Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - BOYD GAMING CORP | d510570dex992.htm |

| 8-K - FORM 8-K - BOYD GAMING CORP | d510570d8k.htm |

Boyd Gaming Acquisition of Pinnacle Entertainment Assets December 18, 2017 Exhibit 99.1

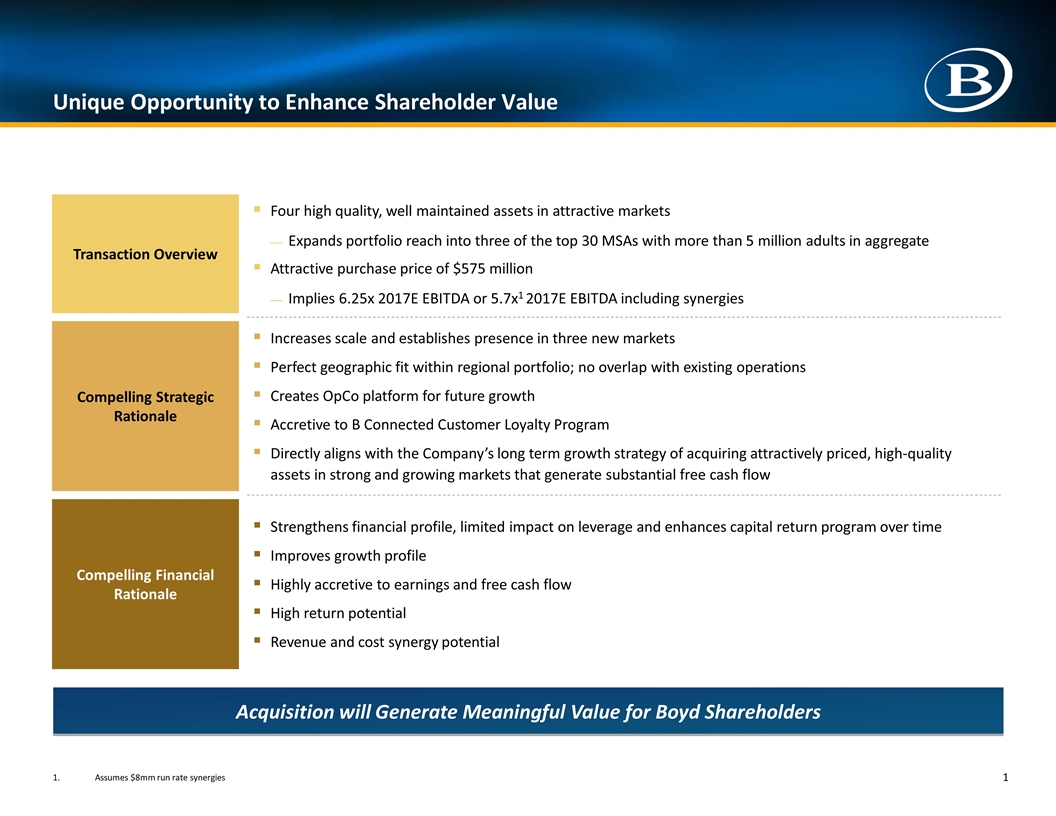

Unique Opportunity to Enhance Shareholder Value Acquisition will Generate Meaningful Value for Boyd Shareholders Transaction Overview Four high quality, well maintained assets in attractive markets Expands portfolio reach into three of the top 30 MSAs with more than 5 million adults in aggregate Attractive purchase price of $575 million Implies 6.25x 2017E EBITDA or 5.7x1 2017E EBITDA including synergies Compelling Strategic Rationale Increases scale and establishes presence in three new markets Perfect geographic fit within regional portfolio; no overlap with existing operations Creates OpCo platform for future growth Accretive to B Connected Customer Loyalty Program Directly aligns with the Company’s long term growth strategy of acquiring attractively priced, high-quality assets in strong and growing markets that generate substantial free cash flow Compelling Financial Rationale Strengthens financial profile, limited impact on leverage and enhances capital return program over time Improves growth profile Highly accretive to earnings and free cash flow High return potential Revenue and cost synergy potential 1. Assumes $8mm run rate synergies 1

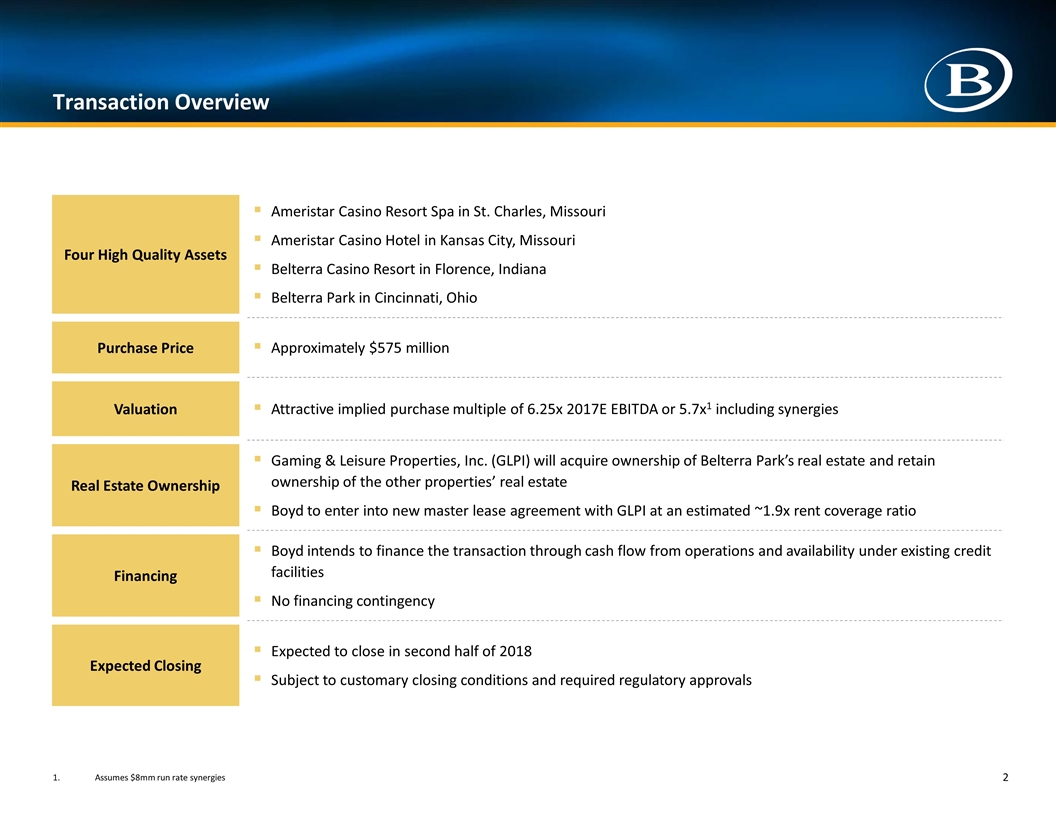

Transaction Overview Four High Quality Assets Ameristar Casino Resort Spa in St. Charles, Missouri Ameristar Casino Hotel in Kansas City, Missouri Belterra Casino Resort in Florence, Indiana Belterra Park in Cincinnati, Ohio Purchase Price Approximately $575 million Valuation Attractive implied purchase multiple of 6.25x 2017E EBITDA or 5.7x1 including synergies Real Estate Ownership Gaming & Leisure Properties, Inc. (GLPI) will acquire ownership of Belterra Park’s real estate and retain ownership of the other properties’ real estate Boyd to enter into new master lease agreement with GLPI at an estimated ~1.9x rent coverage ratio Financing Boyd intends to finance the transaction through cash flow from operations and availability under existing credit facilities No financing contingency Expected Closing Expected to close in second half of 2018 Subject to customary closing conditions and required regulatory approvals 1. Assumes $8mm run rate synergies 2

