As filed with the Securities and Exchange Commission on December 19, 2017

Registration No. 333-221741

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MY SIZE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2836 | 51-0394367 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

3 Arava St., pob 1026

Airport City, Israel 7010000

972-3-600-9030

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

1-800-927-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard A. Friedman, Esq. Andrea Cataneo, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, New York 10112 Phone: (212) 653-8700 Fax: (212) 370-7889 |

Michael A. Adelstein, Esq. Jason P. Katz, Esq. Kelley Drye & Warren LLP 101 Park Avenue New York, New York 10178 Tel: (212) 808-7800 Fax: (212) 808-7897 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer (Do not check if a smaller reporting company) ☐ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Offering Price per Share (2) | Amount of Registration Fee | ||||||

| Common stock, $0.001 par value per share(1)(3) | ||||||||

| Pre-funded warrants to purchase shares of common stock and common stock issuable upon exercise thereof(1)(3) | ||||||||

| Common warrants to purchase shares of common stock and common stock issuable upon exercise thereof(1)(4) | ||||||||

| Total | $ | 2,500,000 | $ | 311.25 | * | |||

| (1) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. |

| (3) | The proposed maximum offering price of the common stock offered hereunder will be reduced on a dollar-for-dollar basis based on the offering price of any pre-funded warrants offered and sold, and as such the proposed aggregate maximum offering price of the common stock and pre-funded warrants (including the common stock issuable upon exercise of the pre-funded warrants), if any, is $2,500,000. |

(4) |

No additional registration fee is payable pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

* Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED DECEMBER 19, 2017 |

My Size, Inc.

$2,500,000

Shares of Common Stock

Pre-funded Warrants to Purchase Shares of Common Stock

Common Warrants to Purchase Shares of Common Stock

We are offering up to 3,850,000 shares of our common stock together with 2,887,500 common warrants to purchase shares of our common stock (and the shares of common stock that are issuable from time to time upon exercise of the common warrants). Each common warrant upon exercise at a price of $0.851 will result in the issuance of one share of common stock to the holder of such common warrant. A portion of such exercise price will be paid to us at the closing of this offering and, at the time of exercise, the payment of the remaining unpaid amount will be paid in cash or pursuant to a cashless exercise to effect the exercise of each common warrant. See “Description of Securities, Common Warrants, Exercise Price and Duration”. We are also offering to each purchaser whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants, in lieu of shares of common stock that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock. Subject to limited exceptions, a holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one share of our common stock. The purchase price of each pre-funded warrant will equal the price per share at which the shares of common stock are being sold to the public in this offering, minus $0.001. The exercise price of each pre-funded warrant will equal $0.64925 per share, the purchase price of one share of our common stock and 0.75 of a common warrant to purchase one share of common stock being sold in this offering. A portion of such exercise price will be paid to us at the closing of this offering and, at the time of exercise, the payment of the remaining unpaid amount will be paid in cash or pursuant to a cashless exercise to effect the exercise of each pre-funded warrant. See “Description of Securities, Pre-Funded Warrant, Exercise Price and Duration”. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. Each pre-funded warrant is being sold together with a common warrant with the same terms as the common warrant described above. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because a common warrant is being sold together in this offering with each share of common stock and, in the alternative, each pre-funded warrant to purchase one share of common stock, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. The common warrants will be exercisable immediately and will expire five years from the date of issuance. The shares of common stock and pre-funded warrants, if any, can each be purchased only with the accompanying common warrants, but will be issued separately, and will be immediately separable upon issuance.

Our common stock is listed on The NASDAQ Capital Market under the symbol “MYSZ” and on the Tel Aviv Stock Exchange (“TASE”) under the symbol “MYSZ”. The closing price of our common stock on December 18, 2017, as reported by The NASDAQ Capital Market, was $0.83 per share. There is no established public trading market for the pre-funded warrants or common warrants, and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the pre-funded warrants or common warrants on any national securities exchange. Without an active trading market, the liquidity of the pre-funded warrants or common warrants will be limited.

Investing in our securities involves risks. See the section entitled “Risk Factors” beginning on page 12 of this prospectus and in the documents incorporated by reference herein for a discussion of information that should be considered in connection with an investment in our securities.

We have engaged Roth Capital Partners, LLC as our exclusive placement agent in connection with this offering. The placement agent is not purchasing the securities offered by us and is not required to sell any specific number or dollar amount of securities but will assist us in this offering on a commercially reasonable “best efforts” basis. See “Plan of Distribution” beginning on Page 32 of this prospectus for more information regarding these arrangements. There is no minimum purchase requirement for this offering. We have agreed to pay the placement agent the placement agent fee set forth in the table below, which assumes that we sell all of the securities we are offering.

| Per Share and Accompanying 0.75 Common Warrant | Per Pre-Funded Warrant and Accompanying 0.75 Common Warrant | Total (1) | ||||||||||

| Public offering price(2) | $ | $ | $ | |||||||||

| Placement agent fees | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

| (1) | Assumes no sale of pre-funded warrants. |

| (2) | In addition, we have agreed to reimburse the placement agent for certain expenses. See “Plan of Distribution” beginning on page 32 of this prospectus for additional information. |

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

We expect to deliver the shares of common stock and common warrants and any pre-funded warrants to purchasers on or about , 2017, subject to the satisfaction of certain conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus is , 2017

You should rely only on the information contained in this prospectus. We have not, and the placement agent has not, authorized anyone to provide you with any information other than that contained or incorporated by reference in this prospectus or in any applicable prospectus supplement or free writing prospectus prepared by or on behalf of us to which we have referred you. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates. We are not, and the placement agent is not, making an offer of these securities in any jurisdiction where the offer is not permitted.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Information contained in, and that can be accessed through, our web site www.MySizeID.com shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the securities offered hereunder.

Notice to Non-U.S. Investors: We have not, and the placement agent has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby the distribution of this prospectus outside the United States.

These securities are not being offered in Israel. This offering or this prospectus are not, and under no circumstances are to be construed as, an advertisement or a public offering of securities in Israel. Any public offer or sale of securities in Israel may be made only in accordance with the Israeli Securities Law 5728-1968 (the “Israeli Securities Law”) (which requires, among other things, the filing of a prospectus in Israel or an exemption therefrom). This document does not constitute a prospectus under the Israeli Securities Law and has not been filed with or approved by the Israel Securities Authority.

