Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HERSHEY CO | d465455dex991.htm |

| EX-2.1 - EX-2.1 - HERSHEY CO | d465455dex21.htm |

| 8-K - 8-K - HERSHEY CO | d465455d8k.htm |

Acquisition of Amplify Snack Brands, Inc. December 18, 2017 1 Exhibit 99.2

FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements. Many of these forward-looking statements can be identified by the use of words such as “intend,” “believe,” “expect,” “anticipate,” “should,” “planned,” “projected,” “estimated,” and “potential,” among others. These statements are made based upon current expectations that are subject to risk and uncertainty. Because actual results may differ materially from those contained in the forward-looking statements, you should not place undue reliance on the forward-looking statements when deciding whether to buy, sell or hold the company's securities. Factors that could cause results to differ materially include, but are not limited to: the ability to timely satisfy the conditions to the closing of the tender offer; the ability to realize the benefits of the transaction; issues or concerns related to the quality and safety of our products, ingredients or packaging; changes in raw material and other costs, along with the availability of adequate supplies of raw materials; selling price increases, including volume declines associated with pricing elasticity; market demand for our new and existing products; increased marketplace competition; disruption to our manufacturing operations or supply chain; failure to successfully execute and integrate acquisitions, divestitures and joint ventures; changes in governmental laws and regulations, including taxes; political, economic, and/or financial market conditions; risks and uncertainties related to our international operations; disruptions, failures or security breaches of our information technology infrastructure; our ability to hire, engage and retain a talented global workforce; our ability to realize expected cost savings and operating efficiencies associated with strategic initiatives or restructuring programs; complications with the design or implementation of our new enterprise resource planning system; and such other matters as discussed in our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the quarter ended October 1, 2017. All information in this presentation is as of December 18, 2017. The company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the company's expectations. 2

Important information In connection with the proposed acquisition, Hershey will commence a tender offer for the outstanding shares of common stock of Amplify Snack Brands. The tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Amplify Snack Brands, nor is it a substitute for the tender offer materials that Hershey will file with the SEC upon commencement of the tender offer. At the time the tender offer is commenced, Hershey will file tender offer materials on Schedule TO with the SEC, and Amplify Snack Brands will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY AMPLIFY SNACK BRANDS’ STOCKHOLDERS BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Amplify Snack Brands’ stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Amplify Snack Brands by contacting Amplify Snack Brands by phone at (646) 277-1228. In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website: www.sec.gov, upon filing with the SEC. AMPLIFY SNACK BRANDS’ STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO AND THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO. 3

MICHELE BUCK PRESIDENT AND CHIEF EXECUTIVE OFFICER 4

Amplify joining the Hershey family Financial Highlights Net Sales1: $371.7 million Organic sales growth: +9.4% and +8.6%, year-over-year, for the quarter and year-to-date period ended 9/30/17, respectively #2 share leader in the ready-to-eat popcorn category Adjusted EBITDA Margin1: 23.4%2 5 112 Months ended 9/30/17 2 See Press Release, dated November 7, 2017, issued by Amplify Snack Brands, Inc. for a reconciliation of GAAP Net Income to Adjusted EBITDA

Expanding breadth across the snacking spectrum CREATING A SNACKING POWERHOUSE THROUGH INNOVATION AND M&A Chocolate / Candy Snackfection Salty snacks SkinnyPop will become Hershey’s 6th largest brand 6

