Attached files

| file | filename |

|---|---|

| 8-K - WEC ENERGY GROUP 8-K - WEC ENERGY GROUP, INC. | wecenergygroupform8-k12122.htm |

Poised for Growth

Investor Update: December 2017

1

Cautionary Statement Regarding Forward-Looking Information

Much of the information contained in this presentation is forward-looking information based upon management’s

current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among

other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow,

dividend growth and dividend payout ratios, capital plans, construction costs, generating unit retirements, investment

opportunities, corporate initiatives (including any generation restructuring plan), rate base, and environmental matters

(including emission reductions). Readers are cautioned not to place undue reliance on this forward-looking

information. Forward-looking information is not a guarantee of future performance and actual results may differ

materially from those set forth in the forward-looking information.

In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors

that could cause WEC Energy Group’s actual results to differ materially from those contemplated in any forward-

looking information or otherwise affect our future results of operations and financial condition include, among others,

the following: general economic conditions, including business and competitive conditions in the company’s service

territories; timing, resolution and impact of future rate cases and other regulatory decisions; the company’s ability to

continue to successfully integrate the operations of its subsidiaries; availability of the company’s generating facilities

and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes;

varying weather conditions; continued industry consolidation; cyber-security threats; the value of goodwill and its

possible impairment; construction risks; equity and bond market fluctuations; the impact of any legislative and

regulatory changes, including changes to existing and/or anticipated environmental standards and tax laws; current

and future litigation and regulatory investigations; changes in accounting standards; and other factors described under

the heading “Factors Affecting Results, Liquidity, and Capital Resources” in Management’s Discussion and Analysis of

Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-

Looking Information” and “Risk Factors” contained in WEC Energy Group’s Form 10-K for the year ended December

31, 2016 and in subsequent reports filed with the Securities and Exchange Commission. WEC Energy Group

expressly disclaims any obligation to publicly update or revise any forward-looking information.

2

Company Statistics

$21.9 billion market cap (1)

1.6 million electric customers

2.8 million gas customers

60% ownership of ATC

69,000 miles electric distribution

46,000 miles gas distribution

$17.7 billion of rate base (2)

99+% regulated (3)

(1) As of 11/30/17

(2) 2016 average rate base

(3) Based on earnings from operations

3

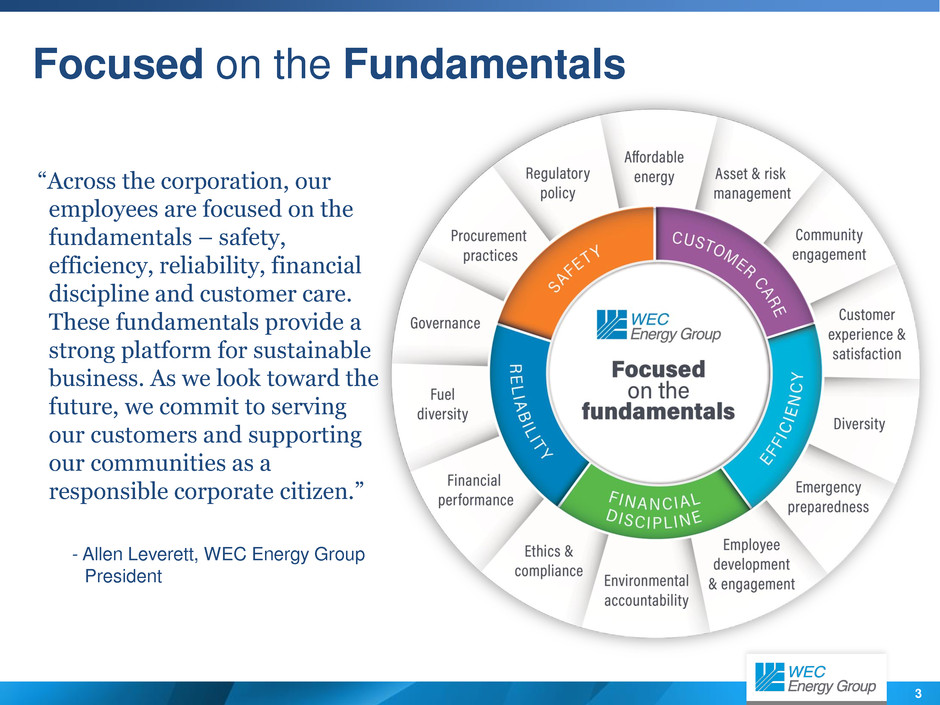

Focused on the Fundamentals

“Across the corporation, our

employees are focused on the

fundamentals – safety,

efficiency, reliability, financial

discipline and customer care.

These fundamentals provide a

strong platform for sustainable

business. As we look toward the

future, we commit to serving

our customers and supporting

our communities as a

responsible corporate citizen.”

- Allen Leverett, WEC Energy Group

President

4

Focused on the Fundamentals

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Best in Midwest 7 years in a row

