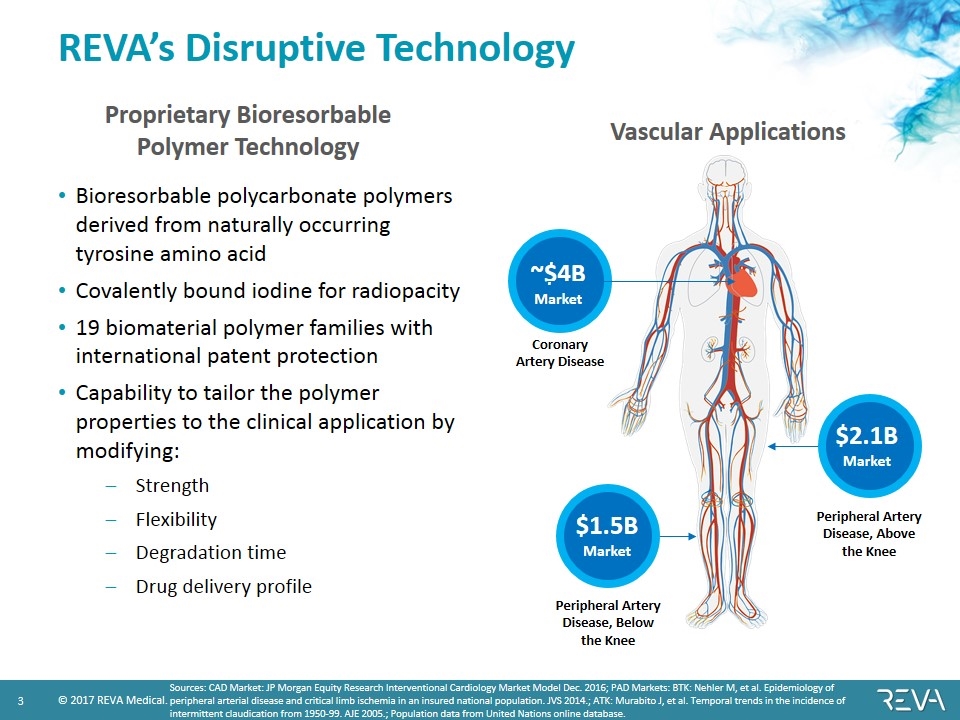

REVA’s Disruptive Technology Proprietary Bioresorbable Polymer Technology Bioresorbable polycarbonate polymers derived from naturally occurring tyrosine amino acid Covalently bound iodine for radiopacity 19 biomaterial polymer families with international patent protection Capability to tailor the polymer properties to the clinical application by modifying: Strength Flexibility Degradation time Drug delivery profile ~$4B Market $1.5B Market $2.1B Market Vascular Applications Coronary Artery Disease Peripheral Artery Disease, Above the Knee Peripheral Artery Disease, Below the Knee Sources: CAD Market: JP Morgan Equity Research Interventional Cardiology Market Model Dec. 2016; PAD Markets: BTK: Nehler M, et al. Epidemiology of peripheral arterial disease and critical limb ischemia in an insured national population. JVS 2014.; ATK: Murabito J, et al. Temporal trends in the incidence of intermittent claudication from 1950-99. AJE 2005.; Population data from United Nations online database.

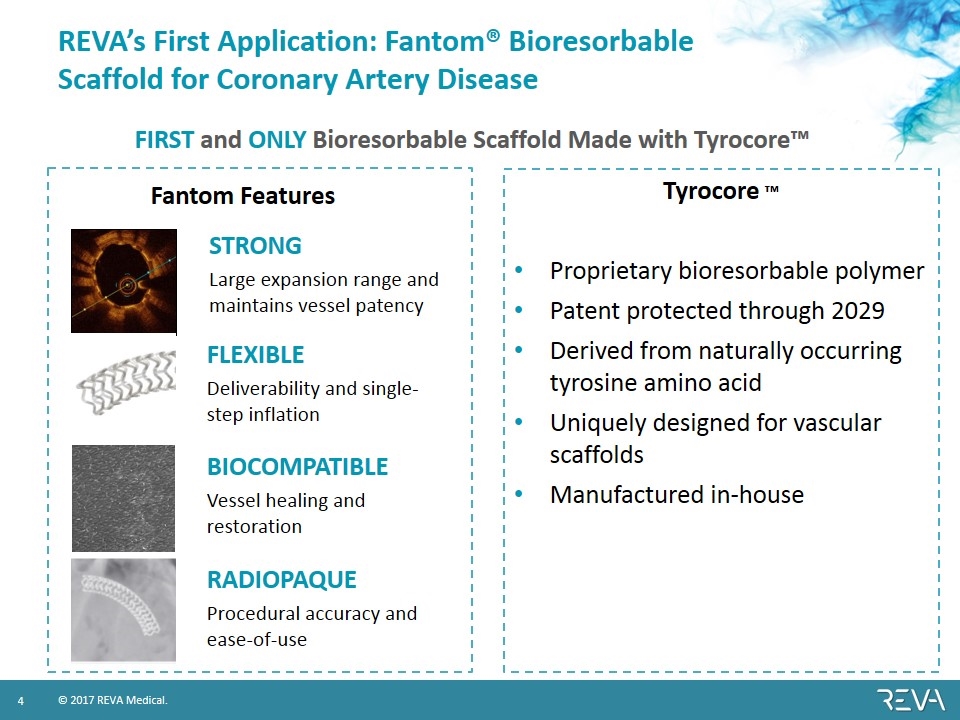

REVA’s First Application: Fantom® Bioresorbable Scaffold for Coronary Artery Disease Tyrocore ™ Proprietary bioresorbable polymer Patent protected through 2029 Derived from naturally occurring tyrosine amino acid Uniquely designed for vascular scaffolds Manufactured in-house STRONG Large expansion range and maintains vessel patency FLEXIBLE Deliverability and single-step inflation RADIOPAQUE Procedural accuracy and ease-of-use BIOCOMPATIBLE Vessel healing and restoration FIRST and ONLY Bioresorbable Scaffold Made with Tyrocore™ Fantom Features

