Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | ex991.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | a2018jpmorgan8-k.htm |

J.P. Morgan

Healthcare Conference

January 2018

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

1

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other

federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, expectations regarding

AMAG’s future growth and diversification; expectations regarding Intrarosa’s commercial opportunity and revenue potential, including the number of

women who suffer from dyspareunia in the U.S.; AMAG’s goal to achieve 65% unrestricted commercial coverage by month end; 2018 launch priorities

for Intrarosa, including to broaden its utilization and differentiating it with health care professionals; the expected bremelanotide regulatory timeline

and initiatives in preparation for commercial launch; AMAG’s beliefs regarding the target product profile for bremelanotide, including the presumed

dosing and administration, indication, safety profile and mechanism of action; the breadth of the hypoactive sexual desire disorder (HSDD) market and

bremelanotide’s market potential; beliefs regarding Makena’s position in the market; future revenue drivers for Makena, including securing

reimbursement and distribution for the subcutaneous auto-injector (if FDA approval is received), educating health care professionals on the auto-

injector product, expanding conversion through alternative treatment sites and launching an authorized generic; growth drivers for Cord Blood

Registry (CBR), including plans to grow first time enrollments, optimize first year price, strengthen core audiences, explore new channels and leverage

advancements in stem cell research; growth drivers for Feraheme, including initiating launch activities for the expanded label (if approved) to include

all eligible adult IDA patients, expanding access beyond chronic kidney disease through contracting and relationships in new specialties (if the broader

indication is approved) and continued market share growth; beliefs regarding the size of the current addressable market and expectations that the size

of the addressable market would double if the broader indication is approved; AMAG’s 2018 financial guidance, including forecasted GAAP and non-

GAAP revenue, GAAP operating income, and non-GAAP adjusted EBITDA; plans to issue fourth quarter and full year 2017 financial results in late

February 2018; and AMAG’s 2018 key priorities related to its products and product candidates, portfolio expansion and financial goals are forward-

looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-

looking statements. In addition, AMAG has presented 2018 guidance in this presentation, which guidance is based upon management’s current

assumptions and beliefs about various risks and opportunities, including key milestones whose outcomes may be determined during the first quarter

and first half of 2018. AMAG makes no assurances that such guidance numbers will be indicative of actual results or that any or all of the 2018

guidance assumptions will be realized on the anticipated timelines, or at all, or that the impact on revenues, operating income and adjusted EBITDA

will be as projected, and the company does not undertake any obligation to update such guidance to reflect actual outcomes or revised expectations.

Such risks and uncertainties include, the possibility that the company’s expectations as to key 2018 priorities, goals and expectations will not be

realized, including the results of the pending FDA submissions for the Makena subcutaneous auto-injector and the Feraheme label expansion, as well

as the timing for entrance of generics to the Makena intramuscular formulation, and those other risks identified in AMAG’s Securities and Exchange

Commission (“SEC”) filings, including its Annual Report on Form 10-K for the year ended December 31, 2016 and subsequent filings with the SEC.

AMAG cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. AMAG disclaims

any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on

which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking

statements.

AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. MuGard® is a registered trademark of Abeona

Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Cord Blood Registry® and CBR® are registered trademarks of Cbr

Systems, Inc. Intrarosa® is a trademark of Endoceutics, Inc.

