Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST MID BANCSHARES, INC. | exh_991.htm |

| EX-2.1 - EXHIBIT 2.1 - FIRST MID BANCSHARES, INC. | exh_21.htm |

| 8-K - FORM 8-K - FIRST MID BANCSHARES, INC. | f8k_121117.htm |

Exhibit 99.2

Announces the Acquisition of December 11, 2017 First BancTrust Corp.

Disclosures Forward - looking Statements This document may contain certain forward - looking statements, such as discussions of First Mid and First Bank’s pricing and fee trend s, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned schedules. Fir st Mid and First Bank intend such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in the Private Securities Litigation Reform Act of 1955. Forward - looking statements, which are based on certain assump tions and describe future plans, strategies and expectations of First Mid and First Bank, are identified by use of the words “belie ve, ” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could differ materially from the results indicated by these statements because the realization of those results is subject to many risks and uncertainties, including, am ong other things, the possibility that any of the anticipated benefits of the proposed transactions between First Mid and First B ank will not be realized or will not be realized within the expected time period; the risk that integration of the operations of First Ban k w ith First Mid will be materially delayed or will be more costly or difficult than expected; the inability to complete the proposed tran sac tions due to the failure to obtain the required stockholder approval; the failure to satisfy other conditions to completion of the prop ose d transactions, including receipt of required regulatory and other approvals; the failure of the proposed transactions to close fo r any other reason; the effect of the announcement of the transaction on customer relationships and operating results; the possibil ity that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; ch ang es in interest rates; general economic conditions and those in the market areas of First Mid and First Bank; legislative/regulatory ch anges; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; t he quality or composition of First Mid’s and First Bank’s loan or investment portfolios and the valuation of those investment portfolios ; d emand for loan products; deposit flows; competition, demand for financial services in the market areas of First Mid and First Bank; an d accounting principles, policies and guidelines. Additional information concerning First Mid, including additional factors and ri sks that could materially affect First Mid’s financial results, are included in First Mid’s filings with the Securities and Exchange C omm ission (the “SEC”), including its Annual Reports on Form 10 - K. Forward - looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC, we do not undertake any obligation to upd ate or review any forward - looking information, whether as a result of new information, future events or otherwise. 2

Special Note Concerning Proxy Statements Important Information about the Merger and Additional Information First Mid will file a registration statement on Form S - 4 with the SEC in connection with the proposed transaction. The registrat ion statement will include a proxy statement of First Bank that also constitutes a prospectus of First Mid, which will be sent to th e stockholders of First Bank. Investors in First Bank are urged to read the proxy statement/prospectus, which will contain important information, including detailed risk factors, when it becomes available. The proxy statement/prospectus and other documents which will be filed by First Mid with the SEC will be available free of charge at the Securities and Exchange Commission’s website, www.sec.gov, or by directing a request when such a filing is made to First Mid - Illinois Bancshares, P.O. Box 499, Mattoon, IL 61 938, Attention: Investor Relations; or to First BancTrust Corporation, 114 West Church Street, Champaign, IL 61824, Attention: Investor Relations. A final proxy statement/prospectus will be mailed to the stockholders of First Bank. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there b e a ny sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualifica tio n under the securities laws of such jurisdiction. 3 Participants in the Solicitation First Mid and First Bank, and certain of their respective directors, executive officers and other members of management and employees are participants in the solicitation of proxies in connection with the proposed transactions. Information about the directors and executive officers of First Mid is set forth in the proxy statement for its 2017 annual meeting of stockholders, which wa s f iled with the SEC on March 14, 2017. Information about the directors and executive officers of First Bank is set forth in its prox y statement for its 2017 annual meeting of stockholders, which is available on its website. Investors may obtain additional information regarding the interests of such participants in the proposed transactions by reading the proxy statement/prospectus for such pro posed transactions when it becomes available.

