Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HUBBELL INC | d444268dex991.htm |

| EX-2.1 - EX-2.1 - HUBBELL INC | d444268dex21.htm |

| 8-K - FORM 8-K - HUBBELL INC | d444268d8k.htm |

Hubbell Incorporated to Acquire Aclara Technologies LLC December 26, 2017 Exhibit 99.2

Forward Looking Statements Certain statements contained herein may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements concerning certain plans, expectations, goals, projections, and statements about the benefits of the proposed acquisition, Hubbell’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not strictly historic in nature. In addition, all statements regarding anticipated growth or improvement in operating results, anticipated market conditions, and economic recovery are forward-looking. These statements may be identified by the use of forward-looking words or phrases such as "target", "believe", "continues", "improved", "leading", "improving", "continuing growth", "continued", "ranging", "contributing", "primarily", "plan", "expect", "anticipated", "expected", "expectations", "should result", "uncertain", "goals", "projected", "on track", "likely", "intend" and others. Such forward-looking statements are based on the Company's current expectations and involve numerous assumptions, known and unknown risks, uncertainties and other factors which may cause actual and future performance or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to: achieving sales levels to fulfill revenue expectations; unexpected costs or charges, certain of which may be outside the control of the Company; expected benefits of productivity improvements and cost reduction actions; pension expense; effects of unfavorable foreign currency exchange rates; price and material costs; general economic and business conditions; the impact of and the ability to complete strategic acquisitions and integrate acquired companies; the ability to effectively develop and introduce new products, expand into new markets and deploy capital; the possibility that the proposed transaction does not close when expected or at all because required regulatory approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the risk that the financing required to fund the transaction is not obtained; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; uncertainties as to the timing of the transaction; competitive responses to the transaction; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies; diversion of management’s attention from ongoing business operations and opportunities; Hubbell’s ability to complete the acquisition and integration of Aclara Technologies LLC successfully; litigation relating to the transaction; and other factors described in our Securities and Exchange Commission filings, including the "Business", "Risk Factors", and "Quantitative and Qualitative Disclosures about Market Risk" Sections in the Annual Report on Form 10-K for the year ended December 31, 2016.