2

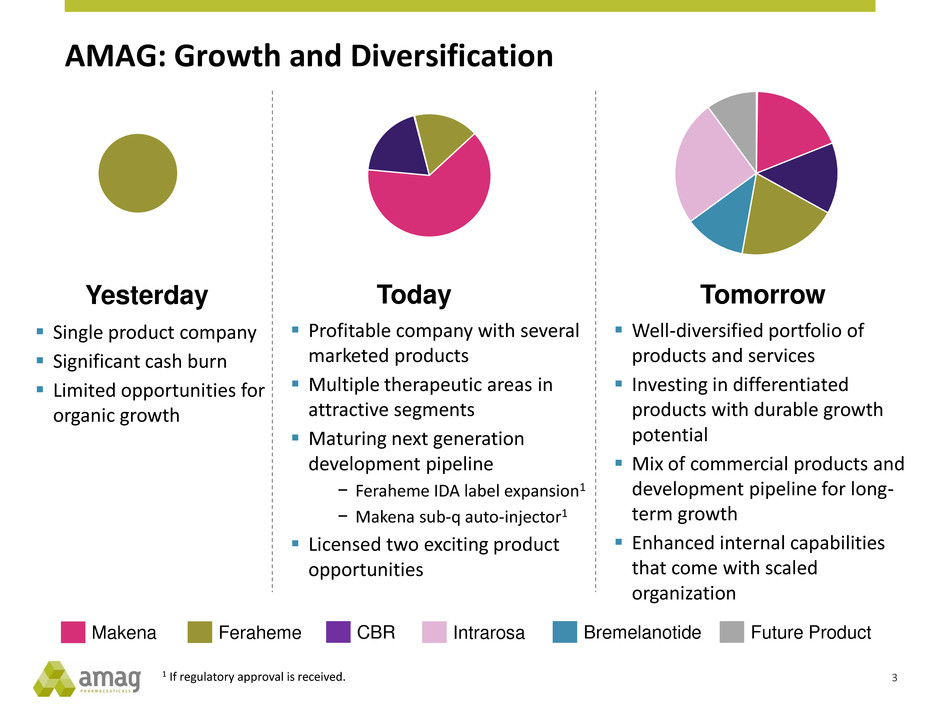

AMAG: Growth and Diversification

Tomorrow

Well-diversified portfolio of

products and services

Investing in differentiated

products with durable growth

potential

Mix of commercial products and

development pipeline for long-

term growth

Enhanced internal capabilities

that come with scaled

organization

Today

Profitable company with several

marketed products

Multiple therapeutic areas in

attractive segments

Maturing next generation

development pipeline

− Feraheme IDA label expansion1

− Makena sub-q auto-injector1

Licensed two exciting product

opportunities

Yesterday

Single product company

Significant cash burn

Limited opportunities for

organic growth

1 If regulatory approval is received.

Makena Feraheme CBR Intrarosa Bremelanotide Future Product

3

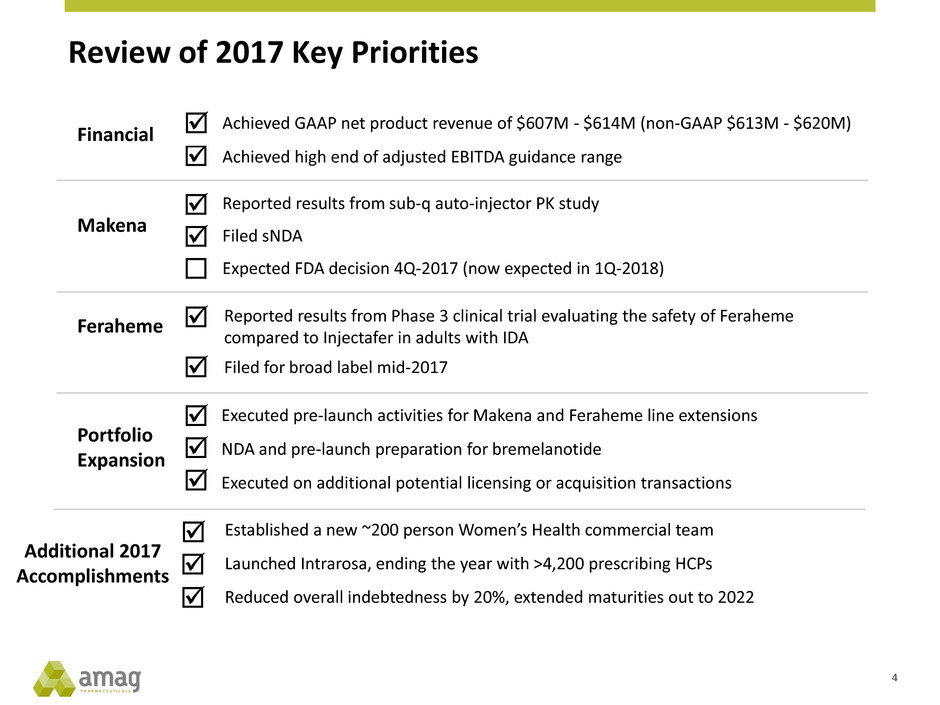

Review of 2017 Key Priorities

Makena

Feraheme

Executed pre-launch activities for Makena and Feraheme line extensions

NDA and pre-launch preparation for bremelanotide

Executed on additional potential licensing or acquisition transactions

Portfolio

Expansion

Financial

Reported results from sub-q auto-injector PK study

Filed sNDA

Expected FDA decision 4Q-2017 (now expected in 1Q-2018)

Reported results from Phase 3 clinical trial evaluating the safety of Feraheme

compared to Injectafer in adults with IDA

Filed for broad label mid-2017

Achieved GAAP net product revenue of $607M - $614M (non-GAAP $613M - $620M)

Achieved high end of adjusted EBITDA guidance range

Established a new ~200 person Women’s Health commercial team

Launched Intrarosa, ending the year with >4,200 prescribing HCPs

Reduced overall indebtedness by 20%, extended maturities out to 2022

Additional 2017

Accomplishments

4

2017 Financial Results

Preliminary and Unaudited

($M)

4Q-2017 Preliminary Results Full Year 2017 Preliminary Results

GAAP Non-GAAP GAAP Non-GAAP

Makena $97 - $102 $97 - $102 $385 - $390 $385 - $390

Feraheme/MuGard $26 - $28 $26 - $28 $106 - $108 $106 - $108

Cord Blood Registry ~$30 ~$311 ~$114 ~$1201

Intrarosa ~$2 ~$2 ~$2 ~$2

Total revenue $155 - $162 $156 - $1631 $607 - $614 $613 - $6201

Operating loss ($16) – ($6) N/A ($302) – ($292) N/A

Adjusted EBITDA2 N/A $58 - $68 N/A $220 - $230

Total GAAP revenue increased 5% and 15% in the fourth

quarter and full year, respectively, over 2016

1 Non-GAAP revenue includes purchase accounting adjustments related to CBR deferred revenue of $1.4M and $5.5M

in the fourth quarter and full year of 2017, respectively.

