Attached files

| file | filename |

|---|---|

| EX-99 - PRESS RELEASE - Longfin Corp | pressrelease.htm |

| 8-K - 8-K ACQUISITION - Longfin Corp | 8kacquisition.htm |

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (the “Agreement”) is made on December 11th, 2017 by and between Longfin Corp, a Delaware Corporation (the "Purchaser") with its legal address being 16-017, Broad Street, New York 1004 and Meridian Enterprises Pte. Ltd (the “Seller”) with its legal address being at 105, CECIL Street #11-00, The Octagon Singapore-069534 and with other affiliates collectively represented M/s. Galaxy Media Ltd, Hong Kong located at Unit 1, 8/F, Tower II, South Seas Center, 75 Mody Road, Tsimshatsui East, Kowloon, Hong Kong (the “Parties”)

RECITALS

WHEREAS, Seller owns and operates a website namely www.Ziddu.com ((the “Website”) specialized in providing warehouse coins (WC) to importers/exporters of commodities against their warehouse receipts. Ziddu Warehouse Coins (WC) are powered by Block chain technology (with ERC20 Token Standard).

WHEREAS, Seller desires to sell to the Purchaser and Purchaser desires to purchase from the Seller the entire rights, titles and interest in such web property upon the Terms and subject to the Conditions set forth in this Agreement

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

SECTION 1.Sale Of Assets

TERMS AND CONDITIONS

1.1 The Purchaser agrees to purchase and accept from Seller all of its rights, title and interest in and to the Website www.Ziddu.com and all of its respective content, and any other rights associated with the Website, including, without limitation, any intellectual property rights, copyrights to designs, graphics, logos, customer lists and agreements, programming, database, email lists, passwords, usernames and trade names; and all of the related social media accounts including but not limited to, Twitter, Facebook, Instagram, and Pinterest and all internet traffic to the www. Ziddu.com (collectively referred hereto as the "Property").

1.12 Assets. Subject to the other provisions of this Agreement, as of the Closing Date, defined in Section 2, Seller shall sell, convey, transfer and assign to Purchaser, free and clear of all liens, charges, encumbrances, debts, obligations and liabilities whatsoever, all of the Seller's right, title and interest in and to the assets of the Business, as set forth on Exhibit A, attached hereto and made a part of this Agreement.

1.3Account Receivables.

(a)Seller will retain and be responsible for collecting on all account receivables for services provided to customers prior to and at Closing (“Retained A/R”). Purchaser will purchase and be responsible for collecting on all account receivables for services provided to customers after Closing.

(b)All account receivables for products sold but not yet delivered and services partially provided to customers prior to and at Closing will be prorated between Seller and Purchaser. The prorated amount between Seller and Purchaser will be calculated by Purchaser based on the percentage of work completed by Seller and Purchaser, respectively, in connection with the product sold and delivered, and the services rendered. Each party will be responsible for collection the portion of the account receivables allocated to

Meridian Longfin assets acquisition agreement.

that party. Seller’s prorated portion of the account receivables is included in the definition of “Retained A/R”.

SECTION 2.Closing Date

The closing of the purchase and sale provided for herein (the "Closing Date") will take place at any location agreed to by the parties on December 11, 2017. Administrative costs associated with closing this transaction will be shared equally between the Seller and Purchaser. The Parties will be responsible for their respective legal and professional fees associated with this purchase and sale unless otherwise indicated in this Agreement.

SECTION 3.Consideration And Payment

3.1Purchase Price. The total purchase price (the "Purchase Price") for the Assets shall be 2,500,000 restricted class A common shares of Longfin, allocated as set forth in Exhibit B.

SECTION 4.Assumption Of Liabilities

4.1Seller agrees to deliver the said assets to the purchaser on the Closing Date, Purchaser shall assume and agrees to pay and perform on any and all liabilities incurred by the assets after the Closing Date that the Purchaser has assumed (“Assumed Liabilities”).

4.2All other liabilities and obligations shall be discharged and promptly paid by Seller as they become due pre the closing date.

