Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL PACIFIC FINANCIAL CORP | a8-kdecember2017.htm |

A. CATHERINE NGO

President & Chief Executive Officer

DAVID S. MORIMOTO

Executive Vice President & Chief

Financial Officer

December 2017

Forward-Looking Statements

1

This presentation may contain forward-looking statements concerning: projections of revenues, income/loss, earnings/loss per share, capital

expenditures, dividends, capital structure, or other financial items, plans and objectives of management for future operations, future economic

performance, or any of the assumptions underlying or relating to any of the foregoing. Forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts, and may include the words “believes,” “plans,” “intends,” “expects,” “anticipates,”

“forecasts,” “hopes,” “should,” “estimates”, “may”, “will”, “target” or words of similar meaning. While we believe that our forward-looking

statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and

uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could materially differ from forward-looking

statements for a variety of reasons, including, but not be limited to: an increase in inventory or adverse conditions in the Hawaii and California real

estate markets and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers

and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and

international economies and events (including natural disasters such as wildfires, tsunamis, storms and earthquakes) on the Company’s business

and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the

Company does business; deterioration or malaise in domestic economic conditions, including destabilization in the financial industry and

deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in

general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof

under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes

in capital standards, other regulatory reform, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau,

government-sponsored enterprise reform, and any related rules and regulations on our business operations and competitiveness; the costs and

effects of legal and regulatory developments, including the resolution of legal proceedings or regulatory or other governmental inquiries and the

results of regulatory examinations or reviews; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and

changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve

System; inflation, interest rate, securities market and monetary fluctuations; negative trends in our market capitalization and adverse changes in

the price of the Company’s common shares; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings

habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; technological changes; changes

in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting

policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial

Accounting Standards Board and other accounting standard setters; our ability to attract and retain skilled employees; changes in our

organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information on

factors that could cause actual results to materially differ from forward-looking statements, please see the Company’s publicly available Securities

and Exchange Commission filings, including the Company’s Form 10-K for the fiscal year ended December 31, 2016, and, in particular, the

discussion of “Risk Factors” set forth therein. The Company does not update any of its forward-looking statements except as required by law.

Corporate Profile

2

Founded in 1954 by Japanese-American veterans

of World War II

Fourth largest financial institution in Hawaii.

2011: $345 million recapitalization, including rights offering.

Profitable every quarter since recapitalization

CPF stock price is up ~ 222% from recapitalization; CAGR of 19%

3Q2013-3Q2017: Returned $355 million to shareholders through

repurchase of $274 million of CPF common stock and aggregate cash

dividends of $81 million.

Today: NYSE market capitalization of approximately $896 million.

Total assets of $5.6 billion Deposit market share of 11%

Note: Market data as of November 13, 2017.

Shareholder Value Drivers

3

Strong Hawaii Market

Relationship Banking Growth

Opportunities

Asset Quality Improvements

Efficiency Enhancements

Capital Optimization

Population of 1.4 million (2016).

Four major islands – Oahu is home to 70% of the state’s total population.

Real State GDP (2016) $72.9 billion, +2.0% from 2015. Forecasts expect a 1.9%

increase in 2017.

State unemployment rate of 2.5% is below the national unemployment rate of

4.2% (September 2017).

Economy driven primarily by tourism, military & real estate construction

industries.

2016 marked the fifth straight year of record tourism in Hawaii and is on pace

for a sixth straight record year in 2017. In 2016, visitor spending was $15.6

billion and over 8.9 million visitors came to Hawaii. Through September 2017,

visitor spending and arrivals increased 7.1% and 4.9%, respectively, over the

same prior year period.

Hawaii at a Glance

4

Source: US Census Bureau, Bureau of Economic Analysis , Bureau of Labor Statistics, Hawaii

Tourism Authority and State of Hawaii Department of Business Economic Development & Tourism

