Attached files

| file | filename |

|---|---|

| 8-K - 8-K SMARTFINANCIAL ANNOUNCES MERGER WITH TENNESSEE BANCSHARES - SMARTFINANCIAL INC. | form8-k_39714173x1.htm |

| EX-99.1 - EXHIBIT 99.1 - SMARTFINANCIAL INC. | pressrelease-exhibit991tof.htm |

| EX-2.1 - EXHIBIT 2.1 - SMARTFINANCIAL INC. | atlasagreementandplanofmer.htm |

SmartFinancial Inc. Announces

Acquisition of Tennessee

Bancshares, Inc.

December 12, 2017

Exhibit 99.2

Important Information for Investors and Shareholders

In connection with the proposed merger, SmartFinancial, Inc. (“SmartFinancial”) will file a registration statement on Form S-4 with

the Securities and Exchange Commission (the “SEC”), which will contain the proxy statement of Tennessee Bancshares, Inc.

(“Tennessee Bancshares”) and a prospectus of SmartFinancial. Shareholders of Tennessee Bancshares are encouraged to read

the registration statement, including the proxy statement/prospectus that will be part of the registration statement, because it will

contain important information about the merger, Tennessee Bancshares, and SmartFinancial. After the registration statement is

filed with the SEC, the proxy statement/prospectus and other relevant documents will be mailed to all Tennessee Bancshares

shareholders and will be available for free on the SEC’s website (www.sec.gov). The proxy statement/prospectus will also be made

available for free by contacting Billy Carroll at 865.868.0613. This presentation shall not constitute an offer to sell, the solicitation of

an offer to sell, or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any

sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as amended.

SmartFinancial, Tennessee Bancshares, their directors and executive officers, and other members of management and employees

may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the

directors and executive officers of SmartFinancial is set forth in SmartFinancial’s proxy statement for its 2017 annual shareholders

meeting. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be

filed with the SEC when they become available.

Important Information

2

Important Information

3

Forward Looking Statement Disclosure

Certain of the statements made in this presentation may constitute forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements, including

statements regarding the intent, belief, or current expectations of SmartFinancial’s management regarding the company’s strategic

direction, prospects, future results, and benefits of the merger, are subject to numerous risks and uncertainties. Such factors

include, among others, (1) the risk that the cost savings and any revenue synergies from the merger may not be realized or take

longer than anticipated to be realized, (2) disruption from the merger with customers, suppliers or employee relationships, (3) the

occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (4) the

risk of successful integration of the two companies’ businesses, (5) the failure of Tennessee Bancshares’s shareholders to approve

the merger, (6) the amount of the costs, fees, expenses and charges related to the merger, (7) the ability to obtain required

governmental approvals of the proposed terms of the merger, (8) reputational risk and the reaction of the parties’ customers to the

merger, (9) the failure of the closing conditions to be satisfied, (10) the risk that the integration of Tennessee Bancshares’s

operations with SmartFinancial will be materially delayed or will be more costly or difficult than expected, (11) the possibility that

the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the

dilution caused by SmartFinancial’s issuance of additional shares of its common stock in the merger and (13) general competitive,

economic, politics of and market conditions. Additional factors which could affect the forward looking statements can be found in

SmartFinancial’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K filed with or

furnished to the SEC and available on the SEC’s website at http://www.sec.gov. SmartFinancial disclaims any obligation to update

or revise any forward-looking statements contained in this release which speak only as of the date hereof, whether as a result of

new information, future events or otherwise.

Transactio

n

Overview

Acquisition Overview

Company Overview

Transaction Rationale

Transaction Terms

Key Transaction Assumptions

4

Acquisition Overview

Source: S&P Global Market Intelligence

By closing, the combined company is expected to be approximately $2B

in total assets

Accelerates the company towards a 1%+ ROAA target in 2019

Positioned to add deposit market share in several Southeast growth

markets, with additional nearby attractive markets remaining

This transaction marks the management team’s fifth consolidation,

making the company one of the most experienced acquirers in its asset

size range

Strong step forward in the quest to become “The Southeast’s next

great community banking franchise”

5

Company Overview

Source: S&P Global Market Intelligence

ALABAMA

Nashville

Huntsville

Chattanooga

Knoxville

TENNESSEE

6

Solid base in home Tullahoma market that

has supported recent expansion into three

growth markets (Chattanooga, Huntsville and

Murfreesboro)

Near 1% ROAA and solid credit quality =

strong operator

Consolidated financials are SMBK estimates based on the 9/30/17 call

report data of Southern Community Bank and the 6/30/17 FRY-9SP of

Tennessee Bancshares

Tennessee Bancshares, Inc.

