Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SCANA CORP | mergerannouncement.htm |

| EX-99.8 - EXHIBIT 99.8 - SCANA CORP | exhbit998finald-usq_transc.htm |

| EX-99.7 - EXHIBIT 99.7 - SCANA CORP | ex997dominionwebsite-linke.htm |

| EX-99.5 - EXHIBIT 99.5 - SCANA CORP | exhibit995investorpresenta.htm |

| EX-99.4 - EXHIBIT 99.4 - SCANA CORP | exhibit994farrelltranscrip.htm |

| EX-99.3 - EXHIBIT 99.3 - SCANA CORP | exhibit993scanaemployeemee.htm |

| EX-99.2 - EXHIBIT 99.2 - SCANA CORP | exhibit992textofaudiomessa.htm |

| EX-99.1 - EXHIBIT 99.1 - SCANA CORP | exhibit991dominionenergy-s.htm |

Exhibit 99.6

IMPORTANT ADDITIONAL INFORMATION

In connection with the proposed transaction, Dominion Energy will file a registration statement on Form S-4, which will include a document that serves as a prospectus of Dominion Energy and a proxy statement of SCANA (the “proxy statement/prospectus”), and each party will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement/prospectus will be sent to SCANA’s shareholders. Investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website (http://www.sec.gov) or from Dominion Energy or SCANA. The documents filed by Dominion Energy with the SEC may be obtained free of charge by directing a request to Dominion Energy, Inc., 120 Tredegar Street, Richmond, Virginia 23219, Attention: Corporate Secretary, Corporate.Secretary@dominionenergy.com, and the documents filed by SCANA with the SEC may be obtained free of charge to SCANA Corporation, 220 Operation Way, Mail Code D133, Cayce, South Carolina 29033, Attention: Office of the Corporate Secretary, BoardInformation@scana.com.

PARTICIPANTS IN THE SOLICITATION

Dominion Energy and SCANA and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Dominion Energy’s directors and executive officers is available in Dominion Energy’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, in its proxy statement dated March 20, 2017, for its 2017 Annual Meeting of Shareholders, and certain of its Current Reports on Form 8-K. Information about SCANA’s directors and executive officers is available in SCANA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, in its proxy statement dated March 24, 2017, for its 2017 Annual Meeting of Shareholders and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Dominion Energy or SCANA as indicated above.

Who We Are Have Questions? Customer Benefits

Brighter Together

Our energy future: bright, reliable, strong

Customer Benefits »

Brighter Together

Our energy future: bright, reliable, strong

Customer Benefits »

Our Story

Dominion Energy and SCANA coming together would bring a brighter energy future for South Carolina, North Carolina and Georgia.

SCANA and Dominion Energy share proud histories of serving our customers and communities. Together, we would create even greater opportunities for the people who depend on us in those states.

SCANA customers would be joining one of the nation’s largest producers and transporters of energy, one consistently ranked among the most admired in our industry. Having a strong energy partner would help promote economic growth and access to new energy resources.

SCANA electric customers would see dramatic savings following the merger—both in cash payments and lower rates—while natural gas customers can look for continued safe and reliable service.

Read full media release here.

Dominion Energy and SCANA coming together would bring a brighter energy future for South Carolina, North Carolina and Georgia.

SCANA and Dominion Energy share proud histories of serving our customers and communities. Together, we would create even greater opportunities for the people who depend on us in those states.

SCANA customers would be joining one of the nation’s largest producers and transporters of energy, one consistently ranked among the most admired in our industry. Having a strong energy partner would help promote economic growth and access to new energy resources.

SCANA electric customers would see dramatic savings following the merger—both in cash payments and lower rates—while natural gas customers can look for continued safe and reliable service.

Read full media release here.

Customer Benefits

A merger between Dominion Energy and SCANA makes sense because it would benefit all parties, providing certainty and a path forward.

Dominion Energy would provide immediate financial relief for electric customers now paying for the uncompleted new nuclear units. Both a cash payment and lower rates are planned. For communities, it means holding on to a community partner that would have more resources to meet new and changing energy needs. And for SCANA shareholders, including thousands of retirees and working families, it is a fair deal, too.