Diversity of Tourism – Visitor Arrivals

5

Source: Hawaii Tourism Authority

2016 Growth Regions

Korea +27%

US West +4%

US East +4%

US West

40.9%

US East

20.9%

Japan

16.6%

Canada

5.4%

Australia

4.5%

China

1.9%

Korea

2.7%

Europe

1.6%

Other

5.5%

Visitor Arrivals

2016

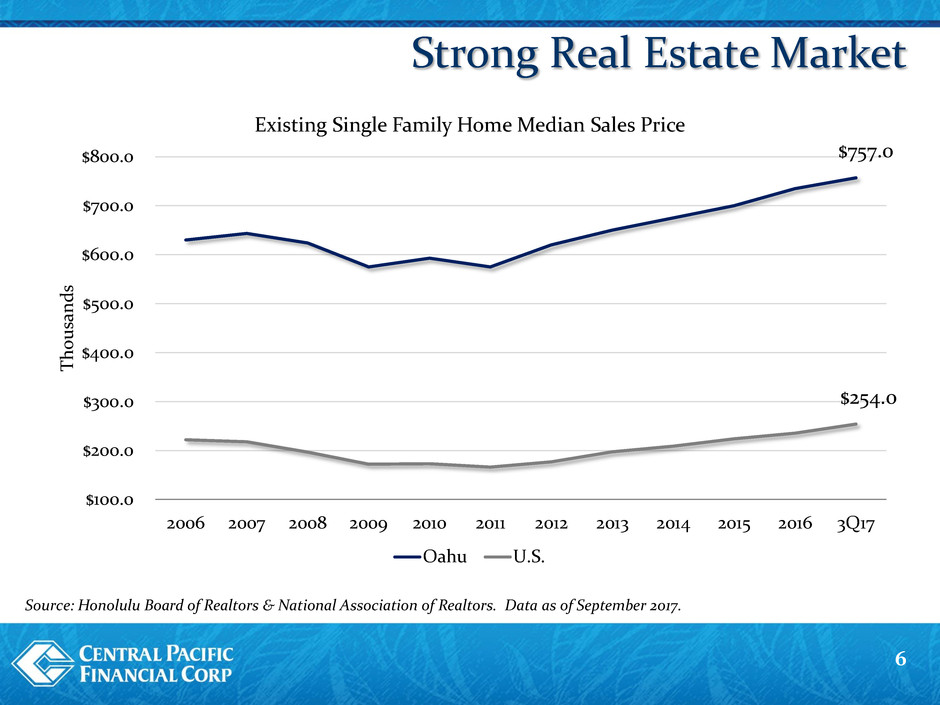

6

Source: Honolulu Board of Realtors & National Association of Realtors. Data as of September 2017.

Strong Real Estate Market

$757.0

$254.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

$700.0

$800.0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 3Q17

T

h

ous

an

d

s

Existing Single Family Home Median Sales Price

Oahu U.S.

Continued Growth and Development

7

1. Residential High-Rise Condominium Development in Honolulu

Proposed master plan includes 22 new high-rise towers in Honolulu.

Thirteen developments have completed successful sales and begun construction or have

completed construction over the past few years.

2. Rail Construction

$10.0 billion, 20-mile route. Full route to be in operation by 2024.

3. Modernization of Honolulu International Airport

$1.3 billion effort that began in 2013 and is expected to be completed by the end of 2020.

4. Military Construction

Hawaii remains a key strategic location for the U.S. Military as it is the headquarters of

the United States Pacific Command. As a result, Hawaii benefits from consistent federal

construction investments in its military bases.

5. Ko Olina Resort Development in West Oahu

Four Seasons Resort Oahu Ko Olina completed $500 million renovation in 2016. China

Oceanwide Holdings Group Company plans to break ground in 2017 on a $1 billion+

project to develop an Atlantis Resorts in West Oahu.

Source: Honolulu Star Advertiser, Hawaii Community Development Authority, Honolulu Rail Transit, Hawaii Airports Modernization,

Pacific Business News.

Continued Growth and Development

8

Hawaii Banking Market

Note: Deposit data as of September 30, 2017. For consistency, total deposits at the regulated depository level.

Source: SNL Financial

9

Total

Deposits Market

Rank Institution Type Ownership Branches (millions) Share

1 First Hawaiian Bank Bank Public - BNP 62 $17,605 38.1%

2 Bank of Hawaii Bank Public 70 15,094 32.7%

3 American Savings Bank Savings Bank Private - HEI 50 5,797 12.5%

4 Central Pacific Bank Bank Public 35 4,927 10.7%

5 Territorial Savings Bank Savings Bank Public 30 1,608 3.5%

6 Hawaii National Bank Bank Private 14 591 1.3%

7 Finance Factors Bank Private 13 468 1.0%

8 Ohana Pacific Bank Bank Private 2 126 0.3%

Market Total 276 $46,216

Kauai (2)

Oahu (27)

Maui (4)

Hawaii (2)

CPB Branch Positioning

($ millions) September 30, 2017

10

Total Assets $5,569

Total Loans $3,636

Total Deposits $4,927

Total Branches 35

Relationship Banking Growth Opportunities

11

Launched a company-wide customer

experience initiative.