2 See slide 41 for a reconciliation of GAAP to non-GAAP financials.

5

Treatment of iron

deficiency anemia (IDA)

in adult patients with

chronic kidney disease

(CKD)

The only FDA-approved

therapy to reduce

recurrent preterm birth

in certain at-risk women

World’s largest umbilical

cord stem cell collection

and storage company

Candidate for the

treatment of severe

preeclampsia

An investigational

product for the

treatment of hypoactive

sexual desire disorder

(HSDD) in pre-

menopausal women

Management of oral

mucositis, a common

side effect of radiation or

chemotherapy

Maternal and Women’s HealthHematology /

Oncology Pregnancy

& Birth

Wellness

Post-Menopausal

Health

Velo

Option

Bremelanotide

FDA-approved locally

administered non-

estrogen1 product to

treat moderate to

severe dyspareunia

(pain during sex), a

symptom of VVA, due

to menopause, which

does not carry a boxed

warning in its label

61 Intrarosa is converted by enzymes in the body into androgens and estrogens, though the mechanism of action is not fully established.

AMAG’s Expanding Portfolio of Products

Product Portfolio Overview

•Intrarosa®

• Bremelanotide

• Makena®

• Cord Blood Registry®

• Feraheme®

7

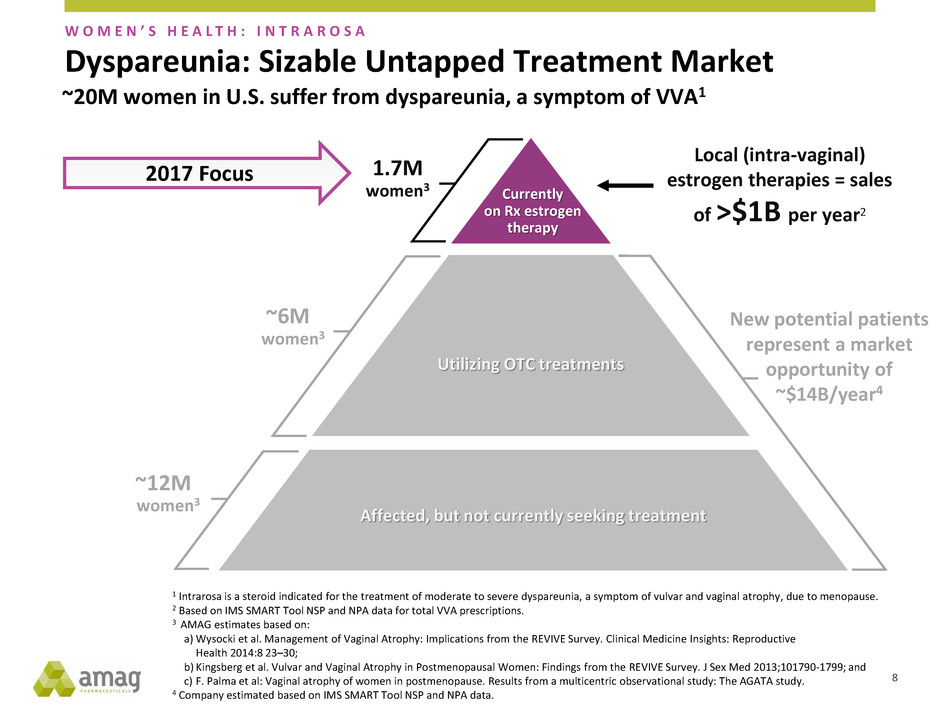

Affected, but not currently seeking treatment

Utilizing OTC treatments

Dyspareunia: Sizable Untapped Treatment Market

8

1 Intrarosa is a steroid indicated for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy, due to menopause.

2 Based on IMS SMART Tool NSP and NPA data for total VVA prescriptions.

3 AMAG estimates based on:

a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive

Health 2014:8 23–30;

b) Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799; and

c) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study.

4 Company estimated based on IMS SMART Tool NSP and NPA data.

Currently

on Rx estrogen

therapy

Local (intra-vaginal)

estrogen therapies = sales

of >$1B per year2

1.7M

women3

~6M

women3

~12M

women3

W O M E N ’ S H E A L T H : I N T R A R O S A

~20M women in U.S. suffer from dyspareunia, a symptom of VVA1

New potential patients

represent a market

opportunity of

~$14B/year4

2017 Focus

9

Intrarosa: Two Key Differentiators

W O M E N ’ S H E A L T H : I N T R A R O S A

Non-Estrogen1 with

No Boxed Warning Differentiated Mechanism of Action

1 Intrarosa is converted by enzymes in the body into androgens and estrogens, though the mechanism of action is not fully established.

®

DHEA levels decrease with age

Launch Priority 3

Increase HCP

prescribing

Launch Priority 2

Increase market

awareness

Intrarosa Launch: Strong Progress in Awareness and Access

10

W O M E N ’ S H E A L T H : I N T R A R O S A

Launch Priority 1

Create affordable

access for all patients

2017: Focused on HCP experience

and patient access to treatment

• Broad use of patient

copay savings card

• ~65% of commercial

lives with unrestricted

formulary access

expected by month end

• 140 sales reps,

>90,0001 calls made

to ~22,0001 HCPs

• 2402 speaker

programs with

>2,5002 HCP

attendees

• NRx market share 2.6%3

• Early adopters with

samples driving higher

NRx share

‒ 9%3 and growing

• >4,2003 HCP prescribers

(>2x since November)

1 SFDC call notes data through 12/22/17.

2 Avant Health Speaker program data.

3 IMS data through w/e 12/22/17.

Performance vs. Previous Osphena® Launch

11

W O M E N ’ S H E A L T H : I N T R A R O S A

Aggregate TRx totals in first 23 weeks of launch – Intrarosa vs. Osphena1

TRx

1 IMS data for the first 23 weeks of each respective launch.

9,002

19,727

-

5,000

10,000

15,000

20,000

25,000

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Week #

Osphena Intrarosa

W O M E N ’ S H E A L T H : I N T R A R O S A

Intrarosa Growth Strategy

12

Affected, but not currently seeking treatment

Utilizing OTC treatments

Dyspareunia: Sizable Untapped Treatment Market

13

1 Intrarosa is a steroid indicated for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy, due to menopause.

2 Based on IMS SMART Tool NSP and NPA data for total VVA prescriptions.

3 AMAG estimates based on:

a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive

Health 2014:8 23–30;

b) Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799; and

c) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study.