SECTION 5.Documents And Other Instruments To Be Delivered On The Closing Date

5.1 Seller’ s Obligations . Seller agrees to deliver or cause to be delivered to Purchaser on the Closing Date:

(a)a duly executed the asset purchase agreement conveying the Assets to Purchaser;

(b)a duly executed Affidavit of Title that such Assets are being conveyed free and clear of all liens, charges, encumbrances, debts, obligations and liabilities whatsoever;

(c)any and all assignments, certificates and other instruments of transfer, with full warranty of title, as may be necessary or desirable to transfer all of Seller's right, title and interest in and to all of the Assets to Purchaser, free of all liens or claims; and

5.2 Purchaser ’ s Obligations . Purchaser agrees to deliver to Seller on the Closing Date:

(a)a corporate authorization authoring the issuance of the said shares to the seller of two and half million restricted shares 2,500,0000 class A Common shares.

(b a duly executed the asset purchase agreement.

SECTION 6.Seller's Representations And Warranties

Seller hereby represents and warrants as follows, which representations and warranties shall survive the Closing Date:

6.1Organization and Good Standing. Seller is a limited liability company duly organized,

Meridian Longfin assets acquisition agreement.

validly existing and in good standing under the laws of the State of Singapore and is qualified to transact business in the State of Singapore.

6.2Authority Relative to this Agreement. Seller has full power and authority to execute and deliver this Agreement and to consummate the transactions contemplated in this Agreement.

6.3Binding Obligation. This Agreement is the legal, valid, and binding obligation of Seller, enforceable against Seller in accordance with its terms.

6.4No Conflict. The signing and delivery of this Agreement by Seller and the performance by Seller of all of Seller’s obligations under this Agreement will not:

(a)conflict with Seller’s articles of organization, articles of incorporation or operating agreement, or bylaws];

(b)breach any agreement to which Seller is a party, or give any person the right to accelerate any obligation of Seller;

(c)violate any law, judgment, or order to which Seller is subject; or

(d)require the consent, authorization, or approval of any person, including but not limited to any governmental body.

6.5 Broker or Finder’ s Fee . Seller has not incurred any liability or obligation – whether contingent or otherwise – for a brokerage commission, a finder’s fee, or any other similar payment in connection with this Agreement or the transaction. If Seller has incurred or will incur such a broker or finder’s fee, the parties agree that Seller will be solely responsible for payment of any such fee or commission.

6.6Title. Seller has good and marketable title to all the Assets, free and clear of any liens, mortgages, pledges, security interests, and other encumbrances of any kind.

6.7Compliance with Laws.Seller has complied with all applicable I nt er na t i o na l , na t i o na l , city, state, and federal laws, ordinances, regulations, and rules with respect to the conduct of its operations, and has not received any notice or notices (whether written or oral) of violations of any such statutes or regulations which have not been cured.

6.8Litigation.There a r e no actions, suits, proceedings or investigations pending or threatened against or affecting Seller, the Assets, or the Business.

6.9Finances.The financing statements for the Business, including but not limited to statements and balance sheets, fairly present the results of operation and the financial condition of the Business, and have been prepared in accordance with generally accepted accounting principles, consistently applied. The financial statements properly reflect all assets and liabilities as then in existence, including but not limited to any accounts receivable.

6.10Contracts. Seller has canceled any and all contracts between it and any other party, and has delivered proof of those cancellations to Purchaser. Seller warrants that there are no contracts, agreements, licenses, or other commitments and arrangements in effect as of the Closing Date, including but not limited to all customer contracts. There are no existing disputes or grounds for dispute under any such cancelled contracts and no act, event, or omission has occurred that, whether with or without notice, lapse of time, or both, would constitute a material default under such cancelled contracts.

Meridian Longfin assets acquisition agreement.

6.11Assets.As of the Closing Date, all of the tangible Assets are in good operating order, and condition, and are suitable for use in the ordinary course of the Business.

6.12Conduct of Business. Seller has operated the Business in the ordinary course consistent with past practices and there has been no adverse material change in the Business. Seller has not accrued debts on behalf of the Business or disposed of any assets of the Business, other than those debts accrued in the ordinary course of business.

6.13Taxes.All tax returns of every kind (including returns of real and personal property taxes, intangible taxes, withholding taxes, and unemployment compensation taxes) relating to the Business that Seller was required to file in accordance with any applicable law have been duly filed, and all taxes shown to be due on such returns have been paid in full.

