Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - SEMPRA ENERGY | d494912dex994.htm |

| EX-99.3 - EX-99.3 - SEMPRA ENERGY | d494912dex993.htm |

| EX-99.2 - EX-99.2 - SEMPRA ENERGY | d494912dex992.htm |

| EX-99.1 - EX-99.1 - SEMPRA ENERGY | d494912dex991.htm |

| EX-23.2 - EX-23.2 - SEMPRA ENERGY | d494912dex232.htm |

| EX-23.1 - EX-23.1 - SEMPRA ENERGY | d494912dex231.htm |

| 8-K - FORM 8-K - SEMPRA ENERGY | d494912d8k.htm |

Exhibit 99.5

Unaudited Pro Forma Condensed Combined Financial Information

The Unaudited Pro Forma Condensed Combined Financial Information of Sempra Energy has been derived from the historical consolidated financial statements of Sempra Energy and its subsidiaries (“Sempra Energy,” “we,” “our,” or “us”) and Energy Future Holdings Corp. and subsidiaries (“EFH”). The unaudited pro forma condensed combined financial information should be read in conjunction with the:

| • | accompanying notes herein; |

| • | unaudited condensed consolidated financial statements of Sempra Energy as of and for the nine months ended September 30, 2017, included in Sempra Energy’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017; |

| • | audited consolidated financial statements of Sempra Energy as of and for the year ended December 31, 2016, included in Sempra Energy’s Annual Report on Form 10-K for the year ended December 31, 2016; |

| • | unaudited condensed consolidated financial statements of EFH as of and for the nine months ended September 30, 2017, included in this Current Report on Form 8-K; and |

| • | audited consolidated financial statements of EFH as of and for the year ended December 31, 2016, included in this Current Report on Form 8-K. |

As the consolidated financial statements of EFH include its equity method investment in Oncor Electric Delivery Holdings Company LLC (“Oncor Holdings”) and the associated equity method earnings, the unaudited pro forma condensed combined financial information should also be read in conjunction with Oncor Holdings’ unaudited condensed consolidated financial statements as of and for the nine months ended September 30, 2017 and audited consolidated financial statements as of and for the year ended December 31, 2016, both included in this Current Report on Form 8-K.

Proposed Acquisition of Energy Future Holdings Corp.

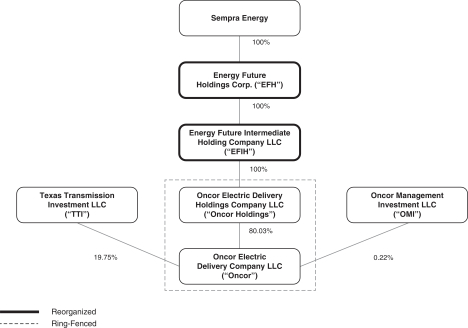

On August 21, 2017, Sempra Energy, along with an indirect, wholly owned subsidiary (“Merger Sub”), entered into an Agreement and Plan of Merger, as supplemented by a Waiver Agreement dated October 3, 2017 (together referred to as the “Merger Agreement”), with EFH, the indirect owner of 80.03% of the membership interests in Oncor Electric Delivery Company LLC (“Oncor”), and EFH’s subsidiary, Energy Future Intermediate Holding Company LLC (“EFIH”). Oncor is a regulated electric distribution and transmission business that operates the largest distribution and transmission system in Texas. Under the Merger Agreement, we will pay total consideration of $9.45 billion, subject to possible adjustment as described in the Merger Agreement (the “Merger Consideration”). Pursuant to the Merger Agreement and subject to the satisfaction of certain closing conditions, EFH will be merged with Merger Sub, with EFH continuing as the surviving company and an indirect, wholly owned subsidiary of Sempra Energy (the “Merger”), as follows:

The foregoing is a simplified ownership structure that does not present all of the subsidiaries of, or other equity interests owned by, these entities.

1

Texas Transmission Investment LLC (“TTI”), an investment vehicle indirectly owned by third parties unaffiliated with EFH or Sempra Energy, owns 19.75% of Oncor’s outstanding membership interests, and certain current and former directors and officers of Oncor indirectly beneficially own 0.22% of Oncor’s outstanding membership interests through their ownership of Class B membership interests in Oncor Management Investment LLC (“OMI”). On October 3, 2017, Sempra Energy provided written confirmation to Oncor Holdings and Oncor that, contemporaneously with the closing of the Merger, equivalent value (approximately $25.9 million) will be provided in exchange for the Class B membership interests in OMI in the form of cash, or if mutually agreed by the parties, alternative benefit and/or incentive plans. The consummation of the Merger is not conditioned on the acquisition of these interests in OMI, and there has been no formal agreement by us or the owners of these interests to accept the terms of our written confirmation. Any potential impacts of this arrangement to provide equivalent value for these membership interests in OMI have not been reflected in the unaudited pro forma condensed combined financial information.

Financing

We currently intend to initially finance the Merger Consideration, as well as associated transaction costs, with the net proceeds from debt and equity issuances, commercial paper supported by our revolving credit facilities and borrowings under our revolving credit facilities, although we could also utilize cash on hand. We expect to ultimately fund approximately 65% of the total Merger Consideration with the net proceeds from the sales of Sempra Energy common stock and other equity securities although we may use cash on hand and proceeds from asset sales in place of some of this equity financing, and approximately 35% with the net proceeds from issuances of Sempra Energy debt securities. Some of the equity issuances will likely occur following the Merger to repay outstanding indebtedness, including indebtedness that we expect to incur to initially finance the Merger Consideration and associated transaction costs. We may also use cash on hand and proceeds from asset sales to repay indebtedness initially incurred to pay a portion of the Merger consideration and related fees and expenses. We have entered into a commitment letter with a syndicate of banks providing, subject to customary conditions, for a $4.0 billion, 364-day senior unsecured bridge facility to backstop a portion of our obligations to pay the Merger Consideration. However, the $4.0 billion commitment is reduced by the amount of funds received through Sempra Energy’s sales of equity securities and debt securities, subject in each case to certain exceptions, and increases in our borrowing capacity under our existing revolving credit facilities. We have prepared the unaudited pro forma condensed combined financial information assuming that the Merger Consideration and associated transaction costs will be financed with the net proceeds from debt and equity issuances based on current market conditions, and as a result, the unaudited pro forma condensed combined financial information assumes that Sempra Energy will not borrow any amounts under the unsecured bridge facility.