Compelling Rationale • Creates a $3.3 billion Midwest community banking franchise • Execution of Strategic Plan to deepen First Mid’s presence in target markets • Enhances First Mid’s presence in the attractive Champaign - Urbana market (FMBH currently ranks 15 th in deposit market share will move to 4 th ) • Seasoned lending staff and loan portfolio of $368 million in total loans at 9/30/2017; 63% commercial and ag - related • Opportunity to leverage First Mid’s expanded service offerings 4 Strategic Opportunity Financially Attractive Low Risk Profile • A ccretive to EPS in first full year • Minimal tangible book value dilution estimated at closing with an earn - back anticipated in less than 2 years • Operating synergies estimated at 28%, fully achievable by the end of the first year of operation • First Mid’s management team has substantial merger integration experience • Well - known markets to the First Mid team • Comprehensive due diligence process and thorough loan review completed • Similar cultures and retention of First Bank’s current President will help facilitate a successful integration process

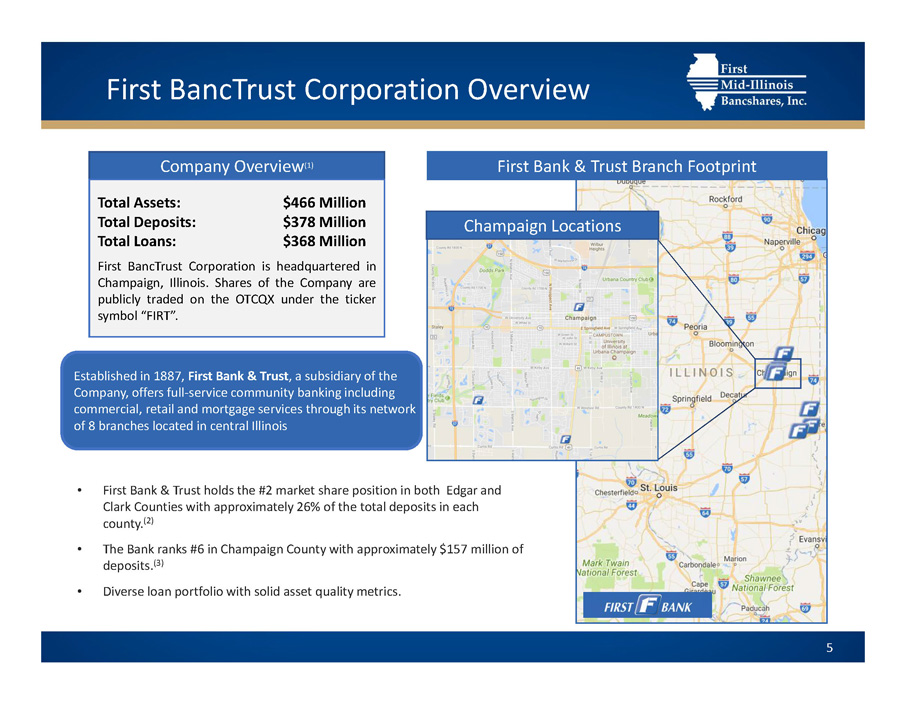

First BancTrust Corporation Overview 5 Company Overview (1) Total Assets: $466 Million Total Deposits: $378 Million Total Loans: $368 Million First BancTrust Corporation is headquartered in Champaign, Illinois . Shares of the Company are publicly traded on the OTCQX under the ticker symbol “FIRT” . First Bank & Trust Branch Footprint • First Bank & Trust holds the #2 market share position in both Edgar and Clark Counties with approximately 26% of the total deposits in each county. (2) • The Bank ranks #6 in Champaign County with approximately $157 million of deposits. (3) • Diverse loan portfolio with solid asset quality metrics. Established in 1887, First Bank & Trust , a subsidiary of the Company, offers full - service community banking including commercial, retail and mortgage services through its network of 8 branches located in central Illinois Champaign Locations

Transaction Terms and Pricing Ratios 6 $73.8 million 0.800 FMBH shares and $5.00 in cash for each outstanding share of First Bank common stock 1.6 million FMBH shares issued 11.5% Transaction Value (1) Consideration Structure Shares Issued FIRT Pro Forma Ownership Price/TBV Price/LTM EPS Required Approvals 160.5% 22.9x Customary regulatory and FIRT shareholder approval (1) Based on 2,054,883 shares of FIRT outstanding and $38.67 per share for FMBH – the Closing Price as on December 8, 2017 Note: All multiples based on September 30, 2017 financials