4 Company estimated based on IMS SMART Tool NSP and NPA data.

Currently

on Rx estrogen

therapy

Local (intra-vaginal)

estrogen therapies = sales

of >$1B per year2

1.7M

women3

~6M

women3

~12M

women3

W O M E N ’ S H E A L T H : I N T R A R O S A

~20M women in U.S. suffer from dyspareunia, a symptom of VVA1

New potential patients

represent a market

opportunity of

~$14B/year4

2017 Focus

2018

A

d

d

iti

o

n

al

E

ff

ort

s

Develop

condition

awareness

The Digital Patient Journey

W O M E N ’ S H E A L T H : I N T R A R O S A

or

Consult MD

Office visit

or on-line

On-line adherence programs

Seek

treatment

options

14

Product Portfolio Overview

• Intrarosa®

•Bremelanotide

• Makena®

• Cord Blood Registry®

• Feraheme®

15

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

Investigational product to treat hypoactive sexual desire disorder (HSDD)

Self-administered auto-injector pen used in anticipation of sexual activity

Novel mechanism of action: melanocortin receptor agonist (MCR4)

Two Phase 3 studies met co-primary, pre-specified endpoints on desire

and distress

Favorable safety profile

On track for NDA submission Q1-2018

Large market opportunity

Significant Opportunity in Area of High Unmet Need

W O M E N ’ S H E A L T H : B R E M E L A N O T I D E

Bremelanotide Overview

16

Treated (Rx)

Presented

to HCP, but

not treated

Not

diagnosed

.5M4

1.6M1,2,4

3.7M

Significant Market Opportunity

~10M pre-menopausal women in U.S. with HSDD1

17

1 Rosen et al, Characteristics of premenopausal and postmenopausal women with acquired, generalized HSDD: the HSDD Registry for women.

2 Patient segmentation market research sponsored by Palatin Technologies, Inc. and conducted by the Burke Institute, September 2016.

3 Survey data from Shifren (2008); 2014 U.S. census data.

4 Dectiva market research report (HSDD registry).

Pre-menopausal

women with HSDD

(primary symptom)

Initial target

patient population

Pre-menopausal

women with HSDD

(not primary symptom)

Post-menopausal

women

with HSDD

W O M E N ’ S H E A L T H : B R E M E L A N O T I D E

4.8M1

4.4M

5.8M2

15M U.S.

Women with HSDD3

Differentiated Target Product Profile

Bremelanotide

Dosing &

Administration

Self-administered subcutaneous auto-injector pen used in anticipation of

sexual activity

Indication The treatment of pre-menopausal women with HSDD

Clinical

Two successful Phase 3 studies completed

Randomized 1,267 pre-menopausal women with primary HSDD

Co-primary efficacy endpoints met

Increase in sexual desire and decrease in distress associated with low

sexual desire

Safety

No known alcohol interaction (alcohol interaction study completed)

Favorable overall safety profile in Phase 3 controlled studies

Most common AEs were nausea, flushing and headache; generally mild-

to-moderate in severity

Only two treatment related SAEs; both occurred in one subject

(nausea/vomiting and headache)

~80% of patients that completed the Phase 3 trials elected to participate

in the open label roll-over safety study

Presumed Mechanism

of Action

Targets pathways (melanocortin receptor agonist) involved in sexual

desire and arousal response

W O M E N ’ S H E A L T H : B R E M E L A N O T I D E

18

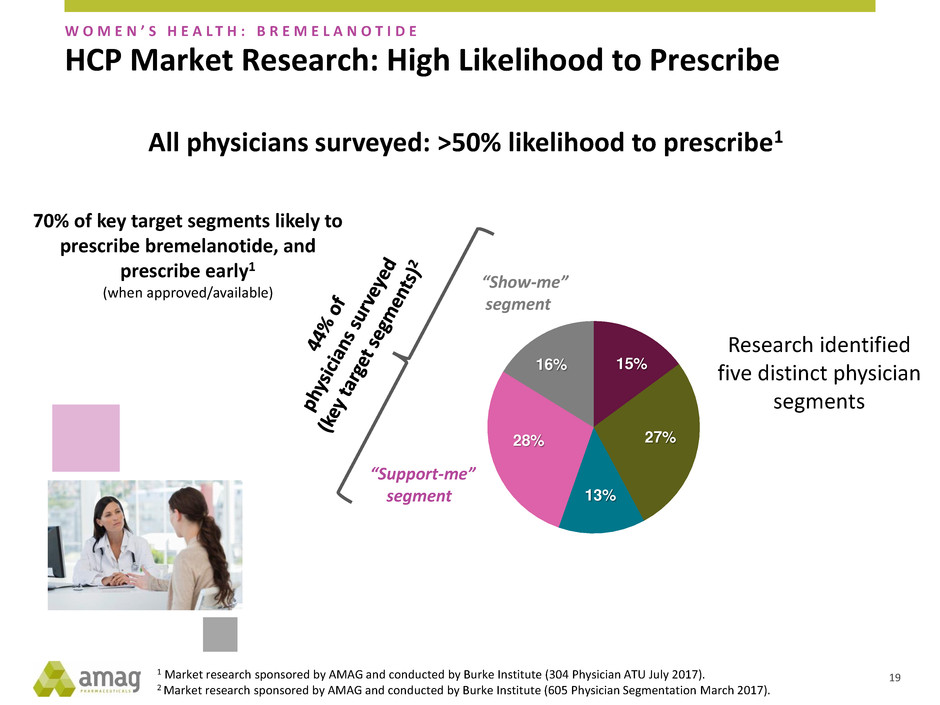

HCP Market Research: High Likelihood to Prescribe

W O M E N ’ S H E A L T H : B R E M E L A N O T I D E

19

15%

27%

13%

28%

16%

All physicians surveyed: >50% likelihood to prescribe1

“Show-me”

segment

“Support-me”

segment

70% of key target segments likely to

prescribe bremelanotide, and

prescribe early1

(when approved/available)

Research identified

five distinct physician

segments

1 Market research sponsored by AMAG and conducted by Burke Institute (304 Physician ATU July 2017).

2 Market research sponsored by AMAG and conducted by Burke Institute (605 Physician Segmentation March 2017).

2016 2017 2018 2019

Estimated Timeline to Approval

20

▪ Targeted FDA approval

▪ Phase 3 studies completed

▪ Completed drug-drug

interaction and safety

pharmacology studies

▪ Planned NDA submission

W O M E N ’ S H E A L T H : B R E M E L A N O T I D E

2018 launching HSDD awareness and education

initiatives in preparation for early 2019 potential approval and launch

Product Portfolio Overview

• Intrarosa®

• Bremelanotide

•Makena®

• Cord Blood Registry®

• Feraheme®

21

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

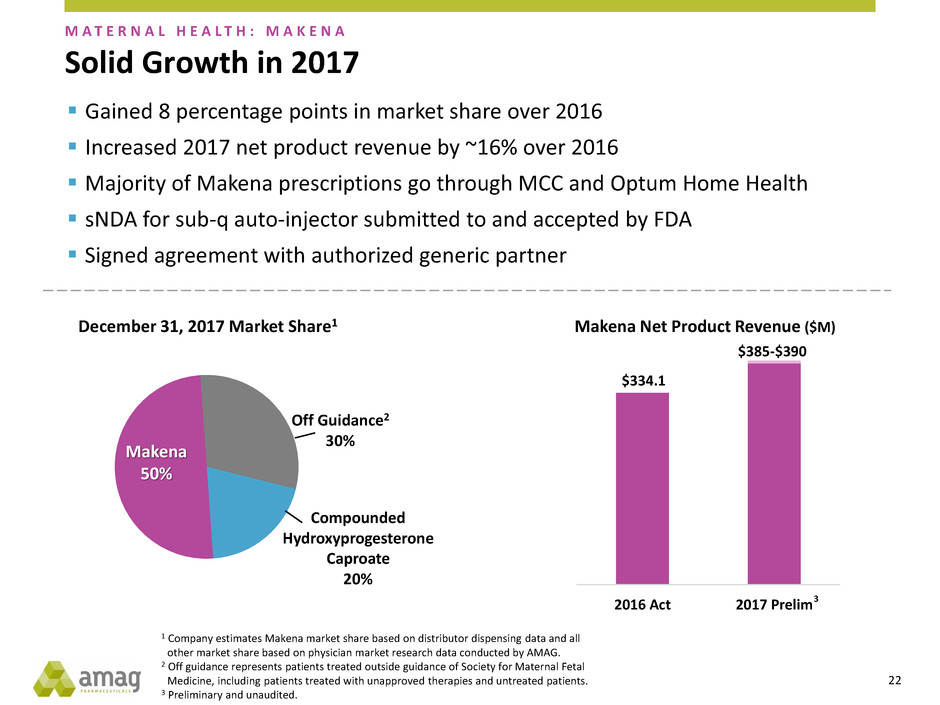

$334.1

2016 Act 2017 Prelim

$385-$390

Solid Growth in 2017

M A T E R N A L H E A L T H : M A K E N A

1 Company estimates Makena market share based on distributor dispensing data and all

other market share based on physician market research data conducted by AMAG.

2 Off guidance represents patients treated outside guidance of Society for Maternal Fetal

Medicine, including patients treated with unapproved therapies and untreated patients.

3 Preliminary and unaudited.

Off Guidance2

30%

Makena

50%

Compounded

Hydroxyprogesterone

Caproate

20%

December 31, 2017 Market Share1

Gained 8 percentage points in market share over 2016

Increased 2017 net product revenue by ~16% over 2016

Majority of Makena prescriptions go through MCC and Optum Home Health

sNDA for sub-q auto-injector submitted to and accepted by FDA

Signed agreement with authorized generic partner

Makena Net Product Revenue ($M)

22

3

M A T E R N A L H E A L T H : M A K E N A

2018 Revenue Drivers

1 If regulatory approval by FDA is received. 23

Secure approval, reimbursement and

distribution of sub-q auto-injector1

Quickly educate HCPs on sub-q auto

injector to facilitate new patient

starts

– Sales force

– Makena Care Connection

Expand conversion activity through

alternate treatment sites (i.e. retail

pharmacies)

Launch authorized generic upon first

generic entrant to capture economics

on residual IM business

Product Portfolio Overview

• Intrarosa®

• Bremelanotide

• Makena®

•Cord Blood Registry®

• Feraheme®

24© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

$99.6

~$114

2016 Act 2017 Prelim

25

1 Preliminary and unaudited.

2 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $17M and $5.5M for 2016

and 2017, respectively.