6.14Disclosure. No representation, warranty, or statement made by Seller in this Agreement or in any Exhibit to this Agreement contains or will contain any untrue statement or omits or will omit any fact necessary to make the statements contained herein or therein not misleading. Seller has disclosed to Purchaser all facts that are material to the financial condition, operation, or prospects of the Business, the Assets, and the Assumed Liabilities.

SECTION 7.Purchaser's Representations And Warranties

Purchaser hereby represents and warrants as follows, which representations and warranties shall survive the Closing Date:

7.1Organization and Good Standing. Longfin Corp is duly organized and validly existing under the laws of the State of Delaware.

7.2Authority Relative to this Agreement. The execution and performance of this Agreement by Purchaser has been duly and validly authorized by all necessary action on the part of Purchaser. Purchaser has full power and authority to execute and deliver this Agreement and to consummate the transactions contemplated hereby.

7.3Binding Obligation.This Agreement is the legal, valid, and binding obligation of Purchaser, enforceable against Purchaser in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, or other similar laws of general application or by general principles of equity.

7.4 Broker or Finder’s Fee . Purchaser has not incurred any liability or obligation – whether contingent or otherwise – for a brokerage commission, a finder’s fee, or any other similar payment in connection with this Agreement or the transaction.

SECTION 8.Covenants of Seller Prior to the Closing Date

Seller agrees that prior to the Closing Date, Seller will:

8.1continue to operate the Business in its usual and ordinary course and in substantially the same manner as presently conducted and consistent with the past practices of Seller, in accordance with all applicable city, state, and federal laws, ordinances, regulations, and rules, and will use its best efforts to preserve its business organization and continued operation of its business with its customers, suppliers, and others having a business relationship with Seller;

8.2not assign, sell, lease, or otherwise transfer or dispose of any of the Assets used in the performance of its business, whether now owned or hereafter acquired, except in the ordinary course of business;

Meridian Longfin assets acquisition agreement.

8.3maintain all the Assets in their present condition;

8.4notify Purchaser promptly of any material change or loss in the business prospects, financial condition, assets, liabilities, or operations of the Business;

8.5provide reasonable access for Purchaser and Purchaser’s representatives to the Business, including but not limited to the property, personnel, books, papers, records, clients, and suppliers relating to its operations, assets, and liabilities, on an as needed basis in order to complete a due diligence investigation (but only for this purpose) to the sole satisfaction of the Purchaser and Purchaser’s representatives;

Party;

8.6perform all of Seller’s liabilities and obligations under all contracts to which Seller is a

8.7refrain, and will cause the Seller’s officers, members, managers, or employees, and any

banker, lawyer, accountant, or other agent to refrain from initiating negotiations with third parties relating to the purchase and sale contemplated in this Agreement;

8.8cancel all existing contracts and agreements with any parties; and

8.9notify Purchaser of any breach by Seller of any representation, warranty, or covenant in this Agreement.

SECTION 9.Covenants of Seller After the Closing Date

Seller agrees that after the Closing Date, Seller will:

9.1will make all filings, give all notices, and transfer all accounts that Purchaser is required to make and give to close the transaction contemplated in this Agreement (understanding however that all accounts receivable of the Business prior to the Closing Date shall be retained by Seller);

9.2assist in transferring the accounts that may need to be transferred to Purchaser; and

SECTION 10. Conditions to P urchaser’s Closi ng Date Obligations

Purchaser’s obligation to close this transaction and purchase the Assets is subject to satisfaction, in Purchaser’s reasonable discretion, of the following conditions:

10.1Purchaser obtaining all licenses, approvals, permits, and waivers from the public authorities necessary to authorize the ownership and operation of the Business;

10.2a satisfactory completion, in the sole discretion of Purchaser and Purchaser’s accountants, attorneys, and other representatives, of a due diligence review and/or audit of the Business;

10.3the Business has not suffered any material adverse change, in Purchaser’s sole discretion, in the business prospects, financial condition, assets, liabilities, or operations.

SECTION 11. Best Efforts

Each party shall use its best reasonable efforts to take all action and to do all things necessary, proper, and advisable, including obtaining all necessary approvals required to authorize the execution and delivery of this Agreement, in order to consummate and make effective the transactions contemplated by this Agreement.