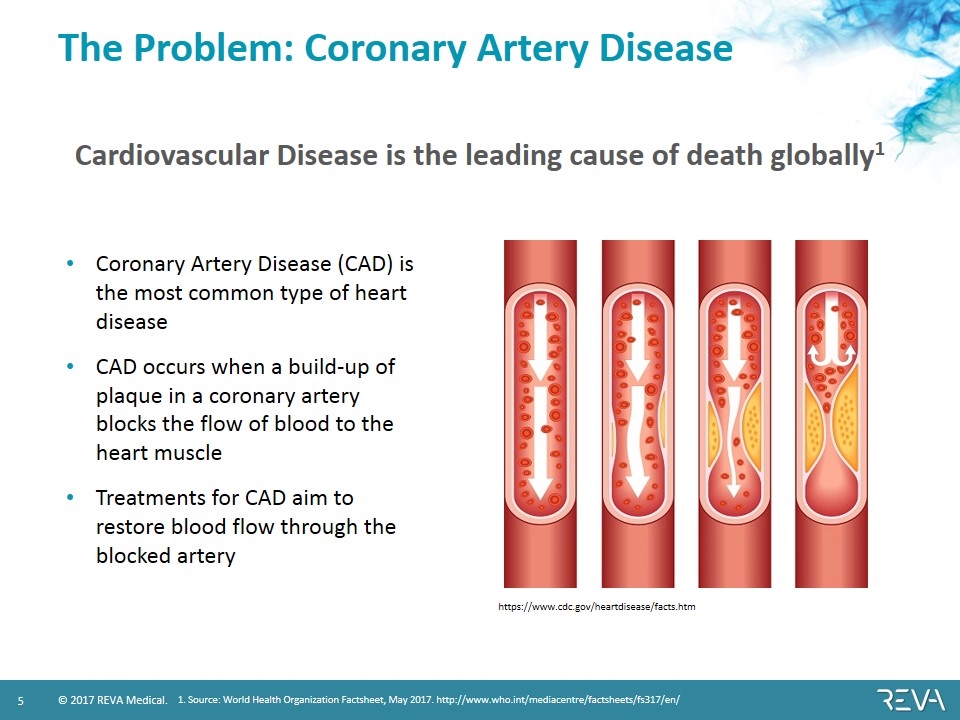

The Problem: Coronary Artery Disease Cardiovascular Disease is the leading cause of death globally1 1. Source: World Health Organization Factsheet, May 2017. http://www.who.int/mediacentre/factsheets/fs317/en/ https://www.cdc.gov/heartdisease/facts.htm Coronary Artery Disease (CAD) is the most common type of heart disease CAD occurs when a build-up of plaque in a coronary artery blocks the flow of blood to the heart muscle Treatments for CAD aim to restore blood flow through the blocked artery

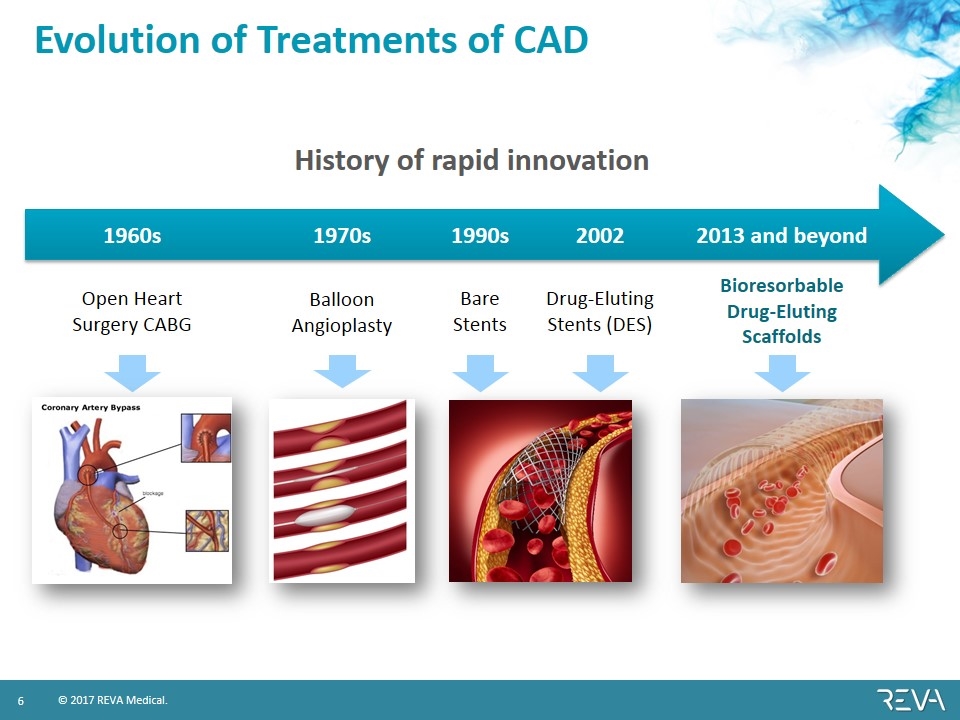

Evolution of Treatments of CAD Open Heart Surgery CABG 1960s Bioresorbable Drug-Eluting Scaffolds 2013 and beyond Balloon Angioplasty 1970s Bare Stents 1990s 2002 Drug-Eluting Stents (DES) History of rapid innovation

