Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEALTHEQUITY, INC. | jpmhcconf2018.htm |

| 8-K - 8-K - HEALTHEQUITY, INC. | a8-kxestimatedsalesresults.htm |

Copyright © 2017 HealthEquity, Inc. All rights reserved.

Investor presentation

JP Morgan Healthcare Conference January 2018

Safe Harbor

2

This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes.

This presentation is a summary of information contained in our public filings filed with the Securities and Exchange Commission (SEC), which public filings

are expressly incorporated herein by reference (see http://ir.healthequity.com/), and other publicly available information. Readers are encouraged to review

our public filings for further information.

This presentation contains “forward-looking” statements that are based on our management’s beliefs and assumptions and on information currently available to

management. These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations

concerning our market position, product expansion, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and

other financial and operating information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,”

“should,” “assumes,” “continues,” “could,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent

our management’s beliefs and assumptions only as of the date of this presentation. Our actual future results may be materially different from what we expect. Except as

required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those

anticipated in the forward-looking statements, even if new information becomes available in the future. Readers are encouraged to review our public filings with the SEC

for further disclosure of other factors that could cause actual results to differ materially from those indicated in any forward-looking statements included herein.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our

industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

This presentation includes certain non-GAAP financial measures as defined by SEC rules. As required by Regulation G, we have provided a reconciliation of those

measures to the most directly comparable GAAP measures, which is available in our public filings.

No part of this presentation may be copied, recorded, or rebroadcast in any form.