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain, in addition to historical information, certain forward-looking statements. within the meaning of Section 27A of the Securities Act or 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, that include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact. These forward-looking statements are based on our current expectations and projections about future events and they are subject to risks and uncertainties known and unknown that could cause actual results and developments to differ materially from those expressed or implied in such statements.

In some cases, you can identify forward-looking statements by terminology, such as “expects,” “anticipates,” “intends,” “estimates,” “plans,” “believes,” “seeks,” “may,” “should”, “could” or the negative of such terms or other similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this prospectus or incorporated herein by reference.

You should read this prospectus and the documents we have incorporated by reference or filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

Risks, uncertainties and other factors that may cause our actual results, performance or achievements to be different from those expressed or implied in our written or oral forward-looking statements may be found in this prospectus under the heading “Risk Factors” and in our Annual Report on Form 10-K for the year ended December 31, 2016 under the headings “Risk Factors” and “Business,” as updated in our Quarterly Report(s) on Form 10-Q.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and incorporated herein by reference, and particularly our forward-looking statements, by these cautionary statements.

| ii |

The following summary highlights certain of the information contained elsewhere in or incorporated by reference into this prospectus. Because this is only a summary, however, it does not contain all the information you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information included elsewhere in or incorporated by reference into this prospectus. Before you make an investment decision, you should read this entire prospectus carefully, including the risks of investing in our securities discussed under the section of this prospectus entitled “Risk Factors” and similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Unless the context otherwise requires, references to “we,” “our,” “us,” “My Size” or the “Company” in this prospectus mean My Size, Inc. on a consolidated basis with its wholly-owned subsidiary, My Size (Israel) 2014 Ltd., as applicable.

OUR BUSINESS

Overview

The Company is a technology company whose strategy is based on the development of applications that can be utilized to accurately take measurements of a variety of items via a smartphone. By downloading the application to a smartphone, the user is then able to run the smartphone over the surface of an item the user wishes to measure. The information is then automatically sent to a cloud-based server where the dimensions are calculated through the Company’s proprietary algorithms, and the accurate measurements (+ or - 2 centimeters) are then sent back to the users smartphone. We believe that the commercial applications for this technology are significant in many areas.

Currently, we are focusing on the following market segments:

| ● | E-commerce apparel industry – our main target-market; |

| ● | Courier services; |

| ● | Do it yourself (“DIY”) uses; and |

| ● | Usage as a tape measure. |

While we are currently devoting much of our focus on the applications for the apparel business, management believes that all of the above mentioned applications will be useful to users, retailers and vendors alike.

The Market - The Apparel Industry

The growth in online apparel shopping has been positive and negative for retailers. The positive: what was an approximately $72.13 billion apparel and accessories market in 2016 is projected to increase to approximately $116.3 billion U.S. dollars by 2021 (https://www.statista.com/statistics/278890/us-apparel-and-accessories-retail-e-commerce-revenue). The negative: although online apparel shopping is growing quickly, customer returns are also growing quickly due to a bad fit.

For apparel retailers, both in retail and online, customer returns are a necessary pain point, backed by flexible return policies and in some instances, free return shipping. However, online retailers have higher operating costs as at least 30% of all products ordered online are returned, compared to 8.89% from retail stores, according to recent data (http://www.business2community.com/infographics/e-commerce-product-return-statistics-trends-infographic-01505394#Js0FFKfd6xZEorqz.97). The U.S. Census Bureau estimated that total e-commerce sales for 2016 were $394.9 billion, an increase of 15.1% from 2015. According to Euromonitor International, most online apparel retailers have average return rates of 15-20%, of which around 80% are fit-based. According to the National Retail Federation, when translating these figures into hard currency, in the United States, online consumers returned approximately $260 billion in merchandise to retailers in 2015, or 8% of all purchases.

MySizeID

We are currently in development of an application (“MySizeID”) which assists the consumer to accurately take the measurements of his or her own body using a smartphone in order to fit clothing in the best way possible without the need to try the clothes on. The purpose of our application is to simplify the process of clothing acquisition through the internet and to significantly reduce the rate of returns of ill-fitting clothing which are acquired through the internet.

| 1 |

The application is the result of a research and development effort that combines:

| ● | Anthropometric research – analyses of information pertaining to body measurements derived from a survey and the subsequent determination of correlations between body parts; | |

| ● | Body measurement algorithm research – an algorithm created by the Company to measure body parts; and | |

| ● | Retailers size chart analyses – adopting a deep understanding of the size charts of retailers and the corresponding “body to garment size.” |

MySizeID will operate based on the use of existing sensors in smart phones which enable, through a specific purpose application, the measurement of the body of consumers independently by moving the cellular phone along his or her body. The measurements will then be saved on the Company’s cloud database, enabling the user to search for clothes in various retailer websites without worrying about size. When a search is made, the retailer will connect to the Company’s cloud database and then provide results based on the user’s measurements and other parameters as he or she may have defined. This data will also be saved for use when a customer enters a brick and mortar store to help serve the customer more efficiently and to provide a better shopping experience.

As soon as the item is found and the acquisition is completed, the retailer will be charged a certain percentage of the acquisition price. The rate to be charged by My Size for the acquisition has not yet been fixed, and will be determined following negotiations with fashion companies, in a more advanced stage of the development.

How MySizeID Can be Utilized by the Apparel Industry

| 1. | MySizeID: This application will allow consumers to create a secure, online profile of their personal measurements, which can then be utilized with partnered online retailers to insure that no matter the manufacturer or size chart, they will get the right fit. The MySizeID application will utilize a patent-pending measurement technology that does not rely on user photographs or any additional hardware; all a user needs to do is scan their body with their smartphone and the app records their measurements. |

| 2. | In Store Shopping Tool: The Company is developing technology which will permit users of MySizeID to allow brick and mortar merchants to access their profile to receive more personalized attention. This anticipated concierge like service will enable a salesperson to better serve customers by accessing the user’s size and style preferences to make the in-store shopping experience more pleasant, time efficient and satisfactory. |

| 3. | Cross Site Search Feature: The Company is developing the MySizeID profile which will enable users to search for a specific product or item across multiple online retailers, but, unlike most shopping comparison shopping tools, MySizeID will deliver results that fit each individual user’s measurements. The Company will develop this feature so that it can be customized for personalized filters that go beyond sizing and measurements, and can also include a user’s favorite colors, brands, styles and more. |

The application is being designed to use a person’s body measurements to help determine correct apparel sizes when shopping on-line. To begin, the app will measure the hip breadth, and uses statistical, mathematical algorithms to recommend the most appropriate size trousers.