Targeted small business market niches –

CPB won the 2017 Overall SBA Lender of

the Year Award.

Initiated strategic business development

agreements with Hokuyo Bank in 2015

and with the TSUBASA Alliance of Japan

in 2017.

Established joint ventures with local real

estate companies and developers to

source residential mortgage loan volume.

Strong Loan Growth

12

5.75 Year

CAGR

+11%

+25%

+19%

-8%

+5%

$4,030

$3,042

$2,169 $2,064

$2,204

$2,631

$2,932

$3,212

$3,525 $3,546 $3,592

$3,636

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

Balances Outstanding

Comml Mtg Construct/Dev C&I Consumer/Other Res Mtg

Million

s

Core Deposit Franchise

13

$4.9 billion in deposits as of September 30, 2017, with total core deposits at 80%

Noninterest-

Bearing DDA

28%

Interest-Bearing

DDA

19%

Savings & Money

Mkt

30%

CDs < $100M

4%

CDs > $100M

5%

Government CDs

14%

Total Deposit Cost Advantage

14

Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (84 banks).

Source: SNL Financial

1.63%

1.09%

0.64%

0.30%

0.14% 0.11% 0.09% 0.09% 0.12%

0.18% 0.21%

0.25%

2.35%

1.59%

1.05%

0.78%

0.54%

0.40% 0.34% 0.33% 0.36%

0.40% 0.40%

0.47%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

CPF Peer

Significantly Reduced NPAs

15

0.11% of

Total Assets

$144

$500

$303

$196

$90

$47 $42

$16 $9 $9 $9 $6

$-

$100

$200

$300

$400

$500

$600

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

Million

s

C&D Comml Mtg Res Mtg C&I/Other

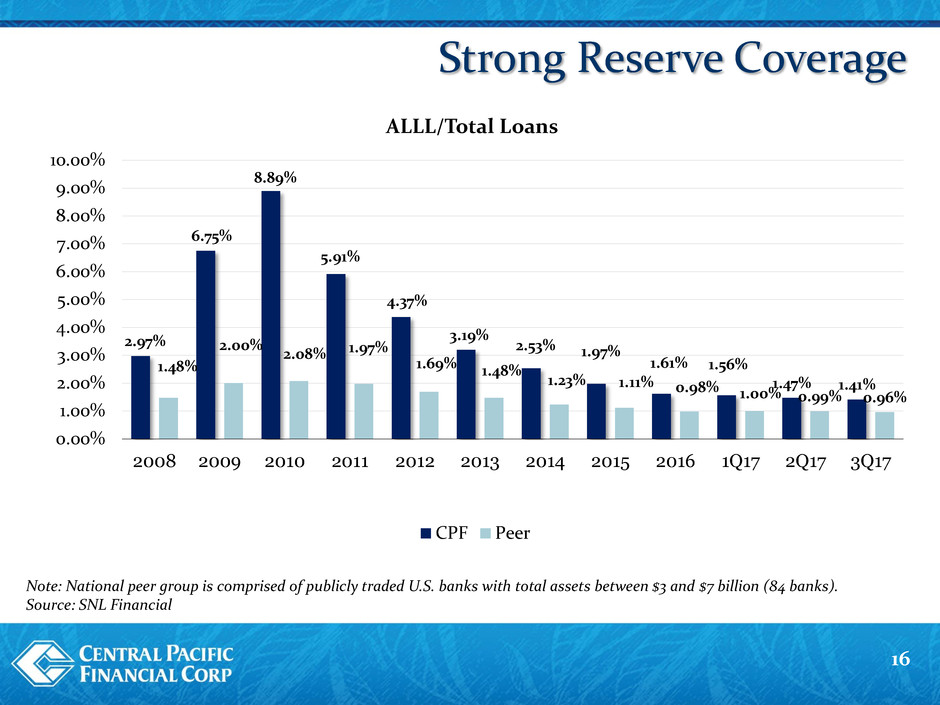

Strong Reserve Coverage

16

Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (84 banks).