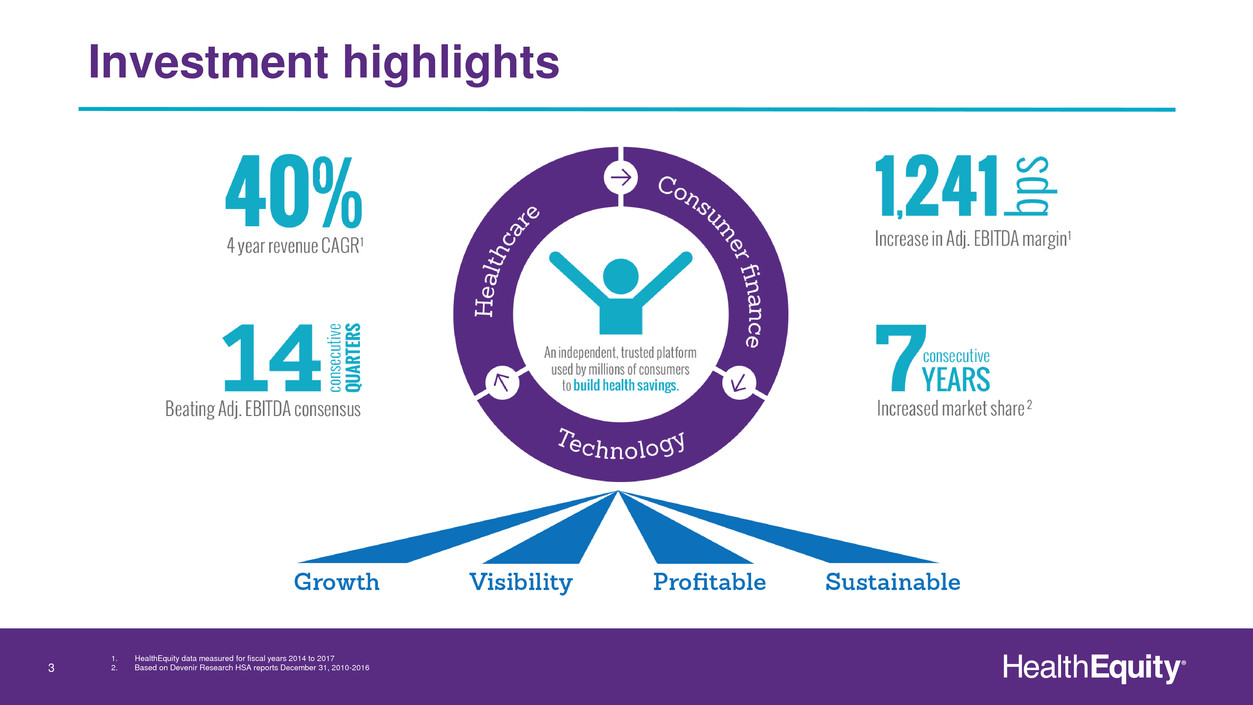

Investment highlights

3

1. HealthEquity data measured for fiscal years 2014 to 2017

2. Based on Devenir Research HSA reports December 31, 2010-2016

Key metrics

4

0%

100%

200%

300%

400%

500%

600%

700%

FY14 FY15 FY16 FY17 YTD FY18 TTM

C

u

m

ula

ti

ve

Gro

w

th

1. For the fiscal year ended January 31, 2017

2. Balances as of October 31, 2017

Revenue

Adj. EBITDA

HSAs

Custodial Assets

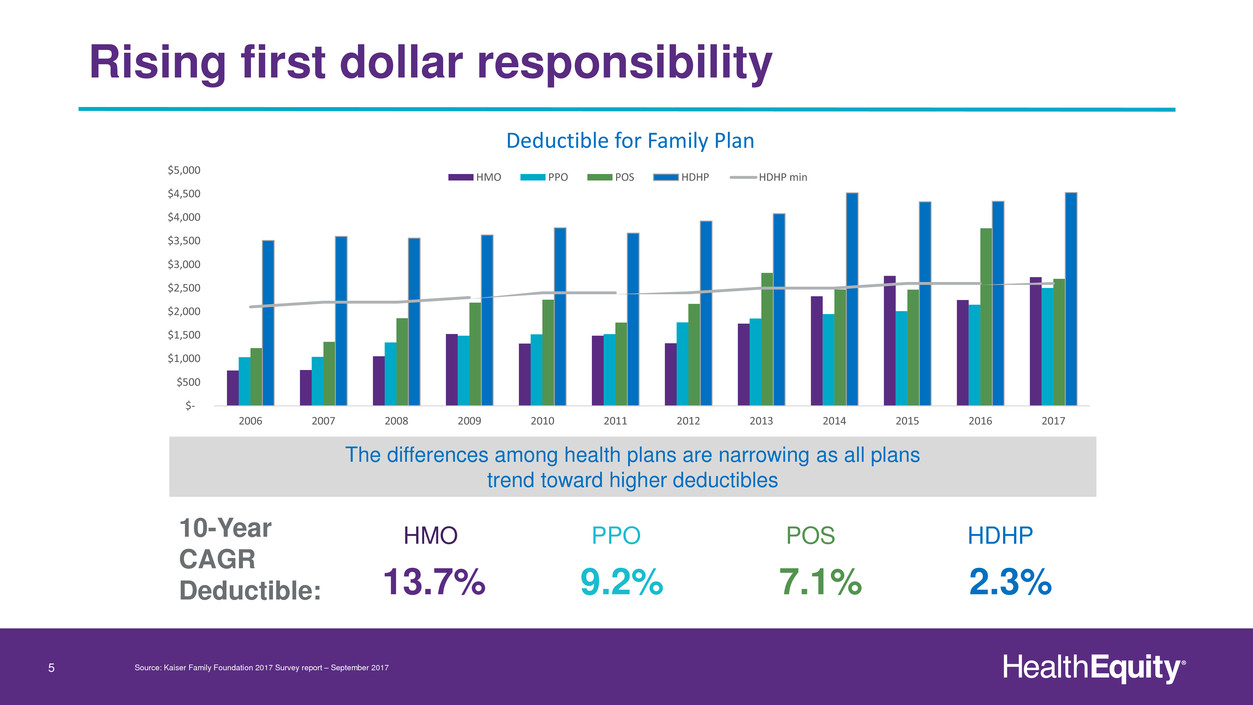

Rising first dollar responsibility

5

The differences among health plans are narrowing as all plans

trend toward higher deductibles

10-Year

CAGR

Deductible:

HMO PPO POS HDHP

Source: Kaiser Family Foundation 2017 Survey report – September 2017

13.7% 9.2% 7.1% 2.3%

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Deductible for Family Plan

HMO PPO POS HDHP HDHP min

Our core – health savings accounts

6

$6,900

Maximum family HSA contribution

$1,900

Average premium savings1

$1,417

Average employer contribution1

SOURCE: 1. Kaiser Family Foundation, 2017 Employee Benefits Survey

2. MEDACorp Survey referenced in Leerink 2017 Outlook report December 12, 2016.

6%

9%

11% 11%

14%

15%

19% 19%

8%

7%

7% 7% 6% 6% 6% 6%

2010 2011 2012 2013 2014 2015 2016 2017

HSA plan penetration1

Commercial healthcare inflation2

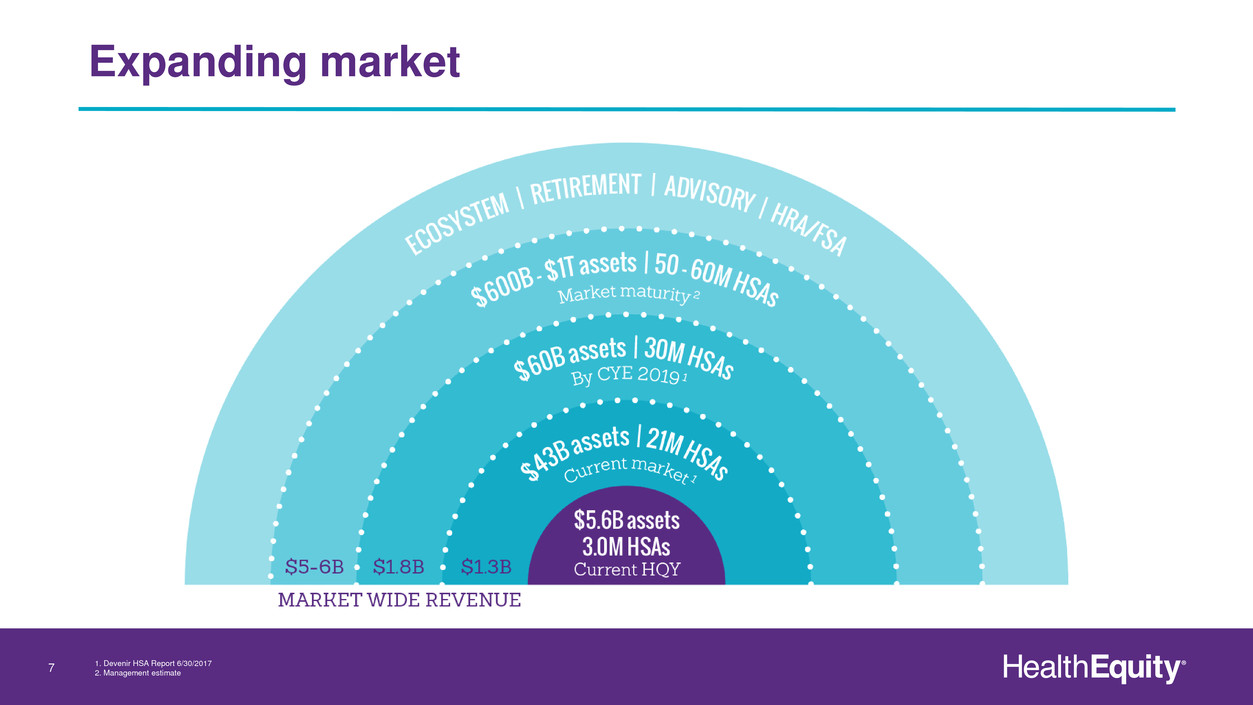

