Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SITE Centers Corp. | d512795dex991.htm |

| 8-K - 8-K - SITE Centers Corp. | d512795d8k.htm |

Exhibit 99.2

|

D D R C O R P.

STRATEGIC TRANSFORMATION INVESTOR PRESENTATION

DECEMBER 2017

|

SAFE HARBOR

DDR Corp. considers portions of the information in this presentation to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, both as amended, with respect to the Company’s expectation for future periods. Although the Company believes that the expectations reflected in such forward-looking statements are based

upon reasonable assumptions, it can give no assurance that its expectations will be achieved. For this purpose, any statements contained herein that are not historical fact may be deemed to be forward-looking statements. There are a number of

important factors that could cause our results to differ materially from those indicated by such forward-looking statements, including, among other factors, our ability to complete the spin-off in a timely

manner or at all, our ability to satisfy the various closing conditions to the spin-off and the financing thereof or have such conditions waived, our ability to obtain regulatory approvals required to complete

the spin-off in a timely manner or at all, the expected tax treatment of the spin-off, the composition of the spin-off portfolio,

our ability to obtain third-party consents required to transfer certain properties in connection with the spin-off, the impact of the spin-off on our business and that

of the spun-off company (“Spin-Co”), and the Company’s and Spin-Co’s ability to execute their respective business strategies following the spin-off. Other risks and uncertainties that could cause our results to differ materially from those indicated by such forward-looking statements include property damage, expenses related thereto and other business

and economic consequences (including the potential loss of rental revenues) resulting from extreme weather conditions in locations where we own properties, and the ability to estimate accurately the amounts thereof; sufficiency and timing of any

insurance recovery payments related to damages from extreme weather conditions; local conditions such as supply of space or a reduction in demand for real estate in the area; competition from other available space; dependence on rental income from

real property; the loss of, significant downsizing of or bankruptcy of a major tenant; redevelopment and construction activities may not achieve a desired return on investment; our ability to buy or sell assets on commercially reasonable terms; our

ability to complete acquisitions or dispositions of assets under contract; our ability to secure equity or debt financing on commercially acceptable terms or at all; our ability to enter into definitive agreements with regard to our financing and

joint venture arrangements or our failure to satisfy conditions to the completion of these arrangements; the success of our deleveraging strategy; and our ability to maintain our REIT status.

For additional factors that could cause the results of the Company to differ materially from those indicated in the forward-looking statements, please refer to the Company’s

most recent reports on Form 10-K and Form 10-Q. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or

circumstances that arise after the date hereof.

In addition, this presentation includes certain non-GAAP financial

measures. Non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP measures. Reconciliations of these

non-GAAP financial measures to the most directly comparable

GAAP measures can be found in the appendix to this

presentation.

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

2

|

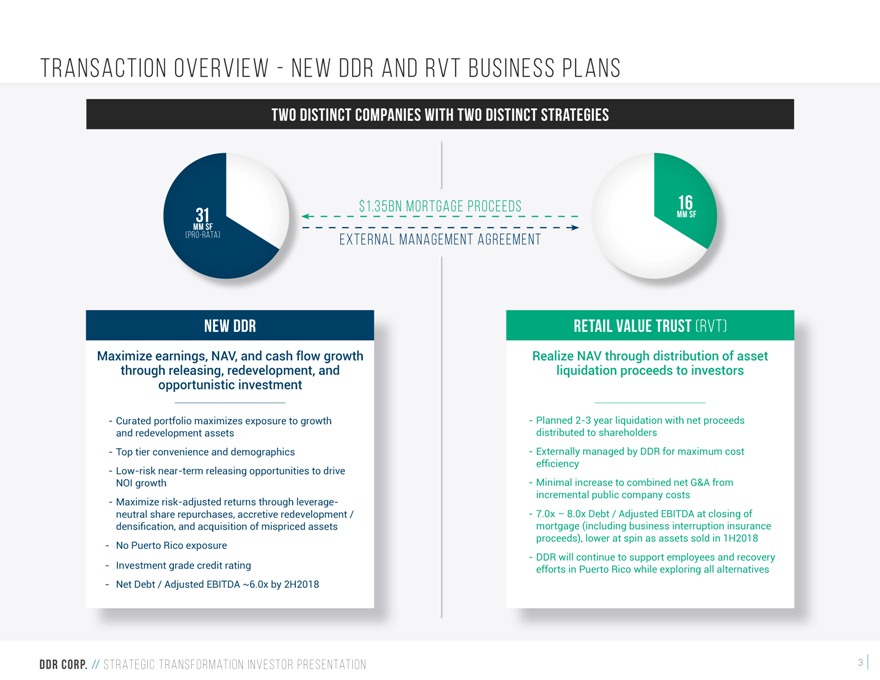

TRANSACTION OVERVIEW—NEW DDR AND RVT BUSINESS

PLANS

TWO DISTINCT COMPANIES WITH TWO DISTINCT STRATEGIES

MM 31 SF

(PRO-RATA)

$1.35BN MORTGAGE PROCEEDS

EXTERNAL MANAGEMENT AGREEMENT

16 MM SF

NEW DDR

Maximize earnings, NAV, and cash flow growth through releasing, redevelopment, and

opportunistic investment

Curated portfolio maximizes exposure to growth and redevelopment assets Top tier convenience and demographics Low-risk near-term releasing opportunities to drive NOI growth Maximize risk-adjusted returns through leverage- neutral share repurchases, accretive redevelopment /

densification,andacquisitionofmispricedassets

No Puerto Rico exposure Investment grade credit

rating

Net Debt / Adjusted EBITDA ~6.0x by 2H2018

RETAIL VALUE TRUST (RVT)

Realize NAV through distribution of asset liquidation proceeds to investors

Planned 2-3 year liquidation with net proceeds distributed to shareholders Externally managed by DDR for maximum cost

efficiency

Minimal increase to combined net G&A from incremental public

company costs 7.0x – 8.0x Debt / Adjusted EBITDA at closing of mortgage (including business interruption insurance proceeds), lower at spin as assets sold in 1H2018 DDR will continue to support employees and recovery efforts in Puerto Rico

while exploring all alternatives

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

3

|

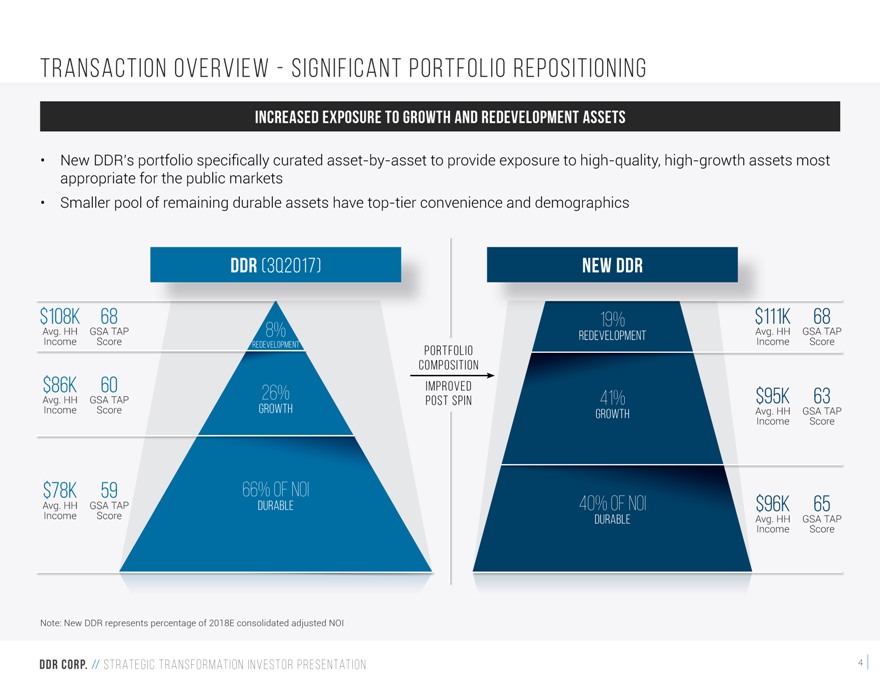

TRANSACTION OVERVIEW—SIGNIFICANT PORTFOLIO

REPOSITIONING

INCREASED EXPOSURE TO GROWTH AND REDEVELOPMENT ASSETS

New

DDR’s portfolio specifically curated asset-by-asset to provide exposure to high-quality, high-growth assets most appropriate for the public markets Smaller pool of

remaining durable assets have top-tier convenience and demographics

DDR (3Q2017)

$108K 68

Avg. Income HH GSA Score TAP 8%

REDEVELOPMENT

$86K 60 26%

Avg. HH GSA TAP

Income Score GROWTH

$78K 59 66% OF NOI

Avg. Income HH GSA Score TAP DURABLE

PORTFOLIO COMPOSITION

IMPROVED POST SPIN

NEW DDR

19%

REDEVELOPMENT

41%

GROWTH

40% OF NOI

DURABLE

$111K 68

Avg. Income HH GSA Score TAP

$95K 63

Avg. Income HH GSA Score TAP

$96K 65

Avg. Income HH GSA Score TAP

Note: New DDR represents percentage of 2018E consolidated

adjusted NOI

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

4

|

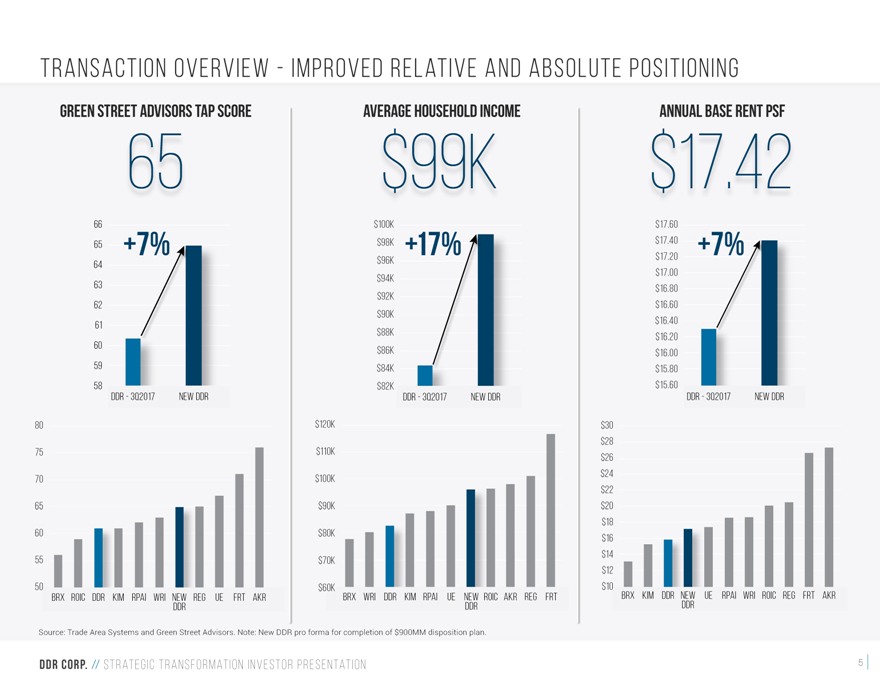

TRANSACTION OVERVIEW—IMPROVED RELATIVE AND

ABSOLUTE POSITIONING

GREEN STREET ADVISORS TAP SCORE

65

66

65 +7%

64 63 62 61 60 59 58

DDR—3Q2017 NEW DDR

80 75 70 65 60 55 50

BRX ROIC DDR KIM RPAI WRI NEW DDR REG UE FRT AKR

AVERAGE HOUSEHOLD INCOME

$99K

$100K $98K +17% $96K $94K $92K $90K $88K $86K $84K $82K

DDR—3Q2017 NEW DDR

$120K $110K $100K $90K $80K $70K

$60K BRX WRI DDR KIM RPAI UE NEW ROIC AKR REG FRT DDR

ANNUAL BASE RENT PSF

$17.42

$17.60 $17.40 +7% $17.20 $17.00 $16.80 $16.60 $16.40 $16.20 $16.00 $15.80 $15.60

DDR—3Q2017 NEW DDR

$30 $28 $26 $24 $22 $20 $18 $16 $14 $12

$10 BRX KIM DDR NEW UE RPAI WRI ROIC REG FRT AKR

DDR

Source: Trade Area Systems and Green Street Advisors. Note: New DDR pro forma for completion of $900MM disposition plan.