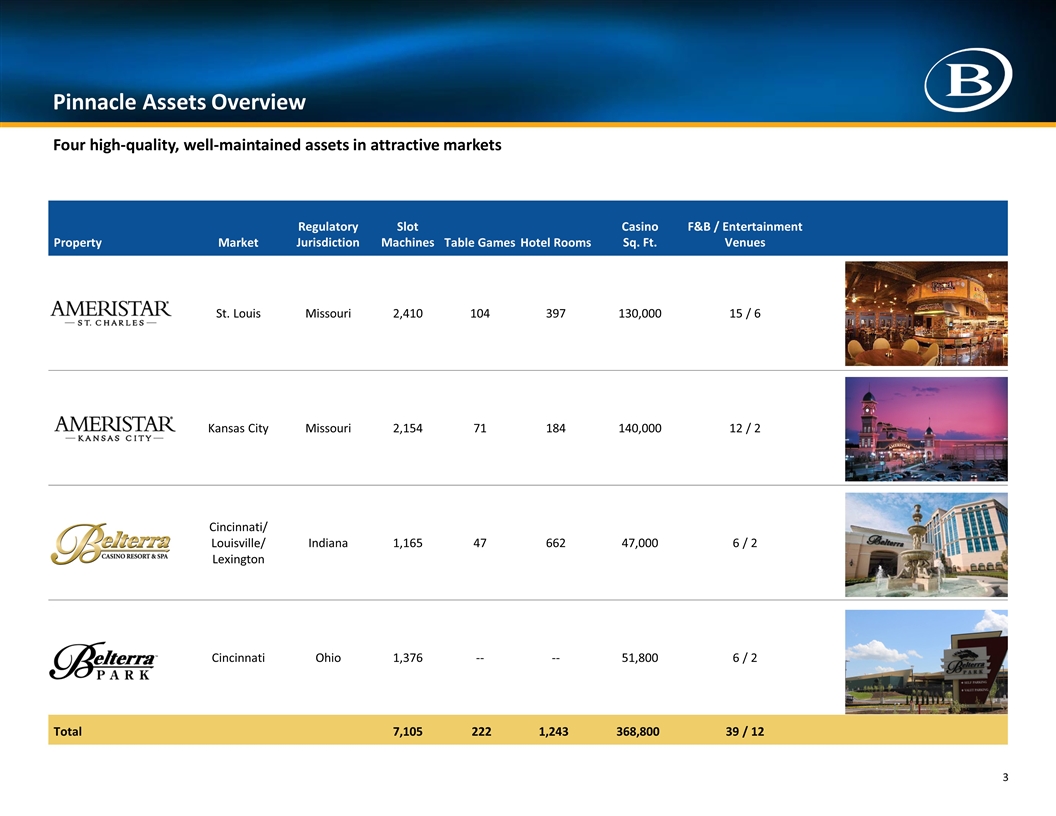

Pinnacle Assets Overview Four high-quality, well-maintained assets in attractive markets Property Market Regulatory Jurisdiction Slot Machines Table Games Hotel Rooms Casino Sq. Ft. F&B / Entertainment Venues Ameristar St. Charles St. Louis Missouri 2,410 104 397 130,000 15 / 6 Ameristar Kansas City Kansas City Missouri 2,154 71 184 140,000 12 / 2 Belterra Cincinnati/ Louisville/ Lexington Indiana 1,165 47 662 47,000 6 / 2 Belterra Park Cincinnati Ohio 1,376 -- -- 51,800 6 / 2 Total 7,105 222 1,243 368,800 39 / 12 3

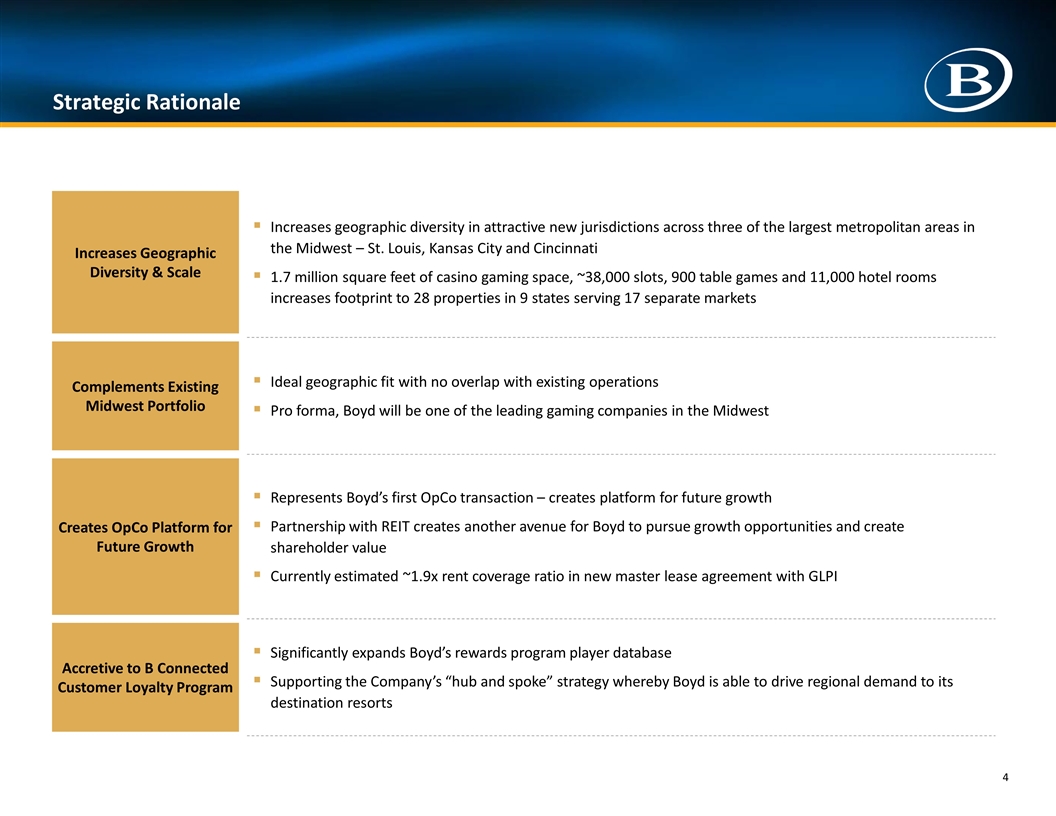

Strategic Rationale Increases Geographic Diversity & Scale Increases geographic diversity in attractive new jurisdictions across three of the largest metropolitan areas in the Midwest – St. Louis, Kansas City and Cincinnati 1.7 million square feet of casino gaming space, ~38,000 slots, 900 table games and 11,000 hotel rooms increases footprint to 28 properties in 9 states serving 17 separate markets Complements Existing Midwest Portfolio Ideal geographic fit with no overlap with existing operations Pro forma, Boyd will be one of the leading gaming companies in the Midwest Creates OpCo Platform for Future Growth Represents Boyd’s first OpCo transaction – creates platform for future growth Partnership with REIT creates another avenue for Boyd to pursue growth opportunities and create shareholder value Currently estimated ~1.9x rent coverage ratio in new master lease agreement with GLPI Accretive to B Connected Customer Loyalty Program Significantly expands Boyd’s rewards program player database Supporting the Company’s “hub and spoke” strategy whereby Boyd is able to drive regional demand to its destination resorts 4