The unaudited pro forma condensed combined financial information gives effect to the following assumptions:

| • | consideration of $9.45 billion paid for the Merger, excluding both estimated transaction costs and a possible adjustment based on the timing of dividends paid by Oncor to Oncor Holdings, which adjustment, if any, we do not expect to be material. Collectively, “transaction costs” include estimated fees, expenses and discounts associated with the Merger and financing of the Merger Consideration; |

| • | $150 million of estimated transaction costs expected to be (i) charged against related gross proceeds of debt and equity financings; or (ii) included in the basis of our investment in Oncor Holdings, as follows: (a) $59 million of equity issuance costs and discounts and $37 million of debt issuance costs and discounts; and (b) $54 million of other transaction costs, respectively; |

| • | the repayment and cancellation through EFH’s Chapter 11 bankruptcy proceedings of the indebtedness of EFH and EFIH immediately prior to the consummation of the Merger, including liabilities subject to compromise and debtor-in-possession (“DIP”) financing, and the cancellation of the existing common equity of EFH and related historical statements of operations impacts that are not expected to continue post-Merger; and |

| • | our receipt of net proceeds from the following financing transactions to fund the Merger Consideration and estimated transaction costs: |

| • | proceeds of $2,463 million from the assumed issuance and sale of shares of our common stock (sold pursuant to forward sale agreements and assuming full physical settlement at the closing of the Merger), net of estimated issuance costs and discounts of $37 million; |

| • | proceeds of $1,478 million from the assumed issuance and sale of shares of our mandatory convertible preferred stock (the “mandatory convertible preferred stock”), net of estimated issuance costs and discounts of $22 million, with an assumed dividend rate of 6.25% per annum based on current market conditions; the actual dividend rate on the mandatory convertible preferred stock, if and when issued, may differ, perhaps substantially, from the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information; |

| • | proceeds of $4,963 million from the assumed issuance and sale of Sempra Energy’s long-term debt securities (the “long-term debt”), net of estimated issuance costs and discounts of $37 million, at an assumed weighted-average interest rate of 3.2% per annum based on current market conditions; the actual interest rate on the long-term debt, if and when issued, may differ, perhaps substantially, from the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information; and |

2

| • | proceeds of $600 million from borrowings under our revolving credit facilities and the issuance and sale of our commercial paper supported by our revolving credit facilities (the “short-term debt”) at a weighted-average interest rate of 2% per annum based on current market conditions; the actual interest rate on the short-term debt, if and when issued, may differ, perhaps substantially, from the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information. |

For purposes of this unaudited pro forma condensed combined financial information, we sometimes refer to the planned issuance and sale of our common stock (including pursuant to forward sale agreements), mandatory convertible preferred stock, long-term debt and short-term debt as described in the preceding paragraph as, collectively, the “Financing Transactions” and we sometimes refer to the Merger, the Financing Transactions and the payment of associated transaction costs as the “Transactions.” The actual size and terms of, and amounts of proceeds we receive from, the respective Financing Transactions will depend on, among other things, market conditions at the time of those transactions and such other factors as we deem relevant and may differ, perhaps substantially, from the size, terms and amounts we have assumed for purposes of this unaudited pro forma condensed combined financial information.

The unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2017 and the year ended December 31, 2016 assume that the Transactions had occurred on January 1, 2016. The unaudited pro forma condensed combined balance sheet as of September 30, 2017 assumes that the Transactions had occurred on September 30, 2017.

We currently expect that the proceeds we receive from the sale of our common stock will be through sales under forward sale agreements that we plan to enter into with certain financial institutions. We expect that proceeds from sales under these forward sale agreements will ultimately be received in multiple settlements, on or prior to December 15, 2019. However, for purposes of this unaudited pro forma condensed combined financial information, we have assumed that we will receive all of the net proceeds under the forward sale agreements upon full physical settlement concurrently with the closing of the Merger, which is assumed to be as of January 1, 2016, in the case of the unaudited pro forma condensed combined statements of operations, or September 30, 2017, in the case of the unaudited pro forma condensed combined balance sheet. We also expect that the forward sale agreements will permit us to elect cash settlement or net share settlement for all or a portion of our obligations under the forward sale agreements. If we were to elect cash settlement or net share settlement, the amount of cash proceeds we receive upon settlement would differ, perhaps substantially, from the amount we have assumed for purposes of this unaudited pro forma condensed combined financial information, or we may not receive any cash proceeds or we may deliver cash (in an amount which could be significant) or shares of our common stock to the forward purchasers.

It is expected that contemporaneously with the closing of the Merger, EFH and EFIH will emerge from Chapter 11 bankruptcy and their then existing indebtedness will be settled using (i) the proceeds from the Merger Consideration; and (ii) EFH’s and EFIH’s assets that are not being acquired by us in the Merger. The unaudited pro forma condensed combined financial information removes assets and liabilities of EFH and EFIH that are expected to be settled as a result of the Merger, other than those being acquired or assumed in the Merger, as described below in Note 2, “Preliminary Purchase Price Allocation.” Additionally, the unaudited pro forma condensed combined financial information removes income and expenses of EFH and EFIH that are not expected to continue post-Merger. We believe that because EFH and EFIH will be reorganized upon the consummation of the Merger and their ongoing activities will be related primarily to their investment in Oncor Holdings, the removal of assets and liabilities other than those described below in Note 2 and related income or expenses of EFH or EFIH that will not continue post-Merger is indicative of the business had the Transactions been consummated as of September 30, 2017 for purposes of the unaudited pro forma condensed combined balance sheet and as of January 1, 2016 for purposes of the unaudited pro forma condensed combined statements of operations.