Source: SNL Financial

2.97%

6.75%

8.89%

5.91%

4.37%

3.19%

2.53% 1.97%

1.61% 1.56%

1.47% 1.41%

1.48%

2.00%

2.08% 1.97%

1.69% 1.48%

1.23% 1.11% 0.98% 1.00% 0.99% 0.96%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

ALLL/Total Loans

CPF Peer

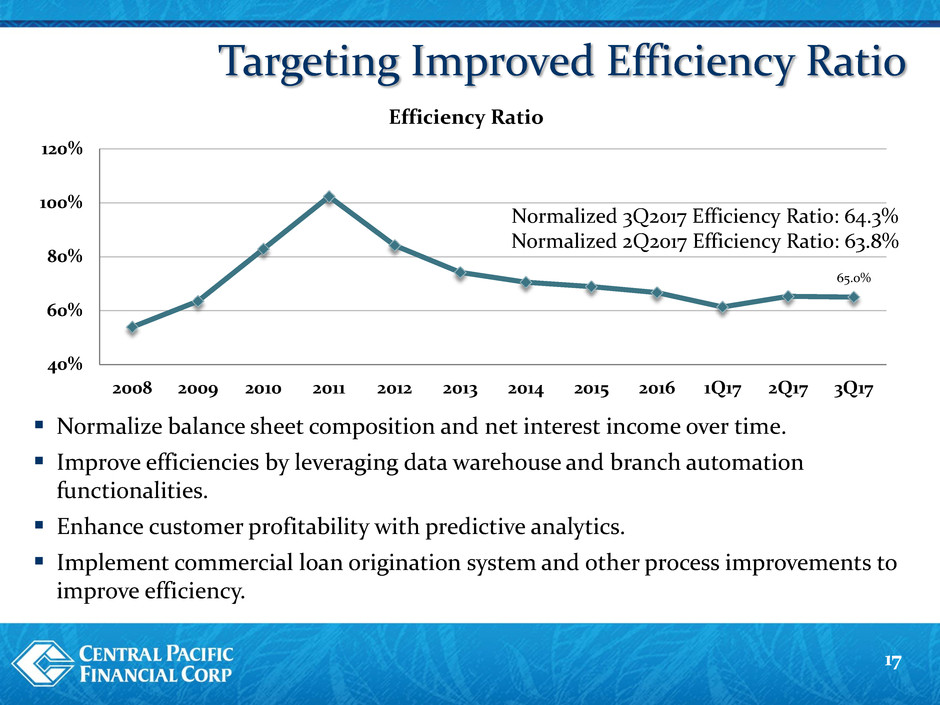

Targeting Improved Efficiency Ratio

17

Normalize balance sheet composition and net interest income over time.

Improve efficiencies by leveraging data warehouse and branch automation

functionalities.

Enhance customer profitability with predictive analytics.

Implement commercial loan origination system and other process improvements to

improve efficiency.

Normalized 3Q2017 Efficiency Ratio: 64.3%

Normalized 2Q2017 Efficiency Ratio: 63.8%

65.0%

40%

60%

80%

100%

120%

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

Efficiency Ratio

Capital Optimization

18

Reinstated quarterly cash dividend of $0.08 per share in 3Q2013.

Increased cash dividend by 25% in 3Q2014, 20% in 1Q2015, 17% in

4Q2015, 14% in 3Q2016 and 13% in 2Q2017.

Aggregate cash dividends of $81 million returned to our

shareholders since 3Q2013.

Share repurchase activity to optimize the capital structure.

Repurchased over 12.6 million shares of CPF common stock at a

total cost of $274 million, or $21.66 per share, through 3Q2017.

Capital ratios remain strong as of September 30,2017:

Common Equity Tier 1 Capital: 12.8% Total Risk Based Capital: 16.3%

Tier 1 Risk Based Capital: 15.1% Leverage Capital: 10.6%

Shareholder Value Drivers

19

Strong Hawaii Market

Relationship Banking Growth

Opportunities

Asset Quality Improvements

Efficiency Enhancements

Capital Optimization

APPENDIX

20

Relative Value Comparison

21

Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (84 banks).

