Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Colfax CORP | a8-k2018guidance.htm |

December 18, 2017

2018 Outlook

2

Forward-looking Statements

These slides and accompanying oral presentation contain forward-looking statements, including forward-looking

statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning Colfax’s plans, objectives, expectations and intentions

and other statements that are not historical or current fact. Forward-looking statements are based on Colfax’s current

expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed

or implied in such forward-looking statements. Factors that could cause Colfax’s results to differ materially from current

expectations include, but are not limited to factors detailed in Colfax’s reports filed with the U.S. Securities and

Exchange Commission including its 2016 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the

period ended September 29, 2017 under the caption “Risk Factors.” In addition, these statements are based on a

number of assumptions that are subject to change. Colfax disclaims any duty to update the information herein.

The term "Colfax" in reference to the activities described in these slides may mean one or more of Colfax's global

operating subsidiaries and/or their internal business divisions and does not necessarily indicate activities engaged in by

Colfax Corporation.

3

Executing Our Strategy in 2017

Completed Fluid Handling sale

Committed $430M on 7 complementary bolt-ons

Returned to organic growth

Accelerating new product innovation

Achieving target of $50 million restructuring cost savings

Affirming 2017 guidance with continuing operations representing

$1.37 to $1.47 of Adjusted EPS

Reshaping the portfolio and building momentum

4

Improving and Growing in 2018

Accelerating growth initiatives at ESAB

− Improving regional market conditions

− Increasing pace of new products

− Leveraging recent acquisitions

Making the turn at Howden

− Focusing on industrial and mining growth

− Positioning for Oil & Gas recovery in second half

− Restructuring to drive margin expansion

Shaping the portfolio with attractive acquisitions

− Accretive, strategic bolt-ons

− New growth platform

Driving >20% improvement in Adj. EPS

5

2018 Outlook and Reporting Changes

Business improvement and acquisitions create significant earnings

growth

Adding back intangibles amortization and other non-cash acquisition-

related charges in 2018

ADJUSTED EARNINGS PER SHARE

FH Sale

$1.65 –

$1.80

$2.00 –

$2.15

2018

Cont. Ops.

Improvement

& Growth

$1.65 –

$1.75

2017

Guidance

2018

Guidance

2017

Cont. Ops.

$1.37 –

$1.47

Add-back

amortization and

other non-cash

acquisition related

charges

+20%

6

2018 Expectations

0% to 2% organic revenue growth

Sales quarterly seasonality: 22-23%, 25-26%, 24-25%, 26-27%

Continuing restructuring actions to achieve $25-$30M in savings

Partially offset by $10-$20M of inflation and growth investments,

net of productivity

Approximately $28-$32M of interest expense1

1 Interest estimate does not include acquisitions not yet closed

7

Market Orders Outlook

Current Environment

• Remains sluggish as customers

minimize expenses

• Lower power utilization rates in

the US and China

• Almost all regions back to growth

for welding

• Environmental spend continues

in China

• Slow recent project progression

• Number of projects stable to

increasing but long gestation

• Policy changes in China slows

new build

• Steady pace in SEA

• New regulations in India

Aftermarket

General

Industrial

Oil & Gas

Power

Source: Internal company management estimates.

Order Indicators

• Increasing oil prices

• Maintenance deferments

already in comps

• Installed base growth

• Stable to up global PMI

• GDP forecast uptick in ’18

• Internal growth initiatives

continue

• Stable to increasing oil

prices

• Refinery utilization

• Refined products demand

• Projects reduced in China

• Utilization remains low in

the US and China

Improving outlook with expected second half uptick in A&G Handling

(2H)