True Size

In November 2016, the Company introduced a new product called TrueSize.

TrueSize is a customizable, white-label, mobile application that empowers retailers to improve the online shopping experience of their customers by perfectly matching their true measurements with the retailer’s offerings. The level of accuracy and ease of use integrated into the retailer’s website ensures that the customers will select the right size apparel every time, and we believe this will significantly reduce the amount of returns.

How Does TrueSize Work?

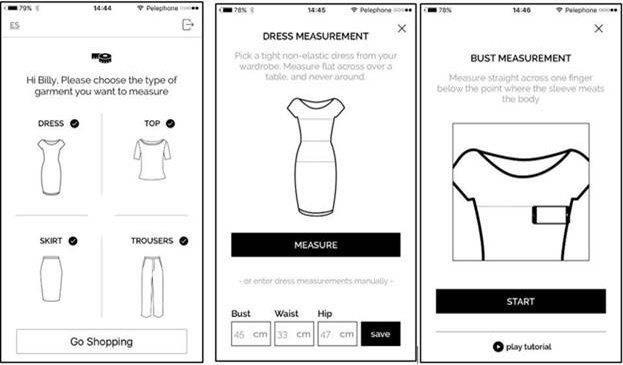

TrueSize has two components: a white label application and a small application located on each page of the retailer’s website. First, the customer downloads the TrueSize app, branded to a specific retailer’s website, and signs in, using the same credentials used for the online store. The application will then guide the customer through the process.

Using the TrueSize app, the customer next takes accurate measurements of an item of clothing from their wardrobe by placing the smartphone first on one end of the item and then on the other end. The app. will then prompt the user to take several different measurements to get a complete reading. The information pertaining to each item is then saved, but can be updated at any time. Measurements are next stored in the cloud and a recommended size for the user is calculated. The user may continue shopping directly from the app by clicking the “Go Shopping” button, which will direct them to the retailer’s mobile website.

| 2 |

The chart below illustrates how consumers can interact with the prompts from the TrueSize application.

Shopping with TrueSize

A “TrueSize” widget in the form of a button is located in proximity to the size selection feature on each product page of the retailer’s website. If the customer has signed in to the website and has already downloaded the TrueSize app and taken measurements, a recommended size will automatically appear in the widget. Users then have the option to manually update their size parameters – height, weight, and an item’s parameters – at any time by simply clicking on the widget. If the customer has not yet signed into the website, a prompt will appear requesting the customer to do so.

TRUCCO – RealSize

RealSize is a white label measurement application developed based on the Company’s TrueSize technology. The first customer to use the TrueSize technology is IN SITU S.A., the owner of the rights to the fashion brand-name TRUCCO. TRUCCO is a women’s clothing brand and has over 240 points of sale in more than 20 countries all over the world including, but not limited to, Andorra, Chile, China, Costa Rica, Czech Republic, Dominican Republic, France, Guatemala, Israel, Kuwait, Libya, Malaysia, Mexico, Panama, Paraguay, Peru, Portugal, Qatar, Russia, Singapore, Slovakia, Spain, Taiwan and Thailand.

The Market - Courier Services

When an individual wishes to ship boxes from place to place, they often call a courier service and request a pick up. The individual is then usually asked about the dimensions of the package to be shipped. Unfortunately, the response given to the courier can be rather vague (big, medium, small, etc.). This is often the cause of much confusion between the shipper and the courier. This confusion can lead to the courier sending out the wrong vehicle for the pick-up and/or a large price differential than what was originally quoted by the courier causing customer dissatisfaction.

How My Size Can be Utilized for Courier Services

My Size operates based on the use of existing sensors in smart phones which enable, through a specific purpose application, measurement of the dimensions of packages by moving the cellular phone along packages (length, height and width) to be sent via courier. The measurements are then be saved on the Company’s cloud database and shared with the courier. This allows for:

| ● | Courier services to provide accurate pricing to their consumers with little to no confusion; and | |

| ● | Courier services can send the proper sized vehicle to pick up package(s). |

Accordingly to Market Realist, the courier service market in the United States alone had revenues of over $90 billion in 2014. Accordingly, the Company views this as an excellent opportunity to create value in the courier market.

| 3 |

Agreement with Katz Delivery Services, LTD

On November 20, 2015, My Size entered into an agreement (the “Katz Agreement”) with Katz Deliveries, LTD (“Katz”), one of the largest courier services in Israel. Katz delivers approximately five million parcels per year, the most in Israel. Katz has more than 250 vehicles. Pursuant to the Katz Agreement, the parties have agreed to mutually work together to develop and integrate My Size technology with the technology of Katz to accurately monitor the volume of all parcels delivered to it for shipment by its clients. The goal is for Katz to use our technology to help with planning its distribution lines, thus reducing operational costs by adjusting the distribution vehicles to the volume of the shipments. My Size expects to generate revenues from this endeavor by the second half of 2018, but is still in negotiations with Katz regarding the terms of the Katz Agreement.

SizeUp

My Size is working on additional consumer applications. One of these applications is in the category of DIY. In this application, users will be able to visualize how an object or a piece of furniture will fit in an existing room in their home or office. As many people have difficulty with spatial recognition, the Company hopes this will help alleviate the problem.

In the third quarter of 2015, My Size launched the SizeUp application, a smart tape measure for the business to consumer market. SizeUp is a project that My Size has already completed and launched. This application allows users to utilize their smartphone as a tape measurer. The application provides measurements with an accuracy plus or minus 2 centimeters. In the first quarter of 2016, a second version of SizeUp for the iOS operating system was released. This release included the ability to measure both horizontal and vertical measurements. In January 2017, a third version of SizeUp for the iOS operating system was released. This release included an innovative air measurement algorithm which allows the user to measure over the air without the need to slide the phone over the surface during the measurement. Through November 2017, there have been over 530,000 downloads of the SizeUp app.