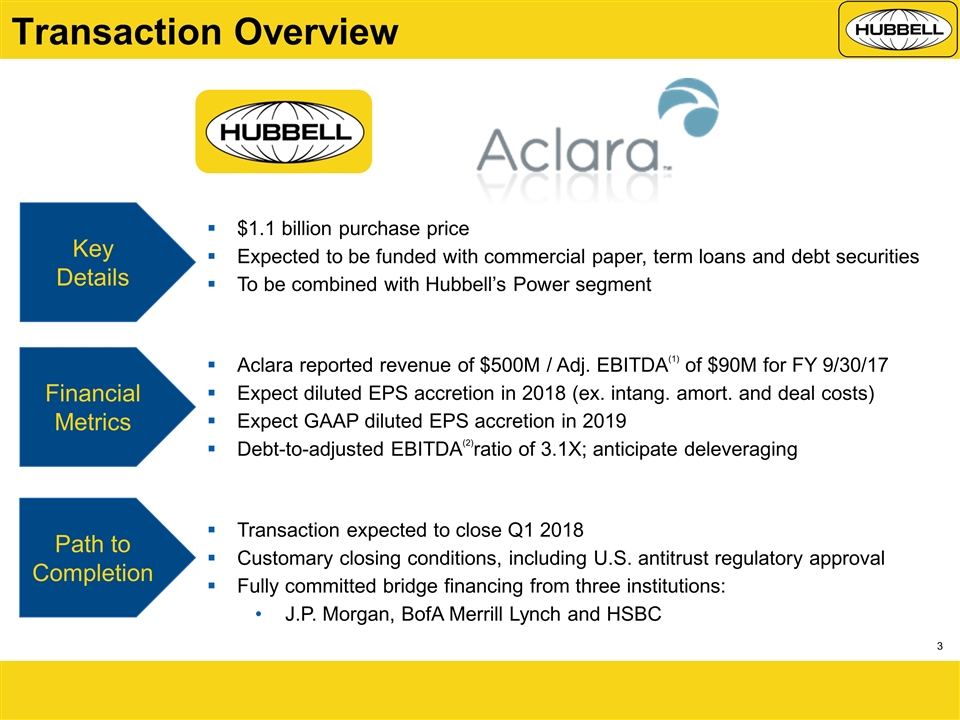

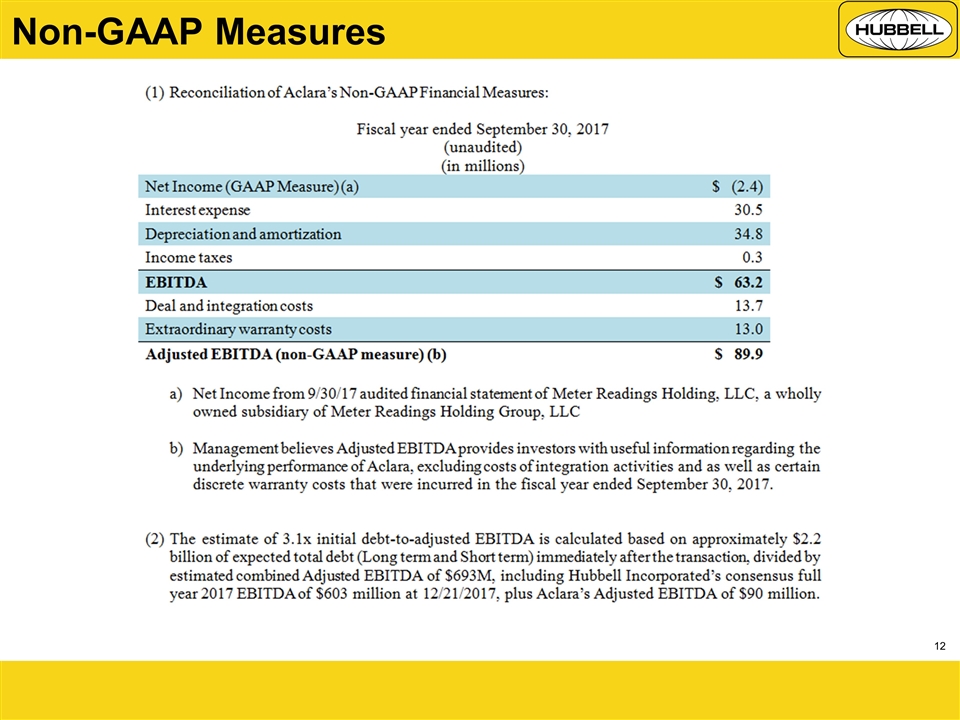

Path to Completion Transaction expected to close Q1 2018 Customary closing conditions, including U.S. antitrust regulatory approval Fully committed bridge financing from three institutions: J.P. Morgan, BofA Merrill Lynch and HSBC Key Details $1.1 billion purchase price Expected to be funded with commercial paper, term loans and debt securities To be combined with Hubbell’s Power segment Financial Metrics Aclara reported revenue of $500M / Adj. EBITDA(1) of $90M for FY 9/30/17 Expect diluted EPS accretion in 2018 (ex. intang. amort. and deal costs) Expect GAAP diluted EPS accretion in 2019 Debt-to-adjusted EBITDA(2)ratio of 3.1X; anticipate deleveraging Transaction Overview

