Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Mr. Cooper Group Inc. | d504414dex993.htm |

| EX-99.1 - EX-99.1 - Mr. Cooper Group Inc. | d504414dex991.htm |

| EX-10.3 - EX-10.3 - Mr. Cooper Group Inc. | d504414dex103.htm |

| EX-10.2 - EX-10.2 - Mr. Cooper Group Inc. | d504414dex102.htm |

| EX-3.1 - EX-3.1 - Mr. Cooper Group Inc. | d504414dex31.htm |

| 8-K - 8-K - Mr. Cooper Group Inc. | d504414d8k.htm |

WMIH CORP. Discussion with Series B Preferred Holders November 2017 Exhibit 99.2

Confidentiality, General Information and Limitations These materials and the existence and contents of this presentation are confidential and may not be disclosed without the prior written consent of WMIH Corp. (“WMIH”). Except with regard to the first sentence of this paragraph, this presentation is intended for discussion purposes only and neither we nor the recipients hereof shall have any obligation, express or implied, to negotiate, proceed with or to consummate the proposed transactions described herein. This presentation is not intended to be and does not constitute a legally binding obligation of WMIH or the recipients hereof and no such obligations shall be created unless and until definitive written documents are executed by all parties (and no oral contracts will be deemed to exist). This document and the information contained herein do not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative. Forward-Looking Statements This document and the oral statements made in connection therewith may include forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this document or oral statements made in connection therewith that address activities, events, conditions or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Forward-looking statements give our current expectations and projections relating to the Company’s financial condition, results of operations, plans, objectives, future performance and business and these statements are not guarantees of future performance. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements may include the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “strategy,” “future,” “opportunity,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in the Company’s Form 10-K for the year ended December 31, 2016 under Risk Factors in Part I, Item 1A. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither we nor the Company will undertake to update any forward-looking statement, except as required by law. Readers should carefully review the statements set forth in the reports, which the Company has filed or will file from time to time with the Securities and Exchange Commission.

Executive Summary WMIH is seeking consent to amend the terms of the 3.00% Series B Preferred Stock in order to provide the company additional time to find and execute an attractive acquisition Absent an extension, the Series B Preferred is redeemable on January 5, 2018 The original investment thesis for holders of the Series B Preferred Stock is still intact We believe WMIH remains an advantaged acquirer due to its financial attributes, including $6 billion of net operating loss carryforwards and accessibility of financing Opportunities previously pursued by WMIH evidence the view that attractive opportunities to acquire attractively-positioned platforms at compelling prices continue to exist WMIH has been disciplined in its pursuit of acquisitions and is focused on finding the right platform in an effort to maximize long-term value for all stakeholders An extension of the Series B Preferred would mitigate short-term dynamics to “just do a deal” The WMIH Board proposes an extension that is good for all stakeholders 21-Month Extension: Provides adequate time to identify an acquisition Reduction in Exercise Price Range to $1.60-$1.90/share (from $1.75-$2.25/share): Taken in conjunction with recent declines in the price of the company’s common stock represents a 29% reduction in the presumed conversion price for Series B holders ($1.60/share vs. $2.25/share) Coupon in Common Stock: Allows preferred stockholders to accumulate common stock at attractive levels (floor of $0.85/share) while eliminating the cash burden on the company KKR Transaction Approval Right: KKR would have explicit transaction approval rights for the next 18 months, which we believe facilitates better alignment between Series B Preferred Stockholders and WMIH KKR Support: KKR, a holder of $200MM of Series B Preferred Stock, supports these terms Benefits All Stakeholders: We believe that amending the Series B Preferred Stock, including extending the term thereof, provides an opportunity to continue seeking an accretive transaction that benefits all stakeholders, including Series B and common stockholders