Meridian Longfin assets acquisition agreement.

SECTION 12. Taxes

Seller shall be responsible for and pay any and all sales, use, real property transfer taxes, or other taxes due and payable on and after the Closing Date arising in connection with the sale by Seller of the Assets and the acquisition thereof by Purchaser, including without limitation taxes imposed in connection with Seller, the Business, or the Assets for all taxable periods (or portions thereof) ending on or prior to the Closing Date. Seller shall remit and file such taxes, including any and all necessary returns and reports, to the appropriate governmental agency in a timely manner.

SECTION 13. Termination

13.1Termination. This Agreement may be terminated by written notice at any time prior to or on the Closing Date:

(a)by mutual written agreement of Seller and Purchaser;

(b)by Purchaser, in the event that there has been a material misrepresentation in this Agreement by Seller, or a material breach of any of Seller’s representations, warranties or covenants set forth herein; or

(c)by Seller, in the event that there has been a material misrepresentation in this Agreement by Purchaser, or a material breach of any of Purchaser’s representations, warranties or covenants set forth herein.

13.2Effect of Termination.In the event of termination of this Agreement as provided in Section 13.1, this Agreement shall become void and of no further force and effect, without any liability or obligations on the part of Purchaser or Seller.

SECTION 14. Press Release

Purchaser and Seller will draft a press release regarding the transaction contemplated in this Agreement for distribution to customers, suppliers, and the general public that introduces and endorses Purchaser, which will be signed on the Closing Date by the parties. Any news release pertaining to the transaction contemplated in this Agreement shall be reviewed and approved by both parties prior to its release.

SECTION 15. Non-Competition; Non-Solicitation

For a period of three (3) years from the Closing Date, provided Purchaser is not in default, Seller, shall not:

15.1directly or indirectly advise, invest in, own, manage, operate, control, be employed by, provide services to, or otherwise assist any person engaged in or planning to be engaged in any business whose products, services, or activities compete or will compete in whole or in part with Purchaser’s products, services, or activities.

15.2solicit any employee of Purchaser to become an employee or independent contractor of Seller or any other person or entity, or suggest to any employee that they should reduce or terminate their employment relationship with Purchaser; and

15.3solicit any customer, or other business relationship of Purchaser to become a business

Meridian Longfin assets acquisition agreement.

relation of Seller or, or suggest to a business relationship of Purchaser that the business relation should reduce or terminate the business relation’s business or relationship with Purchaser.

SECTION 16. Indemnification

16.1 Seller’ s Indemnification.Seller hereby agrees to indemnify, defend, and hold Purchaser and its assigns, directors, members, managers, partners, officers, and authorized representatives harmless from and against any and all claims, liabilities, obligations, costs, taxes, fees, wages, financial obligations, and expenses of every kind, including reasonable attorney fees, whether known or unknown, arising out of or related to:

(a)Seller’s breach of the representations, warranties, covenants, or other obligations of Seller made in this Agreement or any other agreement or document relating to this transaction;

(b)Seller’s breach of any liabilities or obligations of Seller in connection with the use, ownership, condition, maintenance, or operation of the Business or the Assets by Seller or its members on or before the Closing Date.

16.2 Purchaser ’sIndemnification.Purchaser hereby agrees to indemnify, defend, and hold Seller and its assigns, directors, members, managers, partners, officers, and authorized representatives harmless from and against any and all claims, liabilities, obligations, costs, taxes, fees, wages, financial obligations, and expenses of every kind, including reasonable attorney fees, whether known or unknown, arising out of or related to:

(a)Purchaser’s breach of the representations, warranties, covenants or other obligations of Purchaser made in this Agreement or any other agreement or document relating to this transaction;

(b)Any liabilities or obligations of Purchaser, including the Assumed Liabilities, in connection with the use, ownership, condition, maintenance, or operation of the Business or the Assets by Purchaser after the Closing Date.

16.3Notice of Claim. If any claim is asserted against a party that would give rise to a claim by that party against the other party for indemnification under the provisions of this Section, then the party to be indemnified will promptly give written notice to the indemnifying party concerning such claim and the indemnifying party will, at no expense to the indemnified party, defend the claim.