Ranked #2 in our sector

GAAP Adjusted

A Decade of Consistent EPS Growth

Best in America - 2017

5

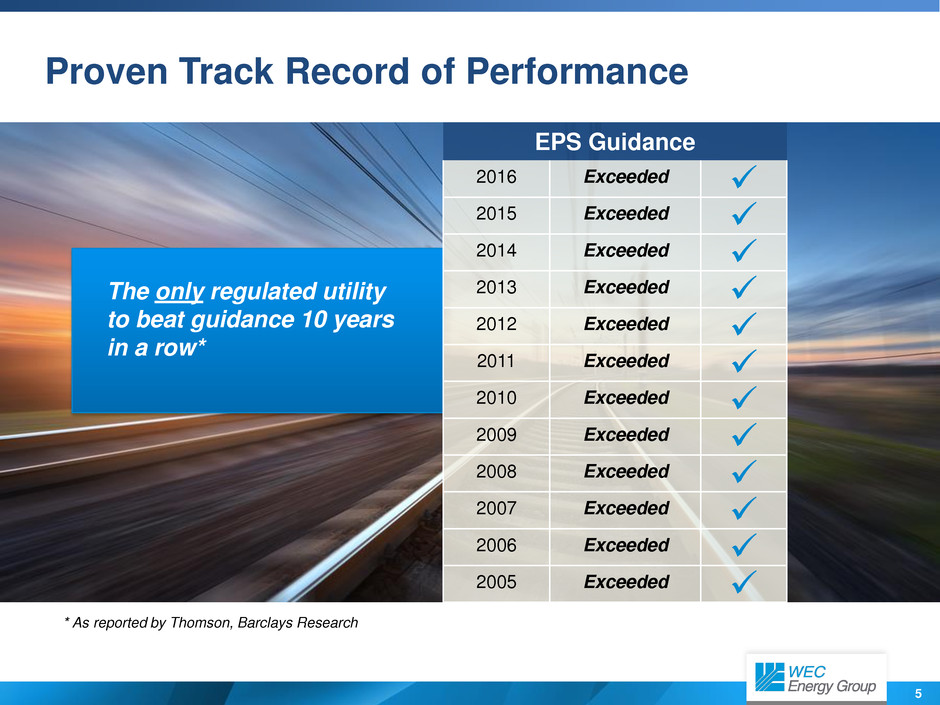

Proven Track Record of Performance

EPS Guidance

2016 Exceeded

2015 Exceeded

2014 Exceeded

2013 Exceeded

2012 Exceeded

2011 Exceeded

2010 Exceeded

2009 Exceeded

2008 Exceeded

2007 Exceeded

2006 Exceeded

2005 Exceeded

* As reported by Thomson, Barclays Research

The only regulated utility

to beat guidance 10 years

in a row*

6

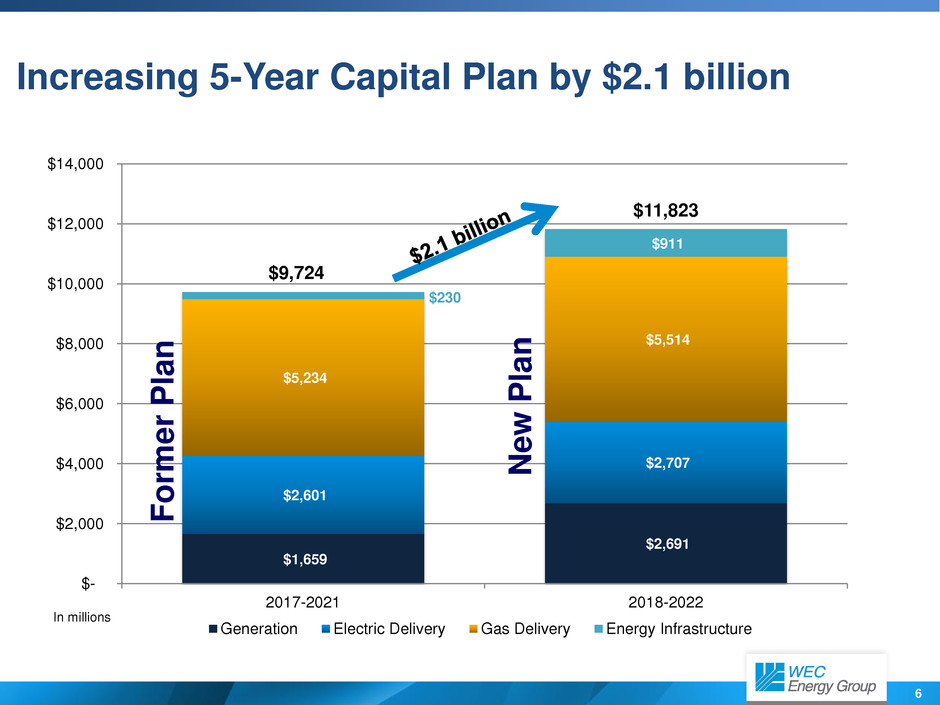

Increasing 5-Year Capital Plan by $2.1 billion

$1,659

$2,691

$2,601

$2,707

$5,234

$5,514

$230

$911

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

2017-2021 2018-2022

Generation Electric Delivery Gas Delivery Energy Infrastructure

In millions

$9,724

$11,823

Former Pla

n

N

e

w

Pla

n

7

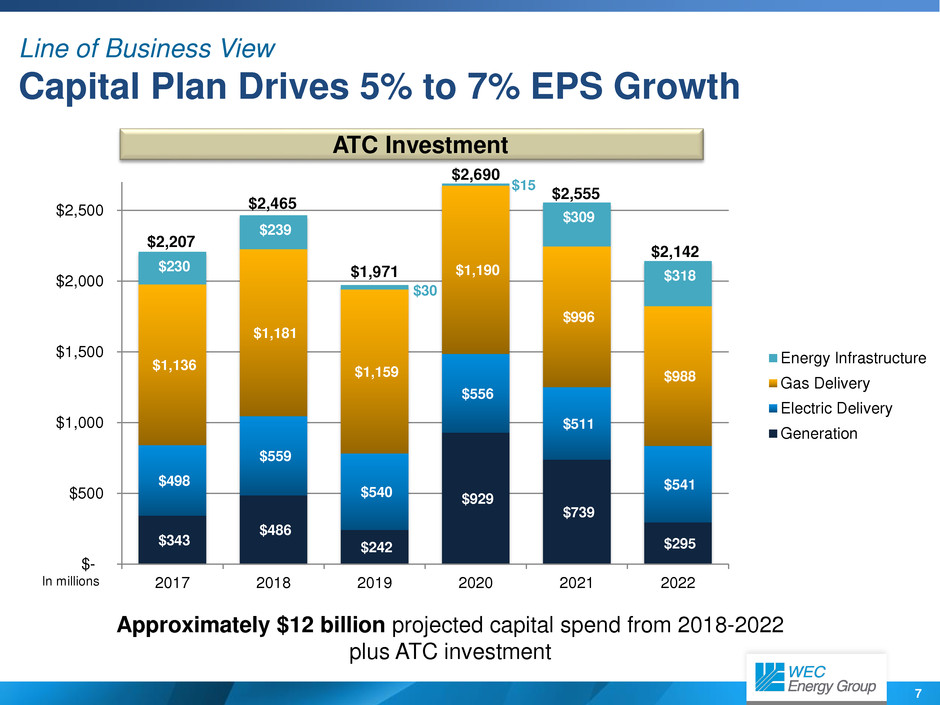

Line of Business View

Capital Plan Drives 5% to 7% EPS Growth

$343

$486

$242

$929

$739

$295

$498

$559

$540

$556

$511

$541

$1,136

$1,181

$1,159

$1,190

$996

$988

$230

$239

$30

$15

$309

$318

$-

$500

$1,000

$1,500

$2,000

$2,500

2017 2018 2019 2020 2021 2022

Energy Infrastructure

Gas Delivery

Electric Delivery

Generation

In millions

Approximately $12 billion projected capital spend from 2018-2022

plus ATC investment

$2,465

$1,971

$2,690

$2,555

$2,207

ATC Investment

$2,142

8

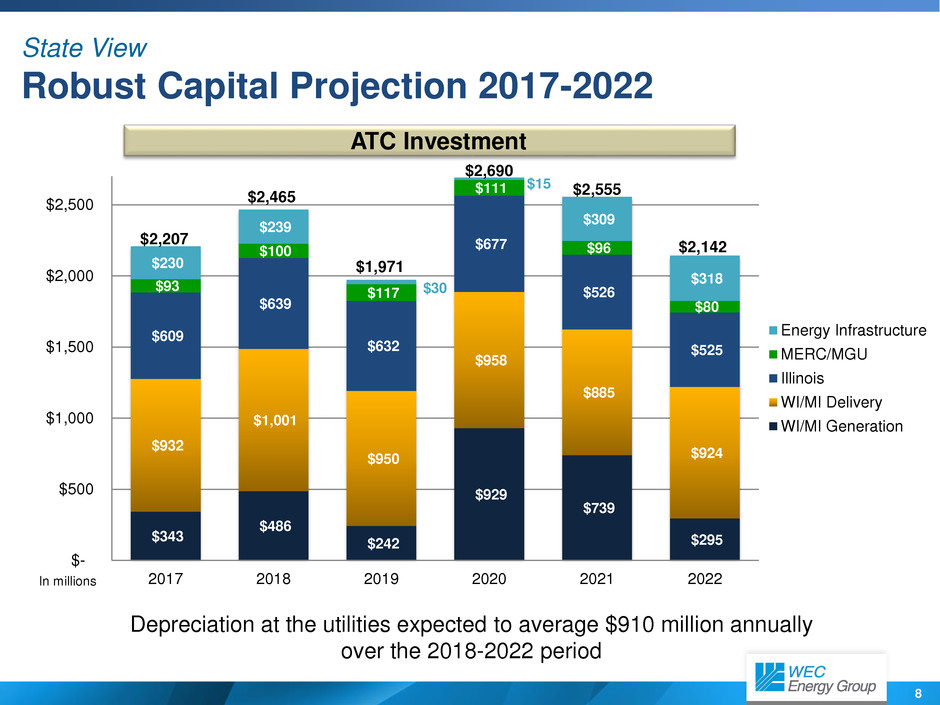

State View

Robust Capital Projection 2017-2022

$343

$486

$242

$929

$739

$295

$932

$1,001

$950

$958

$885

$924

$609

$639

$632

$677

$526

$525

$93

$100

$117

$111

$96

$80

$230

$239

$30

$15

$309

$318

$-

$500

$1,000

$1,500

$2,000

$2,500

2017 2018 2019 2020 2021 2022

Energy Infrastructure

MERC/MGU

Illinois

WI/MI Delivery

WI/MI Generation

In millions

Depreciation at the utilities expected to average $910 million annually

over the 2018-2022 period

$2,690

$2,465

$1,971

$2,555

$2,207

ATC Investment

$2,142

9

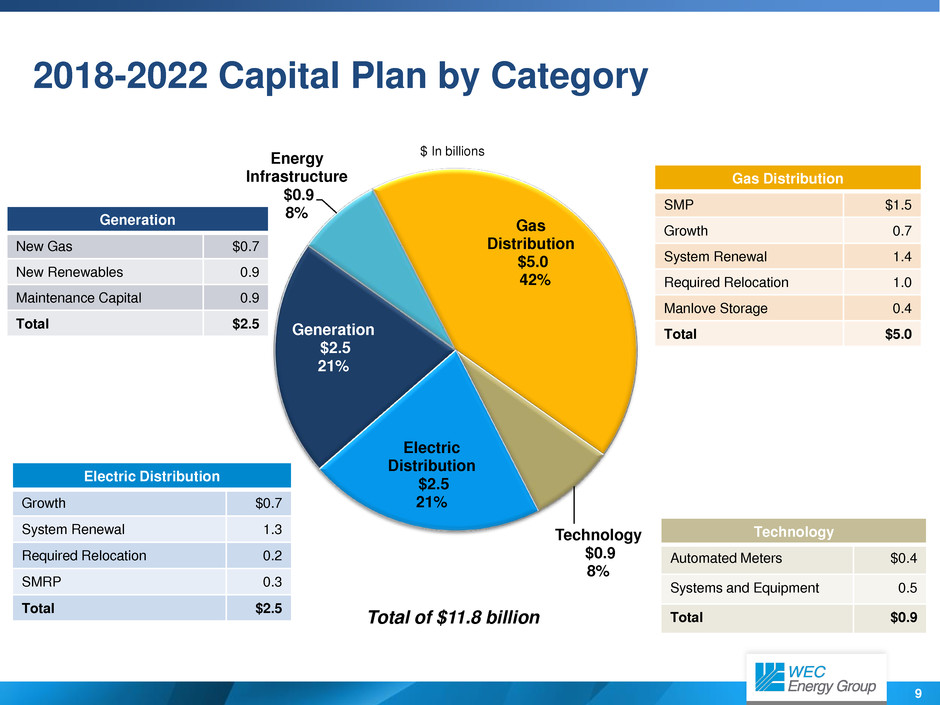

Generation

$2.5

21%

Energy

Infrastructure

$0.9

8%

Gas

Distribution

$5.0

42%

Technology

$0.9

8%

Electric

Distribution

$2.5

21%

Gas Distribution

SMP $1.5

Growth 0.7

System Renewal 1.4

Required Relocation 1.0

Manlove Storage 0.4

Total $5.0

Generation

New Gas $0.7

New Renewables 0.9

Maintenance Capital 0.9

Total $2.5

2018-2022 Capital Plan by Category

$ In billions

Electric Distribution

Growth $0.7

System Renewal 1.3

Required Relocation 0.2

SMRP 0.3

Total $2.5

Technology

Automated Meters $0.4

Systems and Equipment 0.5

Total $0.9 Total of $11.8 billion

10

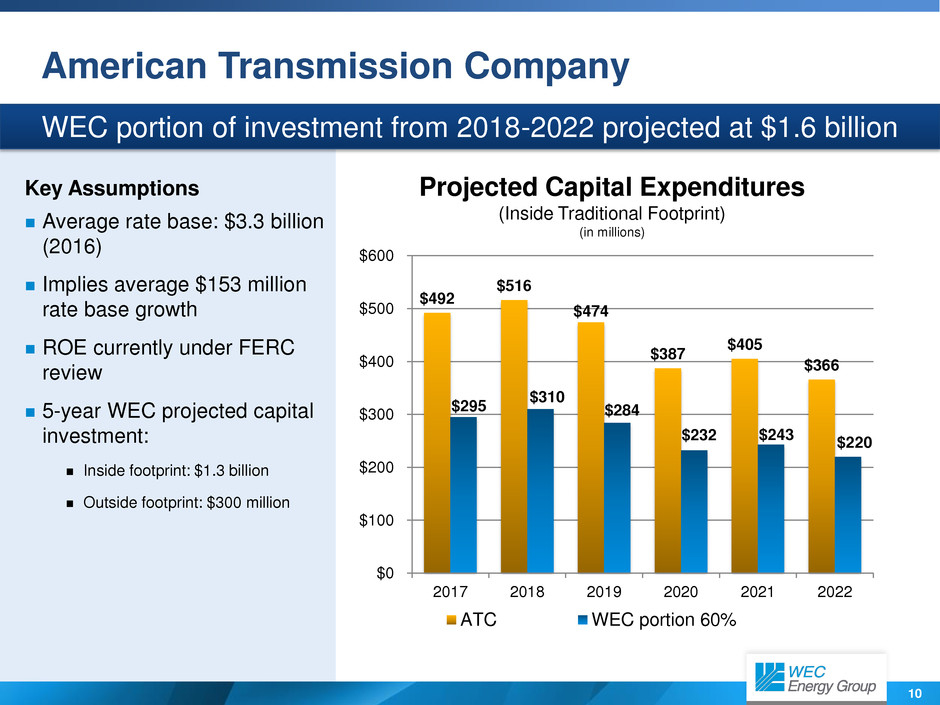

$492

$516

$474

$387

$405

$366

$295

$310

$284

$232 $243 $220

$0

$100

$200

$300

$400

$500

$600

2017 2018 2019 2020 2021 2022

ATC WEC portion 60%

American Transmission Company

Key Assumptions

Average rate base: $3.3 billion

(2016)

Implies average $153 million

rate base growth

ROE currently under FERC

review

5-year WEC projected capital

investment:

Inside footprint: $1.3 billion

Outside footprint: $300 million

Projected Capital Expenditures

(Inside Traditional Footprint)

(in millions)

WEC portion of investment from 2018-2022 projected at $1.6 billion

11

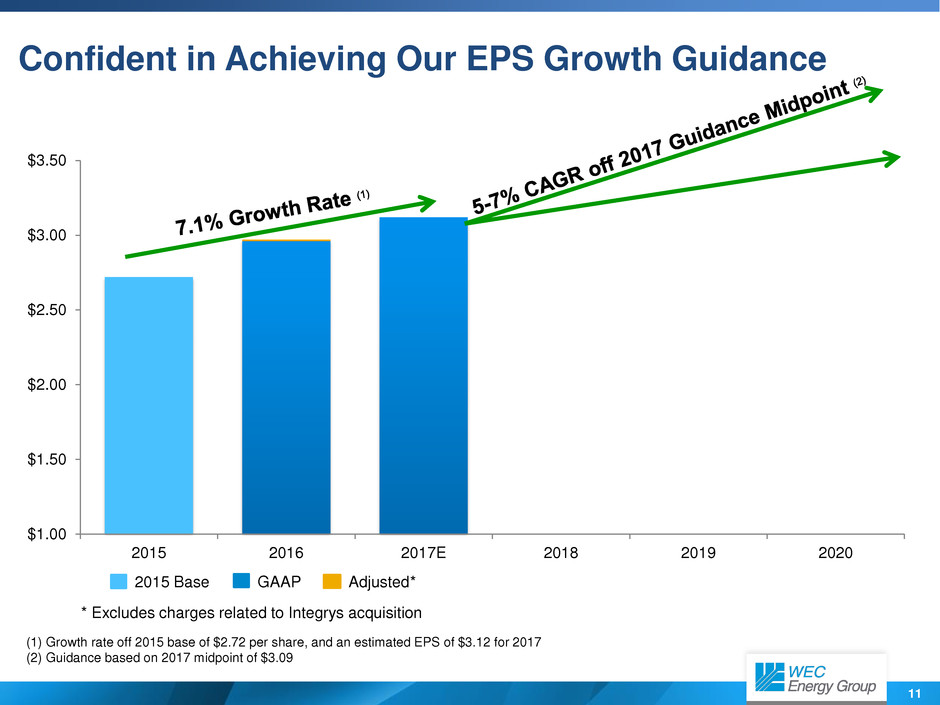

Confident in Achieving Our EPS Growth Guidance

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2015 2016 2017E 2018 2019 2020

* Excludes charges related to Integrys acquisition

2015 Base GAAP Adjusted*

(1) Growth rate off 2015 base of $2.72 per share, and an estimated EPS of $3.12 for 2017