Customer payments

Each SCE&G electric customer would get a cash payment based on their historical electric usage—worth $1,000 for an average residential customer, with regulatory approval of the merger plan.

Continued Savings

Beyond the one-time cash payment, customers would see a rate reduction of about 5 percent, equal to more than $7 a month for a typical SCE&G residential customer, pending regulatory approval. Additional customer savings are planned to come from the resolution of the nuclear build issues, meaning all customer costs would decline until they disappear in 20 years rather than the currently scheduled 50-to-60 years.

Employee Protection

SCANA employees would have employment protection until 2020. Dominion Energy also would maintain a headquarters for SCE&G in South Carolina, continuing to be an economic driver for the state and region.

Charitable Giving

Investing in our communities is a Dominion Energy core value. Dominion Energy would not only maintain SCANA’s philanthropic efforts, but would increase that charitable giving by an additional $1 million a year for at least five years.

A merger between Dominion Energy and SCANA makes sense because it would benefit all parties, providing certainty and a path forward.

Dominion Energy would provide immediate financial relief for electric customers now paying for the uncompleted new nuclear units. Both a cash payment and lower rates are planned. For communities, it means holding on to a community partner that would have more resources to meet new and changing energy needs. And for SCANA shareholders, including thousands of retirees and working families, it is a fair deal, too.

Customer payments

Each SCE&G electric customer would get a cash payment based on their historical electric usage—worth $1,000 for an average residential customer, with regulatory approval of the merger plan.

Continued Savings

Beyond the one-time cash payment, customers would see a rate reduction of about 5 percent, equal to more than $7 a month for a typical SCE&G residential customer, pending regulatory approval. Additional customer savings are planned to come from the resolution of the nuclear build issues, meaning all customer costs would decline until they disappear in 20 years rather than the currently scheduled 50-to-60 years.

Employee Protection

SCANA employees would have employment protection until 2020. Dominion Energy also would maintain a headquarters for SCE&G in South Carolina, continuing to be an economic driver for the state and region.

Charitable Giving

Investing in our communities is a Dominion Energy core value. Dominion Energy would not only maintain SCANA’s philanthropic efforts, but would increase that charitable giving by an additional $1 million a year for at least five years.

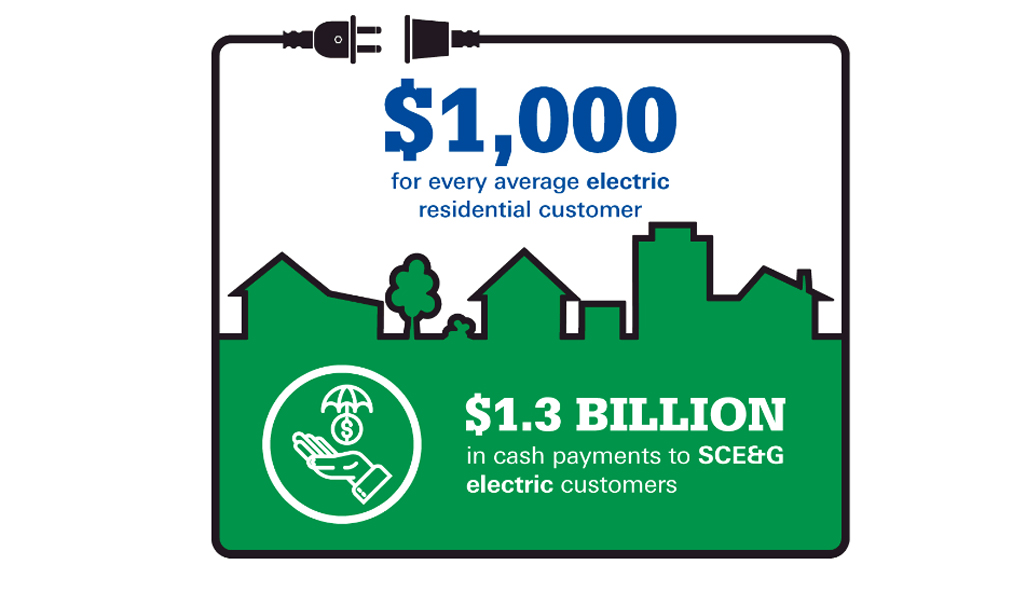

$1,000 for every average electric residential customer $1.3 billion in cash payments to SCE$G electric customers