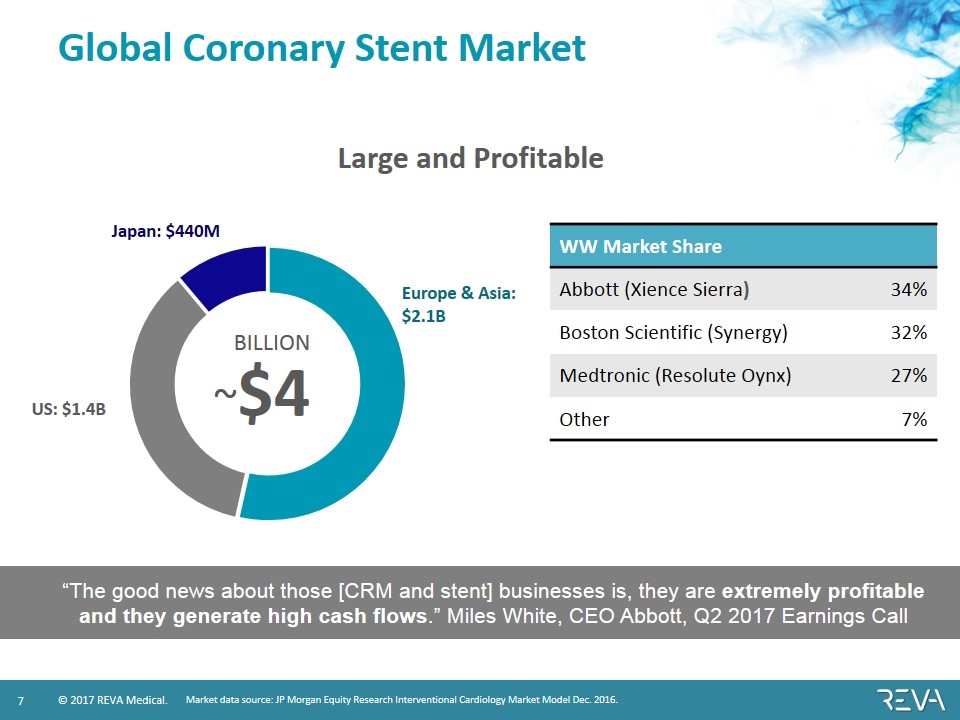

Global Coronary Stent Market WW Market Share Abbott (Xience Sierra) 34% Boston Scientific (Synergy) 32% Medtronic (Resolute Oynx) 27% Other 7% Market data source: JP Morgan Equity Research Interventional Cardiology Market Model Dec. 2016. ~$4 BILLION US: $1.4B Japan: $440M Europe & Asia: $2.1B Large and Profitable “The good news about those [CRM and stent] businesses is, they are extremely profitable and they generate high cash flows.” Miles White, CEO Abbott, Q2 2017 Earnings Call

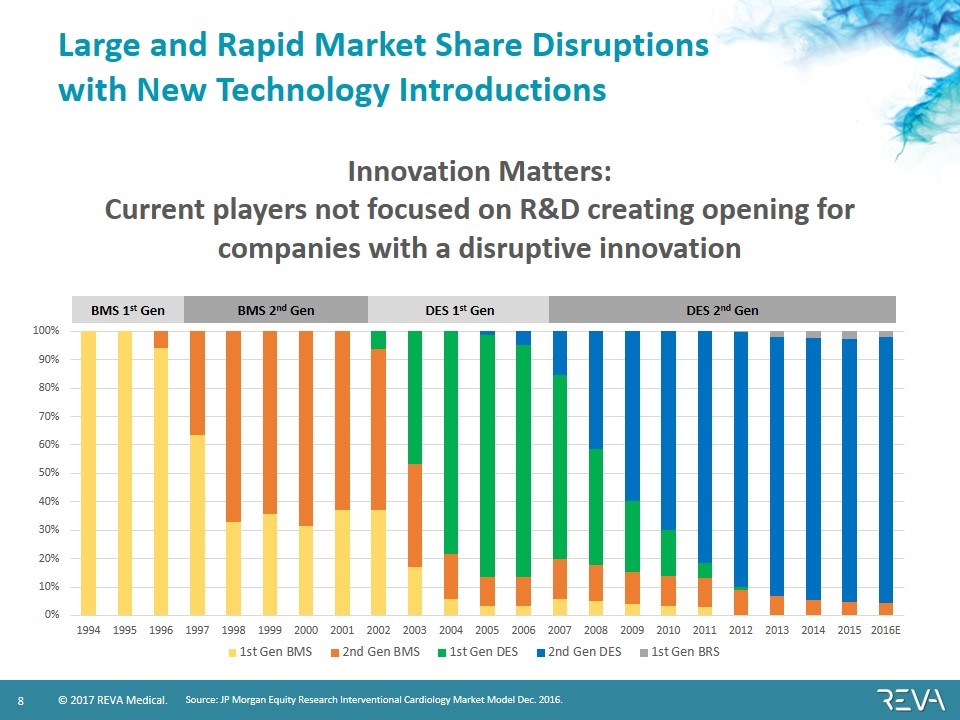

Large and Rapid Market Share Disruptions with New Technology Introductions Source: JP Morgan Equity Research Interventional Cardiology Market Model Dec. 2016. BMS 1st Gen BMS 2nd Gen DES 1st Gen DES 2nd Gen Innovation Matters: Current players not focused on R&D creating opening for companies with a disruptive innovation

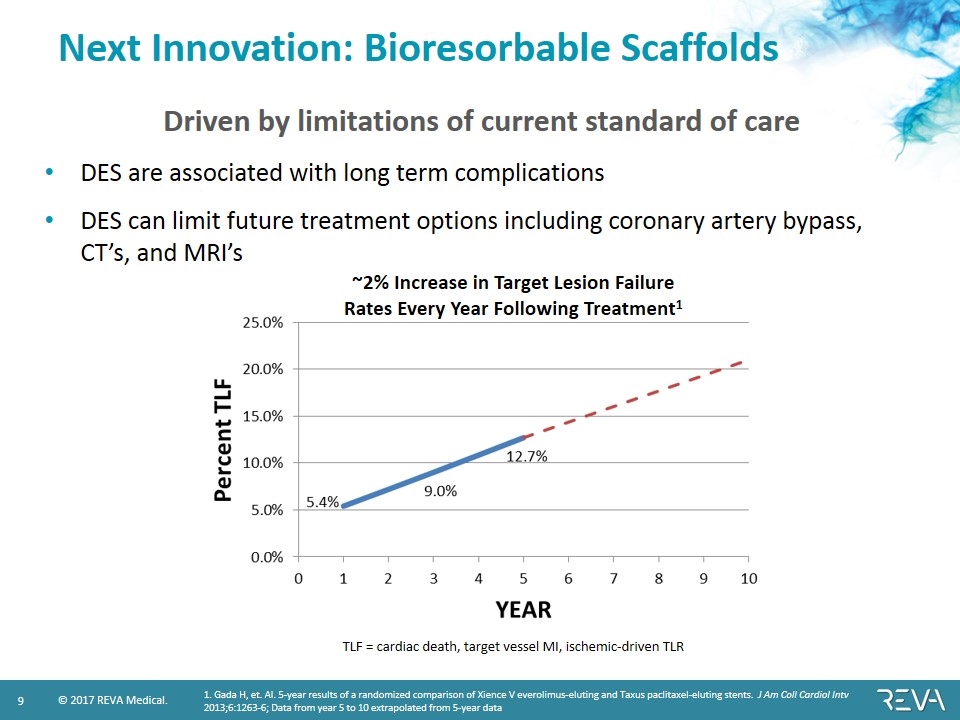

Next Innovation: Bioresorbable Scaffolds 1. Gada H, et. Al. 5-year results of a randomized comparison of Xience V everolimus-eluting and Taxus paclitaxel-eluting stents. J Am Coll Cardiol Intv 2013;6:1263-6; Data from year 5 to 10 extrapolated from 5-year data TLF = cardiac death, target vessel MI, ischemic-driven TLR ~2% Increase in Target Lesion Failure Rates Every Year Following Treatment1 DES are associated with long term complications DES can limit future treatment options including coronary artery bypass, CT’s, and MRI’s Driven by limitations of current standard of care

