Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Logistics LP | a2018januarypbfxinvestorco.htm |

PBF Energy

January 2018

1

This presentation contains forward-looking statements made by PBF Energy Inc. (“PBF Energy”), the indirect parent of PBF Logistics LP (“PBFX”, or

“Partnership”, and together with PBF Energy, the “Companies”, or “PBF”), and their management teams. Such statements are based on current

expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and

intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and

may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements

are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual

performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not

limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products;

the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics

infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent

impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or

regulations or differing interpretations or enforcement thereof affecting our business or industry; actions taken or non-performance by third

parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other

labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to

complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; ability to consummate potential

acquisitions, the timing for the closing of any such acquisition and our plans for financing any acquisition; unforeseen liabilities associated with any

potential acquisition; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future

laws and governmental regulations, including environmental, health and safety regulations; and, various other factors.

Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no

responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information after such date.

See the Appendix for reconciliations of the differences between the non-GAAP financial measures used in this presentation, including various

estimates of EBITDA, and their most directly comparable GAAP financial measures.

Safe Harbor Statements

Second most complex independent refiner with geographically diverse footprint

Crude and feedstock optionality provides access to most economic input slate

Strategic relationship with PBF Logistics (NYSE:PBFX) provides growth partnership

Long and successful history of executing accretive acquisitions and driving growth

Proven track record of investing in organic, margin-improvement projects

Targeting self-help projects to enhance margin capture and increase commercial

flexibility

Focused internal investment to drive growth and enhance margins

Maintain conservative balance sheet and strong liquidity

Access to low cost-of-capital through strategic PBFX relationship

Refining and Logistics segments provide dual growth platforms

Increase refining profitability through reliable operations and reduced costs

Diversify logistics footprint through organic growth and third-party transactions

Attractive

Asset Base

PBF – A Compelling Investment

Proven

Track Record

Disciplined

Capital Allocation

Future

Growth Opportunities

3

Attractive Asset Diversification and Growth

PBF's core strategy is to operate safely,

reliably and responsibly

Pursue disciplined growth strategy through

strategic refining and logistics acquisitions

and development of organic projects

Diversified asset base with five refineries and

884,000 barrels per day of processing capacity

• Second most complex refining system with

12.2 Nelson Complexity

Region

Throughput Capacity

(bpd)

