Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - CAMPBELL SOUP CO | ex99-3.htm |

| EX-99.2 - EXHIBIT 99.2 - CAMPBELL SOUP CO | ex99-2.htm |

| EX-2.2 - EXHIBIT 2.2 - CAMPBELL SOUP CO | ex2-2.htm |

| EX-2.1 - EXHIBIT 2.1 - CAMPBELL SOUP CO | ex2-1.htm |

| 8-K - CAMPBELL SOUP CO FORM 8-K - CAMPBELL SOUP CO | campbells8k.htm |

Exhibit 99.1

December 18, 2017 Campbell to Acquire Snyder’s-Lance

Forward-Looking Statements The factors that could cause actual results to vary materially from those anticipated or expressed in any forward-looking statement include: changes in consumer demand for our products and favorable perception of our brands; the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies; the impact of strong competitive responses to our efforts to leverage brand power with product innovation, promotional programs and new advertising; changing inventory management practices by certain of our key customers; a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of our key customers continue to increase their significance to our business; our ability to realize projected cost savings and benefits from efficiency and/or restructuring initiatives; our ability to manage changes to our organizational structure and/or business processes; product quality and safety issues, including recalls and product liabilities; the ability to complete and to realize the projected benefits of acquisitions, divestitures and other business portfolio changes; the conditions to the completion of the Snyder’s-Lance transaction, including obtaining Snyder’s-Lance shareholder approval, may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected, on the anticipated schedule, or at all; long-term financing for the Snyder’s-Lance transaction may not be available on favorable terms, or at all; closing of the Snyder’s-Lance transaction may not occur or may be delayed, either as a result of litigation related to the transaction or otherwise; we may be unable to achieve the anticipated benefits of the Snyder’s-Lance transaction; completing the Snyder’s-Lance merger may distract our management from other important matters; disruptions to our supply chain, including fluctuations in the supply of and inflation in energy and raw and packaging materials cost; the uncertainties of litigation and regulatory actions against us; the possible disruption to the independent contractor distribution models used by certain of our businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification; the impact of non-U.S. operations, including trade restrictions, public corruption and compliance with foreign laws and regulations; impairment to goodwill or other intangible assets; our ability to protect our intellectual property rights; increased liabilities and costs related to our defined benefit pension plans; a material failure in or a breach of our information technology systems; our ability to attract and retain key talent; changes in currency exchange rates, tax rates, interest rates, debt and equity markets, inflation rates, economic conditions, law, regulation and other external factors; unforeseen business disruptions in one or more of our markets due to political instability, civil disobedience, terrorism, armed hostilities, extreme weather conditions, natural disasters or other calamities; and other factors described in our most recent Form 10-K and subsequent Securities and Exchange Commission filings. We disclaim any obligation or intent to update these statements to reflect new information or future events.

Today’s Presenters 3 Campbell to Acquire Snyder’s-Lance Anthony DiSilvestroSenior Vice President & CFOCampbell Soup Company Denise MorrisonPresident & CEOCampbell Soup Company Brian DriscollPresident & CEOSnyder’s-Lance

Campbell to Acquire Snyder’s-Lance Combination of Campbell and Snyder’s-Lance creates a snacking leader

