Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - BOYD GAMING CORP | d484084dex992.htm |

| EX-2.1 - EX-2.1 - BOYD GAMING CORP | d484084dex21.htm |

| 8-K - 8-K - BOYD GAMING CORP | d484084d8k.htm |

Boyd Gaming Acquisition of Valley Forge Casino Resort December 20, 2017 Exhibit 99.1

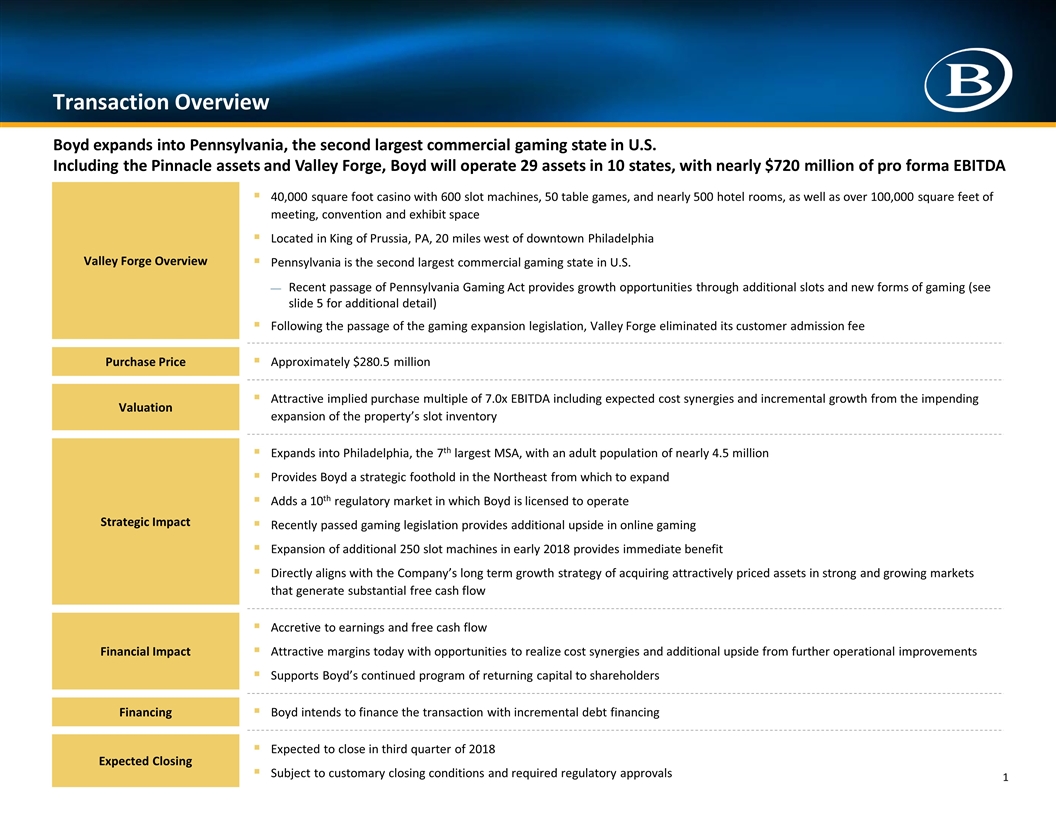

Transaction Overview Valley Forge Overview 40,000 square foot casino with 600 slot machines, 50 table games, and nearly 500 hotel rooms, as well as over 100,000 square feet of meeting, convention and exhibit space Located in King of Prussia, PA, 20 miles west of downtown Philadelphia Pennsylvania is the second largest commercial gaming state in U.S. Recent passage of Pennsylvania Gaming Act provides growth opportunities through additional slots and new forms of gaming (see slide 5 for additional detail) Following the passage of the gaming expansion legislation, Valley Forge eliminated its customer admission fee Purchase Price Approximately $280.5 million Valuation Attractive implied purchase multiple of 7.0x EBITDA including expected cost synergies and incremental growth from the impending expansion of the property’s slot inventory Strategic Impact Expands into Philadelphia, the 7th largest MSA, with an adult population of nearly 4.5 million Provides Boyd a strategic foothold in the Northeast from which to expand Adds a 10th regulatory market in which Boyd is licensed to operate Recently passed gaming legislation provides additional upside in online gaming Expansion of additional 250 slot machines in early 2018 provides immediate benefit Directly aligns with the Company’s long term growth strategy of acquiring attractively priced assets in strong and growing markets that generate substantial free cash flow Financial Impact Accretive to earnings and free cash flow Attractive margins today with opportunities to realize cost synergies and additional upside from further operational improvements Supports Boyd’s continued program of returning capital to shareholders Financing Boyd intends to finance the transaction with incremental debt financing Expected Closing Expected to close in third quarter of 2018 Subject to customary closing conditions and required regulatory approvals 1 Boyd expands into Pennsylvania, the second largest commercial gaming state in U.S. Including the Pinnacle assets and Valley Forge, Boyd will operate 29 assets in 10 states, with nearly $720 million of pro forma EBITDA

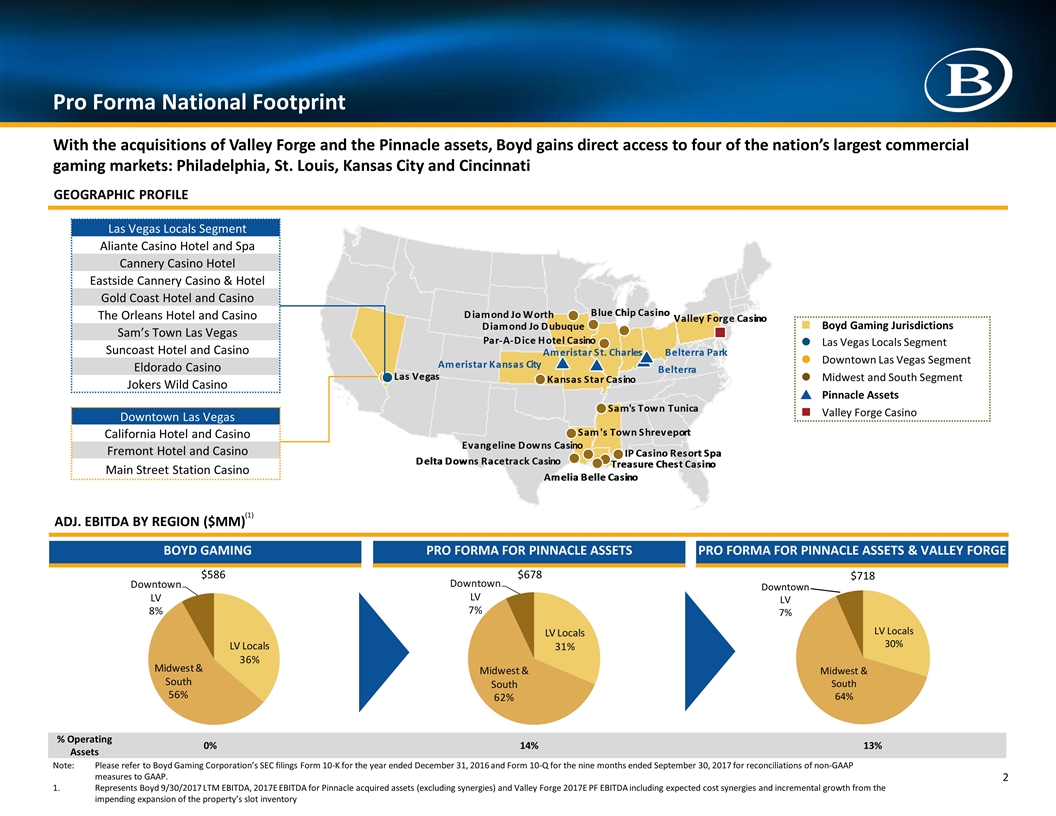

Downtown Las Vegas California Hotel and Casino Fremont Hotel and Casino Main Street Station Casino Pro Forma National Footprint Las Vegas Locals Segment Aliante Casino Hotel and Spa Cannery Casino Hotel Eastside Cannery Casino & Hotel Gold Coast Hotel and Casino The Orleans Hotel and Casino Sam’s Town Las Vegas Suncoast Hotel and Casino Eldorado Casino Jokers Wild Casino GEOGRAPHIC PROFILE ADJ. EBITDA BY REGION ($MM) BOYD GAMING $586 $678 % Operating Assets 0% 14% 13% With the acquisitions of Valley Forge and the Pinnacle assets, Boyd gains direct access to four of the nation’s largest commercial gaming markets: Philadelphia, St. Louis, Kansas City and Cincinnati Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. Represents Boyd 9/30/2017 LTM EBITDA, 2017E EBITDA for Pinnacle acquired assets (excluding synergies) and Valley Forge 2017E PF EBITDA including expected cost synergies and incremental growth from the impending expansion of the property’s slot inventory PRO FORMA FOR PINNACLE ASSETS PRO FORMA FOR PINNACLE ASSETS & VALLEY FORGE $718 Downtown LV 7% (1) Midwest & South 64% 2 LV Locals 30% n Boyd Gaming Jurisdictions l Las Vegas Locals Segment l Downtown Las Vegas Segment l Midwest and South Segment p Pinnacle Assets n Valley Forge Casino

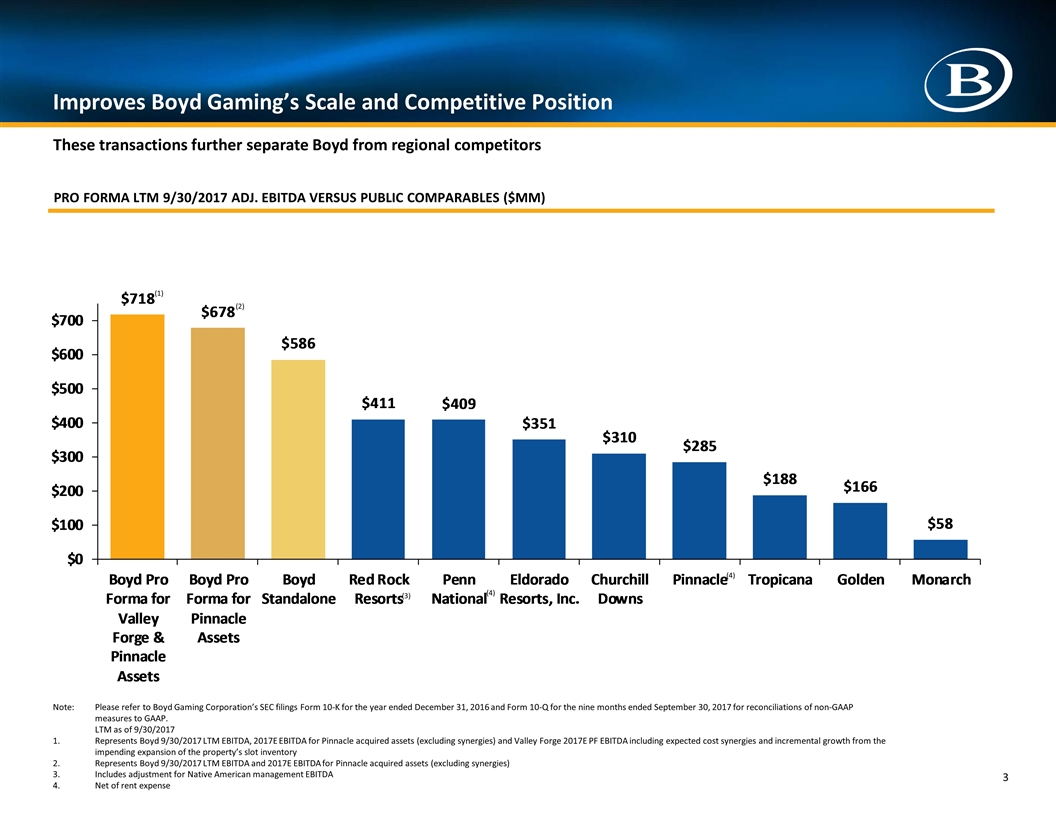

Improves Boyd Gaming’s Scale and Competitive Position PRO FORMA LTM 9/30/2017 ADJ. EBITDA VERSUS PUBLIC COMPARABLES ($MM) These transactions further separate Boyd from regional competitors 3 Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. LTM as of 9/30/2017 Represents Boyd 9/30/2017 LTM EBITDA, 2017E EBITDA for Pinnacle acquired assets (excluding synergies) and Valley Forge 2017E PF EBITDA including expected cost synergies and incremental growth from the impending expansion of the property’s slot inventory Represents Boyd 9/30/2017 LTM EBITDA and 2017E EBITDA for Pinnacle acquired assets (excluding synergies) Includes adjustment for Native American management EBITDA Net of rent expense (1) (3) (4) (4) (2)

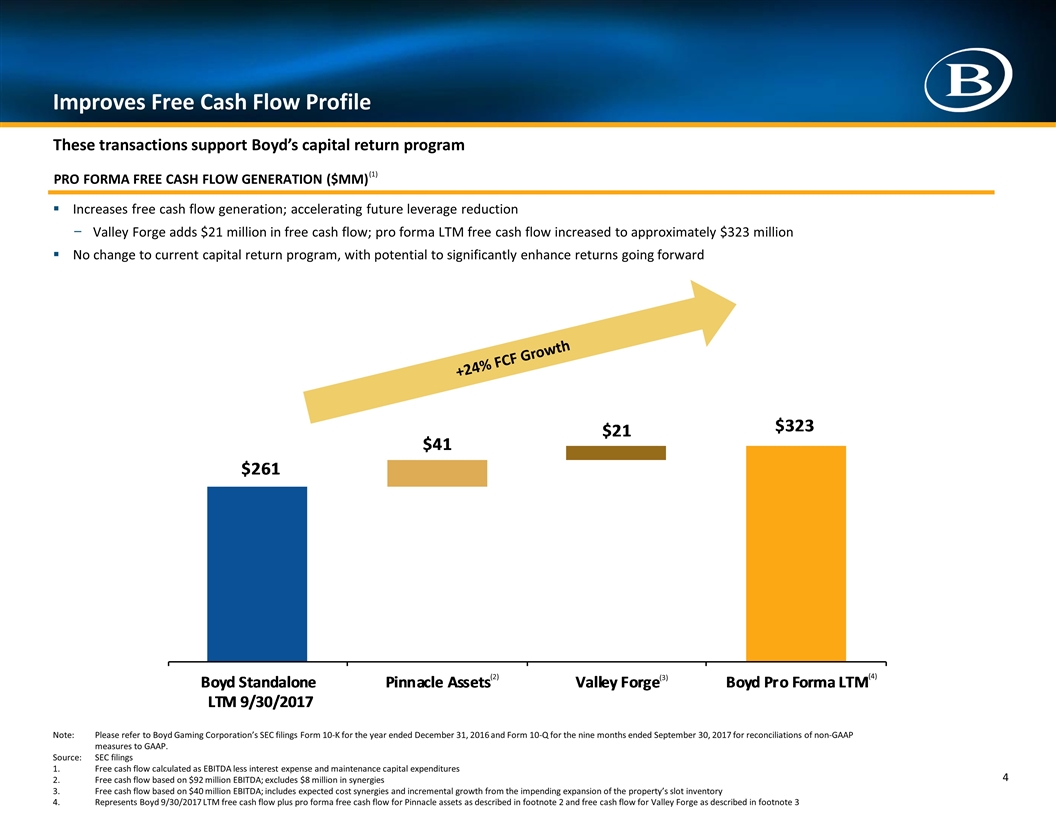

PRO FORMA FREE CASH FLOW GENERATION ($MM) Improves Free Cash Flow Profile Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. Source: SEC filings Free cash flow calculated as EBITDA less interest expense and maintenance capital expenditures Free cash flow based on $92 million EBITDA; excludes $8 million in synergies Free cash flow based on $40 million EBITDA; includes expected cost synergies and incremental growth from the impending expansion of the property’s slot inventory Represents Boyd 9/30/2017 LTM free cash flow plus pro forma free cash flow for Pinnacle assets as described in footnote 2 and free cash flow for Valley Forge as described in footnote 3 These transactions support Boyd’s capital return program Increases free cash flow generation; accelerating future leverage reduction Valley Forge adds $21 million in free cash flow; pro forma LTM free cash flow increased to approximately $323 million No change to current capital return program, with potential to significantly enhance returns going forward +24% FCF Growth 4 (3) (2) (4) (1)

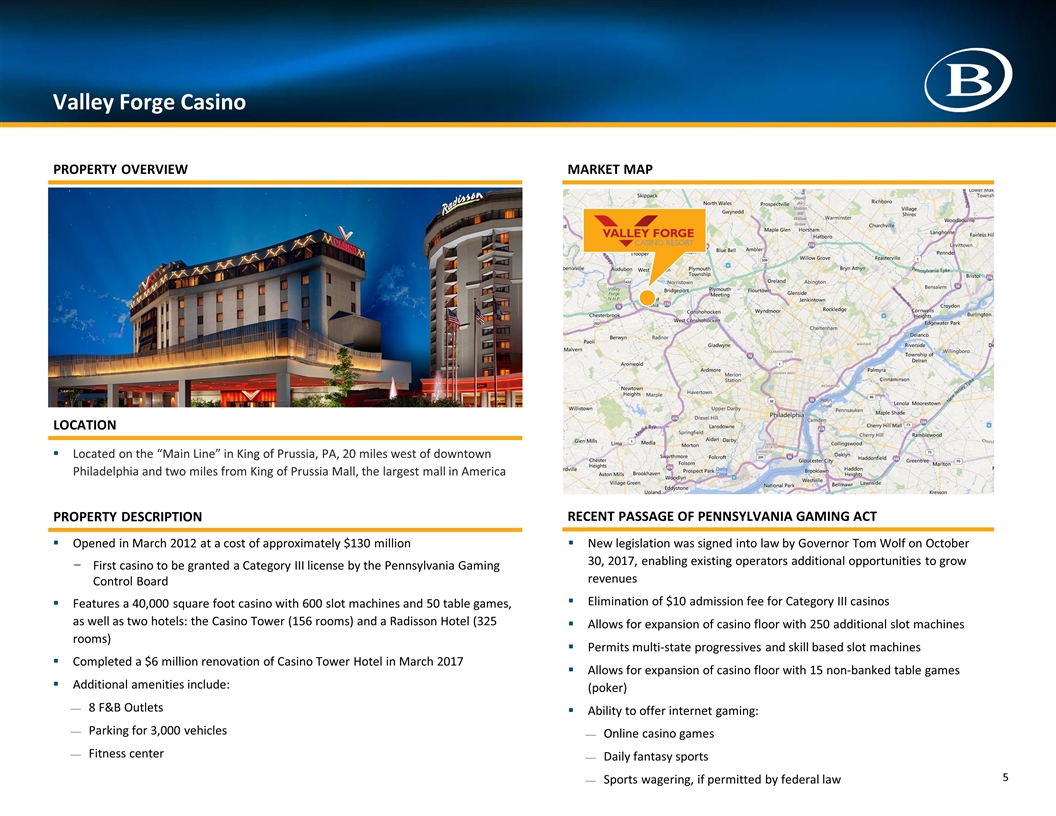

Located on the “Main Line” in King of Prussia, PA, 20 miles west of downtown Philadelphia and two miles from King of Prussia Mall, the largest mall in America Opened in March 2012 at a cost of approximately $130 million First casino to be granted a Category III license by the Pennsylvania Gaming Control Board Features a 40,000 square foot casino with 600 slot machines and 50 table games, as well as two hotels: the Casino Tower (156 rooms) and a Radisson Hotel (325 rooms) Completed a $6 million renovation of Casino Tower Hotel in March 2017 Additional amenities include: 8 F&B Outlets Parking for 3,000 vehicles Fitness center Valley Forge Casino PROPERTY OVERVIEW LOCATION MARKET MAP PROPERTY DESCRIPTION 5 RECENT PASSAGE OF PENNSYLVANIA GAMING ACT New legislation was signed into law by Governor Tom Wolf on October 30, 2017, enabling existing operators additional opportunities to grow revenues Elimination of $10 admission fee for Category III casinos Allows for expansion of casino floor with 250 additional slot machines Permits multi-state progressives and skill based slot machines Allows for expansion of casino floor with 15 non-banked table games (poker) Ability to offer internet gaming: Online casino games Daily fantasy sports Sports wagering, if permitted by federal law

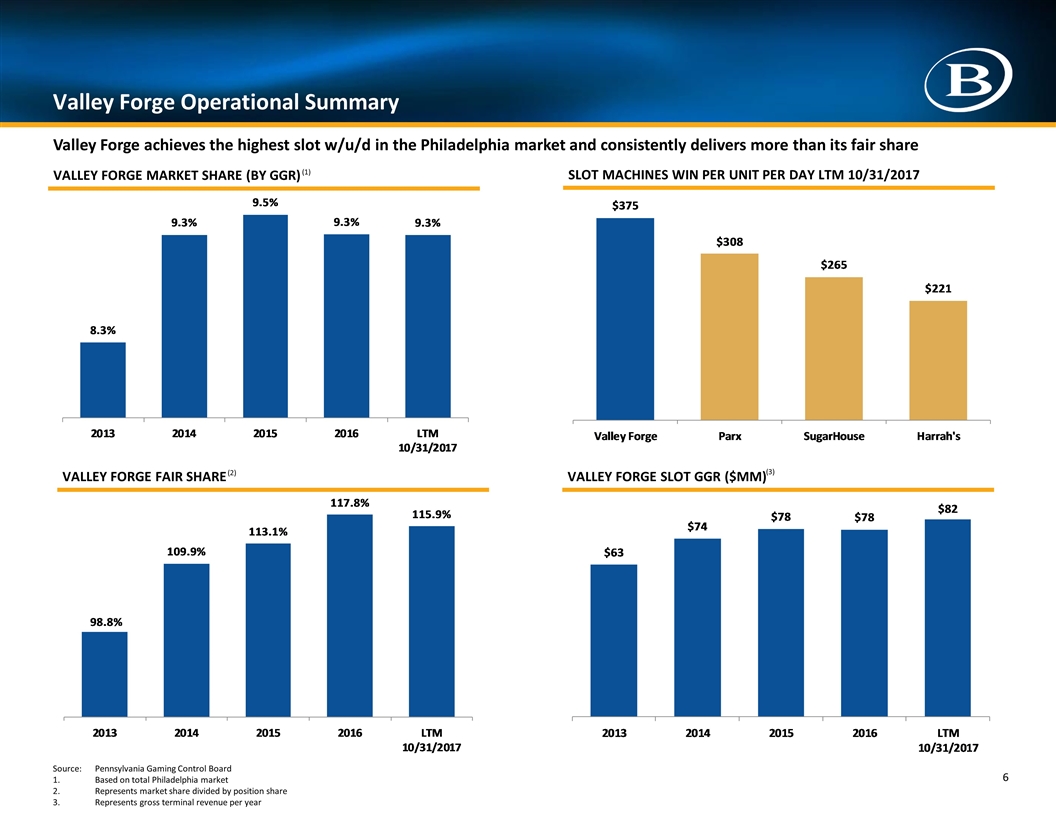

Valley Forge Operational Summary 6 VALLEY FORGE SLOT GGR ($MM) VALLEY FORGE FAIR SHARE VALLEY FORGE MARKET SHARE (BY GGR) SLOT MACHINES WIN PER UNIT PER DAY LTM 10/31/2017 Source: Pennsylvania Gaming Control Board Based on total Philadelphia market Represents market share divided by position share Represents gross terminal revenue per year Valley Forge achieves the highest slot w/u/d in the Philadelphia market and consistently delivers more than its fair share (1) (2) (3)

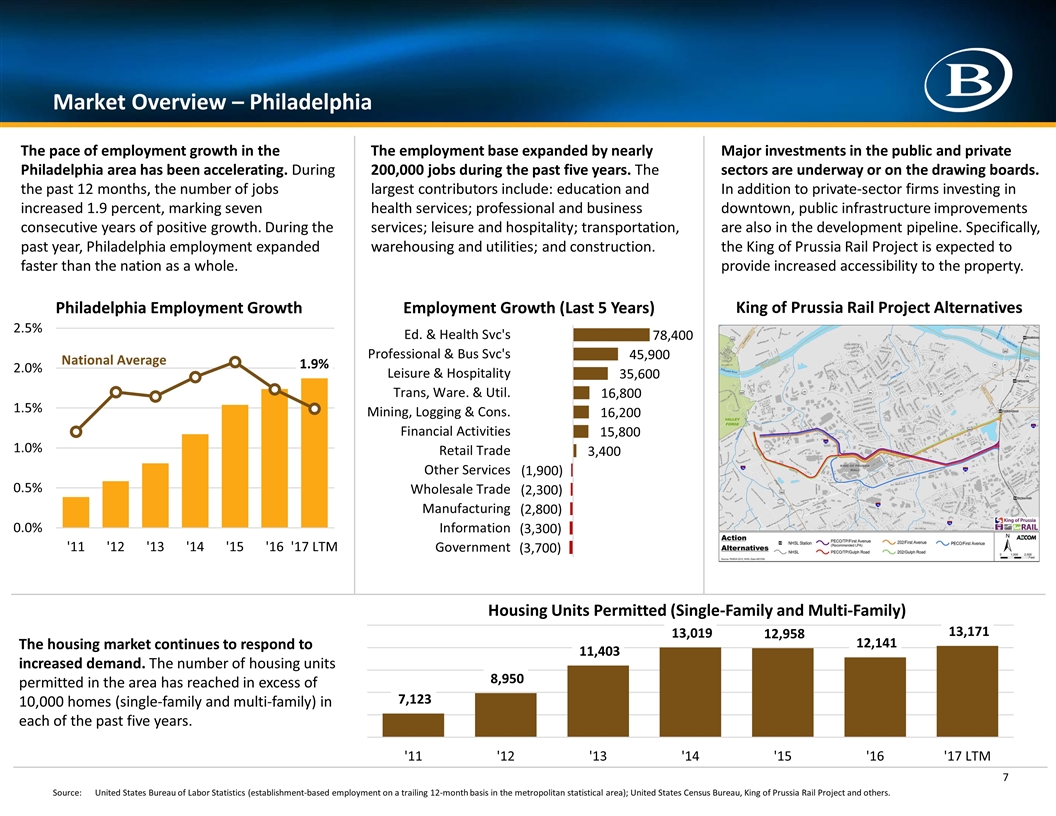

Market Overview – Philadelphia 7 The pace of employment growth in the Philadelphia area has been accelerating. During the past 12 months, the number of jobs increased 1.9 percent, marking seven consecutive years of positive growth. During the past year, Philadelphia employment expanded faster than the nation as a whole. The employment base expanded by nearly 200,000 jobs during the past five years. The largest contributors include: education and health services; professional and business services; leisure and hospitality; transportation, warehousing and utilities; and construction. Major investments in the public and private sectors are underway or on the drawing boards. In addition to private-sector firms investing in downtown, public infrastructure improvements are also in the development pipeline. Specifically, the King of Prussia Rail Project is expected to provide increased accessibility to the property. National Average King of Prussia Rail Project Alternatives The housing market continues to respond to increased demand. The number of housing units permitted in the area has reached in excess of 10,000 homes (single-family and multi-family) in each of the past five years. Source:United States Bureau of Labor Statistics (establishment-based employment on a trailing 12-month basis in the metropolitan statistical area); United States Census Bureau, King of Prussia Rail Project and others.

Forward Looking Statements 8 Important information regarding forward-looking statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and may include (without limitation) statements regarding the transaction to acquire Valley Forge, Boyd Gaming’s expectations regarding the amount of the purchase price, timing of closing, the potential benefits to be achieved from the acquisition, the potential benefits to be achieved from the acquisition, including the effects on Boyd Gaming's size, scale, customer base, and free cash flow, expectations regarding timing for the transaction to be free cash flow positive and accretive to Boyd Gaming's earnings, the expected cost synergies, Valley Forge’s plans to expand its gaming capacity, the potential for driving incremental growth at Valley Forge, the effects of recent legislation, including the ability to conduct online gaming, and any statements or assumptions underlying any of the foregoing. These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the possibility that the transactions contemplated by the definitive agreement will not close on the expected terms (or at all), or that Boyd Gaming is unable to successfully integrate the acquired assets or realize the expected synergies or that the properties will be cash flow positive or accretive to Boyd Gaming’s earnings as anticipated; litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the closing of the transactions contemplated by the definitive agreement; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd Gaming’s annual, periodic and current reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd Gaming as of the date hereof, and Boyd Gaming assumes no obligation to update any forward-looking statement. Non-GAAP Financial Measures Regulation G, "Conditions for Use of Non-GAAP Financial Measures," prescribes the conditions for use of non-GAAP financial information in public disclosures. We do not provide a reconciliation of forward-looking non-GAAP financial measures due to our inability to project special charges and certain expenses.

Disclosures 9 Important disclosures regarding information contained within this document We obtained the industry, market and competitive position data throughout this presentation from (i) our own internal estimates and research of third party company websites and other sources, (ii) industry and general publications and research or (iii) studies and surveys conducted by third parties. Such sources generally do not guarantee the accuracy or completeness of included information. While we believe that the information included in this presentation from such publications, research, studies, surveys and websites is reliable, we have not independently verified data from these third-party sources. While we believe our internal estimates and research are reliable, neither such estimates and research nor such definitions have been verified by any independent source. This presentation also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or TM symbols, but we do not intend our use or display of other companies’ trade names, trademarks or service marks with or without such symbols to imply relationships with, or endorsement or sponsorship of us by, these other companies.