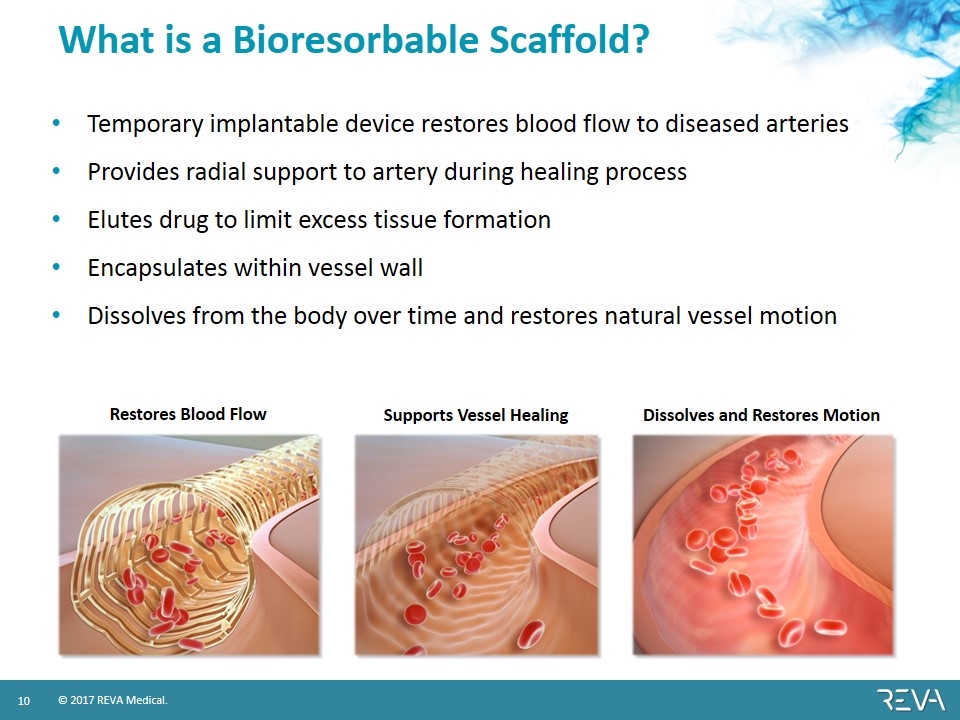

What is a Bioresorbable Scaffold? Temporary implantable device restores blood flow to diseased arteries Provides radial support to artery during healing process Elutes drug to limit excess tissue formation Encapsulates within vessel wall Dissolves from the body over time and restores natural vessel motion Restores Blood Flow Supports Vessel Healing Dissolves and Restores Motion

The Appeal of a Bioresorbable Scaffold Value to Physician and Patient Preserves maximum flexibility for future treatment options (bypass grafting, MRI, CT) Allows artery to return to its natural state to restore freedom of movement May reduce the rate of future clinical events “The ideal of a stent that does its job and disappears is a valuable long-term goal, especially in young patients with long life-expectancy.” EuroPCR 2017 course director Dr. William Wijns “I think it’s not at all inconceivable to think that a better device… …will allow what will hopefully be shown to be long-term advantages of no longer having the permanent metal frame in the vessel…” Gregg Stone, MD, New-York Presbyterian/Columbia University quoted in tctmd.com1 1. Wood, S. New Absorb BVS meta-analysis begs the question: when to stop studying a first-gen device. tctmd.com July 2017.

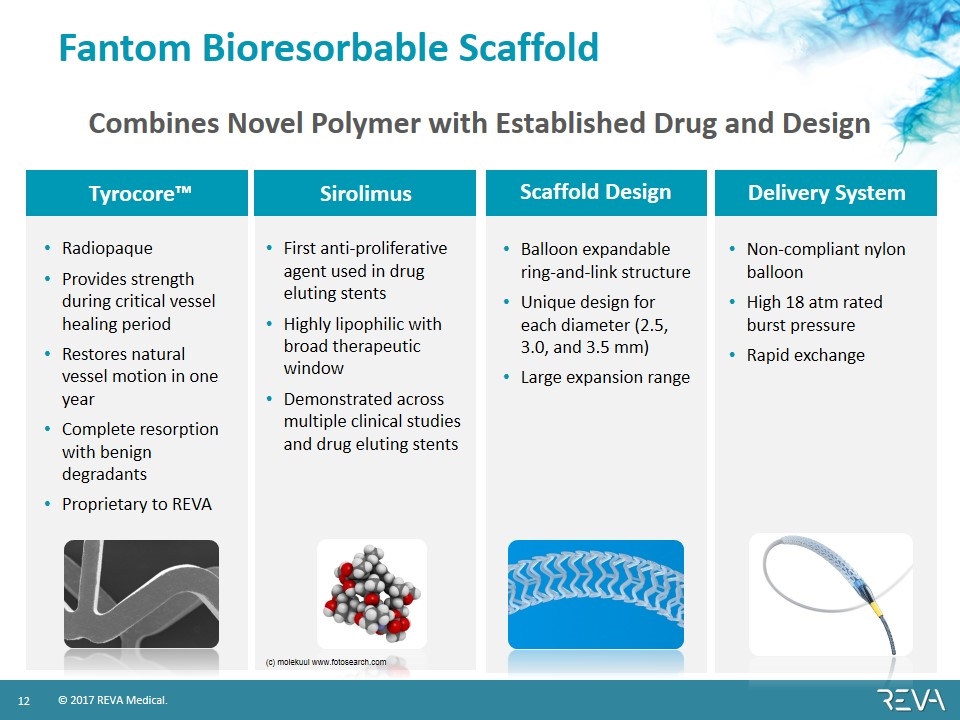

Fantom Bioresorbable Scaffold Tyrocore™ Sirolimus Scaffold Design Delivery System Radiopaque Provides strength during critical vessel healing period Restores natural vessel motion in one year Complete resorption with benign degradants Proprietary to REVA Balloon expandable ring-and-link structure Unique design for each diameter (2.5, 3.0, and 3.5 mm) Large expansion range Non-compliant nylon balloon High 18 atm rated burst pressure Rapid exchange First anti-proliferative agent used in drug eluting stents Highly lipophilic with broad therapeutic window Demonstrated across multiple clinical studies and drug eluting stents (c) molekuul www.fotosearch.com Combines Novel Polymer with Established Drug and Design