The first version of the SizeUp app for Android was released in March 2016 and included vertical measurement. An update to the app was released in June, 2017 which update includes a one-time calibration process for ensuring high accuracy. Currently both versions of the SizeUp app (for Android and iOS) are available for free for the first 30 days, where after a user will be required to pay a one-time fee of $1.99 to continue using the application. To date, the Company has accumulated immaterial revenues from the mentioned fee.

Research and Development

The Company has incurred research and development expenses of $727,000 in 2016 and $301,000 in 2015, and $624,000 in the nine month period ended September 30, 2017, relating to the development of its applications and technologies.

Income Sources - Projected Income

The Company’s business model currently contemplates five methods of producing revenue through its products:

| 1. | Fees - The Company intends to charge sellers a fee for every garment and clothing item purchased using its services, which fees are currently anticipated to be in the range of 1% to 3% of royalties on product sales, depending on volume, resulting from usage of the MySizeID platform. |

| 2. | Advertisements - the Company may generate revenue by using specialized ads using its database to identify the user’s exact needs. |

| 3. | “Offline Shopping” - the Company may offer its services for clothing and fashion stores, for real-time use by their customers. The service may allow the store to immediately offer the customer a fitting garment suitable for his or her size. | |

| 4. | Pay Per API call – every time a user is looking onto an item in the retailers website and clicks the “what’s my size” button to find out his size the retailer will be charged a fixed amount based on the SDK pricing matrix. | |

| 5. | SizeUp – SizeUp is the first B2C app that MySize has released in the Apple App Store and on Google Play. The Company charges a one-time fee of $1.99 for every download of the app from either store. |

Competition

Management of the Company believes that its technology and applications are a win-win solution for consumers, retailers, couriers and individuals. The Company’s technology is protected by three issued patents, one in each of Russia, Japan and the U.S., one patent-pending submission and an additional patent application which is in process. My Size’s products are designed to allow users to measure themselves simply by sliding a smartphone over their body, and the measurements are recorded by the My Size application.

Unlike other products claiming similar capabilities, there is no need for additional accessories (no webcam, photos, measuring tape, etc.). Users of the My Size apps will have their information protected and a unique identification number is provided that matches personal sizes with retailer size charts. When consumers get the right size products, there are fewer returns of such products involved.

| 4 |

My Size’s advantage lies in its easy to use application in recording body measurements. Using special algorithmic equations, the software is able to determine which sizes will best fit the customer. The collection of this data, and tracking shoppers’ preferences, allows for a unique shopping experience both online and in brick and mortar stores where the technology can instantly match clothes the customer likes in sizes that will fit them.

However, My Size does face competition in helping retailers increase conversation rate and reduce shipping costs.

Competitive Landscape

The following chart lists some but not all of our competitors:

| Name | Technology | User Action | Product / Service | ||||

| True Fit | Algorithm driven engine matches manufacturer specs and data points with customer profile | Answer questions to create profile | ● | Based on statistics; doesn’t reflect real measurement | |||

| Fits.me | Software solution based on a personal avatar; Algorithm driven engine matches manufacturer specs and data points with customer profile | Answer questions to create profile | ● ● |

Virtual fitting room size Recommendations based on statistics

| |||

| Virtusize | Compares a reference item the silhouette of the garment they are looking to buy | Reference items: a previous purchase or a favorite item. Measure it manually and enter results to the app | ● | Garment-to-garment comparison with tape measure (manually) | |||

| EasyMeasure | Uses camera and motion sensors | User needs to photograph according to the instructions and conditions of the app. (i.e certain lighting conditions) | ● | Allows the user to measure large objects and from far away (i.e. a building). Low accuracy requires optimal lighting conditions | |||

| ● | Only on iOS platform | ||||||

| ● | Very intuitive | ||||||

| AR MeasureKit | AR kit and motion sensors | Allows the user to measure objects from a distance with the camera | ● | Requires bright light, and a contrast between the object and the background | |||

| ● | When measuring small objects it can be difficult to “mark” them | ||||||

| ● | Only on iOS platform | ||||||

| Smart Measure | Camera and motion sensors | Allows the user to measure objects from a distance | ● ● |

Easy to use Requires the user to know the height of the device | |||

| ● | Requires optimal lighting conditions | ||||||

| ● | Only on Android platform | ||||||

Some of our competitors have significantly greater financial, marketing, personnel and other resources than we do, and many of our competitors are well established in markets in which we have existing retailers or intend to locate new retailers. We may also need to evolve our concepts in order to compete with popular new retail formats or concepts that develop from time to time, and we cannot offer any assurance that we will be successful in doing so or that modifications to our concepts will not reduce our profitability.

| 5 |

Legal Proceedings

On May 3, 2017, Lightcom (Israel) Ltd., an Israeli company, alleging that it is a shareholder of the Company, filed a motion with the Tel Aviv District Court (Financial Division) to approve an action against the Company and the Company’s officers and directors, as a shareholders’ class action. The complaint alleges, inter alia, that the Company’s report dated April 19, 2017 regarding its engagement with the Israeli Post was false and misleading, and that as a result thereof financial damages have been incurred by two purported classes of shareholders: (i) any shareholder who sold Company’s shares as of April 20, 2017 and until April 27, 2017, with respect to damage directly caused by such sale and (ii) any shareholder which held shares on April 20, 2017 and subsequent to April 27, 2017 with respect to damage caused by permanent adverse effect to the shares’ value. The alleged financial damage caused to members of both classes is estimated at NIS 18.8 million. The Company reviewed the Motion initially with its legal counsel and retained an expert to review and analyze the allegations and data upon which the motion is based. The Company’s management, after considering the conclusions of a report issued by a third party expert and an opinion of U.S. legal counsel, is of the opinion that the chances that the class motion will be denied exceed the risk that it will be approved In the event that the class motion will be approved, the complaint will become a class action which will be heard by the court on its merits. Should this occur, the Company will respond to the class motion in the time frame ordered by the court. On November 15, 2017 the Company filed its response to the class motion and a motion to dismiss the class motion. On November 15, 2017, the Court ordered the respondent (the original plaintiff) to respond to the motion to dismiss within 30 days, which response was filed by the respondent on November 29, 2017. A hearing on the foregoing matter is scheduled to be held on January 3, 2018. As of the date of this filing, the motion to dismiss is still pending.