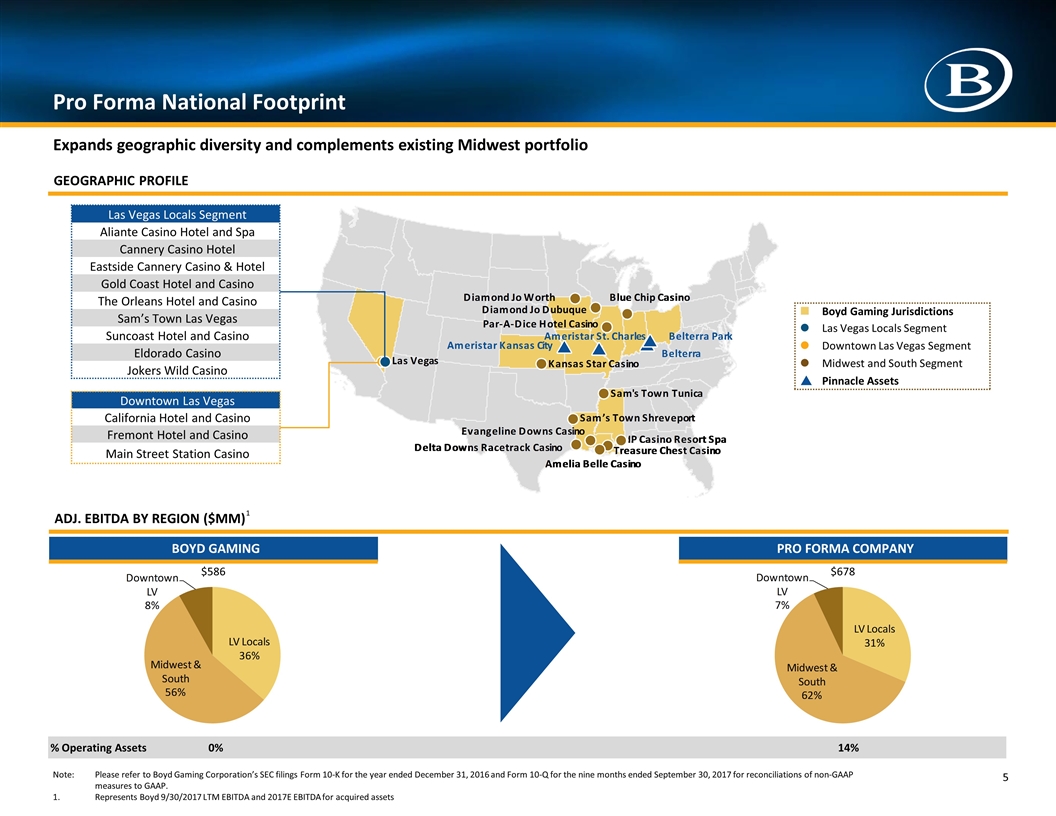

Pro Forma National Footprint Downtown Las Vegas California Hotel and Casino Fremont Hotel and Casino Main Street Station Casino Las Vegas Locals Segment Aliante Casino Hotel and Spa Cannery Casino Hotel Eastside Cannery Casino & Hotel Gold Coast Hotel and Casino The Orleans Hotel and Casino Sam’s Town Las Vegas Suncoast Hotel and Casino Eldorado Casino Jokers Wild Casino GEOGRAPHIC PROFILE ADJ. EBITDA BY REGION ($MM) BOYD GAMING PRO FORMA COMPANY $586 $678 % Operating Assets 0% 14% n Boyd Gaming Jurisdictions l Las Vegas Locals Segment l Downtown Las Vegas Segment l Midwest and South Segment p Pinnacle Assets Expands geographic diversity and complements existing Midwest portfolio Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. Represents Boyd 9/30/2017 LTM EBITDA and 2017E EBITDA for acquired assets 5 Who’s the Midwest leader? Largest regional gaming company by EBITDA Even compared to Caesars? (Need to confirm) Just leave it 1

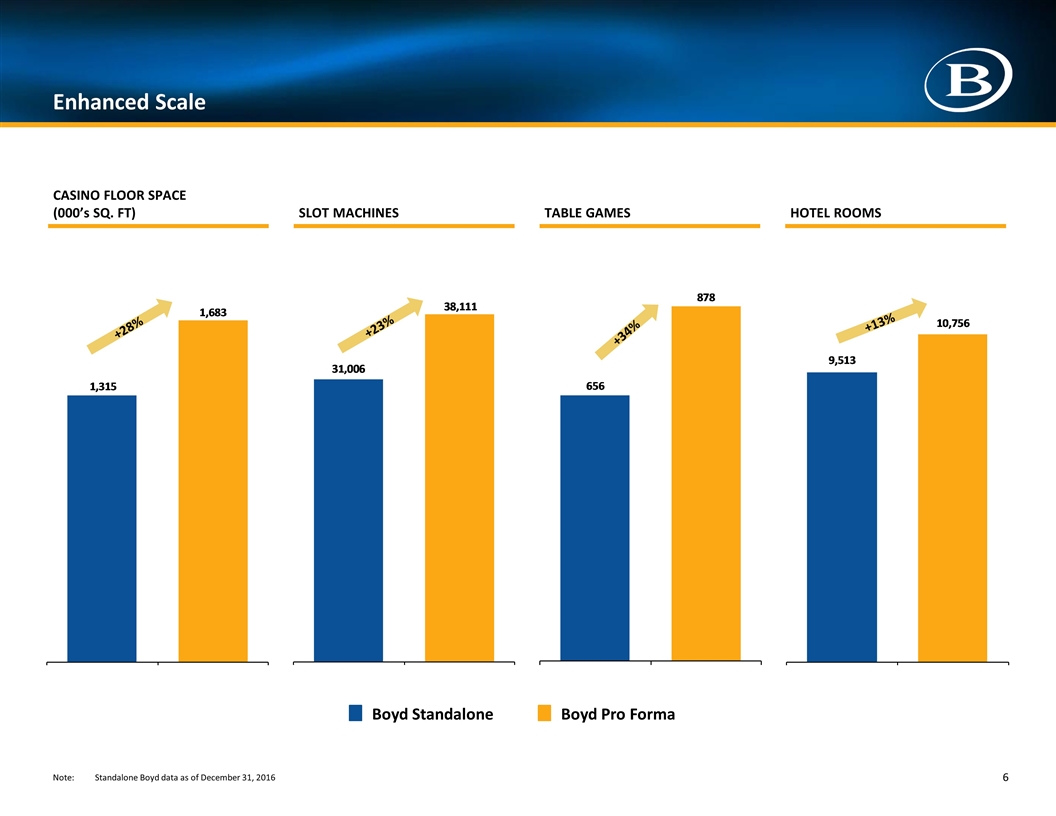

Enhanced Scale CASINO FLOOR SPACE (000’s SQ. FT) SLOT MACHINES TABLE GAMES HOTEL ROOMS Note: Standalone Boyd data as of December 31, 2016 +28% +23% +34% +13% 6 Boyd Standalone Boyd Pro Forma

