Attached files

| file | filename |

|---|---|

| EX-3.4 - EX-3.4 - PlayAGS, Inc. | d511860dex34.htm |

| EX-3.2 - EX-3.2 - PlayAGS, Inc. | d511860dex32.htm |

| EX-3.1 - EX-3.1 - PlayAGS, Inc. | d511860dex31.htm |

| EX-2.1 - EX-2.1 - PlayAGS, Inc. | d511860dex21.htm |

| 8-K - FORM 8-K - PlayAGS, Inc. | d511860d8k.htm |

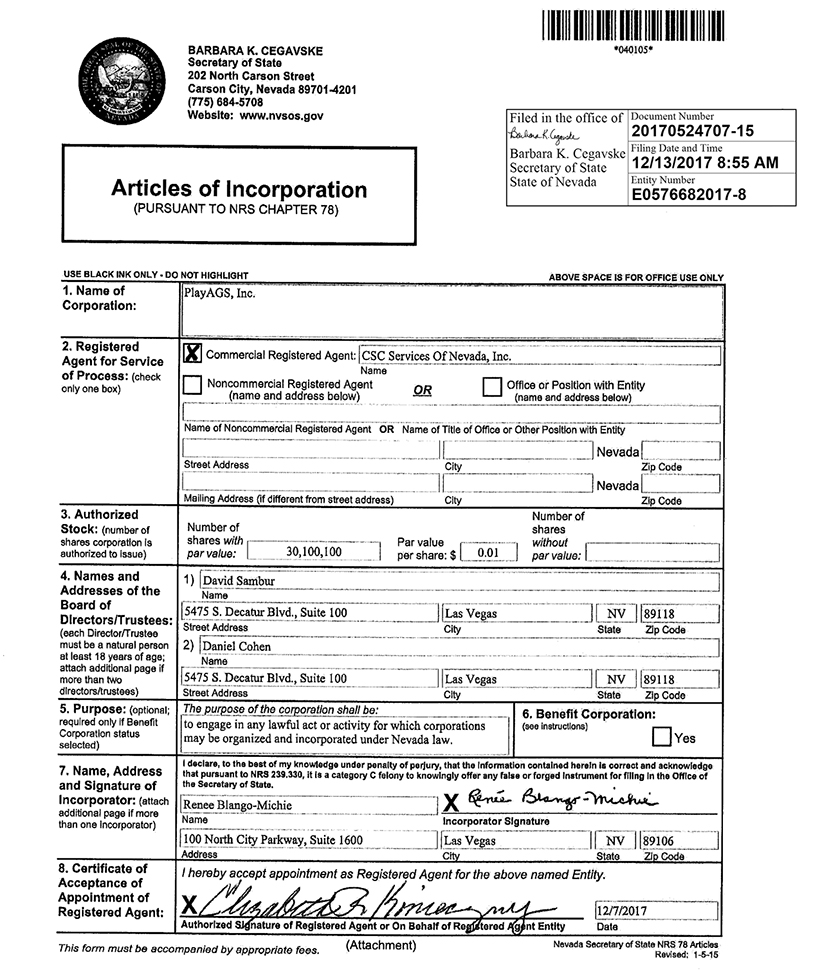

Exhibit 3.3

BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov Filed in the office of Document Number 20170524707-15 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov Barbara K. Cegavske Filing Date and Time 12/13/2017/8:55AM Secretary of State 12/13/2017 8.55 AM State of Nevada Entity Number E0576682017-8 Articles of Incorporation (PURSUANT TO NRS CHAPTER 78) USE BLACK INK ONLY DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY 1. Name of Corporation: PlayAGS, Inc. 2. Registered Agent for Service of Process: (check only one box) Commercial Registered Agent: |CSC Services Of Nevada, Inc. Noncommercial Registered Agent (name and address below) Office or Position with Entity (name and address below) OR Name of Noncommercial Registered Agent OR Name of Title of Office or Other Position with Entity Nevada | Street Address City Zip Code Nevada Mailing Address (if different from street address) City Zip Code Authorized Number of Stock: (number of Number of shares shares corporation Is shares with Par value without authorized to issue) par value: 30,100,100 per share: $ 0.01 parvalue: Names and 1) David Sambur ‘ Addresses of the Name” Board of [5475 S. Decatur Blvd., Suite 100 Las Vegas NV 89118 Directors/Trustees: (each Director/Trustee Street Address; Clty State Zip Code must be a natural person 2) j Daniel Cohen at least 18 years of age; Name attach additional page if more than two 15475 S. Decatur Blvd., Suite 100 Las Vegasn NV 89118 dlrectors/tnjstees) Street AddressCity State Zip Code The purpose of the corporation shall be: to engage in any lawful act or activity for which corporations may be organized and incorporated under Nevada law. 5. Purpose: (optional; required only If Benefit Corporation status selected) 6. Benefit Corporation: (see instructions) Yes I declare, to the best of my knowledge under penalty of perjury, that the Information contained herein Is correct and acknowledge that pursuant to NRS 239.330, It Is a category C felony to knowingly offer any false or forged Instrument for filing In the Office of the Secretary of State. 7. Name, Address and Signature of incorporator: (attach additional page if more than one Incorporator) [Renee Blango-Michie Name Incorporator Signature Las Vegas City 89106 Zip Code NV State 100 North City Parkway, Suite 1600 Address 8. Certificate of Acceptance of Appointment of Registered Agent: I hereby accept appointment as Registered Agent for the above named Entity. 12/7/2017 Authorized Signature of Registered Agent or On Behalf of Rei Date This form must be accompanied by appropriate fees. (Attachment) Nevada Secretary of State NRS 78 Articles Revised: 1-5-16