On September 9, 2015, fourteen shareholders filed a complaint against the Company and its CEO Mr. Ronen Luzon, alleging that in accordance with agreements signed between plaintiffs and the Company, the plaintiffs are entitled to register their shares for sale with the stock market, while the Company allegedly breached its obligation and refrained from doing its duty to register the plaintiffs’ shares. On November 5, 2015, the Company filed its defense and a counter claim against the plaintiffs and against two additional defendants (who are not plaintiffs) Mr. Asher Shmuelevitch and Mr. Eitan Nahum. In its counter claim, the Company alleged that the agreements by force of which the counter defendants hold their shares are defunct, based on fraud, as the counter defendants never paid and never intended to pay the agreed consideration for their shares. The Company further alleged that Mr. Shmuelevitch used his position as a director and controlling stockholder of the Company to knowingly cause the Company to enter such defunct agreements. On September 5, 2017, the court rendered a judgment pursuant to which the complaint against the Company was accepted, the complaint against Mr. Ronen Luzon was rejected and the Company’s counter-claim was rejected. The judgment included: (1) a declaratory remedy, under which the Company breached its contractual undertakings toward the plaintiffs, to list their shares both on TASE and on NASDAQ; (2) an order that the Company take any and all actions required for the listing of the plaintiffs shares, including instructing the Company’s transfer agent to remove the legend or any other restriction from the plaintiffs stock certificate and to issue them with new stock certificates free and clear from any restriction; (3) an order that the registration company of Bank Hapoalim electronically list all of the plaintiffs’ shares detailed in the complaint on the electronic trading system; and (4) an order that the Company pay the plaintiffs costs in the amount of NIS 70,000. On October 3, 2017, the Company appealed the judgment with the Supreme Court of Israel, and simultaneously, filed with the Supreme Court a Motion for Stay of Execution of the judgement, pending the outcome of the appeal. On November 8, 2017, the Supreme Court upheld the Motion to Stay and ordered that the execution of the judgment will be stayed pending the outcome of the appeal, provided that the Company deposit in the Supreme Court’s treasury an autonomous Israeli CPI linked bank guarantee in an amount of NIS 1,700,000, to cover the respondents’ potential damages should the appeal be ultimately denied. The Company did not deposit the bank guarantee in the amount of NIS 1,700,000 and will instead register the shares held by the plaintiffs on TASE and on NASDAQ and will issue such shares free of any restrictive legends. In the event that the Company is successful in its appeal, the Company may seek relief from the shareholders which have sold their shares either in private or public sales in the amount of the proceeds from such sales. Although the Company has appealed such matter, there can be no assurance that the appeal will result in a judgment favorable to the Company. If the judgment rendered on appeal is not favorable to the Company, the Company may be ordered to pay the respondents legal costs in connection with the appeal. On November 16, 2017, the Company deposited NIS 45,000 with the Supreme Court to cover respondents’ potential legal costs if the appeal is ultimately denied.

The Company received legal advice from its counsel that the burden of proof that the judgment is wrong and should be reversed lies with the appellant. Consequently, the Company believes that it is more likely than not that the appeal will be denied rather than being accepted. In the event that the appeal is denied, no direct financial liability will be imposed on the Company (other than legal costs which the court may order the losing side to pay).

It should be noted that the plaintiffs may file a complaint against the Company seeking reimbursement of economic loss or damages due to the fact that their shares remained restricted, in breach of the Company’s contractual undertakings. A formal demand has not yet been filed, but in their response to the Company’s motion to stay the judgment, the plaintiffs argued, that they suffered economic loss in the sum of NIS 12,100,000. As of the date of this filing no formal request or complaint were filed; however, we are unable to assess the financial risk inherent in such a claim since, among other things, the estimate of alleged damage is dependent upon the actual revenues to be received by the plaintiffs from the future sale of the shares, the method of calculating the damage and data relating to the Company's share price and trading volume of stock. Needless to say, that in the event that the Company is successful in its appeal, there will be no grounds to such reimbursement.

| 6 |

On December 27, 2015, a legal complaint was filed against the Company. The defendants named in the complaint are the Company, the members of the Board of Directors of the Company, Mrs. Shoshana Zigdon, a shareholder and related party in the Company, as well as two additional defendants who are not shareholders of the Company. The plaintiff alleges that the Company violated its obligation to register his shares (the “Original Shares”) for trade with the TASE causing damage in total amount of NIS 2,622,500. The plaintiff seeks relief against the defendants through financial compensation in the sum of the aforementioned alleged damage; additional compensation in the sum of NIS 400,000 for mental anguish; and if and to the extent that until such time as the plaintiff may be able to sell its shares on TASE ("the Exercise Date"), the price of a Company share will be in excess of NIS 20.98 ("the Base Price"), an additional amount equal to the difference between the Base Price and the highest price of a Company share between the time the claim was submitted and the Exercise Date for each share held by the plaintiff. The plaintiff has also requested costs of trial and attorney's fees. Following the recommendation of the court, on March 20, 2016, the plaintiff filed a notice of deletion of certain defendants including board and management members, excluding the chairman of the Board and the CEO of the Company from the statement of claim. Pursuant to the Israeli court's recommendation, the case was referred to mediation and the Company and the plaintiff entered into a settlement agreement (the "Settlement") dated June 20, 2017. Pursuant to the Settlement, (i) the Company shall pay the plaintiff the sum of NIS325,000 (the "Down Payment") within 30 days from the date of the Settlement, (ii) the Company is obligated to register the Original Shares within a specified time frame and (ii) the Company will issue, within 60 days, 80,358 additional shares of common stock (the “New Shares”) to the plaintiff which shares shall be registered, deposited in escrow and sold for the benefit of the plaintiff. Such New Shares shall be sold at a maximum aggregate price of NIS10,000 or an amount constituting no more than 2% of the average volume of trades within the last 90 days, according to the higher amount, in one single trading day. To the extent the Company does not issue the unrestricted New Shares within 60 days, the plaintiff has a right, at his exclusive discretion, to resume the legal proceedings pursuant to the complaint, provided that the Down Payment is deposited by him in an escrow account, pending the court's final adjudication of the complaint. Additionally, the Settlement provides that to the extent the aggregate proceeds from the sale of the Original Shares and the New Shares is less than NIS1,600,000, the Company will either complement the difference in cash or shall issue to the plaintiff additional shares of common stock in lieu thereof, at the Company's sole discretion. If the Company does not comply with the terms of the Settlement, plaintiff may resume the legal proceedings which could result in substantial costs, diversion of management’s attention and diversion of the Company’s resources.