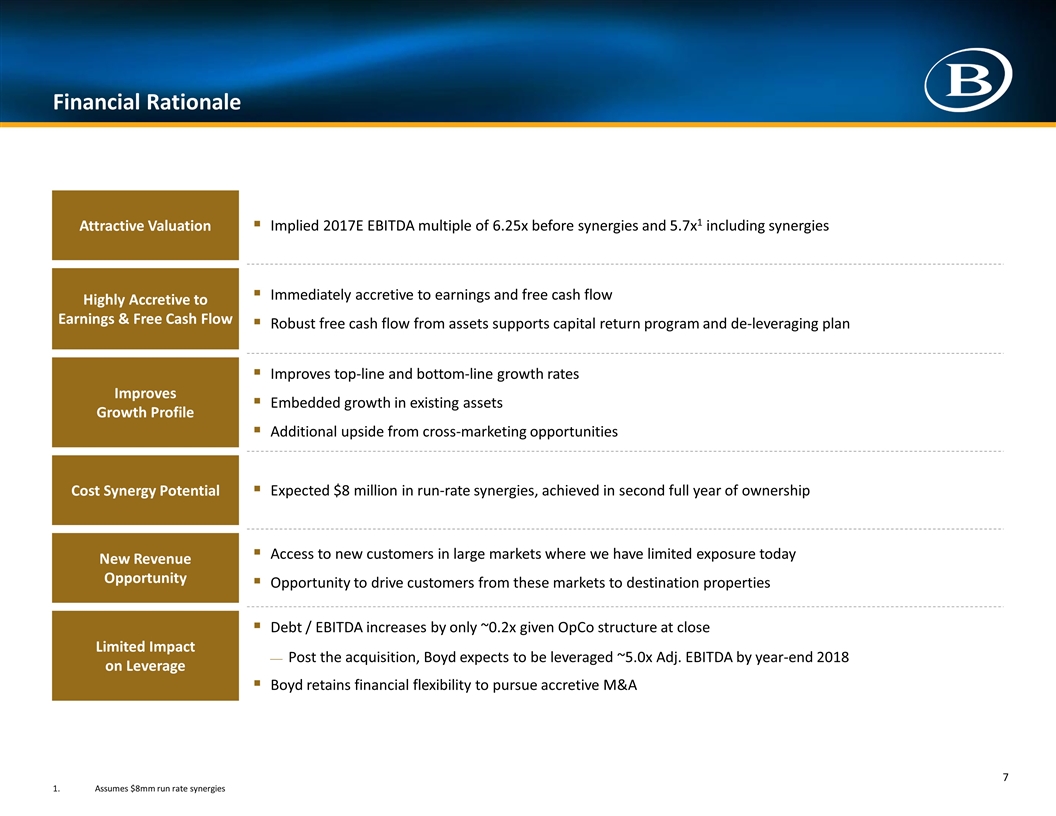

Financial Rationale Attractive Valuation Implied 2017E EBITDA multiple of 6.25x before synergies and 5.7x1 including synergies Highly Accretive to Earnings & Free Cash Flow Immediately accretive to earnings and free cash flow Robust free cash flow from assets supports capital return program and de-leveraging plan Improves Growth Profile Improves top-line and bottom-line growth rates Embedded growth in existing assets Additional upside from cross-marketing opportunities Cost Synergy Potential Expected $8 million in run-rate synergies, achieved in second full year of ownership New Revenue Opportunity Access to new customers in large markets where we have limited exposure today Opportunity to drive customers from these markets to destination properties Limited Impact on Leverage Debt / EBITDA increases by only ~0.2x given OpCo structure at close Post the acquisition, Boyd expects to be leveraged ~5.0x Adj. EBITDA by year-end 2018 Boyd retains financial flexibility to pursue accretive M&A 1. Assumes $8mm run rate synergies 7

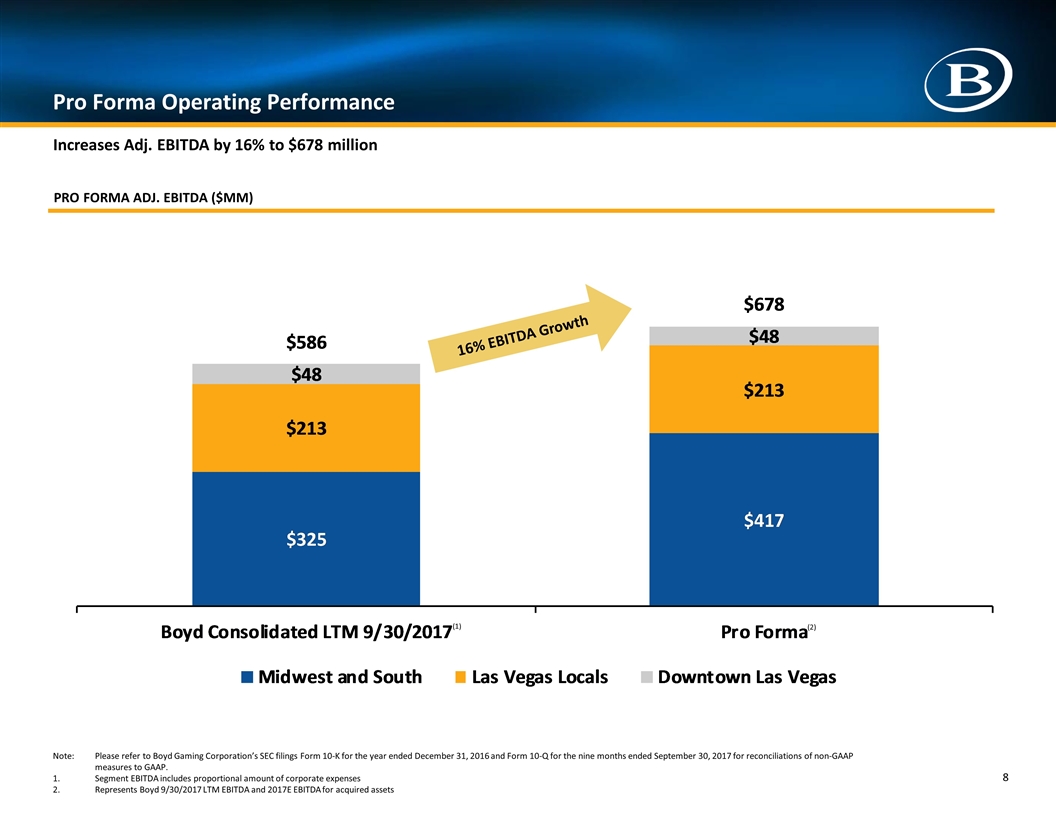

16% EBITDA Growth PRO FORMA ADJ. EBITDA ($MM) Pro Forma Operating Performance Increases Adj. EBITDA by 16% to $678 million 8 (2) Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. Segment EBITDA includes proportional amount of corporate expenses Represents Boyd 9/30/2017 LTM EBITDA and 2017E EBITDA for acquired assets (1)

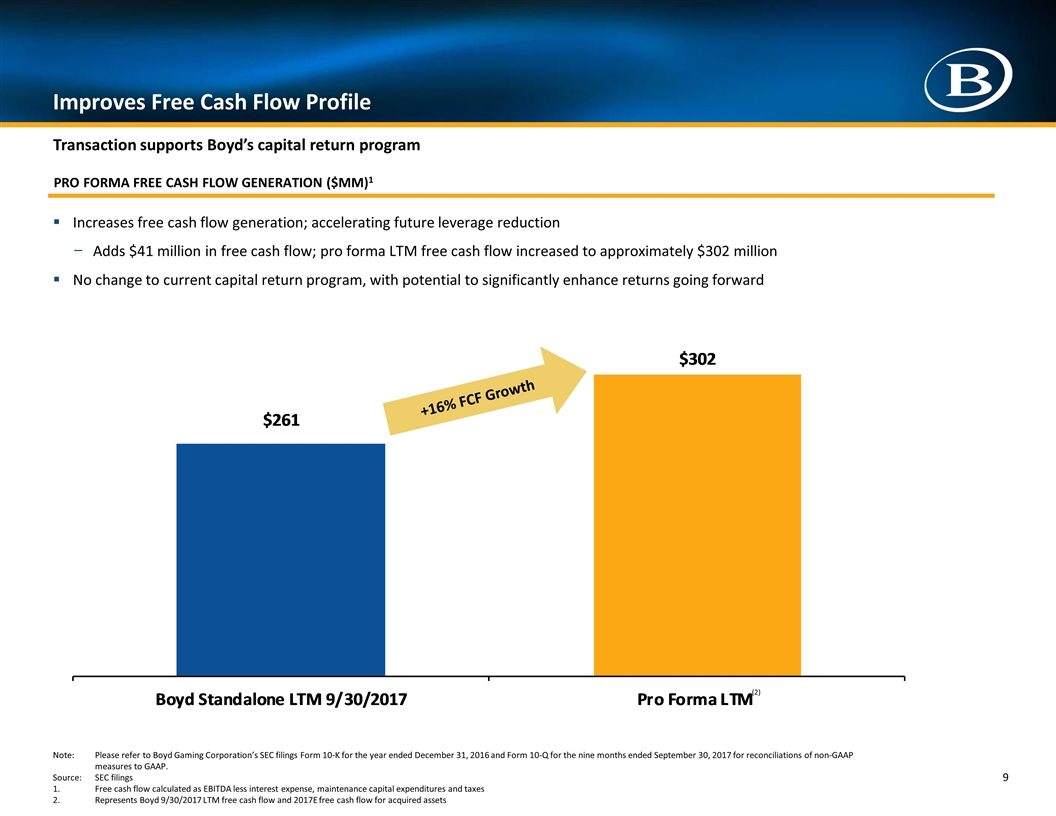

PRO FORMA FREE CASH FLOW GENERATION ($MM)1 Improves Free Cash Flow Profile Note: Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. Source: SEC filings Free cash flow calculated as EBITDA less interest expense, maintenance capital expenditures and taxes Represents Boyd 9/30/2017 LTM free cash flow and 2017E free cash flow for acquired assets Transaction supports Boyd’s capital return program Increases free cash flow generation; accelerating future leverage reduction Adds $41 million in free cash flow; pro forma LTM free cash flow increased to approximately $302 million No change to current capital return program, with potential to significantly enhance returns going forward +16% FCF Growth 9 (2)