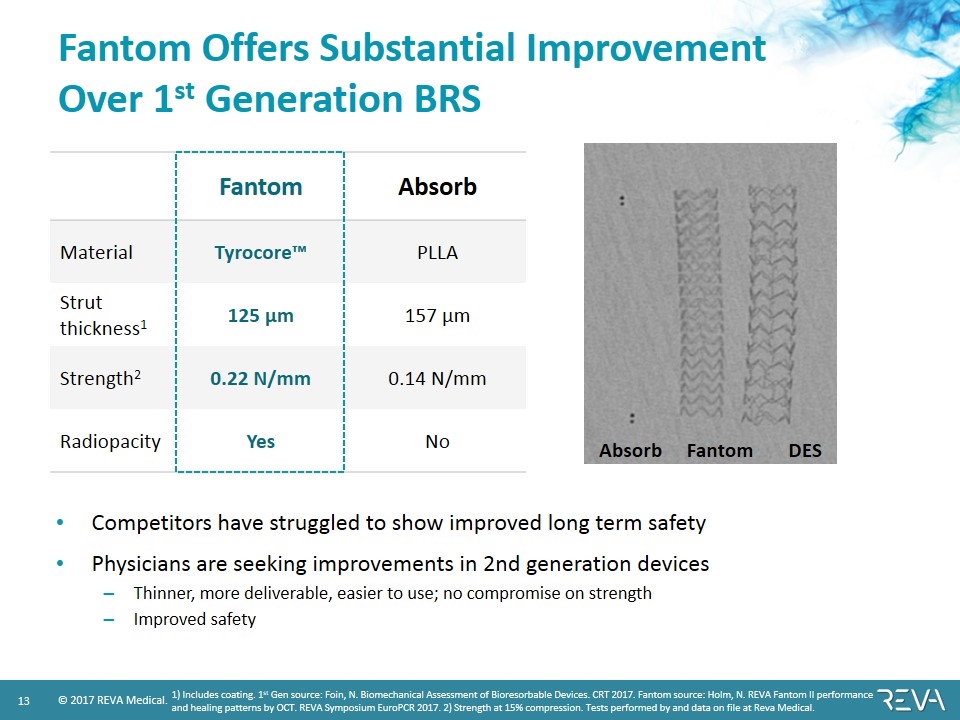

Fantom Offers Substantial Improvement Over 1st Generation BRS Competitors have struggled to show improved long term safety Physicians are seeking improvements in 2nd generation devices Thinner, more deliverable, easier to use; no compromise on strength Improved safety Fantom Absorb Material Tyrocore™ PLLA Strut thickness1 125 µm 157 µm Strength2 0.22 N/mm 0.14 N/mm Radiopacity Yes No 1) Includes coating. 1st Gen source: Foin, N. Biomechanical Assessment of Bioresorbable Devices. CRT 2017. Fantom source: Holm, N. REVA Fantom II performance and healing patterns by OCT. REVA Symposium EuroPCR 2017. 2) Strength at 15% compression. Tests performed by and data on file at Reva Medical. DES Absorb Fantom

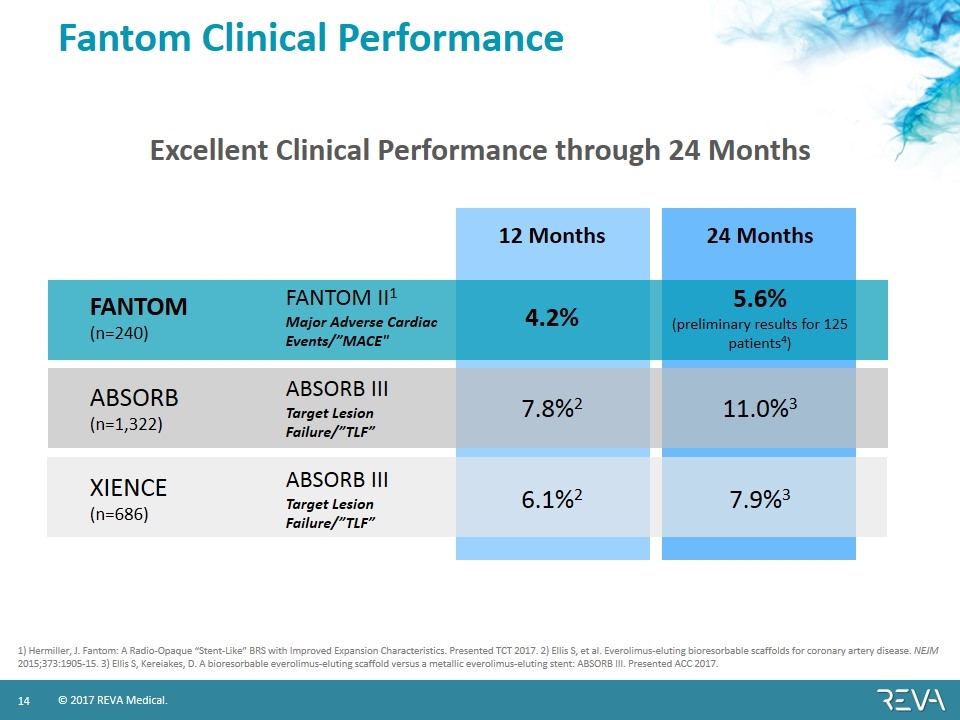

Fantom Clinical Performance 12 Months 24 Months FANTOM (n=240) FANTOM II1 Major Adverse Cardiac Events/”MACE" 4.2% 5.6% (preliminary results for 125 patients4) ABSORB (n=1,322) ABSORB III Target Lesion Failure/”TLF” 7.8%2 11.0%3 XIENCE (n=686) ABSORB III Target Lesion Failure/”TLF” 6.1%2 7.9%3 1) Hermiller, J. Fantom: A Radio-Opaque “Stent-Like” BRS with Improved Expansion Characteristics. Presented TCT 2017. 2) Ellis S, et al. Everolimus-eluting bioresorbable scaffolds for coronary artery disease. NEJM 2015;373:1905-15. 3) Ellis S, Kereiakes, D. A bioresorbable everolimus-eluting scaffold versus a metallic everolimus-eluting stent: ABSORB III. Presented ACC 2017. Excellent Clinical Performance through 24 Months