(2) Guidance based on 2017 midpoint of $3.09

12

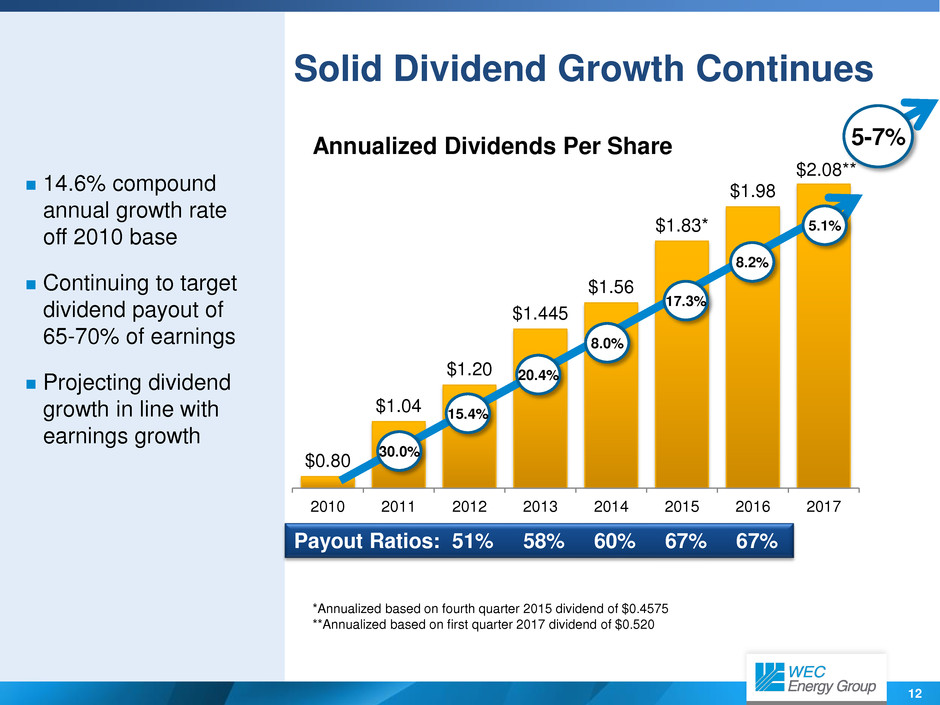

$0.80

$1.04

$1.20

$1.445

$1.56

$1.83*

$1.98

$2.08**

2010 2011 2012 2013 2014 2015 2016 2017

Solid Dividend Growth Continues

14.6% compound

annual growth rate

off 2010 base

Continuing to target

dividend payout of

65-70% of earnings

Projecting dividend

growth in line with

earnings growth

*Annualized based on fourth quarter 2015 dividend of $0.4575

**Annualized based on first quarter 2017 dividend of $0.520

Annualized Dividends Per Share

30.0%

Payout Ratios: 51% 58% 60% 67% 67%

15.4%

20.4%

8.0%

17.3%

8.2%

5.1%

5-7%

13

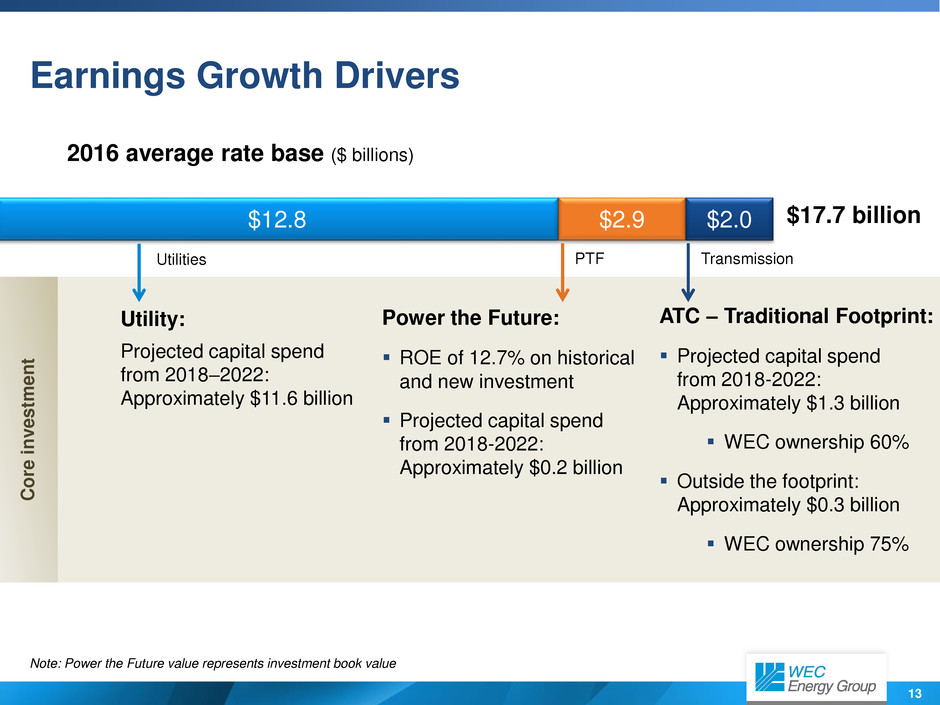

Earnings Growth Drivers

$2.7

2016 average rate base ($ billions)

Note: Power the Future value represents investment book value

$17.7 billion $12.8 $2.9 $2.0

Utility:

Projected capital spend

from 2018–2022:

Approximately $11.6 billion

ATC – Traditional Footprint:

Projected capital spend

from 2018-2022:

Approximately $1.3 billion

WEC ownership 60%

Outside the footprint:

Approximately $0.3 billion

WEC ownership 75%

Power the Future:

ROE of 12.7% on historical

and new investment

Projected capital spend

from 2018-2022:

Approximately $0.2 billion

Utilities PTF Transmission

C

o

re

i

n

v

estme

n

t

14

Focus on efficiency

Reshaping our Generation Fleet

for a Clean, Reliable Future

Our goal is to work with

industry partners,

environmental groups and

the state of Wisconsin with

a goal of reducing CO2

emissions by approximately

40 percent below 2005

levels by 2030.

Balancing reliability and customer cost with environmental stewardship

Taken as a whole, changes to our generation

fleet should reduce costs to customers, preserve

fuel diversity and reduce carbon emissions.

Reshaping our generation includes:

Retiring older, fossil-fueled generating units

Building state-of-the-art, natural gas

generation

Investing in cost-effective, zero-carbon

generation

15

Retiring Coal-Fueled Generation

Our plan includes retiring more than 1,800

megawatts (MW) of coal generation by 2020

Pulliam Power Plant

200 MW

Expected fall 2018 or later

Edgewater 4

WPS share – 100 MW

Expected end of third quarter 2018

Presque Isle Power Plant

350 MW

Expected mid-2019

Pleasant Prairie Power Plant

1,190 MW

Expected second quarter 2018

Achieving targeted CO2

reductions by 2022

16

Building Natural Gas-Fueled Generation

U.P. of Michigan (UMERC)

RICE generation

180 MW

Expected in-service – by mid-2019

West Marinette (WPS)

RICE generation

50 MW

Anticipated need – 2021

Option to invest in West Riverside Energy Center

Combined cycle

200 MW

2020-2022

Additional projects being actively developed

Reciprocating Internal

Combustion Engines

(RICE) are modular, run

on natural gas and

allow for reliable and

flexible operations.

400+ MW of natural gas-fueled generation

17

Investing in Zero-Carbon Generation

Solar

WPS – purchase 200 MW from developer

We Energies – purchase150 MW from developer

Qualifies for Investment Tax Credit (ITC)

Battery storage

Option to add as part of solar developments,

if cost effective

Qualifies for Investment Tax Credit (ITC)

Additional projects being actively developed

Solar generation technology

has greatly improved, become

more cost-effective and

complements our summer

demand curve.