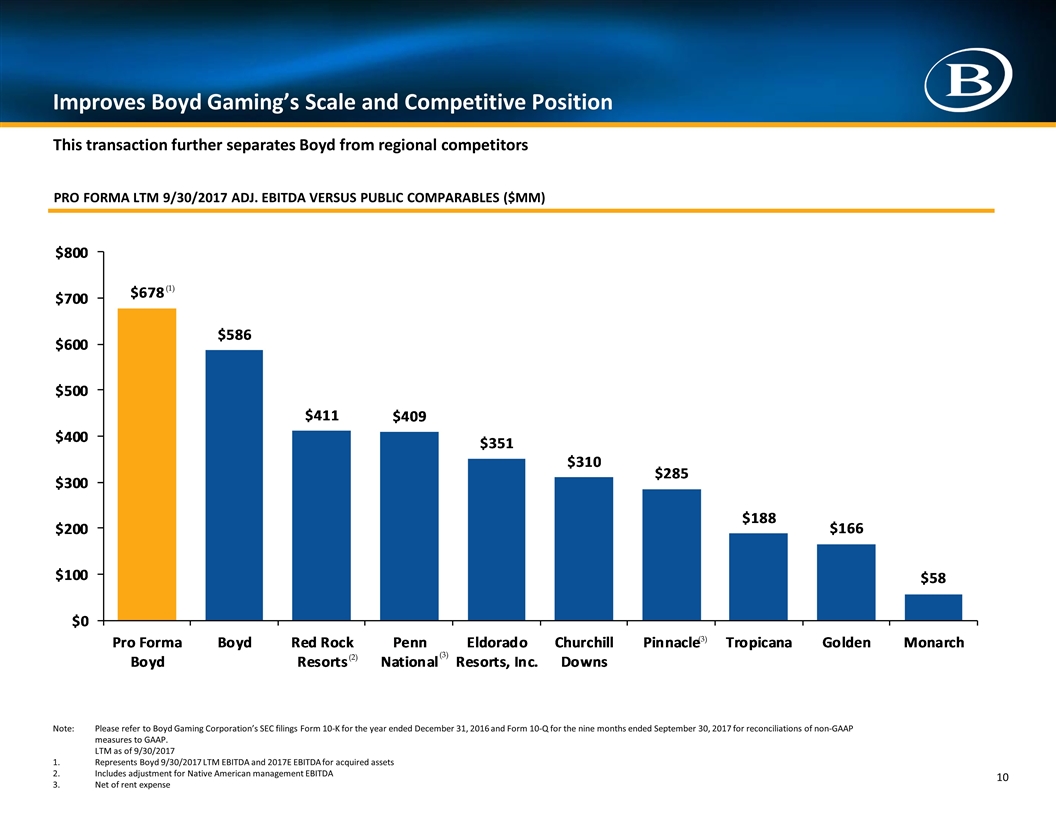

Improves Boyd Gaming’s Scale and Competitive Position PRO FORMA LTM 9/30/2017 ADJ. EBITDA VERSUS PUBLIC COMPARABLES ($MM) Note:Please refer to Boyd Gaming Corporation’s SEC filings Form 10-K for the year ended December 31, 2016 and Form 10-Q for the nine months ended September 30, 2017 for reconciliations of non-GAAP measures to GAAP. LTM as of 9/30/2017 Represents Boyd 9/30/2017 LTM EBITDA and 2017E EBITDA for acquired assets Includes adjustment for Native American management EBITDA Net of rent expense This transaction further separates Boyd from regional competitors 10 (3) (2) (3) (1)

I. Property-Level Details

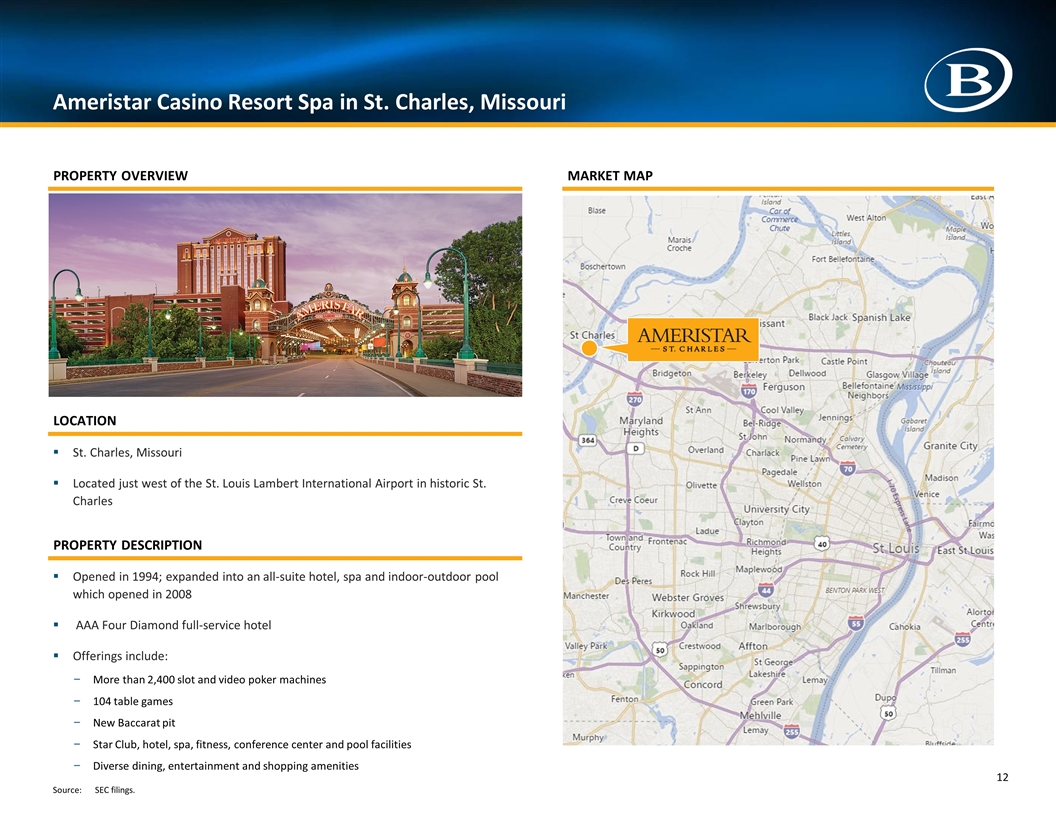

Opened in 1994; expanded into an all-suite hotel, spa and indoor-outdoor pool which opened in 2008 AAA Four Diamond full-service hotel Offerings include: More than 2,400 slot and video poker machines 104 table games New Baccarat pit Star Club, hotel, spa, fitness, conference center and pool facilities Diverse dining, entertainment and shopping amenities Ameristar Casino Resort Spa in St. Charles, Missouri Placeholder photo PROPERTY OVERVIEW LOCATION MARKET MAP PROPERTY DESCRIPTION St. Charles, Missouri Located just west of the St. Louis Lambert International Airport in historic St. Charles Source:SEC filings. 12