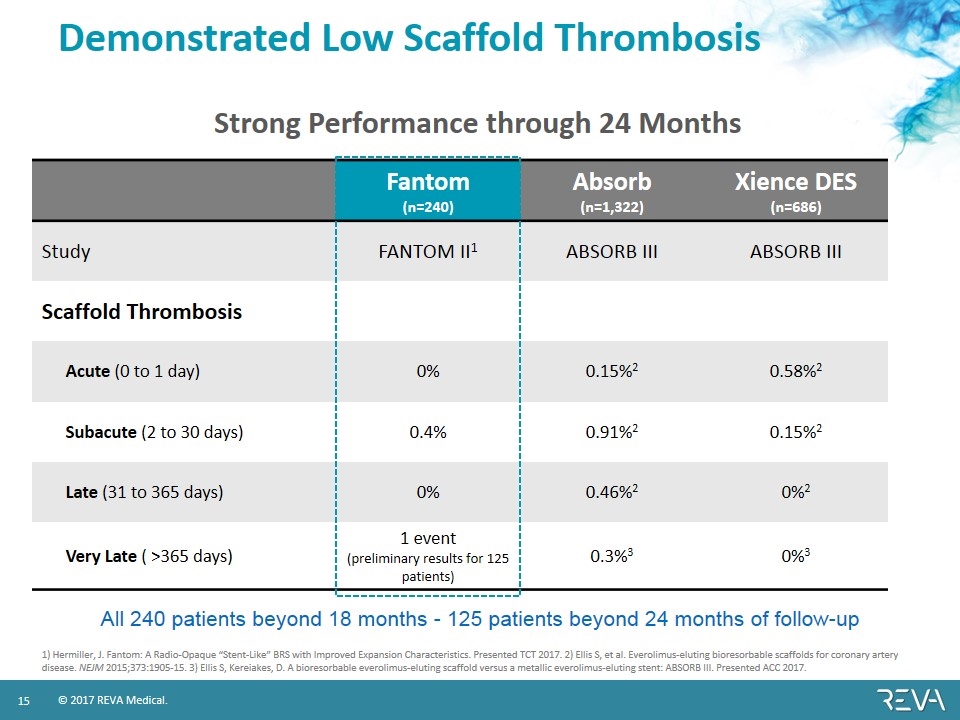

Demonstrated Low Scaffold Thrombosis Fantom (n=240) Absorb (n=1,322) Xience DES (n=686) Study FANTOM II1 ABSORB III ABSORB III Scaffold Thrombosis Acute (0 to 1 day) 0% 0.15%2 0.58%2 Subacute (2 to 30 days) 0.4% 0.91%2 0.15%2 Late (31 to 365 days) 0% 0.46%2 0%2 Very Late ( >365 days) 1 event (preliminary results for 125 patients) 0.3%3 0%3 1) Hermiller, J. Fantom: A Radio-Opaque “Stent-Like” BRS with Improved Expansion Characteristics. Presented TCT 2017. 2) Ellis S, et al. Everolimus-eluting bioresorbable scaffolds for coronary artery disease. NEJM 2015;373:1905-15. 3) Ellis S, Kereiakes, D. A bioresorbable everolimus-eluting scaffold versus a metallic everolimus-eluting stent: ABSORB III. Presented ACC 2017. All 240 patients beyond 18 months - 125 patients beyond 24 months of follow-up Strong Performance through 24 Months

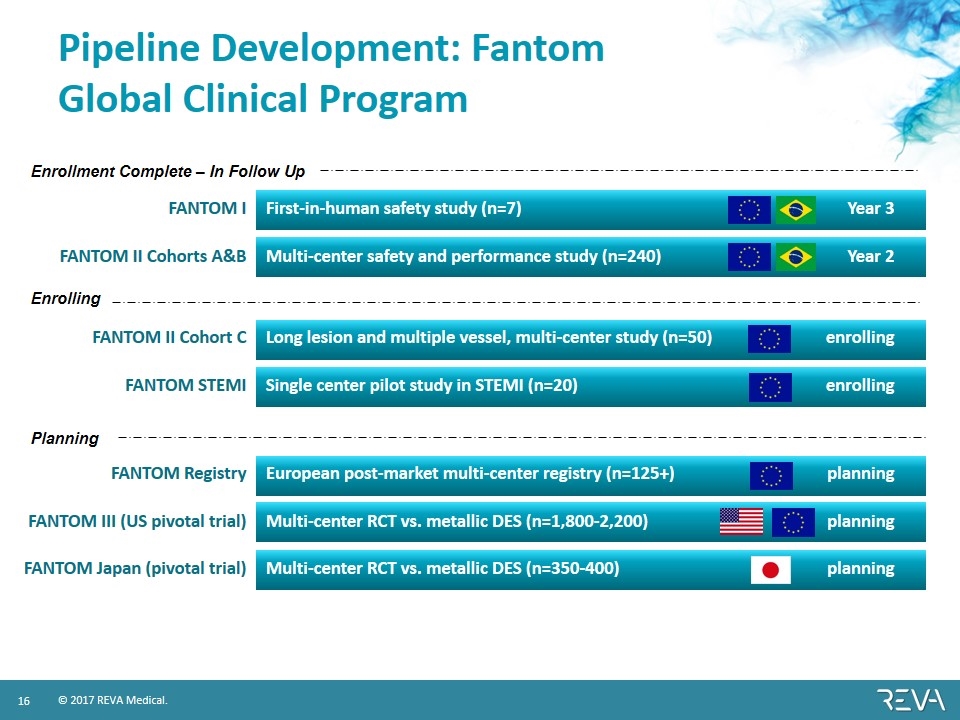

Pipeline Development: Fantom Global Clinical Program FANTOM I First-in-human safety study (n=7) Year 3 FANTOM II Cohorts A&B Multi-center safety and performance study (n=240) Year 2 FANTOM II Cohort C Long lesion and multiple vessel, multi-center study (n=50) enrolling FANTOM STEMI Single center pilot study in STEMI (n=20) enrolling FANTOM Registry European post-market multi-center registry (n=125+) planning FANTOM III (US pivotal trial) Multi-center RCT vs. metallic DES (n=1,800-2,200) planning FANTOM Japan (pivotal trial) Multi-center RCT vs. metallic DES (n=350-400) planning Enrollment Complete – In Follow Up Enrolling Planning