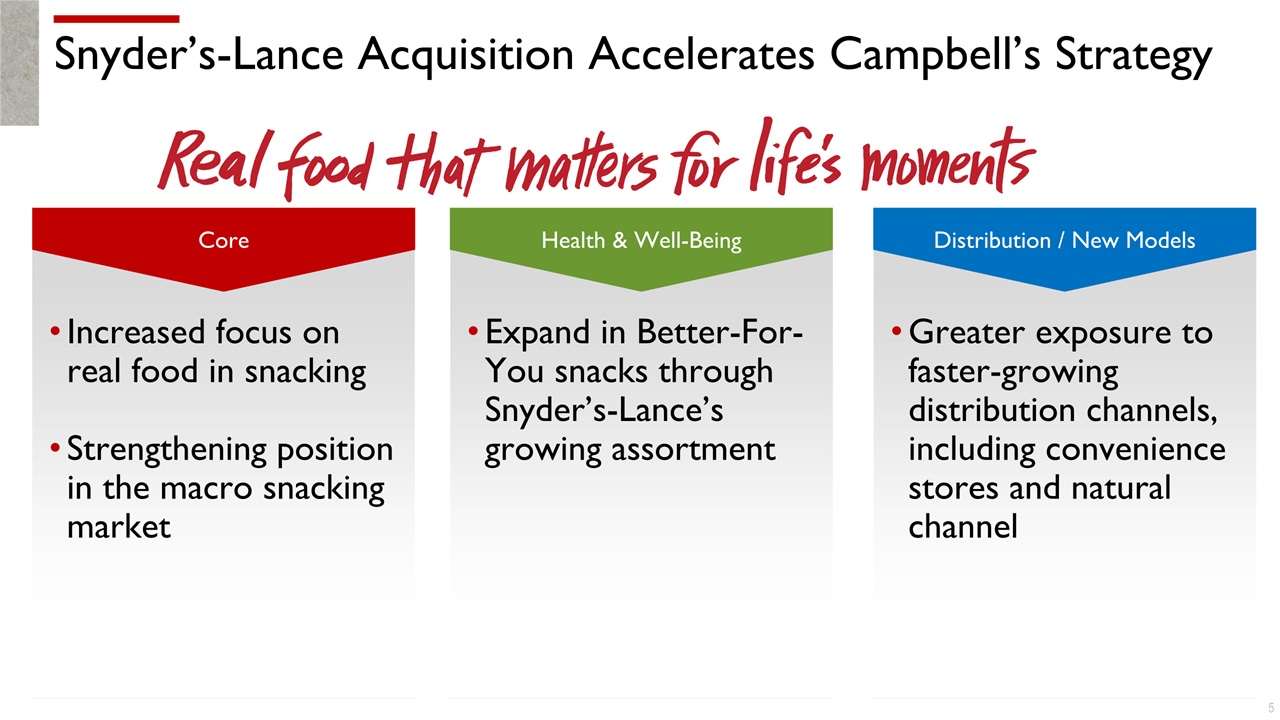

Snyder’s-Lance Acquisition Accelerates Campbell’s Strategy Increased focus on real food in snackingStrengthening position in the macro snacking market Core Expand in Better-For-You snacks through Snyder’s-Lance’s growing assortment Health & Well-Being Greater exposure to faster-growing distribution channels, including convenience stores and natural channel Distribution / New Models

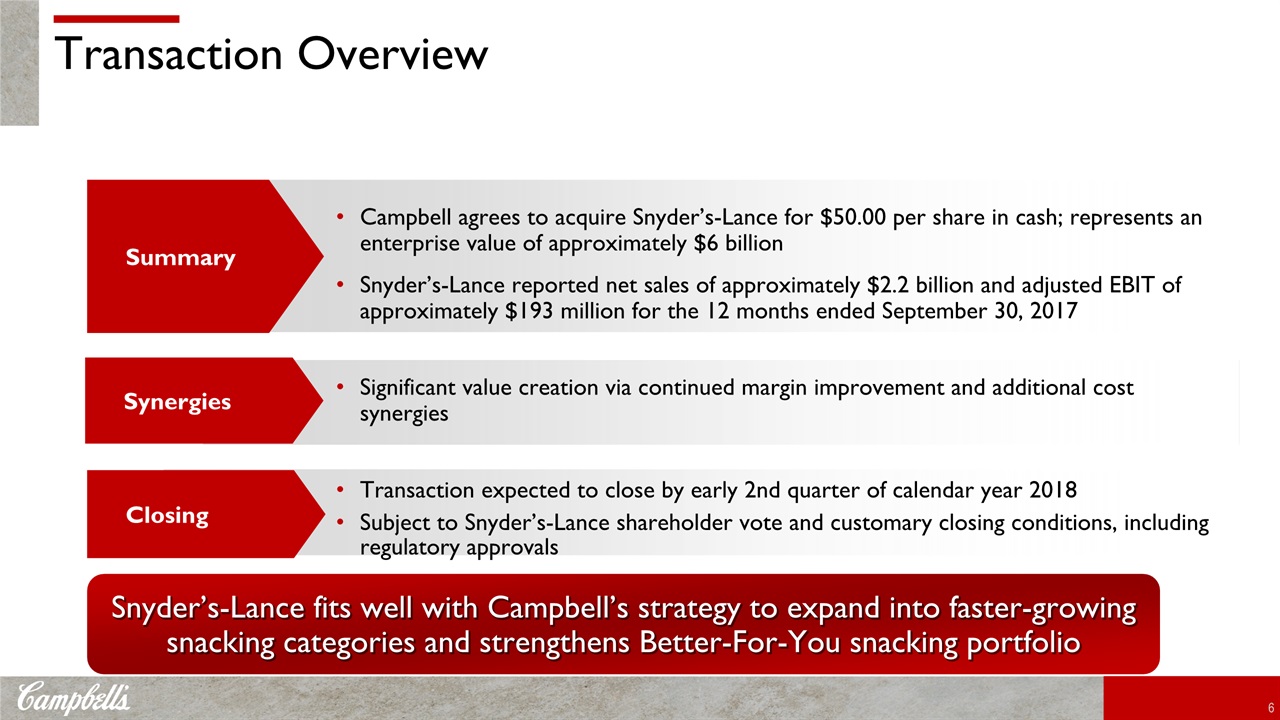

Transaction Overview Snyder’s-Lance fits well with Campbell’s strategy to expand into faster-growing snacking categories and strengthens Better-For-You snacking portfolio Summary Campbell agrees to acquire Snyder’s-Lance for $50.00 per share in cash; represents an enterprise value of approximately $6 billionSnyder’s-Lance reported net sales of approximately $2.2 billion and adjusted EBIT of approximately $193 million for the 12 months ended September 30, 2017 Synergies Significant value creation via continued margin improvement and additional cost synergies Closing Transaction expected to close by early 2nd quarter of calendar year 2018Subject to Snyder’s-Lance shareholder vote and customary closing conditions, including regulatory approvals