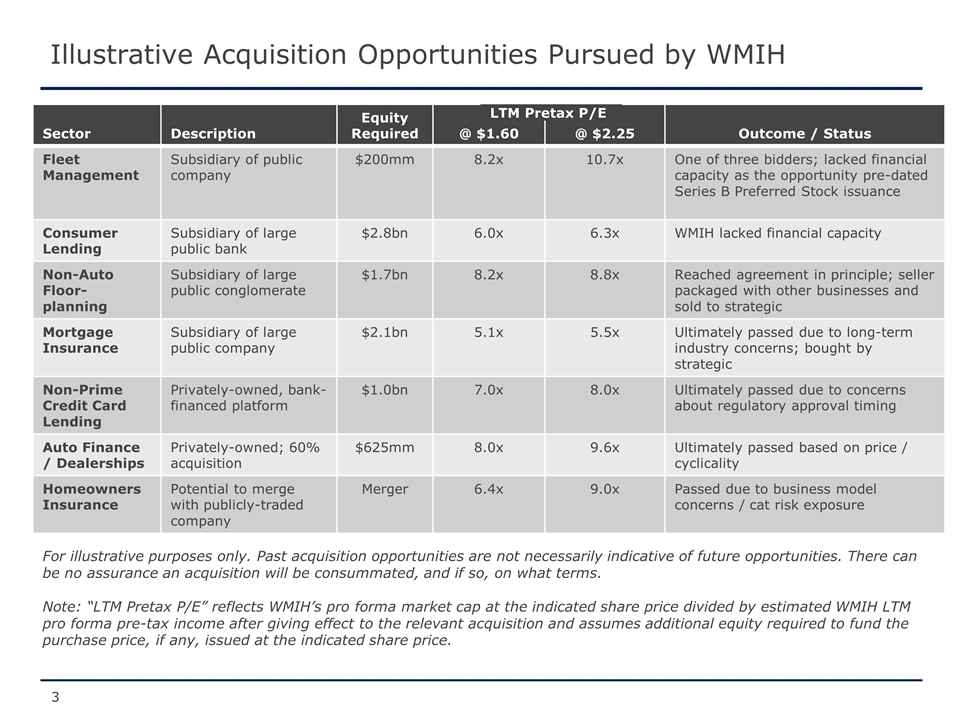

Sector Description Equity Required @ $1.60 @ $2.25 Outcome / Status Fleet Management Subsidiary of public company $200mm 8.2x 10.7x One of three bidders; lacked financial capacity as the opportunity pre-dated Series B Preferred Stock issuance Consumer Lending Subsidiary of large public bank $2.8bn 6.0x 6.3x WMIH lacked financial capacity Non-Auto Floor-planning Subsidiary of large public conglomerate $1.7bn 8.2x 8.8x Reached agreement in principle; seller packaged with other businesses and sold to strategic Mortgage Insurance Subsidiary of large public company $2.1bn 5.1x 5.5x Ultimately passed due to long-term industry concerns; bought by strategic Non-Prime Credit Card Lending Privately-owned, bank-financed platform $1.0bn 7.0x 8.0x Ultimately passed due to concerns about regulatory approval timing Auto Finance / Dealerships Privately-owned; 60% acquisition $625mm 8.0x 9.6x Ultimately passed based on price / cyclicality Homeowners Insurance Potential to merge with publicly-traded company Merger 6.4x 9.0x Passed due to business model concerns / cat risk exposure Illustrative Acquisition Opportunities Pursued by WMIH LTM Pretax P/E For illustrative purposes only. Past acquisition opportunities are not necessarily indicative of future opportunities. There can be no assurance an acquisition will be consummated, and if so, on what terms. Note: “LTM Pretax P/E” reflects WMIH’s pro forma market cap at the indicated share price divided by estimated WMIH LTM pro forma pre-tax income after giving effect to the relevant acquisition and assumes additional equity required to fund the purchase price, if any, issued at the indicated share price.