SECTION 17. Equitable Relief

The parties acknowledge that the remedies available at law for any breach of this Agreement by a breaching party will, by their nature, be inadequate. Accordingly, the non- breaching party may obtain injunctive relief or other equitable relief to restrain a breach or threatened breach of this Agreement or to specifically enforce this Agreement, without proving that any monetary damages have been sustained. Neither party shall require the posting of a bond prior to obtaining such equitable relief.

SECTION 18. General Provisions

18.1Notices.All notices required under this Agreement shall be in writing, and shall be deemed duly given (a) when delivered, if delivered personally, (b) at the end of the day after deposit if sent by overnight express courier service, or (c) at the end of the third business day after deposit if sent by registered or certified mail, return receipt requested and postage prepaid, to the parties as set forth in the signature page below, or at such other address as may be supplied by similar written notice, or (d) when

Meridian Longfin assets acquisition agreement.

sent, if by email.

18.2Amendment; Waiver. This Agreement may not be amended, nor may any rights under it be waived except by an instrument in writing signed by both parties.

18.3Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable to agreements made and to be performed wholly within such jurisdiction, without giving effect to the provisions, policies or principles thereof relating to choice or conflict of laws.

18.4Arbitration.Any controversy or claim arising out of this Agreement will be will be settled by arbitration before a single arbitrator in New York. If the Parties agree on an arbitrator, the arbitration will be held before the arbitrator selected by the Parties. If the Parties do not agree on an arbitrator, each Party will designate an arbitrator and the arbitration will be held before a third arbitrator selected by the designated arbitrators. Each arbitrator will be an attorney knowledgeable in the area of business law. The resolution of any controversy or claim as determined by the arbitrator will be binding on the Parties. A Party may seek from a court an order to compel arbitration, or any other interim relief or provisional remedies pending an arbitrator’s resolution of any controversy or claim.

18.5Binding Effect. Except as provided otherwise herein, this Agreement shall be binding upon and shall inure to the benefit of the parties and their respective legal representatives, successors and assigns.

18.6Severability. If a provision of this Agreement is determined to be unenforceable in any respect, the enforceability of the provision in any other respect and of the remaining provisions of this Agreement will not be impaired.

18.7Headings. The section and other headings contained in this Agreement are for reference purposes only and shall not affect the meaning of this Agreement.

18.8Expenses.All fees and expenses incurred by each party in connection with this Agreement and the transaction contemplated in this Agreement shall be borne by that party.

18.9Survival. All provisions of this Agreement that would reasonably be expected to survive the termination of this Agreement will do so.

18.10Attorney Fees. If any arbitration or litigation is instituted to interpret, enforce, or rescind this Agreement, including but not limited to any proceeding brought under the United States Bankruptcy Code, the prevailing party on a claim will be entitled to recover with respect to the claim, in addition to any other relief awarded, the prevailing party’s reasonable attorney's fees and other fees, costs, and expenses of every kind.

18.11Attachments. All exhibits and other attachments referenced in this Agreement are part of this Agreement.

18.12Entire Agreement. This Agreement constitutes the entire agreement among the parties and supersedes any prior agreement or understanding among the parties concerning its subject matter.

18.13Assignment. This Agreement may not be transferred, assigned, pledged or hypothecated by either party without the prior written consent of the other party.

18.14Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original but all of which shall constitute one agreement. Furthermore, this Agreement may be executed by a party's signature transmitted by facsimile or by electronic mail, and

Meridian Longfin assets acquisition agreement.

copies of this Agreement executed and delivered by means of faxed or electronic mail shall have the same force and effect as copies hereof executed and delivered with original signatures. All parties hereto may rely upon faxed or electronic mail as if such signatures were originals.

[Signature page to follow]

Meridian Longfin assets acquisition agreement.