8

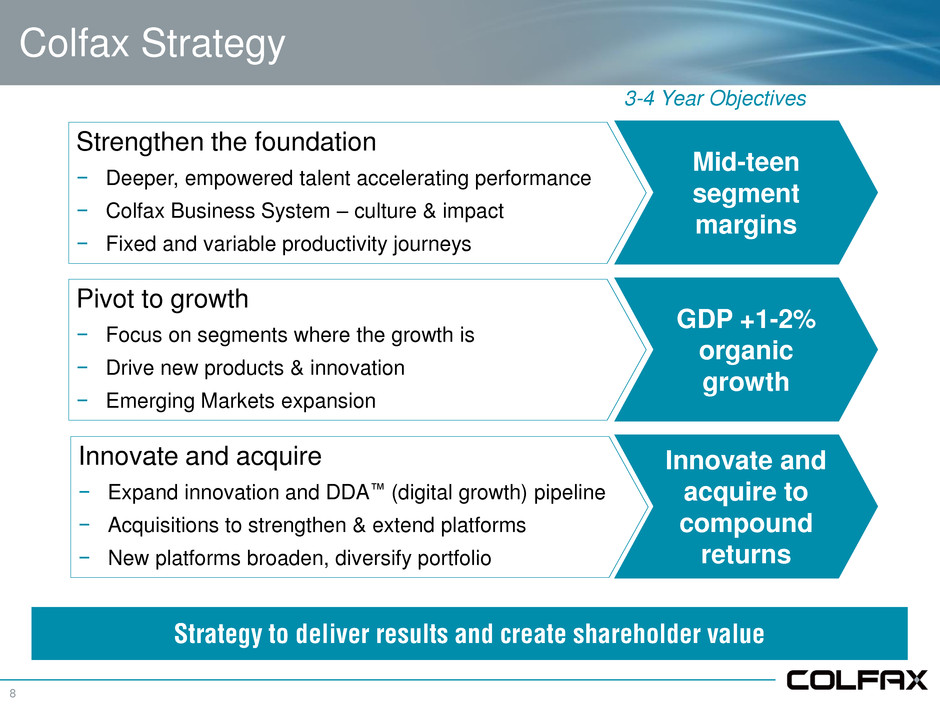

Colfax Strategy

Mid-teen

segment

margins

GDP +1-2%

organic

growth

Innovate and

acquire to

compound

returns

Strengthen the foundation

− Deeper, empowered talent accelerating performance

− Colfax Business System – culture & impact

− Fixed and variable productivity journeys

Pivot to growth

− Focus on segments where the growth is

− Drive new products & innovation

− Emerging Markets expansion

Innovate and acquire

− Expand innovation and DDA™ (digital growth) pipeline

− Acquisitions to strengthen & extend platforms

− New platforms broaden, diversify portfolio

3-4 Year Objectives

Strategy to deliver results and create shareholder value

9

APPENDIX

10

Non-GAAP Financial Measures

Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP

financial measures are adjusted net income, adjusted net income per share, and projected adjusted net income per

share. These non-GAAP financial measures assist Colfax management in comparing its operating performance over

time because certain items may obscure underlying business trends and make comparisons of long-term performance

difficult. Colfax management believes presenting these measures may be useful to investors as it allows investors to

view its performance over time using additional measures the Company uses in evaluating its financial and business

trends. Non-GAAP measures should be read in conjunction with the GAAP financial measures, and not as a

replacement for the comparable GAAP measure. Each of the non-GAAP measures noted above, may not be

comparable to a similarly titled measure reported by other companies. Certain items have been excluded from the

non-GAAP measures presented herein, to the extent they affect the periods presented, because:

• They are of a nature and/or size that occur with inconsistent frequency;

• Relate to discrete restructuring plans that are fundamentally different from the ongoing productivity improvements of

the Company; or

• Relate to intangibles amortization and other non-cash acquisition related charges where the amount and timing of

such charges are significantly impacted by the specific type of acquisitions we consummate. While we have a

history of acquisition activity, these acquisitions do not occur over a uniform period of time, and the amount of an

acquisition’s purchase value assigned to intangible assets and related amortization term can vary based on the

acquisition target, which would affect the timing and size of the amortization charges. Accordingly, commencing with

this presentation, we will exclude these amounts to enhance our ability to make more consistent comparisons of

operating results over time and amongst peer companies.