Our Commitment

Dominion Energy is one of the nation’s largest producers and transporters of energy, serving more than 6 million utility and retail energy customers. Headquartered in Virginia with operations in 18 states including South Carolina, Dominion Energy is a longtime operator in electric generation and distribution as well as natural gas storage and transmission. In addition, we are on the cutting edge of developing future-looking energy sources including renewables. Our history gives us a stability you can rely on, while our push for innovation ensures we are always delivering the cleanest, most efficient and most affordable energy.

But Dominion Energy is about more than our business transactions. Our company is built on a proud legacy of public service, innovation and community involvement. Dominion Energy and our 16,200 employees invest in the communities where we live and work and practice responsible environmental stewardship wherever we operate. We seek out people who share our values and volunteerism—plus, one in five new Dominion Energy hires is a veteran.

See here to read important additional information about the Registration Statement being filed with the U.S. Securities and Exchange Commission in connection with the merger and persons deemed to be participants in the solicitation of proxies in respect of the proposed transaction.

Dominion Energy is one of the nation’s largest producers and transporters of energy, serving more than 6 million utility and retail energy customers. Headquartered in Virginia with operations in 18 states including South Carolina, Dominion Energy is a longtime operator in electric generation and distribution as well as natural gas storage and transmission. In addition, we are on the cutting edge of developing future-looking energy sources including renewables. Our history gives us a stability you can rely on, while our push for innovation ensures we are always delivering the cleanest, most efficient and most affordable energy.

But Dominion Energy is about more than our business transactions. Our company is built on a proud legacy of public service, innovation and community involvement. Dominion Energy and our 16,200 employees invest in the communities where we live and work and practice responsible environmental stewardship wherever we operate. We seek out people who share our values and volunteerism—plus, one in five new Dominion Energy hires is a veteran.

See here to read important additional information about the Registration Statement being filed with the U.S. Securities and Exchange Commission in connection with the merger and persons deemed to be participants in the solicitation of proxies in respect of the proposed transaction.

Frequently Asked Questions

Question 1: How will the merger impact customers in the short and long term?

This merger includes very significant customer benefits. All electric customers would share in $1.3 billion in cash payments to offset costs related to the withdrawn construction of two new nuclear units that will not be completed because they grew too costly. For an average residential customer, the amount would be $1,000.

Question 2: How will the cash payment be calculated?

Each electric customer of SCE&G will get a cash payment based on the amount of electricity purchased for a 12-month period prior to the merger closing. The cash payment will be about $1,000 for an average residential customer. Cash payments will be paid by check or similar mechanism. They will be sent automatically within 90 days of the merger closing, and customers will not have to apply for them.

All customers also would see an approximate 5 percent rate reduction, driven from refunds of previous customer collections, as well as pass-through of corporate tax reform benefits, equal to more than $7 a month for a typical residential customer.

Dominion Energy will assume nearly $1.7 billion of existing withdrawn nuclear construction assets and will never collect them from customers. The merger will eliminate this cost from customer bills in 20 years, far sooner than the 50-60 that had been planned. And, Dominion Energy will never collect from customers the cost of purchasing a gas-fired power plant that would help replace power that was expected from the nuclear units.

Question 3: Will I have to apply for the cash payment?

Question 1: How will the merger impact customers in the short and long term?

This merger includes very significant customer benefits. All electric customers would share in $1.3 billion in cash payments to offset costs related to the withdrawn construction of two new nuclear units that will not be completed because they grew too costly. For an average residential customer, the amount would be $1,000.

Question 2: How will the cash payment be calculated?

Each electric customer of SCE&G will get a cash payment based on the amount of electricity purchased for a 12-month period prior to the merger closing. The cash payment will be about $1,000 for an average residential customer. Cash payments will be paid by check or similar mechanism. They will be sent automatically within 90 days of the merger closing, and customers will not have to apply for them.