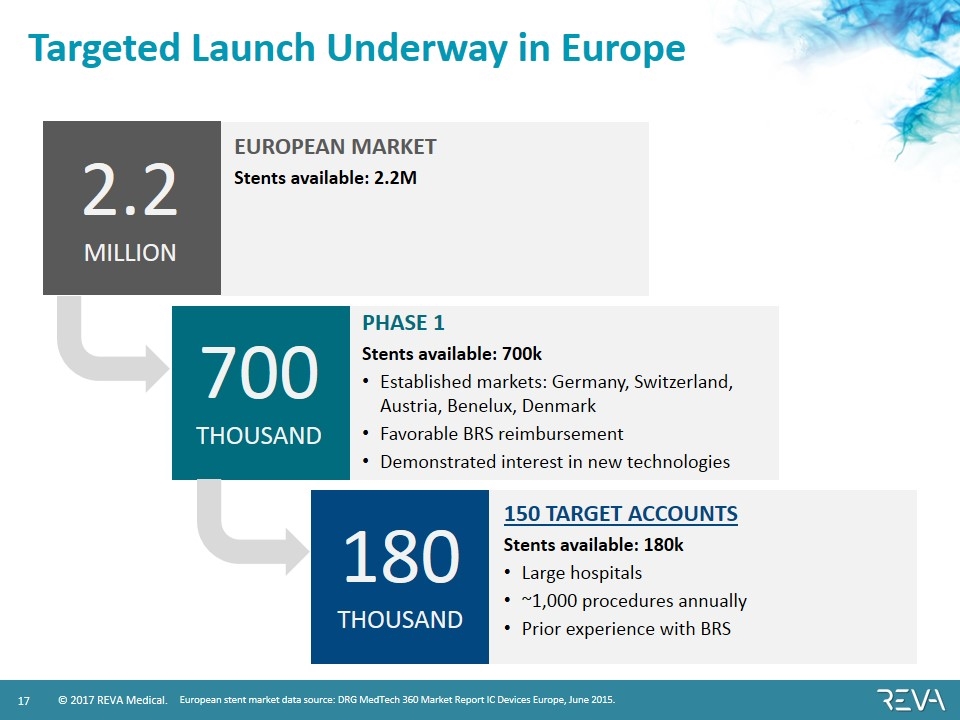

Targeted Launch Underway in Europe PHASE 1 Stents available: 700k Established markets: Germany, Switzerland, Austria, Benelux, Denmark Favorable BRS reimbursement Demonstrated interest in new technologies 150 TARGET ACCOUNTS Stents available: 180k Large hospitals ~1,000 procedures annually Prior experience with BRS European stent market data source: DRG MedTech 360 Market Report IC Devices Europe, June 2015. EUROPEAN MARKET Stents available: 2.2M 2.2 MILLION 700 THOUSAND 180 THOUSAND

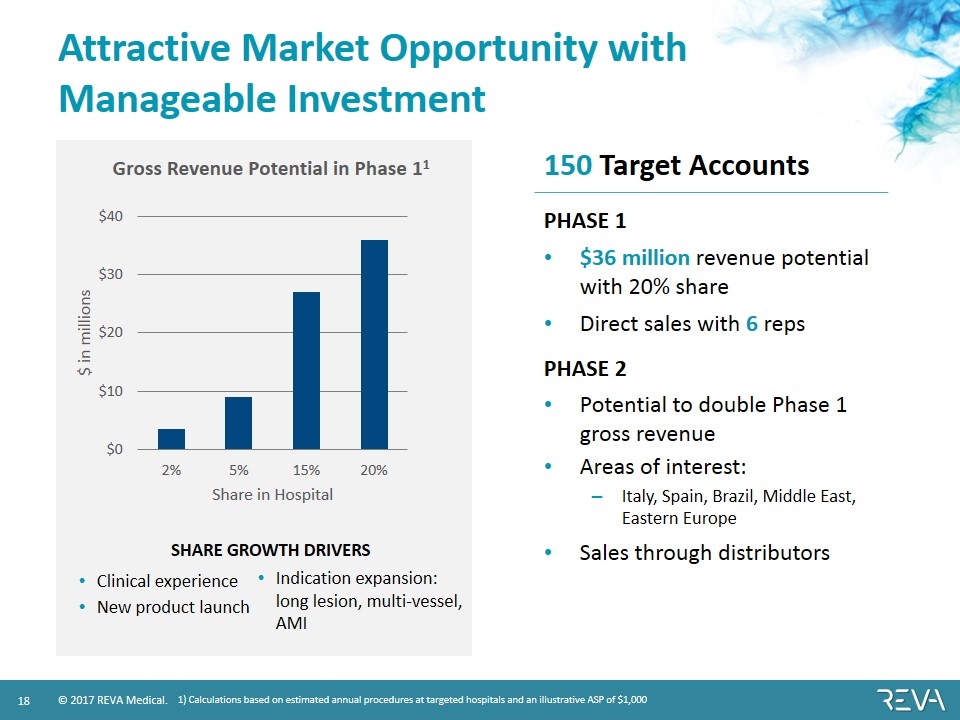

Attractive Market Opportunity with Manageable Investment PHASE 1 $36 million revenue potential with 20% share Direct sales with 6 reps PHASE 2 Potential to double Phase 1 gross revenue Areas of interest: Italy, Spain, Brazil, Middle East, Eastern Europe Sales through distributors 1) Calculations based on estimated annual procedures at targeted hospitals and an illustrative ASP of $1,000 SHARE GROWTH DRIVERS Clinical experience New product launch Indication expansion: long lesion, multi-vessel, AMI 150 Target Accounts