5

|

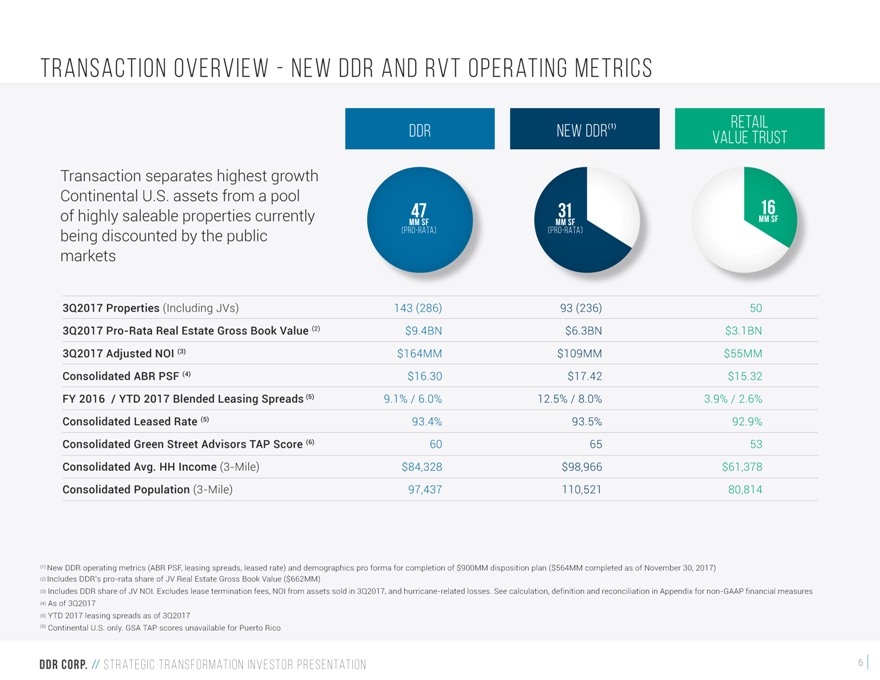

TRANSACTION OVERVIEW—NEW DDR AND RVT OPERATING

METRICS

Transaction separates highest growth Continental U.S. assets from a pool of highly saleable properties currently being discounted by the public markets

(1) RETAIL DDR NEW DDR VALUE TRUST

47 31 MM 16 SF

(PRO-RATA) MM SF (PRO-RATA) MM SF

3Q2017 Properties (Including JVs) 143 (286) 93 (236) 50

3Q2017

Pro-Rata Real Estate Gross Book Value (2) $9.4BN $6.3BN $3.1BN 3Q2017 Adjusted NOI (3) $164MM $109MM $55MM Consolidated ABR PSF (4) $16.30 $17.42 $15.32 FY 2016 / YTD 2017 Blended Leasing Spreads (5) 9.1% /

6.0% 12.5% / 8.0% 3.9% / 2.6% Consolidated Leased Rate (5) 93.4% 93.5% 92.9% Consolidated Green Street Advisors TAP Score (6) 60 65 53

Consolidated Avg. HH Income (3-Mile) $84,328 $98,966 $61,378

Consolidated Population (3-Mile) 97,437 110,521 80,814

(1) New DDR operating metrics (ABR PSF, leasing spreads, leased rate) and demographics pro forma for completion of $900MM disposition plan ($564MM completed as of

November 30, 2017) (2) Includes DDR’s pro-rata share of JV Real Estate Gross Book Value ($662MM)

(3) Includes DDR

share of JV NOI. Excludes lease termination fees, NOI from assets sold in 3Q2017, and hurricane-related losses. See calculation, definition and reconciliation in Appendix for non-GAAP financial measures

(4) As of 3Q2017

(5) YTD 2017 leasing spreads as of 3Q2017

(6) Continental U.S. only. GSA TAP scores unavailable for Puerto Rico

DDR CORP. // STRAT E G I

C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

6

|

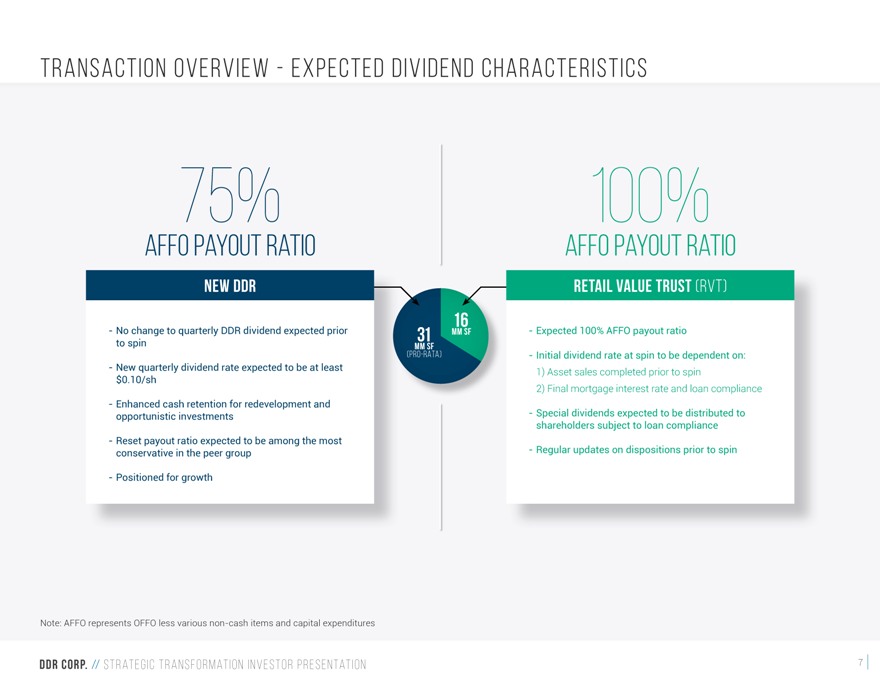

TRANSACTION OVERVIEW—EXPECTED DIVIDEND

CHARACTERISTICS

75%

AFFO PAYOUT RATIO

NEW DDR

No change to quarterly DDR dividend expected prior to spin

New quarterly dividend rate expected to be at least

$0.10/sh

Enhanced cash retention for redevelopment and opportunistic investments

Reset payout ratio

expected to be among the most conservative in the peer group

Positioned for growth

MM 16 SF MM 31 SF

(PRO-RATA)

100%

AFFO PAYOUT RATIO

RETAIL VALUE TRUST (RVT)

Expected 100% AFFO payout ratio

Initial dividend rate at spin to be dependent on:

1) Asset sales completed prior to spin

2) Final mortgage interest rate and loan compliance

Special dividends

expected to be distributed to shareholders subject to loan compliance

Regular updates on dispositions prior to spin

Note: AFFO represents OFFO less various non-cash items and capital expenditures

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

7

|

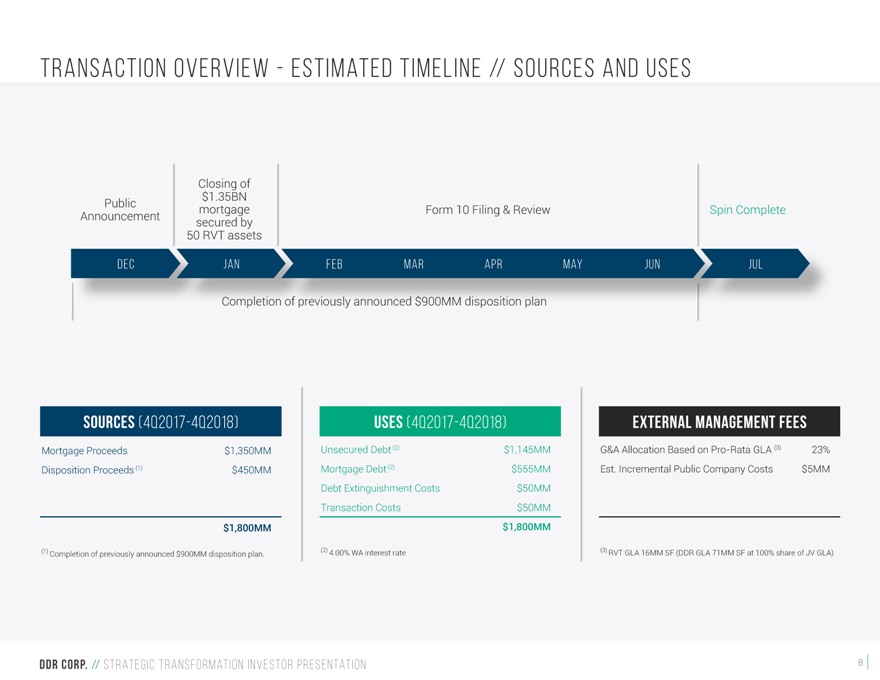

TRANSACTION OVERVIEW—ESTIMATED TIMELINE //

SOURCES AND USES

Closing $1.35BN of Public mortgage

Form 10 Filing &

Review Spin Complete Announcement secured by

50 RVT assets

DEC JAN FEB MAR

APR MAY JUN JUL

Completion of previously announced $900MM disposition plan

SOURCES (4Q2017-4Q2018)

Mortgage Proceeds $1,350MM

Disposition Proceeds (1) $450MM

$1,800MM

(1) Completion of previously announced $900MM disposition plan.

USES (4Q2017-4Q2018)

Unsecured Debt (2) $1,145MM Mortgage Debt (2) $555MM Debt Extinguishment Costs $50MM Transaction Costs $50MM $1,800MM

(2) 4.00% WA interest rate

EXTERNAL MANAGEMENT FEES

G&A Allocation Based on Pro-Rata GLA (3) 23% Est. Incremental Public Company Costs $5MM

(3) RVT GLA 16MM SF (DDR GLA 71MM SF at 100% share of JV GLA)

DDR CORP. // STRAT E G I C T R A

N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

8

|

NEW DDR OVERVIEW

9

|

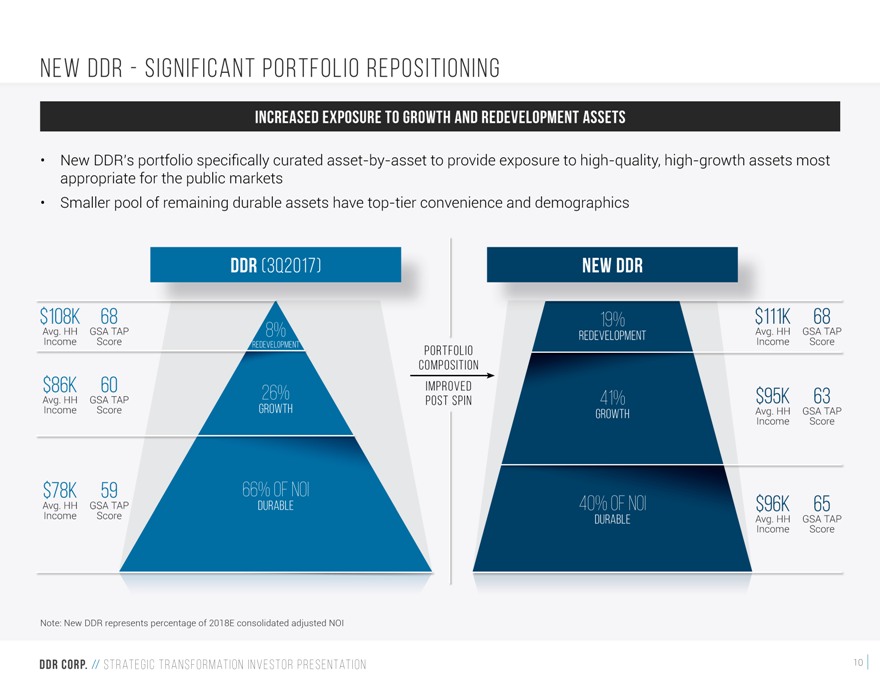

NEW DDR—SIGNIFICANT PORTFOLIO REPOSITIONING

INCREASED EXPOSURE TO GROWTH AND REDEVELOPMENT ASSETS

New DDR’s

portfolio specifically curated asset-by-asset to provide exposure to high-quality, high-growth assets most appropriate for the public markets Smaller pool of remaining

durable assets have top-tier convenience and demographics

DDR (3Q2017)

$108K 68

Avg. Income HH GSA Score TAP 8%

REDEVELOPMENT

$86K 60 26%

Avg. HH GSA TAP

Income Score GROWTH

$78K 59 66% OF NOI

Avg. Income HH GSA Score TAP DURABLE

Note: New DDR represents percentage of 2018E consolidated adjusted NOI

PORTFOLIO COMPOSITION

IMPROVED POST SPIN

NEW DDR

19% $111K 68

REDEVELOPMENT Avg. Income HH GSA Score TAP

41% $95K 63

GROWTH Avg. Income HH GSA Score TAP

40% OF NOI $96K 65

DURABLE Avg. Income HH GSA Score TAP

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

10

|

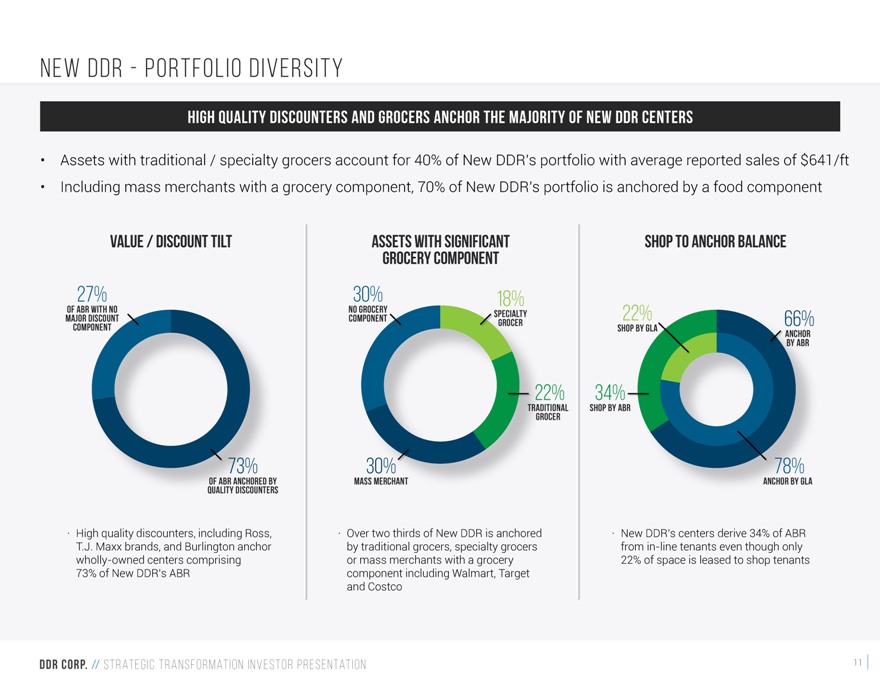

NEW DDR—PORTFOLIO DIVERSITY

HIGH QUALITY DISCOUNTERS AND GROCERS ANCHOR THE MAJORITY OF NEW DDR CENTERS

Assets with

traditional / specialty grocers account for 40% of New DDR’s portfolio with average reported sales of $641/ft Including mass merchants with a grocery component, 70% of New DDR’s portfolio is anchored by a food component

VALUE / DISCOUNT TILT

27%

MAJOR OF ABR DISCOUNT WITH NO

COMPONENT

73%

QUALITY OF ABR ANCHORED DISCOUNTERS BY

High quality discounters, including Ross, T.J. Maxx brands, and Burlington anchor wholly-owned centers comprising

73% of New DDR’s ABR

ASSETS WITH SIGNIFICANT SHOP TO ANCHOR BALANCE

GROCERY COMPONENT

30% 18%

NO COMPONENT GROCERY SPECIALTY 22% 66%

GROCER

SHOP BY GLA

ANCHOR BY ABR

22% 34%

TRADITIONAL GROCER SHOP BY ABR

30% 78%

MASS MERCHANT ANCHOR BY GLA

Over two thirds of New DDR is anchored by traditional grocers, specialty grocers or mass merchants with a grocery component including Walmart, Target and Costco

New DDR’s centers derive 34% of ABR from in-line tenants even though only 22% of space is leased to shop tenants

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

11

|

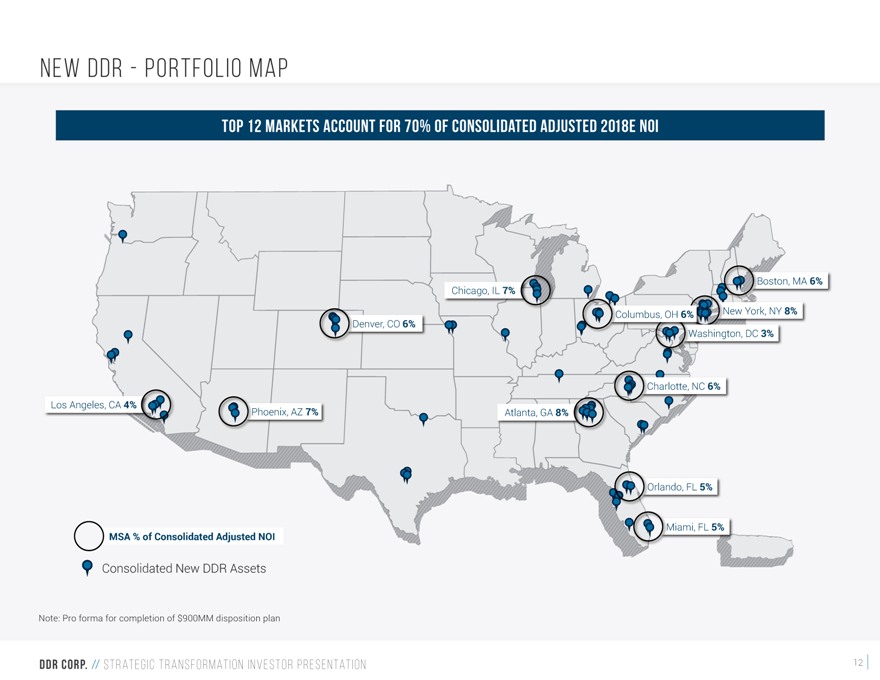

NEW DDR—PORTFOLIO MAP

TOP 12 MARKETS ACCOUNT FOR 70% OF CONSOLIDATED ADJUSTED 2018E NOI

Boston, MA 6%

Chicago, IL 7%

Columbus, OH 6% New York, NY 8%

Denver, CO 6%

Washington, DC 3%

Charlotte, NC 6%

Los Angeles, CA 4%

Phoenix, AZ 7% Atlanta, GA 8%

Orlando, FL 5%

Miami, FL 5%

MSA % of Consolidated Adjusted NOI

Consolidated New DDR Assets

Note: Pro forma for completion of $900MM disposition plan

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

12

|

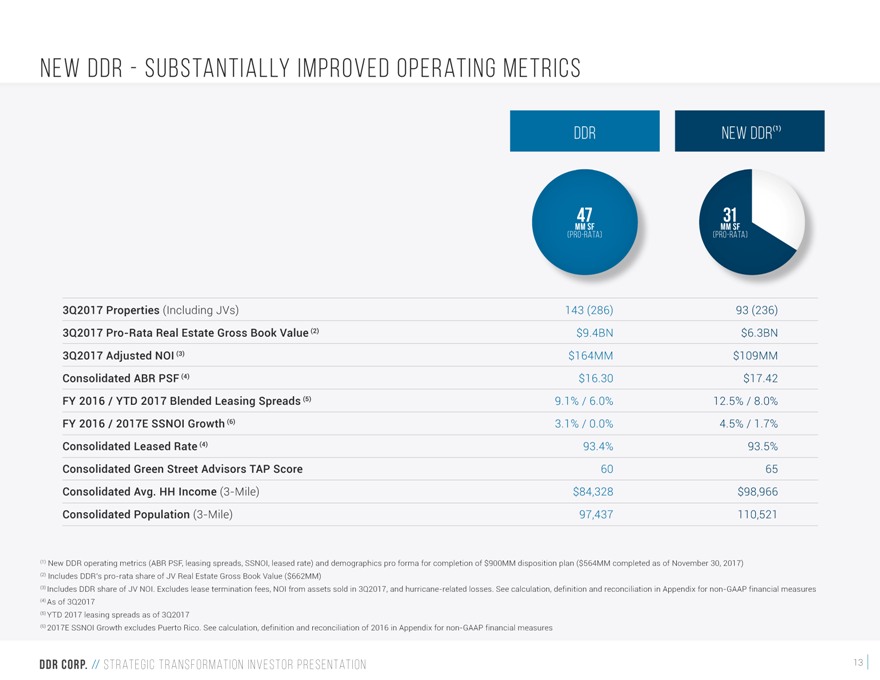

NEW DDR—SUBSTANTIALLY IMPROVED OPERATING

METRICS

DDR NEW DDR(1)

MM 47 SF MM 31 SF

(PRO-RATA) (PRO-RATA)

3Q2017 Properties (Including JVs) 143 (286) 93 (236)

3Q2017

Pro-Rata Real Estate Gross Book Value (2) $9.4BN $6.3BN

3Q2017 Adjusted NOI (3) $164MM $109MM

Consolidated ABR PSF (4) $16.30 $17.42

FY 2016 / YTD 2017 Blended Leasing Spreads (5) 9.1% /

6.0% 12.5% / 8.0%

FY 2016 / 2017E SSNOI Growth (6) 3.1% / 0.0% 4.5% / 1.7%

Consolidated Leased Rate (4) 93.4% 93.5%

Consolidated Green Street Advisors

TAP Score 60 65

Consolidated Avg. HH Income (3-Mile) $84,328 $98,966

Consolidated Population (3-Mile) 97,437 110,521

(1)

New DDR operating metrics (ABR PSF, leasing spreads, SSNOI, leased rate) and demographics pro forma for completion of $900MM disposition plan ($564MM completed as of November 30, 2017) (2) Includes DDR’s

pro-rata share of JV Real Estate Gross Book Value ($662MM)

(3) Includes DDR share of JV NOI. Excludes lease termination

fees, NOI from assets sold in 3Q2017, and hurricane-related losses. See calculation, definition and reconciliation in Appendix for non-GAAP financial measures

(4) As of 3Q2017

(5) YTD 2017 leasing spreads as of 3Q2017

(6) 2017E SSNOI Growth excludes Puerto Rico. See calculation, definition and reconciliation of 2016 in Appendix for non-GAAP financial

measures

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

13

|

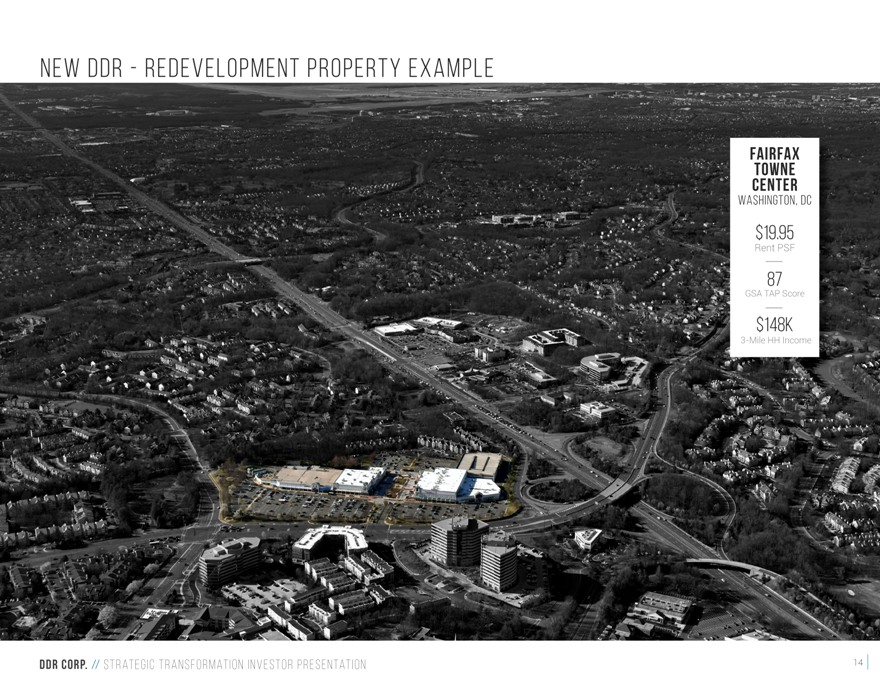

NEW DDR—REDEVELOPMENT PROPERTY EXAMPLE

FAIRFAX TOWNE

CENTER

WASHINGTON, DC

$19.95

Rent PSF

87

GSA TAP Score

$148K

3-Mile HH Income

DDR CORP. // STRAT E G I C T R A N S

F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

14

|

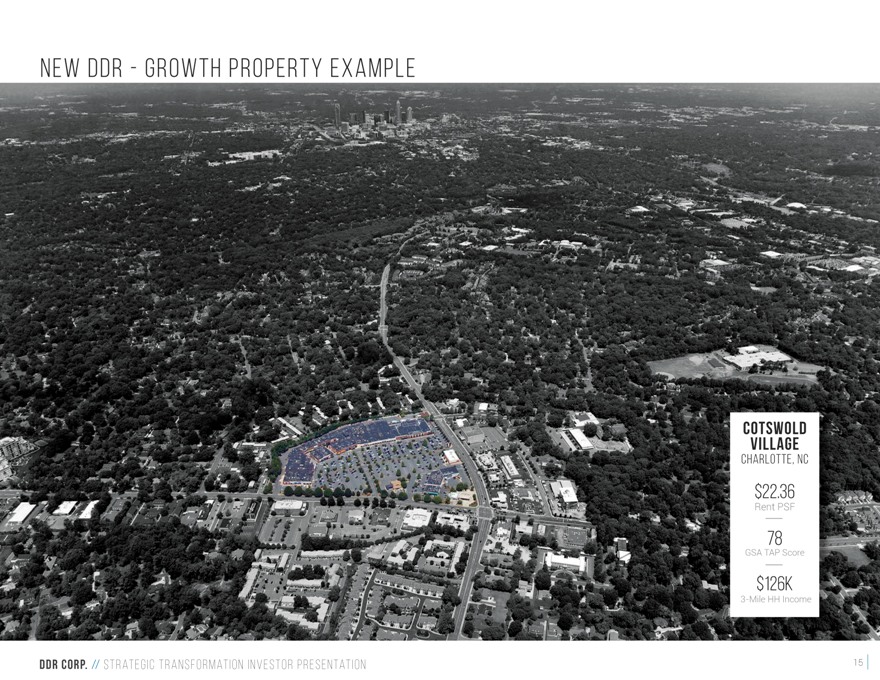

NEW DDR—GROWTH PROPERTY EXAMPLE

COTSWOLD VILLAGE

CHARLOTTE, NC

$22.36

Rent PSF

78

GSA TAP Score

$126K

3-Mile HH Income

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

15

|

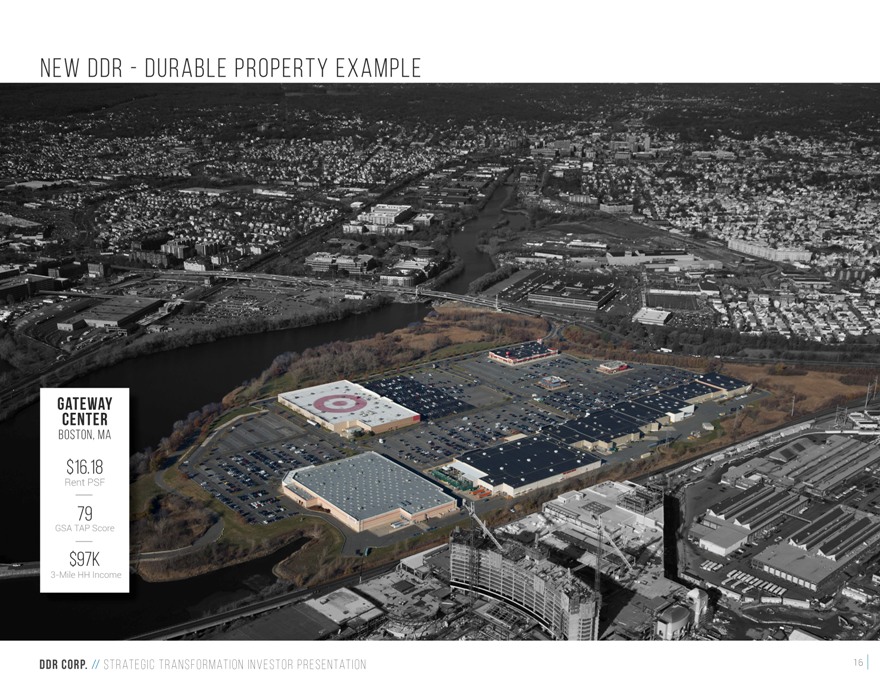

NEW DDR—DURABLE PROPERTY EXAMPLE

GATEWAY CENTER

BOSTON, MA

$16.18

Rent PSF

79

GSA TAP Score

$97K

3-Mile HH Income

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

16

|

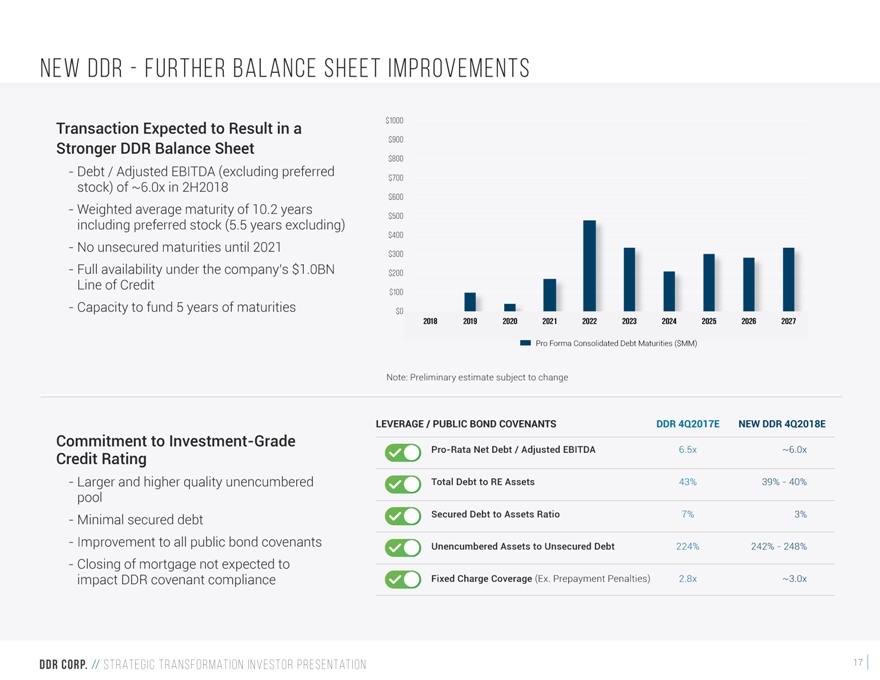

NEW DDR—FURTHER BALANCE SHEET IMPROVEMENTS

Transaction Expected to Result in a Stronger DDR Balance Sheet

Debt /

Adjusted EBITDA (excluding preferred stock) of ~6.0x in 2H2018

Weighted average maturity of 10.2 years including preferred stock (5.5 years excluding)

No unsecured maturities until 2021 Full availability under the company’s $1.0BN Line of Credit

Capacity to fund 5 years of maturities

$1000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

Pro Forma Consolidated Debt

Maturities ($MM)

Note: Preliminary estimate subject to change

Commitment to

Investment-Grade Credit Rating

Larger and higher quality unencumbered pool

Minimal secured debt

Improvement to all public bond covenants Closing of

mortgage not expected to impact DDR covenant compliance

LEVERAGE / PUBLIC BOND COVENANTS DDR 4Q2017E NEW DDR 4Q2018E

Pro-Rata Net Debt / Adjusted EBITDA 6.5x ~6.0x Total Debt to RE Assets 43% 39%—40% Secured Debt to Assets Ratio 7% 3% Unencumbered

Assets to Unsecured Debt 224% 242%—248%

Fixed Charge Coverage (Ex. Prepayment Penalties) 2.8x ~3.0x

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

17

|

RETAIL VALUE TRUST OVERVIEW

18

|

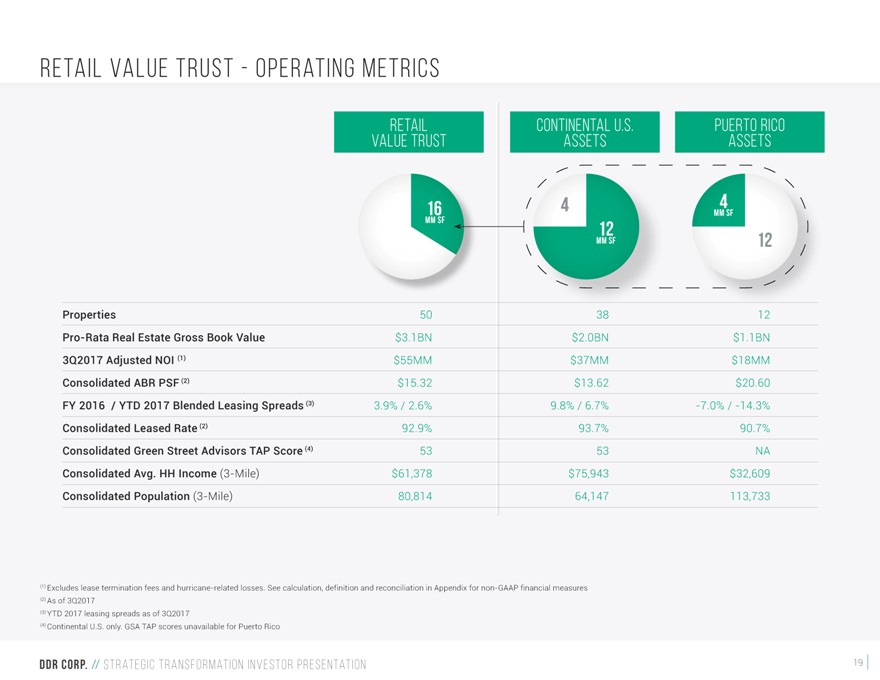

RETAIL VALUE TRUST—OPERATING METRICS

VALUE RETAIL TRUST CONTINENTAL ASSETS U.S. PUERTO ASSETS RICO

16 4 MM 4 SF

MM SF 12

MM SF 12

Properties 50 38 12

Pro-Rata Real Estate Gross Book

Value $3.1BN $2.0BN $1.1BN

3Q2017 Adjusted NOI (1) $55MM $37MM $18MM

Consolidated ABR PSF (2) $15.32 $13.62 $20.60

FY 2016 / YTD 2017 Blended

Leasing Spreads (3) 3.9% / 2.6% 9.8% / 6.7% -7.0% / -14.3%

Consolidated Leased Rate

(2) 92.9% 93.7% 90.7%

Consolidated Green Street Advisors TAP Score (4) 53 53 NA

Consolidated Avg. HH Income (3-Mile) $61,378 $75,943 $32,609

Consolidated Population (3-Mile) 80,814 64,147 113,733

(1) Excludes lease termination fees and hurricane-related losses. See calculation, definition and reconciliation in Appendix for

non-GAAP financial measures

(2) As of 3Q2017

(3) YTD 2017 leasing spreads as of 3Q2017

(4) Continental U.S. only. GSA TAP scores

unavailable for Puerto Rico

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

19

|

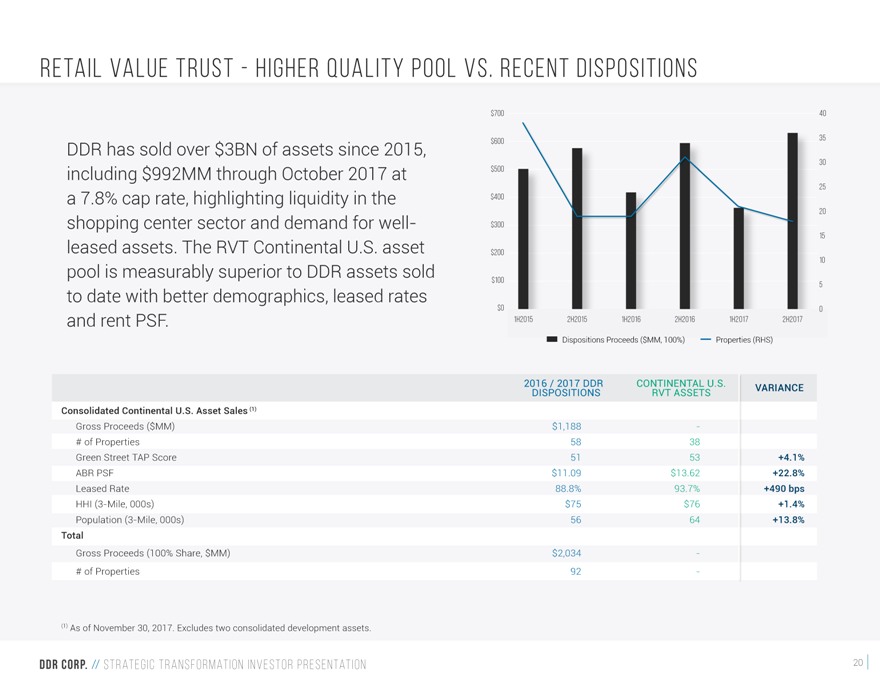

RETAIL VALUE TRUST—HIGHER QUALITY POOL VS.

RECENT DISPOSITIONS

DDR has sold over $3BN of assets since 2015, including $992MM through October 2017 at a 7.8% cap rate, highlighting liquidity in the shopping

center sector and demand for well-leased assets. The RVT Continental U.S. asset pool is measurably superior to DDR assets sold to date with better demographics, leased rates and rent PSF.

$700 40

$600 35

30

$500

25

$400

20

$300

15

$200 10

$100

5

$0 0

1H2015 2H2015 1H2016 2H2016 1H2017 2H2017

Dispositions Proceeds ($MM, 100%) Properties (RHS)

2016 / 2017 DDR CONTINENTAL U.S. VARIANCE

DISPOSITIONS RVT ASSETS

Consolidated Continental U.S. Asset Sales (1)

Gross Proceeds ($MM) $1,188 -

# of Properties 58 38

Green Street TAP Score 51 53 +4.1%

ABR PSF $11.09 $13.62 +22.8%

Leased Rate 88.8% 93.7% +490 bps

HHI (3-Mile, 000s)

$75 $76 +1.4%

Population (3-Mile, 000s) 56 64 +13.8%

Total

Gross Proceeds (100% Share, $MM) $2,034—

# of Properties 92—

(1) As of November 30, 2017. Excludes two consolidated

development assets.

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

20

|

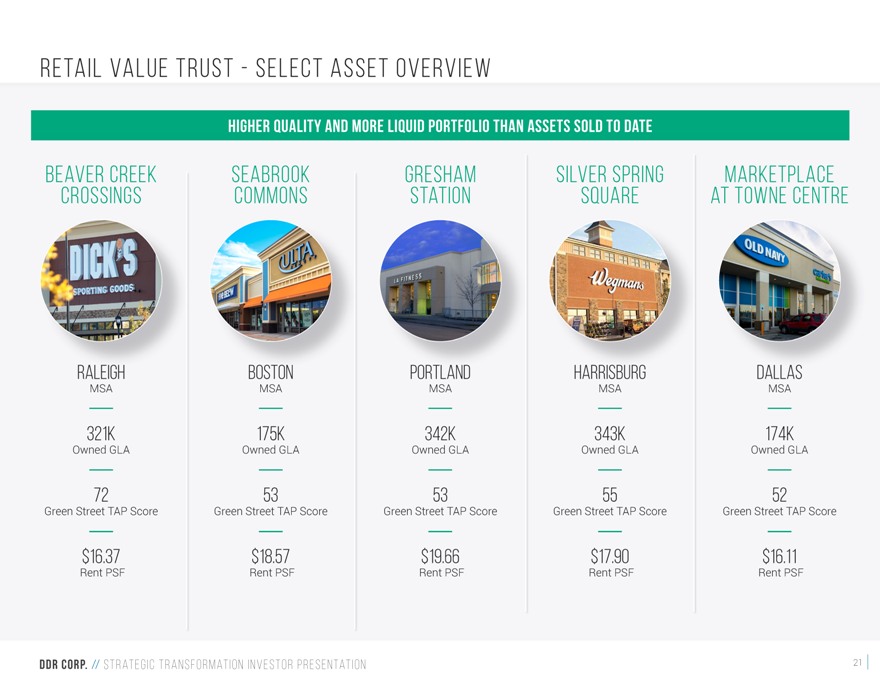

RETAIL VALUE TRUST—SELECT ASSET OVERVIEW

HIGHER QUALITY AND MORE LIQUID PORTFOLIO THAN ASSETS SOLD TO DATE

BEAVER

CREEK SEABROOK GRESHAM SILVER SPRING MARKETPLACE

CROSSINGS COMMONS STATION SQUARE AT TOWNE CENTRE

RALEIGH BOSTON PORTLAND HARRISBURG DALLAS

MSA MSA MSA MSA MSA

321K 175K 342K 343K 174K

Owned GLA Owned GLA Owned GLA Owned GLA Owned GLA

72 53 53 55 52

Green Street TAP Score Green Street TAP Score Green Street TAP Score Green

Street TAP Score Green Street TAP Score

$16.37 $18.57 $19.66 $17.90 $16.11

Rent PSF Rent PSF Rent PSF Rent PSF Rent PSF

DDR CORP. // STRAT E G I C T R A

N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

21

|

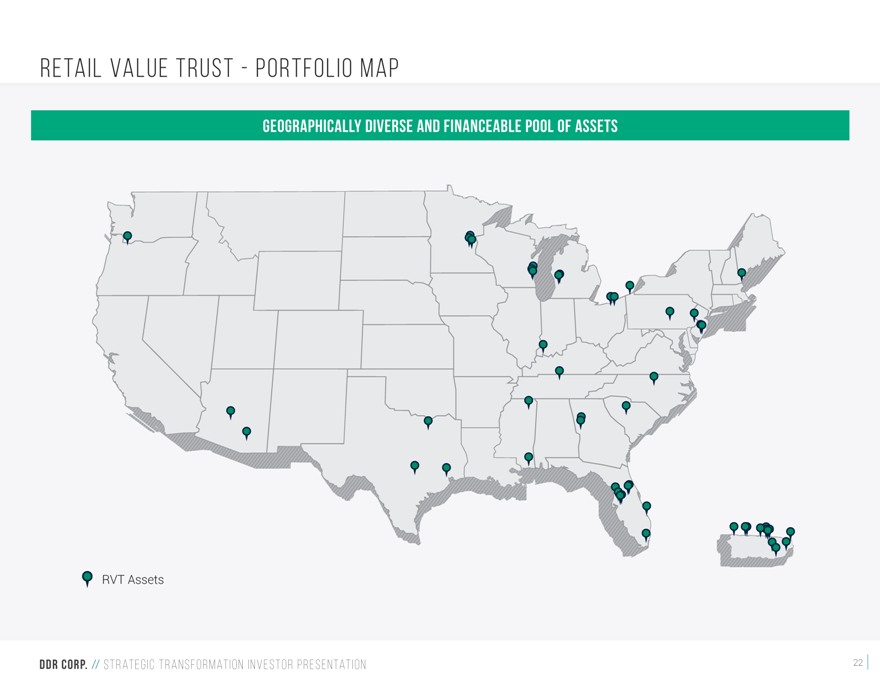

RETAIL VALUE TRUST—PORTFOLIO MAP

GEOGRAPHICALLY DIVERSE AND FINANCEABLE POOL OF ASSETS

RVT Assets

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

22

|

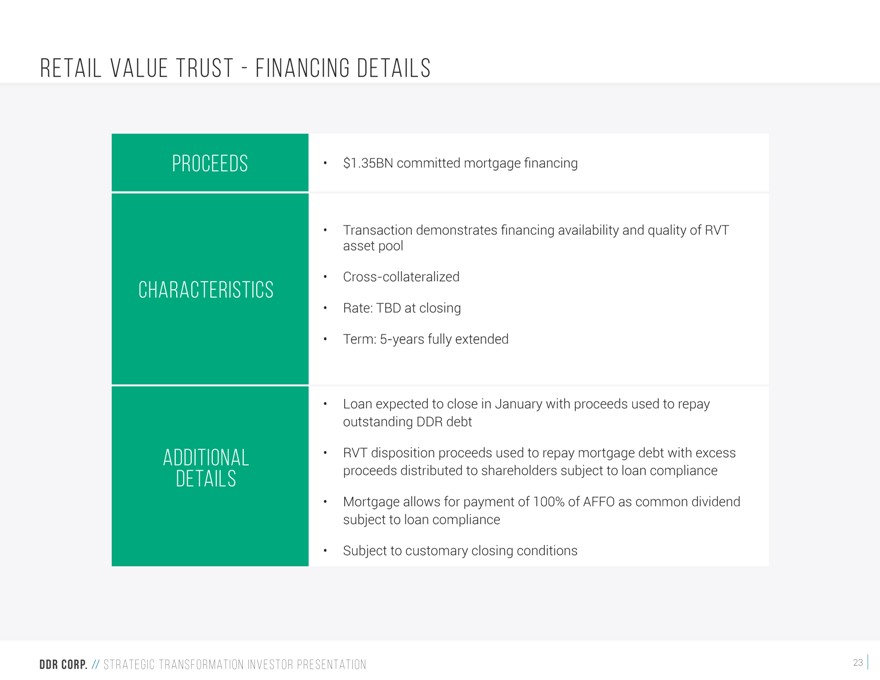

RETAIL VALUE TRUST—FINANCING DETAILS

PROCEEDS

CHARACTERISTICS

ADDITIONAL DETAILS

$1.35BN committed mortgage financing

Transaction demonstrates financing availability and quality of RVT asset pool

Cross-collateralized Rate: TBD at closing Term: 5-years fully extended

Loan expected to close in January with proceeds used to repay outstanding DDR debt RVT disposition proceeds used to repay mortgage debt with excess proceeds distributed to

shareholders subject to loan compliance Mortgage allows for payment of 100% of AFFO as common dividend subject to loan compliance Subject to customary closing conditions

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

23

|

APPENDIX

24

|

RETAIL VALUE TRUST PROPERTY LIST

(GLA IN THOUSANDS)

CONTINENTAL

U.S. 100% DDR OWNERSHIP

# Center MSA Location ST Owned GLA Total GLA

ABR PSF Key Tenants

1 Palm Valley Pavilions West Phoenix Goodyear AZ 233 277 $17.93 Barnes & Noble, Best Buy, Ross Dress for Less, Total Wine &

More

2 Tucson Spectrum Tucson Tucson AZ 717 970 $14.50 Bed Bath & Beyond, Best Buy, Food City, Harkins Theatres, Home Depot (U),

JCPenney, LA Fitness, Marshalls, Michaels, OfficeMax, Old Navy, Party City,

PetSmart, Ross Dress for Less, Target (U)

3 Brandon Boulevard

Shoppes Tampa Valrico FL 86 89 $15.48 LA Fitness

4 Homestead Pavilion Miami Homestead FL 300 391 $18.27 Bed Bath & Beyond, Kohl’s (U), Michaels, Ross

Dress for Less

5 International Drive Value Center Orlando Orlando FL 186 192 $10.44 Bed Bath & Beyond, dd’s Discounts, Ross Dress for Less, T.J. Maxx

6 Lake Walden Square Tampa Plant City FL 245 245 $11.48 Marshalls, Premiere Cinemas, Ross Dress for Less, Winn Dixie

7 Mariner Square Tampa Spring Hill FL 194 519 $9.54 Bealls, Ross Dress for Less, Sam’s Club (U), Walmart (U)

8 Millenia Plaza Orlando Orlando FL 412 412 $10.84 BJ’s Wholesale Club, Dick’s Sporting Goods, Home Depot, Ross Dress for

Less, Total Wine & More, Toys “R” Us/Babies “R” Us

9 Tequesta Shoppes Miami Tequesta FL 110 110 $11.46 Marshalls

10 The Walk at Highwoods

Preserve Tampa Tampa FL 138 232 $16.14 Best Buy, HomeGoods, Michaels, Muvico (U)

11 Douglasville Pavilion Atlanta Douglasville GA 267 370 $11.79 Big Lots,

Marshalls, Michaels, OfficeMax, PetSmart, Ross Dress for Less, Target (U)

12 Newnan Crossing Atlanta Newnan GA 223 453 $8.51 Hobby Lobby, Lowe’s, Walmart (U)

13 East Lloyd Commons Evansville Evansville IN 160 160 $16.03 Best Buy, Michaels

14 Grandville Marketplace Grand Rapids Grandville MI 224 372 $10.75 Hobby Lobby, Lowe’s (U), OfficeMax

15 Green Ridge Square Grand Rapids Grand Rapids MI 216 407 $13.62 Bed Bath & Beyond, Best Buy, Michaels, T.J. Maxx, Target (U), Toys “R” Us (U)

16 Maple Grove Crossing Minneapolis Maple Grove MN 262 350 $12.63 Barnes & Noble, Bed Bath & Beyond, Cub Foods (U), Kohl’s, Michaels

17 Midway Marketplace Minneapolis St. Paul MN 324 487 $8.64 Cub Foods, Herberger’s (U), LA Fitness, T.J. Maxx, Walmart

18 Riverdale Village Minneapolis Coon Rapids MN 788 968 $15.24 Bed Bath & Beyond, Best Buy, Costco (U), Dick’s Sporting Goods, DSW,

JCPenney, Jo-Ann, Kohl’s, Old Navy, T.J. Maxx

19 Big Oaks Crossing Tupelo Tupelo MS 348 348 $6.17 Jo-Ann, Sam’s Club, Walmart

20 Crossroads Center Gulfport Gulfport MS 555 591 $11.65 Academy Sports, Barnes & Noble, Belk, Burke’s Outlet, Cinemark, Forever 21,

Michaels, Ross Dress for Less, T.J. Maxx

21 Seabrook Commons Boston

Seabrook NH 175 393 $18.57 Dick’s Sporting Goods, Walmart (U)

22 Hamilton Commons Atlantic City Mays Landing NJ 397 397 $17.88 Bed Bath & Beyond,

Marshalls, Regal Cinemas, Ross Dress for Less

23 Wrangleboro Consumer Square Atlantic City Mays Landing NJ 842 842 $13.36 Babies “R” Us, Best Buy,

BJ’s Wholesale Club, Books-A-Million, Christmas Tree

Shops, Dick’s Sporting Goods, Just Cabinets, Kohl’s, Michaels, PetSmart, Staples, Target

24 Beaver Creek Crossings Raleigh Apex NC 321 321 $16.37 Burke’s Outlet, Dick’s Sporting Goods, Regal Beaver Creek 12, T.J. Maxx

CONTINUED TO NEXT PAGE >>>

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N

V E S T O R P R E S E N TAT I O N

25

|

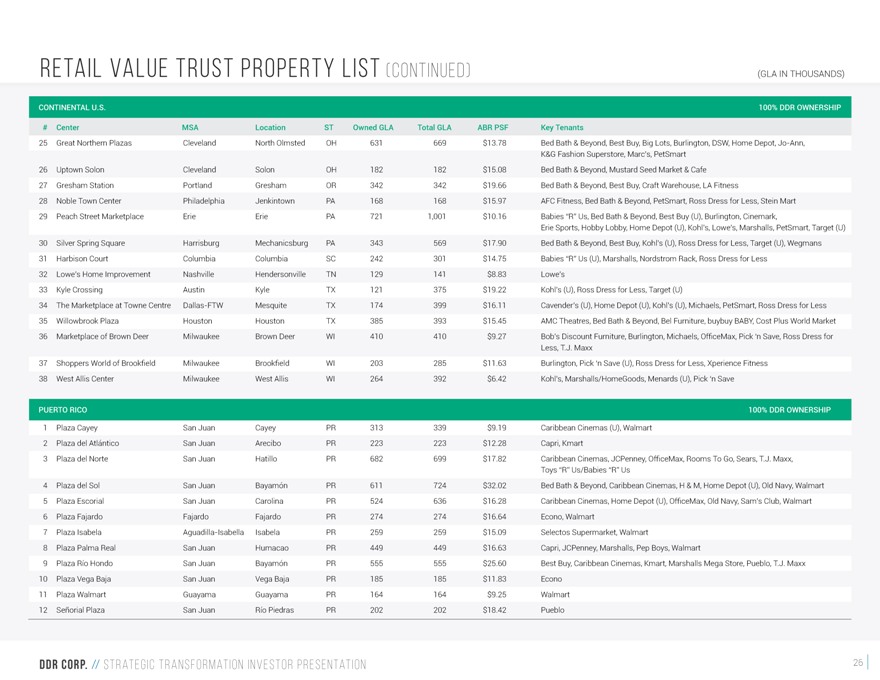

RETAIL VALUE TRUST PROPERTY LIST (CONTINUED)

(GLA IN THOUSANDS)

CONTINENTAL

U.S. 100% DDR OWNERSHIP

# Center MSA Location ST Owned GLA Total GLA

ABR PSF Key Tenants

25 Great Northern Plazas Cleveland North Olmsted OH 631 669 $13.78 Bed Bath & Beyond, Best Buy, Big Lots, Burlington, DSW, Home Depot,

Jo-Ann, K&G Fashion Superstore, Marc’s, PetSmart

26 Uptown Solon Cleveland Solon OH 182 182 $15.08 Bed Bath & Beyond, Mustard Seed Market & Cafe

27 Gresham Station Portland Gresham OR 342 342 $19.66 Bed Bath & Beyond, Best Buy, Craft Warehouse, LA Fitness

28 Noble Town Center Philadelphia Jenkintown PA 168 168 $15.97 AFC Fitness, Bed Bath & Beyond, PetSmart, Ross Dress for Less, Stein Mart

29 Peach Street Marketplace Erie Erie PA 721 1,001 $10.16 Babies “R” Us, Bed Bath & Beyond, Best Buy (U), Burlington, Cinemark,

Erie Sports, Hobby Lobby, Home Depot (U), Kohl’s, Lowe’s, Marshalls, PetSmart, Target (U)

30 Silver Spring Square Harrisburg Mechanicsburg PA 343 569 $17.90 Bed Bath & Beyond, Best Buy, Kohl’s (U), Ross Dress for Less, Target (U), Wegmans

31 Harbison Court Columbia Columbia SC 242 301 $14.75 Babies “R” Us (U), Marshalls, Nordstrom Rack, Ross Dress for Less

32 Lowe’s Home Improvement Nashville Hendersonville TN 129 141 $8.83 Lowe’s

33 Kyle

Crossing Austin Kyle TX 121 375 $19.22 Kohl’s (U), Ross Dress for Less, Target (U)

34 The Marketplace at Towne Centre

Dallas-FTW Mesquite TX 174 399 $16.11 Cavender’s (U), Home Depot (U), Kohl’s (U), Michaels, PetSmart, Ross Dress for Less

35 Willowbrook Plaza Houston Houston TX 385 393 $15.45 AMC Theatres, Bed Bath & Beyond, Bel Furniture, buybuy BABY, Cost Plus World Market

36 Marketplace of Brown Deer Milwaukee Brown Deer WI 410 410 $9.27 Bob’s Discount Furniture, Burlington, Michaels, OfficeMax, Pick ‘n Save, Ross Dress

for Less, T.J. Maxx

37 Shoppers World of Brookfield Milwaukee

Brookfield WI 203 285 $11.63 Burlington, Pick ‘n Save (U), Ross Dress for Less, Xperience Fitness

38 West Allis Center Milwaukee West Allis WI 264 392 $6.42

Kohl’s, Marshalls/HomeGoods, Menards (U), Pick ‘n Save

PUERTO

RICO 100% DDR OWNERSHIP

1 Plaza Cayey San Juan Cayey PR 313 339

$9.19 Caribbean Cinemas (U), Walmart

2 Plaza del Atlántico San Juan Arecibo PR 223 223 $12.28 Capri, Kmart

3 Plaza del Norte San Juan Hatillo PR 682 699 $17.82 Caribbean Cinemas, JCPenney, OfficeMax, Rooms To Go, Sears, T.J.

Maxx, Toys “R” Us/Babies “R” Us

4 Plaza del Sol

San Juan Bayamón PR 611 724 $32.02 Bed Bath & Beyond, Caribbean Cinemas, H & M, Home Depot (U), Old Navy, Walmart

5 Plaza Escorial San

Juan Carolina PR 524 636 $16.28 Caribbean Cinemas, Home Depot (U), OfficeMax, Old Navy, Sam’s Club, Walmart

6 Plaza Fajardo Fajardo Fajardo PR 274 274 $16.64

Econo, Walmart

7 Plaza Isabela Aguadilla-Isabella Isabela PR 259 259 $15.09 Selectos Supermarket, Walmart

8 Plaza Palma Real San Juan Humacao PR 449 449 $16.63 Capri, JCPenney, Marshalls, Pep Boys, Walmart

9 Plaza Río Hondo San Juan Bayamón PR 555 555 $25.60 Best Buy, Caribbean Cinemas, Kmart, Marshalls Mega Store, Pueblo, T.J. Maxx

10 Plaza Vega Baja San Juan Vega Baja PR 185 185 $11.83 Econo

11 Plaza Walmart Guayama Guayama

PR 164 164 $9.25 Walmart

12 Señorial Plaza San Juan Río Piedras PR 202 202 $18.42 Pueblo

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

26

|

NON-GAAP

FINANCIAL MEASURES—DEFINITIONS

The Company uses Net Operating Income (“NOI”), a non-GAAP financial measure,

as a supplemental performance measure. NOI is calculated herein as property revenues less property expenses. The Company believes NOI provides useful information to investors regarding the Company’s financial condition and results of operations

because it reflects only those income and expense items that are incurred at the property level and, when compared across periods, reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition and

disposition activity on an unleveraged basis. The Company has further adjusted NOI to exclude lease termination fees, hurricane-related losses and activity associated with all properties sold during the third quarter ended September 30, 2017

(“Adjusted NOI”).

The Company also presents NOI information on a same store basis or SSNOI. The Company defines SSNOI as property revenues less

property-related expenses, which exclude straight-line rental income and expenses, lease termination income, management fee expense, fair market value of leases and expense recovery adjustments. SSNOI also excludes activity associated with

development and major redevelopment and single tenant assets and includes assets owned in comparable periods. SSNOI excludes all non-property and corporate level revenue and expenses as well as

hurricane-related losses. Other real estate companies may calculate SSNOI in a different manner. The Company believes SSNOI provides investors with additional information regarding the operating performances of comparable assets because it excludes

certain non-cash and non-comparable items as noted above. SSNOI is frequently used by the real estate industry, as well as securities analysts, investors and other

interested parties, to evaluate the performance of REITs.

The Company believes that Adjusted NOI and SSNOI are not, and are not intended to be, presentations in

accordance with GAAP. Adjusted NOI and SSNOI information have their limitations as they exclude any capital expenditures associated with the re-leasing of tenant space or as needed to operate the assets.

Adjusted NOI and SSNOI do not represent amounts available for dividends, capital replacement or expansion, debt service obligations or other commitments and uncertainties. Management does not use Adjusted NOI or SSNOI as indicators of the

Company’s cash obligations and funding requirements for future commitments, acquisitions or development activities. Adjusted NOI and SSNOI do not represent cash generated from operating activities in accordance with GAAP, and are not

necessarily indicative of cash available to fund cash needs. Adjusted NOI and SSNOI should not be considered as alternatives to net income (computed in accordance with GAAP), as indicators of operating performance or as alternatives to cash flow as

measures of liquidity. Reconciliations of Adjusted NOI and SSNOI to the most directly comparable GAAP measure of net income (loss) have been provided herein.

DDR

CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

27

|

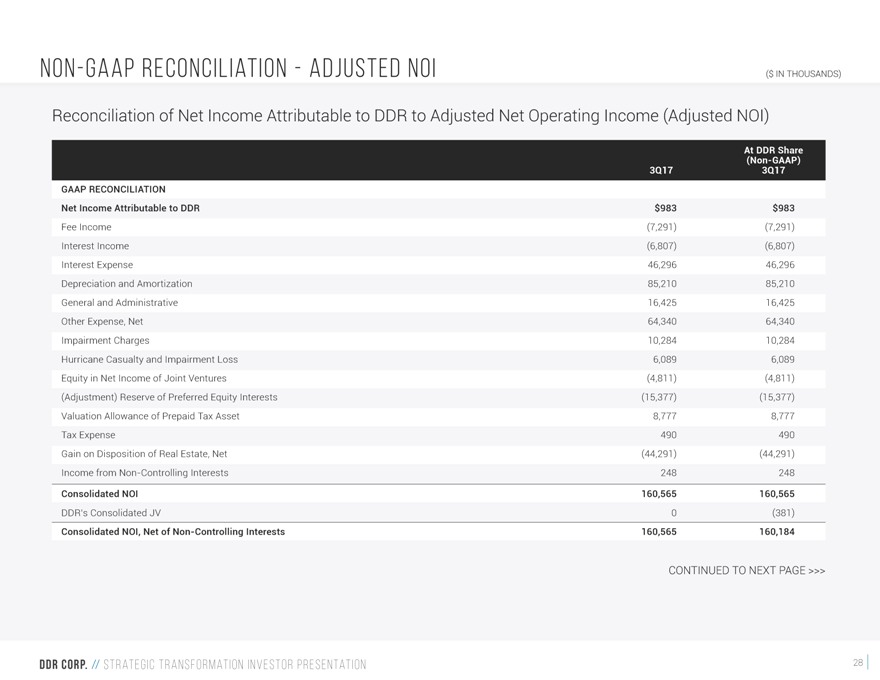

NON-GAAP

RECONCILIATION—ADJUSTED NOI

($ IN THOUSANDS)

Reconciliation of Net

Income Attributable to DDR to Adjusted Net Operating Income (Adjusted NOI)

At (Non DDR -GAAP) Share

3Q17 3Q17

GAAP RECONCILIATION

Net Income Attributable to DDR $983 $983

Fee Income (7,291) (7,291)

Interest Income (6,807) (6,807)

Interest Expense 46,296 46,296

Depreciation and Amortization 85,210 85,210

General and Administrative 16,425 16,425

Other Expense, Net 64,340 64,340

Impairment Charges 10,284 10,284

Hurricane Casualty and Impairment Loss 6,089 6,089

Equity in Net Income of Joint Ventures

(4,811) (4,811)

(Adjustment) Reserve of Preferred Equity Interests (15,377) (15,377)

Valuation Allowance of Prepaid Tax Asset 8,777 8,777

Tax Expense 490 490

Gain on Disposition of Real Estate, Net (44,291) (44,291)

Income from Non-Controlling Interests 248 248

Consolidated NOI 160,565 160,565

DDR’s Consolidated JV 0 (381)

Consolidated NOI, Net of

Non-Controlling Interests 160,565 160,184

CONTINUED TO NEXT PAGE >>>

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

28

|

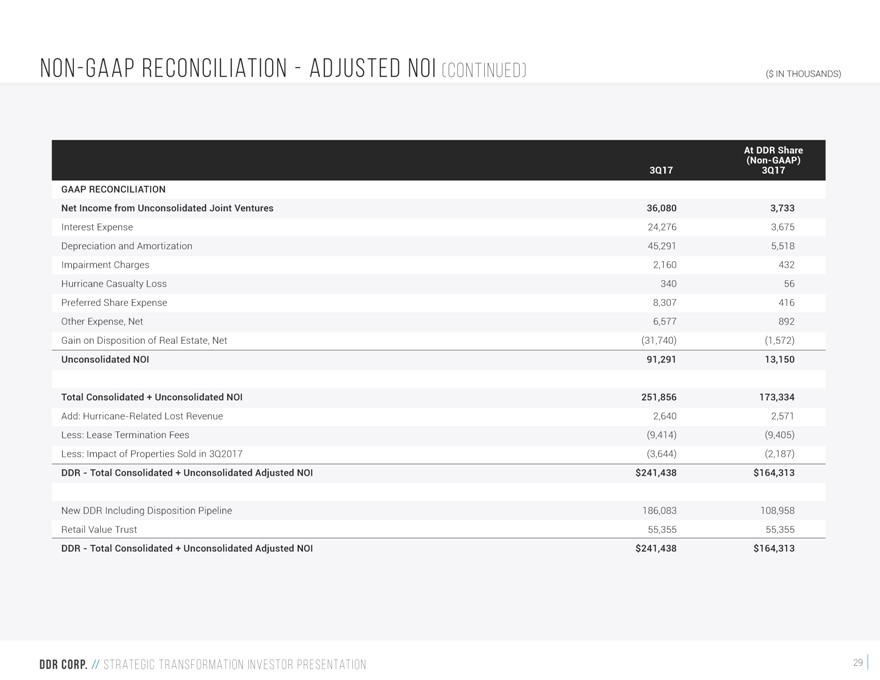

NON-GAAP

RECONCILIATION—ADJUSTED NOI (CONTINUED)

($ IN THOUSANDS)

At (Non-GAAP) DDR Share

3Q17 3Q17

GAAP

RECONCILIATION

Net Income from Unconsolidated Joint Ventures 36,080 3,733

Interest Expense 24,276 3,675

Depreciation and Amortization 45,291 5,518

Impairment Charges 2,160 432

Hurricane Casualty Loss 340 56

Preferred Share Expense 8,307 416

Other Expense, Net 6,577 892

Gain on Disposition of Real Estate, Net (31,740) (1,572)

Unconsolidated NOI 91,291 13,150

Total Consolidated + Unconsolidated NOI 251,856 173,334

Add:

Hurricane-Related Lost Revenue 2,640 2,571

Less: Lease Termination Fees (9,414) (9,405)

Less: Impact of Properties Sold in 3Q2017 (3,644) (2,187)

DDR—Total Consolidated +

Unconsolidated Adjusted NOI $241,438 $164,313

New DDR Including Disposition Pipeline 186,083 108,958

Retail Value Trust 55,355 55,355

DDR—Total Consolidated + Unconsolidated Adjusted NOI

$241,438 $164,313

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

29

|

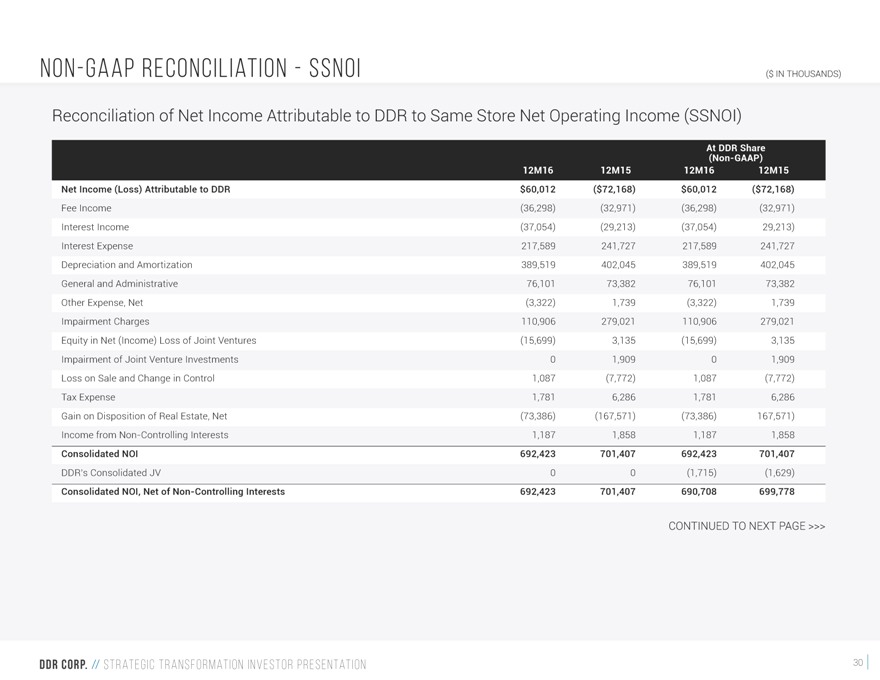

NON-GAAP

RECONCILIATION—SSNOI

($ IN THOUSANDS)

Reconciliation of Net Income

Attributable to DDR to Same Store Net Operating Income (SSNOI)

At (Non-GAAP) DDR Share 12M16 12M15

12M16 12M15

Net Income (Loss) Attributable to DDR $60,012 ($72,168) $60,012 ($72,168)

Fee Income (36,298) (32,971) (36,298) (32,971)

Interest Income (37,054) (29,213) (37,054)

29,213)

Interest Expense 217,589 241,727 217,589 241,727 Depreciation and Amortization 389,519 402,045 389,519 402,045 General and Administrative 76,101 73,382

76,101 73,382 Other Expense, Net (3,322) 1,739 (3,322) 1,739 Impairment Charges 110,906 279,021 110,906 279,021 Equity in Net (Income) Loss of Joint Ventures (15,699) 3,135 (15,699) 3,135

Impairment of Joint Venture Investments 0 1,909 0 1,909

Loss on Sale and Change in Control

1,087 (7,772) 1,087 (7,772) Tax Expense 1,781 6,286 1,781 6,286 Gain on Disposition of Real Estate, Net (73,386) (167,571) (73,386) 167,571) Income from Non-Controlling Interests 1,187 1,858 1,187 1,858

Consolidated NOI 692,423 701,407 692,423 701,407

DDR’s Consolidated JV 0

0 (1,715) (1,629)

Consolidated NOI, Net of Non-Controlling Interests 692,423 701,407 690,708 699,778

CONTINUED TO NEXT PAGE >>>

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N

V E S T O R P R E S E N TAT I O N

30

|

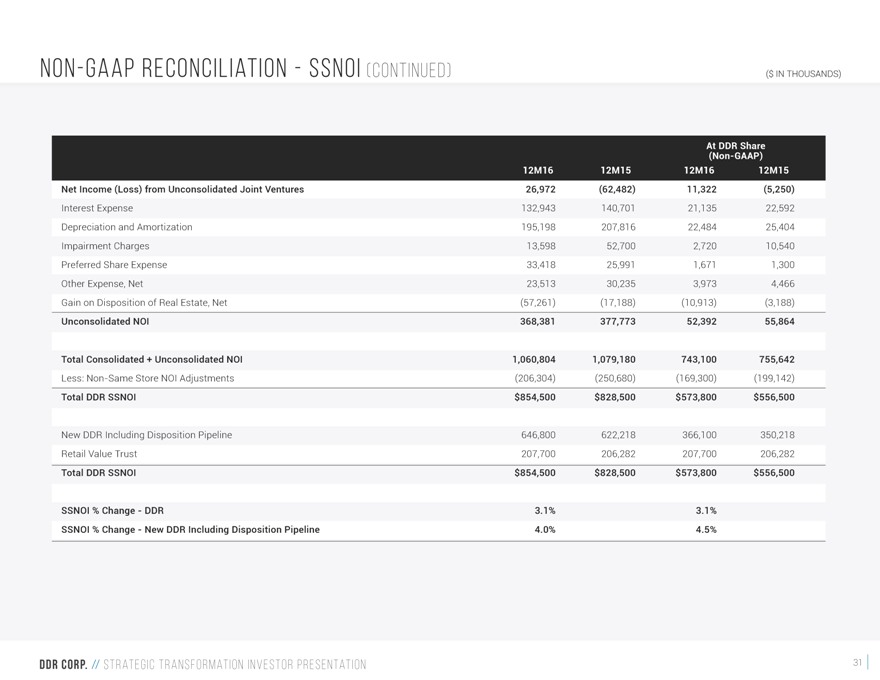

NON-GAAP

RECONCILIATION—SSNOI (CONTINUED)

($ IN THOUSANDS)

At (Non-GAAP) DDR Share 12M16 12M15 12M16 12M15

Net Income (Loss) from Unconsolidated Joint Ventures 26,972

(62,482) 11,322 (5,250)

Interest Expense 132,943 140,701 21,135 22,592

Depreciation and Amortization 195,198 207,816 22,484 25,404 Impairment Charges 13,598 52,700 2,720 10,540 Preferred Share Expense 33,418 25,991 1,671 1,300 Other

Expense, Net 23,513 30,235 3,973 4,466 Gain on Disposition of Real Estate, Net (57,261) (17,188) (10,913) (3,188)

Unconsolidated NOI 368,381 377,773 52,392 55,864

Total Consolidated + Unconsolidated NOI 1,060,804 1,079,180 743,100 755,642

Less: Non-Same Store NOI Adjustments (206,304) (250,680) (169,300) (199,142)

Total DDR SSNOI $854,500 $828,500 $573,800 $556,500

New DDR Including Disposition Pipeline

646,800 622,218 366,100 350,218 Retail Value Trust 207,700 206,282 207,700 206,282

Total DDR SSNOI $854,500 $828,500 $573,800 $556,500

SSNOI % Change—DDR 3.1% 3.1% SSNOI % Change—New DDR Including Disposition Pipeline 4.0% 4.5%

DDR CORP. // STRAT E G I C T R A N S F O R M AT I O N I N V E S T O R P R E S E N TAT I O N

31