350+ MW of zero-carbon generation in Wisconsin by 2020

18

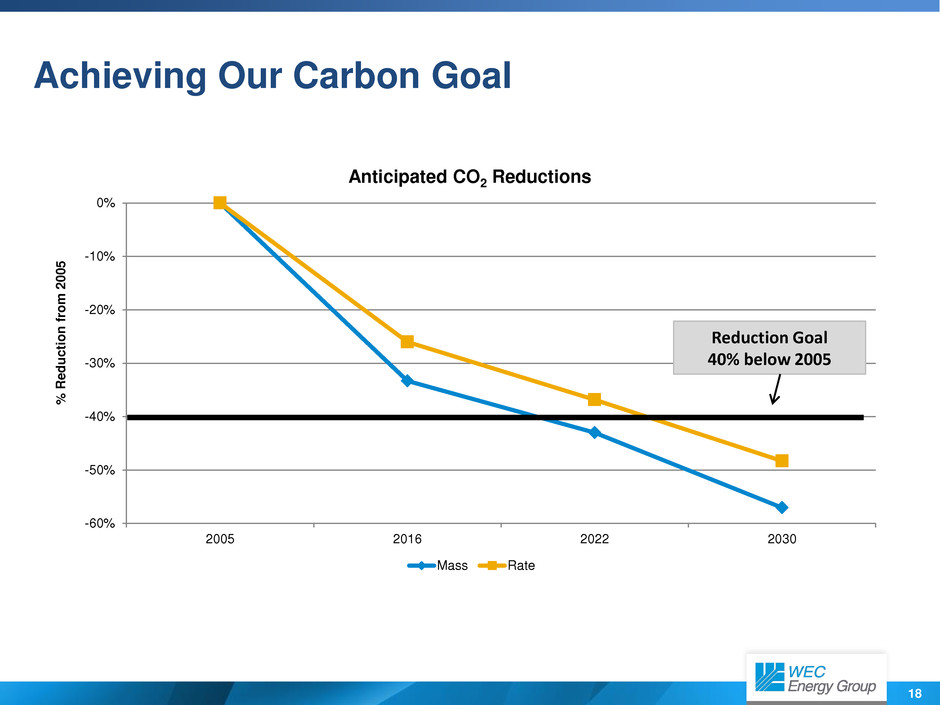

-60%

-50%

-40%

-30%

-20%

-10%

0%

2005 2016 2022 2030

%

Red

u

cti

o

n

f

ro

m 20

0

5

Anticipated CO2 Reductions

Mass Rate

Achieving Our Carbon Goal

Reduction Goal

40% below 2005

19

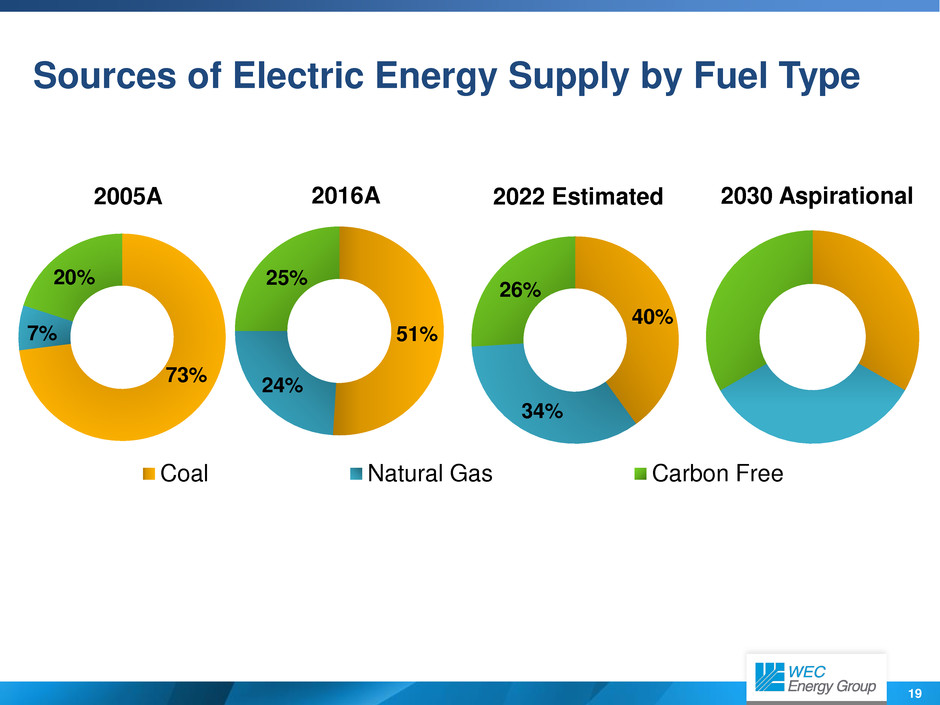

51%

24%

25%

2016A

Coal Natural Gas Carbon Free

73%

7%

20%

2005A

Sources of Electric Energy Supply by Fuel Type

40%

34%

26%

2022 Estimated 2030 Aspirational

20

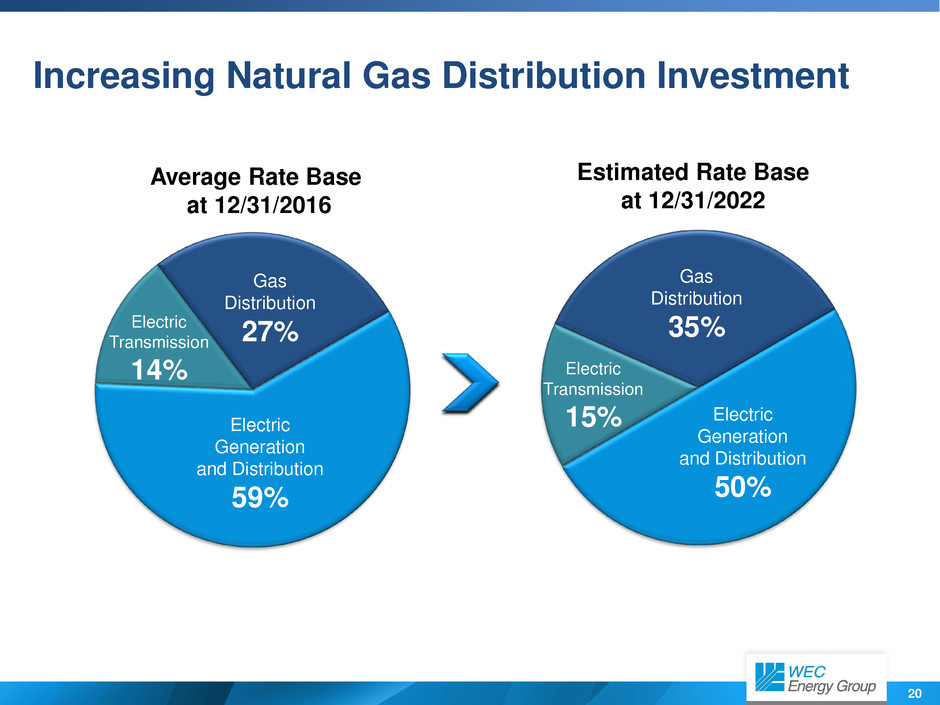

Increasing Natural Gas Distribution Investment

Electric

Generation

and Distribution

59%

Gas

Distribution

27%

Estimated Rate Base

at 12/31/2022

Average Rate Base

at 12/31/2016

Gas

Distribution

35% Electric

Transmission

14% Electric

Transmission

15% Electric

Generation

and Distribution

50%

21

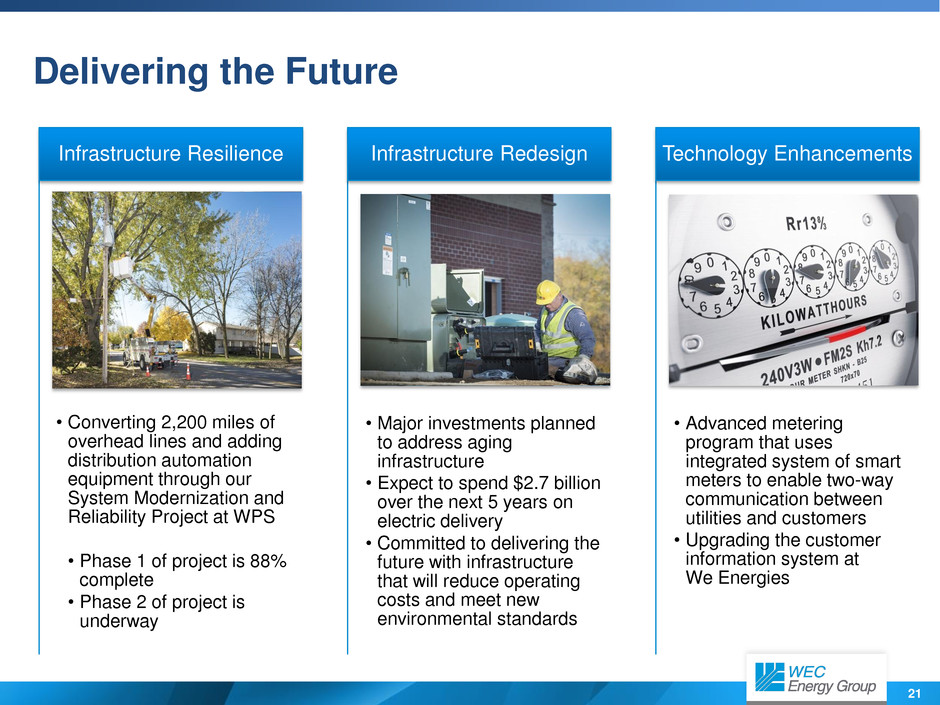

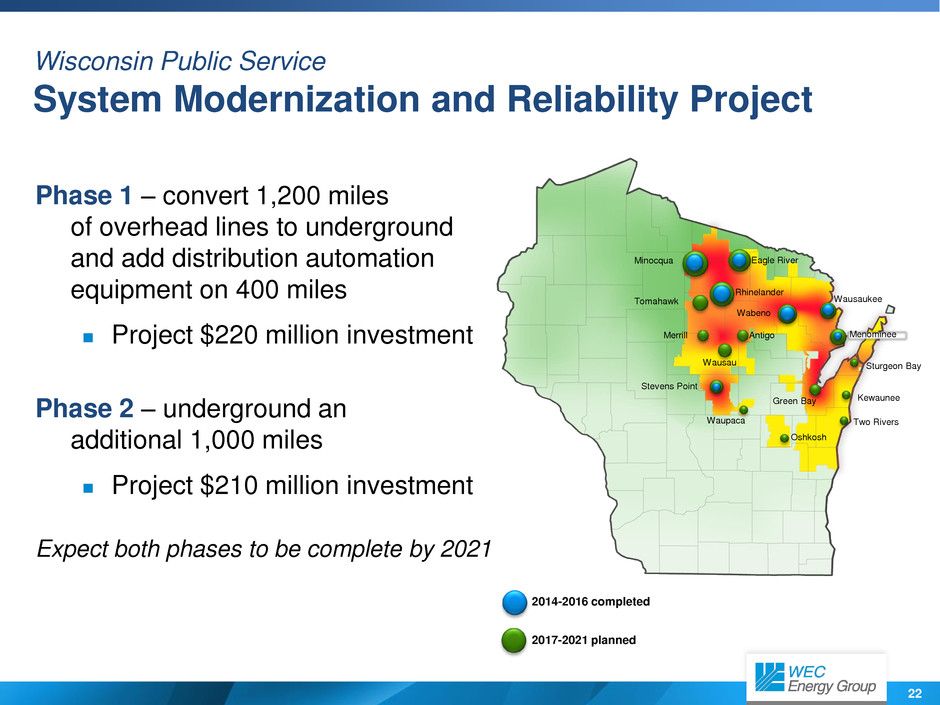

Delivering the Future

• Converting 2,200 miles of

overhead lines and adding

distribution automation

equipment through our

System Modernization and

Reliability Project at WPS

• Phase 1 of project is 88%

complete

• Phase 2 of project is

underway

Infrastructure Resilience

• Major investments planned

to address aging

infrastructure

• Expect to spend $2.7 billion

over the next 5 years on

electric delivery

• Committed to delivering the

future with infrastructure

that will reduce operating

costs and meet new

environmental standards

Infrastructure Redesign

• Advanced metering

program that uses

integrated system of smart

meters to enable two-way

communication between

utilities and customers

• Upgrading the customer

information system at

We Energies

Technology Enhancements

22

Wisconsin Public Service

System Modernization and Reliability Project

Phase 1 – convert 1,200 miles

of overhead lines to underground

and add distribution automation

equipment on 400 miles

Project $220 million investment

Phase 2 – underground an

additional 1,000 miles

Project $210 million investment

Expect both phases to be complete by 2021

2017-2021 planned

Green Bay

Two Rivers

Kewaunee

Sturgeon Bay

Waupaca

Oshkosh

Tomahawk

Merrill

Wausau

Antigo

Stevens Point

2014-2016 completed

Minocqua

Rhinelander

Eagle River

Wausaukee

Menominee

Wabeno

23

Investment recovery under a monthly rider

Major Construction Projects – Peoples Gas

Natural Gas System Modernization Program

Project $280-$300 million average annual investment

Enabling legislation in effect from 2014-2023

Extensive effort to modernize natural gas infrastructure in city of Chicago

Ultimately replace 2,000 miles

23% complete*

*Total program completion percentage is based on the weighted average of program categories

that comprise the major scope components of the SMP project

24

Major Construction Projects – Wisconsin Utilities

Advanced Metering Infrastructure (AMI) Program

AMI is an integrated system of smart meters,

communication networks and data management

systems that enable two-way communication

between utilities and customers

Replaces aging meter-reading equipment on both

our network and customer property

Reduces manual effort for disconnects and

reconnects

Enhances outage management capabilities

Improves revenue protection and theft detection

Project to spend approximately $200 million over

the next four years

25

Acquisition of Bluewater

Natural Gas Holding

Bluewater entered into long-term service

agreements with the three Wisconsin gas

utilities

Total acquisition price: $230 million

Working gas capacity of 23.2 Bcf

Expected to provide a utility return on capital

Public Service Commission of Wisconsin

granted declaratory ruling and approval on

June 15, 2017

Closed acquisition on June 30, 2017

Well Positioned for the Future

Underground natural

gas storage facilities in

Michigan that will

provide one-third of the

storage needs for our

natural gas distribution

companies in Wisconsin

26

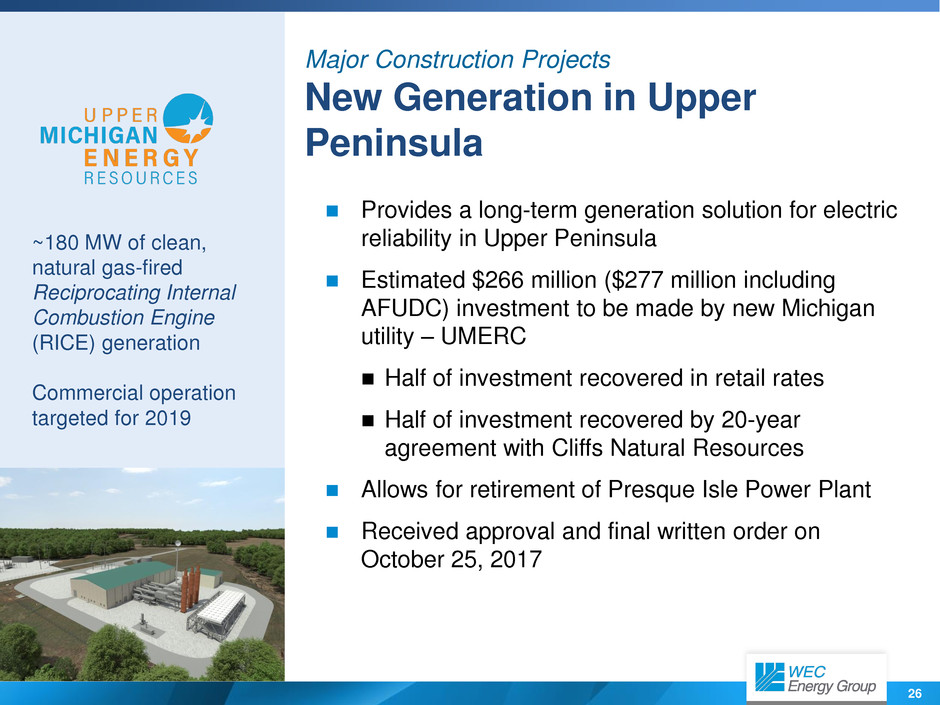

Major Construction Projects

New Generation in Upper

Peninsula

Provides a long-term generation solution for electric

reliability in Upper Peninsula

Estimated $266 million ($277 million including

AFUDC) investment to be made by new Michigan

utility – UMERC

Half of investment recovered in retail rates

Half of investment recovered by 20-year

agreement with Cliffs Natural Resources

Allows for retirement of Presque Isle Power Plant

Received approval and final written order on

October 25, 2017

~180 MW of clean,

natural gas-fired

Reciprocating Internal

Combustion Engine

(RICE) generation

Commercial operation

targeted for 2019

27

Foxconn in Wisconsin

Foxconn announced

July 26, 2017,

Wisconsin’s largest

economic development

project and largest

corporate attraction

project in U.S. history,

as measured by jobs.

Capital investment by Foxconn of $10 billion dollars

Goal of creating 13,000 jobs, with an average salary

of $53,875, plus benefits

Estimated 22,000 indirect jobs created throughout

Wisconsin

Largest greenfield investment by a foreign-based

company in U.S. history as measured by jobs

One of the largest manufacturing campuses

in the world

Project expected to support 10,000 construction

jobs over the next four years and 6,000 indirect

jobs from construction

Estimated $7 billion annual economic impact

on the state

Plans to be operational in 2020

Source: inWisconsin.com

28

Key Takeaways for WEC Energy Group

Track record of exceptional performance

Portfolio of premium businesses with investment

opportunities that can support 5-7 percent EPS growth

with minimal rate impact

Dividend growth projected to be in line with

earnings growth

Poised to deliver among the best risk-adjusted returns

in the industry

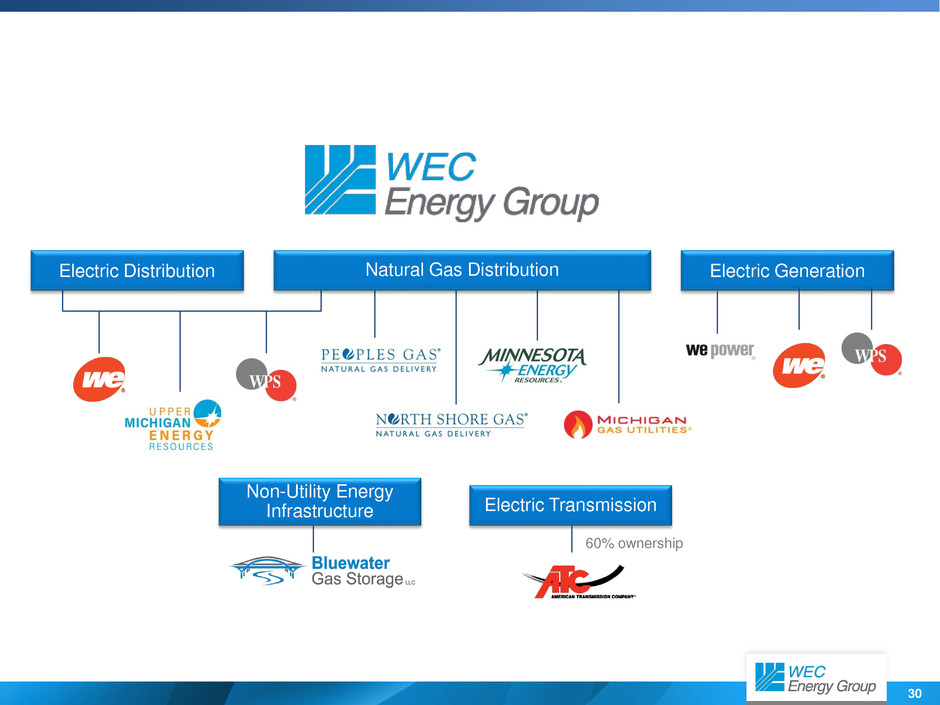

Appendix

30

Electric Distribution

Electric Transmission

60% ownership

Electric Generation

Non-Utility Energy

Infrastructure

Natural Gas Distribution

31

Still Recognizing Benefits from Acquisition

WEC Energy Group formed in 2015 when Wisconsin Energy

acquired Integrys in a transaction valued at $9 billion

Acquisition created the leading electric and natural gas

utility in the Midwest

WEC Energy Group’s subsidiaries combined are the eighth-largest

natural gas distributor in the U.S.