Employees and Independent Contractors

We currently have 12 employees and 7 independent contractors.

Company Information

The Company was incorporated in the State of Delaware and commenced operations in September 1999 under the name Topspin Medical, Inc. In December 2013, the Company changed its name to Knowledgetree Ventures Inc. Subsequently, in February 2014, the Company changed its name to My Size, Inc. Our principal executive offices are located at 3 Arava St., pob 1026, Airport City, Israel 7010000, and our telephone number is +972-3-600-9030. Our website address is www.MySizeID.com. The information on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

Background

The Company (under the name Topspin Medical, Inc.) was a privately held company that was engaged, through 2012, in research and development of a medical magnetic resonance imaging (“MRI”) technology for interventional cardiology and in the development of MRI technology for use in the diagnosis and treatment of prostate cancer.

On September 1, 2005, the Company issued securities to the public in Israel according to a prospectus and became publicly traded on the Tel Aviv Stock Exchange (“TASE”). In 2007, and until August 2012, the Company registered some of its securities with the U.S. Securities and Exchange Commission (“SEC”).

In January 2012, after having received the approval at the general meeting of shareholders of the Company, the Company consummated a transaction whereby it acquired Metamorefix Ltd. (“Metamorefix”). Pursuant to such transaction, Metamorefix became wholly-owned by the Company. Metamorefix was incorporated in 2007, and was engaged in the development of innovative solutions for the rehabilitation of tissues, particularly skin tissues.

On August 21, 2012, the Company’s board of directors (the “Board”) approved the suspension of the Company’s reporting obligations under Section 13(a) and 15(d) of the Securities Exchange Act of 1934 (the “De-Registration”). The Company thereafter filed a Form 15 with the SEC on September 5, 2012 to effect the De-Registration. Upon the filing of the Form 15, the Company’s obligation to file periodic and current reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on form 8-K, was immediately suspended.

By the end of 2012, in view of the Company’s cash flow, the Company ceased its above operations and shortly thereafter the Company’s employees were laid off. In January 2013, the Company sold its entire ownership interest in Metamorefix.

| 7 |

Change in Control Transaction

In September 2013, Ronen Luzon, the Company’s current Chief Executive Officer, purchased control of the Company from Mr. Asher Shmuelevitch (the “Transaction”). Mr. Luzon purchased 1,755,950 shares of common stock from Mr. Shmuelevitch, which shares represented approximately 40% of the issued and outstanding capital stock of the Company at such time, and thus Mr. Luzon became a controlling shareholder of the Company.

Within the framework of the Transaction, Mr. Luzon reached a settlement with the Company’s creditors pursuant to which the main creditor, Mr. Asher Shmuelevitch, was paid a total sum of New Israeli Shekel (“NIS”) 0.5 million (approximately $140,000) in consideration for a full and final waiver of any and all his claims that he may have relating to any monetary indebtedness of the Company to the creditors.

As a result of the various investment rounds in the Company, Mr. Luzon’s beneficial ownership in the Company has been diluted and currently represent approximately 11% of the issued and outstanding shares of common stock of the Company on a fully diluted basis.

In December 2013, the Company changed its name to Knowledgetree Ventures Inc. Thereafter, in January, 2014, the Board approved a transaction with Shoshana Zigdon, a related party, with respect to a technology venture through a new subsidiary, as discussed in the Shoshana Zigdon Agreement below (see “February 2014 Purchase Agreement”). Subsequently, on February 16, 2014, the Company changed its name to My Size, Inc.

February 2014 Purchase Agreement

In February 2014, the Company entered into a Purchase Agreement (the “Purchase Agreement’) with Shoshana Zigdon (“Seller”), with respect to the acquisition of certain rights in a venture for the accumulation of physical data of human beings by portable electronic devices (including smart phones, tablets and other portable devices) for the purpose of locating, based on the accumulated data, articles of clothing in internet apparel stores, which will fit the person whose measurements were so accumulated (the “Venture”). Prior to entering into the Purchase Agreement, in January 2014, the Purchase Agreement was approved by shareholders of the Company as the Seller was also a beneficial owner of over 20% of the outstanding capital of the Company.

Pursuant to the Purchase Agreement, the Company purchased the all of Seller’s rights, title and interest in and to the Venture, including, but not limited to, the method (the “Method”) and the certain patent application that had been filed by Seller (PCT/IL2013/050056) (the “Patent”, and collectively with the Method, the “Assets”).

In consideration for the sale of the Assets, the Company agreed to pay to Seller, 18% of the Company’s operating profit, directly or indirectly connected with the Venture and/or the Method and/or the commercialization of the Patent together with value-added tax (“VAT”) in accordance with the law (the “Consideration”) for a period of seven years from the end of the development period of the Venture. The parties further agreed that Seller’s right to receive the Consideration will apply even in the event the Patent is revoked/rejected/expires and/or the non-receipt of the Patent for any reason. Down payments on account of the Consideration are to be paid to the Seller quarterly, within 14 days from the approval of the reviewed financial reports of the Company, with the exception of the fourth quarter which will be paid after the approval of the audited financial reports of the Company. Payment will be made against a duly issued tax invoice as prescribed by law.

The Agreement may be terminated by either party in the event of a breach of the obligations of the other party and the failure to cure a default within a specified period of time. The Agreement further provides that Seller is entitled to repurchase the Assets from the Company upon the occurrence of one or more of the following events: (a) if an application for liquidation of the Company and/or an application for appointment of a receiver for the Company and/or for a significant part of its assets has been filed, and/or an attachment has been imposed on a significant part of the Company’s assets, and the application or attachment – as the case may be – has not been not canceled within 60 days from the date on which they are filed; or (b) if upon the date that is seven years from the date of execution of the Agreement, the amount of Company’s income, directly and/or indirectly accumulated from the Venture and/or the Method and/or the commercialization of the Patent is less than NIS 3.6 million (approximately $1 million) (a “Repurchase Event”).