The Merger Consideration will be allocated to the identifiable assets acquired and liabilities assumed based on their estimated relative fair values as of the date of the Merger. The impact of any preliminary fair value adjustments, if any, to the assets and liabilities of EFH from performing a purchase price allocation as of the closing of the Merger are assumed to be immaterial, as substantially all of the fair value of the transaction is expected to be attributable to the basis in EFH’s investment in Oncor Holdings. Therefore, to the extent there are any other fair value adjustments that may give rise to potential amortization of basis adjustments in EFH’s investment in Oncor Holdings, such adjustments and related amortization have not been included. The relative fair values of the assets acquired and liabilities assumed are estimates, which are subject to change pending further review. The actual amounts recorded as of the completion of the Merger may differ materially from the information presented in this unaudited pro forma condensed combined financial information.

We provide this unaudited pro forma condensed combined financial information for informational purposes only. This unaudited pro forma condensed combined financial information is based on numerous assumptions and estimates and is subject to other uncertainties. Among other things, this unaudited pro forma condensed combined financial information has been prepared on the assumption that the Transactions will be completed on the terms and in accordance with the assumptions reflected above and in the following Notes to Unaudited Pro Forma Condensed Combined Financial Information. Any changes in these assumptions (including, without limitation, any changes in the types or sizes of the Financing Transactions, the assumed interest and dividend rates on the long-term debt, short-term debt and mandatory convertible preferred stock we issue, the number of shares of common stock and mandatory convertible preferred stock we issue, the settlement prices and dates for, and manner in which we settle, the forward sale agreements, and the amounts of net proceeds we receive from the respective Financing Transactions) would result in a change in the unaudited condensed combined pro forma financial information, which could be material. We have also assumed that EFH’s and

3

EFIH’s Chapter 11 bankruptcy proceedings will be concluded on the terms currently contemplated, including, without limitation, the settlement of EFH’s and EFIH’s liabilities and creditor and other claims in accordance with those contemplated terms. Accordingly, the unaudited pro forma condensed combined financial information does not purport to reflect what our results of operations or financial condition would have been had the Transactions actually occurred on the assumed dates, nor does it purport to project our future financial condition or results of operations.

4

Unaudited Pro Forma Condensed Combined Balance Sheet

as of September 30, 2017

(dollars in millions)

| Sempra Energy, as Reported |

Financing and Other (Note 4) |

EFH, as Reported (Note 1) |

Merger/ Bankruptcy Adjustments (Note 4) |

Sempra Energy Pro Forma |

||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Current assets: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 189 | $ | 9,504 | (a) | $ | 777 | $ | (10,279 | )(e) | $ | 191 | ||||||||

| Restricted cash |

59 | — | 10 | (10 | )(e) | 59 | ||||||||||||||

| Other current assets |

2,630 | — | 6 | (6 | )(j) | 2,630 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

2,878 | 9,504 | 793 | (10,295 | ) | 2,880 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other assets: |

||||||||||||||||||||

| Investments |

2,128 | — | 6,327 | 2,707 | (f)(g) | 11,162 | ||||||||||||||

| Deferred income taxes |

132 | — | 1,246 | (720 | )(h) | 658 | ||||||||||||||

| Other noncurrent assets |

9,607 | — | 32 | (55 | )(f)(j) | 9,584 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other assets |

11,867 | — | 7,605 | 1,932 | 21,404 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Property, plant and equipment: |

||||||||||||||||||||

| Property, plant and equipment |

46,725 | — | — | — | 46,725 | |||||||||||||||

| Less accumulated depreciation and amortization |

(11,341 | ) | — | — | — | (11,341 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Property, plant and equipment, net ($328 related to VIE) |

35,384 | — | — | — | 35,384 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 50,129 | $ | 9,504 | $ | 8,398 | $ | (8,363 | ) | $ | 59,668 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND EQUITY |

||||||||||||||||||||

| Current liabilities: |

||||||||||||||||||||

| Short-term debt |

$ | 2,498 | $ | 600 | (b) | $ | — | $ | — | $ | 3,098 | |||||||||

| Borrowings under debtor-in-possession credit facilities |

— | — | 6,300 | (6,300 | )(i) | — | ||||||||||||||

| Accounts payable – trade and other |

1,333 | — | — | — | 1,333 | |||||||||||||||

| Due to unconsolidated affiliates |

10 | — | 10 | — | 20 | |||||||||||||||

| Dividends and interest payable |

386 | — | 2 | (2 | )(j) | 386 | ||||||||||||||

| Current portion of long-term debt |

1,423 | — | — | — | 1,423 | |||||||||||||||

| Other current liabilities |

1,544 | — | 50 | (71 | )(f)(j) | 1,523 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

7,194 | 600 | 6,362 | (6,373 | ) | 7,783 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities subject to compromise |

— | — | 5,556 | (5,556 | )(i)(j) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Long-term debt ($286 related to VIE) |

14,803 | 4,963 | (b) | — | — | 19,766 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Deferred credits and other liabilities |

12,630 | — | 96 | (50 | )(i)(j) | 12,676 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Commitments and contingencies |

||||||||||||||||||||

| Equity: |

||||||||||||||||||||

| Mandatory convertible preferred stock |

— | 1,478 | (c) | — | — | 1,478 | ||||||||||||||

| Common stock |

3,088 | 2,463 | (d) | 7,970 | (7,970 | )(k) | 5,551 | |||||||||||||

| Retained earnings (deficit) |

10,855 | — | (11,497 | ) | 11,497 | (k) | 10,855 | |||||||||||||

| Accumulated other comprehensive income (loss) |

(678 | ) | — | (89 | ) | 89 | (k) | (678 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total shareholders’ equity |

13,265 | 3,941 | (3,616 | ) | 3,616 | 17,206 | ||||||||||||||

| Preferred stock of subsidiary |

20 | — | — | — | 20 | |||||||||||||||

| Other noncontrolling interests |

2,217 | — | — | — | 2,217 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total equity |

15,502 | 3,941 | (3,616 | ) | 3,616 | 19,443 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

$ | 50,129 | $ | 9,504 | $ | 8,398 | $ | (8,363 | ) | $ | 59,668 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

See Notes to Unaudited Pro Forma Condensed Combined Financial Information.