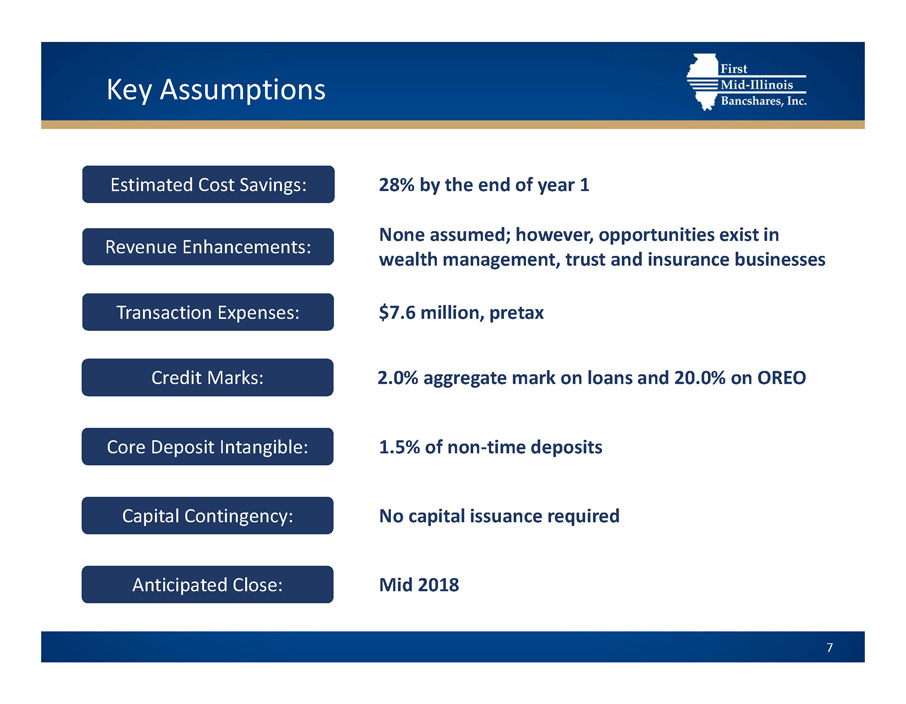

Key Assumptions 7 Estimated Cost Savings: Transaction Expenses: Credit Marks: Core Deposit Intangible: Capital Contingency: Revenue Enhancements: None assumed; however, opportunities exist in wealth management, trust and insurance businesses $7.6 million, pretax 2.0% aggregate mark on loans and 20.0% on OREO 1.5% of non - time deposits No capital issuance required 28% by the end of year 1 Anticipated Close: Mid 2018