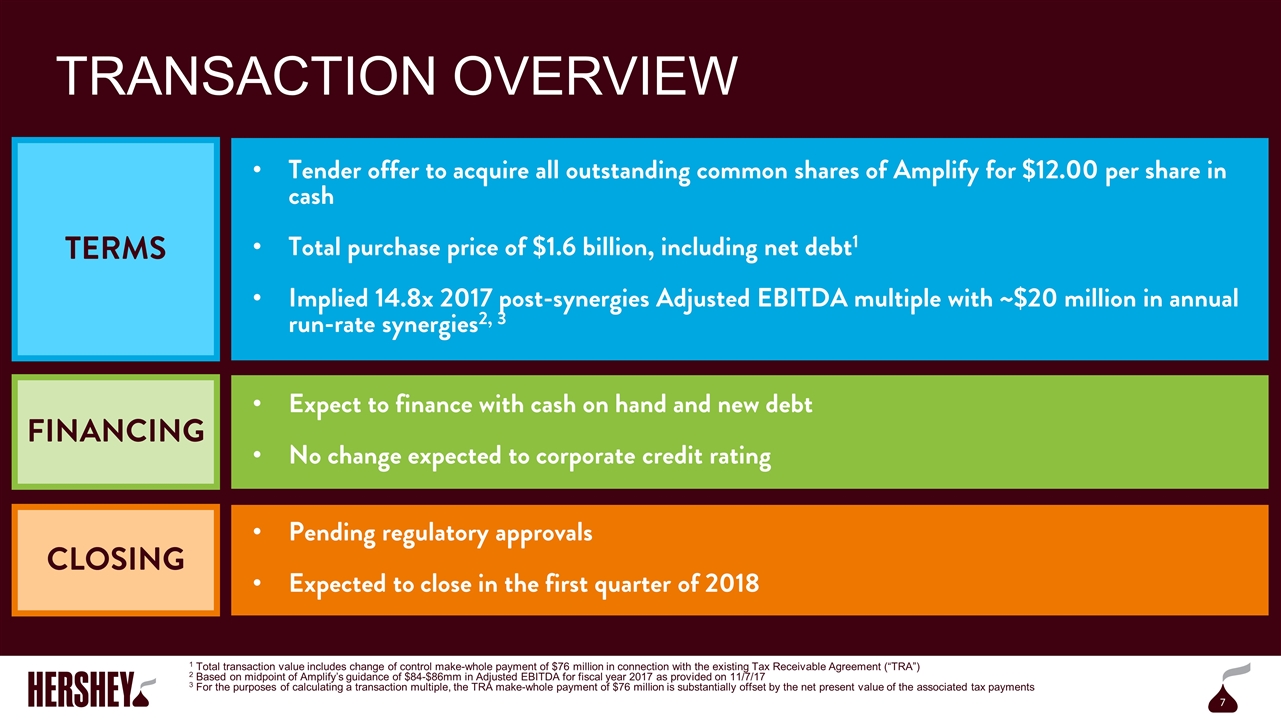

Transaction overview Tender offer to acquire all outstanding common shares of Amplify for $12.00 per share in cash Total purchase price of $1.6 billion, including net debt1 Implied 14.8x 2017 post-synergies Adjusted EBITDA multiple with ~$20 million in annual run-rate synergies2, 3 Expect to finance with cash on hand and new debt No change expected to corporate credit rating Pending regulatory approvals Expected to close in the first quarter of 2018 1 Total transaction value includes change of control make-whole payment of $76 million in connection with the existing Tax Receivable Agreement (“TRA”) 2 Based on midpoint of Amplify’s guidance of $84-$86mm in Adjusted EBITDA for fiscal year 2017 as provided on 11/7/17 3 For the purposes of calculating a transaction multiple, the TRA make-whole payment of $76 million is substantially offset by the net present value of the associated tax payments TERMS FINANCING CLOSING 7