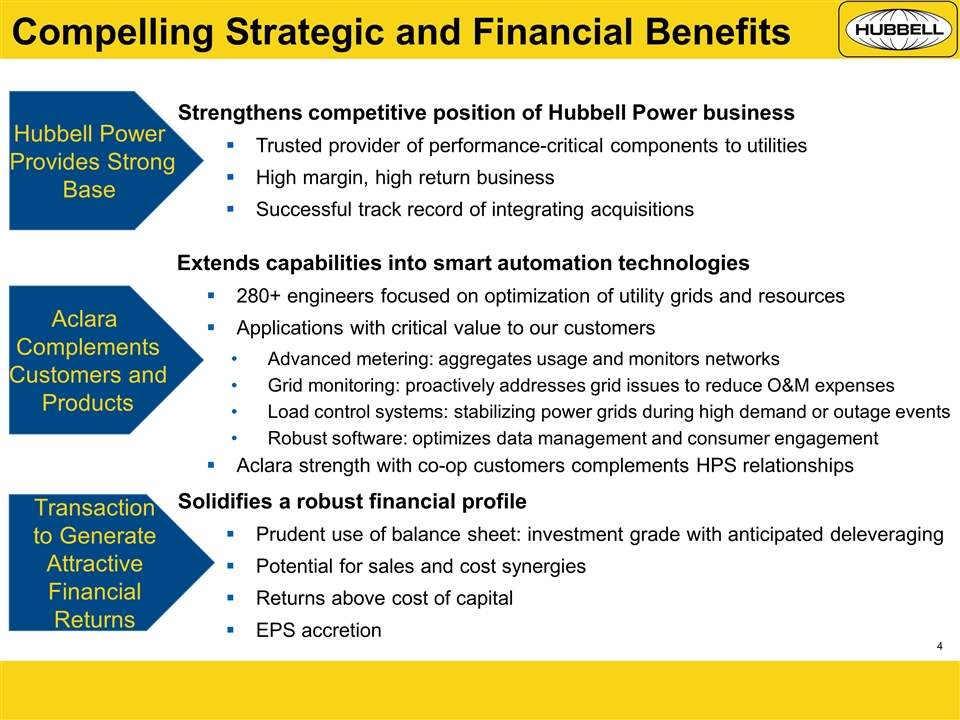

Hubbell Power Provides Strong Base Strengthens competitive position of Hubbell Power business Trusted provider of performance-critical components to utilities High margin, high return business Successful track record of integrating acquisitions Aclara Complements Customers and Products Extends capabilities into smart automation technologies 280+ engineers focused on optimization of utility grids and resources Applications with critical value to our customers Advanced metering: aggregates usage and monitors networks Grid monitoring: proactively addresses grid issues to reduce O&M expenses Load control systems: stabilizing power grids during high demand or outage events Robust software: optimizes data management and consumer engagement Aclara strength with co-op customers complements HPS relationships Transaction to Generate Attractive Financial Returns Solidifies a robust financial profile Prudent use of balance sheet: investment grade with anticipated deleveraging Potential for sales and cost synergies Returns above cost of capital EPS accretion Compelling Strategic and Financial Benefits

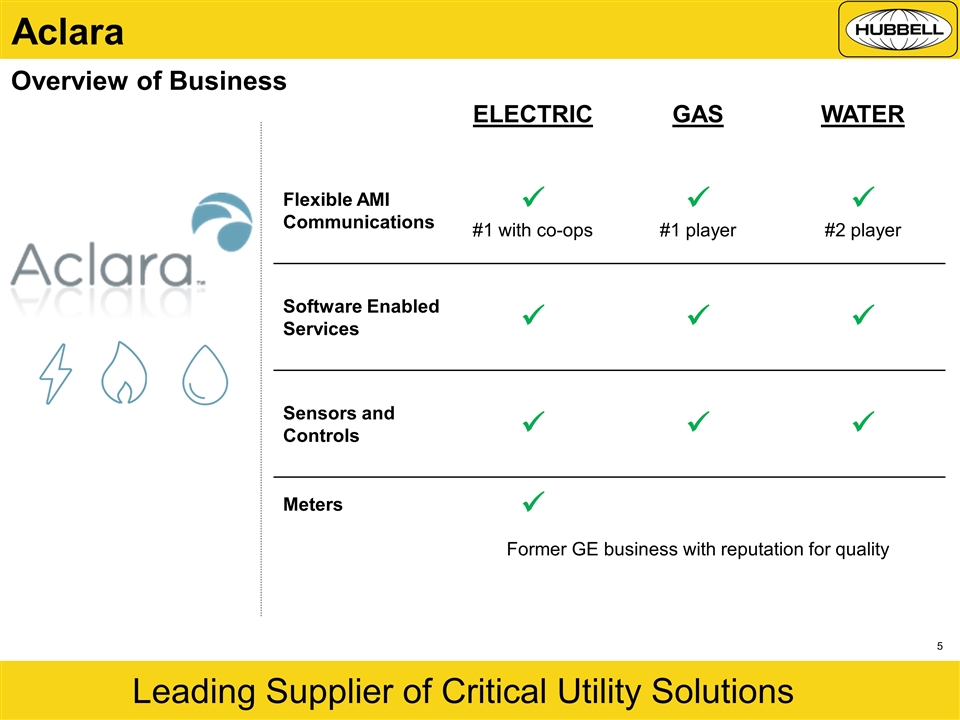

Aclara Leading Supplier of Critical Utility Solutions Overview of Business 77% ELECTRIC GAS WATER Flexible AMI Communications ü #1 with co-ops ü #1 player ü #2 player Software Enabled Services ü ü ü Sensors and Controls ü ü ü Meters ü Former GE business with reputation for quality