Expanding market

7 1. Devenir HSA Report 6/30/20172. Management estimate

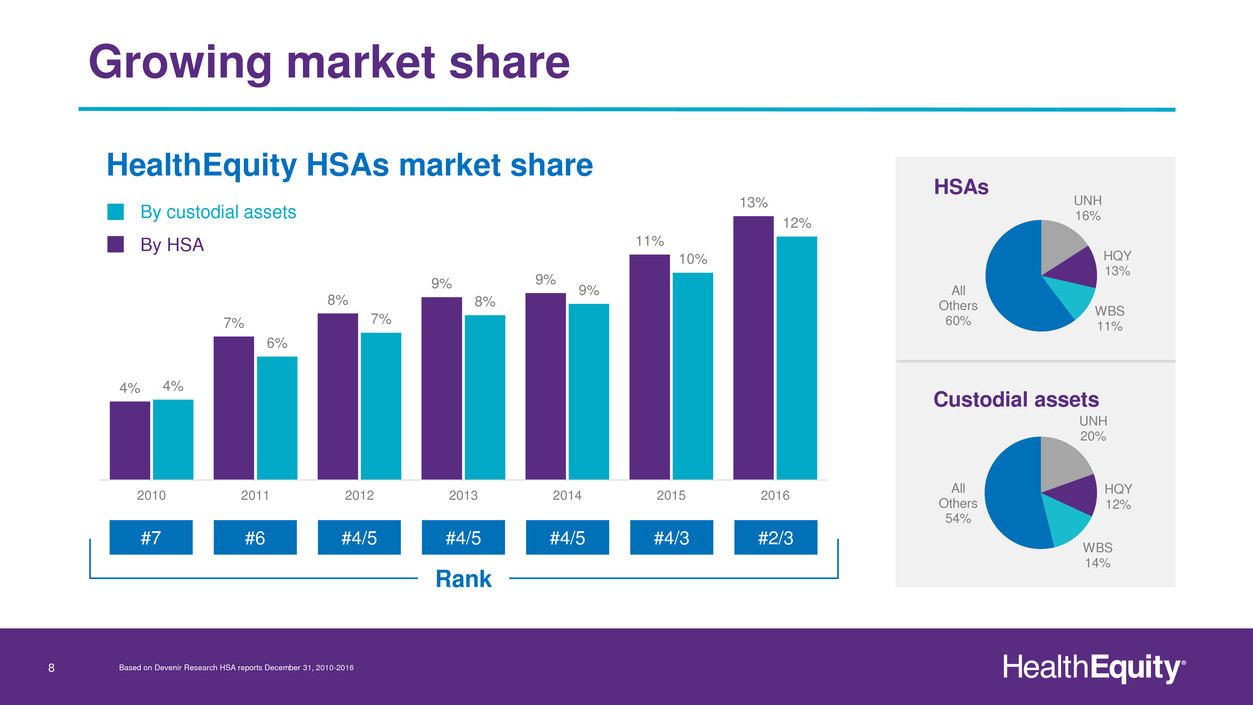

Growing market share

8

4%

7%

8%

9% 9%

11%

13%

4%

6%

7%

8%

9%

10%

12%

2010 2011 2012 2013 2014 2015 2016

Rank

Based on Devenir Research HSA reports December 31, 2010-2016

HealthEquity HSAs market share

UNH

20%

HQY

12%

WBS

14%

All

Others

54%

Custodial assets

UNH

16%

HQY

13%

WBS

11%

All

Others

60%

HSAs

#7 #6 #4/5 #4/5 #4/5 #4/3 #2/3

By custodial assets

By HSA

Proprietary end-to-end platform

9 HealthEquity data as of January 31, 2017

FY 18 sales results

10

• Largest HSA take

away

• Preferred relationship

agreements with