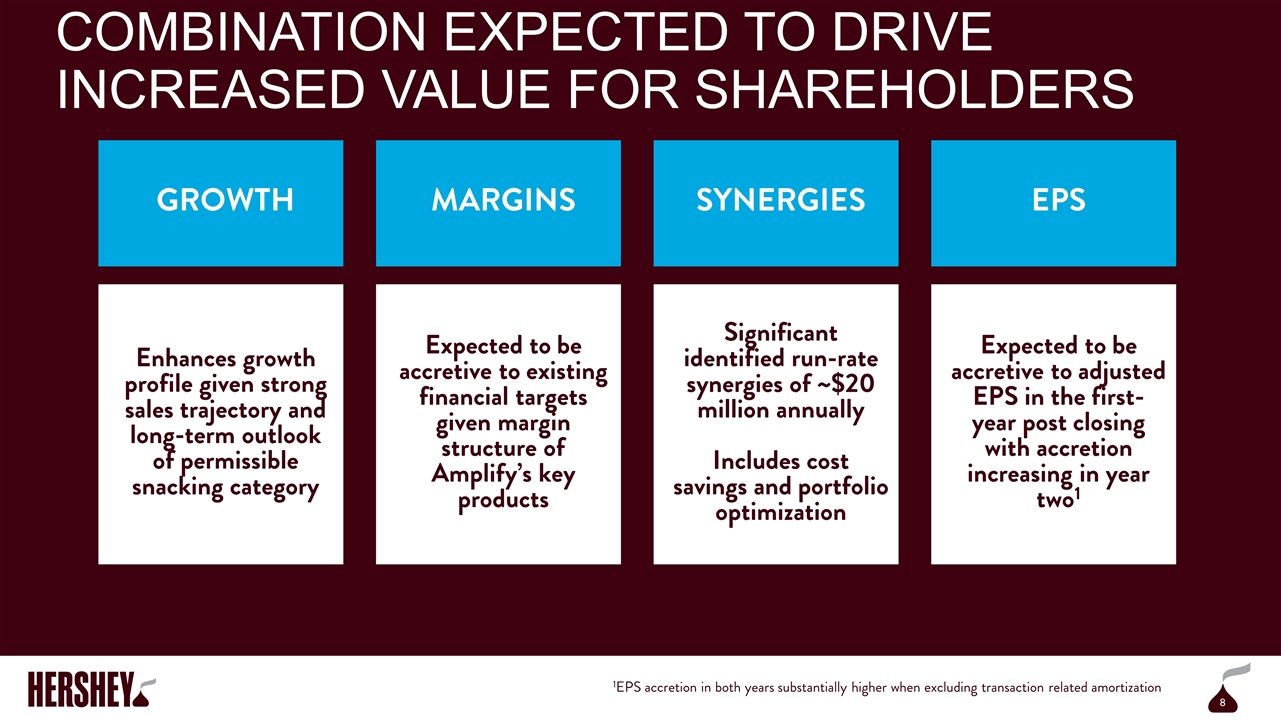

Combination expected to drive Increased value for shareholders Significant identified run-rate synergies of ~$20 million annually Includes cost savings and portfolio optimization Expected to be accretive to adjusted EPS in the first-year post closing with accretion increasing in year two1 GROWTH MARGINS SYNERGIES EPS Enhances growth profile given strong sales trajectory and long-term outlook of permissible snacking category Expected to be accretive to existing financial targets given margin structure of Amplify’s key products 8 1EPS accretion in both years substantially higher when excluding transaction related amortization