Met or exceeded WEC’s acquisition criteria

Accretive to earnings per share starting in first full calendar year of

combined operations

Largely credit neutral

Long-term growth prospects of combined entity equal to or greater than

stand-alone company

32

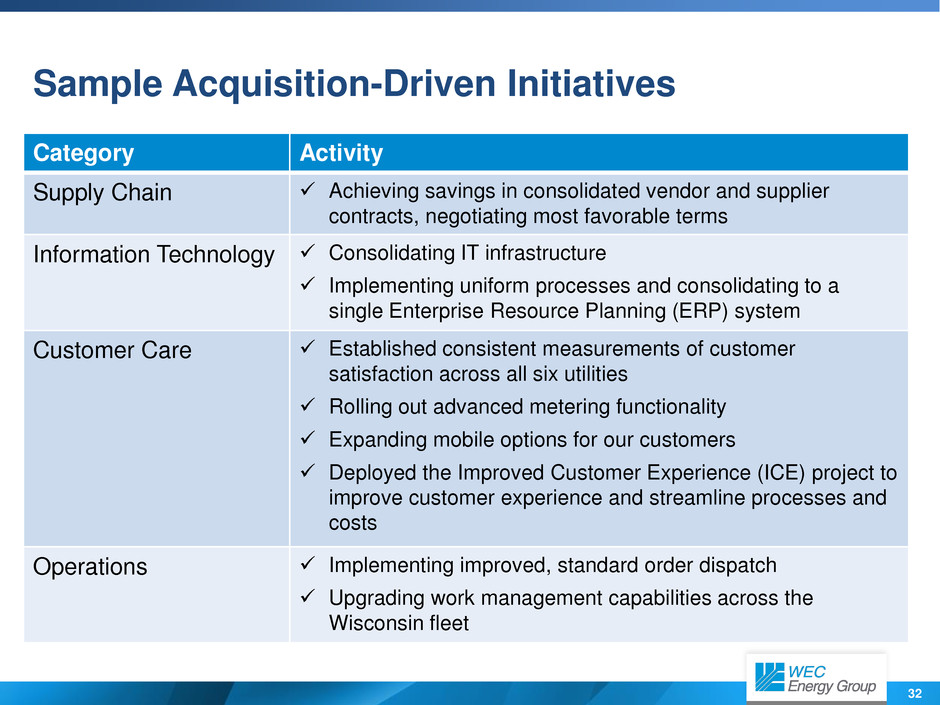

Sample Acquisition-Driven Initiatives

Category Activity

Supply Chain Achieving savings in consolidated vendor and supplier

contracts, negotiating most favorable terms

Information Technology Consolidating IT infrastructure

Implementing uniform processes and consolidating to a

single Enterprise Resource Planning (ERP) system

Customer Care Established consistent measurements of customer

satisfaction across all six utilities

Rolling out advanced metering functionality

Expanding mobile options for our customers

Deployed the Improved Customer Experience (ICE) project to

improve customer experience and streamline processes and

costs

Operations Implementing improved, standard order dispatch

Upgrading work management capabilities across the

Wisconsin fleet

33

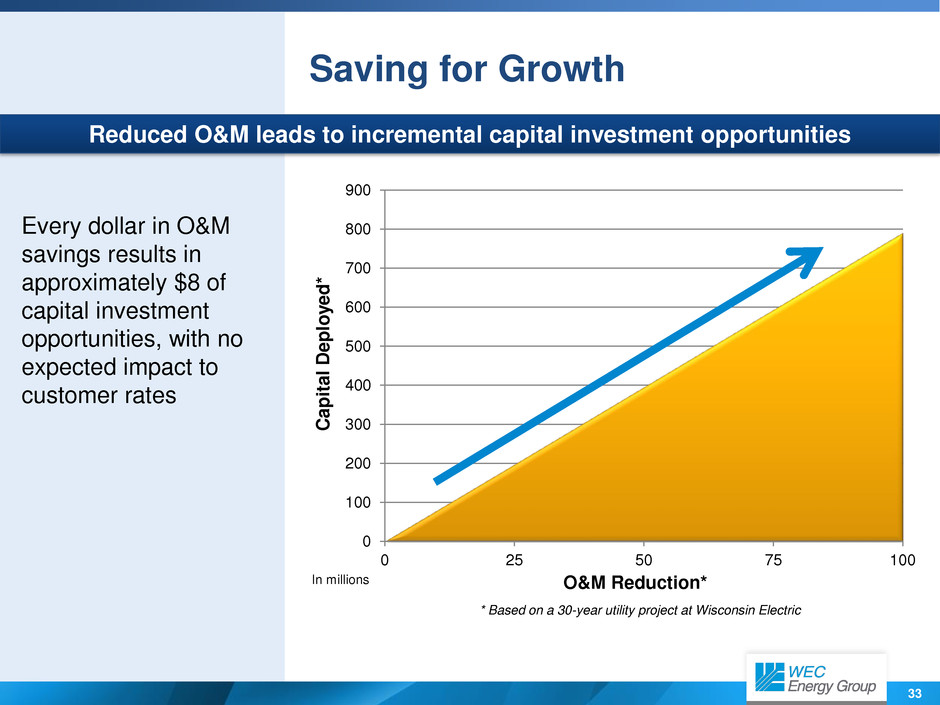

Saving for Growth

Every dollar in O&M

savings results in

approximately $8 of

capital investment

opportunities, with no

expected impact to

customer rates

0

100

200

300

400

500

600

700

800

900

0 25 50 75 100

C

a

p

ita

l

D

e

p

lo

y

e

d

*

O&M Reduction* In millions

* Based on a 30-year utility project at Wisconsin Electric

Reduced O&M leads to incremental capital investment opportunities

34

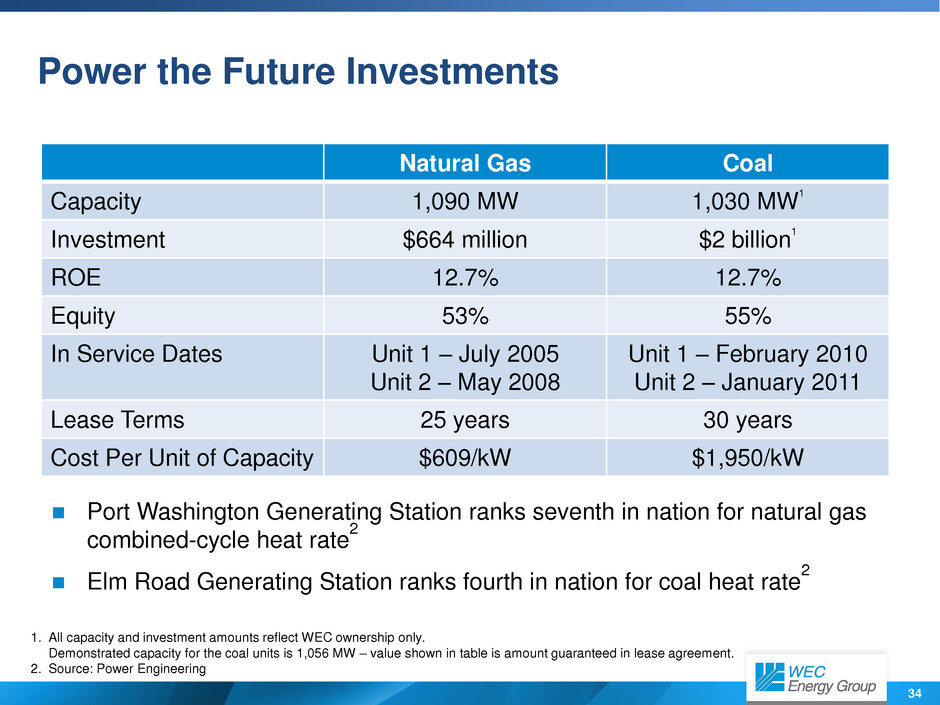

Power the Future Investments

Port Washington Generating Station ranks seventh in nation for natural gas

combined-cycle heat rate

2

Elm Road Generating Station ranks fourth in nation for coal heat rate

2

Natural Gas Coal

Capacity 1,090 MW 1,030 MW

1

Investment $664 million $2 billion

1

ROE 12.7% 12.7%

Equity 53% 55%

In Service Dates Unit 1 – July 2005

Unit 2 – May 2008

Unit 1 – February 2010

Unit 2 – January 2011

Lease Terms 25 years 30 years

Cost Per Unit of Capacity $609/kW $1,950/kW

1. All capacity and investment amounts reflect WEC ownership only.

Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement.

2. Source: Power Engineering

35

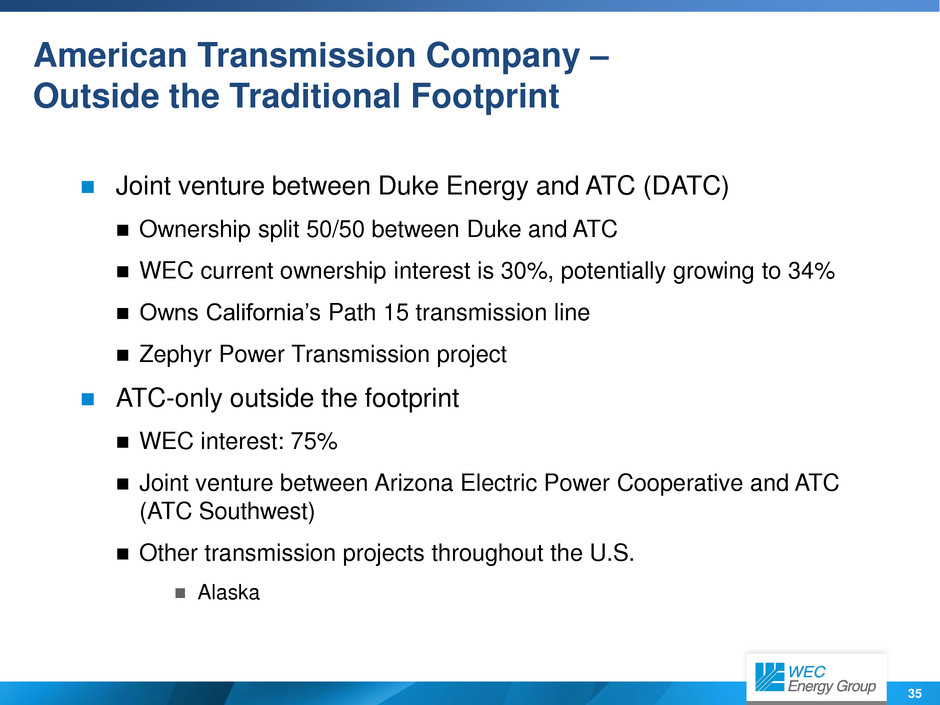

American Transmission Company –

Outside the Traditional Footprint

Joint venture between Duke Energy and ATC (DATC)

Ownership split 50/50 between Duke and ATC

WEC current ownership interest is 30%, potentially growing to 34%

Owns California’s Path 15 transmission line

Zephyr Power Transmission project

ATC-only outside the footprint

WEC interest: 75%

Joint venture between Arizona Electric Power Cooperative and ATC

(ATC Southwest)

Other transmission projects throughout the U.S.

