Attached files

| file | filename |

|---|---|

| EX-3.1 - EXHIBIT 3.1 - MPLX LP | ex31secondamended.htm |

| 8-K - 8-K - MPLX LP | mplx8-kjan8.htm |

UBS Midstream & MLP

Conference

January 2018

Forward‐Looking Statements

This presentation contains forward-looking statements within the meaning of federal securities laws regarding MPLX LP (“MPLX”) and Marathon Petroleum Corporation (“MPC”). These forward-looking statements relate to, among

other things, expectations, estimates and projections concerning the business and operations of MPLX and MPC, including proposed strategic initiatives and our value creation plans. You can identify forward-looking statements by

words such as “anticipate,” “believe,” “design,” “estimate,” “expect,” “forecast,” “goal,” “guidance,” “imply,” “intend,” “ob jective,” “opportunity,” “outlook,” “plan,” “position,” “pursue,” “prospective,” “predict,” “project,” “potential,” “seek,”

“strategy,” “target,” “could,” “may,” “should,” “would,” “will” or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are

subject to risks, uncertainties and other factors, some of which are beyond the companies’ control and are difficult to predict. Factors that could cause MPLX’s actual results to differ materially from those implied in the forward-looking

statements include: negative capital market conditions, including an increase of the current yield on common units, adversely affecting MPLX’s ability to meet its distribution growth guidance; the time, costs and ability to obtain

regulatory or other approvals and consents and otherwise consummate the strategic initiatives discussed herein and other proposed transactions; the satisfaction or waiver of conditions in the agreements governing the strategic

initiatives discussed herein and other proposed transactions; our ability to achieve the strategic and other objectives related to the strategic initiatives discussed herein and other proposed transactions; adverse changes in laws

including with respect to tax and regulatory matters; the adequacy of MPLX’s capital resources and liquidity, including, but not limited to, availability of sufficient cash flow to pay distributions and access to debt to fund anticipated

dropdowns on commercially reasonable terms, and the ability to successfully execute its business plans and growth strategy; the timing and extent of changes in commodity prices and demand for crude oil, refined products,

feedstocks or other hydrocarbon-based products; continued/further volatility in and/or degradation of market and industry conditions; changes to the expected construction costs and timing of projects; completion of midstream

infrastructure by competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC’s obligations under MPLX’s commercial

agreements; modifications to earnings and distribution growth objectives; the level of support from MPC, including dropdowns, alternative financing arrangements, taking equity units, and other methods of sponsor support, as a result

of the capital allocation needs of the enterprise as a whole and its ability to provide support on commercially reasonable terms; compliance with federal and state environmental, economic, health and safety, energy and other policies

and regulations and/or enforcement actions initiated thereunder; adverse results in litigation; changes to MPLX’s capital budget; other risk factors inherent to MPLX’s industry; and the factors set forth under the heading “Risk Factors”

in MPLX’s Annual Report on Form 10-K for the year ended Dec. 31, 2016, filed with the Securities and Exchange Commission (SEC). Factors that could cause MPC’s actual results to differ materially from those implied in the forward-

looking statements include: the time, costs and ability to obtain regulatory or other approvals and consents and otherwise consummate the strategic initiatives discussed herein; the satisfaction or waiver of conditions in the

agreements governing the strategic initiatives discussed herein; our ability to achieve the strategic and other objectives related to the strategic initiatives discussed herein; our ability to manage disruptions in credit markets or changes

to our credit rating; adverse changes in laws including with respect to tax and regulatory matters; changes to the expected construction costs and timing of projects; continued/further volatility in and/or degradation of market and

industry conditions; the availability and pricing of crude oil and other feedstocks; slower growth in domestic and Canadian crude supply; the effects of the lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas

outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units and other equipment; MPC’s ability to successfully implement growth opportunities; the impact of adverse

market conditions affecting MPLX’s midstream business; modifications to MPLX earnings and distribution growth objectives, and other risks described above with respect to MPLX; compliance with federal and state environmental,

economic, health and safety, energy and other policies and regulations, including the cost of compliance with the Renewable Fuel Standard, and/or enforcement actions initiated thereunder; adverse results in litigation; changes to

MPC’s capital budget; other risk factors inherent to MPC’s industry; and the factors set forth under the heading “Risk Factors” in MPC’s Annual Report on Form 10-K for the year ended Dec. 31, 2016, filed with the SEC. In addition,

the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPLX’s Form 10-K or in MPC’s Form

10-K could also have material adverse effects on forward-looking statements. Copies of MPLX’s Form 10-K are available on the SEC website, MPLX’s website at http://ir.mplx.com or by contacting MPLX’s Investor Relations office.

Copies of MPC’s Form 10-K are available on the SEC website, MPC’s website at http://ir.marathonpetroleum.com or by contacting MPC’s Investor Relations office.

Non-GAAP Financial Measures

Adjusted EBITDA, distributable cash flow (DCF) and distribution coverage ratio are non-GAAP financial measures provided in this presentation. Adjusted EBITDA and DCF reconciliations to the nearest GAAP financial measure are

included in the Appendix to this presentation. Adjusted EBITDA with respect to the joint-interest acquisition is calculated as cash distributions adjusted for maintenance capital, growth capital and financing activities. Distribution

coverage ratio is the ratio of DCF attributable to GP and LP unitholders to total GP and LP distributions declared. Adjusted EBITDA, DCF and distribution coverage ratio are not defined by GAAP and should not be considered in

isolation or as an alternative to net income attributable to MPLX, net cash provided by operating activities or other financial measures prepared in accordance with GAAP. The EBITDA forecasts related to certain projects were

determined on an EBITDA-only basis. Accordingly, information related to the elements of net income, including tax and interest, are not available and, therefore, reconciliations of these non-GAAP financial measures to the nearest

GAAP financial measures have not been provided.