Blue Cross Blue

Shield Association

and Health Plan

Alliance

• Renewal of

Anthem partnership

Powerful monetization

11

Service

Card

Cash

Investing

Service

40%

Custodial

38%

Interchange

22%

FY18 YTD*

Service

50%

Custodial

31%

Interchange

19%

FY14

*Nine months as of October 31, 2017

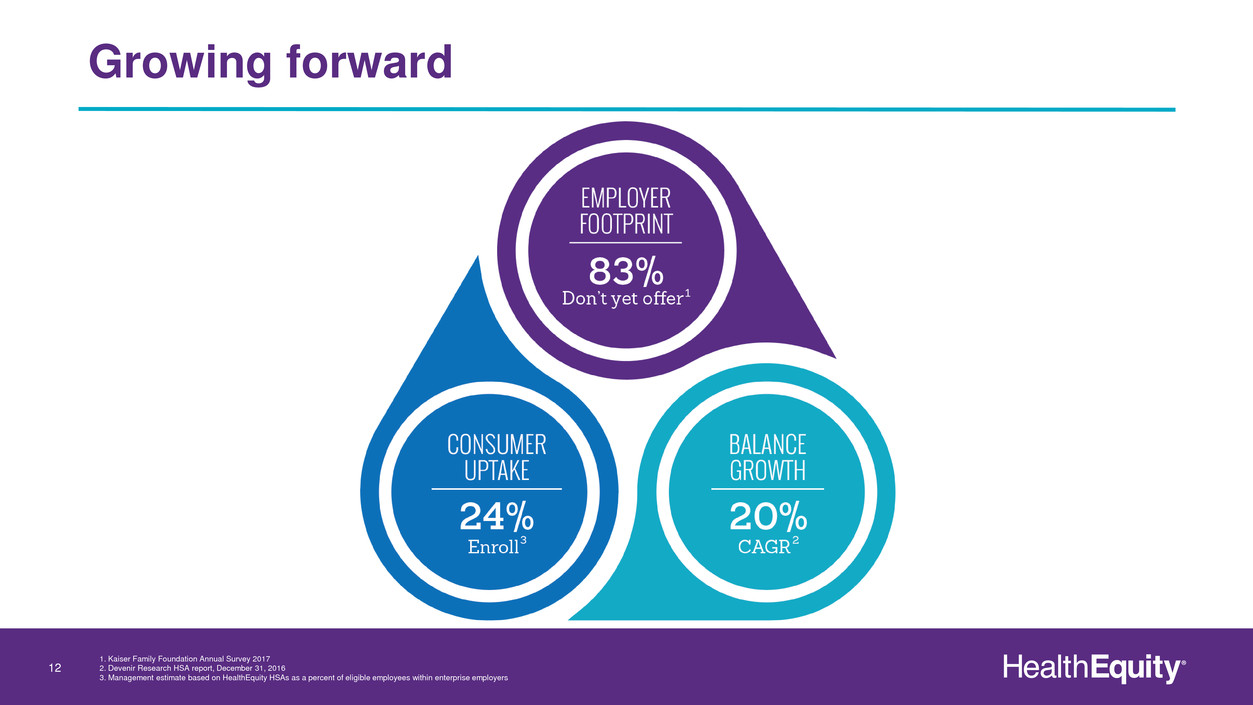

Growing forward

12

1. Kaiser Family Foundation Annual Survey 2017

2. Devenir Research HSA report, December 31, 2016

3. Management estimate based on HealthEquity HSAs as a percent of eligible employees within enterprise employers

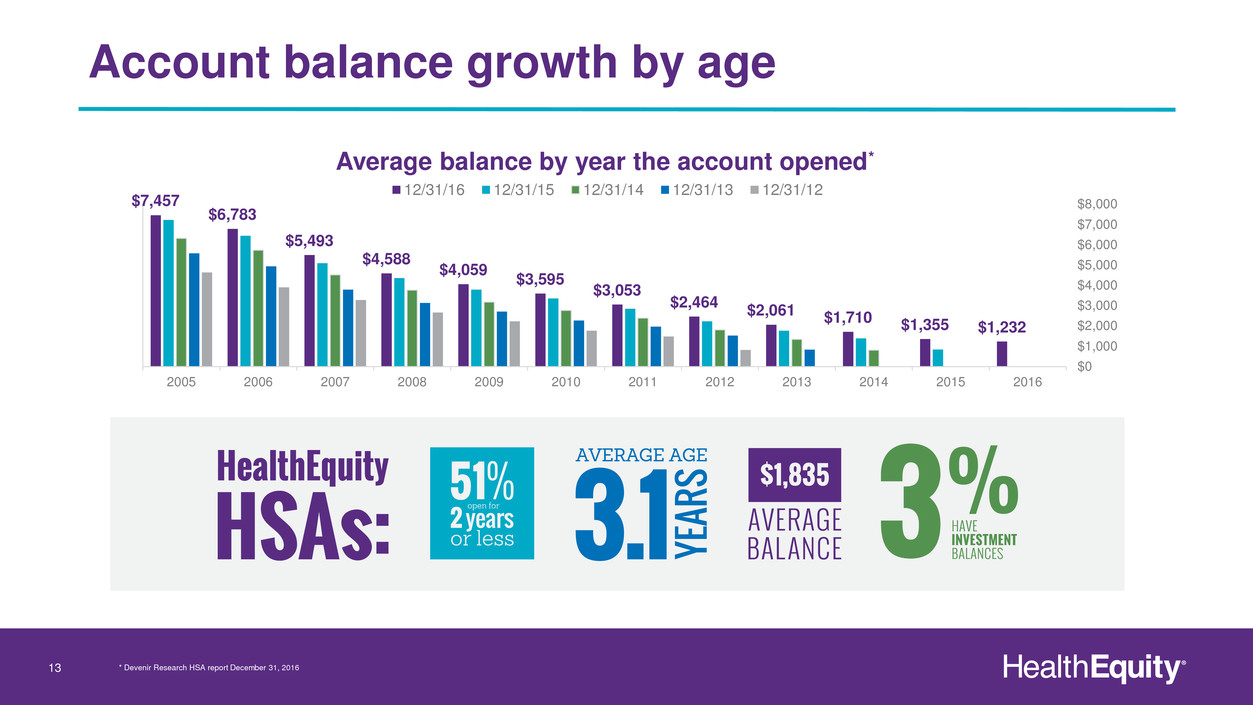

Account balance growth by age

13

$7,457

$6,783

$5,493

$4,588

$4,059

$3,595

$3,053