Headquarters Tullahoma, TN

CEO William L. Yoder

Number of Directors 7

Dollars in Thousands (Consolidated as of 9/ 30/ 17)

Total Assets 243,950

Net Loans 193,642

Total Deposits 210,107

Equity 22,919

Tangible Common Equity 21,348

Net Income, 2016 1,729

Net Income, YTD 1,889

Percentages (Bank Level, Twelve Months Ended 9/ 30/ 17)

ROAA 0.94

ROAE 9.25

Net Interest Margin 3.88

Noninterest Income/Avg Assets 0.52

Efficiency Ratio 58.98

NPAs/Assets 0.59

TCE Ratio 10.36

Bank Leverage Ratio 9.93

Bank Total Risk-Based Capital 12.69

Key management of Tennessee Bancshares will remain with SMBK

Conservative credit culture

Complementary business lines that are easily integrated

Attractive financial transaction with strong geographic fit

Good mix of consolidation opportunities and growth market expansion

Assists company in achievement of 1%+ ROAA run rate target

Transaction Rationale

7

10% EPS accretion projected in 2019

Less than 2.5 years to earn back TBV dilution (crossover method)

Preservation of strong capital position and balance sheet

Extends footprint further into Tennessee and Alabama

Improves market share position in Chattanooga

Entry into the Nashville-Davidson-Murfreesboro-Franklin, TN and Huntsville, AL MSAs

Financially Attractive

Low Risk

Strategic

Markets & Growth

Sources: Definitive Agreement, SMBK

Transaction Terms(1)

8

Consideration 100% stock

Exchange Ratio 0.8065 fixed exchange ratio

Implied Announced Price per Share2 $17.57

Aggregate Announced Transaction Value2 $31.8 million

Board Representation Clifton N. Miller (Tennessee Bancshares director) to be appointed to SMBK board

Management Retention

Tennessee Bancshares CEO and other key executives to maintain senior

positions with SMBK

Required Approvals Tennessee Bancshares shareholders and customary regulatory approvals

Estimated Transaction Multiples3

Price/LTM EPS: 13.8x

Price/ TBVPS: 149.1%

TBV Dilution Earn Back: < 2.5 Years (crossover method)

Expected Closing 2nd Quarter 2018

Termination Fee $1.3 million

Sources: Definitive Agreement, SMBK

(2) Based on SMBK’s stock price of $21.79 as of 12/11/17

(3) Based on SMBK estimates of unaudited consolidated financials of

Tennessee Bancshares as of 9/30/17

(1) Exclusive of contingent one-time, special dividend of up to $0.70 per share (approximately $1.27 million in the

aggregate) to be paid to Tennessee Bancshares shareholders subject to the satisfaction of certain conditions

Key Transaction Assumptions

9

Expected Savings

Merger & Integration Costs

Purchase Accounting & Other

Adjustments

Pro Forma Capital

Approximately $2.3 million in pre-tax merger expenses

1.75% pre-tax opportunity cost of cash

Day 1 Total Equity of $238 million

9.7% Day 1 TCE Ratio

Total credit mark of $9.0 million(1)