2

Key Investment Highlights

Diversified large-cap MLP positioned to deliver attractive returns over the long term

Forecast distribution growth of ~12% for 2017 and ~10% for 2018

Gathering &

Processing

Logistics &

Storage

Stable Cash Flows

Cost of Capital

Optimization

• Largest processor and fractionator in the Marcellus/Utica basins

• Strong footprint in STACK play and growing presence in Permian basin

• Supports extensive operations of second-largest U.S. refiner

• Expanding third-party business and delivering industry solutions

• Substantial fee-based income with limited commodity exposure

• Long-term relationships with diverse set of producer customers

• Transportation and storage agreements with sponsor MPC

• Visibility to growth through robust portfolio of organic projects and strong coverage ratio

• Exchange of IDRs for MPLX LP units planned

• Anticipate no issuance of public equity to fund organic growth capital in 2018

3

Strategic Actions to Enhance Unitholder Value

4

(1)Adjusted EBITDA with respect to anticipated joint-interest acquisitions is calculated as cash distributions adjusted for maintenance capital, growth capital and financing activities

(2)All transactions subject to closing conditions, including tax and regulatory clearances

Exchange for

Asset Dropdowns

MLP-qualifying EBITDA

Simplifies structure

Expected to lower cost of capital

EBITDA from asset dropdowns adds

substantial stable cash flow

Provides unique opportunity to

target strong distribution coverage

while maintaining an attractive and

sustainable distribution growth rate

for the long term

First dropdown in March

– ~$250 MM annual EBITDA

– ~8x EBITDA multiple

Second dropdown in September

– ~$138 MM annual adjusted EBITDA(1)

– ~7.6x adjusted EBITDA multiple

Executed agreement for remaining dropdown

in November – expected to close Feb. 1, 2018

– ~$1 B annual EBITDA

– ~8.1x EBITDA multiple

Executed agreement for exchange of GP

economic interests, including IDRs, in

December – expected to close Feb. 1, 2018

– 275 MM newly issued common units

– ~$10.1 B transaction value

Remaining dropdown and IDR exchange

expected to close Feb. 1, 2018

Agreement to Exchange MPC’s GP Economic Interests

Completes the announced plan

Announced Dec. 15, 2017 and expected to close Feb. 1, 2018 subject to the completion of refining

logistics assets and fuels distribution services dropdown(1)

Exchanges MPC’s GP economic interests, including IDR’s, for 275 million MPLX common units

~$10.1 B transaction value(2)

Transaction represents one of the fastest paths to accretion compared with similar GP

transactions

– Result of rapid growth of GP/IDR cash flows in status-quo scenario

5

(1)All transactions subject to closing conditions including tax and other regulatory clearances

(2)As calculated in Dec. 15, 2017 press release

Exchange Agreement – Cont’d.

Exchanges MPLX GP/IDR cash distribution requirements to MPC for limited partner unit

distributions

Expected to be accretive to MPLX distributable cash flow (“DCF”) attributable to common

unitholders on a per unit basis in the third quarter and for the full-year 2018

– Compares pre- and post-exchange on DCF per unit available to common unitholders basis

– Pre-exchange basis allocates to LP DCF the maximum amount which is distributable per partnership

agreement

• In the high splits, total excess cash flow is allocated equally to LP and GP DCF – beyond actual distributions

– Post exchange basis eliminates the fully distributed GP/IDR take which results in an increase to total cash

flow allocated to LP DCF

Supports attractive long-term distribution growth rate and lower cost of capital for MPLX

– Continue to forecast ~10% distribution growth for 2018

6

All transactions subject to closing conditions including tax and other regulatory clearances

MPC and MPLX’s Long-term Strategic Linkage

MPLX was created in 2012 to grow MPC’s midstream platform

Assets and services provided by MPLX are integral to MPC’s operations and MPC is

MPLX’s largest customer

Earnings streams for assets/businesses sold to MPLX have effectively been converted

into distribution streams

Distributions from MPLX are fundamental elements of MPC’s discretionary free cash flow

and capital resources

LP unitholders, including MPC, benefit from continued

growth in DCF and distributions from MPLX

7

MPC expects to hold MPLX units permanently

Executed Agreement for Remaining Dropdown from MPC

Assets include:

– Refining logistics assets: storage tanks, rail and truck

racks, docks, and gasoline blending and inter-battery

piping

– Fuels distribution services: scheduling and marketing

services that support MPC’s refinery and marketing

operations

Total consideration of ~$8.1 B

– $4.1 B in cash and 114 million MPLX units

– ~$1 B annual EBITDA

– Expected to be immediately accretive to MPLX’s

distributable cash flow

8

Expect to close Feb. 1, 2018

Refining Logistics Overview

9

Integrated Tank Farm Assets Supporting MPC’s Operations

Tanks

Annual EBITDA ~$400 MM Fee for Capacity Arrangement

~56 MMBBL storage Multiple rail and truck loading racks

Handle ocean- and river-going

vessels at Gulf Coast refineries and

asphalt barges at Detroit refinery

Piping to connect process units,

tank farms, terminals

Racks

Docks Gasoline Blending & Associated Piping

Fuels Distribution Overview

10

Extensive Range of Scheduling and Marketing Services that Support MPC’s Refining and Marketing Operations

Services Description

Supply and demand balancing

Third-party exchange, terminaling and storage

Bulk purchases and sale of products

Product movements coordination

Products and intermediates inventory

Marketing Services

Customer identification, evaluation and set-up

Marketing analytics and forecasting

Sale of products

Branded product marketing

Annual EBITDA ~$600 MM

Supported by MPLX logistics assets

no additional maintenance capital

Scheduling

Model is different from other Fuels Distribution models

No title to inventory

Margin risk stays with MPC

100% fee for services

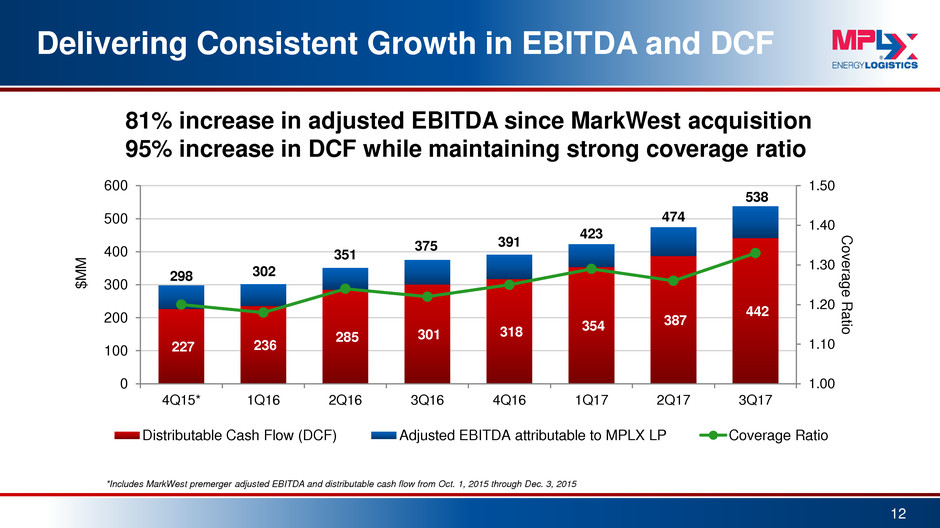

Demonstrated Track Record

11

Strong Financial and Operational Results – 2017 Highlights

Delivering results

– Consistent growth in EBITDA and DCF

– On track for year-over-year distribution growth of ~12%

– Multiple quarterly volume records

Executing organic growth capital plan

– Two new processing plants and three new fractionation plants placed in service

Completed strategic acquisitions in L&S segment

– Ozark Pipeline

– Equity interest in Bakken Pipeline system

Strong financial position with investment grade credit profile

– Year-to-date September coverage ratio of 1.29x

– Leverage ratio of 3.6x at end of third quarter

– No public equity issuances in the fourth quarter

Full-year results will be announced Feb. 1, 2018

Delivering Consistent Growth in EBITDA and DCF

12

227 236

285 301 318

354 387

442

298 302

351

375 391

423

474

538

1.00

1.10

1.20

1.30

1.40

1.50

0

100

200

300

400

500

600

4Q15* 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

C

o

vera

g

e

R

ati

o

$

M

M

Distributable Cash Flow (DCF) Adjusted EBITDA attributable to MPLX LP Coverage Ratio