If a Repurchase Event occurs, Seller shall have a 90 day right, subject to delivery of written notice to the Company of Seller’s intention to exercise such right, to repurchase the Assets from the Company. The repurchase price will be based upon a market price to be determined by an external and independent valuer, who shall be chosen by agreement by the parties, and the Audit Committee shall conduct the negotiations on behalf of the Company to determine the identity of the valuer. In the absence of agreement on the identity of the valuer, the valuer shall be appointed by the President of the Institute of Certified Public Accountants in Israel. If one of the parties appeals against the valuation, with the Company’s decision to appeal being made by the Audit Committee of the Company, the parties shall approach another agreed valuer from one of the four large accounting firms in Israel (and in the absence of agreement he shall be chosen by the President of the Institute of Certified Public Accountants) and an average shall be taken of the two valuations which are received. The parties shall bear the valuers’ fees and all the expenses of the valuation in equal shares. Unless Seller gives the Company written notice of the retraction of Seller’s intention to repurchase the Assets, the Seller shall be obligated to repurchase the Assets within 60 days from the date of receipt of the valuation. Seller shall have the right to retract its intention to repurchase the Assets, provided Seller gives written notice to the Company within 30 days of receiving the valuation and subject to Seller refunding the Company the expenses borne by the Company in respect of the valuation (provided that the Company gives Seller details of the expenses borne by it).

| 8 |

In addition to the foregoing, the Agreement provides that all developments, improvements knowledge and know-how developed and/or accumulated by the Company after the execution of the Agreement will be owned by the Company. Further, the Seller agreed not to compete, directly or indirectly, with the Company in any matter relating to the Assets and/or the Venture and/or the Method for a period of seven years from the end of the development period of the Venture.

On July 25, 2016, the Company’s common stock began publicly trading on the NASDAQ Capital Market under the symbol “MYSZ”.

Potential Corporate Actions to be Approved at a Meeting of Stockholders

On December 18, 2017, the Company filed a preliminary information statement on Schedule 14C with the SEC in connection with the following proposed contemplated corporate actions: (i) a reverse stock split of the Company’s issued and outstanding common stock in a ratio to be determined by the Board which ratio shall not be less than 1-for-2 nor more than 1-for-10, with the exact ratio to be set at a whole number within this range as determined by the Board; (ii) an amendment to the Company’s 2017 Consultant Equity Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder from 3,000,000 to 4,500,000 shares; and (iii) an amendment to the Certificate of Incorporation to increase the number of authorized shares of common stock from 50,000,000 to 100,000,000 shares (which would not be affected by the aforementioned reverse stock split) (collectively, the “Corporate Actions”). None of the contemplated Corporate Actions were related to or are required to be completed in connection with the offering contemplated by this Prospectus. Based upon concerns regarding form eligibility in connection with the information statement, the Company no longer intends to pursue the information statement for purposes of approving the Corporation Actions. If and when the Company seeks approval for the Corporate Actions, the Company will file a proxy statement on Schedule 14A with the SEC in order to hold a meeting of stockholders. Accordingly, no Corporate Actions will be effected, if at all, until such time as such actions have been approved by the required number of stockholders at a meeting duly convened for this purpose. This prospectus is not intended to and shall not be deemed a solicitation in connection with the approval of the Corporate Actions.

| 9 |

| Common stock offered by us in this offering | 3,850,000 shares | |

| Pre-funded warrants offered by us in this offering | We are also offering to each purchaser whose purchase of shares of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants, in lieu of shares of common stock that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock. Subject to limited exceptions, a holder of pre-funded warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one share of our common stock. The exercise price of each pre-funded warrant will equal $0.64925 per share, the difference of (x) the purchase price of one share of our common stock and 0.75 of a common warrant to purchase one share of common stock being sold in this offering and (y) the nominal value of the exercise price of 0.75 of a common warrant to purchase one share of common stock being sold in this offering. $0.64825 of such exercise price, including the nominal value of $0.001 per share of our common stock issuable upon exercise of each pre-funded warrant, will be paid to us at the closing of this offering and, at the time of exercise, the payment of the remaining unpaid amount of $0.001 per share (subject to adjustment as described herein) will be paid in cash or pursuant to a cashless exercise to effect the exercise of each pre-funded warrant. See “Description of Securities, Pre-Funded Warrants, Exercise Price and Duration”. This offering also relates to the shares of common stock issuable upon exercise of any pre-funded warrants sold in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because a common warrant to purchase 0.75 shares of our common stock is being sold together in this offering with each share of common stock and, in the alternative, each pre-funded warrant to purchase one share of common stock, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. | |

| Common warrants offered by us in this offering | Common warrants to purchase an aggregate of 2,887,500 shares of our common stock. Each share of our common stock is being sold together with a common warrant to purchase 0.75 share of our common stock. Each common warrant will have an exercise price of $0.851 per share (subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events), will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The nominal value of $0.001 per share of such exercise price will be paid to us at the closing of this offering and, at the time of exercise, the payment of the remaining $0.85 unpaid amount (subject to adjustment as described herein) will be paid in cash or pursuant to a cashless exercise to effect the exercise of each common warrant. See “Description of Securities, Common Warrants, Exercise Price and Duration”. No fractional shares of common stock will be issued in connection with the exercise of a common warrant. In lieu of fractional shares, we will round up to the next whole share. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the common warrants. | |

| Common stock to be outstanding after this offering | 22,256,245 shares (assuming no sale of any pre-funded warrants and assuming none of the common warrants issued in this offering are exercised). | |

| Use of proceeds | We estimate that the net proceeds to us from this offering will be approximately $[●] million if we sell all of the securities we are offering, based upon the assumed public offering price of $[●] per share or pre-funded warrant, after deducting placement agent fees and estimated offering expenses payable by us and assuming no exercise of the common or pre-funded warrants. We intend to use the net proceeds from the sale of the securities for working capital, repayment of trade payables, general corporate purposes, the repayment of $666,666 million in promissory notes sold in our October 2017 private placement of securities, and $60,000 in fees payable to the placement agent in connection with such October 2017 private placement. See “Use of Proceeds” on page 24 for additional information. | |

| 10 |

| Risk factors | You should carefully read and consider the information set forth under “Risk Factors” on page 12 of this prospectus and the documents incorporated by reference herein before deciding to invest in our securities. | |