Nelson

Complexity

Mid-continent 170,000 9.2

East Coast 370,000 12.2

Gulf Coast 189,000 12.7

West Coast 155,000 14.9

Total 884,000 12.2

Source: Company reports

0

500

1,000

1,500

2,000

2,500

V

LO

P

S

X

M

P

C

A

N

D

V

P

B

F

H

F

C

D

K

C

V

I

US Independent Refiners by Throughput Capacity

Paulsboro

Toledo

Chalmette

Torrance

PADD

2

PADD

3

PADD

5

Delaware City

PADD

4

PADD

1

4

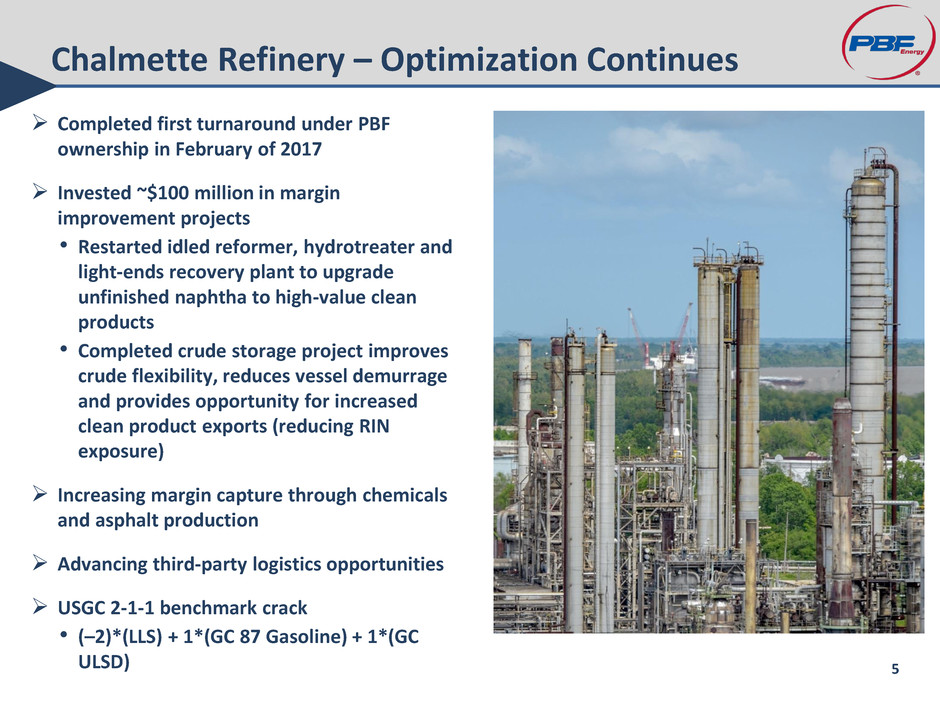

Completed first turnaround under PBF

ownership in February of 2017

Invested ~$100 million in margin

improvement projects

• Restarted idled reformer, hydrotreater and

light-ends recovery plant to upgrade

unfinished naphtha to high-value clean

products

• Completed crude storage project improves

crude flexibility, reduces vessel demurrage

and provides opportunity for increased

clean product exports (reducing RIN

exposure)

Increasing margin capture through chemicals

and asphalt production

Advancing third-party logistics opportunities

USGC 2-1-1 benchmark crack

• (–2)*(LLS) + 1*(GC 87 Gasoline) + 1*(GC

ULSD)

Chalmette Refinery – Optimization Continues

5

Torrance Refinery – Focus on Operations

Focus on stable and reliable operations

• Executed first major turnarounds in the

second quarter of 2017

• Putting the right team in place to execute

Targeting $50 million operating cost

reductions over the next two years

Margin enhancement

• Increased rack throughput to

approximately 70% of gasoline yield

• Optimizing distillate margin contribution

through rapid, low-cost opportunities

• Successfully entering new markets,

including exports

LA 4-3-1 benchmark crack

• (–4)*(ANS) + 3*(85.5 CARBOB) + 1*(LA

CARB Diesel)

6

Toledo, Ohio

• Processes WTI-based light crude oil and Canadian

syncrude which produces a high-value clean product yield

including gasoline, ultra-low sulfur diesel and a variety

petrochemicals including nonene, xylene, tetramer and

toluene

• Chicago 4-3-1 benchmark crack = (–4)*(WTI) + 3*(Chic

CBOB pipe) + .5*(Chic ULSD Pipe) + .5*(USGC Jet Kero 54)

M

id

-C

on

tinen

t

Ea

s

t

C

oa

s

t

Paulsboro, New Jersey

• Processes a variety of medium and heavy sour crude oils

and produces a diverse product slate including gasoline,

heating oil, jet fuel, lube oils and asphalt

Delaware City, Delaware

• Processes a predominantly heavy crude oil slate with a

high concentration of high sulfur crudes, making it one of

the largest and most complex refineries on the East Coast

NYH 2-1-1 benchmark crack = (–2)*(Dated Brent) + 1*(NY

RBOB) + 1*(ULSD)