Source: SNL Financial

National

Peer

CPF Average

ROAA 0.90% 0.96%

ROATCE 9.26% 10.73%

Net Interest Margin 3.27% 3.46%

Efficiency Ratio 64.02% 59.87%

ALLL/Gross Loans 1.59% 0.97%

NPAs/Total Assets 0.49% 0.80%

NCOs/Avg Loans 0.03% 0.20%

Tang. Common Equity Ratio 9.29% 9.24%

Total RBC Ratio 15.49% 14.40%

Price/Tang. Book Value 1.8x 2.1x

Price/2018 Est. EPS 16.7x 16.6x

LTM Profitability

Asset Quality

Capital Adequacy

Valuation

Financial Highlights

22

($ in millions) QTD QTD QTD

3Q17 2Q17 1Q17 2016 2015 2014 2013 2012 2011

Balance Sheet (period end data)

Loans and leases $3,636.4 $3,591.7 $3,545.7 $3,524.9 $3,211.5 $2,932.2 $2,630.6 $2,203.9 $2,064.4

Total assets 5,569.2 5,553.1 5,443.2 5,384.2 5,131.3 4,853.0 4,741.2 4,370.4 4,132.9

Total deposits 4,927.5 4,886.4 4,777.4 4,608.2 4,433.4 4,110.3 3,936.2 3,680.8 3,443.5

Total shareholders' equity 509.8 512.9 511.5 504.7 494.6 568.0 660.1 504.8 456.4

Income Statement

Net interest income $42.0 $41.6 $41.3 $158.0 $149.5 $143.4 $133.1 $119.7 $117.8

Provision (credit) for loan & lease losses (0.1) (2.3) (0.1) (5.5) (15.7) (6.4) (11.3) (18.9) (40.7)

Other operating income 9.6 7.9 10.0 42.3 34.8 41.2 50.2 54.2 52.8

Other operating expense (excl goodwill) 33.5 32.3 31.5 133.6 127.0 130.2 134.8 145.4 174.8

Income taxes (benefit) 6.4 7.4 6.8 25.2 27.1 20.4 (112.2) 0.0 0.0

Net income 11.8 12.1 13.1 47.0 45.9 40.4 172.1 47.4 36.5

Profitability

Return on average assets 0.85% 0.88% 0.96% 0.90% 0.92% 0.85% 3.73% 1.13% 0.90%

Return on avg shareholders' equity 9.16% 9.32% 10.24% 9.16% 8.91% 6.80% 27.70% 9.81% 9.83%

Efficiency ratio 64.99% 65.32% 61.36% 66.69% 68.92% 70.51% 73.53% 83.60% 102.41%

Net interest margin 3.25% 3.29% 3.30% 3.27% 3.30% 3.32% 3.19% 3.10% 3.09%

Capital Adequacy (period end data)

Leverage capital ratio 10.6% 10.7% 10.7% 10.6% 10.7% 12.0% 13.7% 14.3% 13.8%

Total risk-based capital ratio 16.3% 16.4% 16.5% 15.5% 15.7% 18.2% 21.6% 23.8% 24.2%

Asset Quality

Net loan charge-offs/average loans 0.16% 0.03% 0.13% 0.03% -0.16% 0.12% 0.05% 0.32% 1.42%

Nonaccrual loans/total loans (period end) 0.14% 0.22% 0.23% 0.24% 0.44% 1.33% 1.58% 3.60% 5.89%

Year ended December 31,

Loan and Credit Composition

23

($ in Millions)

Balance % Balance % $ %

Hawaii Portfolio

Residential Mortgage $1,267 35% $1,161 33% $106 9%

Home Equity 397 11% 351 10% 46 13%

Commercial Mortgage 801 22% 743 22% 58 8%

Commercial & Ind/Leasing 399 11% 368 11% 31 8%

Construction 95 3% 105 3% -10 -10%

Automobiles 152 4% 126 4% 26 21%

Other Consumer 162 4% 164 5% -2 -1%

Total Hawaii Portfolio $3,273 90% $3,018 88% $255 8%

Mainland Portfolio

Commercial Mortgage $139 4% $120 3% $19 16%

Commercial & Industrial 88 2% 140 4% -52 -37%

Constructio 3 0% 3 0% 0 0%

Automobiles 98 3% 92 3% 6 7%

Other Consumer 35 1% 67 2% -32 -48%

Total Mainland Portfolio $363 10% $422 12% -$59 -14%

Total Loan Portfolio $3,636 100% $3,440 100% $196 6%

September 30, 2017 September 30, 2016 Change

Stable Net Interest Margin

24

NIM has been stable around 3.30% for the last 3 years.

Expect NIM to be in the 3.20 t0 3.30% range over the next couple of quarters.

Future improvements in the NIM will result from continuing to grow the loan

portfolio and stabilizing the investment and loan yields.