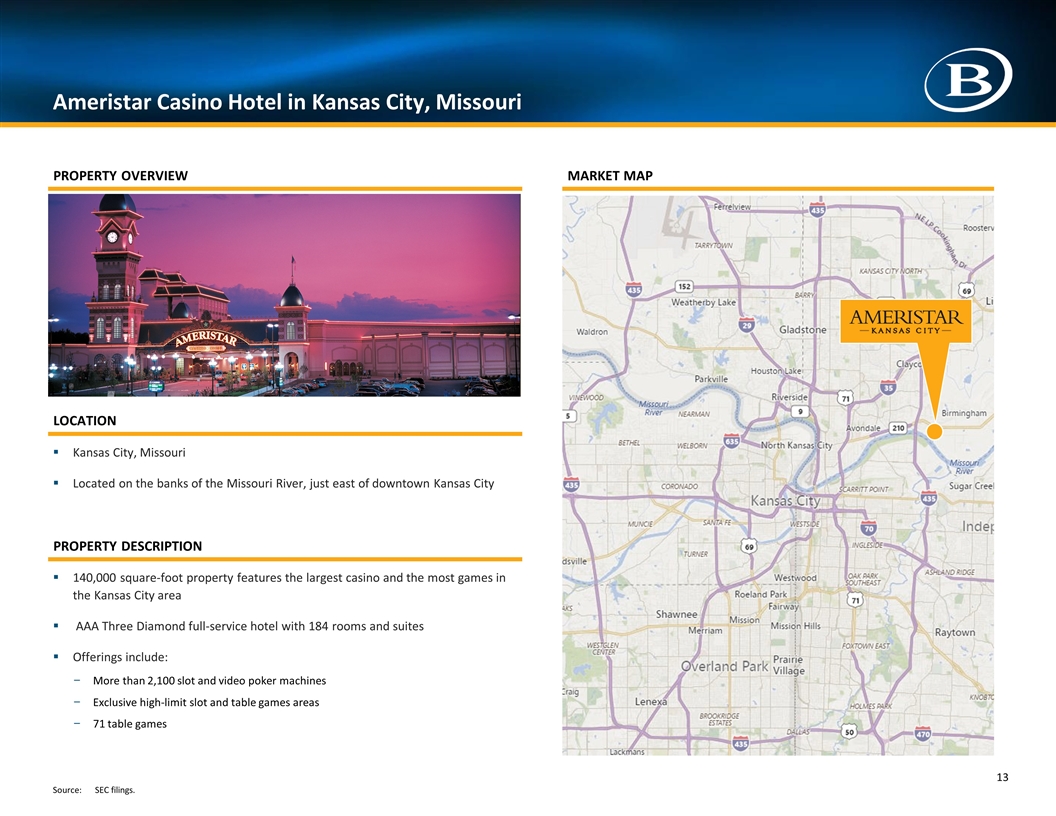

Ameristar Casino Hotel in Kansas City, Missouri 140,000 square-foot property features the largest casino and the most games in the Kansas City area AAA Three Diamond full-service hotel with 184 rooms and suites Offerings include: More than 2,100 slot and video poker machines Exclusive high-limit slot and table games areas 71 table games PROPERTY OVERVIEW LOCATION MARKET MAP PROPERTY DESCRIPTION Kansas City, Missouri Located on the banks of the Missouri River, just east of downtown Kansas City Source:SEC filings. 13

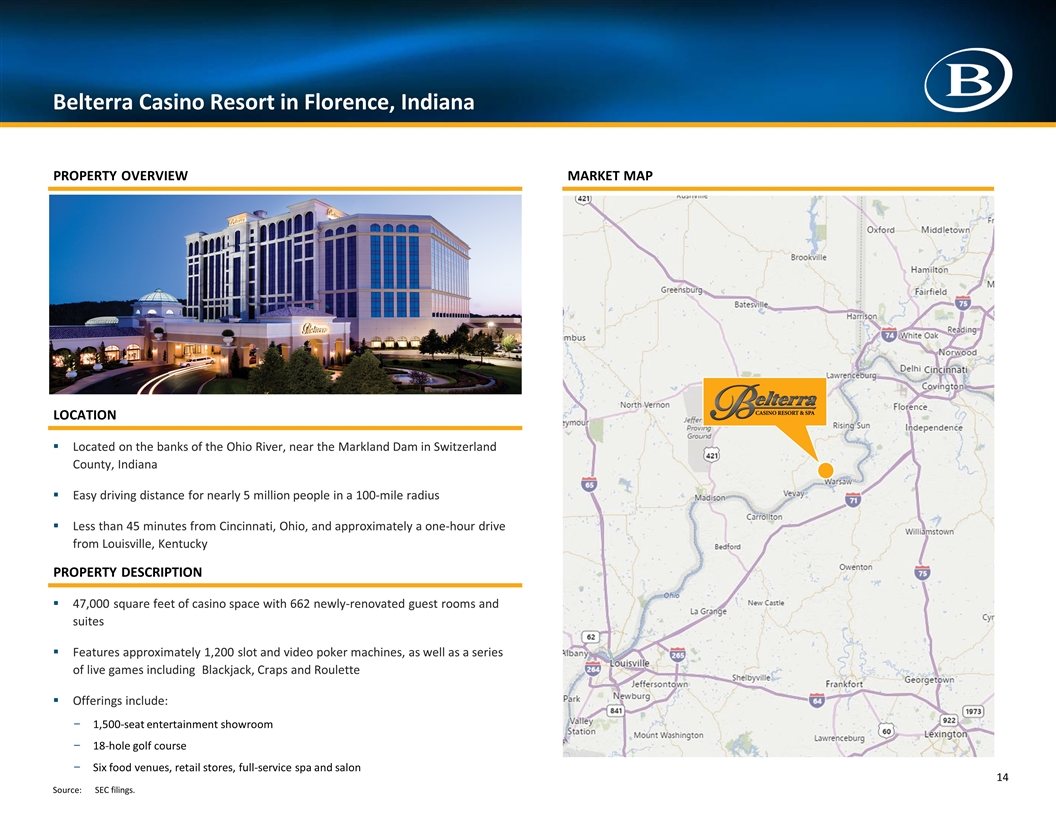

Belterra Casino Resort in Florence, Indiana 47,000 square feet of casino space with 662 newly-renovated guest rooms and suites Features approximately 1,200 slot and video poker machines, as well as a series of live games including Blackjack, Craps and Roulette Offerings include: 1,500-seat entertainment showroom 18-hole golf course Six food venues, retail stores, full-service spa and salon PROPERTY OVERVIEW LOCATION MARKET MAP PROPERTY DESCRIPTION Located on the banks of the Ohio River, near the Markland Dam in Switzerland County, Indiana Easy driving distance for nearly 5 million people in a 100-mile radius Less than 45 minutes from Cincinnati, Ohio, and approximately a one-hour drive from Louisville, Kentucky Source:SEC filings. 14

