Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XCel Brands, Inc. | tv481981_8k.htm |

Exhibit 99.1

Investor Fact Sheet 2017 Q3 About Xcel Brands, Inc. Xcel Brands is a Fast - to - Market, media and technology driven, consumer products company engaged in the design, production, licensing, marketing, and direct - to - consumer sales of branded apparel, footwear, accessories, jewelry, home goods, and other consumer products, and the acquisition of dynamic consumer lifestyle brands . Currently, Xcel’s brand portfolio consists of the Isaac Mizrahi, Judith Ripka , H Halston, C Wonder, Highline Collective brands and the Say Yes licensed brand . Unique, diversified retail distribution channels Xcel designs, produces, markets and distributes products and, in certain cases, licenses its brands to third parties, and generates licensing, design and sourcing fee revenues through contractual arrangements with manufacturers and retailers . This includes distribution through a ubiquitous - channel retail sales strategy, which includes distribution through interactive television, the internet, and traditional brick - and - mortar retail channels . Reimagining shopping, entertainment, and social as one By leveraging digital and social media content across all distribution channels, Xcel seeks to drive customer engagement and generate retail sales across its brands . Xcel’s strong relationships with leading retailers and interactive television companies and cable network TV enables it to reach consumers in over 400 million homes worldwide and hundreds of millions of social media followers . Retail Sales of Products under Xcel Brands (1) Key Statistics Xcel Brands Inc. ● 1333 Broadway 10 th Floor ● New York, New York ● 10018 ● Ph: 347 - 727 - 2474 Differentiated Fast - to - Market and Next Generation Integrated Technology Platform Nasdaq : XELB Market Cap ( 2 ) : $ 48 . 2 mil . Price ( 2 ) : $ 2 . 55 52 Wk . High/Low ( 2 ) : $ 5 . 05 / $ 1 . 80 TTM Sales ( 1 ) : $ 31 . 5 mil . TTM Adj . EBITDA ( 1 )( 3 ) : $ 8 . 0 mil . Investment Highlights • Experienced and motivated management • Differentiated retail growth platform • Owns high - quality brands • Well capitalized and low leverage • No working capital or inventory risk Compelling Valuation Price to Book ( 1 )( 2 ) : 0 . 4 x EV/TTM Sales ( 1 )( 2 ) : 2 . 1 x EV/TTM Adj . EBITDA ( 1 )( 2 )( 3 ) : 8 . 1 x Net Debt to Equity ( 1 ) : 0 . 2 x ( 1 ) Represents the period 10 / 1 / 16 – 9 / 30 / 17 ( 2 ) Market data at November 30 , 2017 ( 3 ) See Table A for a reconciliation of Adj . EBITDA with Net Income $142MM $473MM 2012 2016 Xcel’s innovative Fast - to - Market ( FTM ) production platform provides its retail partners with short lead - time production capabilities, helping drive traffic and respond quickly to customer demand . Xcel supplies high - quality, trend - right products in as little as four to six weeks through its FTM platform, compared to three to six months through the traditional retail supply chain . Xcel successfully shortens the supply chain by utilizing trend analytics and data science to actively monitor fashion trends, while leveraging its experience and know - how to quickly design, test market, produce, and source high - quality items . This is a highly scalable, low - overhead, and light working - capital business model . Xcel’s next generation integrated technology platform uses trend analytics, consumer insight testing, artificial intelligence, 3 D design, and data science to improve Xcel’s ability to identify and execute emerging design trends and opportunities . (1) Estimated based on sales reports from Xcel’s licensees and retail partners, with wholesale and first cost sales converted to retail based on estimated margins.

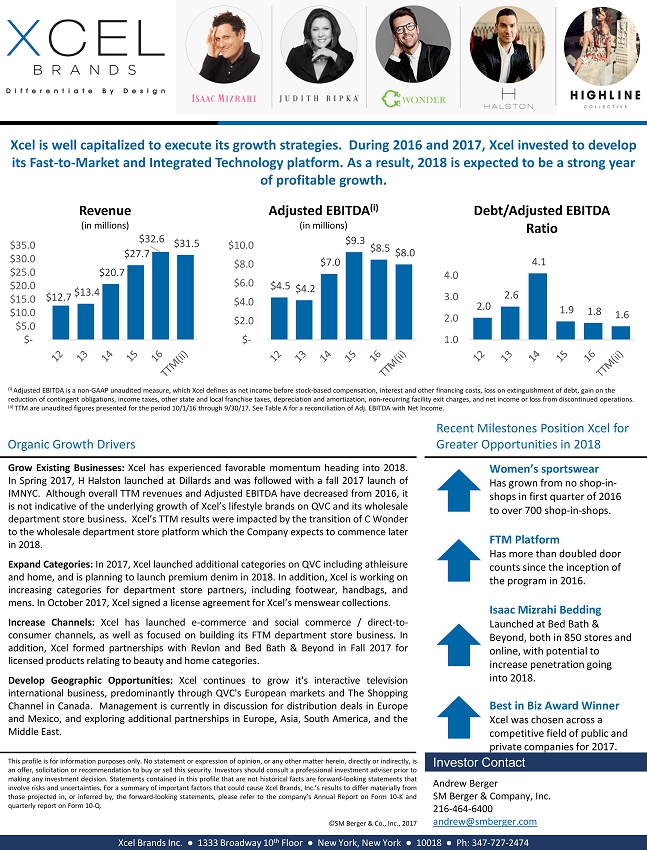

$12.7 $13.4 $20.7 $27.7 $32.6 $31.5 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Revenue (in millions) Xcel Brands Inc. ● 1333 Broadway 10 th Floor ● New York, New York ● 10018 ● Ph: 347 - 727 - 2474 This profile is for information purposes only . No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell this security . Investors should consult a professional investment adviser prior to making any investment decision . Statements contained in this profile that are not historical facts are forward - looking statements that involve risks and uncertainties . For a summary of important factors that could cause Xcel Brands, Inc . ’s results to differ materially from those projected in, or inferred by, the forward - looking statements, please refer to the company’s Annual Report on Form 10 - K and quarterly report on Form 10 - Q . ©SM Berger & Co., Inc., 2017 Investor Contact Andrew Berger SM Berger & Company, Inc. 216 - 464 - 6400 andrew@smberger.com Xcel is well capitalized to execute its growth strategies. During 2016 and 2017, Xcel invested to develop its Fast - to - Market and Integrated Technology platform. As a result, 2018 is expected to be a strong year of profitable growth. $4.5 $4.2 $7.0 $9.3 $8.5 $8.0 $- $2.0 $4.0 $6.0 $8.0 $10.0 Adjusted EBITDA ( i ) (in millions) Recent Milestones Position Xcel for Greater Opportunities in 2018 Organic Growth Drivers Grow Existing Businesses : Xcel has experienced favorable momentum heading into 2018 . In Spring 2017 , H Halston launched at Dillards and was followed with a fall 2017 launch of IMNYC . Although overall TTM revenues and Adjusted EBITDA have decreased from 2016 , it is not indicative of the underlying growth of Xcel’s lifestyle brands on QVC and its wholesale department store business . Xcel’s TTM results were impacted by the transition of C Wonder to the wholesale department store platform which the Company expects to commence later in 2018 . Expand Categories : In 2017 , Xcel launched additional categories on QVC including athleisure and home, and is planning to launch premium denim in 2018 . In addition, Xcel is working on increasing categories for department store partners, including footwear, handbags, and mens . In October 2017 , Xcel signed a license agreement for Xcel’s menswear collections . Increase Channels : Xcel has launched e - commerce and social commerce / direct - to - consumer channels, as well as focused on building its FTM department store business . In addition, Xcel formed partnerships with Revlon and Bed Bath & Beyond in Fall 2017 for licensed products relating to beauty and home categories . Develop Geographic Opportunities : Xcel continues to grow it's interactive television international business, predominantly through QVC's European markets and The Shopping Channel in Canada . Management is currently in discussion for distribution deals in Europe and Mexico, and exploring additional partnerships in Europe, Asia, South America, and the Middle East . 2.0 2.6 4.1 1.9 1.8 1.6 1.0 2.0 3.0 4.0 Debt/Adjusted EBITDA Ratio ( i ) Adjusted EBITDA is a non - GAAP unaudited measure, which Xcel defines as net income before stock - based compensation, interest and other financing costs, loss on extinguishment of debt, gain on the reduction of contingent obligations, income taxes, other state and local franchise taxes, depreciation and amortization, non - rec urring facility exit charges, and net income or loss from discontinued operations. (ii) TTM are unaudited figures presented for the period 10/1/16 through 9/30/17. See Table A for a reconciliation of Adj. EBITDA with Ne t Income. Women’s sportswear Has grown from no shop - in - shops in first quarter of 2016 to over 700 shop - in - shops. FTM Platform Has more than doubled door counts since the inception of the program in 2016. Isaac Mizrahi Bedding Launched at Bed Bath & Beyond, both in 850 stores and online, with potential to increase penetration going into 2018. Best in Biz Award Winner Xcel was chosen across a competitive field of public and private companies for 2017.

| TABLE A |

| Twelve Months Ended September 30, | ||||

| (amounts in thousands) | 2017 | |||

| Net income (loss) (Unaudited) | $ | 2.82 | ||

| Depreciation and amortization | 1.56 | |||

| Interest and finance expense | 1.46 | |||

| Income tax provision (benefit) | 2.02 | |||

| State and local franchise taxes | 0.11 | |||

| Stock-based compensation | 3.47 | |||

| Gain on reduction of contingent obligations | (3.41 | ) | ||

| (Income) loss from discontinued operations, net | (0.03 | ) | ||

| Adjusted EBITDA | $ | 8.00 | ||

| Adjusted EBITDA is a non-GAAP unaudited measure, which we define as net income before stock-based compensation, interest and other financing costs, gain on the reduction of contingent obligations, income tax provision (benefit), other state and local franchise taxes, depreciation and amortization and net income or loss from discontinued operations. | ||