4.02%

3.62%

2.91%

3.09% 3.10%

3.19%

3.32% 3.30% 3.27% 3.30% 3.29% 3.25%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

2008 2009 2010 2011 2012 2013 2014 2015 2016 1Q17 2Q17 3Q17

Net Interest Margin

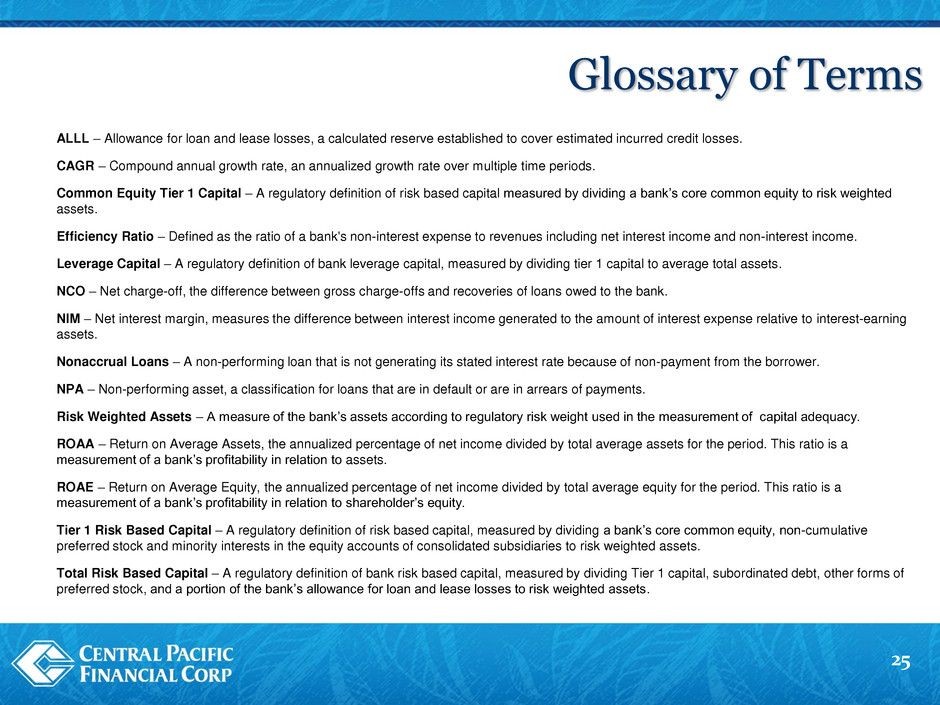

ALLL – Allowance for loan and lease losses, a calculated reserve established to cover estimated incurred credit losses.

CAGR – Compound annual growth rate, an annualized growth rate over multiple time periods.

Common Equity Tier 1 Capital – A regulatory definition of risk based capital measured by dividing a bank’s core common equity to risk weighted

assets.

Efficiency Ratio – Defined as the ratio of a bank's non-interest expense to revenues including net interest income and non-interest income.

Leverage Capital – A regulatory definition of bank leverage capital, measured by dividing tier 1 capital to average total assets.

NCO – Net charge-off, the difference between gross charge-offs and recoveries of loans owed to the bank.

NIM – Net interest margin, measures the difference between interest income generated to the amount of interest expense relative to interest-earning

assets.

Nonaccrual Loans – A non-performing loan that is not generating its stated interest rate because of non-payment from the borrower.

NPA – Non-performing asset, a classification for loans that are in default or are in arrears of payments.

Risk Weighted Assets – A measure of the bank’s assets according to regulatory risk weight used in the measurement of capital adequacy.

ROAA – Return on Average Assets, the annualized percentage of net income divided by total average assets for the period. This ratio is a

measurement of a bank’s profitability in relation to assets.

ROAE – Return on Average Equity, the annualized percentage of net income divided by total average equity for the period. This ratio is a

measurement of a bank’s profitability in relation to shareholder’s equity.

Tier 1 Risk Based Capital – A regulatory definition of risk based capital, measured by dividing a bank’s core common equity, non-cumulative

preferred stock and minority interests in the equity accounts of consolidated subsidiaries to risk weighted assets.

Total Risk Based Capital – A regulatory definition of bank risk based capital, measured by dividing Tier 1 capital, subordinated debt, other forms of

preferred stock, and a portion of the bank’s allowance for loan and lease losses to risk weighted assets.

Glossary of Terms

25