81% increase in adjusted EBITDA since MarkWest acquisition

95% increase in DCF while maintaining strong coverage ratio

*Includes MarkWest premerger adjusted EBITDA and distributable cash flow from Oct. 1, 2015 through Dec. 3, 2015

Priorities for 2018

Positioning partnership through execution of strategic actions

– Expect to close remaining dropdown and IDR exchange on Feb. 1

Execution of organic growth capital plan

Deliver attractive returns for unitholders

– Forecast ~10% year-over-year distribution growth

– Expand portfolio of organic growth projects

Financing strategy

– Maintain investment grade credit profile

– Sustain strong coverage ratio

– Fund ~$2 B organic growth capital with retained cash and debt

– Anticipate no issuance of public equity to fund organic growth capital

13

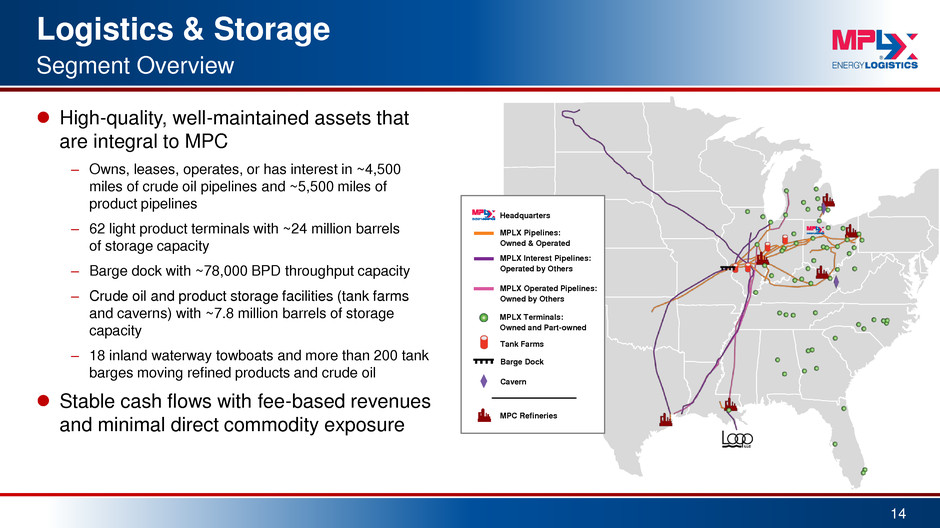

Logistics & Storage

14

Segment Overview

High-quality, well-maintained assets that

are integral to MPC

– Owns, leases, operates, or has interest in ~4,500

miles of crude oil pipelines and ~5,500 miles of

product pipelines

– 62 light product terminals with ~24 million barrels

of storage capacity

– Barge dock with ~78,000 BPD throughput capacity

– Crude oil and product storage facilities (tank farms

and caverns) with ~7.8 million barrels of storage

capacity

– 18 inland waterway towboats and more than 200 tank

barges moving refined products and crude oil

Stable cash flows with fee-based revenues

and minimal direct commodity exposure

MPC Refineries

MPLX Terminals:

Owned and Part-owned

Tank Farms

MPLX Pipelines:

Owned & Operated

MPLX Interest Pipelines:

Operated by Others

Cavern

Barge Dock

Headquarters

MPLX Operated Pipelines:

Owned by Others

Attractive Portfolio of Organic Growth Capital

15

Logistics & Storage Segment

Utica Build-out and related connectivity

Industry solution for Marcellus and Utica liquids

Multiple investments – estimated to complete

throughout 2017 and 1Q 2018

Ozark Pipeline Expansion

Crude sourcing optionality to Midwest refineries

Mid-2018 estimated completion

Texas City Tank Farm

MPC and third-party logistics solutions

3Q 2018 estimated completion

Robinson Butane Cavern

MPC shifting third-party services to MPLX and

optimizing Robinson butane handling

2Q 2018 estimated completion

Other projects in development

Gathering & Processing

16

Segment Overview

One of the largest NGL and natural gas midstream service providers

– Gathering capacity of 5.9 Bcf/d

• ~65% Marcellus/Utica; ~35% Southwest

– Processing capacity of 8.0 Bcf/d*

• ~70% Marcellus/Utica; ~20% Southwest; ~10% Southern Appalachia

– C2 + Fractionation capacity of ~610 MBPD**

• ~90% Marcellus/Utica; ~5% Southwest; ~5% Southern Appalachia

Top-rated midstream service provider since 2006 as determined by independent research provider

Primarily fee-based business with highly diverse customer base and established long-term contracts

Raw

Natural Gas

Production

Processing

Plants

Mixed

NGLs

Fractionation

Facilities

NGL

Products

• Ethane

• Propane

• Normal Butane

• Isobutane

• Natural Gasoline

Gathering

and

Compression

*Includes processing capacity of non-operated joint venture **Includes condensate stabilization capacity

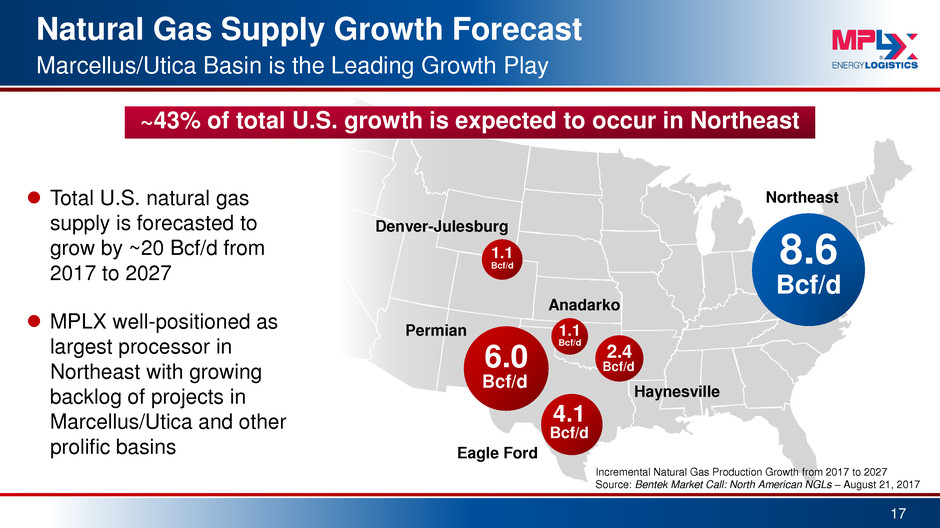

Natural Gas Supply Growth Forecast

17

Marcellus/Utica Basin is the Leading Growth Play

Incremental Natural Gas Production Growth from 2017 to 2027

Source: Bentek Market Call: North American NGLs – August 21, 2017

8.6

Bcf/d

Northeast Total U.S. natural gas

supply is forecasted to

grow by ~20 Bcf/d from

2017 to 2027

MPLX well-positioned as

largest processor in

Northeast with growing

backlog of projects in

Marcellus/Utica and other

prolific basins

Permian

6.0

Bcf/d

4.1

Bcf/d

Eagle Ford

Anadarko

1.1

Bcf/d

Denver-Julesburg

1.1

Bcf/d

Haynesville

2.4

Bcf/d

~43% of total U.S. growth is expected to occur in Northeast

Marcellus/Utica Processing Capacity

18

Building Infrastructure to Support Basin Volume Growth

0

2

4

6

8

2013 2014 2015 2016 2017E* 2018E

B

c

f/

d

~7.0 Bcf/d processing capacity by end of 2018

Throughput Year-end Capacity

Currently operate ~66% of processing capacity in Marcellus/Utica basin

2017 plant completions

Sherwood VII (in service 1Q17)

Sherwood VIII (in service 3Q17)

2018 expected plant completions

Harmon Creek

Houston I

Majorsville VII

Sherwood IX

Sherwood X

Sherwood XI

*2017 throughput assumes 15% growth rate over prior year Note: 2013 through 2015 include MarkWest volumes prior to acquisition by MPLX

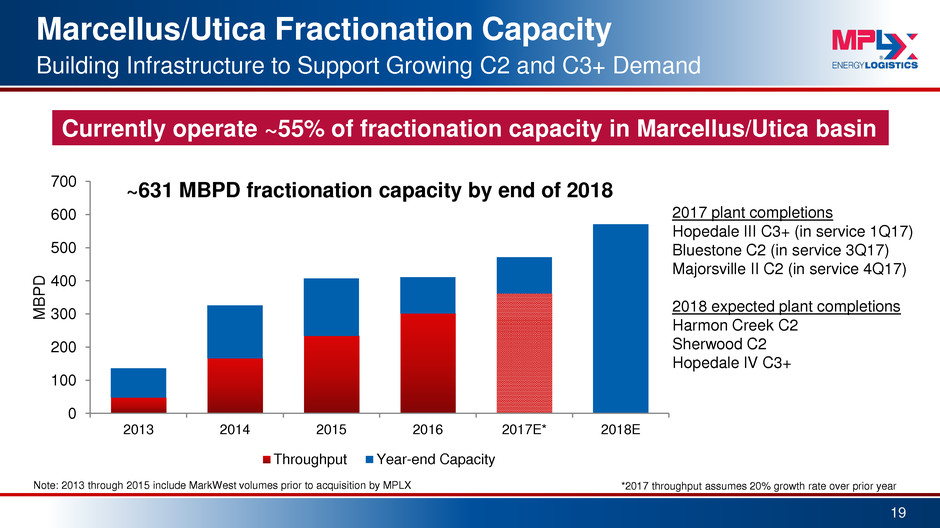

Marcellus/Utica Fractionation Capacity

Building Infrastructure to Support Growing C2 and C3+ Demand

0

100

200

300

400

500

600

700

2013 2014 2015 2016 2017E* 2018E

M

B

P

D

~631 MBPD fractionation capacity by end of 2018

Throughput Year-end Capacity

Currently operate ~55% of fractionation capacity in Marcellus/Utica basin

2017 plant completions

Hopedale III C3+ (in service 1Q17)

Bluestone C2 (in service 3Q17)

Majorsville II C2 (in service 4Q17)

2018 expected plant completions

Harmon Creek C2

Sherwood C2

Hopedale IV C3+

*2017 throughput assumes 20% growth rate over prior year Note: 2013 through 2015 include MarkWest volumes prior to acquisition by MPLX

19

Northeast Operations Well-Positioned

in Ethane Market

Ethane demand growing as exports and

steam cracker development continues in

Gulf Coast and Northeast

MPLX well-positioned to support

producer customers’ rich-gas

development with extensive distributed

de-ethanization system

Based on current utilization, MPLX can

support the production of an additional

~60 MBPD of purity ethane with existing

assets

Opportunity to invest $500 MM to

$1 B to support Northeast ethane

recovery over the next five years

20

West Virginia

Pennsylvania Ohio

Sherwood

Mobley

Majorsville

Cadiz Houston

Bluestone

Harmon Creek

Seneca

MPLX De-ethanization

Facility

MPLX Processing

Complex

MPLX Planned

De-ethanization Facility

Steam Cracker Planned

Steam Cracker Proposed

MPLX Ethane Pipeline

ATEX Pipeline

Mariner West Pipeline

Mariner East 1 Pipeline

Considerable Scale in the Southwest

2.1 Bcf/d Gathering, 1.5 Bcf/d Processing & 29 MBPD C2+ Fractionation Capacity

21

Southeast Oklahoma

120MMcf/d

Processing*

755MMcf/d

Gathering

East Texas

Gulf Coast

142MMcf/d

Processing

Western Oklahoma Oklahoma

Texas

425MMcf/d

Processing

585MMcf/d

Gathering

600MMcf/d

Gathering

680MMcf/d

Processing

Fractionation

29,000BPD

*Represents 40% of processing capacity through the Partnership’s

Centrahoma JV with Targa Resources Corp. Permian

200MMcf/d

Processing

Expanding Southwest Position to Support Growing

Production in High Performance Resource Plays

Hidalgo processing plant in Culberson County, Texas,

placed in service in 2Q 2016, currently operating at

near 100% utilization

Began construction of 200 MMcf/d processing plant in

Delaware Basin (Argo) expected to be in service in

1Q 2018

Began construction of 75 MMcf/d processing plant in

STACK shale (Omega) expected to be in service in

mid-2018

Full connectivity to 435 MMcf/d of processing capacity

via a 60-mile high-pressure rich-gas pipeline

Constructing rich-gas and crude oil gathering systems

with related storage and logistics facilities

22

Cana-Woodford

Dewey

Blaine Kingfisher

Canadian

Caddo

Grady

McClain

Garvin Comanche

Stephens

Washita

Beckham

Roger Mills

Custer

Buffalo Creek

Complex

Arapaho Complex

Newfield

STACK

area of

operations

Rich-gas

pipeline

Woodford Play

Meramec Play

Permian

Hidalgo Complex

200 MMcf/d

Delaware

Basin

Culberson

Eddy

Permian

Basin

Argo Complex

200 MMcf/d – Q1 2018

Strong Financial Flexibility to Manage and

Grow Asset Base

23

Committed to maintaining

investment grade credit profile

$2.25 B senior notes issued

1Q 2017

~$2.1 B of available liquidity at

end of 3Q 2017

No public equity issuance in 4Q

2017

Anticipate no issuance of public

equity to fund 2018 organic

growth capital

($MM except ratio data)