The Acquisition Shifts Campbell’s Portfolio Toward Faster- Growing Snacking Category FY2011 Reported Pro Forma1 FY2017 Pro Forma1,2 FY2017 Total FY2011 net sales:$7.1bn Pro Forma FY2017 net sales:$8.1bn Pro Forma net sales:$10.3bn 1 Pro Forma FY2017 data based on FY2017 CPB net sales including fiscal year estimate of Pacific Foods 2 Snyder’s-Lance net sales for the trailing 12 months ended July 1, 2017 The Snyder’s-Lance acquisition demonstrates our focus on expanding into faster-growing spaces

Transaction Has Highly Compelling Strategic Rationale 1 Strengthens CPB core and expands our macro snacking business, particularly in Better-For-You snacks 2 Complementary to existing Pepperidge Farm business 3 Results in a more diversified and balanced portfolio with leading differentiated brands 4 Advances access to faster-growing distribution channels 5 Significant value creation through synergies and operational excellence +

CY13 – CY16 CAGR Snacking is a Faster-Growing Consumer Space Source: Euromonitor.(1) Hartman Group, 2014(2) Nielsen Scan Track Data, 2014 Source: IRI, MULO, 3yr CAGR CY13 to CY16 IRI Market Structure 2016 and Total US MULO Categories(US retail dollar sales(3)) 90% of consumers snack multiple times a day(1) >50% of all U.S.eating occasionsare snacks(1) Nearly Halfof U.S. consumersreplace mealswith snacks(2) The U.S. Snack Market is $89 billion and growing faster than other grocery categories (4)

Snyder’s-Lance’s Branded Portfolio Category Source: IRI MULO L52W through September 3, 2017. Based on IRI’s Snyder’s-Lance custom definitions. Pretzels Sandwich Crackers Kettle Chips Deli Organic/Natural Tortilla Chips Microwave Popcorn Snack Nuts Brand Market Size $1.2bn$1.1bn$1.0bn$0.6bn$0.2bn$0.8bn$4.6bn Market Position #1#1#1#1#2#2#4

A Diversified Macro Snacking Platform Fresh Convenient Mini Meals Sweet Savory

12 Campbell to Acquire Snyder’s-Lance Brian DriscollPresident & CEOSnyder’s-Lance

13 Campbell to Acquire Snyder’s-Lance Anthony DiSilvestroSenior Vice President & CFOCampbell Soup Company

Compelling Transaction with Significant Value Creation TransactionMetrics All cash purchase price of $50.00 per shareEnterprise value of $6.1 billionRepresents Adjusted EBITDA multiple of 19.9x pre-synergies1Represents Adjusted EBITDA multiple of 12.8x post-synergies127% premium to Snyder’s-Lance’s closing stock price on Dec. 13, 2017 ValueCreation Achieve majority of Snyder’s-Lance existing cost transformation program Additional $170 million of cost synergies by the end of FY2022Expected to be 5-7% accretive to FY2019 EPS2 and 15–20% accretive by FY2021 1 Based on Snyder’s-Lance CY2017E Adjusted EBITDA 2 Estimate, includes estimated impact of incremental depreciation and amortization

Compelling Transaction with Significant Value Creation (cont’d) Capital Structure Committed bridge financing in placeFinancing expected through $6.2 billion of new debtLeverage of 4.8x1 expected by FY2018, committed to deleveraged to 3x by FY2022Suspend share repurchases to maximize FCF for deleveragingMaintain current dividend policyExpect to maintain investment grade rating Conditions / Timing Subject to Snyder’s-Lance shareholder vote and customary closing conditions, including regulatory approvalsExpected close by early 2nd quarter of calendar year 2018 1 Assumes debt of $10.2 billion and pro-forma projected FY2018 EBITDA assuming Pacific Foods and Snyder’s-Lance were acquired as of 7/31/17, projected to 7/29/18.

Combination Will Yield Significant Cost Synergies and Potential Revenue Opportunities Distribution Unlock warehouse and depot efficiencies Manufacturing Optimize manufacturing and supply chain network Procurement Leverage volume to create value – ingredient procurementScale benefit within packaging costs Sales & marketing and administrative Optimize sales & marketing Leverage shared services Potential Revenue opportunities Distribution cross-sell opportunitiesCapabilities in sales, marketing and innovationExpand brands into a broader kids snacking platformAccelerate e-commerce capabilities $275-$325 million of expected one-time costs1 1 Includes transaction costs, integration costs and costs to achieve synergies and existing Snyder’s-Lance cost transformation program (includes ~$50-$75 million capital)

The Acquisition of Snyder’s-Lance is an Attractive Opportunity 1 Aligned with, and advances our strategy 2 Meaningfully shifts our portfolio to higher growth snacking categories 3 Significant cost synergy and potential revenue opportunity + 4 Significant value creation

Questions & Answers