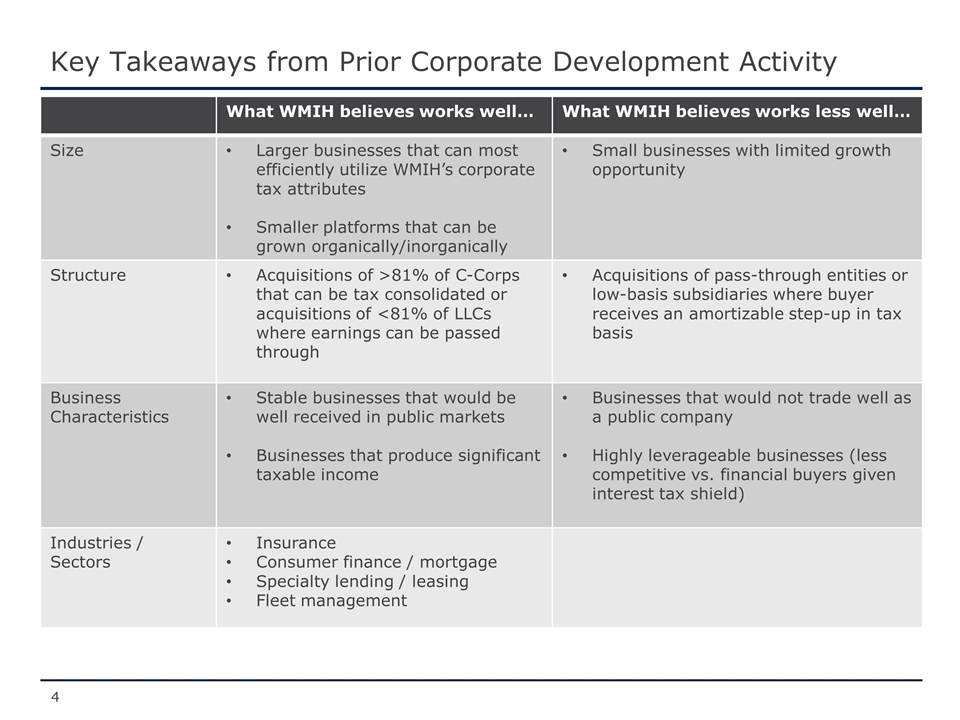

Key Takeaways from Prior Corporate Development Activity What WMIH believes works well… What WMIH believes works less well… Size Larger businesses that can most efficiently utilize WMIH’s corporate tax attributes Smaller platforms that can be grown organically/inorganically Small businesses with limited growth opportunity Structure Acquisitions of >81% of C-Corps that can be tax consolidated or acquisitions of <81% of LLCs where earnings can be passed through Acquisitions of pass-through entities or low-basis subsidiaries where buyer receives an amortizable step-up in tax basis Business Characteristics Stable businesses that would be well received in public markets Businesses that produce significant taxable income Businesses that would not trade well as a public company Highly leverageable businesses (less competitive vs. financial buyers given interest tax shield) Industries / Sectors Insurance Consumer finance / mortgage Specialty lending / leasing Fleet management

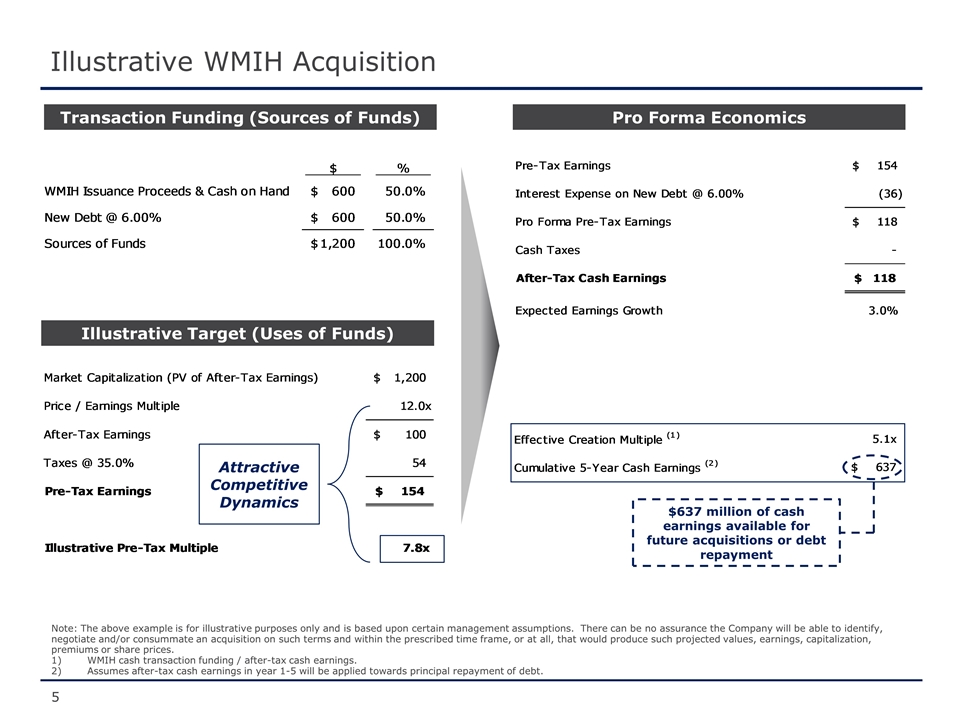

Illustrative WMIH Acquisition Note: The above example is for illustrative purposes only and is based upon certain management assumptions. There can be no assurance the Company will be able to identify, negotiate and/or consummate an acquisition on such terms and within the prescribed time frame, or at all, that would produce such projected values, earnings, capitalization, premiums or share prices. WMIH cash transaction funding / after-tax cash earnings. Assumes after-tax cash earnings in year 1-5 will be applied towards principal repayment of debt. Attractive Competitive Dynamics Transaction Funding (Sources of Funds) Pro Forma Economics Illustrative Target (Uses of Funds) $637 million of cash earnings available for future acquisitions or debt repayment