ATTACHMENT TO

ARTICLES OF INCORPORATION

OF

PLAYAGS, INC.

The Articles of Incorporation of Play AGS, Inc., a Nevada corporation (the “Corporation”), consist of the articles set forth on the prior page and the additional articles set forth on this attachment as follows:

Article 3. Authorized Stock (continued)

Section 1. Authorized Capital Stock. The total number of shares of stock which the Corporation shall be authorized to issue is 30,100,100 shares which shall consist of (a) 100 shares of voting Common Stock, par value $0.01 per share (the “Class A Common Stock”), (b) 30,000,000 shares of non-voting Common Stock, par value $0.01 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”) and (c) 100,000 shares of Preferred Stock, par value $0.01 per share (“Preferred Stock”).

Section 2. Preferred Stock. The Board of Directors of the Corporation (the “Board”) is hereby expressly authorized to provide for the issuance of all or any shares of the Preferred Stock in one or more classes or series, to fix the number of shares constituting such series, and to increase or decrease the number of shares of any such series (but not below the number of shares thereof then outstanding) and to fix for each such class or series such voting powers, full or limited, or no voting powers, and such distinctive designations, powers, preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by a majority of the entire Board providing for the issuance of such class or series including, without limitation, the authority to provide that any such class or series may be (a) subject to redemption at such time or times and at such price or prices, (b) entitled to receive dividends (which may be cumulative or noncumulative) at such rates, on such conditions, and at such times, and payable in preference to, or in such relation to, the dividends payable on any other class or classes or any other series, (c) entitled to such rights upon the dissolution of, or upon any distribution of the assets of, the Corporation, or (d) convertible into, or exchangeable for, shares of any other class or classes of stock, or of any other series of the same or any other class or classes of stock, of the Corporation at such price or prices or at such rates of exchange and with such adjustments, all as may be stated in such resolution or resolutions. Notwithstanding the foregoing, the rights of each holder of the Preferred Stock shall be subject at all times to compliance with all gaming and other statutes, laws, rules and regulations applicable to the Corporation and such holder at that time.

Section 3. Common Stock.

(a) Economic Interest. Except as provided in this Article 3, Section 3, the Class A Common Stock shall have no economic rights or privileges, including rights in liquidation.

1

(b) Dividends. The holders of Class A Common Stock shall have no right to receive dividends or any other distributions. Subject to the rights of holders of any Preferred Stock, when, as and if, dividends are declared on the Common Stock, whether payable in cash, in property or in securities of the Corporation, the holders of Class B Common Stock shall be entitled to share equally, share for share, in such dividends.

(c) Liquidation or Dissolution. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, holders of Class B Common Stock shall receive a pro rata distribution of any remaining assets after payment of or provision for liabilities and the liquidation preference on Preferred Stock, if any.

(d) Voting Rights. The holders of Class A Common Stock shall be entitled to one vote per share of Class A Common Stock on all matters to be voted on by the stockholders of the Corporation, and to the maximum extent permitted by the Nevada Revised Statutes (“NRS”), the holders of the Class B Common Stock shall have no right to vote on any matter to be voted on by the stockholders of the Corporation (including, without limitation, any election or removal of the directors of the Corporation and any matters for which a separate vote of the Class B Common Stock might otherwise be required by the NRS) and the Class B Common Stock shall not be included in determining the number of shares voting or entitled to vote on such matters. For the avoidance of doubt, the Class B Common Stock shall not be entitled to any right to vote on any matter whatsoever, and to the extent the NRS would nonetheless grant or otherwise permit any such right to vote (including, without limitation, pursuant to NRS 78.2055, 78.207 or 78.390), such right to vote is hereby specifically denied.

Section 4. Consideration for Shares. The Common Stock and Preferred Stock authorized by this Article 3 shall be issued for such consideration as shall be fixed, from time to time, by the Board.

Section 5. Assessment of Stock. The capital stock of the Corporation, after the amount of the subscription price has been fully paid in, shall not be assessable for any purpose, and no stock issued as fully paid shall ever be assessable or assessed. No stockholder of the Corporation is individually liable for the debts or liabilities of the Corporation.

Section 6. Cumulative Voting for Directors. No stockholder of the Corporation shall be entitled to cumulative voting of his shares for the election of directors.