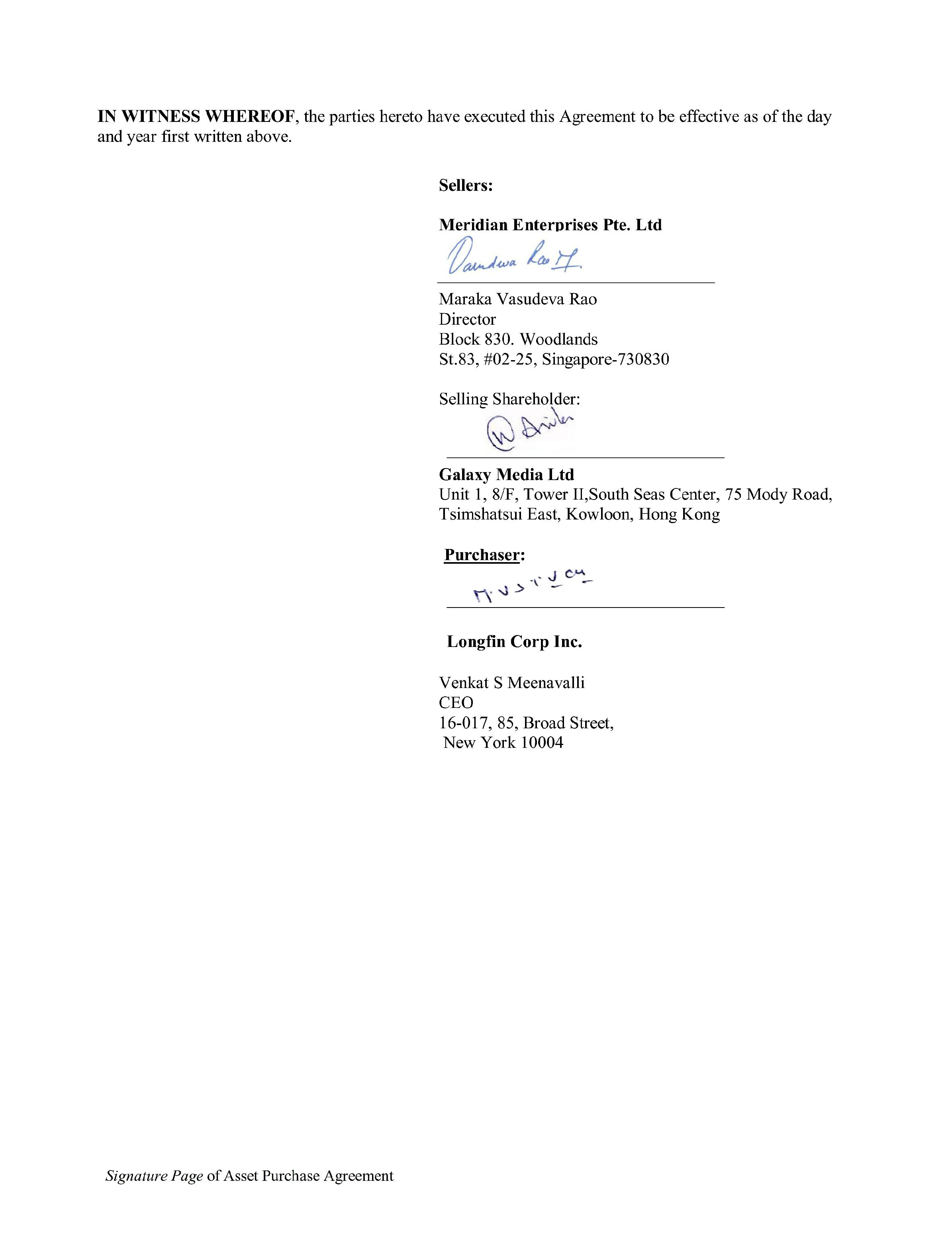

Signature Page of Asset Purchase Agreement

Exhibit A

website : www.Ziddu.com

website www.Ziddu.com and all of its respective content, and any other rights associated with the Website, including, without limitation, any intellectual property rights, copyrights to designs, graphics, logos, customer lists and agreements, programming, database, email lists, passwords, usernames and trade names; and all of the related social media accounts including but not limited to, Twitter, Facebook, Instagram, and Pinterest and all internet traffic to the www. Ziddu.com.

Exhibit B.

Purchase Price. The total purchase price for the Assets purchase shall be 2,500,000 restricted class A common shares of Longfin.

1.Meridian Enterprises Pte Ltd- 2.150,000 Shares

2.Galaxy Media Ltd-100,000 Shares

3.Bachchan Abhishek-125,000 Shares

4.Bachchan Amitab-125,000 Shares

---------------------

Total- 2,500,000 Shares

---------------------

****

Signature Page of Asset Purchase Agreement