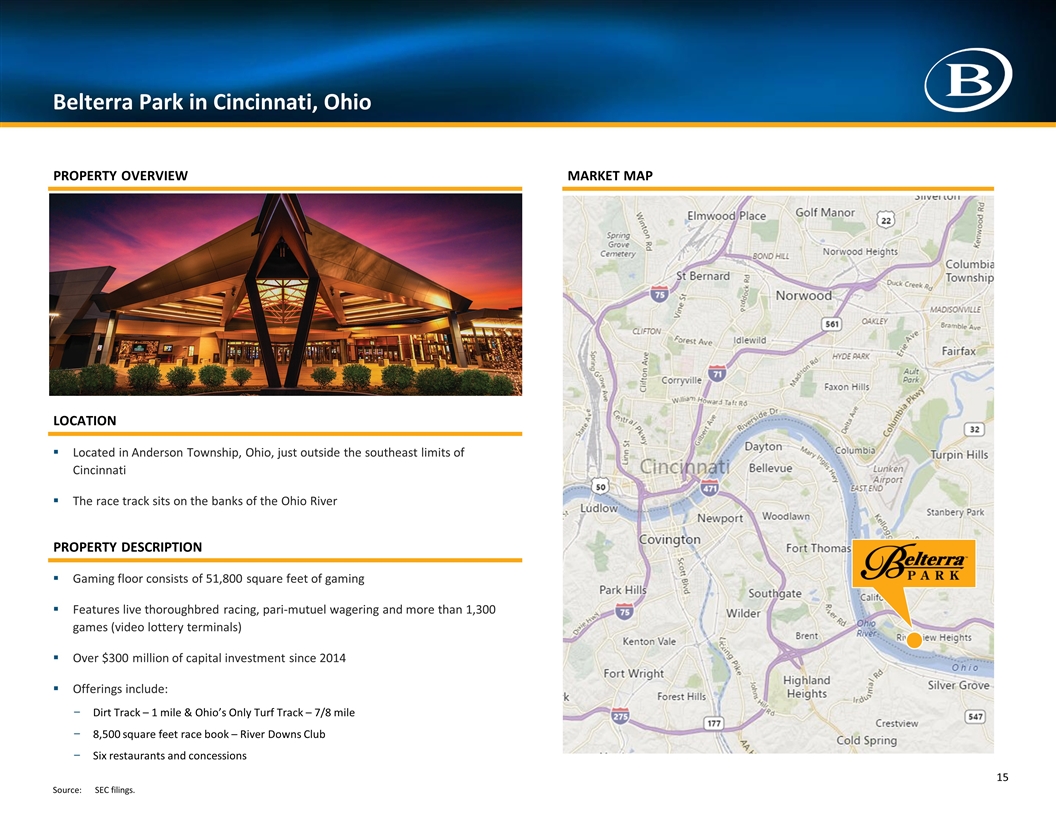

Belterra Park in Cincinnati, Ohio Gaming floor consists of 51,800 square feet of gaming Features live thoroughbred racing, pari-mutuel wagering and more than 1,300 games (video lottery terminals) Over $300 million of capital investment since 2014 Offerings include: Dirt Track – 1 mile & Ohio’s Only Turf Track – 7/8 mile 8,500 square feet race book – River Downs Club Six restaurants and concessions PROPERTY OVERVIEW LOCATION MARKET MAP PROPERTY DESCRIPTION Located in Anderson Township, Ohio, just outside the southeast limits of Cincinnati The race track sits on the banks of the Ohio River Source:SEC filings. 15

II. Market Overviews

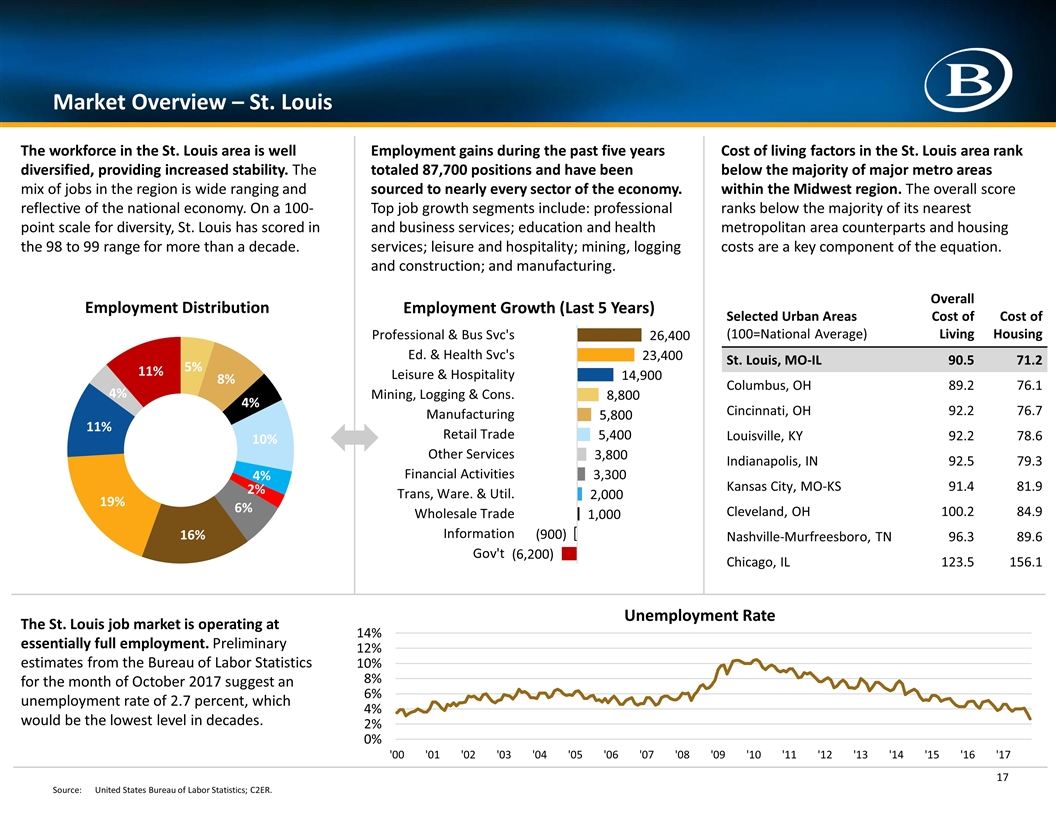

Market Overview – St. Louis 17 The workforce in the St. Louis area is well diversified, providing increased stability. The mix of jobs in the region is wide ranging and reflective of the national economy. On a 100-point scale for diversity, St. Louis has scored in the 98 to 99 range for more than a decade. Employment gains during the past five years totaled 87,700 positions and have been sourced to nearly every sector of the economy. Top job growth segments include: professional and business services; education and health services; leisure and hospitality; mining, logging and construction; and manufacturing. Cost of living factors in the St. Louis area rank below the majority of major metro areas within the Midwest region. The overall score ranks below the majority of its nearest metropolitan area counterparts and housing costs are a key component of the equation. The St. Louis job market is operating at essentially full employment. Preliminary estimates from the Bureau of Labor Statistics for the month of October 2017 suggest an unemployment rate of 2.7 percent, which would be the lowest level in decades. Selected Urban Areas (100=National Average) Overall Cost of Living Cost of Housing St. Louis, MO-IL 90.5 71.2 Columbus, OH 89.2 76.1 Cincinnati, OH 92.2 76.7 Louisville, KY 92.2 78.6 Indianapolis, IN 92.5 79.3 Kansas City, MO-KS 91.4 81.9 Cleveland, OH 100.2 84.9 Nashville-Murfreesboro, TN 96.3 89.6 Chicago, IL 123.5 156.1 Source:United States Bureau of Labor Statistics; C2ER.