20.0% on adjusted nonperforming loans

4.3% on performing loans

20.0% on OREO

1.15% mark on FHLB advances

Cost savings target = 30% of seller’s annual expense base

50% realized in 2018

100% realized thereafter

Sources: Definitive Agreement, SMBK

(1)$9.0mm credit mark may be lower if certain assets are disposed of prior to

closing, with a dividend paid to Tennessee Bancshares shareholders (footnote

on slide 8) that would be neutral to slightly positive to transaction metrics

Market

Highlights

Chattanooga, TN

Huntsville, AL

Murfreesboro, TN

Tullahoma, TN

10

Chattanooga Major Employers

Selected Data: Chattanooga, TN MSA

Market Highlights

In 2011, Volkswagen Group of America

opened an auto manufacturing plant in

Chattanooga. The plant employs 3,200 and

supports more than 9,500 indirect supplier

employees

In 2017, Volkswagen announced that it is

spending $600 million to expand its

Chattanooga factory increasing their

workforce by 4,500 employees

McKee Foods Corp. plans to invest $102

million in its manufacturing plant

Whirlpool Corp. opened a new $120 million

plant in the Chattanooga area in 2012

Chattanooga has a 10-gigabit network that is

making it one of America’s most tech start-up

friendly cities, according to Fortune

Total Population: (Actual) 552,944

Proj. 5 Year Population Growth: 3.81%

Median HH Income: $49,405

Proj. HH 5 Year Income Growth: 7.57%

Total Market Deposits: ($B) $9.4

Market YoY Deposit Growth: 3.98%

Financial data as of 2016; Demographic data as of 2017

Sources: Chattanooga Times Free Press, Volkswagen Group of

America, Olin Corporation, Wacker Chemie AG, Hamilton County

Chamber of Commerce, S&P Global Market Intelligence

11

Huntsville Major Employers

Selected Data: Huntsville, AL MSA

Market Highlights

Huntsville is nicknamed “Rocket City”

because of its long and significant role in the

U.S. space and missile programs, with the city

at the forefront in developing space

technology

Huntsville is one of the 40 fastest growing

metropolitan areas in the United States

Huntsville GDP growth is among the Top 10

major metropolitan areas in the country

Huntsville GDP accounts for 25% of

Alabama’s total GDP, and the 33,700 added

new net jobs accounts for 88% of Alabama’s

total growth

Total Population: (Actual) 451,892

Proj. 5 Year Population Growth: 4.44%

Median HH Income: $59,376

Proj. HH 5 Year Income Growth: 4.34%

Total Market Deposits: ($B) $7.5

Market YoY Deposit Growth: 7.80%

Financial data as of 2016; Demographic data as of 2017

Sources: Huntsville Chamber of Commerce, S&P Global Market

Intelligence

12

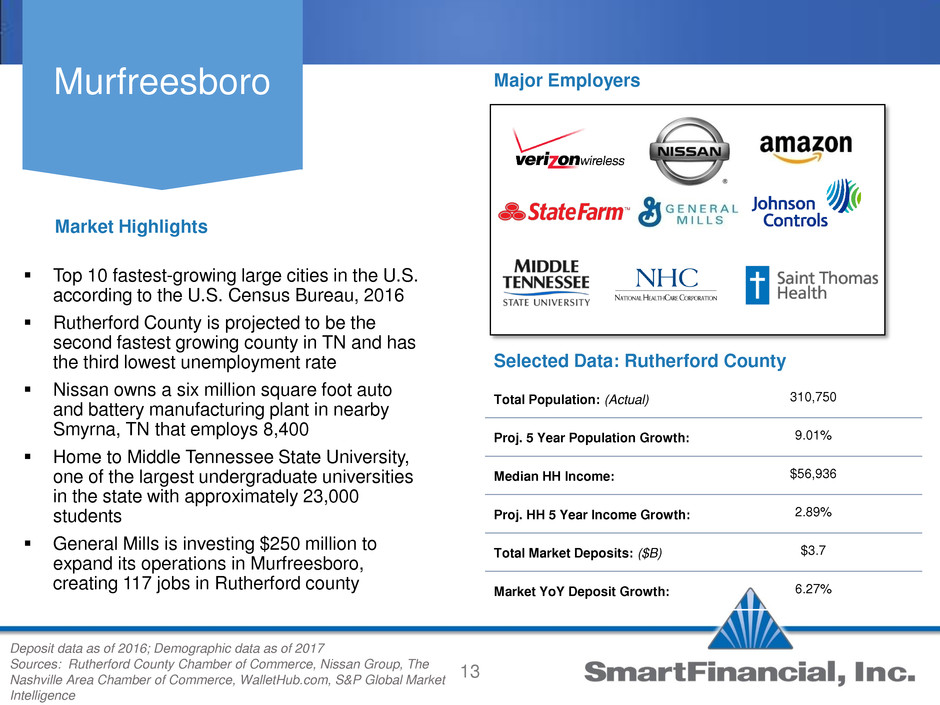

Murfreesboro

Total Population: (Actual) 310,750

Proj. 5 Year Population Growth: 9.01%

Median HH Income: $56,936

Proj. HH 5 Year Income Growth: 2.89%

Total Market Deposits: ($B) $3.7

Market YoY Deposit Growth: 6.27%

Major Employers

Selected Data: Rutherford County

Top 10 fastest-growing large cities in the U.S.