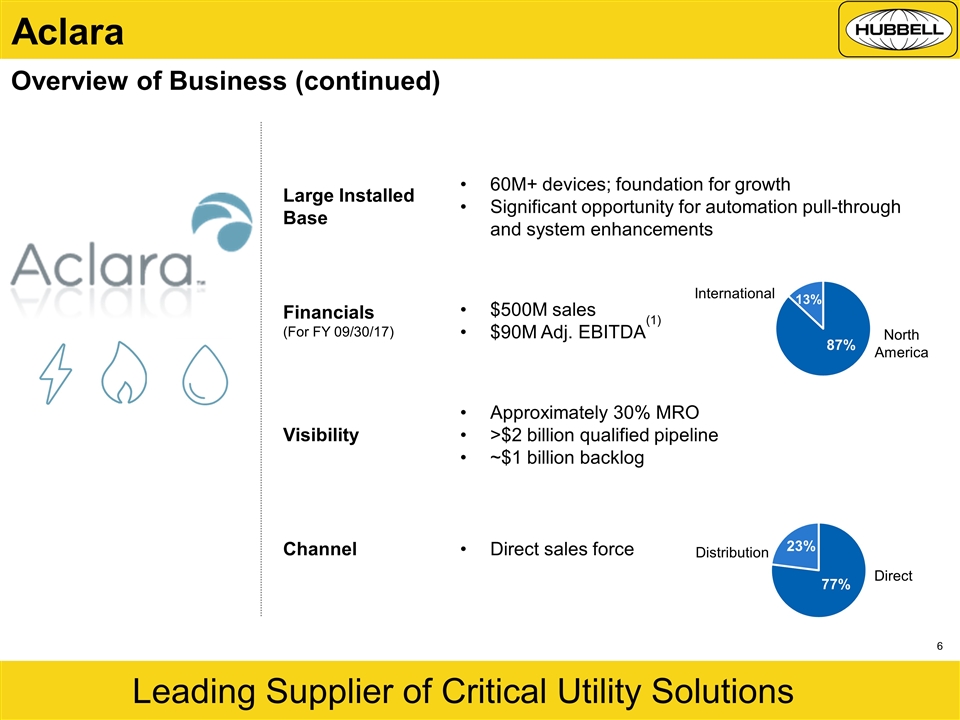

Aclara Leading Supplier of Critical Utility Solutions Overview of Business (continued) 77% Large Installed Base 60M+ devices; foundation for growth Significant opportunity for automation pull-through and system enhancements Financials (For FY 09/30/17) $500M sales $90M Adj. EBITDA(1) Visibility Approximately 30% MRO >$2 billion qualified pipeline ~$1 billion backlog Channel Direct sales force International North America 23% 77% 13% 87% Distribution Direct 23% 77%