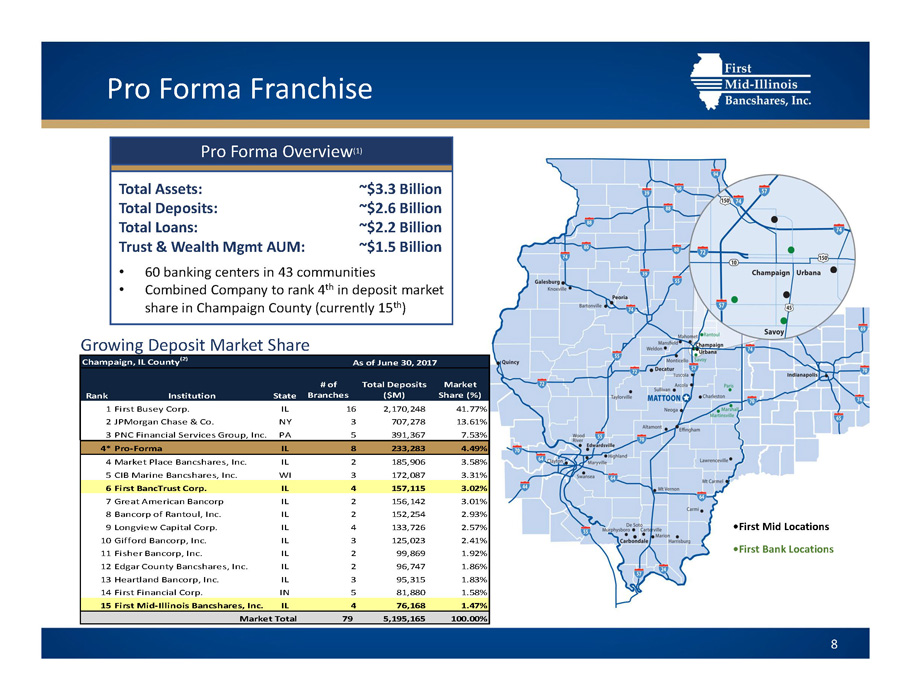

Pro Forma Franchise 8 Pro Forma Overview (1) Total Assets: ~$3.3 Billion Total Deposits: ~$2.6 Billion Total Loans: ~$2.2 Billion Trust & Wealth Mgmt AUM: ~$1.5 Billion • 60 banking centers in 43 communities • Combined Company to rank 4 th in deposit market share in Champaign County (currently 15 th ) Champaign, IL County (2) Rank Institution State # of Branches Total Deposits ($M) Market Share (%) 1First Busey Corp. IL 16 2,170,248 41.77% 2JPMorgan Chase & Co. NY 3 707,278 13.61% 3PNC Financial Services Group, Inc. PA 5 391,367 7.53% 4*Pro-Forma IL 8 233,283 4.49% 4Market Place Bancshares, Inc. IL 2 185,906 3.58% 5CIB Marine Bancshares, Inc. WI 3 172,087 3.31% 6First BancTrust Corp. IL 4 157,115 3.02% 7Great American Bancorp IL 2 156,142 3.01% 8Bancorp of Rantoul, Inc. IL 2 152,254 2.93% 9Longview Capital Corp. IL 4 133,726 2.57% 10Gifford Bancorp, Inc. IL 3 125,023 2.41% 11Fisher Bancorp, Inc. IL 2 99,869 1.92% 12Edgar County Bancshares, Inc. IL 2 96,747 1.86% 13Heartland Bancorp, Inc. IL 3 95,315 1.83% 14First Financial Corp. IN 5 81,880 1.58% 15First Mid-Illinois Bancshares, Inc. IL 4 76,168 1.47% Market Total 79 5,195,165 100.00% As of June 30, 2017 Growing Deposit Market Share •First Bank Locations •First Mid Locations