according to the U.S. Census Bureau, 2016

Rutherford County is projected to be the

second fastest growing county in TN and has

the third lowest unemployment rate

Nissan owns a six million square foot auto

and battery manufacturing plant in nearby

Smyrna, TN that employs 8,400

Home to Middle Tennessee State University,

one of the largest undergraduate universities

in the state with approximately 23,000

students

General Mills is investing $250 million to

expand its operations in Murfreesboro,

creating 117 jobs in Rutherford county

Market Highlights

Deposit data as of 2016; Demographic data as of 2017

Sources: Rutherford County Chamber of Commerce, Nissan Group, The

Nashville Area Chamber of Commerce, WalletHub.com, S&P Global Market

Intelligence

13

14

Tullahoma

Selected Data: Tullahoma-Manchester, TN MSA

Major Employers

Tullahoma is a leader in the aerospace and

technology industries and serves as a hub for

medical and retail services

Tullahoma is ranked as the #1 “Micropolitan”

city in the state of TN

Among the 20 Micropolitan Statistical Areas in

TN, Tullahoma ties for the state’s second

lowest unemployment rate

Presence of Arnold Air Force Base, University

of Tennessee’s Space Institute, and a variety

of aerospace companies broadens

Tullahoma’s employment base

Located in close proximity to the Jack Daniel’s

and George Dickel distilleries

Market Highlights

Total Population: (Actual) 102,873

Proj. 5 Year Population Growth: 3.09%

Median HH Income: $44,044

Proj. HH 5 Year Income Growth: 7.47%

Total Market Deposits: ($B) $1.5

Market YoY Deposit Growth: 4.23%

Deposit data as of 2016; Demographic data as of 2017

Sources: Tullahoma Chamber of Commerce, S&P Global Market

Intelligence

Pro Forma

Company

Pro Forma Footprint & Highlights

Combined Leadership Team

Pro Forma Loan Composition

Pro Forma Deposit Composition

15

Pro Forma Footprint and Highlights

TENNESSEE

ALABAMA

FLORIDA

Tuscaloosa

Birmingham

Nashville

Tallahassee

Huntsville

Montgomery

Chattanooga

Knoxville

Pensacola SMBK Branches (including Capstone)

Tennessee Bancshares Branches

Pro forma balance sheet based on unaudited consolidated

financials of SmartFinancial as of 9/30/17, call report for

Capstone Bank as of 9/30/17, FRY-9SP for Capstone

Bancshares as of 6/30/17, and SMBK estimates of unaudited

consolidated financials of Tennessee Bancshares as of

9/30/17. Numbers exclude purchase accounting adjustments

Source: S&P Global Market Intelligence

16 Pricing data as of 12/11/17 close

Assets ($mm) 1,891

Net Loans ($mm) 1,479

Deposits ($mm) 1,608

TCE ($mm) 203

Branches 26

Loans/Deposits 92%

Market Cap ($mm) 273.8

Pro Forma Highlights

Combined Leadership Team

13 SMBK Directors

1 Tennessee

Bancshares

Director

Billy Carroll

(Chief Executive Officer)

C. Bryan Johnson

(Chief Financial Officer)

Rhett Jordan

(Chief Credit Officer)

Gary Petty

(Chief Risk Officer)

Greg Davis

(Chief Lending Officer)

Diane Short

(Chief HR Officer)

Bill Yoder

(Chief Banking Officer)

Miller Welborn

(Chairman of the Board)