East Coast and Mid-Continent Operations

7

PBFX – A Strategic and Valuable Partner

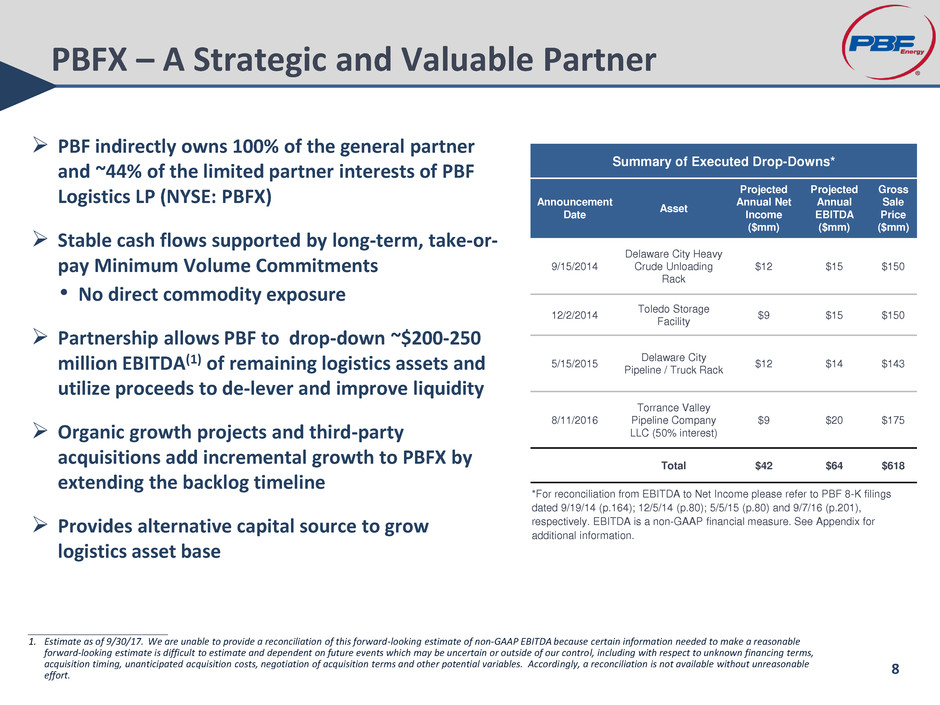

PBF indirectly owns 100% of the general partner

and ~44% of the limited partner interests of PBF

Logistics LP (NYSE: PBFX)

Stable cash flows supported by long-term, take-or-

pay Minimum Volume Commitments

• No direct commodity exposure

Partnership allows PBF to drop-down ~$200-250

million EBITDA(1) of remaining logistics assets and

utilize proceeds to de-lever and improve liquidity

Organic growth projects and third-party

acquisitions add incremental growth to PBFX by

extending the backlog timeline

Provides alternative capital source to grow

logistics asset base

Summary of Executed Drop-Downs*

Announcement

Date

Asset

Projected

Annual Net

Income

($mm)

Projected

Annual

EBITDA

($mm)

Gross

Sale

Price

($mm)

9/15/2014

Delaware City Heavy

Crude Unloading

Rack

$12 $15 $150

12/2/2014

Toledo Storage

Facility

$9 $15 $150

5/15/2015

Delaware City

Pipeline / Truck Rack

$12 $14 $143

8/11/2016

Torrance Valley

Pipeline Company

LLC (50% interest)

$9 $20 $175

Total $42 $64 $618

*For reconciliation from EBITDA to Net Income please refer to PBF 8-K filings

dated 9/19/14 (p.164); 12/5/14 (p.80); 5/5/15 (p.80) and 9/7/16 (p.201),

respectively. EBITDA is a non-GAAP financial measure. See Appendix for

additional information.

8

___________________________

1. Estimate as of 9/30/17. We are unable to provide a reconciliation of this forward-looking estimate of non-GAAP EBITDA because certain information needed to make a reasonable

forward-looking estimate is difficult to estimate and dependent on future events which may be uncertain or outside of our control, including with respect to unknown financing terms,

acquisition timing, unanticipated acquisition costs, negotiation of acquisition terms and other potential variables. Accordingly, a reconciliation is not available without unreasonable

effort.