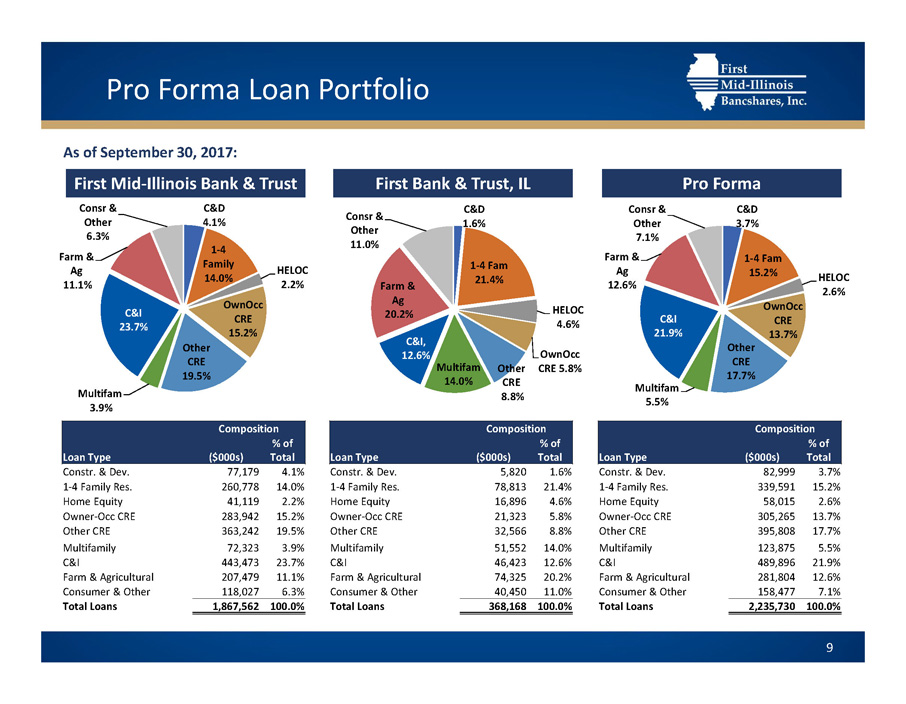

Pro Forma Loan Portfolio 9 First Mid - Illinois Bank & Trust First Bank & Trust, IL Pro Forma As of September 30, 2017: Composition Loan Type ($000s) % of Total Constr. & Dev. 5,820 1.6% 1 - 4 Family Res. 78,813 21.4% Home Equity 16,896 4.6% Owner - Occ CRE 21,323 5.8% Other CRE 32,566 8.8% Multifamily 51,552 14.0% C&I 46,423 12.6% Farm & Agricultural 74,325 20.2% Consumer & Other 40,450 11.0% Total Loans 368,168 100.0% Composition Loan Type ($000s) % of Total Constr. & Dev. 82,999 3.7% 1 - 4 Family Res. 339,591 15.2% Home Equity 58,015 2.6% Owner - Occ CRE 305,265 13.7% Other CRE 395,808 17.7% Multifamily 123,875 5.5% C&I 489,896 21.9% Farm & Agricultural 281,804 12.6% Consumer & Other 158,477 7.1% Total Loans 2,235,730 100.0% Composition Loan Type ($000s) % of Total Constr. & Dev. 77,179 4.1% 1 - 4 Family Res. 260,778 14.0% Home Equity 41,119 2.2% Owner - Occ CRE 283,942 15.2% Other CRE 363,242 19.5% Multifamily 72,323 3.9% C&I 443,473 23.7% Farm & Agricultural 207,479 11.1% Consumer & Other 118,027 6.3% Total Loans 1,867,562 100.0% C&D 4.1% 1 - 4 Family 14.0% HELOC 2.2% OwnOcc CRE 15.2% Other CRE 19.5% Multifam 3.9% C&I 23.7% Farm & Ag 11.1% Consr & Other 6.3% C&D 1.6% 1 - 4 Fam 21.4 % HELOC 4.6% OwnOcc CRE 5.8% Other CRE 8.8% Multifam 14.0% C&I , 12.6% Farm & Ag 20.2% Consr & Other 11.0% C&D 3.7% 1 - 4 Fam 15.2% HELOC 2.6% OwnOcc CRE 13.7% Other CRE 17.7% Multifam 5.5% C&I 21.9% Farm & Ag 12.6% Consr & Other 7.1%

