Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - WESCO INTERNATIONAL INC | wcc-2018outlooknewsrelease.htm |

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | wcc-8k2018outlook.htm |

Webcast Presentation – December 13, 2017

2018 Outlook

2

Safe Harbor Statement

All statements made herein that are not historical facts should be considered as “forward-looking statements”

within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown

risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties

and other factors include, but are not limited to: adverse economic conditions; disruptions in operations or

information technology systems; supply chain disruptions, changes in supplier strategy or loss of key suppliers;

product or other cost fluctuations; expansion of business activities; personnel turnover or labor cost increases; tax

law changes or challenges to tax matters; increase in competition; risks related to acquisitions, including the

integration of acquired businesses; exchange rate fluctuations; legal or regulatory matters; litigation, disputes,

contingencies or claims; debt levels, terms, financial market conditions or interest rate fluctuations; goodwill or

intangible asset impairment; stock market, economic or political instability; and other factors described in detail in

the Form 10-K for WESCO International, Inc. for the year ended December 31, 2016 and any subsequent filings

with the Securities & Exchange Commission. The following presentation includes a discussion of certain non-

GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial

measures can be found in the appendix and obtained via WESCO’s website, www.wesco.com.

3

2018 Priorities

• Outperform the end markets

− Execute One WESCO sales growth initiatives

− Maintain focus on sales execution and effectiveness

− Differentiate via value-added services

− Capitalize on growth markets

− Make accretive acquisitions

• Sustain and expand operating margin

− Execute pricing and sourcing initiatives

− Increase focus and awareness on the value of our services

− Deliver productivity through operational excellence initiatives

• Maintain strong free cash flow generation and flexible capital structure

− Execute against capital deployment priorities

…outperform the market while maintaining cost and cash management discipline

4

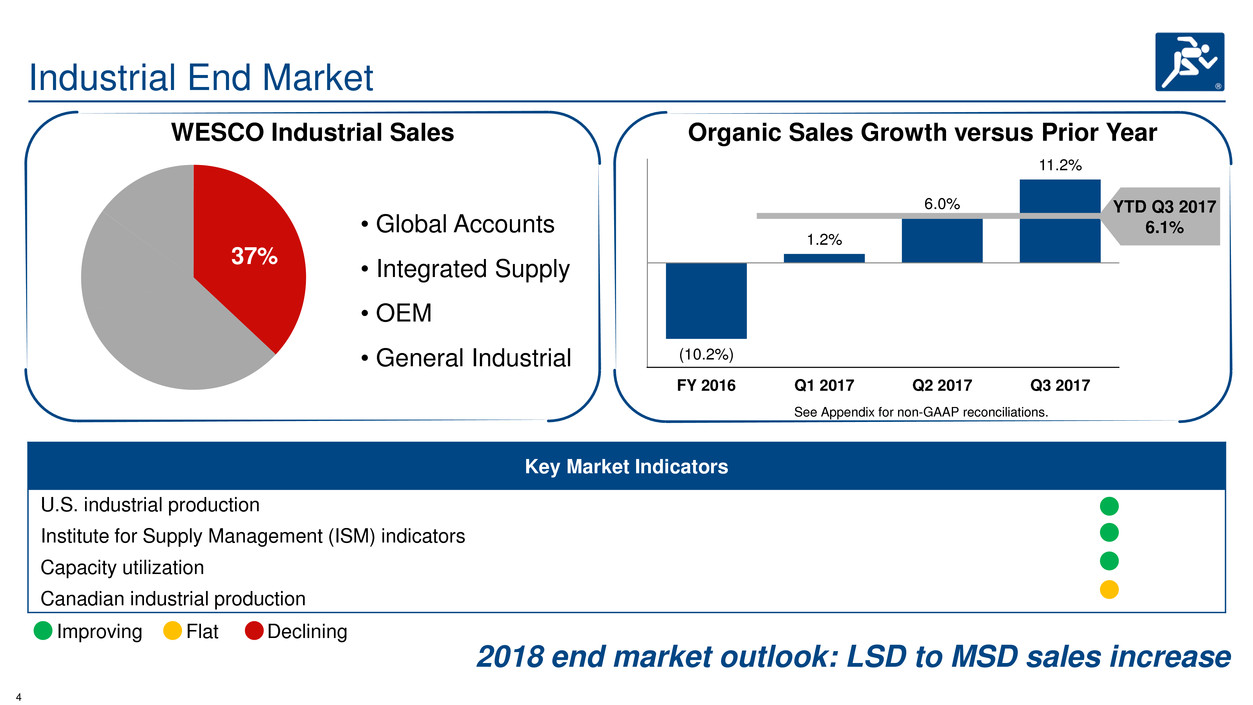

Improving Flat Declining

(10.2%)

1.2%

6.0%

11.2%

FY 2016 Q1 2017 Q2 2017 Q3 2017

Organic Sales Growth versus Prior Year 42%

Key Market Indicators

U.S. industrial production

Institute for Supply Management (ISM) indicators

Capacity utilization

Canadian industrial production

• Global Accounts

• Integrated Supply

• OEM

• General Industrial

WESCO Industrial Sales

37%

YTD Q3 2017

6.1%

See Appendix for non-GAAP reconciliations.

Industrial End Market

2018 end market outlook: LSD to MSD sales increase

5

(2.2%)

(3.6%)

(4.4%)

6.0%

FY 2016 Q1 2017 Q2 2017 Q3 2017

Key Market Indicators

Architectural Billings Index

Capital goods orders growth

U.S. construction starts and put in place

Canadian non-residential construction

• Non-residential

• Contractors

33%

YTD Q3 2017

(0.6%)

Construction End Market

2018 end market outlook: Flat to MSD sales increase

Organic Sales Growth versus Prior Year WESCO Construction Sales

Improving Flat Declining

See Appendix for non-GAAP reconciliations.

6

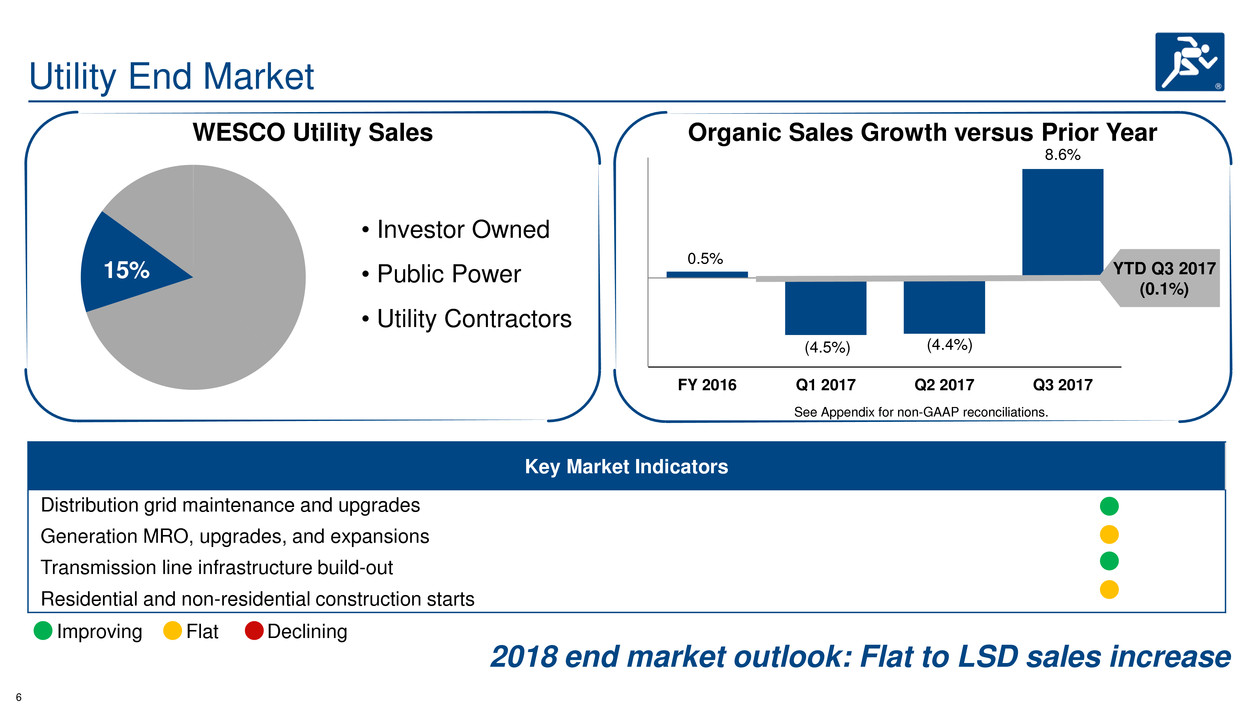

0.5%

(4.5%) (4.4%)

8.6%

FY 2016 Q1 2017 Q2 2017 Q3 2017

42%

Key Market Indicators

Distribution grid maintenance and upgrades

Generation MRO, upgrades, and expansions

Transmission line infrastructure build-out

Residential and non-residential construction starts

• Investor Owned

• Public Power

• Utility Contractors

15% YTD Q3 2017

(0.1%)

Utility End Market

2018 end market outlook: Flat to LSD sales increase

Organic Sales Growth versus Prior Year WESCO Utility Sales

Improving Flat Declining

See Appendix for non-GAAP reconciliations.

7

(1.7%) (2.0%)

7.4%

9.0%

FY 2016 Q1 2017 Q2 2017 Q3 2017

Key Market Indicators

Government spending

Communications and security upgrades

Education, healthcare and financial

• Commercial

• Institutional

• Government

15%

YTD Q3 2017

4.9%

CIG End Market

2018 end market outlook: LSD to MSD sales increase

Organic Sales Growth versus Prior Year WESCO CIG Sales

Improving Flat Declining

See Appendix for non-GAAP reconciliations.

8

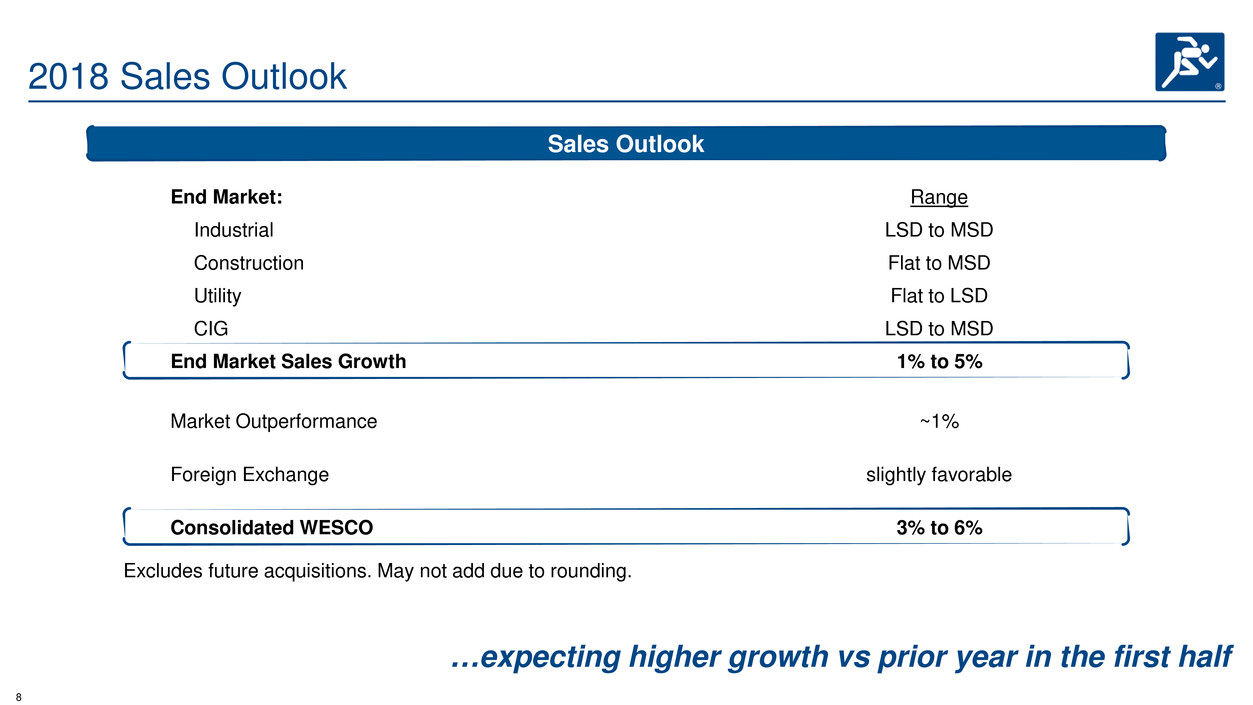

2018 Sales Outlook

Sales Outlook

End Market: Range

Industrial LSD to MSD

Construction Flat to MSD

Utility Flat to LSD

CIG LSD to MSD

End Market Sales Growth 1% to 5%

Market Outperformance ~1%

Foreign Exchange slightly favorable

Consolidated WESCO 3% to 6%

Excludes future acquisitions. May not add due to rounding.

…expecting higher growth vs prior year in the first half

9

2018 Sales Outlook by Geography

U.S.

Canada

International

LSD to MSD growth

LSD to MSD growth

Flat

…expecting solid U.S. and Canadian growth

Sales Outlook

Excludes future acquisitions.

10

Range

2017 Operating Margin Outlook 4.1% to 4.3%

Expected margin improvement

• Operating leverage

• Favorable business mix

• Improved pricing

+30 to 50 bps

Subtotal

Fully restore variable compensation

4.4% to 4.8%

(20 bps)

2018 Operating Margin Outlook

4.2% to 4.6%

2018 Operating Margin Outlook

…outlook delivers >50% pull-through before restoring variable compensation

May not add due to rounding.

11

3.80 ~3.75

~4.05

2016 2017E 2018E

2018 Financial Outlook

Sales

($B)

Diluted EPS(1)

($)

~4.55

4.5%

~4.1% ~4.2%

2016 2017E 2018E

Operating Margin

(%)

Sales +3% to 6% Effective tax rate ~28%

Diluted shares outstanding ~47.5M

7.3 ~7.6

~7.8

2016 2017E 2018E

~8.1 ~4.6% ~4.3% ~3.95

Margin improvement

Variable compensation

restoration

+30 to 50 bps

(20) bps

…sales and margin improvement are expected to drive double-digit EPS growth

(1) Earnings per diluted share in 2016 was $2.10, based on 48.3 million diluted shares. Adjusted earnings per diluted share for 2016 was $3.80, which excludes the third quarter 2016 loss per diluted

share of approximately $1.70 resulting from the redemption of the Company’s 6.0% Convertible Senior Debentures due 2029.

Outlook excludes impacts from proposed U.S. tax reform.

12

1.5

2

2.5

3

3.5

4

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3

Cash Generation and Leverage

(1) See Appendix for non-GAAP reconciliations.

(2) Excludes the third quarter 2016 loss of $123.9M and related income tax benefit of $41.2M resulting from the redemption of the Company’s 6.0% Convertible Senior Debentures due 2029.

125%

154%

~90%

Free Cash Flow(1) as a Percentage

of Adjusted Net Income(2)

Leverage

(Total Debt to TTM EBITDA)(1) ~$1B of free

cash flow over

last 4 years Target Leverage

2.0x – 3.5x

3.7X

2015 2016 2017

…expecting 2018 free cash flow of at least 90% of net income

2015 2016 2017E

13

Effective Capital Allocation

Added New Share Repurchase Program

• Up to $300M through end of 2020

• Replaces previous $300M authorization

expiring in 2017

− utilized $250M through Q3 2017

• Authorization will enable WESCO to:

− offset dilution from annual equity awards

− make opportunistic purchases

…maintaining fiscal discipline while funding sales and EPS growth

Consistent Cash Deployment Priorities

• Support organic growth

• Fund accretive acquisitions

• Manage financial leverage

• Repurchase shares

14

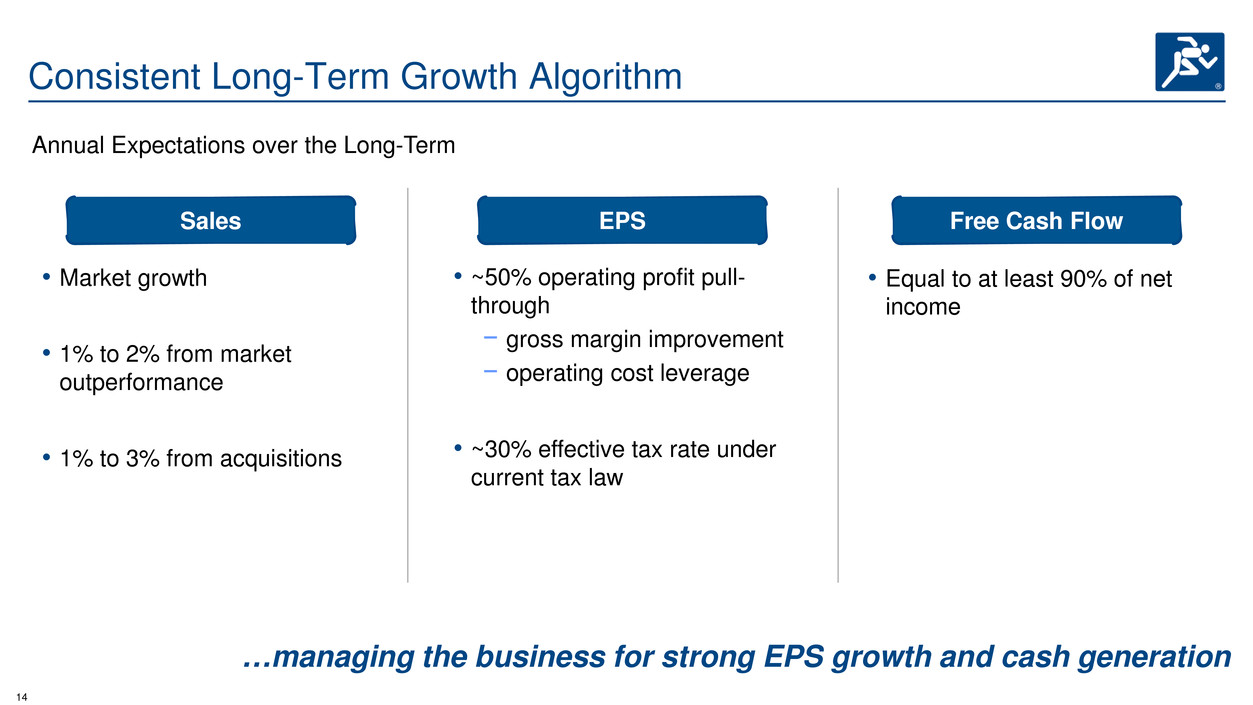

Consistent Long-Term Growth Algorithm

• Market growth

• 1% to 2% from market

outperformance

• 1% to 3% from acquisitions

• ~50% operating profit pull-

through

− gross margin improvement

− operating cost leverage

• ~30% effective tax rate under

current tax law

Annual Expectations over the Long-Term

• Equal to at least 90% of net

income

Sales EPS Free Cash Flow

…managing the business for strong EPS growth and cash generation

15

16

Non-GAAP Financial Measures

Appendix

This presentation includes certain non-GAAP financial measures. These financial measures include

organic sales growth, financial leverage, free cash flow, adjusted net income and adjusted earnings

per diluted share. WESCO believes that these non-GAAP measures are useful to investors as they

provide a better understanding of sales performance, and the use of debt and liquidity on a

comparable basis. Additionally, certain of the aforementioned non-GAAP measures either focus on or

exclude transactions impacting comparability of results, allowing investors to more easily compare the

Company's financial performance from period to period. Management does not use these non-GAAP

financial measures for any purpose other than the reasons stated above.

17

Definitions

• Financial leverage ratio is calculated by dividing total debt, which excludes debt discount and debt issuance

costs, by the trailing twelve months earnings before interest, taxes, depreciation, and amortization (EBITDA).

• Free cash flow is calculated by deducting capital expenditures from cash flow provided by operating activities.

• Income from operations is defined as net sales less cost of goods sold (excluding depreciation and amortization),

selling, general and administrative expenses, and depreciation and amortization.

• Operating margin is calculated by dividing income from operations by net sales.

• Organic sales growth is calculated by deducting the percentage impact from acquisitions in the first year of

ownership, foreign exchange rates and number of workdays from the overall percentage change in consolidated

net sales.

• Sales change abbreviations include:

− HSD = High-single-digits

− MSD = Mid-single-digits

− LSD = Low-single-digits

18

WESCO Profile Q3 2017

37%

33%

15%

15%

40%

15%

15%

12%

10%

8%

Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis.

Products & Services Markets & Customers

Utility

CIG

Industrial

Construction

Investor Owned | Public Power

Utility Contractors

Commercial | Institutional | Government

Global Accounts | Integrated Supply

OEM | General Industrial

Non-Residential | Contractors

Automation, Controls & Motors

Lighting & Sustainability

General Supplies

Communications & Security

Wire, Cable & Conduit

Electrical Distribution & Controls

19

Note: The prior period end market amounts noted above contain reclassifications to conform to current period presentation.

($ Millions)

Sales Growth - End Markets

YTD Q3 2017 vs. YTD Q3 2016

YTD Q3 YTD Q3 %

2017 2016 Growth

Industrial 2,120 2,008 5.6%

Construction 1,858 1,875 (0.9)%

Utility 865 869 (0.5)%

CIG 843 807 4.4%

Total Core Gross Sales 5,686 5,559 2.3%

Gross Sales from Acquisitions 21 4 n/a

Total Gross Sales 5,707 5,564 2.6%

Gross Sales Reductions (25) (21) n/a

Total Net Sales 5,682 5,543 2.5%

20

YTD Q3 2017 Organic Sales by End Market

Industrial Construction Utility CIG WESCO

Core Sales Growth 5.6 (0.9) (0.5) 4.4 2.3

FX Impact 0.0 0.2 0.1 0.0 0.1

Workday Impact (0.5) (0.5) (0.5) (0.5) (0.5)

Organic Growth 6.1 (0.6) (0.1) 4.9 2.7

(%)

Note: For organic sales growth in 2017, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the ‘Investors” page of

WESCO’s website at www.wesco.com.

21

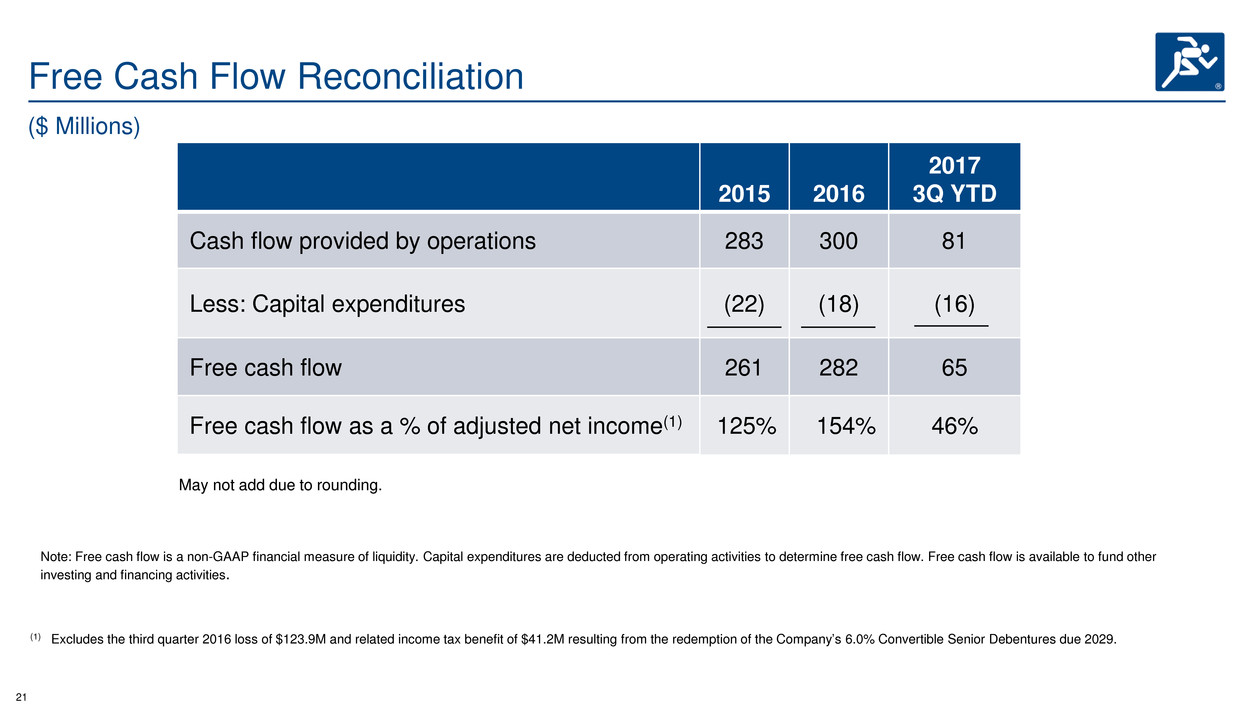

Free Cash Flow Reconciliation

2015 2016

2017

3Q YTD

Cash flow provided by operations 283 300 81

Less: Capital expenditures (22) (18) (16)

Free cash flow 261 282 65

Free cash flow as a % of adjusted net income(1) 125% 154% 46%

Note: Free cash flow is a non-GAAP financial measure of liquidity. Capital expenditures are deducted from operating activities to determine free cash flow. Free cash flow is available to fund other

investing and financing activities.

(1) Excludes the third quarter 2016 loss of $123.9M and related income tax benefit of $41.2M resulting from the redemption of the Company’s 6.0% Convertible Senior Debentures due 2029.

($ Millions)

May not add due to rounding.

22

Financial Leverage Ratio

Twelve Months Ended

September 30, 2017

Financial leverage ratio:

Income from operations $ 322

Depreciation and amortization 64

EBITDA $ 386

September 30, 2017

Short-term borrowings and current debt $ 41

Long-term debt 1,368

Debt discount and debt issuance costs(1) 14

Total debt $ 1,423

Less: cash and cash equivalents $ 94

Total debt, net of cash $ 1,329

Financial leverage ratio 3.7X

Financial leverage ratio, net of cash 3.4X

($ Millions)

(1) Long-term debt is presented in the condensed consolidated balance sheet as of September 30, 2017, net of debt discount and debt issuance costs.

Note: For financial leverage ratio in 2017, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the ‘Investors” page of

WESCO’s website at www.wesco.com.

23

Work Days

Q1

Q2 Q3 Q4 FY

2016 64 64 64 62 254

2017 64 64 63 62 253

2018 64 64 63 62 253

24