$2,464

$2,061 $1,710 $1,355 $1,232

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

12/31/16 12/31/15 12/31/14 12/31/13 12/31/12

Average balance by year the account opened*

* Devenir Research HSA report December 31, 2016

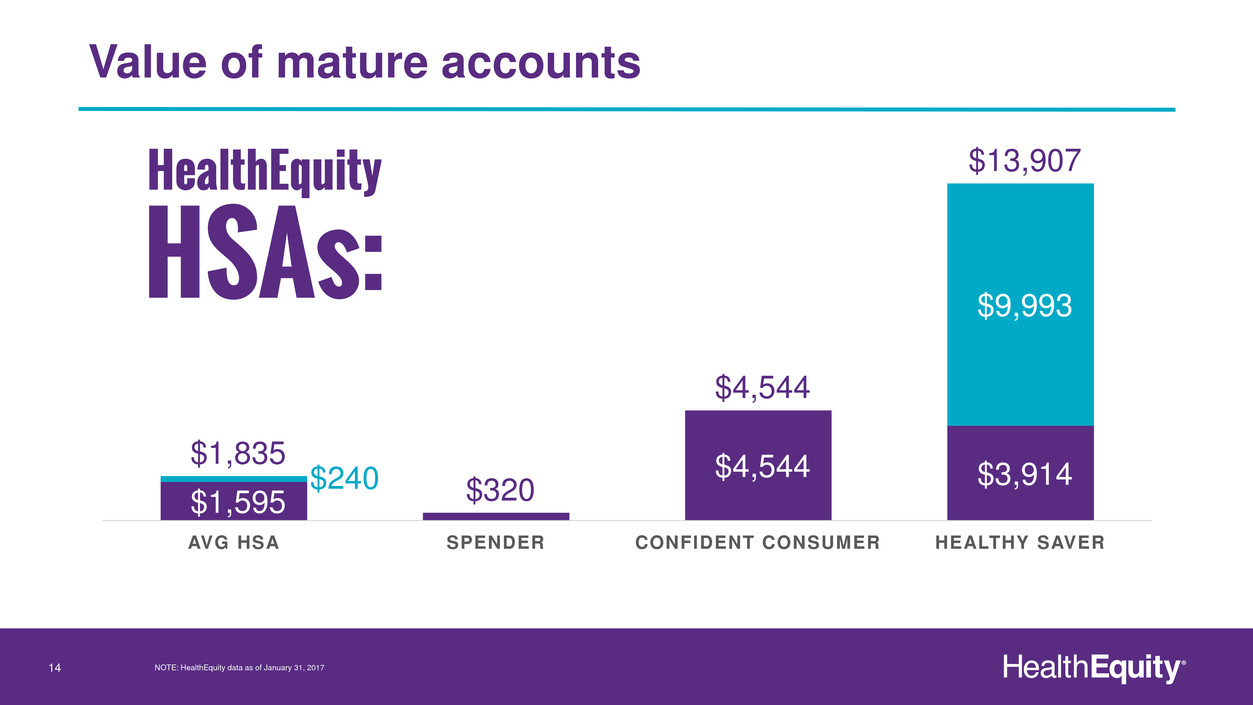

Value of mature accounts

14

$1,595

$4,544 $3,914 $240

$9,993

$1,835

$320

$4,544

$13,907

AVG HSA SPENDER CONFIDENT CONSUMER HEALTHY SAVER

NOTE: HealthEquity data as of January 31, 2017

Rising above

15

1. Data as of January 31, 2017

2. Devenir Research HSA report, December 31, 2016

3. Management estimate as of January 31, 2017

4. HealthEquity data as of October 31, 2017

3rd quarter operating results

16

HSAs (000s)