11

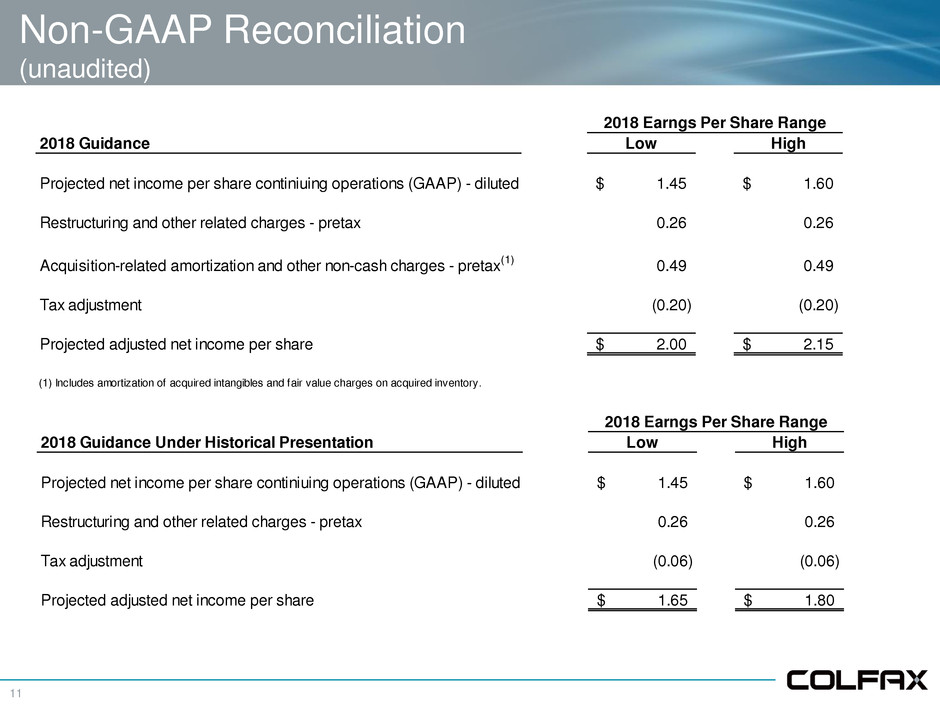

Non-GAAP Reconciliation

(unaudited)

2018 Guidance Low High

Projected net income per share continiuing operations (GAAP) - diluted 1.45$ 1.60$

Restructuring and other related charges - pretax 0.26 0.26

Acquisition-related amortization and other non-cash charges - pretax

(1)

0.49 0.49

Tax adjustment (0.20) (0.20)

Projected adjusted net income per share 2.00$ 2.15$

(1) Includes amortization of acquired intangibles and fair value charges on acquired inventory.

2018 Earngs Per Share Range

2018 Guidance Under Historical Presentation Low High

Projected net income per share continiuing operations (GAAP) - diluted 1.45$ 1.60$

Restructuring nd other related ch rges - pret x 0.26 0.26

Tax adjustment (0.06) (0.06)

Projected adjusted net income per share 1.65$ 1.80$

2018 Earngs Per Share Range

12

Non-GAAP Reconciliation

(unaudited)

Colfax Corporation Low High

Projected net income per share (GAAP) - diluted 1.34$ 1.44$

Restructuring and other related charges - pretax 0.30 0.30

Divestiture-related expense, net - pretax 0.13 0.13

Tax adjustment (0.12) (0.12)

Projected adjusted net income per share 1.65$ 1.75$

2017 Earngs Per Share Range

Contin ing Operations Low High

r j t net income per share (GAAP) - diluted .12 .22

Restructuring and other related charges - pretax 0.34 0.34

Tax adjustment (0.09) (0.09)