Alaska

36

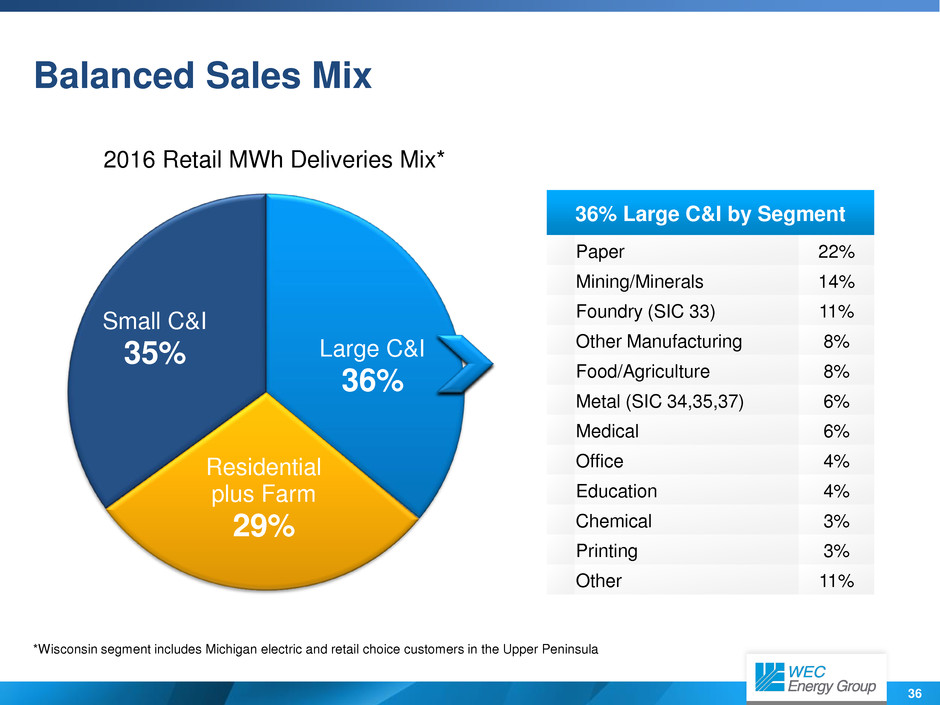

36% Large C&I by Segment

Paper 22%

Mining/Minerals 14%

Foundry (SIC 33) 11%

Other Manufacturing 8%

Food/Agriculture 8%

Metal (SIC 34,35,37) 6%

Medical 6%

Office 4%

Education 4%

Chemical 3%

Printing 3%

Other 11%

Balanced Sales Mix

Large C&I

36%

Residential

plus Farm

29%

Small C&I

35%

2016 Retail MWh Deliveries Mix*

*Wisconsin segment includes Michigan electric and retail choice customers in the Upper Peninsula

37

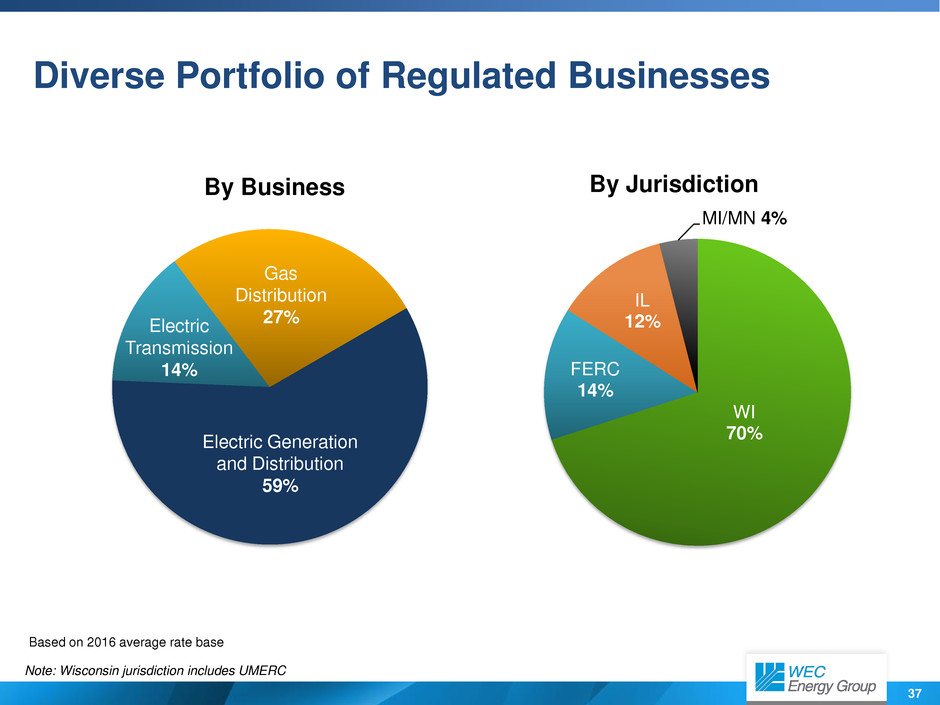

Diverse Portfolio of Regulated Businesses

Electric Generation

and Distribution

59%

Gas

Distribution

27% Electric

Transmission

14%

Based on 2016 average rate base

WI

70%

FERC

14%

IL

12%

MI/MN 4%

By Jurisdiction By Business

Note: Wisconsin jurisdiction includes UMERC

38

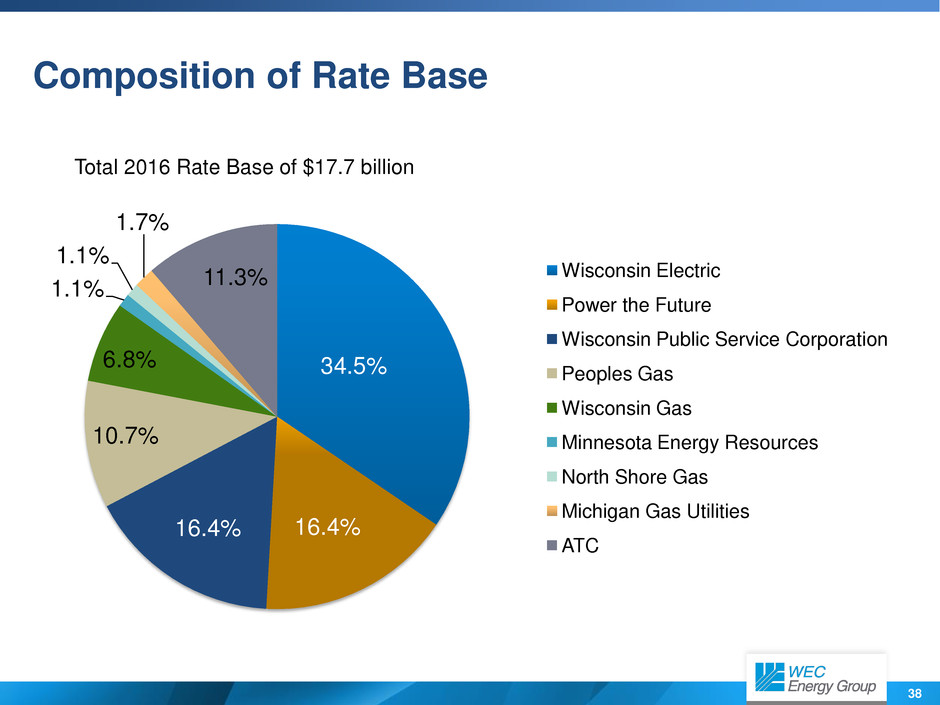

Composition of Rate Base

34.5%

16.4% 16.4%

10.7%

6.8%

1.1%

1.1%

1.7%

11.3% Wisconsin Electric

Power the Future

Wisconsin Public Service Corporation

Peoples Gas

Wisconsin Gas

Minnesota Energy Resources

North Shore Gas

Michigan Gas Utilities

ATC

Total 2016 Rate Base of $17.7 billion

39

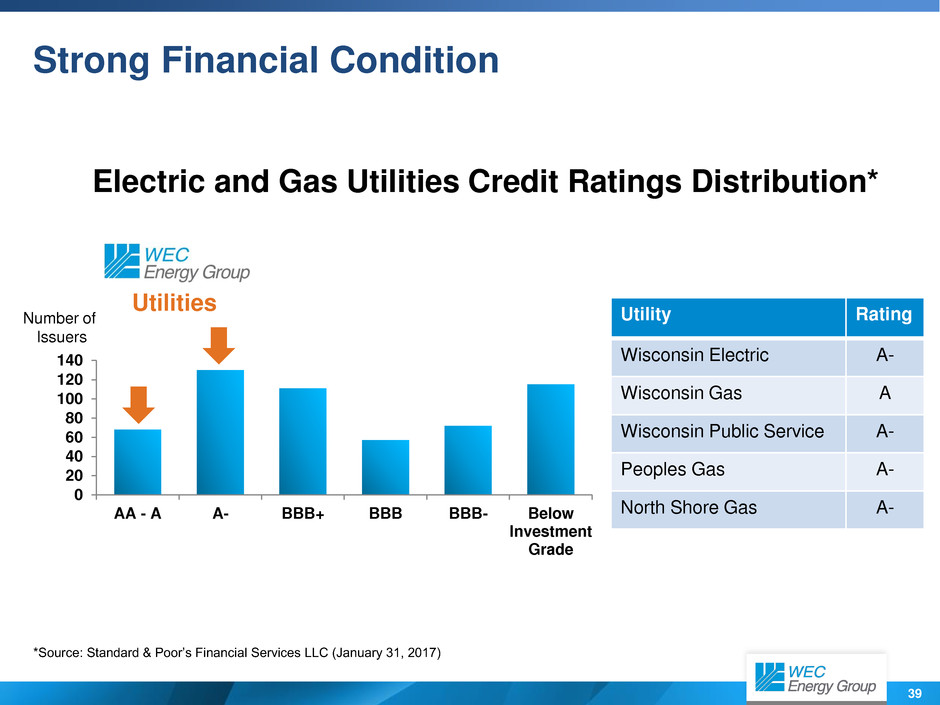

0

20

40

60

80

100

120

140

AA - A A- BBB+ BBB BBB- Below

Investment

Grade

Strong Financial Condition

Number of

Issuers

*Source: Standard & Poor’s Financial Services LLC (January 31, 2017)