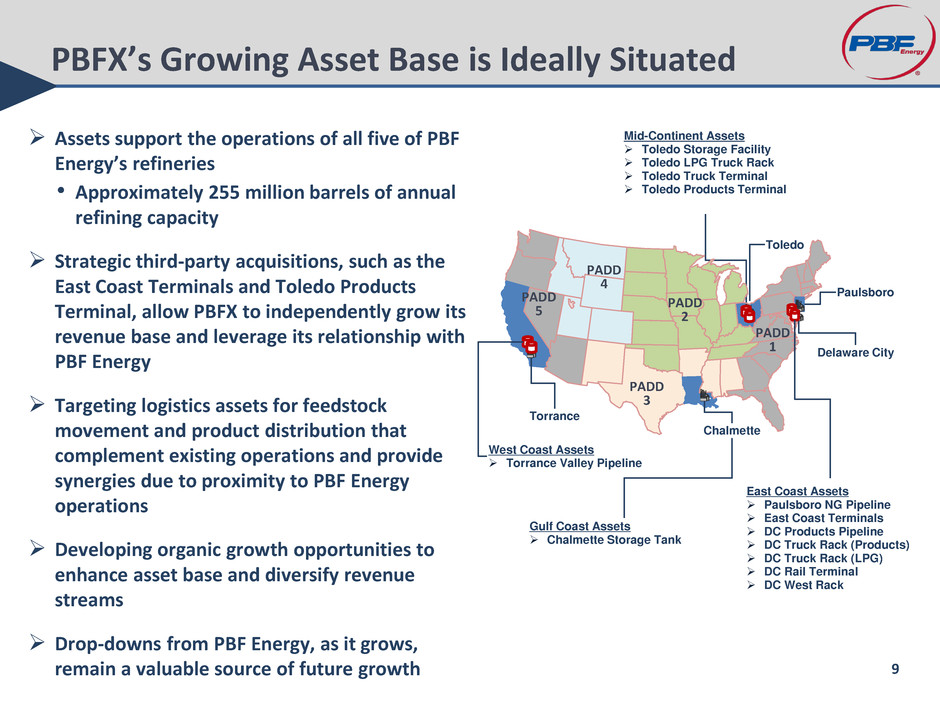

PBFX’s Growing Asset Base is Ideally Situated

Mid-Continent Assets

Toledo Storage Facility

Toledo LPG Truck Rack

Toledo Truck Terminal

Toledo Products Terminal

East Coast Assets

Paulsboro NG Pipeline

East Coast Terminals

DC Products Pipeline

DC Truck Rack (Products)

DC Truck Rack (LPG)

DC Rail Terminal

DC West Rack

Assets support the operations of all five of PBF

Energy’s refineries

• Approximately 255 million barrels of annual

refining capacity

Strategic third-party acquisitions, such as the

East Coast Terminals and Toledo Products

Terminal, allow PBFX to independently grow its

revenue base and leverage its relationship with

PBF Energy

Targeting logistics assets for feedstock

movement and product distribution that

complement existing operations and provide

synergies due to proximity to PBF Energy

operations

Developing organic growth opportunities to

enhance asset base and diversify revenue

streams

Drop-downs from PBF Energy, as it grows,

remain a valuable source of future growth

Paulsboro

Toledo

Chalmette

Torrance

PADD

2

PADD

3

PADD

5

Delaware City

PADD

4

PADD

1

West Coast Assets

Torrance Valley Pipeline

9

Gulf Coast Assets

Chalmette Storage Tank

Macro Landscape Outlook

Abundant global supply of crude oil

• Increasing North American production

•OPEC cuts driving near-term tightness in L-H spread

Global product demand expected to outpace refinery

capacity utilization and additions

•Global products inventories have reverted to the

norm from a state of oversupply

IMO 2020 changing bunker fuel specification should

drive increased diesel demand and support wider L-H

differentials

10

Appendix

Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) as a measure

of operating performance to assist in comparing performance from period to period on a consistent basis and to

readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating

actual results against such expectations, and in communications with our board of directors, creditors, analysts and

investors concerning our financial performance.