5

Unaudited Pro Forma Condensed Combined Statement of Operations

for the Nine Months Ended September 30, 2017

(dollars in millions, except per share amounts)

| Sempra Energy, as Reported |

Financing and Other (Note 5) |

EFH, as Reported (Note 1) |

Merger/ Bankruptcy Adjustments (Note 5) |

Sempra Energy Pro Forma |

||||||||||||||||

| REVENUES |

||||||||||||||||||||

| Utilities |

$ | 7,172 | $ | — | $ | — | $ | — | $ | 7,172 | ||||||||||

| Energy-related businesses |

1,071 | — | — | — | 1,071 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

8,243 | — | — | — | 8,243 | |||||||||||||||

| EXPENSES AND OTHER INCOME |

||||||||||||||||||||

| Utilities: |

||||||||||||||||||||

| Cost of electric fuel and purchased power |

(1,730 | ) | — | — | — | (1,730 | ) | |||||||||||||

| Cost of natural gas |

(903 | ) | — | — | — | (903 | ) | |||||||||||||

| Energy-related businesses: |

||||||||||||||||||||

| Cost of natural gas, electric fuel and purchased power |

(226 | ) | — | — | — | (226 | ) | |||||||||||||

| Other cost of sales |

(5 | ) | — | — | — | (5 | ) | |||||||||||||

| Operation and maintenance |

(2,207 | ) | — | (10 | ) | 5 | (n) | (2,212 | ) | |||||||||||

| Depreciation and amortization |

(1,106 | ) | — | — | — | (1,106 | ) | |||||||||||||

| Franchise fees and other taxes |

(325 | ) | — | — | — | (325 | ) | |||||||||||||

| Impairment of wildfire regulatory asset |

(351 | ) | — | — | — | (351 | ) | |||||||||||||

| Other impairment losses |

(72 | ) | — | — | — | (72 | ) | |||||||||||||

| Gain on sale of assets |

2 | — | — | — | 2 | |||||||||||||||

| Equity earnings, before income tax |

31 | — | — | — | 31 | |||||||||||||||

| Other income, net |

301 | — | 82 | (82 | )(o) | 301 | ||||||||||||||

| Interest income |

26 | — | 3 | (3 | )(p) | 26 | ||||||||||||||

| Interest expense |

(493 | ) | (133 | )(l) | (810 | ) | 810 | (q) | (626 | ) | ||||||||||

| Reorganization items |

— | — | (84 | ) | 84 | (r) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (losses) before income taxes and equity (losses) earnings of certain unconsolidated subsidiaries |

1,185 | (133 | ) | (819 | ) | 814 | 1,047 | |||||||||||||

| Income tax (expense) benefit |

(378 | ) | 54 | (m) | 180 | (178 | )(m) | (322 | ) | |||||||||||

| Equity (losses) earnings, net of income tax |

(5 | ) | — | 265 | — | 260 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

802 | (79 | ) | (374 | ) | 636 | 985 | |||||||||||||

| Earnings attributable to noncontrolling interests |

(44 | ) | — | — | — | (44 | ) | |||||||||||||

| Preferred dividends of subsidiary |

(1 | ) | — | — | — | (1 | ) | |||||||||||||

| Mandatory convertible preferred stock dividends |

— | (70 | )(s) | — | — | (70 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) attributable to common shares |

$ | 757 | $ | (149 | ) | $ | (374 | ) | $ | 636 | $ | 870 | (t) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per common share |

$ | 3.01 | $ | 3.17 | (s) | |||||||||||||||

| Weighted-average number of shares outstanding, basic (thousands) |

251,425 | 274,610 | (s) | |||||||||||||||||

| Diluted earnings per common share |

$ | 2.99 | $ | 3.15 | (s)(t) | |||||||||||||||

| Weighted-average number of shares outstanding, diluted (thousands) |

252,987 | 276,172 | (s) | |||||||||||||||||

See Notes to Unaudited Pro Forma Condensed Combined Financial Information.

6

Unaudited Pro Forma Condensed Combined Statement of Operations

for the Year Ended December 31, 2016

(dollars in millions, except per share amounts)

| Sempra Energy, as Reported |

Financing and Other (Note 5) |

EFH, as Reported (Note 1) |

Merger/ Bankruptcy Adjustments (Note 5) |

Sempra Energy Pro Forma |

||||||||||||||||

| REVENUES |

||||||||||||||||||||

| Utilities |

$ | 9,261 | $ | — | $ | — | $ | — | $ | 9,261 | ||||||||||

| Energy-related businesses |

922 | — | — | — | 922 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

10,183 | — | — | — | 10,183 | |||||||||||||||

| EXPENSES AND OTHER INCOME |

||||||||||||||||||||

| Utilities: |

||||||||||||||||||||

| Cost of electric fuel and purchased power |

(2,188 | ) | — | — | — | (2,188 | ) | |||||||||||||

| Cost of natural gas |

(1,067 | ) | — | — | — | (1,067 | ) | |||||||||||||

| Energy-related businesses: |

||||||||||||||||||||

| Cost of natural gas, electric fuel and purchased power |

(277 | ) | — | — | — | (277 | ) | |||||||||||||

| Other cost of sales |

(322 | ) | — | — | — | (322 | ) | |||||||||||||

| Operation and maintenance |

(2,970 | ) | — | (18 | ) | 13 | (n) | (2,975 | ) | |||||||||||

| Depreciation and amortization |

(1,312 | ) | — | — | — | (1,312 | ) | |||||||||||||

| Franchise fees and other taxes |

(426 | ) | — | — | — | (426 | ) | |||||||||||||

| Impairment losses |

(153 | ) | — | — | — | (153 | ) | |||||||||||||

| Gain on sale of assets |

134 | — | — | — | 134 | |||||||||||||||

| Equity earnings, before income tax |

6 | — | — | — | 6 | |||||||||||||||

| Remeasurement of equity method investment |

617 | — | — | — | 617 | |||||||||||||||

| Other income (expense), net |

132 | — | (680 | ) | 669 | (o) | 121 | |||||||||||||

| Interest income |

26 | — | — | — | 26 | |||||||||||||||

| Interest expense |

(553 | ) | (177 | )(l) | (384 | ) | 384 | (q) | (730 | ) | ||||||||||

| Reorganization items |

— | — | (89 | ) | 89 | (r) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (losses) before income taxes and equity earnings of certain unconsolidated subsidiaries |