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

Attractive Recurring Revenue Stream

($M)

$116.6

~$120

2016 Act 2017 Prelim1 1

GAAP CBR Full Year Revenue Non-GAAP CBR Full Year Revenue2

Accomplishments & Growth Drivers

2018 Growth Drivers

Grow ‘first time’ enrollments

Optimize first year price

Strengthen core audiences (HCPs and consumers)

Explore new channels (i.e. employers)

Leverage advancements in stem cell research

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

2017 Accomplishments

Reached 700,000 cord blood and cord tissue units stored

‘First time’ enrollments returned to growth

Stabilized new enrollment pricing

Increased annual storage fee on ~1/3 of existing customers

26

Product Portfolio Overview

• Intrarosa®

• Bremelanotide

• Makena®

• Cord Blood Registry®

•Feraheme®

27

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

Feraheme Continued Growth

($M)

$97.1

2016 Act 2017 Prelim

$106-$108

1 Represents revenues from Feraheme only. Excludes revenues from MuGard as reported on financial statements.

2 Preliminary and unaudited numbers.

21

2017 Accomplishments

Completed an additional head-to-head

Phase 3 trial for broader indication well

ahead of schedule

Received FDA acceptance for review of

submission to broaden the current label

5.3% growth in Feraheme grams over 2016

Continued broad patient access strategy,

creating reimbursement predictability

‒ >95% of business is contracted

28

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

Initiate launch activities for

potential Q1 expanded label to

include all eligible adult IDA

patients1

Grow market share of Feraheme

through clinical differentiation

Expand access through contracting

beyond CKD with key accounts and

GPOs

Build relationships in new

specialties to maximize expanded

indication

2018 Growth Drivers

1 If regulatory approval is received for expansion of the label to include adult

IDA patients who have an intolerance to iron or have had an unsatisfactory

response to oral iron.

29

Large IV Iron Market Opportunity of $780M1,2

30

1 If regulatory approval is received for broad IDA indication.

2 AMAG estimates market opportunity using ~$600/gram and 1.3M grams (Q2-2017 IMS data annualized).

3 AMAG estimates current market using IMS data and internal analytics.

Feraheme

23%3

Other IV irons

77%3

Current Addressable

IV Iron Market:

$390M3

Additional Addressable

IV Iron Market:

$390M

‒ Iron deficiency anemia

caused by other diseases

– Iron deficiency anemia caused

by chronic kidney disease

Label expansion

doubles

our addressable

market1

Non-dialysis IV iron market

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

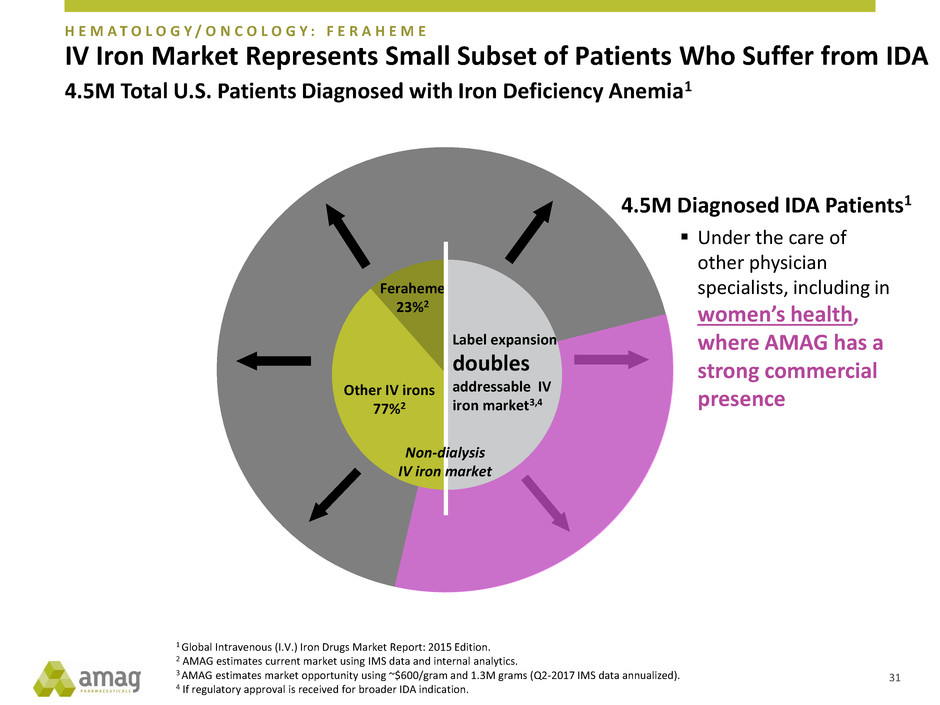

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

IV Iron Market Represents Small Subset of Patients Who Suffer from IDA

31

1 Global Intravenous (I.V.) Iron Drugs Market Report: 2015 Edition.

2 AMAG estimates current market using IMS data and internal analytics.

3 AMAG estimates market opportunity using ~$600/gram and 1.3M grams (Q2-2017 IMS data annualized).

4 If regulatory approval is received for broader IDA indication.

4.5M Total U.S. Patients Diagnosed with Iron Deficiency Anemia1

4.5M Diagnosed IDA Patients1

Under the care of

other physician

specialists, including in

women’s health,

where AMAG has a

strong commercial

presence

Feraheme

23%2

Other IV irons

77%2

Label expansion

doubles

addressable IV

iron market3,4

Non-dialysis

IV iron market

Financial Overview

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved. 32

Solid 2017 GAAP Revenue Growth

Q4-2016 Act Q4-2017 Prelim

$151.5 $155-$162

Fourth Quarter Revenue

~5%

($M)

Makena CBRFeraheme/MuGard

2016 Act 2017 Prelim

$532.1

$607-$614

Full Year Revenue

~15%

1 Preliminary and unaudited.

1 1

Intrarosa

33

Solid 2017 Non-GAAP Revenue Growth

Q4-2016 Act Q4-2017 Prelim

$152.9 $156-$163

Fourth Quarter Revenue

~4%

($M)

2016 Act 2017 Prelim

$549.1

$613-$620

Full Year Revenue

~12%

1,2 1,2

1 Preliminary and unaudited.

2 Includes purchase accounting adjustments related to deferred revenue of $1.4M in Q4-2016, $1.4M in Q4-2017, $17M in 2016 and $5.5M

in 2017.

22

Makena CBRFeraheme/MuGardIntrarosa

34

GAAP Operating Income and Non-GAAP Adjusted EBITDA1

$14.6

($11)

$77.4

$63

35

Operating Income (Loss)

$78.9

$265.7

$225

Fourth Quarter Full Year

1 See slide 41 for a reconciliation of GAAP to non-GAAP financials results.

2 Preliminary and unaudited.

3 2017 non-GAAP adjusted EBITDA reflects the mid-point of preliminary, unaudited results. AMAG plans to issue final 2017 financial results in late

February 2018.

2,3 2,3

($M)

Q4-2016 Act Q4-2017 Prelim 2016 Act 2017 Prelim

($297)

Adjusted EBITDA

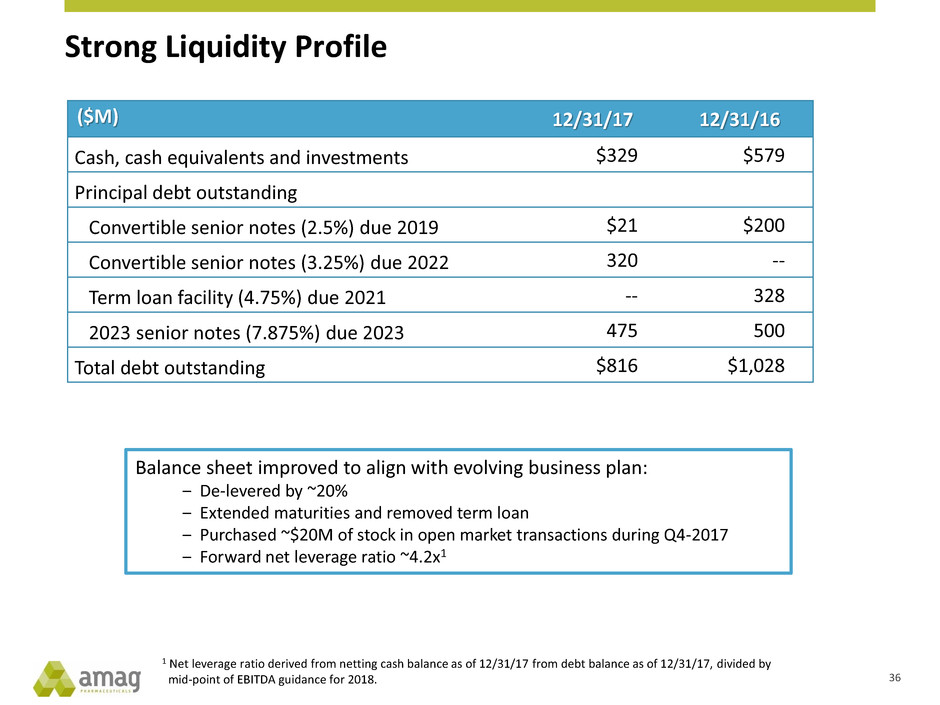

Strong Liquidity Profile

($M) 12/31/17 12/31/16

Cash, cash equivalents and investments $329 $579

Principal debt outstanding

Convertible senior notes (2.5%) due 2019 $21 $200

Convertible senior notes (3.25%) due 2022 320 --

Term loan facility (4.75%) due 2021 -- 328

2023 senior notes (7.875%) due 2023 475 500

Total debt outstanding $816 $1,028

Balance sheet improved to align with evolving business plan:

‒ De-levered by ~20%

‒ Extended maturities and removed term loan

‒ Purchased ~$20M of stock in open market transactions during Q4-2017

‒ Forward net leverage ratio ~4.2x1

36

1 Net leverage ratio derived from netting cash balance as of 12/31/17 from debt balance as of 12/31/17, divided by

mid-point of EBITDA guidance for 2018.