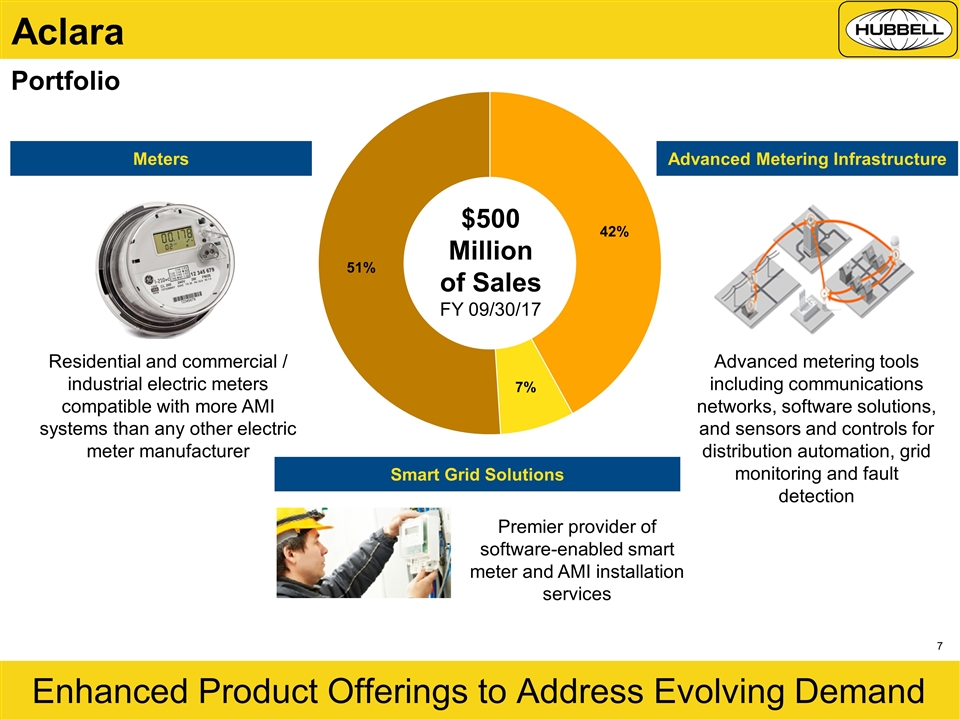

Advanced metering tools including communications networks, software solutions, and sensors and controls for distribution automation, grid monitoring and fault detection Aclara Enhanced Product Offerings to Address Evolving Demand Advanced Metering Infrastructure Meters Smart Grid Solutions Residential and commercial / industrial electric meters compatible with more AMI systems than any other electric meter manufacturer Premier provider of software-enabled smart meter and AMI installation services Portfolio $500 Million of Sales FY 09/30/17

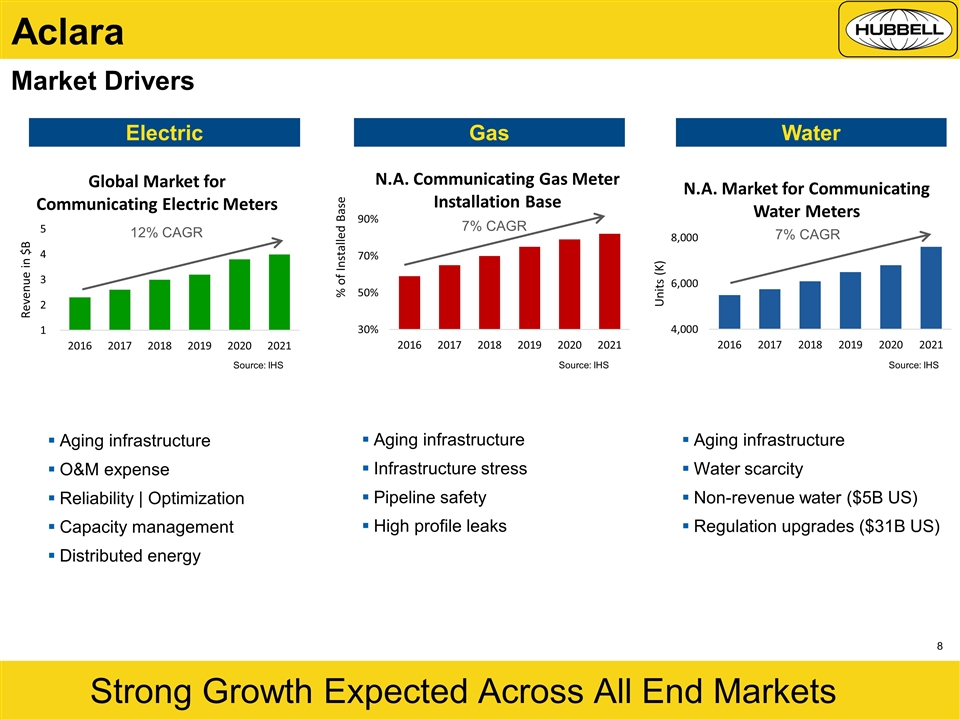

Aclara Strong Growth Expected Across All End Markets Market Drivers Electric Water Gas Aging infrastructure O&M expense Reliability | Optimization Capacity management Distributed energy Aging infrastructure Infrastructure stress Pipeline safety High profile leaks Aging infrastructure Water scarcity Non-revenue water ($5B US) Regulation upgrades ($31B US) 12% CAGR 7% CAGR 7% CAGR Source: IHS Source: IHS Source: IHS