As of

9/30/17

Cash and cash equivalents 3

Total assets 19,238

Total debt(a) 7,051

Redeemable preferred units 1,000

Total equity 10,086

Consolidated total debt to LTM pro forma adjusted

EBITDA ratio(b)

3.6x

Remaining capacity available under $2.25 B revolving

credit agreement

1,827

Remaining capacity available under $500 MM credit

agreement with MPC

298

(a)Total debt includes $202 MM of outstanding intercompany borrowings classified in current liabilities as of Sept. 30, 2017

(b)Calculated using face value total debt and last twelve month adjusted EBITDA, which is pro forma for acquisitions. Face value

total debt includes approximately $428 MM of unamortized discount and debt issuance costs as of Sept. 30, 2017.

Long-Term Value Objectives

Deliver Sustainable Distribution Growth rate that provides attractive total

unitholder returns

Drive Lower Cost of Capital to achieve most efficient mix of growth and yield

Execute and expand Robust Portfolio of Organic Growth Projects in support of

producer customers and overall energy infrastructure build-out

Maintain Investment Grade Credit profile

Become Consolidator in midstream space

24

25

Appendix

About MPLX

Growth-oriented, diversified MLP with high-quality,

strategically located assets with leading midstream

position

Two primary businesses

– Logistics & Storage includes transportation, storage

and distribution of crude oil, refined petroleum products

and other hydrocarbon-based products

– Gathering & Processing includes gathering, processing,

and transportation of natural gas and the gathering,

transportation, fractionation, storage and marketing of NGLs

Investment grade credit profile with strong financial

flexibility

MPC as sponsor has interests aligned with MPLX

– MPLX assets are integral to MPC

– Growing stable cash flows through continued investment in

midstream infrastructure

26

See appendix for legend

March 1, 2017 Dropdown from MPC

27

Terminal, pipeline and storage assets

– 62 light product terminals with ~24 million barrels of

storage capacity

– 11 pipeline systems consisting of 604 pipeline miles

– 73 tanks with ~7.8 million barrels of storage capacity

– Crude oil truck unloading facility at MPC’s refinery in

Canton, Ohio

– Natural gas liquids storage cavern in Woodhaven,

Michigan, with ~1.8 million barrels of capacity

Total consideration of $2.015 B

– $1.511 B in cash and $504 MM in MPLX equity

– Represents ~8 times EBITDA multiple

– ~$250 MM estimated annual EBITDA

– Expected to be immediately accretive to

MPLX’s distributable cash flow

Sept. 1, 2017 Dropdown from MPC

Assets include MPC’s ownership interests:

– Explorer Pipeline Company, representing a 24.51 percent

ownership interest in the company

– Lincoln Pipeline LLC, representing a 35 percent interest in

the Southern Access Extension Pipeline (SAX)

– MPL Louisiana Holdings, representing a 40.7 percent

interest in the Louisiana Offshore Oil Port (LOOP)

– LOCAP LLC, representing an overall 58.52 percent

ownership interest in the company

Total consideration of $1.05 B

– $630 MM in MPLX equity and $420 MM in cash

– Represents 7.6 times EBITDA multiple

– ~$138 MM annual adjusted EBITDA(1)

– Expected to be immediately accretive to MPLX’s

distributable cash flow per unit

28

(1)Adjusted EBITDA with respect to joint-interest ownership is calculated as cash

distributions adjusted for maintenance capital, growth capital and financing activities.

Growth Capital Forecast

29

Projects completed in 2017

(a)Utica Rich- and Dry-Gas Gathering is a joint venture between MarkWest Utica EMG’s and Summit Midstream LLC. Dry-Gas Gathering in the Utica Shale is completed through a joint venture with MarkWest and EMG.

(b)MarkWest and MarkWest Utica EMG shared fractionation capacity

(c)Sherwood Midstream investment

Gathering & Processing Projects Shale Resource Capacity

Est. Completion

Date

Rich- and Dry-Gas Gathering(a) Marcellus & Utica N/A Ongoing

Western Oklahoma - STACK Rich-Gas and Oil

Gathering

Cana Woodford N/A Ongoing

Hopedale III C3+ Fractionation and NGL

Logistics(b)(c)