Projected adjusted net income per share 1.37$ 1.47$

2017 Earngs Per Share Range

13

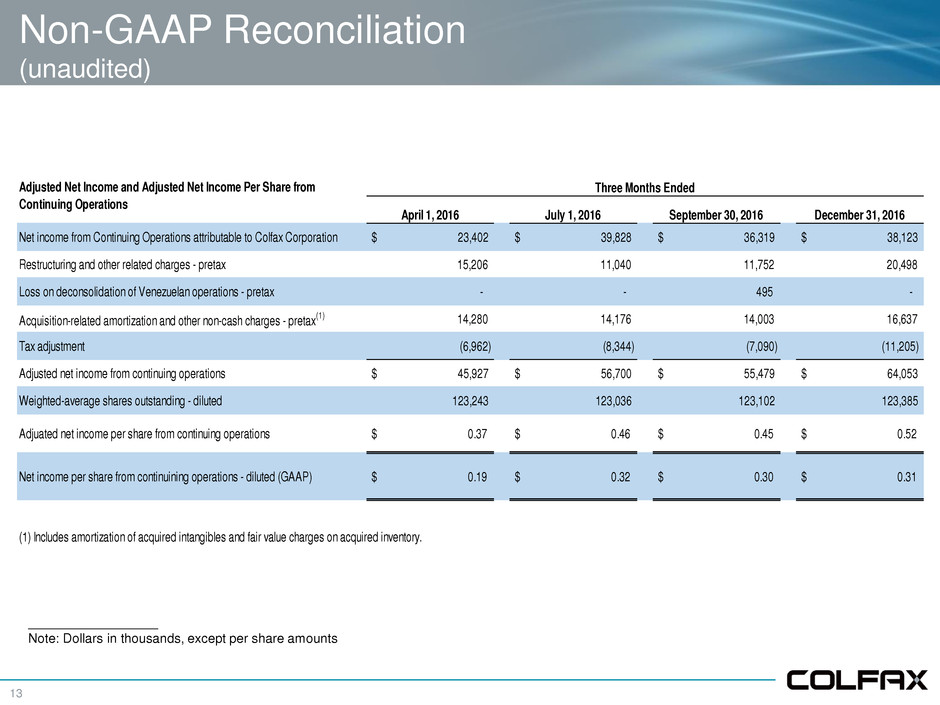

Non-GAAP Reconciliation

(unaudited)

April 1, 2016 July 1, 2016 September 30, 2016 December 31, 2016

Net income from Continuing Operations attributable to Colfax Corporation $ 23,402 $ 39,828 $ 36,319 $ 38,123

Restructuring and other related charges - pretax 15,206 11,040 11,752 20,498

Loss on deconsolidation of Venezuelan operations - pretax - - 495 -

Acquisition-related amortization and other non-cash charges - pretax

(1) 14,280 14,176 14,003 16,637

Tax adjustment (6,962) (8,344) (7,090) (11,205)

Adjusted net income from continuing operations $ 45,927 $ 56,700 $ 55,479 $ 64,053

Weighted-average shares outstanding - diluted 123,243 123,036 123,102 123,385

Adjuated net income per share from continuing operations $ 0.37 $ 0.46 $ 0.45 $ 0.52

Net income per share from continuining operations - diluted (GAAP) $ 0.19 $ 0.32 $ 0.30 $ 0.31

(1) Includes amortization of acquired intangibles and fair value charges on acquired inventory.

Three Months EndedAdjusted Net Income and Adjusted Net Income Per Share from

Continuing Operations

__________________

Note: Dollars in thousands, except per share amounts

14

Non-GAAP Reconciliation

(unaudited)

__________________

Note: Dollars in thousands, except per share amounts

March 31, 2017 June 30, 2017 September 29, 2017

Net income from Continuing Operations attributable to Colfax Corporation $ 35,446 $ 36,783 43,781$

Restructuring and other related charges - pretax 4,773 11,060 7,298

Acquisition-related amortization and other non-cash charges - pretax

(1) 13,394 13,684 14,286

Tax adjustment (5,397) (5,824) (8,788)

Adjusted net income from continuing operations $ 48,215 $ 55,703 56,577$

Weighted-average shares outstanding - diluted 123,795 123,954 124,081

Adjuated net income per share from continuing operations $ 0.39 $ 0.45 0.46$

Net income per share from continuining operations - diluted (GAAP) $ 0.29 $ 0.30 0.35$

(1) Includes amortization of acquired intangibles and fair value charges on acquired inventory.

Three Months EndedAdjusted Net Income and Adjusted Net Income Per Share from

Continuing Operations