Board of Directors

Executive Leadership

17

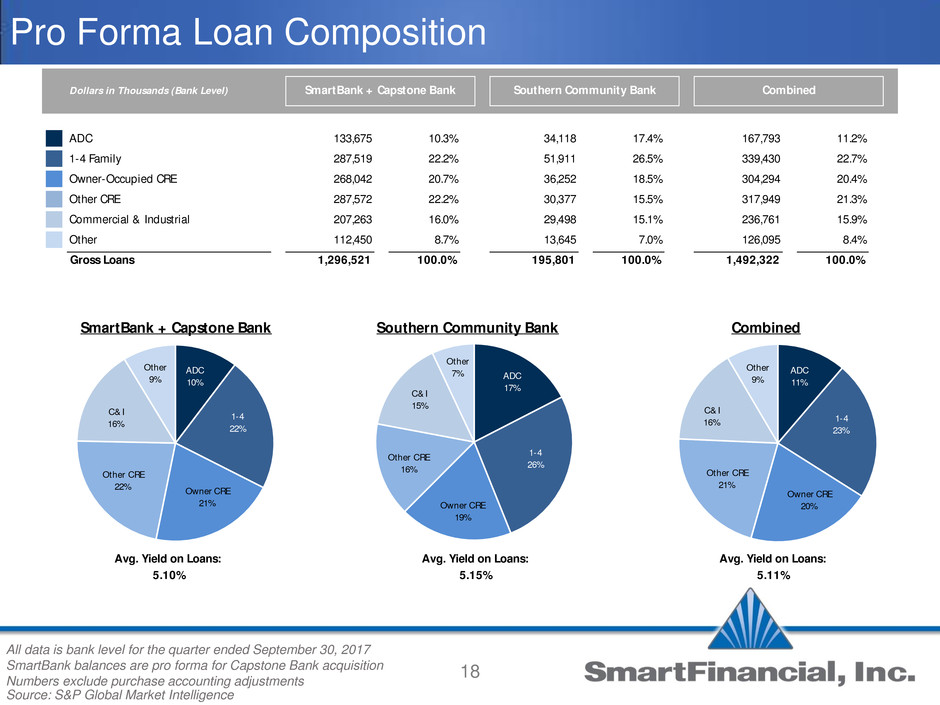

Pro Forma Loan Composition

Source: S&P Global Market Intelligence

18

All data is bank level for the quarter ended September 30, 2017

SmartBank balances are pro forma for Capstone Bank acquisition

Numbers exclude purchase accounting adjustments

Dollars in Thousands (Bank Level)

ADC 133,675 10.3% 34,118 17.4% 167,793 11.2%

1-4 Family 287,519 22.2% 51,911 26.5% 339,430 22.7%

Owner-Occupied CRE 268,042 20.7% 36,252 18.5% 304,294 20.4%

Other CRE 287,572 22.2% 30,377 15.5% 317,949 21.3%

Commercial & Industrial 207,263 16.0% 29,498 15.1% 236,761 15.9%

Other 112,450 8.7% 13,645 7.0% 126,095 8.4%

Gross Loans 1,296,521 100.0% 195,801 100.0% 1,492,322 100.0%

Southern Community Bank

Avg. Yield on Loans:

5.10%

SmartBank + Capstone Bank Southern Community Bank Combined

SmartBank + Capstone Bank Combined

Avg. Yield on Loans:

5.15%

Avg. Yield on Loans:

5.11%

ADC

10%

1-4

22%

Owner CRE

21%

Other CRE

22%

C& I

16%

Other

9% ADC

17%

1-4

26%

Owner CRE

19%

Other CRE

16%

C& I

15%

Other

7% ADC

11%

1-4

23%

Owner CRE

20%

Other CRE

21%

C& I

16%

Other

9%

Pro Forma Deposit Composition

Source: S&P Global Market Intelligence

19

All data is bank level for the quarter ended September 30, 2017

SmartBank balances are pro forma for Capstone Bank acquisition

Numbers exclude purchase accounting adjustments

Dollars in Thousands (Bank Level)

Demand Deposits 233,632 16.5% 23,865 11.4% 257,497 15.9%

NOW and Other Transaction 221,179 15.7% 16,789 8.0% 237,968 14.7%

MMDA & Savings 498,419 35.3% 52,118 24.8% 550,537 33.9%

Retail CDs 351,456 24.9% 88,446 42.1% 439,902 27.1%

Jumbo CDs 107,949 7.6% 28,889 13.7% 136,838 8.4%

Total Deposits 1,412,635 100.0% 210,107 100.0% 1,622,742 100.0%

Southern Community Bank

Avg. Cost of Deposits:

0.59%

CombinedSmartBank + Capstone Bank

Avg. Cost of Deposits:

0.79%

Avg. Cost of Deposits:

0.62%

SmartBank + Capstone Bank Southern Community Bank Combined

Demand

16%

Other

Transaction

16%

MMDA &

Savings

35%

Retail CD

25%

Jumbo

CD

8%

Demand

11%

Other

Transaction

8%

MMDA &

Savings

25%

Retail CD

42%

Jumbo CD

14%

Demand

16%

Other

Transaction

15%

MMDA &

Savings

34%

Retail CD

27%

Jumbo CD

8%

Appendix

Comprehensive Due Diligence Overview

Investor Contacts

20

Comprehensive Due Diligence Overview

Broad due diligence process

Thorough review of credit files, underwriting methodology, process and

policy

Reviewed 71% of the total dollar amount of Tennessee Bancshares

loans outstanding (all loans >$350,000)

In-depth review of cost savings items

Credit diligence resulted in a gross $9 million credit mark

21

Investor Contacts

Billy Carroll

President & CEO

865.868.0613

billy.carroll@smartbank.com

Miller Welborn

SmartFinancial, Inc.

5401 Kingston Pike, Suite 600

Knoxville, TN 37919

Chairman

423.385.3067

miller.welborn@smartbank.com

22