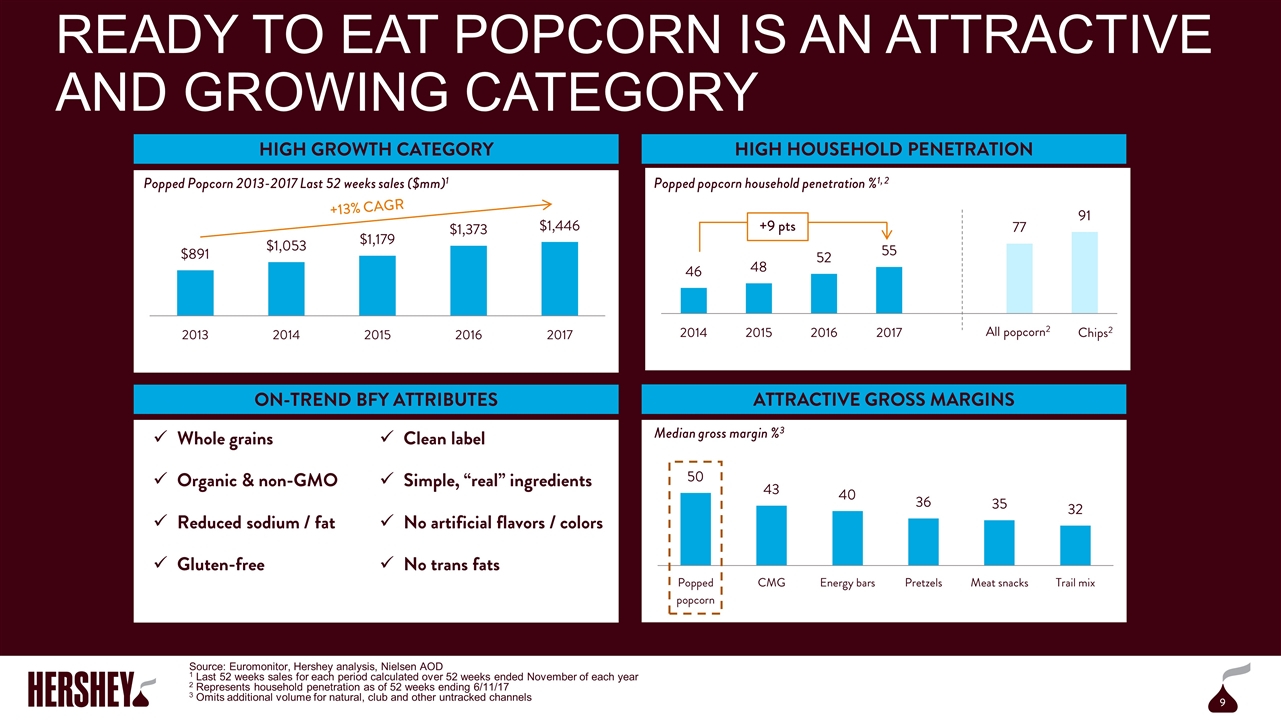

Ready to eat popcorn is an attractive and growing category HIGH GROWTH CATEGORY HIGH HOUSEHOLD PENETRATION ON-TREND BFY ATTRIBUTES ATTRACTIVE GROSS MARGINS +13% CAGR Popped Popcorn 2013-2017 Last 52 weeks sales ($mm)1 Popped popcorn household penetration %1, 2 +9 pts Whole grains Organic & non-GMO Reduced sodium / fat Gluten-free Clean label Simple, “real” ingredients No artificial flavors / colors No trans fats Median gross margin %3 9 All popcorn2 Chips2 Source: Euromonitor, Hershey analysis, Nielsen AOD 1 Last 52 weeks sales for each period calculated over 52 weeks ended November of each year 2 Represents household penetration as of 52 weeks ending 6/11/17 3 Omits additional volume for natural, club and other untracked channels