All customers also would see an approximate 5 percent rate reduction, driven from refunds of previous customer collections, as well as pass-through of corporate tax reform benefits, equal to more than $7 a month for a typical residential customer.

Dominion Energy will assume nearly $1.7 billion of existing withdrawn nuclear construction assets and will never collect them from customers. The merger will eliminate this cost from customer bills in 20 years, far sooner than the 50-60 that had been planned. And, Dominion Energy will never collect from customers the cost of purchasing a gas-fired power plant that would help replace power that was expected from the nuclear units.

Question 3: Will I have to apply for the cash payment?

No, it will be sent to you automatically. It will be sent within 90 days after closing the merger, pending regulatory approval.

Question 4: What if I was a SCANA Electric & Gas electric customer for part of that time but no longer am a customer? Will I still get a cash payment?

Details of the plan will be provided later

Question 5: Why aren’t PSNC Energy and SCANA Energy gas customers getting a cash payment?

The cash payment is to help cover costs paid for the withdrawn construction of two nuclear units. Only electric customers have paid toward that project, not natural gas customers.

Copyright © 2018 Dominion Energy

Question 4: What if I was a SCANA Electric & Gas electric customer for part of that time but no longer am a customer? Will I still get a cash payment?

Details of the plan will be provided later

Question 5: Why aren’t PSNC Energy and SCANA Energy gas customers getting a cash payment?

The cash payment is to help cover costs paid for the withdrawn construction of two nuclear units. Only electric customers have paid toward that project, not natural gas customers.

Copyright © 2018 Dominion Energy

Safe Harbor and Legends

IMPORTANT ADDITIONAL INFORMATION

In connection with the proposed transaction between Dominion Energy, Inc. and SCANA Corporation, Dominion Energy will file with the SEC a Registration Statement on Form S-4 that will include a combined Proxy Statement of SCANA and Prospectus of Dominion Energy, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Dominion Energy and SCANA will be submitted to SCANA’s shareholders for their consideration. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Shareholders of SCANA are urged to read the registration statement and the proxy statement/prospectus regarding the transaction when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information.

Shareholders will be able to obtain a free copy of the definitive proxy statement/prospectus, as well as other filings containing information about Dominion Energy and SCANA, without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Dominion Energy, Inc., 120 Tredegar Street, Richmond, Virginia 23219, Attention: Corporate Secretary, Corporate.Secretary@dominionenergy.com or to SCANA Corporation, 220 Operation Way, Mail Code 0133, Cayce, South Carolina 29033, Attention: Office of the Corporate Secretary, BoardInformation@scana.com.

PARTICIPANTS IN THE SOLICITATION

Dominion Energy, SCANA and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Dominion Energy’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 20, 2017, Dominion Energy’s Annual Report on Form 10-K, which was filed with the SEC on February 28, 2017 and certain of its Current Reports on Form 8-K. Information regarding SCANA’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 24, 2017, SCANA’s Annual Report on Form 10-K, which was filed with the SEC on February 24, 2017 and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described under Important Additional Information.

FORWARD-LOOKING STATEMENTS

This website contains statements that constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The statements relate to, among other things, expectations, estimates and projections. We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “outlook”, “predict”, “project”, “should”, “strategy”, “target”, “will”, “would”, “potential” and similar terms and phrases to identify forward-looking statements in this presentation. Factors that could cause actual results to differ include, but are not limited to: the expected timing and likelihood of completion of the proposed acquisition of SCANA, including the ability to obtain the requisite approvals of SCANA’s shareholders; the risk that Dominion Energy or SCANA may be unable to obtain necessary regulatory approvals for the transaction or required regulatory approvals may delay the transaction or cause the parties to abandon the transaction; the risk that conditions to the closing of the transaction may not be satisfied; or the risk that an unsolicited offer for the assets or capital stock of SCANA may interfere with the transaction. Other risk factors for Dominion Energy’s and SCANA’s businesses are detailed from time to time in Dominion Energy’s and SCANA’s quarterly reports on Form 10-Q or most recent annual report on Form 10-K filed with the Securities and Exchange Commission.