Marcellus & Utica 60,000 BPD In Service - 1Q17

Sherwood VII Processing Plant(c) Marcellus 200 MMcf/d In Service - 1Q17

Bluestone C2 Fractionation Marcellus 20,000 BPD In Service - 3Q17

Sherwood VIII Processing Plant Marcellus 200 MMcf/d In Service - 3Q17

Majorsville II C2 Fractionation Marcellus 40,000 BPD In Service - 4Q17

NGL Pipeline Expansions Marcellus N/A Ongoing

Logistics & Storage

Projects

Est. Completion

Date

Utica Build-out projects In Service – 3Q17

Midwest connectivity projects 4Q17/1Q18

Growth Capital Forecast

30

Projects expected to be completed in 2018

(a)Replacement of existing Houston 35 MMcf/d plant

(b)Sherwood Midstream investment

Gathering & Processing Projects Shale Resource Capacity

Est. Completion

Date

Houston I Processing Plant(a) Marcellus 200 MMcf/d 1Q18

Sherwood IX Processing Plant(b) Marcellus 200 MMcf/d 1Q18

Argo Processing Plant Delaware 200 MMcf/d 1Q18

Omega Processing Plant Cana-Woodford 75 MMcf/d Mid-2018

Majorsville VII Processing Plant Marcellus 200 MMcf/d 3Q18

Sherwood X Processing Plant(b) Marcellus 200 MMcf/d 3Q18

Sherwood C2 Fractionation Marcellus 20,000 BPD 3Q18

Sherwood XI Processing Plant(b) Marcellus 200 MMcf/d 4Q18

Harmon Creek Processing Plant Marcellus 200 MMcf/d 4Q18

Harmon Creek C2 Fractionation Marcellus 20,000 BPD 4Q18

Hopedale IV C3+ Fractionation Marcellus & Utica 60,000 BPD 4Q18

Logistics & Storage

Projects

Est. Completion

Date

Ozark Pipeline Expansion Mid-2018

Wood River-to-Patoka

Pipeline Expansion

Mid-2018

Midwest connectivity projects 1Q18

Robinson Butane Cavern 2Q18

Texas City Tank Farm 3Q18

Pipeline Acquisitions Announced in 2017

31

Extending the Footprint of the L&S Segment

– ~$220 MM investment

– 433 mile, 22″ crude pipeline running from Cushing,

Oklahoma, to Wood River, Illinois, with capacity of

~230 MBPD

–Planned expansion to ~345 MBPD in progress and

expected to be completed by mid-2018

Ozark Pipeline

Ozark Pipeline Acquisition Bakke Pipeline

– $500 MM investment

– ~9.2% equity interest in the Dakota Access Pipeline

(DAPL) and the Energy Transfer Crude Oil Pipeline

(ETCOP) projects

– Expected to deliver ~520 MBPD from the Bakken/Three

Forks production area to the Midwest and Gulf Coast with

capacity up to ~570 MBPD

– Commenced operations 2Q 2017

Executing a Comprehensive Utica Strategy

32

Phased Infrastructure Investment

Cornerstone Pipeline commenced

operations in October 2016

Hopedale pipeline connection

completed December 2016

Harpster-to-Lima pipeline fully

operational in July 2017

Links Marcellus and Utica condensate

and natural gasoline with Midwest

refiners

Constructing additional connectivity

and expanding pipelines to provide

more optionality for Midwest refiners

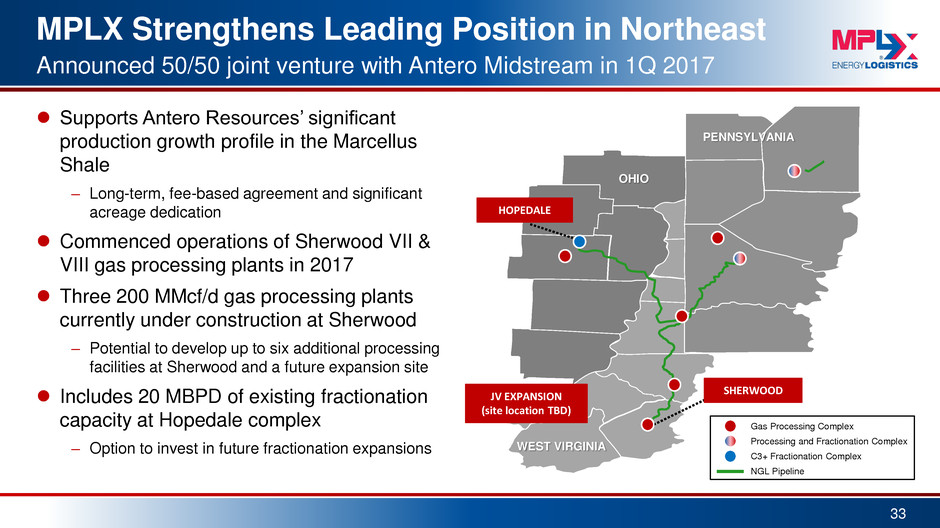

Supports Antero Resources’ significant

production growth profile in the Marcellus

Shale

– Long-term, fee-based agreement and significant

acreage dedication

Commenced operations of Sherwood VII &

VIII gas processing plants in 2017

Three 200 MMcf/d gas processing plants

currently under construction at Sherwood

– Potential to develop up to six additional processing

facilities at Sherwood and a future expansion site

Includes 20 MBPD of existing fractionation

capacity at Hopedale complex

– Option to invest in future fractionation expansions

33

MPLX Strengthens Leading Position in Northeast

Announced 50/50 joint venture with Antero Midstream in 1Q 2017

WEST VIRGINIA

PENNSYLVANIA

OHIO

SHERWOOD

JV EXPANSION

(site location TBD)

HOPEDALE

C3+ Fractionation Complex

NGL Pipeline

Gas Processing Complex

Processing and Fractionation Complex

Major Residue Gas Takeaway Expansion Projects

Originate at MPLX Facilities

New takeaway pipelines expected to

improve Northeast basis differentials

MPLX processing complexes:

– Access to all major gas residue gas

takeaway pipelines

– Provide multiple options with significant

excess residue capacity

– Ability to bring mass and synergies to

new residue gas pipelines

Critical new projects designed to serve

our complexes include:

Rover, Leach/Rayne Xpress, Ohio

Valley Connector, Mountaineer

Express and Mountain Valley Pipeline

34

Utica Complex

Marcellus Complex

Marcellus/Utica Overview

3.8 Bcf/d Gathering, 5.8 Bcf/d Processing & 531 MBPD C2+ Fractionation Capacity

WEST VIRGINIA

PENNSYLVANIA

OHIO

BLUESTONE COMPLEX

HARMON CREEK COMPLEX

(currently under construction)

MAJORSVILLE COMPLEX

MOBLEY COMPLEX SHERWOOD COMPLEX

CADIZ & SENECA COMPLEXES

MarkWest Joint Venture with EMG

HOPEDALE FRACTIONATION COMPLEX

HOUSTON COMPLEX

OHIO CONDENSATE

MarkWest Joint Venture with Summit Midstream

Utica Complex

ATEX Express Pipeline

Purity Ethane Pipeline

NGL Pipeline

Mariner East Pipeline

Marcellus Complex

Gathering System

Mariner West Pipeline

TEPPCO Product Pipeline

MarkWest Joint Venture with EMG

35

Gathering & Processing Segment

36

Marcellus & Utica Operations

Gathering

– Record volumes averaged over 2.3 Bcf/d

– Third-quarter volumes up ~25% versus

the same quarter last year

Processing

– Record volumes averaged ~5.0 Bcf/d

– Commenced operations of Sherwood VIII

in July

– Third-quarter volumes up ~15% versus

the same quarter last year

(a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance

Processed Volumes

Area

Available

Capacity

(MMcf/d)(a)

Average

Volume

(MMcf/d)

Utilization

(%)

Marcellus 4,520 3,986 88%

Houston 520 510 98%

Majorsville 1,070 937 88%

Mobley 920 654 71%

Sherwood 1,600 1,561 98%

Bluestone 410 324 79%

Utica 1,325 1,000 75%

Cadiz 525 514 98%

Seneca 800 486 61%

3Q 2017 Total 5,845 4,986 85%

2Q 2017 Total 5,645 4,690 83%

Gathering & Processing Segment

37

Marcellus & Utica Fractionation

Record fractionated volumes of

~365 MBPD

First full quarter of operations for

second de-ethanization plant at

Bluestone

Third-quarter fractionated volumes

up ~16% versus the same quarter

last year

Fractionated Volumes

Area

Available

Capacity

(MBPD)(a)(b)

Average

Volume

(MBPD)

Utilization

(%)