EBITDA is not a presentation made in accordance with GAAP and our computation of EBITDA may vary from others in

our industry. EBITDA should not be considered as an alternative to operating income (loss) or net income (loss) as

measures of operating performance. In addition, EBITDA is not presented as, and should not be considered, an

alternative to cash flows from operations as a measure of liquidity.

This presentation includes references to EBITDA and EBITDA attributable to PBFX, which is a non-GAAP financial

measure that is reconciled to its most directly comparable GAAP measure in the quarterly and annual reports on

Forms 10-Q and 10-K for PBFX. We define EBITDA attributable to PBFX as net income (loss) attributable to PBFX

before net interest expense, income tax expense, depreciation and amortization expense attributable to PBFX, which

excludes the results attributable to noncontrolling interests and acquisitions from affiliate companies under common

control prior to the effective dates of such transactions. With respect to projected MLP-qualifying EBITDA, we are

unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable

effort, as, among other things, certain items that impact these measures, such as the provision for income taxes,

depreciation of fixed assets, amortization of intangibles and financing costs have not yet occurred, are subject to

market conditions and other factors that are out of our control and cannot be accurately predicted.

Non-GAAP Financial Measures

12

PBF Energy 2018 Initial Guidance

Initial guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company

configuration. Except where noted, guidance expense figures include consolidated amounts for PBF Logistics LP. All figures are subject to change based on

market and macroeconomic factors, as well as company strategic decision-making and overall company performance.

(Figures in millions except per barrel amounts)

FY 2018E Q1-2018E

East Coast Throughput 330,000 – 350,000 bpd 335,000 – 355,000 bpd

Mid-Continent Throughput 150,000 – 160,000 bpd 125,000 – 135,000 bpd

Gulf Coast Throughput 175,000 – 185,000 bpd 180,000 – 190,000 bpd

West Coast Throughput 140,000 – 150,000 bpd 160,000 – 170,000 bpd

Total Throughput 795,000 – 845,000 bpd 800,000 – 850,000 bpd

FY 2018E Notes

Refining operating expenses $5.25 - $5.50 / bbl

SG&A expenses $160 - $170 Excludes incentive and stock-based compensation

D&A $340 - $360

Interest expense, net $150 - $160

Capital expenditures $525 - $550 Excludes capital expenditures for PBF Logistics LP

Diluted shares outstanding at 12/31/2017 114

Turnaround Schedule Period Duration

Toledo – Hydrocracker / Crude / Reformer Q1 35 – 45 days

Chalmette – FCC / Alky Q1 – 2 30 – 40 days

Delaware City – CT / Alky units Q1 – 2 35 – 45 days

Delaware City – Cat Cracker Q4 30 – 35 days

Paulsboro – Crude / Coker Q3 – 4 30 – 40 days

PBFX 2018 Initial Guidance

Initial guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans using minimum

volume commitments, assumptions and configuration. Revenues, operating expenses, general and administrative expenses, depreciation

and amortization and interest expense figures include amounts related to the portion of the Torrance Valley Pipeline Company that are

currently owned by a subsidiary of PBF Energy Inc. These amounts are consolidated in the PBF Logistics financial statements and the

ownership interest of PBF Energy is reflected in non-controlling Interest. All figures are subject to change based on market and

macroeconomic factors, as well as management’s strategic decision-making and overall Partnership performance.

($ in millions) FY 2018

Initial Guidance

Revenues $276.2

Operating expenses $86.5

SG&A (includes stock-based comp. expense for outstanding awards) $16.2

D&A $26.0

Interest expense, net $39.4

Net Income $108.1

EBITDA to the Partnership $150.8

Maintenance capital expenditures $11.0

Regulatory capital expenditures $5.9

Units outstanding(1) 42.5 million

___________________________

1. Units outstanding at 12/31/2017 represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs