Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - MARTIN MARIETTA MATERIALS INC | d499713dex51.htm |

| EX-4.2 - EX-4.2 - MARTIN MARIETTA MATERIALS INC | d499713dex42.htm |

| 8-K - FORM 8-K - MARTIN MARIETTA MATERIALS INC | d499713d8k.htm |

Exhibit 5.2

December 20, 2017

Martin Marietta Materials, Inc.

$300,000,000 Aggregate Principal Amount of Floating Rate Senior Notes due 2019

$500,000,000 Aggregate Principal Amount of 3.500% Senior Notes due 2027

$600,000,000 Aggregate Principal Amount of 4.250% Senior Notes due 2047

Ladies and Gentlemen:

We have acted as counsel for Martin Marietta Materials, Inc., a North Carolina corporation (the “Company”), in connection with the public offering and sale by the Company of $300,000,000 aggregate principal amount of its Floating Rate Senior Notes due 2019, $500,000,000 aggregate principal amount of its 3.500% Senior Notes due 2027 and $600,000,000 aggregate principal amount of its 4.250% Senior Notes due 2047 (collectively, the “Notes”) to be issued pursuant to an Indenture dated as of May 22, 2017 (the “Base Indenture”), between the Company and Regions Bank (the “Trustee”), as amended and supplemented by the First Supplemental Indenture dated as of May 22, 2017 (the “First Supplemental Indenture”), between the Company and the Trustee and the Second Supplemental Indenture dated as of December 20, 2017 (the “Second Supplemental Indenture” and, together with the Base Indenture and the First Supplemental Indenture, the “Indenture”), between the Company and the Trustee.

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including the Indenture and the Registration Statement on Form S-3 (Registration No. 333-217991) filed with the Securities and Exchange Commission (the “Commission”) on May 12, 2017, for registration under the Securities Act of 1933 (the “Securities Act”) of various securities of the Company, to be issued from time to time by the Company, as

amended by Amendment No. 1 thereto filed with the Commission on June 5, 2017 (such Registration Statement, as amended by such amendment, being hereinafter referred to as the “Registration Statement”). As to various questions of fact material to this opinion, we have relied upon representations of officers or directors of the Company and documents furnished to us by the Company without independent verification of their accuracy. We have also assumed (a) the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted to us as duplicates or copies, (b) that the Indenture has been duly authorized, executed and delivered by, and represents a legal, valid and binding obligation of, the Trustee, (c) that the Indenture has been duly authorized, executed and delivered by the Company and (d) that the Notes have been duly authorized, executed and delivered by the Company.

Based on the foregoing and subject to the qualifications set forth herein, we are of opinion that when the Notes are authenticated in accordance with the provisions of the Indenture and delivered and paid for, the Notes will constitute legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their terms and entitled to the benefits of the Indenture (subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or other laws affecting creditors’ rights generally from time to time in effect and to general principles of equity, including concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether such enforceability is considered in a proceeding in equity or at law).

We hereby consent to the filing of this opinion with the Commission as an exhibit to the Registration Statement. We also consent to the reference to our firm under the caption “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are included in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

We are admitted to practice in the State of New York, and we express no opinion as to matters governed by any laws other than the laws of the State of New York and the Federal laws of the United States of America. In particular, we do not purport to pass on any matter governed by the laws of the State of North Carolina.

Very truly yours,

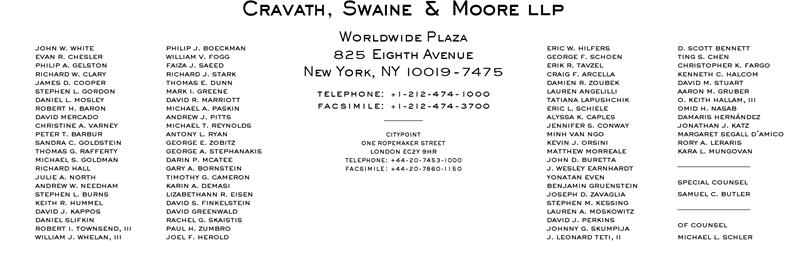

/s/ Cravath, Swaine & Moore LLP

Martin Marietta Materials, Inc.

2710 Wycliff Road

Raleigh, North Carolina 27607

120A

O

2