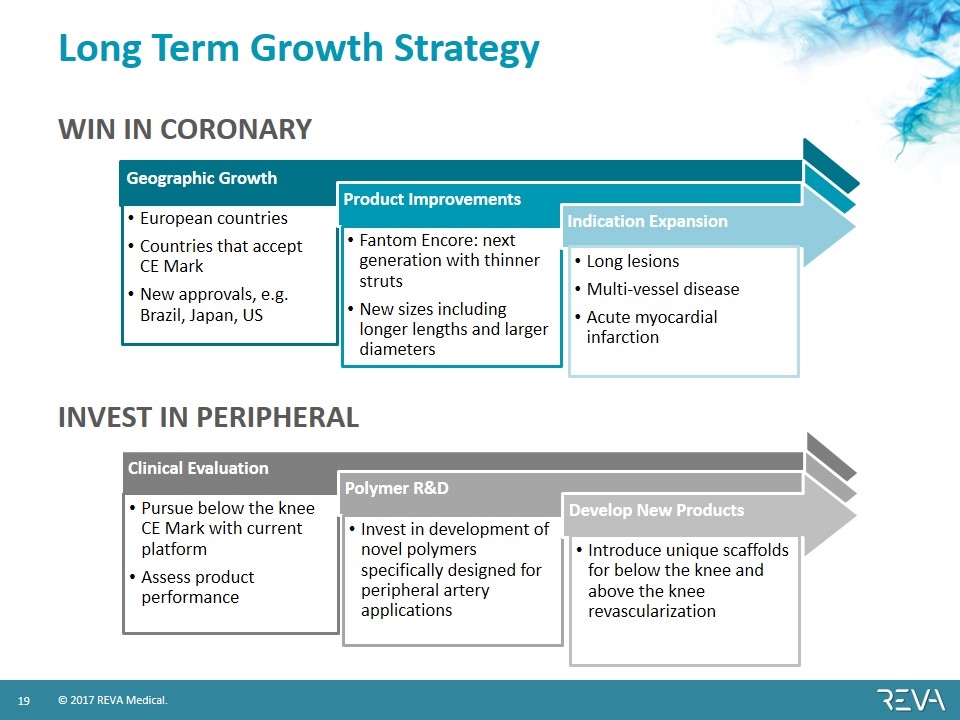

Long Term Growth Strategy WIN IN CORONARY INVEST IN PERIPHERAL Geographic Growth European countries Countries that accept CE Mark New approvals, e.g. Brazil, Japan, US Product Improvements Fantom Encore: next generation with thinner struts New sizes including longer lengths and larger diameters Indication Expansion Long lesions Multi-vessel disease Acute myocardial infarction Clinical Evaluation Pursue below the knee CE Mark with current platform Assess product performance Polymer R&D Invest in development of novel polymers specifically designed for peripheral artery applications Develop New Products Introduce unique scaffolds for below the knee and above the knee revascularization

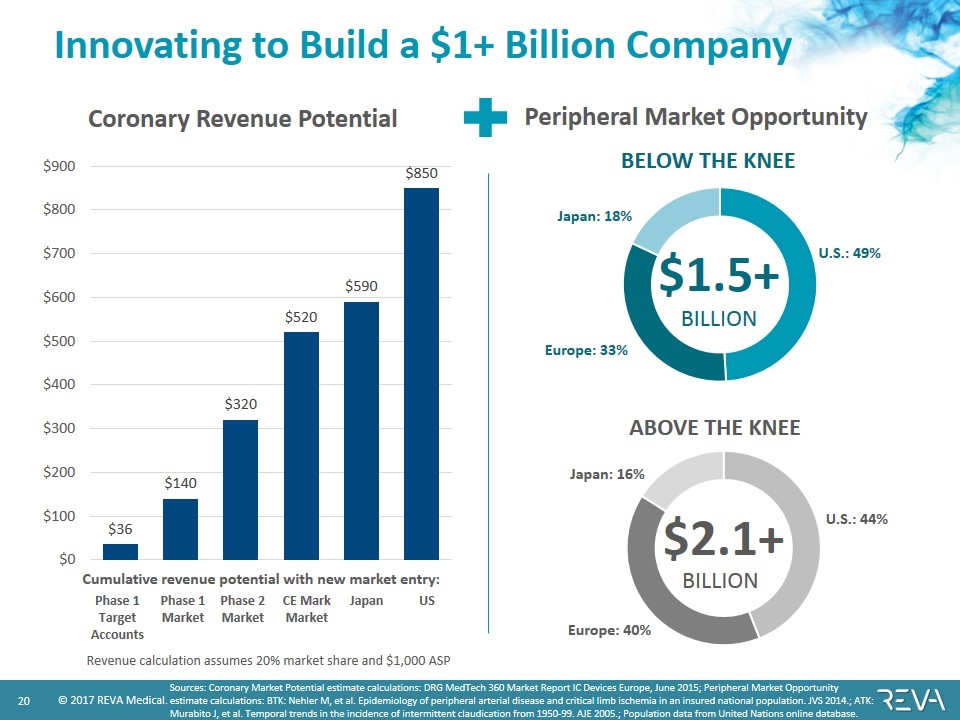

Innovating to Build a $1+ Billion Company Sources: Coronary Market Potential estimate calculations: DRG MedTech 360 Market Report IC Devices Europe, June 2015; Peripheral Market Opportunity estimate calculations: BTK: Nehler M, et al. Epidemiology of peripheral arterial disease and critical limb ischemia in an insured national population. JVS 2014.; ATK: Murabito J, et al. Temporal trends in the incidence of intermittent claudication from 1950-99. AJE 2005.; Population data from United Nations online database. Coronary Revenue Potential Peripheral Market Opportunity $1.5+ BILLION Europe: 33% Japan: 18% U.S.: 49% BELOW THE KNEE $2.1+ BILLION Europe: 40% Japan: 16% U.S.: 44% ABOVE THE KNEE Phase 1 Target Accounts Phase 1 Market Phase 2 Market CE Mark Market Japan US Revenue calculation assumes 20% market share and $1,000 ASP Cumulative revenue potential with new market entry:

Strong IP Portfolio 19 biomaterial polymer families with international patent protection Fantom polymer protected through 2029 Fantom polymer manufacturing developed in-house by REVA Medical and protected as trade secret Patents cover multiple medical applications including vascular scaffolds, embolics, orthopedics, and drug delivery Patents Extending 2029-2034

Experienced Management Team Reggie Groves Chief Executive Officer Brandi Roberts Chief Financial Officer Jeffrey Anderson, SVP, Clinical and Regulatory Affairs Richard Kimes SVP, Operations Carmelo Mastrandrea VP, Europe Joann Yao Sr. Dir., Global Marketing

Upcoming Milestones CLINICAL PROGRAM FANTOM II 24-month data release, H1 2018 Expanded indication acute results, 2018 US IDE study approval, anticipated 2018 PRODUCT DEVELOPMENT CE Mark for Fantom Encore 95 micron 2.5 mm diameter scaffold, H1 2018 Launch Fantom Encore broader matrix, 2018 CE Mark for Fantom in below-the-knee application, 2018

REVA Investment Highlights LARGE, PROFITABLE MARKET DISRUPTIVE TECHNOLOGY Commercializing FANTOM® INNOVATIVE PIPELINE FIRST & ONLY proprietary polymer bioresorbable scaffold for coronary artery disease: Fantom® made with Tyrocore™ ~$4 billion coronary stent market ripe for innovation Proprietary bioresorbable polymer technologies for vascular applications Strong IP Patent protection extending 2029-2034 European launch Q3 2017 Phase 1: Germany, Switzerland, Austria, Benelux, Denmark Phase 2: Geographic expansion anticipated early 2018 CE Mark Fantom Encore anticipated 2018 Multiple opportunities for growth: Product line expansion, geographic growth, and extended indications Peripheral product development below and above the knee SOLID FINANCIAL POSItion Listed on Australian stock exchange in 2010 (ASX: RVA.AX) Cash: $24.1 million1 Mkt Cap: $210 million2 Potential US stock market listing 2018; SEC registered Includes cash, cash equivalents, and investment securities. US dollars as of close November 21, 2017.

o Fantom is not available for sale in the US. Fantom is not available for sale in all countries.