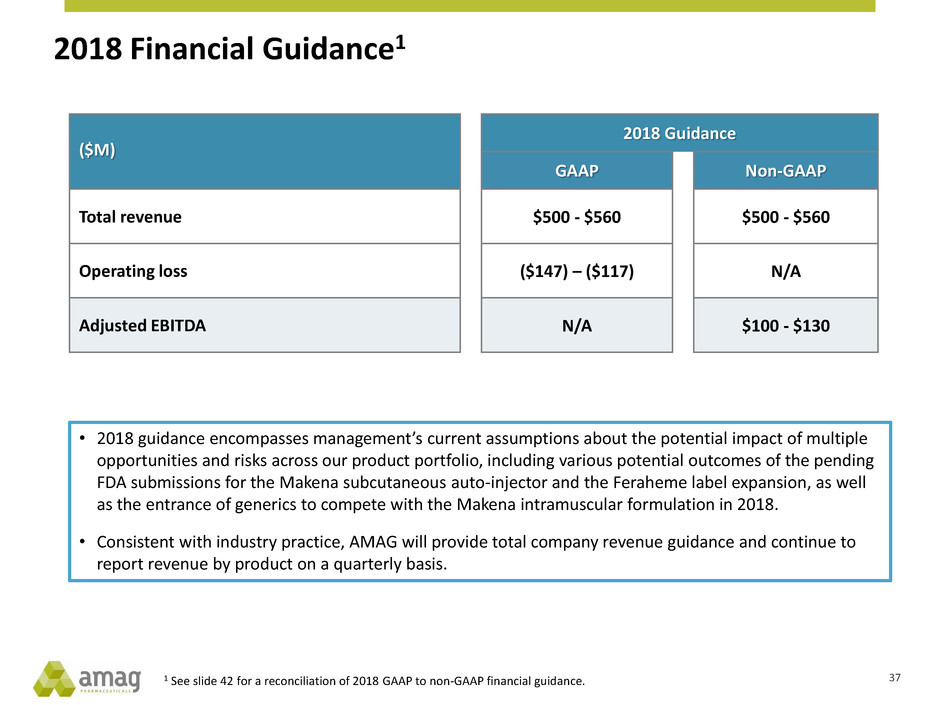

2018 Financial Guidance1

($M)

2018 Guidance

GAAP Non-GAAP

Total revenue $500 - $560 $500 - $560

Operating loss ($147) – ($117) N/A

Adjusted EBITDA N/A $100 - $130

1 See slide 42 for a reconciliation of 2018 GAAP to non-GAAP financial guidance.

• 2018 guidance encompasses management’s current assumptions about the potential impact of multiple

opportunities and risks across our product portfolio, including various potential outcomes of the pending

FDA submissions for the Makena subcutaneous auto-injector and the Feraheme label expansion, as well

as the entrance of generics to compete with the Makena intramuscular formulation in 2018.

• Consistent with industry practice, AMAG will provide total company revenue guidance and continue to

report revenue by product on a quarterly basis.

37

2018 Key Priorities

Intrarosa

Continue to drive awareness and usage of Intrarosa

Initiate digital consumer campaign mid-2018

Invest to expand treatable patient population (i.e. HSDD Phase 3 study)

Makena

Launch subcutaneous auto-injector in Q1-20181

Prepare for potential 2018 competitive generic threat

Authorized generic readiness

CBR Continue to grow ‘first time’ enrollments

Feraheme

Launch expanded IDA label (all causes) in Q1-20181

Increase market share

Bremelanotide

Submit NDA in Q1-2018

Prepare for FDA advisory committee meeting in Q4-2018 (estimated timing)

Portfolio

Expansion

Continue to explore the addition of longer-lived, durable products through

licensing or acquisition transactions

Financial

Drive toward non-GAAP revenue of $530M (midpoint of guidance)

Achieve adjusted EBITDA of $115M (midpoint of guidance)

38

1 If regulatory approval is received.

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

39

J.P. Morgan Healthcare

Conference

January 2018

Appendix

40

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved.

Reconciliation of GAAP to Non-GAAP Preliminary Financial Results

41

($M)

GAAP operating income (loss)

Purchase accounting adjustments related to CBR

deferred revenue

Depreciation and intangible asset amortization

Non-cash inventory step-up adjustments

Stock-based compensation

Adjustments to contingent consideration

Impairment charges of intangible assets

Transaction / acquisition related costs

Acquired IPR&D

Restructuring costs

Non-GAAP adjusted EBITDA

Q4-2017

Prelim

Q4-2016

Actual

2017

Prelim

2016

Actual

($16) – ($6) $14.6 ($302) – ($292) $78.9

1 1.4 6 17.0

68 29.1 152 94.2

1 1.0 2 5.7

5 5.7 23 22.5

(1) 20.6 (48) 25.7

-- 3.7 319 19.7

-- 1.3 2 1.3

-- -- 66 --

-- -- -- 0.7

$58 - $68 $77.4 $220 - $230 $265.7

Reconciliation of GAAP to Non-GAAP 2018 Financial Guidance

42

($M) 2018 Financial Guidance

Operating loss ($147) – ($117)

Depreciation & intangible asset amortization 200

Stock-based compensation 23

Non-cash inventory step up and adjustments to contingent consideration 4

Acquired IPR&D 20

Non-GAAP adjusted EBITDA $100 - $130

J.P. Morgan Healthcare

Conference

January 2018

© 2018 AMAG Pharmaceuticals, Inc. All rights reserved. 43