Utilities

Electric and Gas Utilities Credit Ratings Distribution*

Utility Rating

Wisconsin Electric A-

Wisconsin Gas A

Wisconsin Public Service A-

Peoples Gas A-

North Shore Gas A-

40

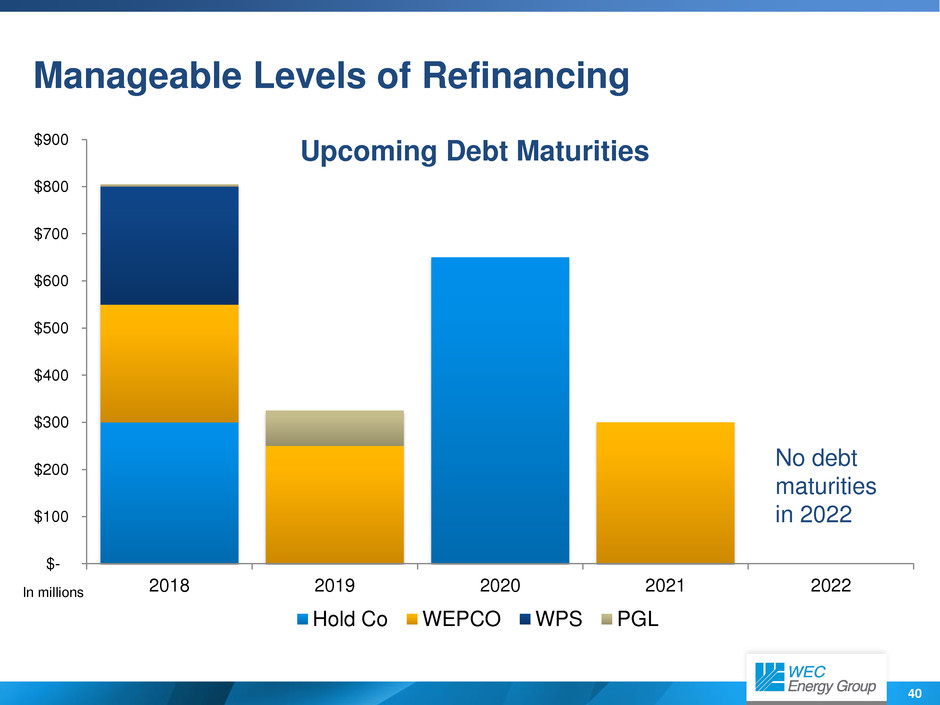

Manageable Levels of Refinancing

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900

2018 2019 2020 2021 2022

Upcoming Debt Maturities

Hold Co WEPCO WPS PGL

No debt

maturities

in 2022

In millions

41

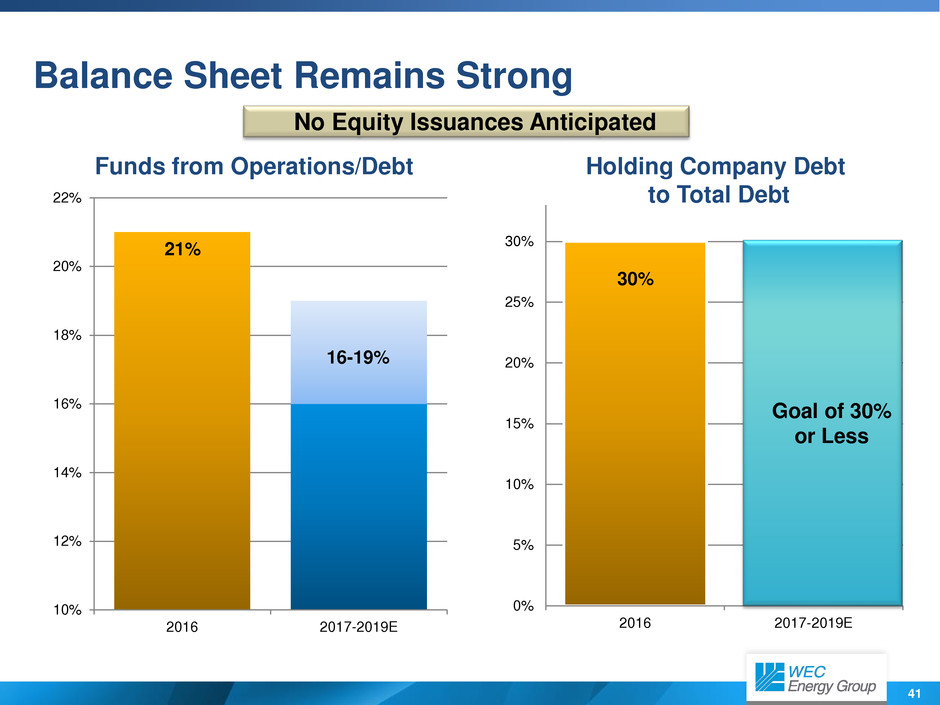

Balance Sheet Remains Strong

Holding Company Debt

to Total Debt

Funds from Operations/Debt

30%

2016 2017-2019E

0%

5%

10%

15%

20%

25%

30%

21%

16-19%

10%

12%

14%

16%

18%

20%

22%

2016 2017-2019E

Goal of 30%

or Less

No Equity Issuances Anticipated

42

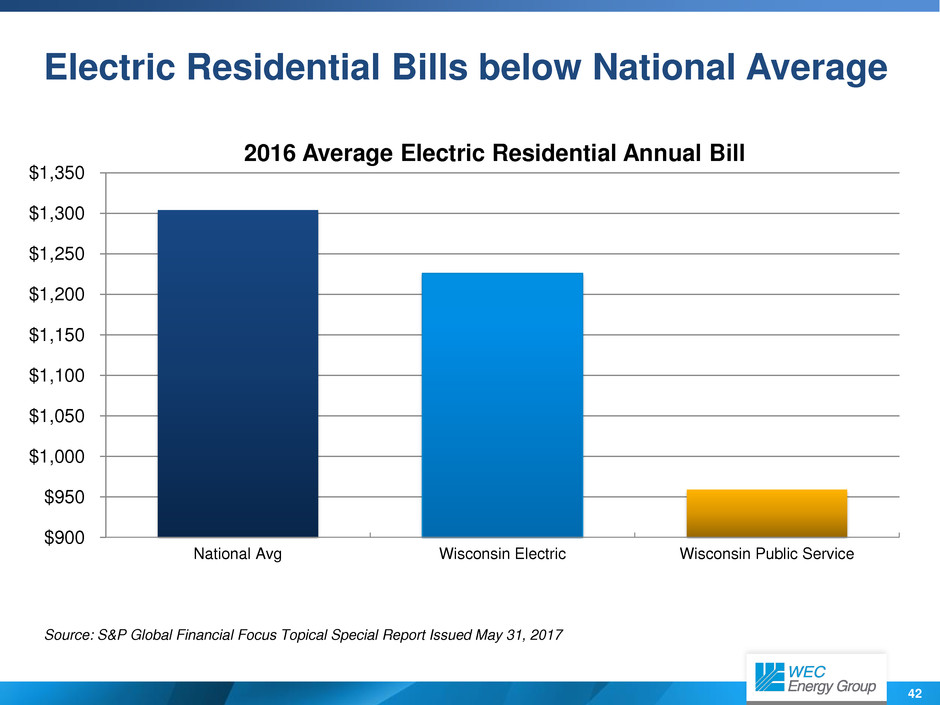

Electric Residential Bills below National Average

$900

$950

$1,000

$1,050

$1,100

$1,150

$1,200

$1,250

$1,300

$1,350

National Avg Wisconsin Electric Wisconsin Public Service

2016 Average Electric Residential Annual Bill

Source: S&P Global Financial Focus Topical Special Report Issued May 31, 2017

43

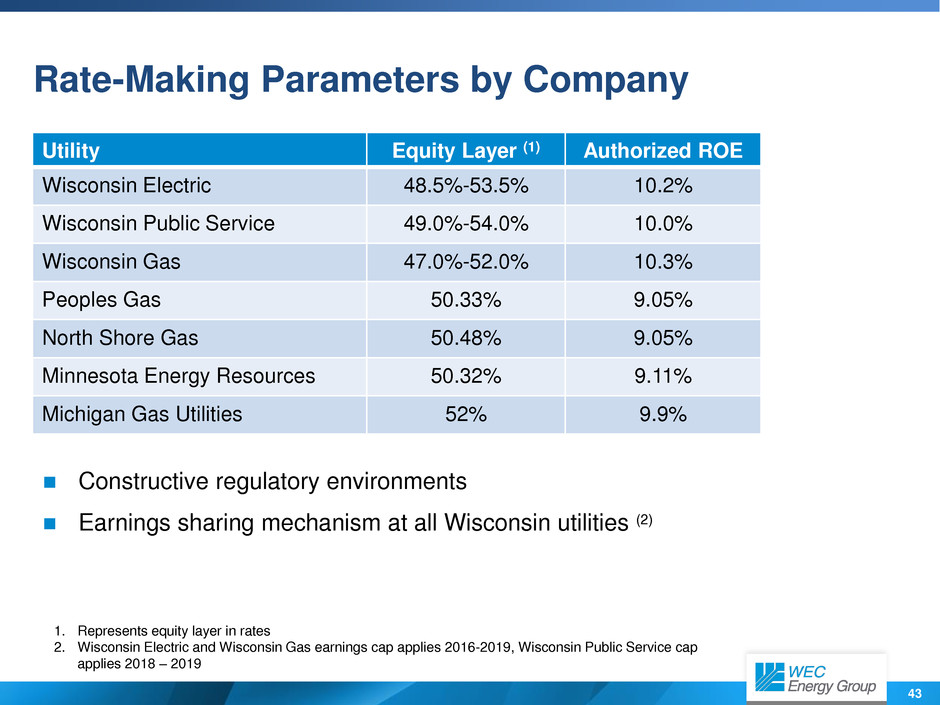

Rate-Making Parameters by Company

Utility Equity Layer (1) Authorized ROE

Wisconsin Electric 48.5%-53.5% 10.2%

Wisconsin Public Service 49.0%-54.0% 10.0%

Wisconsin Gas 47.0%-52.0% 10.3%

Peoples Gas 50.33% 9.05%

North Shore Gas 50.48% 9.05%

Minnesota Energy Resources 50.32% 9.11%

Michigan Gas Utilities 52% 9.9%

1. Represents equity layer in rates

2. Wisconsin Electric and Wisconsin Gas earnings cap applies 2016-2019, Wisconsin Public Service cap

applies 2018 – 2019

Constructive regulatory environments

Earnings sharing mechanism at all Wisconsin utilities (2)

44

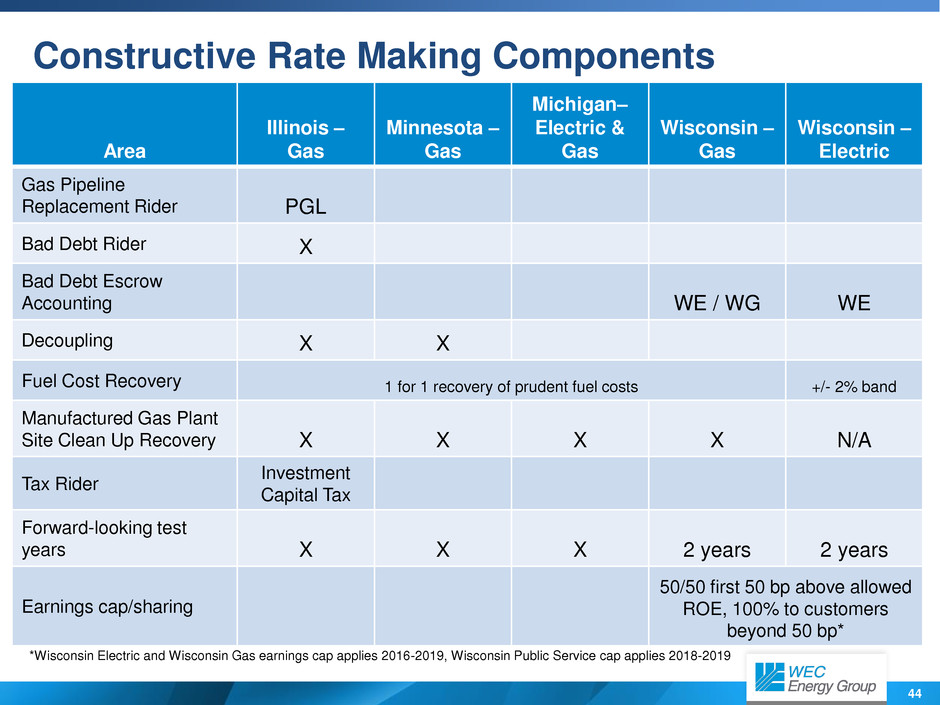

Constructive Rate Making Components

*Wisconsin Electric and Wisconsin Gas earnings cap applies 2016-2019, Wisconsin Public Service cap applies 2018-2019

Area

Illinois –

Gas

Minnesota –

Gas

Michigan–

Electric &

Gas

Wisconsin –

Gas

Wisconsin –

Electric

Gas Pipeline

Replacement Rider PGL

Bad Debt Rider X

Bad Debt Escrow

Accounting WE / WG WE

Decoupling X X

Fuel Cost Recovery 1 for 1 recovery of prudent fuel costs +/- 2% band

Manufactured Gas Plant

Site Clean Up Recovery X X X X N/A

Tax Rider

Investment

Capital Tax

Forward-looking test

years X X X 2 years 2 years

Earnings cap/sharing

50/50 first 50 bp above allowed

ROE, 100% to customers

beyond 50 bp*

45

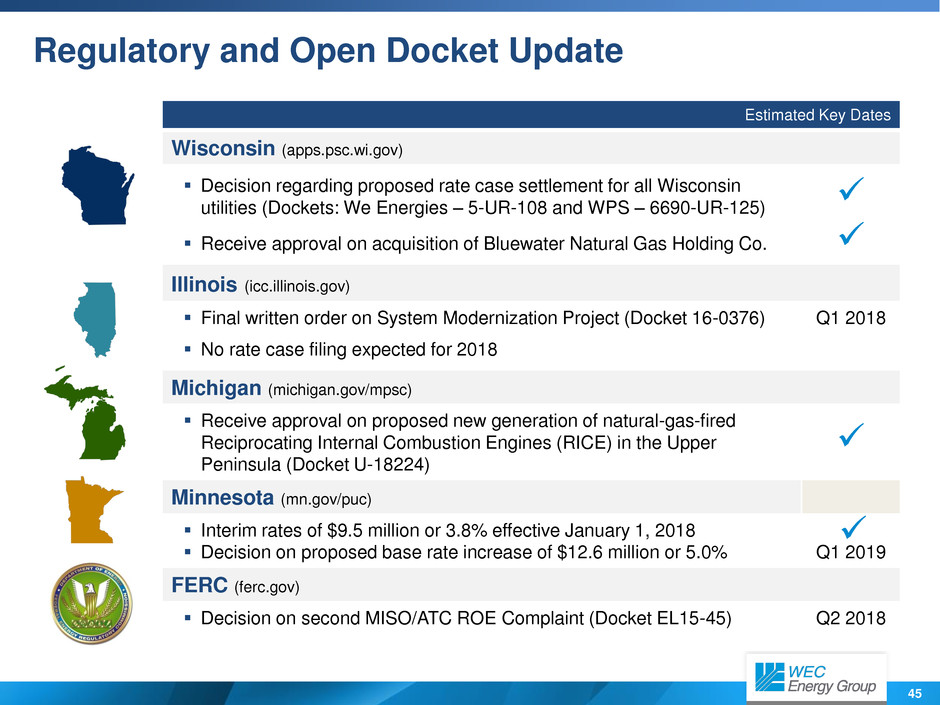

Estimated Key Dates

Wisconsin (apps.psc.wi.gov)

Decision regarding proposed rate case settlement for all Wisconsin

utilities (Dockets: We Energies – 5-UR-108 and WPS – 6690-UR-125)

Receive approval on acquisition of Bluewater Natural Gas Holding Co.