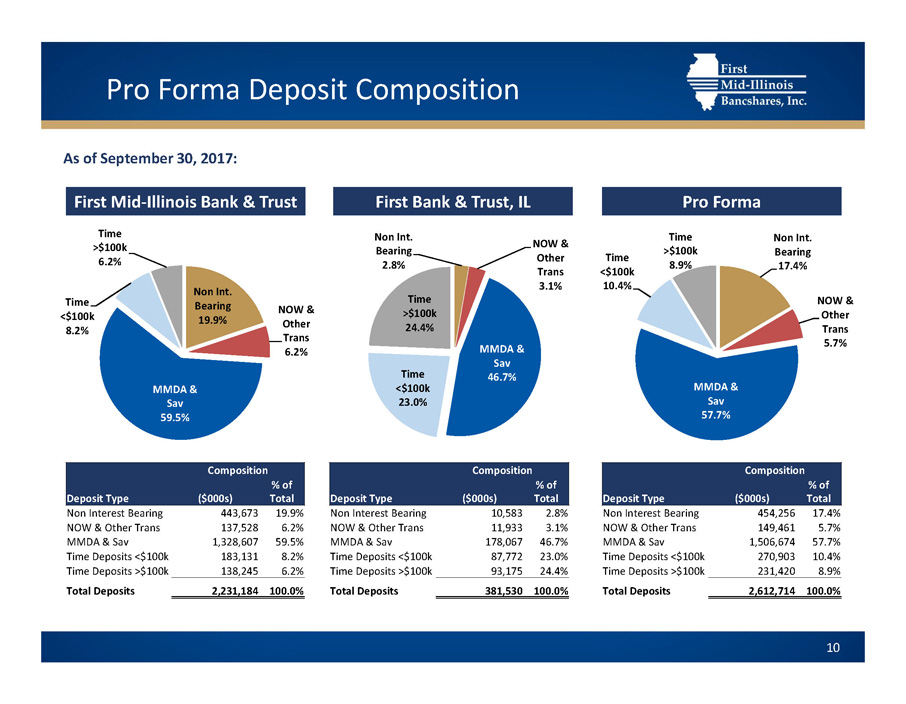

Pro Forma Deposit Composition 10 First Mid - Illinois Bank & Trust First Bank & Trust, IL Pro Forma Non Int. Bearing 19.9% NOW & Other Trans 6.2% MMDA & Sav 59.5% Time <$100k 8.2% Time >$100k 6.2% Composition Deposit Type ($000s) % of Total Non Interest Bearing 443,673 19.9% NOW & Other Trans 137,528 6.2% MMDA & Sav 1,328,607 59.5% Time Deposits <$100k 183,131 8.2% Time Deposits >$100k 138,245 6.2% Total Deposits 2,231,184 100.0% As of September 30, 2017: Composition Deposit Type ($000s) % of Total Non Interest Bearing 10,583 2.8% NOW & Other Trans 11,933 3.1% MMDA & Sav 178,067 46.7% Time Deposits <$100k 87,772 23.0% Time Deposits >$100k 93,175 24.4% Total Deposits 381,530 100.0% Non Int. Bearing 2.8% NOW & Other Trans 3.1% MMDA & Sav 46.7 % Time <$100k 23.0% Time >$100k 24.4% Non Int. Bearing 17.4% NOW & Other Trans 5.7% MMDA & Sav 57.7% Time <$100k 10.4% Time >$100k 8.9% Composition Deposit Type ($000s) % of Total Non Interest Bearing 454,256 17.4% NOW & Other Trans 149,461 5.7% MMDA & Sav 1,506,674 57.7% Time Deposits <$100k 270,903 10.4% Time Deposits >$100k 231,420 8.9% Total Deposits 2,612,714 100.0%

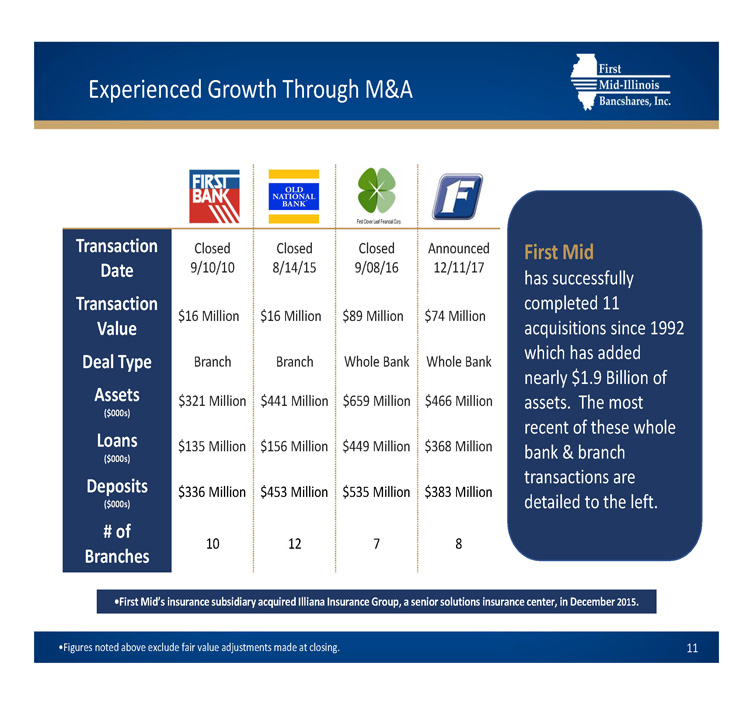

Experienced Growth Through M&A 11 Transaction Date Closed 9/10/10 Closed 8/14/15 Closed 9/08/16 Announced 12/11/17 Transaction Value $16 Million $16 Million $89 Million $74 Million Deal Type Branch Branch Whole Bank Whole Bank Assets ($000s) $321 Million $441 Million $659 Million $466 Million Loans ($000s) $135 Million $156 Million $449 Million $368 Million Deposits ($000s) $336 Million $453 Million $535 Million $383 Million # of Branches 10 12 7 8 First Mid has successfully completed 11 acquisitions since 1992 which has added nearly $1.9 Billion of assets. The most recent of these whole bank & branch transactions are detailed to the left. •First Mid’s insurance subsidiary acquired Illiana Insurance Group, a senior solutions insurance center, in December 2015 . •Figures noted above exclude fair value adjustments made at closing.