3Q17 Total C3+ 287 219 76%

3Q17 Total C2 204 146 72%

2Q17 Total C3+ 287 210 73%

2Q17 Total C2 184 141 77%

(a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance

(b)Excludes Cibus Ranch condensate facility

Gathering & Processing

38

Southwest Operations

0

Gathering capacity

1.5Bcf/d*

Processing capacity

29MBPD

C2+ Fractionation capacity

2.1Bcf/d

Javelina Complex Carthage Complex Buffalo Creek Complex

Transmission capacity

1.4Bcf/d

*Includes 40% of processing capacity through the Partnership’s Centrahoma Joint Venture

Hidalgo

Complex

Gathering & Processing Segment

Southwest Operations

Continued construction of gas

processing plants in the Southwest

– Delaware Basin (Argo)

– STACK (Omega)

2017 YTD processed volumes up

~8% versus same period last year

(a)Based on weighted average number of days plant(s) in service. Excludes periods of maintenance

(b)West Texas is composed of the Hidalgo plant in the Delaware Basin

(c)Processing capacity includes Partnership’s portion of Centrahoma JV and excludes volumes sent to

third parties

Processed Volumes

Area

Available

Capacity

(MMcf/d)(a)

Average

Volume

(MMcf/d)

Utilization

(%)

West Texas(b) 200 197 99%

East Texas 600 381 64%

Western OK 425 362 85%

Southeast OK(c) 120 120 100%

Gulf Coast 142 105 74%

3Q 2017 Total 1,487 1,165 78%

2Q 2017 Total 1,487 1,220 82%

39

74%

20%

6%

MPC Commited MPC Additional Third Party

Logistics & Storage Contract Structure

Fee-based assets with minimal commodity

exposure(c)

MPC has historically accounted for

– over 85% of the volumes shipped on MPLX’s

crude and product pipelines

– 100% of the volumes transported via MPLX’s

inland marine vessels

MPC has entered into multiple

long-term transportation and storage

agreements with MPLX

– Terms of up to 10 years, beginning in 2012

– Pipeline tariffs linked to FERC-based rates

– Indexed storage fees

– Fee-for-capacity inland marine business

40

2016 Revenue – Customer Mix

MPC = 94%

$633 MM

$171 MM

$51

MM

(a,b)

Notes:

(a)Includes revenues generated under Transportation and Storage agreements with MPC (excludes

marine agreements)

(b)Volumes shipped under joint tariff agreements are accounted for as third party for GAAP purposes,

but represent MPC barrels shipped

(c)Commodity exposure only to the extent of volume gains and losses

Gathering & Processing Contract Structure

41

Durable long-term partnerships across leading basins

Marcellus Utica Southwest

Resource Play

Marcellus, Upper Devonian

Utica Haynesville, Cotton Valley,

Woodford, Anadarko Basin,

Granite Wash, Cana-Woodford,

Permian, Eagle Ford

Producers 14 – including Range, Antero,

EQT, CNX, Southwestern, Rex

and others

7 – including Antero, Gulfport,

Ascent, Rice, PDC and others

140 – including Newfield, Devon,

BP, Cimarex, Chevron,

PetroQuest and others

Contract Structure Long-term agreements initially

10-15 years, which contain

renewal provisions

Long-term agreements initially

10-15 years, which contain

renewal provisions

Long-term agreements initially

10-15 years, which contain

renewal provisions

Volume Protection

(MVCs)

77% of 2017 capacity contains

minimum volume commitments

27% of 2017 capacity contains

minimum volume commitments

18% of 2017 capacity contains

minimum volume commitments

Area Dedications 4.1 MM acres 4.1 MM acres 1.4 MM acres

Inflation Protection Yes Yes Yes

Reconciliation of Adjusted EBITDA and Distributable Cash

from Net Income

42

(a)The Partnership makes a distinction

between realized or unrealized gains

and losses on derivatives. During the

period when a derivative contract is

outstanding, changes in the fair value of

the derivative are recorded as an

unrealized gain or loss. When a

derivative contract matures or is settled,

the previously recorded unrealized gain

or loss is reversed and the realized gain

or loss of the contract is recorded.

(b)The Adjusted EBITDA and DCF

adjustments related to the Predecessor

are excluded from adjusted EBITDA

attributable to MPLX LP and DCF prior

to the acquisition dates.

(c)MarkWest pre-merger EBITDA and

undistributed DCF relates to

MarkWest’s EBITDA and DCF from

Oct. 1, 2015, through Dec. 3, 2015.

($MM) 2013 2014 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

Net income (loss) 211 239 333 (14) 72 194 182 187 191 217

Depreciation and amortization 70 75 129 136 151 151 153 187 164 164

Provision (benefit) for income taxes 1 1 1 (4) (8) - - - 2 1

Amortization of deferred financing costs - - 5 11 12 11 12 12 13 13

Non-cash equity-based compensation 1 2 4 2 4 3 1 3 3 4

Impairment expense - - - 129 1 - - - - -

Net interest and other financial costs 1 5 42 57 52 53 53 66 74 80

(Income) loss from equity investments - - (3) (5) 83 (6) 2 (5) (1) (23)

Distributions from unconsolidated subsidiaries - - 15 38 40 33 39 33 33 70

Distributions of cash received from equity method

investments to MPC

- - - - - - - - - (13)

Other adjustments to equity method investment distributions - - - - - - - - - 8

Unrealized derivative (gains) losses(a) - - (4) 9 12 2 13 (16) (3) 17

Acquisition costs - - 30 1 (2) - - 4 - 2

Adjusted EBITDA 284 322 552 360 417 441 455 471 476 540

Adjusted EBITDA attributable to noncontrolling interests (86) (69) (1) (1) - (2) - (1) (2) (2)

Adjusted EBITDA attributable to Predecessor(b) (87) (87) (215) (57) (66) (64) (64) (47) - -

MarkWest’s pre-merger EBITDA(c) - - 162 - - - - - - -

Adjusted EBITDA attributable to MPLX LP 111 166 498 302 351 375 391 423 474 538

Deferred revenue impacts 17 (3) 6 3 4 1 8 8 9 8

Net interest and other financial costs (2) (6) (35) (57) (52) (53) (53) (66) (74) (80)

Maintenance capital expenditures (19) (22) (49) (13) (20) (25) (26) (12) (23) (24)

Portion of DCF adjustments attributable to Predecessor(b) - - 17 1 2 5 - 2 - -

Other 7 2 (6) - - (2) (2) (1) 1 -

Distributable cash flow pre-MarkWest undistributed 114 137 431 236 285 301 318 354 387 442

MarkWest undistributed DCF(c) - - (32) - - - - - - -

Distributable cash flow attributable to MPLX LP 114

137

399 236 285 301 318 354 387 442

Preferred unit distributions - - - - (9) (16) (16) (16) (17) (16)

Distributable cash flow available to GP and LP unitholders 114 137 399 236 276 285 302 338 370 426