Illinois (icc.illinois.gov)

Final written order on System Modernization Project (Docket 16-0376) Q1 2018

No rate case filing expected for 2018

Michigan (michigan.gov/mpsc)

Receive approval on proposed new generation of natural-gas-fired

Reciprocating Internal Combustion Engines (RICE) in the Upper

Peninsula (Docket U-18224)

Minnesota (mn.gov/puc)

Interim rates of $9.5 million or 3.8% effective January 1, 2018

Decision on proposed base rate increase of $12.6 million or 5.0%

Q1 2019

FERC (ferc.gov)

Decision on second MISO/ATC ROE Complaint (Docket EL15-45) Q2 2018

Regulatory and Open Docket Update

46

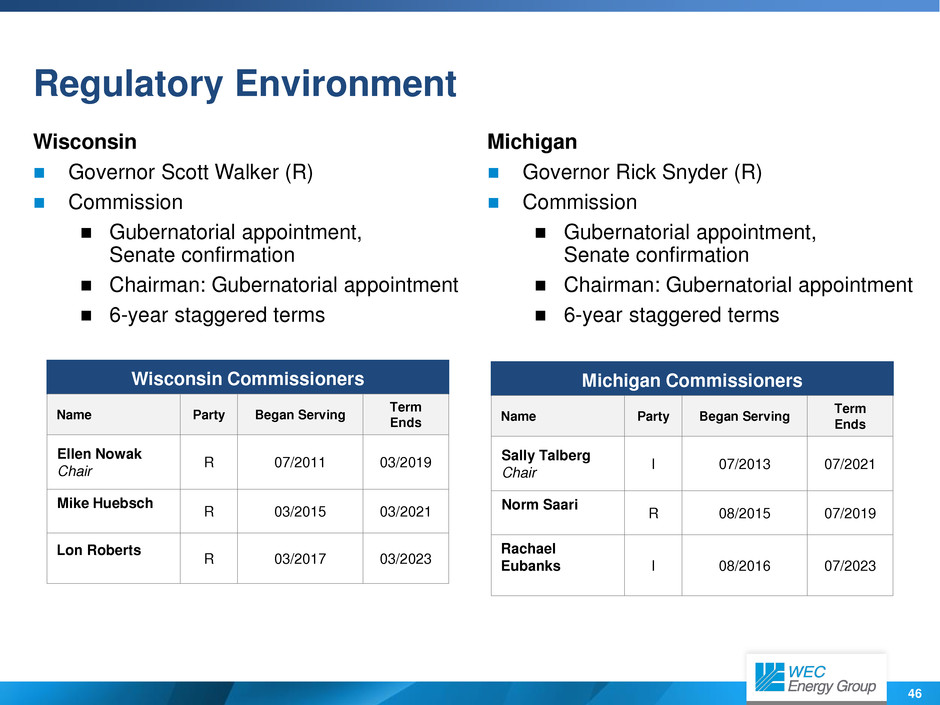

Regulatory Environment

Wisconsin

Governor Scott Walker (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Michigan

Governor Rick Snyder (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Wisconsin Commissioners

Name Party Began Serving

Term

Ends

Ellen Nowak

Chair

R 07/2011 03/2019

Mike Huebsch

R 03/2015 03/2021

Lon Roberts

R 03/2017 03/2023

Michigan Commissioners

Name Party Began Serving

Term

Ends

Sally Talberg

Chair

I 07/2013 07/2021

Norm Saari

R 08/2015 07/2019

Rachael

Eubanks

I 08/2016 07/2023

47

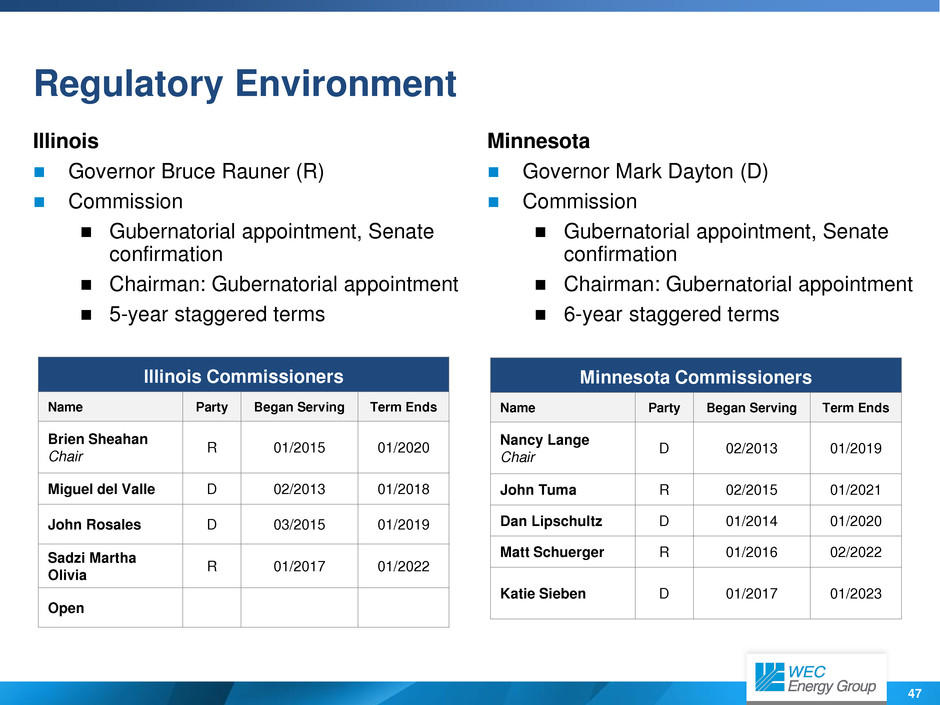

Regulatory Environment

Illinois

Governor Bruce Rauner (R)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

5-year staggered terms

Minnesota

Governor Mark Dayton (D)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Illinois Commissioners

Name Party Began Serving Term Ends

Brien Sheahan

Chair

R 01/2015 01/2020

Miguel del Valle D 02/2013 01/2018

John Rosales D 03/2015 01/2019

Sadzi Martha

Olivia

R 01/2017 01/2022

Open

Minnesota Commissioners

Name Party Began Serving Term Ends

Nancy Lange

Chair

D 02/2013 01/2019

John Tuma R 02/2015 01/2021

Dan Lipschultz D 01/2014 01/2020

Matt Schuerger R 01/2016 02/2022

Katie Sieben D 01/2017 01/2023

48

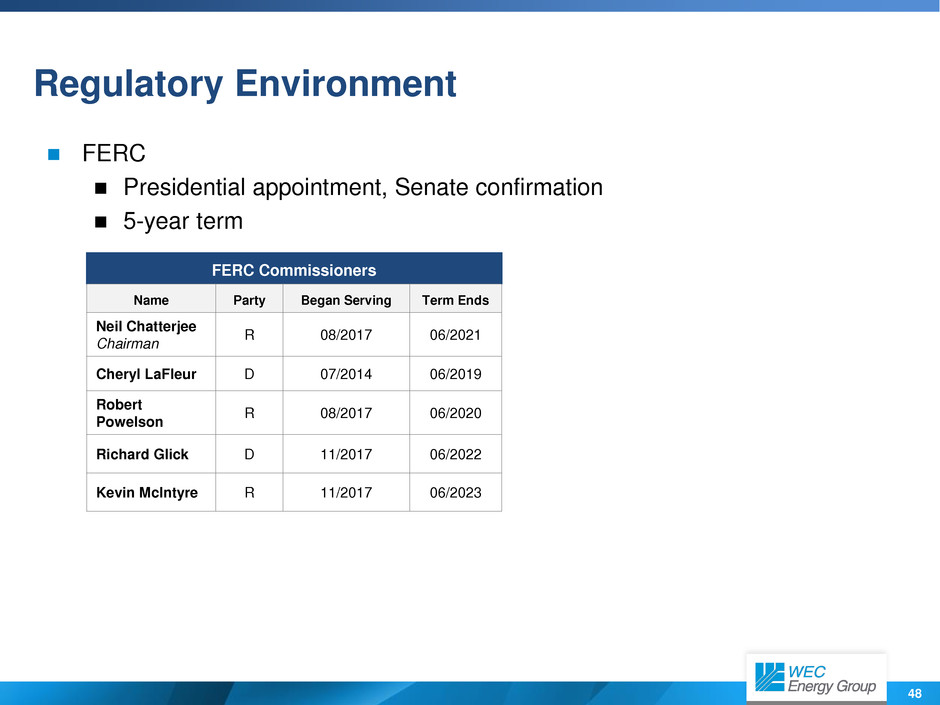

Regulatory Environment

FERC

Presidential appointment, Senate confirmation

5-year term

FERC Commissioners

Name Party Began Serving Term Ends

Neil Chatterjee

Chairman

R 08/2017 06/2021

Cheryl LaFleur D 07/2014 06/2019

Robert

Powelson

R 08/2017 06/2020

Richard Glick D 11/2017 06/2022

Kevin McIntyre R 11/2017 06/2023

49

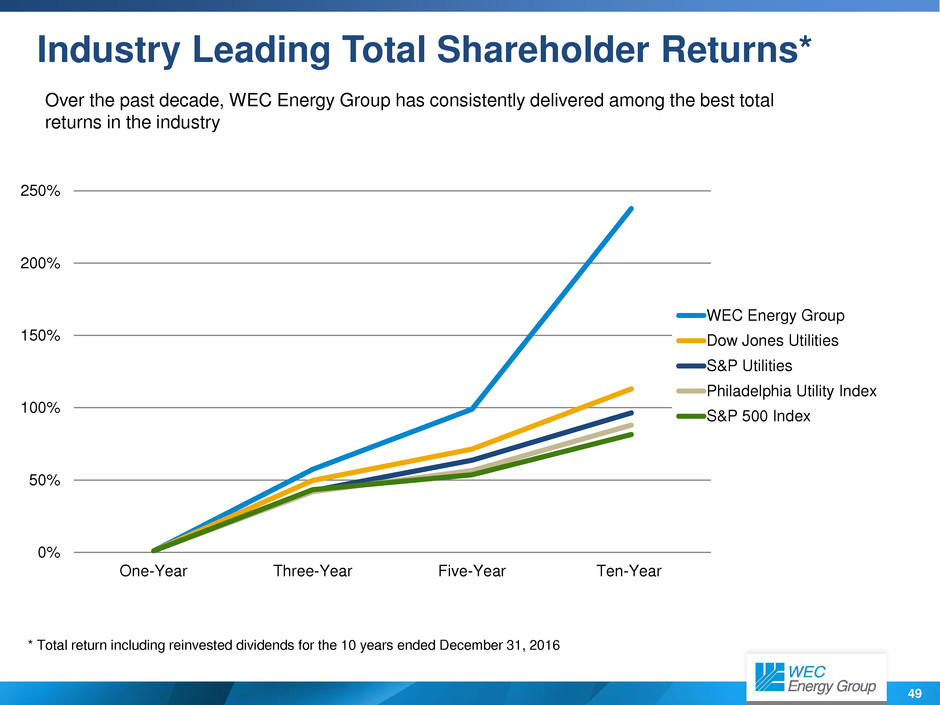

Industry Leading Total Shareholder Returns*

Over the past decade, WEC Energy Group has consistently delivered among the best total

returns in the industry

* Total return including reinvested dividends for the 10 years ended December 31, 2016

0%

50%

100%

150%

200%

250%

One-Year Three-Year Five-Year Ten-Year

WEC Energy Group

Dow Jones Utilities

S&P Utilities

Philadelphia Utility Index

S&P 500 Index

50

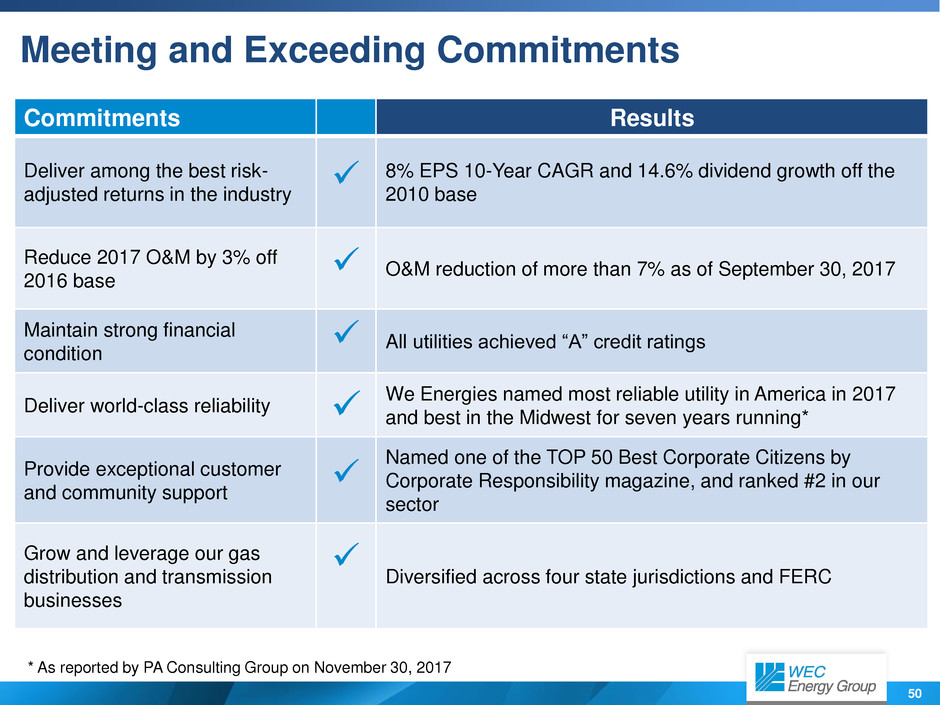

Meeting and Exceeding Commitments

Commitments Results

Deliver among the best risk-

adjusted returns in the industry

8% EPS 10-Year CAGR and 14.6% dividend growth off the

2010 base

Reduce 2017 O&M by 3% off

2016 base

O&M reduction of more than 7% as of September 30, 2017

Maintain strong financial

condition

All utilities achieved “A” credit ratings

Deliver world-class reliability

We Energies named most reliable utility in America in 2017 and best in the Midwest for seven years running*

Provide exceptional customer

and community support

Named one of the TOP 50 Best Corporate Citizens by

Corporate Responsibility magazine, and ranked #2 in our

sector

Grow and leverage our gas

distribution and transmission

businesses

Diversified across four state jurisdictions and FERC

* As reported by PA Consulting Group on November 30, 2017

Contact Information

M. Beth Straka

Senior Vice President – Investor Relations

and Corporate Communications

Beth.Straka@wecenergygroup.com

414-221-4639

Ashley Knutson

Investor Relations Analyst

Ashley.Knutson@wecenergygroup.com

414-221-3339