• New organic Q3 HSAs of 109K vs 89K YoY

• An additional 14K FIBK HSAs

• 27% Q3 growth in ending HSAs YoY

• Net increase of $1.3B YoY

• 30% growth YoY

NOTE: Historic performance depicted is not necessarily indicative of past and future performance. For more information, see our Company’s public filings with the Securities and Exchange Commission

2,308

3,713

4,593

385

571

987

2,693

4,284

5,580

Q3 FY16 Q3 FY17 Q3 FY18

Cash Assets Investment Assets

Custodial Assets ($M)

1,108

1,602

2,378

494

776

635

1,602

2,378

3,013

Q3 FY16 Q3 FY17 Q3 FY18

Net new HSAs

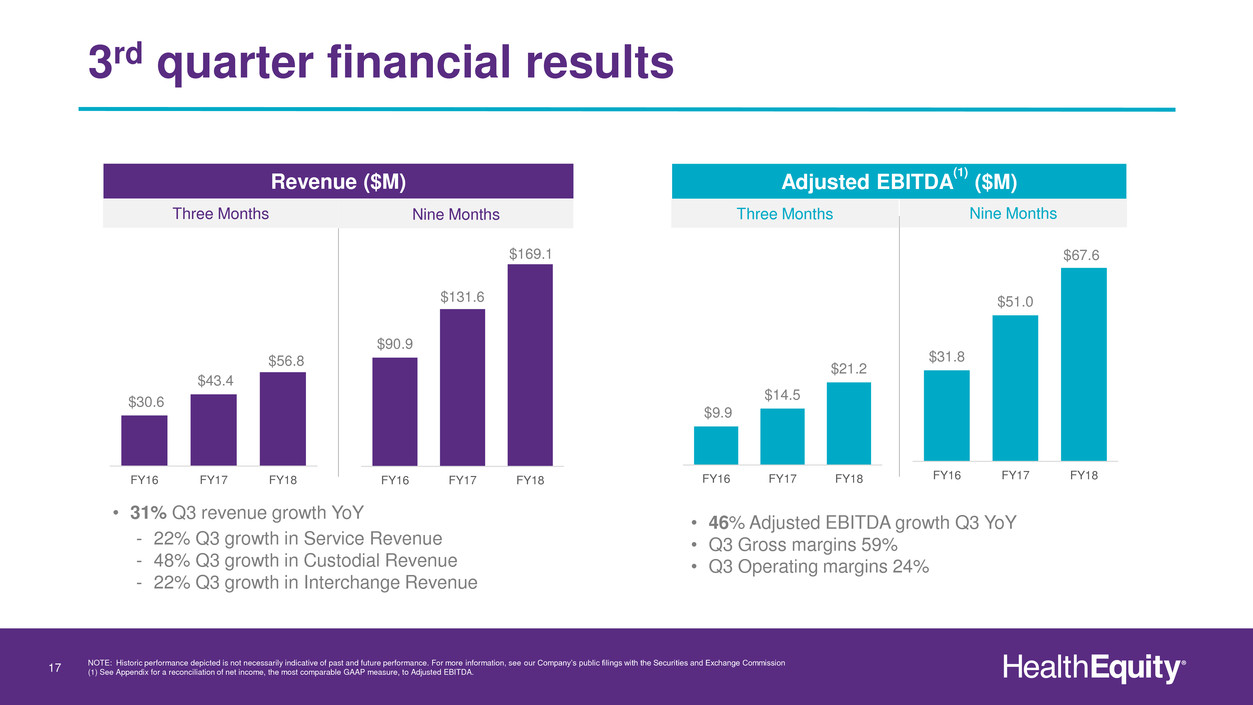

3rd quarter financial results

17

NOTE: Historic performance depicted is not necessarily indicative of past and future performance. For more information, see our Company’s public filings with the Securities and Exchange Commission

(1) See Appendix for a reconciliation of net income, the most comparable GAAP measure, to Adjusted EBITDA.