| Lock-up agreements | We have agreed, subject to certain exceptions, until the earlier of (i) January 10, 2018 and (ii) such time that the Company’s aggregate trading volume on the NASDAQ Capital Market is at least 25,000,000 shares following the public announcement of the terms of this offering, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of directly or indirectly any shares of our common stock or any securities convertible into or exchangeable for shares of our common stock either owned as of the date hereof or thereafter acquired without the prior written consent of the placement agent. In addition, our executive officers, directors, and a stockholder holding over 5% of our common stock have agreed, subject to certain exceptions, for a period of 90 days after the date of this prospectus, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of directly or indirectly any shares of our common stock or any securities convertible into or exchangeable for shares of our common stock either owned as of the date hereof or thereafter acquired without the prior written consent of the placement agent. For more information, see “Plan of Distribution” on page 32 of this prospectus. | |

| Leak-out agreements | Until the earlier of (i) January [●], 2018 and (ii) the fifth consecutive trading day during which the VWAP (as defined in the warrants) for each such trading day during such period is equal to or exceeds $[●] per share, each investor either alone or together with its affiliates, in this offering will be limited to selling no more than [●]% of the daily trading volume of the common stock on such trading day, including shares of common stock or shares of common stock underlying any convertible securities (including any shares of common stock acquirable upon exercise of purchased pre-funded warrants or common warrants). | |

| NASDAQ Capital Market common stock symbol | MYSZ | |

| TASE symbol | MYSZ | |

| Listing of Pre-Funded Warrants and Common Warrants | We do not intend to list the pre-funded warrants or the common warrants on any securities exchange or nationally recognized trading system. | |

The number of shares of common stock to be outstanding immediately after this offering is based on 18,406,245 shares of common stock outstanding as of December 12, 2017 and excludes:

| ● | 925,5001 shares of common stock issuable upon exercise of outstanding options as of December 12, 2017 under our 2017 Equity Incentive Plan at a price of $1.21; |

| ● | 2,190,0002 shares of common stock issuable upon exercise of outstanding options as of December 12, 2017 under our 2017 Consultant Equity Incentive Plan at prices ranging from $1.50 to $5.093; |

| ● | 888,8884 shares of common stock issuable upon the exercise of warrants outstanding as of December 12, 2017 at a of $0.75 per share; and |

| ● | 1,591,717 shares of common stock issuable upon the exercise of warrants outstanding as of December 12, 2017 at prices ranging from $0.04 to $5.095. |

1 The outstanding options are subject to approval by TASE.

2 Excludes options to purchase 1,230,000 shares of common stock, of which 1,000,000 are exercisable at $1.00 per share and 230,000 are exercisable at $2.50 per share. Of such options, 390,000 are subject to TASE approval and the balance, or 840,000 are subject to TASE approval and an increase in the common stock reserve pursuant to the Company’s 2017 Consultant Equity Incentive Plan. Excludes an aggregate of 150,000 shares issuable upon exercise of options by three consultants which options are exercisable at $2.00 per share. The issuance of the foregoing options is subject to approval by TASE and an increase in the common stock reserve pursuant to the Company’s 2017 Consultant Equity Incentive Plan.

3 Based upon a conversion price of NIS 3.539 as of December 12, 2017.

4 The outstanding warrants are subject to approval by TASE.

5 Based upon a conversion price of NIS 3.539 as of December 12, 2017.

| 11 |

An investment in our securities involves a high degree of risk. This prospectus contains a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the heading “Risk Factors” in this prospectus, together with all of the other information contained or incorporated by reference in any prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and any updates described in our Quarterly Reports on Form 10-Q, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities.

Risks Related to Our Company and Our Business

We may never successfully develop any products or generate revenues.

We are a pre-revenue stage company with research, development, marketing and general and administrative expenses. We may be unable to successfully develop or market any of our current or proposed products or technologies, those products or technologies may not generate any revenues, and any revenues generated may not be sufficient for us to become profitable or thereafter maintain profitability. We have only generated very minimal revenues to date.

We have historically incurred significant losses and there can be no assurance when, or if, we will achieve or maintain profitability.

During the twelve months ended December 31, 2016, the Company realized a net loss of $4,334,000 compared with a net loss of $3,437,000 for the year ended December 31, 2015. Our net loss from continuing operations for the nine months ended September 30, 2017 was $3,519,000. Because of the numerous risks and uncertainties associated with the development of the Company’s products and business, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Expected future operating losses will have an adverse effect on our cash resources, stockholders’ equity and working capital. Our failure to become and remain profitable could depress the value of our stock and impair our ability to raise capital, expand our business, maintain our development efforts, diversify our portfolio of staffing companies, or continue our operations. A decline in our value could also cause you to lose all or part of your investment in our Company.

Based on the projected cash flows and the cash balances as of the date of this prospectus, our management is of the opinion that without further fund raising we will not have sufficient resources to enable the Company to continue its operating activities, including the development and marketing of our products, for a period of at least 12 months from the date of filing of this prospectus. As a result, there is substantial doubt about our ability to continue as a going concern.

Management’s plans include the continued commercialization of our products and securing sufficient financing through the sale of additional equity securities, debt or capital inflows from strategic partnerships. There can be no assurances, however, that we will be successful in obtaining the level of financing needed for our operations. If we are unsuccessful in commercializing our products and securing sufficient financing, we may need cease operations.

We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline.

In order to meet our business objectives, we will need to raise additional capital, which may not be available on reasonable terms or at all. Additional capital would be used to accomplish the following:

| ● | finance our current operating expenses; | |

| ● | pursue growth opportunities; | |

| ● | hire and retain qualified management and key employees; | |

| ● | respond to competitive pressures; | |

| ● | comply with regulatory requirements; and | |

| ● | maintain compliance with applicable laws. |

| 12 |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in substantial dilution for our current stockholders. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We may issue additional shares of our common stock or securities convertible into or exchangeable or exercisable for our common stock in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline and existing stockholders may not agree with our financing plans or the terms of such financings.

In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Furthermore, any additional debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans and/or be forced to sell assets, perhaps on unfavorable terms, which would have a material adverse effect on our business, financial condition and results of operations.

The success of our business is highly dependent on being able to predict which applications and technologies will be successful, and on the market acceptance and timely release of those applications and technologies. If we do not accurately predict which applications and technologies will be successful, our financial performance will be materially adversely affected.