Section 7. Preemptive Rights. No stockholder of the Corporation shall have any preemptive rights.

Article 4. Names and Addresses of Board of Directors (continued)

David Lopez—5475 S. Decatur Blvd., Suite 100, Las Vegas, NV 89118

* * *

2

Article 9. No Written Ballot. Unless and except to the extent that the bylaws of the Corporation shall so require, the election of directors of the Corporation need not be by written ballot.

Article 10. Bylaws. In furtherance and not in limitation of the powers conferred by law, the Board is expressly authorized and empowered to make, alter and repeal the bylaws of the Corporation by a majority vote at any regular or special meeting of the Board or by written consent, subject to the power of the stockholders of the Corporation to alter or repeal any bylaws made by the Board.

Article 10. Amendments to Articles. The Corporation reserves the right at any time from time to time to amend, alter, change or repeal any provision contained in these Articles of Incorporation (these “Articles”), and any other provisions authorized by the laws of the State of Nevada at the time in force may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to these Articles in their present form or as hereafter amended are granted subject to the right reserved in this Article 10.

Article 11. Exculpation; Indemnification and Insurance.

Section 1. Elimination of and Limitation on Liability. The liability of directors and officers of the Corporation shall be eliminated or limited to the fullest extent permitted by the NRS. If the NRS are amended to further eliminate or limit or authorize corporate action to further eliminate or limit the liability of directors or officers, the liability of directors and officers of the Corporation shall be eliminated or limited to the fullest extent permitted by the NRS, as so amended from time to time.

Section 2. Indemnification and Insurance.

(a) Right to Indemnification. Each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter a “proceeding”), by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the NRS, as the same exists or may hereafter be amended (but, in the case of any such amendment, to the fullest extent permitted by law, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, amounts paid or to be paid in settlement, and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) reasonably incurred or suffered by such person in connection therewith and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators; provided, however, that, except as provided in paragraph (b)

3

hereof, the Corporation shall indemnify any such person seeking indemnification in connection with a proceeding (or part thereof) initiated by such person only if such proceeding (or part thereof) was authorized by the Board. The right to indemnification conferred in this Section shall be a contract right and shall include the right to be paid by the Corporation the expenses incurred in defending any such proceeding in advance of its final disposition; provided, however, that, if the NRS requires, the payment of such expenses incurred by a director or officer in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such person while a director or officer, including, without limitation, service to an employee benefit plan) in advance of the final disposition of a proceeding, shall be made only upon delivery to the Corporation of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to be indemnified under this Section or otherwise. The Corporation may, by action of the Board, provide indemnification to employees and agents of the Corporation with the same scope and effect as the foregoing indemnification of directors and officers.

(b) Right of Claimant to Bring Suit. If a claim under paragraph (a) of this Section is not paid in full by the Corporation within thirty days after a written claim has been received by the Corporation, the claimant may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim and, if successful in whole or in part, the claimant shall be entitled to be paid also the expense of prosecuting such claim. It shall be a defense to any such action (other than an action brought to enforce a claim for expenses incurred in defending any proceeding in advance of its final disposition where the required undertaking, if any is required, has been tendered to the Corporation) that the claimant has not met the standards of conduct which make it permissible under the NRS for the Corporation to indemnify the claimant for the amount claimed, but the burden of proving such defense shall be on the Corporation. Neither the failure of the Corporation (including its Board, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such action that indemnification of the claimant is proper in the circumstances because he or she has met the applicable standard of conduct set forth in the NRS, nor an actual determination by the Corporation (including its Board, independent legal counsel, or its stockholders) that the claimant has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable standard of conduct.

(c) Non-Exclusivity of Rights. The right to indemnification and the payment of expenses incurred in defending a proceeding in advance of its final disposition conferred in this Section shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, provision of these Articles, bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

(d) Insurance. The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any such expense, liability or loss, whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the NRS.

Section 3. Repeal and Conflicts. Any repeal or modification of any provision of this Article 11 approved by the stockholders of the Corporation shall be prospective only, and shall

4

not adversely affect any limitation on the liability of a director or officer of the Corporation existing as of the time of such repeal or modification. In the event of any conflict between any provision of this Article 11 and any other article of these Articles, the terms and provisions of this Article 11 shall control.

Article 12. Compliance with New Jersey Gaming Laws. Notwithstanding anything to the contrary contained in these Articles, these Articles shall be deemed to include all provisions required by the New Jersey Casino Control Act, N.J.S.A. 5:12-1 et seq., as amended and as may hereafter be amended from time to time, and the attendant regulations promulgated thereunder (collectively, the “Casino Control Act”) and, to the extent that anything contained herein or in the bylaws of the Corporation is inconsistent with the Casino Control Act, the provisions of the Casino Control Act shall govern. All provisions of the Casino Control Act, to the extent required by law to be stated in these Articles, are herewith incorporated by reference.

* * * *

5