• 31% Q3 revenue growth YoY

- 22% Q3 growth in Service Revenue

- 48% Q3 growth in Custodial Revenue

- 22% Q3 growth in Interchange Revenue

• 46% Adjusted EBITDA growth Q3 YoY

• Q3 Gross margins 59%

• Q3 Operating margins 24%

Revenue ($M)

Three Months

$30.6

$43.4

$56.8

FY16 FY17 FY18

$90.9

$131.6

$169.1

FY16 FY17 FY18

Nine Months

$31.8

$51.0

$67.6

FY16 FY17 FY18

Adjusted EBITDA

(1)

($M)

$9.9

$14.5

$21.2

FY16 FY17 FY18

Three Months Nine Months

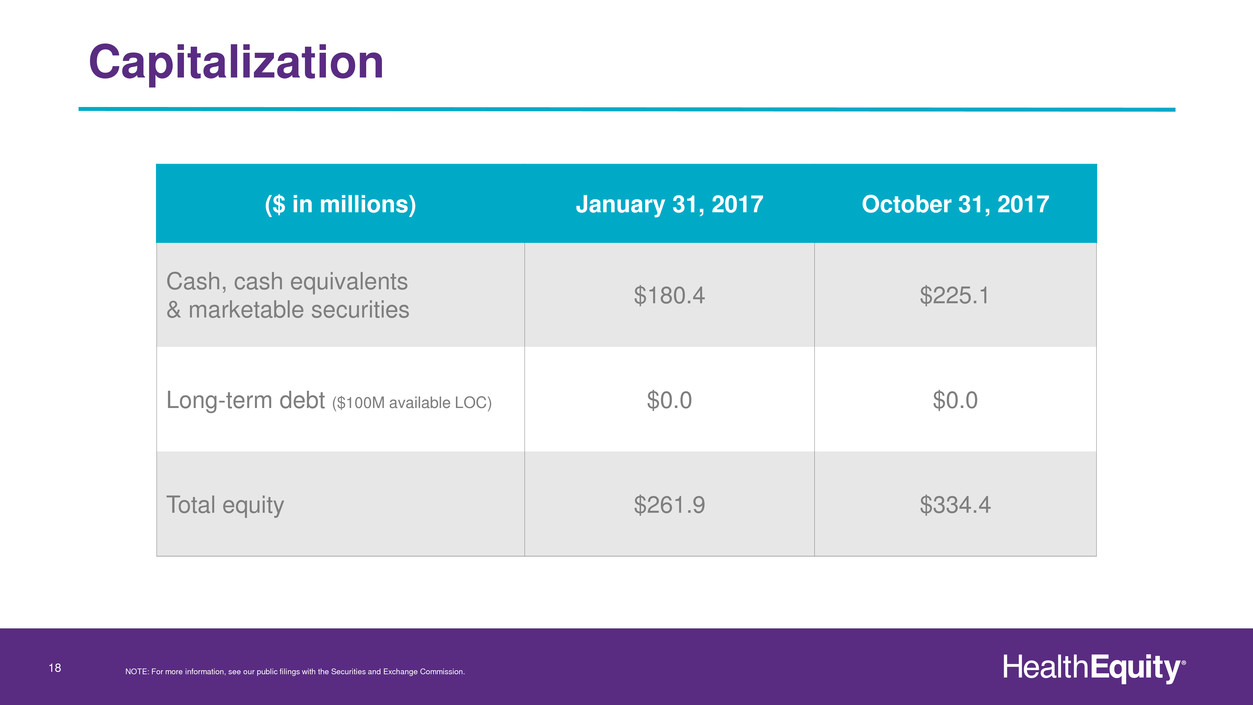

Capitalization

18

($ in millions) January 31, 2017 October 31, 2017

Cash, cash equivalents

& marketable securities $180.4 $225.1

Long-term debt ($100M available LOC) $0.0 $0.0

Total equity $261.9 $334.4

NOTE: For more information, see our public filings with the Securities and Exchange Commission.

Guidance

19

Business Outlook

For the Fiscal Year Ending January 31, 2018

Guidance as of:

($ in millions, except per share) December 5, 2017

* September 5, 2017 June 6, 2017 March 21, 2017

Revenue $225 - $228 $223 – $228 $222 - $227 $220 - $225

Non-GAAP Net Income** $39 - $41 $39 - $43 $38 - $42

Non-GAAP EPS diluted** $0.64 - $0.66 $0.64 - $0.68 $0.62 - $0.67

Adjusted EBITDA** $80 - $83 $79 – $84 $78 - $83 $77 - $82

*Guidance issued in press release dated December 5, 2017. We do not undertake to update this guidance, which speaks only as of the date given.

** See press release on December 5, 2017, for a reconciliation of net income, the most comparable GAAP measure, to Non-GAAP Net Income, Non-GAAP EPS and Adjusted EBITDA.