Reconciliation of Adjusted EBITDA and Distributable Cash

from Net Cash Provided by Operating Activities (YTD)

43

($MM)

Dec 31,

2015

Mar 31,

2016

Jun 30,

2016

Sep 30,

2016

Dec 31,

2016

Mar 31,

2017

Jun 30,

2017

Sep 30,

2017

Net cash provided by operating activities 427 321 670 975 1,491 377 844 1.338

Changes in working capital items 63 (13) (9) 59 (66) 51 1 (41)

All other, net (11) (17) (22) (18) (26) (16) (32) (43)

Non-cash equity-based compensation 4 2 6 9 10 3 6 10

Net gain (loss) on disposal of assets - - - 1 1 (1) 1 1

Net interest and other financial costs 42 57 109 162 215 66 140 220

Current income taxes - - 1 4 5 - 1 1

Asset retirement expenditures 1 - 2 4 6 1 1 2

Unrealized derivative (gains) losses(a) (4) 9 21 23 36 (16) (19) (2)

Acquisition costs 30 1 (1) (1) (1) 4 4 6

Distributions of cash received from equity method investments to MPC - - - - - - - (13)

Other adjustments to equity method investment distributions - - - - - - - 8

Other - - - - 2 2 - -

Adjusted EBITDA 552 360 777 1,218 1,673 471 947 1,487

Adjusted EBITDA attributable to noncontrolling interests (1) (1) (1) (3) (3) (1) (3) (5)

Adjusted EBITDA attributable to Predecessor(b) (215) (57) (123) (187) (251) (47) (47) (47)

MarkWest’s pre-merger EBITDA(c) 162 - - - - - - -

Adjusted EBITDA attributable to MPLX LP 498 302 653 1,028 1,419 423 897 1,435

Deferred revenue impacts 6 3 7 8 16 8 17 25

Net interest and other financial costs (35) (57) (109) (162) (215) (66) (140) (220)

Maintenance capital expenditures (49) (13) (33) (58) (84) (12) (35) (59)

Other (6) - - (2) (4) (1) - -

Portion of DCF adjustments attributable to Predecessor(b) 17 1 3 8 8 2 2 2

Distributable cash flow pre-MarkWest undistributed 431 236 521 822 1,140 354 741 1,183

MarkWest undistributed DCF adjustment(c) (32) - - - - - - -

Distributable cash flow attributable to MPLX LP 399 236 521 822 1,140 354 741 1,183

Preferred unit distributions - - (9) (25) (41) (16) (33) (49)

Distributable cash flow available to GP and LP unitholders 399 236 512 797 1,099 338 708 1,134

(a)The Partnership makes a distinction between

realized or unrealized gains and losses on

derivatives. During the period when a

derivative contract is outstanding, changes in

the fair value of the derivative are recorded as

an unrealized gain or loss. When a derivative

contract matures or is settled, the previously

recorded unrealized gain or loss is reversed

and the realized gain or loss of the contract is

recorded.

(b)The Adjusted EBITDA and DCF adjustments

related to the Predecessor are excluded from

adjusted EBITDA attributable to MPLX LP and

DCF prior to the acquisition dates.

(c)MarkWest pre-merger EBITDA and

undistributed DCF relates to MarkWest’s

EBITDA and DCF from Oct. 1, 2015, through

Dec. 3, 2015.

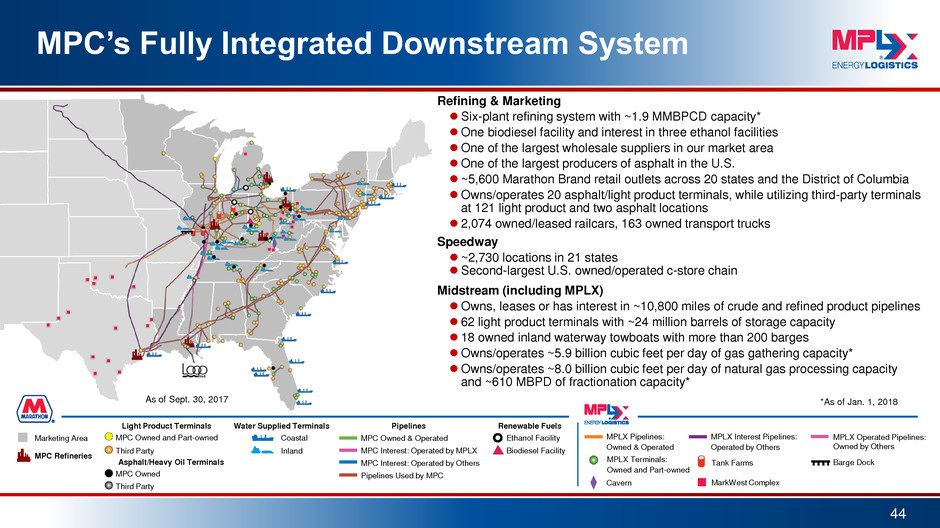

MPC’s Fully Integrated Downstream System

Refining & Marketing

Six-plant refining system with ~1.9 MMBPCD capacity*

One biodiesel facility and interest in three ethanol facilities

One of the largest wholesale suppliers in our market area

One of the largest producers of asphalt in the U.S.

~5,600 Marathon Brand retail outlets across 20 states and the District of Columbia

Owns/operates 20 asphalt/light product terminals, while utilizing third-party terminals

at 121 light product and two asphalt locations

2,074 owned/leased railcars, 163 owned transport trucks

Speedway

~2,730 locations in 21 states

Second-largest U.S. owned/operated c-store chain

Midstream (including MPLX)

Owns, leases or has interest in ~10,800 miles of crude and refined product pipelines

62 light product terminals with ~24 million barrels of storage capacity

18 owned inland waterway towboats with more than 200 barges

Owns/operates ~5.9 billion cubic feet per day of gas gathering capacity*

Owns/operates ~8.0 billion cubic feet per day of natural gas processing capacity

and ~610 MBPD of fractionation capacity*

44

Marketing Area Ethanol Facility

Biodiesel Facility

Renewable Fuels

MPC Interest: Operated by MPLX

MPC Owned & Operated

MPC Interest: Operated by Others

Pipelines

Pipelines Used by MPC

Water Supplied Terminals

Coastal

Inland

MPC Refineries

Light Product Terminals

MPC Owned and Part-owned

Third Party

Asphalt/Heavy Oil Terminals

MPC Owned

Third Party MarkWest Complex

MPLX Terminals:

Owned and Part-owned

MPLX Pipelines:

Owned & Operated

MPLX Interest Pipelines:

Operated by Others

Cavern

Barge Dock Tank Farms

MPLX Operated Pipelines:

Owned by Others

As of Sept. 30, 2017 *As of Jan. 1, 2018