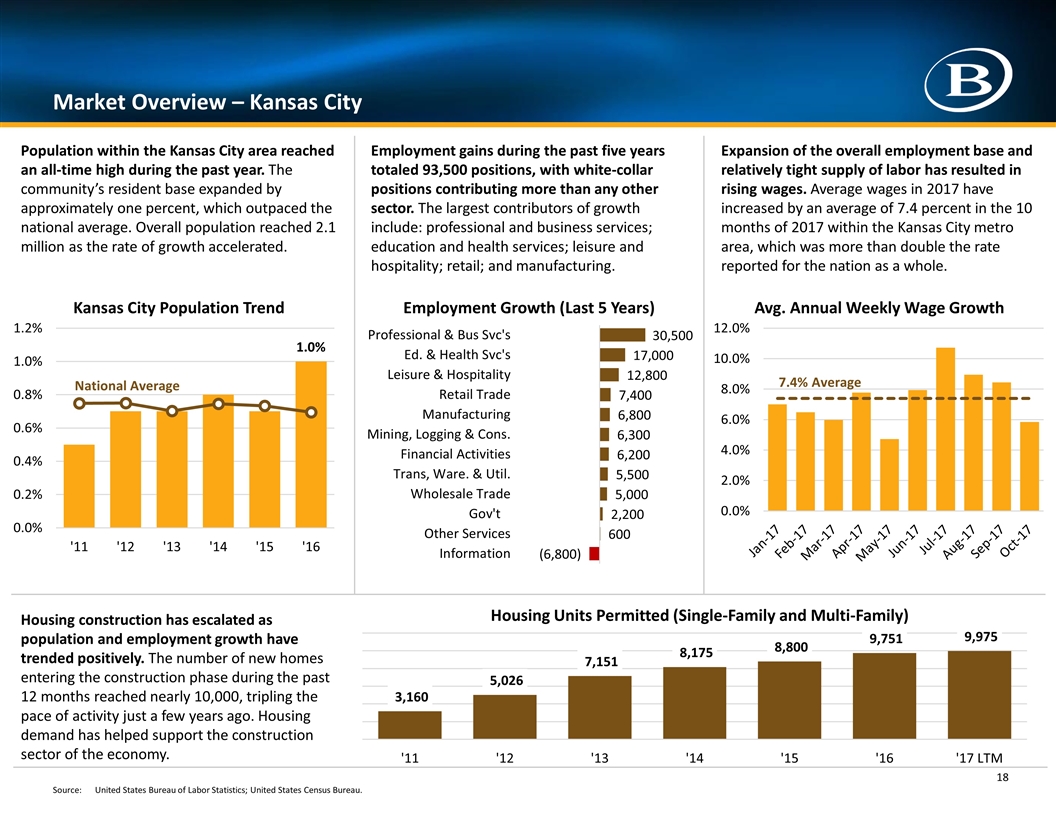

Market Overview – Kansas City 18 Population within the Kansas City area reached an all-time high during the past year. The community’s resident base expanded by approximately one percent, which outpaced the national average. Overall population reached 2.1 million as the rate of growth accelerated. Employment gains during the past five years totaled 93,500 positions, with white-collar positions contributing more than any other sector. The largest contributors of growth include: professional and business services; education and health services; leisure and hospitality; retail; and manufacturing. Expansion of the overall employment base and relatively tight supply of labor has resulted in rising wages. Average wages in 2017 have increased by an average of 7.4 percent in the 10 months of 2017 within the Kansas City metro area, which was more than double the rate reported for the nation as a whole. Housing construction has escalated as population and employment growth have trended positively. The number of new homes entering the construction phase during the past 12 months reached nearly 10,000, tripling the pace of activity just a few years ago. Housing demand has helped support the construction sector of the economy. National Average 7.4% Average Source:United States Bureau of Labor Statistics; United States Census Bureau.

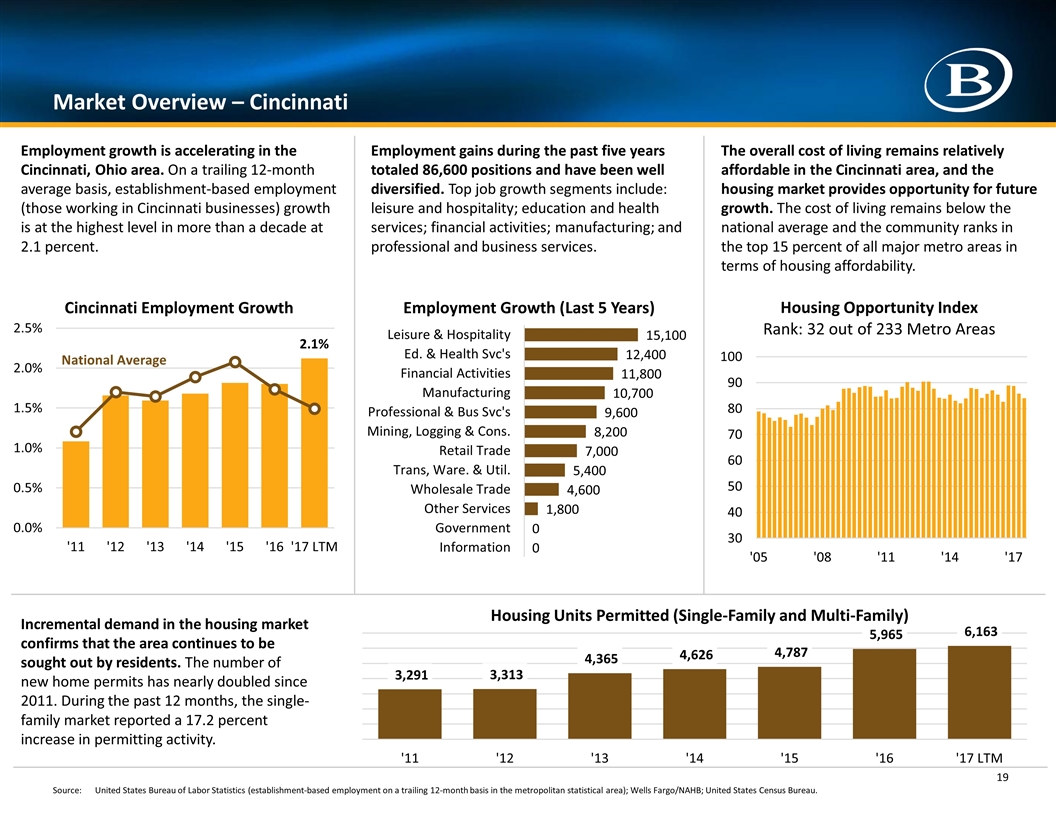

Market Overview – Cincinnati 19 Employment growth is accelerating in the Cincinnati, Ohio area. On a trailing 12-month average basis, establishment-based employment (those working in Cincinnati businesses) growth is at the highest level in more than a decade at 2.1 percent. Employment gains during the past five years totaled 86,600 positions and have been well diversified. Top job growth segments include: leisure and hospitality; education and health services; financial activities; manufacturing; and professional and business services. The overall cost of living remains relatively affordable in the Cincinnati area, and the housing market provides opportunity for future growth. The cost of living remains below the national average and the community ranks in the top 15 percent of all major metro areas in terms of housing affordability. Incremental demand in the housing market confirms that the area continues to be sought out by residents. The number of new home permits has nearly doubled since 2011. During the past 12 months, the single-family market reported a 17.2 percent increase in permitting activity. National Average Source:United States Bureau of Labor Statistics (establishment-based employment on a trailing 12-month basis in the metropolitan statistical area); Wells Fargo/NAHB; United States Census Bureau.

Forward Looking Statements 20 Important information regarding forward-looking statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and may include (without limitation) statements regarding the transaction to acquire the Pinnacle assets, Boyd Gaming’s expectations regarding the amount of the purchase price, timing of closing, the potential benefits to be achieved from the acquisition, including the potential to gain strong positions in three metropolitan areas, the effects on Boyd Gaming’s size, scale, customer base, and free cash flow, expectations regarding timing for the transaction to be free cash flow positive and accretive to Boyd Gaming’s earnings, the expected cost synergies, estimated rent coverage, estimated growth rates, statements regarding the creation of an OpCo platform for future growth and Boyd Gaming’s loyalty program, and any statements or assumptions underlying any of the foregoing. These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the possibility that the transactions contemplated by the definitive agreement will not close on the expected terms (or at all), or that Boyd Gaming is unable to successfully integrate the acquired assets or realize the expected synergies or that the properties will be cash flow positive or accretive to Boyd Gaming’s earnings as anticipated; litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the closing of the transactions contemplated by the definitive agreement; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd Gaming’s annual, periodic and current reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd Gaming as of the date hereof, and Boyd Gaming assumes no obligation to update any forward-looking statement. Non-GAAP Financial Measures Regulation G, "Conditions for Use of Non-GAAP Financial Measures," prescribes the conditions for use of non-GAAP financial information in public disclosures. We do not provide a reconciliation of forward-looking non-GAAP financial measures due to our inability to project special charges and certain expenses.

Disclosures 21 Important disclosures regarding information contained within this document We obtained the industry, market and competitive position data throughout this presentation from (i) our own internal estimates and research of third party company websites and other sources, (ii) industry and general publications and research or (iii) studies and surveys conducted by third parties. Such sources generally do not guarantee the accuracy or completeness of included information. While we believe that the information included in this presentation from such publications, research, studies, surveys and websites is reliable, we have not independently verified data from these third-party sources. While we believe our internal estimates and research are reliable, neither such estimates and research nor such definitions have been verified by any independent source. This presentation also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or TM symbols, but we do not intend our use or display of other companies’ trade names, trademarks or service marks with or without such symbols to imply relationships with, or endorsement or sponsorship of us by, these other companies.