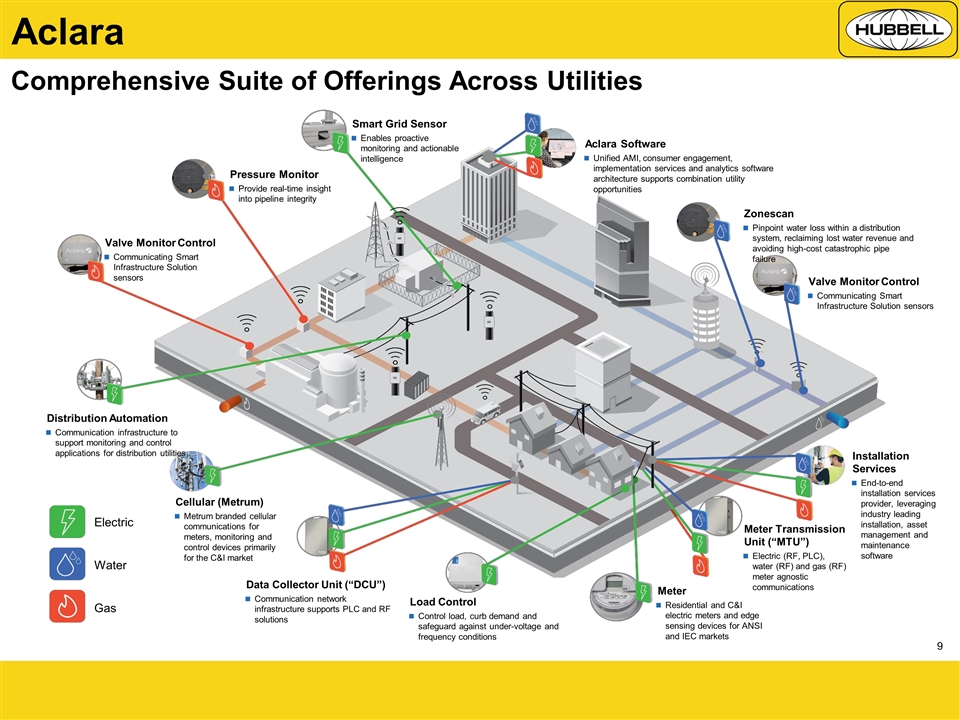

Aclara Valve Monitor Control Communicating Smart Infrastructure Solution sensors Pressure Monitor Provide real-time insight into pipeline integrity Smart Grid Sensor Enables proactive monitoring and actionable intelligence Aclara Software Unified AMI, consumer engagement, implementation services and analytics software architecture supports combination utility opportunities Distribution Automation Communication infrastructure to support monitoring and control applications for distribution utilities Cellular (Metrum) Metrum branded cellular communications for meters, monitoring and control devices primarily for the C&I market Data Collector Unit (“DCU”) Communication network infrastructure supports PLC and RF solutions Load Control Control load, curb demand and safeguard against under-voltage and frequency conditions Meter Residential and C&I electric meters and edge sensing devices for ANSI and IEC markets Valve Monitor Control Communicating Smart Infrastructure Solution sensors Zonescan Pinpoint water loss within a distribution system, reclaiming lost water revenue and avoiding high-cost catastrophic pipe failure Installation Services End-to-end installation services provider, leveraging industry leading installation, asset management and maintenance software Meter Transmission Unit (“MTU”) Electric (RF, PLC), water (RF) and gas (RF) meter agnostic communications Electric Water Gas Comprehensive Suite of Offerings Across Utilities

Transaction Rationale Highlights Compelling Strategic and Financial Benefits Complements and strengthens competitive position of Hubbell Power Systems Expands Hubbell’s presence in utility and smart grid solutions markets Provides opportunity to apply Aclara’s expertise into existing Hubbell products Allocates capital to high margin and high return business

Appendix Non-GAAP Reconciliations

Non-GAAP Measures