1,830 | (177 | ) | (1,171 | ) | 1,155 | 1,637 | |||||||||||||

| Income tax (expense) benefit |

(389 | ) | 71 | (m) | 404 | (398 | )(m) | (312 | ) | |||||||||||

| Equity earnings, net of income tax |

78 | — | 332 | — | 410 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

1,519 | (106 | ) | (435 | ) | 757 | 1,735 | |||||||||||||

| Earnings attributable to noncontrolling interests |

(148 | ) | — | — | — | (148 | ) | |||||||||||||

| Preferred dividends of subsidiary |

(1 | ) | — | — | — | (1 | ) | |||||||||||||

| Mandatory convertible preferred stock dividends |

— | (94 | )(s) | — | — | (94 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (loss) attributable to common shares |

$ | 1,370 | $ | (200 | ) | $ | (435 | ) | $ | 757 | $ | 1,492 | (t) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per common share |

$ | 5.48 | $ | 5.46 | (s) | |||||||||||||||

| Weighted-average number of shares outstanding, basic (thousands) |

250,217 | 273,402 | (s) | |||||||||||||||||

| Diluted earnings per common share |

$ | 5.46 | $ | 5.44 | (s)(t) | |||||||||||||||

| Weighted-average number of shares outstanding, diluted (thousands) |

251,155 | 274,340 | (s) | |||||||||||||||||

See Notes to Unaudited Pro Forma Condensed Combined Financial Information.

7

Notes to Unaudited Pro Forma Condensed Combined Financial Information

| 1. | Basis of Presentation |

EFH’s historical results are derived from EFH’s unaudited Condensed Consolidated Balance Sheet as of September 30, 2017, unaudited Condensed Statement of Consolidated Income (Loss) for the nine months ended September 30, 2017, and audited Statement of Consolidated Income (Loss) for the year ended December 31, 2016, which are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are included in this Current Report on Form 8-K. EFH’s results of operations presented here exclude amounts from discontinued operations.

The unaudited pro forma condensed combined financial information reflects adjustments to give effect to pro forma events that are (1) directly attributable to the Transactions, (2) factually supportable, and (3) with respect to the statements of operations, expected to have a continuing impact on the combined results. The unaudited pro forma condensed combined financial information included herein as of and for the nine months ended September 30, 2017 and for the year ended December 31, 2016 is derived from Sempra Energy’s historical financial statements and those of EFH and is based on certain assumptions that we believe to be reasonable, which are described below.

The unaudited pro forma condensed combined financial information is not intended to represent or be indicative of what the combined company’s financial position or results of operations actually would have been had the Transactions been completed as of the dates indicated. In addition, the unaudited pro forma condensed combined financial information does not purport to project the future financial position or operating results of the combined company.

| 2. | Preliminary Purchase Price Allocation |

The following table sets forth a preliminary allocation of the estimated Merger Consideration of $9,450 million to the estimated relative fair values of the identifiable assets acquired and liabilities assumed of EFH based on EFH’s September 30, 2017 balance sheet, as well as $54 million of estimated transaction costs to be included in the basis of EFH’s investment in Oncor Holdings:

| (Dollars in millions) | ||||

| Assumed Purchase Price and Purchase Price Allocation for the Merger |

| |||

| Assets acquired: |

| |||

| Investments |

$ | 9,034 | ||

| Deferred income taxes |

526 | |||

|

|

|

|||

| Total assets acquired |

9,560 | |||

| Liabilities assumed: |

| |||

| Due to unconsolidated affiliate |

10 | |||

| Deferred credits and other |

46 | |||

|

|

|

|||

| Total liabilities assumed |

56 | |||

|

|

|

|||

| Net assets acquired |

9,504 | |||

|

|

|

|||

| Total estimated purchase price(1) |

$ | 9,504 | ||

|

|

|

|||

| (1) | Includes $54 million of estimated transaction costs. |

We have not completed a final valuation analysis necessary to determine the fair market values of all of EFH’s assets and liabilities or the allocation of our purchase price. The unaudited pro forma condensed combined financial information assumes a preliminary allocation of the purchase price to reflect the fair value of those assets and liabilities attributable predominantly to EFH’s investment in Oncor Holdings. We have assumed the Merger to be an asset acquisition, as substantially all of the fair value is expected to be attributable to the basis in our investment in Oncor Holdings.

8

| 3. | Funding Sources and Uses |

We assume the following sources and uses of funds to pay the Merger Consideration and estimated associated transaction costs in the unaudited pro forma condensed combined financial information:

| (Dollars in millions) | ||

| (1) | Before deducting transaction costs related to the financings, and net of estimated underwriters’ reimbursement of certain expenses relating to the equity financings. |

We expect to ultimately fund approximately 65% of the total Merger Consideration with the net proceeds from sales of our common stock and other equity securities although we may use cash on hand and proceeds from asset sales in place of some of this equity financing, and approximately 35% with the net proceeds from issuances of Sempra Energy debt securities. Some of these equity issuances will likely occur following the Merger, if completed, in order to repay outstanding indebtedness, including indebtedness we expect to incur to initially finance the Merger Consideration and estimated transaction costs. As a result, the above table assumes that approximately 42% of the Merger Consideration and estimated transaction costs will initially be financed with the proceeds from sales of our equity securities, and we expect to seek additional equity financing subsequent to the closing of the Merger to ultimately achieve approximately 65% equity funding for the Merger Consideration. Although we expect to grant options (the “underwriters’ options”) to the underwriters of our common stock and mandatory convertible preferred stock to purchase additional shares, the unaudited pro forma condensed combined financial information assumes that those options are not exercised. To the extent that the proceeds we receive from the issuance of our equity securities exceed the aggregate amount assumed in the above table, including as a result of any exercise of the underwriters’ options, we currently expect to reduce the amount of short-term debt and, potentially, long-term debt incurred to fund a portion of the Merger Consideration and to pay associated transaction costs. To the extent that the proceeds we receive from the issuance of our equity securities are less than the aggregate amount assumed in the table above, we currently expect to fund any shortfall by increasing the amount of debt issuances.

We have assumed that we will raise $2,463 million from the issuance and sale of our common stock, net of $37 million of issuance costs and discounts. We expect that this common stock will be issued and sold pursuant to forward sale agreements that we intend to enter into with certain financial institutions. We currently expect that settlement will ultimately occur in multiple settlements, on or prior to December 15, 2019. However, for purposes of calculating the total proceeds from the sale of our common stock, we have assumed full physical settlement of the forward sale agreements and that all of the forward sale agreements will settle concurrently with the closing of the Merger. We also expect that the forward sale agreements will permit us to elect cash settlement or net share settlement for all or a portion of our obligations under the forward sale agreements. If we were to elect cash settlement or net share settlement, the amount of cash proceeds we receive upon settlement would differ, perhaps substantially, from the amount we have assumed for purposes of this unaudited pro forma condensed combined financial information, or we may not receive any cash proceeds or we may deliver cash (in an amount which could be significant) or shares of our common stock to the forward purchasers.

We expect that the forward sale price under the proposed forward sale agreements will be equal to the public offering price per share of our common stock in the related common stock offering less the underwriting discount, subject to adjustment in accordance with the terms of the agreements, including fixed reductions related to cash dividends.

We have assumed that the forward sale price under our proposed forward sale agreements will be $106.32 per share, net of an estimated underwriting discount. This assumed forward sale price has been calculated on the basis of the last reported sale price of our common stock on the New York Stock Exchange (“NYSE”) on December 27, 2017, which was $107.83 per share, assuming full physical settlement and no adjustments to the initial forward sale price. All shares of common stock issued under the forward sale agreements are assumed to have been issued on January 1, 2016 for purposes of the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2017 and the year ended December 31, 2016 and on September 30, 2017 for purposes of the unaudited pro forma condensed combined balance sheet as of September 30, 2017. We have reflected the impact of changes in our assumed stock price on the number of shares issued in Note 5 below.

9

For purposes of this unaudited pro forma condensed combined financial information, we have assumed that we will issue shares of our mandatory convertible preferred stock for $1,478 million, net of $22 million of issuance costs and discounts, with an aggregate liquidation value of $1,500 million, and that those shares will provide for us to pay dividends, calculated as a percentage of the aggregate liquidation value, at the rate of 6.25% per annum. This assumed dividend rate is based on current market conditions. The actual dividend rate on the mandatory convertible preferred stock at the time it is issued may differ, perhaps substantially, from the rate we have assumed for purposes of the unaudited pro forma condensed combined financial information. In that regard, we have assumed that we will pay those dividends in cash, although we expect to retain the right to pay those dividends in shares of our common stock. In addition, we have further assumed that none of the shares of the mandatory convertible preferred stock have been converted early during the periods presented in the unaudited pro forma condensed combined financial information.

For purposes of determining pro forma interest expense, we have assumed a weighted-average interest rate (including the index rate plus a credit spread) of 3.2% per annum on our proposed long-term debt. This assumed rate is based on current market conditions. The actual interest rate and original issue discount on the long-term debt will be based on market conditions at the time the debt is issued and may differ, perhaps substantially, from the rate and discount assumed for purposes of this pro forma condensed combined financial information. We have assumed a weighted-average interest rate of 2% per annum on our short-term debt incurred to finance a portion of the Merger Consideration and associated transaction costs. This assumed rate is based on current market conditions. The actual interest rate on the short-term debt at the time it is issued may differ, perhaps substantially, from the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information. In addition, to the extent we subsequently incur additional short-term debt to refinance such short-term debt as it comes due, that new short-term debt will be issued at then current market interest rates, which may be higher or lower than the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information. Also, we expect that some of the short-term and long-term debt will be in the form of floating rate instruments and, as a result, the assumed interest rate on those instruments will increase and decrease over time compared to the rate we have assumed for purposes of this unaudited pro forma condensed combined financial information.

| 4. | Adjustments to the Unaudited Pro Forma Condensed Combined Balance Sheet |

| a) | Total net proceeds from financing reflects the following assumptions: |

| (Dollars in millions) | ||||||||

| As of September 30, 2017 |

Note 4 Reference |

|||||||

| Proceeds from issuance of common stock under forward sale agreements |

$ | 2,500 | (d | ) | ||||

| Proceeds from issuance of mandatory convertible preferred stock |

1,500 | (c | ) | |||||

| Proceeds from long-term debt |

5,000 | (b | ) | |||||

| Proceeds from short-term debt |

600 | (b | ) | |||||

| Discounts and fees from issuance of common stock |

(37 | ) | (d | ) | ||||

| Discounts and fees from issuance of mandatory convertible preferred stock |

(22 | ) | (c | ) | ||||

| Discounts and fees from issuance of long-term debt |

(37 | ) | (b | ) | ||||

|

|

|

|||||||

| Total net proceeds from financing |

$ | 9,504 | ||||||

|

|

|

|||||||

| b) | Reflects the following: |

| • | Principal amount of borrowings of $5,000 million from long-term debt, less estimated issuance costs and discounts of $37 million; and |

| • | Short-term debt of $600 million, consisting of borrowings under our revolving credit facility and commercial paper supported by our revolving credit facility. |

The actual amount of indebtedness, and the mix of long-term debt and short-term debt, we incur to finance the Merger Consideration and estimated fees will vary depending on several factors, including net proceeds received from equity offerings, as discussed in Note 3 above.

| c) | Reflects $1,478 million of mandatory convertible preferred stock issued, net of estimated issuance costs and discounts of $22 million. |

| d) | Reflects $2,463 million of common stock issued, net of estimated issuance costs and discounts of $37 million, assuming full physical settlement of our proposed forward sale agreements at the closing of the Merger. |

| e) | Represents the following: |

| • | Estimated $10,237 million of cash and restricted cash to fully retire existing indebtedness of EFH and EFIH that is expected to be settled upon emergence from Chapter 11 bankruptcy; |

10

| • | Payment of estimated transaction costs of $52 million, which are included as a component of our investment in Oncor Holdings, the predominant asset acquired in connection with the Merger. |

| f) | Reflects the reclassification of $23 million of transaction costs incurred by Sempra Energy and recorded in Sundry through September 30, 2017 to include as a component of our investment in Oncor Holdings, $2 million of which had been paid and $21 million of which had been accrued at September 30, 2017. |

| g) | Reflects the step-up in fair value of the basis in our investment in Oncor Holdings. |

| h) | Reflects the reduction of the estimated deferred tax asset associated with a $1,641 million gain recognized by EFH from the settlement of EFH and EFIH indebtedness described in footnote (i) below and other deferred tax asset components that are not part of the Merger. The ultimate gain recognized by EFH will reflect changes in bankruptcy claims and interest accrued on those claims between September 30, 2017 and the actual close of the Merger, which will have a corresponding impact on the ultimate deferred tax amount eliminated. |

| i) | Reflects the settlement of $11,878 million of existing EFH and EFIH indebtedness consisting of liabilities subject to compromise, the EFIH DIP facility and other outstanding liabilities resulting in a pretax gain of $1,641 million related to the forgiveness of remaining outstanding borrowings as of the assumed closing date. We have not included this gain in the unaudited pro forma condensed combined statements of operations as it is associated with the emergence of EFH and EFIH from Chapter 11 bankruptcy contemporaneous with the closing of the Merger. |

| j) | Reflects the removal of miscellaneous assets and liabilities expected to be settled upon EFH’s emergence from Chapter 11 bankruptcy, and reclassification of $26 million of asbestos liabilities and $20 million of other postretirement benefits plan liabilities that Sempra Energy will assume in connection with the Merger. |

| k) | Reflects the elimination of EFH equity accounts. |

| 5. | Adjustments to the Unaudited Pro Forma Condensed Combined Statements of Operations |

| l) | Reflects the interest expense and amortization of deferred financing costs resulting from our estimated new long-term debt issuances and short-term debt. For purposes of estimating the pro forma interest expense, we have assumed a weighted-average interest rate of 3.2% per annum on the long-term debt and a weighted-average interest rate of 2% per annum on the short-term debt, based on current market conditions. We have assumed that long-term debt financing costs of $37 million are amortized over 12 years, or the weighted-average term of the long-term debt. |

A 12.5 basis point increase or decrease in the assumed interest rate under our estimated new long-term borrowings would increase or decrease, respectively, interest expense in the unaudited pro forma condensed combined statements of operations by approximately $5 million, or $0.01 of diluted earnings per common share, for the nine months ended September 30, 2017, and approximately $6 million, or $0.01 of diluted earnings per common share, for the year ended December 31, 2016.

A 12.5 basis point increase or decrease in the assumed interest rate on our estimated new short-term debt would increase or decrease, respectively, interest expense in the unaudited pro forma condensed combined statements of operations by approximately $0.6 million and approximately $0.8 million for the nine months ended September 30, 2017 and the year ended December 31, 2016, respectively, with a negligible impact on diluted earnings per common share.

| m) | Reflects the tax impact of related pro forma adjustments at a statutory tax rate of 40.2% for the benefit related to incremental financing costs at Sempra Energy. EFH pretax income assumed remaining after Merger/bankruptcy adjustments was taxed at EFH’s statutory rate of 35.3%. |

| n) | Reflects the removal of $5 million and $13 million of operation and maintenance expense recorded for the nine months ended September 30, 2017 and year ended December 31, 2016, respectively, that is not expected to continue post-Merger. |

| o) | Reflects the elimination of $79 million of income related to the approval of a make-whole settlement and $3 million of other costs not expected to continue recorded for the nine months ended September 30, 2017 and the removal of $669 million of expense during the year ended December 31, 2016 related to make-whole charges in connection with EFIH First and Second Lien Notes, which notes are assumed to be repaid contemporaneously with the closing of the Merger through EFH’s emergence from Chapter 11 bankruptcy. |

| p) | Reflects the removal of interest income earned in connection with EFH cash balances assumed to be used as of January 1, 2016 to repay EFH indebtedness contemporaneously with the closing of the Merger through EFH’s emergence from Chapter 11 bankruptcy. |

11

| q) | Reflects the removal of historical interest expense related to EFH debt assumed to be repaid as of January 1, 2016 contemporaneously with the closing of the Merger through EFH’s emergence from Chapter 11 bankruptcy. |

| r) | Reflects the elimination of reorganization expense directly associated with EFH’s Chapter 11 bankruptcy proceedings that would not have occurred had the Merger been completed on January 1, 2016. |

| s) | The following table provides the pro forma weighted-average number of basic and diluted common shares outstanding for the nine months ended September 30, 2017 and year ended December 31, 2016. Diluted shares outstanding include the potential dilution of common stock equivalent shares that may occur if securities or other contracts to issue common stock were exercised or converted into common stock. |

| (Shares in thousands) | ||||||||

| Nine months ended September 30, 2017 |

Year ended December 31, 2016 |

|||||||

| Basic: |

||||||||

| Weighted-average common shares outstanding as reported |

251,425 | 250,217 | ||||||

| Common shares assumed issued to fund a portion of the Merger Consideration |

23,185 | 23,185 | ||||||

|

|

|

|

|

|||||

| Pro forma weighted-average common shares outstanding |

274,610 | 273,402 | ||||||

| Diluted: |

||||||||

| Weighted-average common shares outstanding as reported |

252,987 | 251,155 | ||||||

| Common shares assumed issued to fund a portion of the Merger Consideration |

23,185 | 23,185 | ||||||

|

|

|

|

|

|||||

| Pro forma weighted-average common shares outstanding |

276,172 | 274,340 | ||||||

| EPS: |

||||||||

| Pro forma earnings per common share–basic |

$ | 3.17 | $ | 5.46 | ||||

| Pro forma earnings per common share–diluted |

$ | 3.15 | $ | 5.44 | ||||

For purposes of determining the pro forma number of shares of our common stock issued to finance a portion of the Merger Consideration, we have assumed a public offering price of $107.83 per share, which is equal to the last reported sale price of our common stock on the NYSE on December 27, 2017. We have further assumed that the equity forward sale agreements were subject to full physical settlement on January 1, 2016 at a forward price of $106.32 per share, which is the assumed public offering price of $107.83, net of an estimated underwriting discount. The forward sale price is subject to adjustment based on changes in our stock price and the timing of the settlement of the forward sale agreements. A $100 million increase (decrease) in the assumed gross proceeds (before the forward sale discount) from the forward sale of our common stock would increase (decrease), respectively, the number of shares issued on settlement of the forward sale agreements by approximately 927 thousand shares, which would cause our pro forma diluted earnings per common share to (decrease) increase, respectively, by approximately $0.01 for the nine months ended September 30, 2017 and approximately $0.02 for the year ended December 31, 2016, respectively, assuming no change in the assumed public offering price per share. A $4.00 increase (decrease) in the assumed public offering price per share of our common stock that we have used for purposes of calculating the forward sale price would (decrease) increase the number of shares issued on settlement of the forward sale agreements by approximately 829 thousand shares and 893 thousand shares, respectively, which would cause our pro forma diluted earnings per common share to increase (decrease), respectively, by approximately $0.01 for the nine months ended September 30, 2017 and approximately $0.02 for the year ended December 31, 2016, respectively, assuming no change in the assumed gross proceeds we receive from the sale of common stock pursuant to the forward sale agreements. In addition, we expect that the underwriters in the proposed offering of our common stock will have the option to purchase a number of additional shares of our common stock equal to 15% of the number of shares that they would otherwise be purchasing, and if they were to exercise the option in full, it would result in the issuance of an additional approximately 3.5 million shares of our common stock, and a decrease in pro forma diluted earnings per common share of approximately $0.04 and $0.07 for the nine months ended September 30, 2017 and year ended December 31, 2016, respectively, assuming no change in the public offering price per share assumed above or the gross proceeds from the forward sale of our common stock; however, no adjustment for the underwriters’ option is reflected in the unaudited pro forma condensed combined financial information basic or diluted earnings per common share calculations.

We have assumed that the conversion of the mandatory convertible preferred stock would result in the issuance of approximately 13.9 million shares of our common stock, subject to possible adjustment pursuant to the terms of the mandatory convertible preferred stock, based upon the last reported sale price of our common stock on the NYSE on December 27, 2017, which was $107.83 per share, and assuming that the aggregate liquidation value of the mandatory convertible preferred stock we issue and

12

sell is $1,500 million; however, no adjustment for the shares issuable on conversion is reflected in our computation of the unaudited pro forma diluted earnings per common share because the issuance of those shares would be anti-dilutive. Further, we expect that the underwriters in the proposed offering of mandatory convertible preferred stock will have the option to purchase a number of additional shares of our mandatory convertible preferred stock equal to 15% of the number of shares they would otherwise be purchasing; however, no adjustment for the underwriters’ option is reflected in the unaudited pro forma condensed combined financial information diluted earnings per common share calculations.

The unaudited pro forma condensed combined statements of operations include pro forma adjustments reflecting cash dividends at an assumed rate of 6.25% per annum on the $1,500 million aggregate liquidation amount of mandatory convertible preferred stock we assume will be issued, which would result in an aggregate cash dividend of $70 million and $94 million for the nine months ended September 30, 2017 and year ended December 31, 2016, respectively. A 12.5 basis point increase (decrease) in the assumed dividend rate on the foregoing amount of mandatory convertible preferred stock would increase (decrease), respectively, the amount of cash dividends by approximately $1 million for the nine months ended September 30, 2017 and approximately $2 million for the year ended December 31, 2016. The foregoing amounts of dividends assume that we pay dividends on the mandatory convertible preferred stock in cash. However, we expect to retain the right to pay those dividends in shares of our common stock.

| t) | The gross proceeds (before discounts and fees) we receive from the assumed sale of our common stock, mandatory convertible preferred stock and long-term debt securities and from the issuance of our short-term debt will likely differ, perhaps materially, from the respective amounts we have assumed for purposes of this unaudited pro forma condensed combined financial information as set forth under the heading “Sources of funds” in the table in Note 3 above. |

A $100 million increase (decrease) in the assumed gross proceeds from the sale of shares of our common stock pursuant to the forward sale agreements and a corresponding $100 million (decrease) increase in the assumed gross proceeds from the issuance of short-term debt, would increase (decrease), respectively, our pro forma earnings attributable to common shares by approximately $1 million in each instance for both the nine months ended September 30, 2017 and the year ended December 31, 2016 and would (decrease) increase our pro forma diluted earnings per share by approximately $0.01 in each instance for the nine months ended September 30, 2017 and approximately ($0.02) and $0.01, respectively, for the year ended December 31, 2016, assuming no changes in the respective amounts of gross proceeds from the other Financing Transactions or in the assumed public offering price of $107.83 per share of our common stock.

A $100 million increase (decrease) in the assumed gross proceeds from the sale of our mandatory convertible preferred stock, and a corresponding $100 million (decrease) increase in the assumed gross proceeds from the issuance of our short-term debt, would (decrease) increase, respectively, our pro forma earnings attributable to common shares by approximately $4 million in each instance, and our pro forma diluted earnings per share by approximately $0.01 in each instance for the nine months ended September 30, 2017, and would (decrease) increase, respectively, our pro forma earnings attributable to common shares by approximately $5 million in each instance and our pro forma diluted earnings per share by approximately $0.02 in each instance for the year ended December 31, 2016, assuming no changes in the respective amounts of gross proceeds for the other Financing Transactions or in the assumed public offering price of $107.83 per share of our common stock.

To the extent that the gross proceeds we receive from the issuance and sale of our common stock are less than the amount assumed in the table referred to above, it is also possible that the shortfall may be financed by a corresponding increase in the gross proceeds from the sale of our mandatory convertible preferred stock, and vice versa. A $100 million increase (decrease) in the assumed gross proceeds from the sale of shares of our common stock pursuant to the forward sale agreements, and a corresponding $100 million (decrease) increase in the assumed gross proceeds from the sale of shares of our mandatory convertible preferred stock would increase (decrease), respectively, our pro forma earnings attributable to common shares by approximately $5 million in each instance and our pro forma diluted earnings per share by approximately $0.01 in each instance for the nine months ended September 30, 2017, and would increase (decrease), respectively, our pro forma earnings attributable to common shares by approximately $6 million in each instance and our pro forma diluted earnings per share by approximately $0.01 in each instance for the year ended December 31, 2016, assuming no changes in the respective amounts of gross proceeds for the other Financing Transactions or in the assumed public offering price of $107.83 per share of our common stock.

13