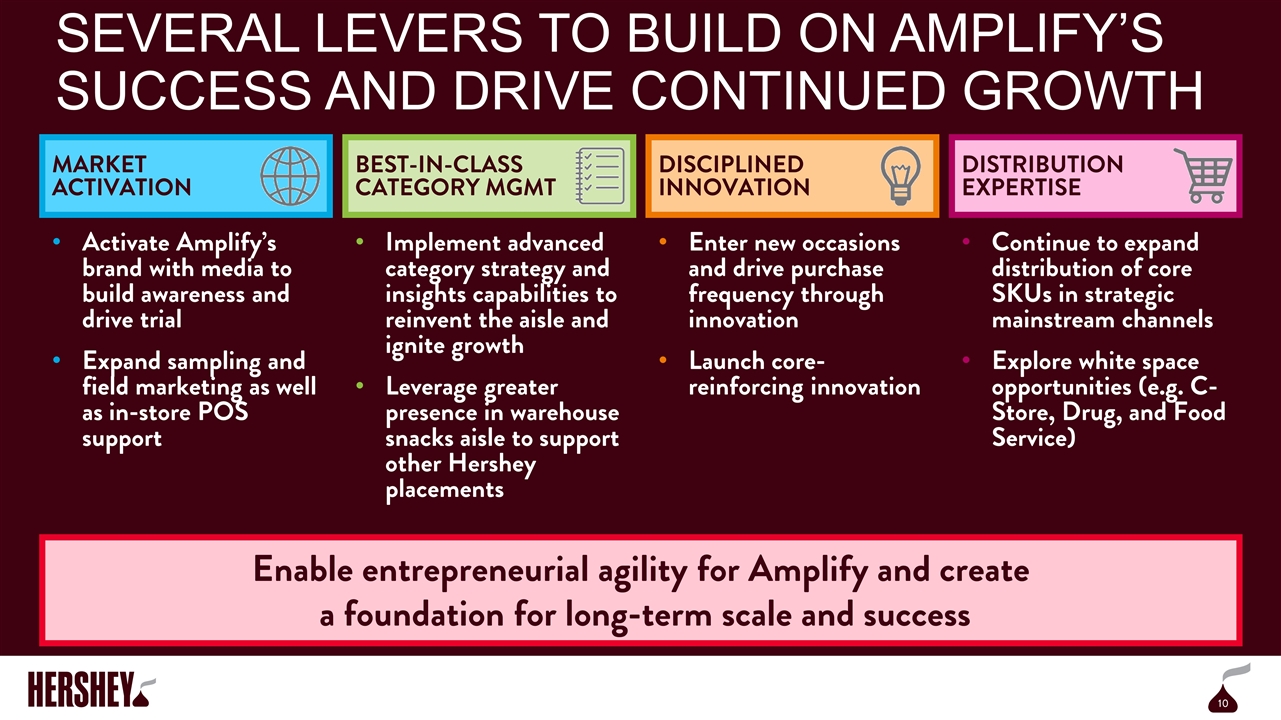

Several levers to build on Amplify’s success and drive continued growth Enable entrepreneurial agility for Amplify and create a foundation for long-term scale and success MARKET ACTIVATION BEST-IN-CLASS CATEGORY MGMT DISCIPLINED INNOVATION DISTRIBUTION EXPERTISE Activate Amplify’s brand with media to build awareness and drive trial Expand sampling and field marketing as well as in-store POS support Implement advanced category strategy and insights capabilities to reinvent the aisle and ignite growth Leverage greater presence in warehouse snacks aisle to support other Hershey placements Enter new occasions and drive purchase frequency through innovation Launch core-reinforcing innovation Continue to expand distribution of core SKUs in strategic mainstream channels Explore white space opportunities (e.g. C-Store, Drug, and Food Service) 10

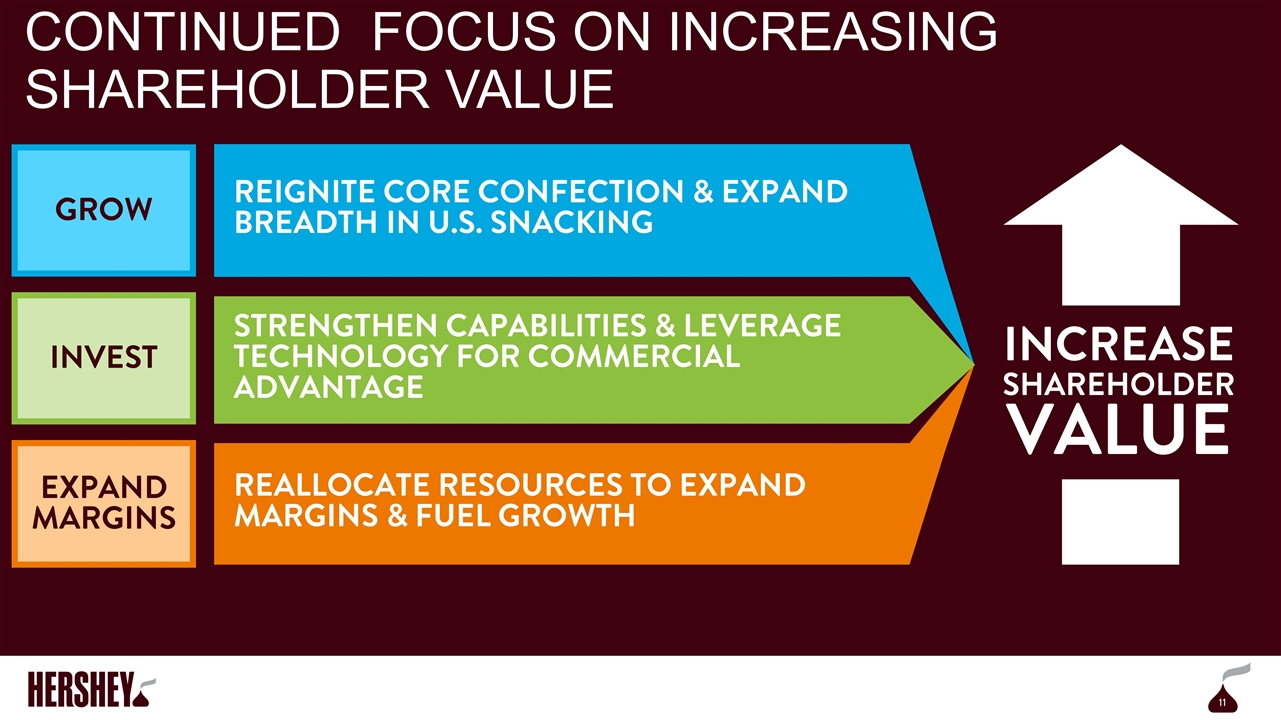

REIGNITE CORE CONFECTION & EXPAND BREADTH IN U.S. SNACKING STRENGTHEN CAPABILITIES & LEVERAGE TECHNOLOGY FOR COMMERCIAL ADVANTAGE REALLOCATE RESOURCES TO EXPAND MARGINS & FUEL GROWTH Continued focus on Increasing shareholder value INCREASE SHAREHOLDER VALUE GROW INVEST EXPAND MARGINS 11