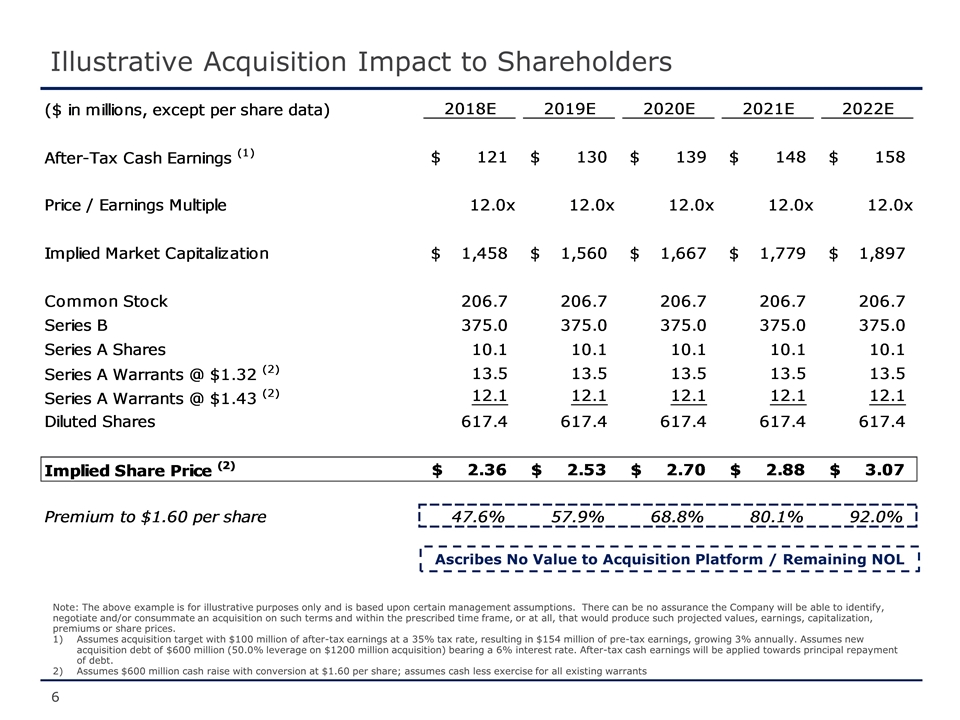

Illustrative Acquisition Impact to Shareholders Ascribes No Value to Acquisition Platform / Remaining NOL Note: The above example is for illustrative purposes only and is based upon certain management assumptions. There can be no assurance the Company will be able to identify, negotiate and/or consummate an acquisition on such terms and within the prescribed time frame, or at all, that would produce such projected values, earnings, capitalization, premiums or share prices. Assumes acquisition target with $100 million of after-tax earnings at a 35% tax rate, resulting in $154 million of pre-tax earnings, growing 3% annually. Assumes new acquisition debt of $600 million (50.0% leverage on $1200 million acquisition) bearing a 6% interest rate. After-tax cash earnings will be applied towards principal repayment of debt. Assumes $600 million cash raise with conversion at $1.60 per share; assumes cash less exercise for all existing warrants

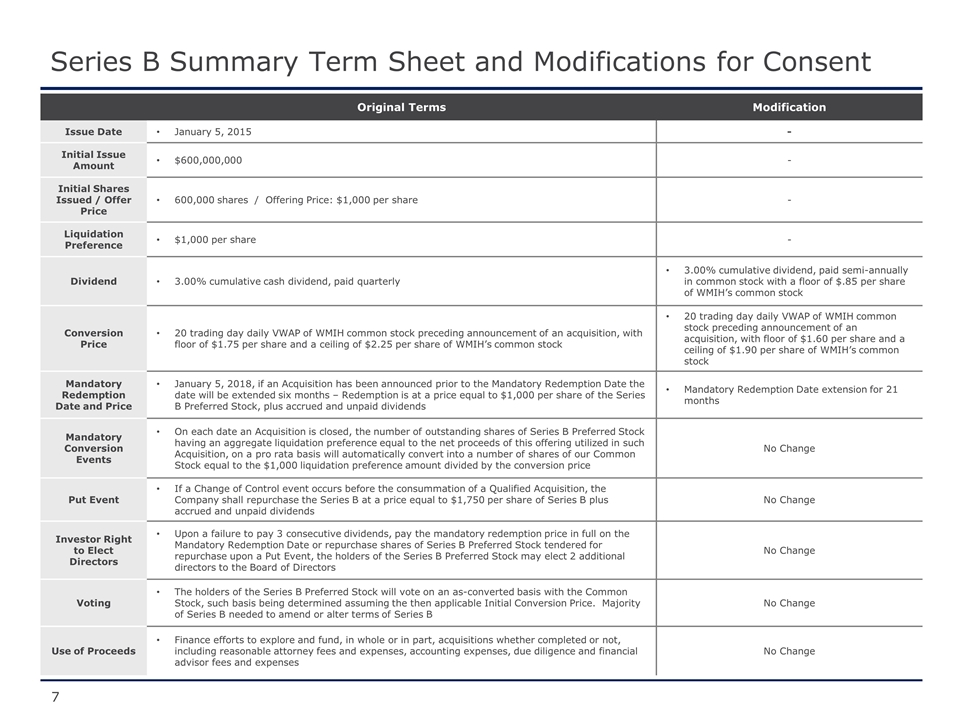

Series B Summary Term Sheet and Modifications for Consent Original Terms Modification Issue Date January 5, 2015 - Initial Issue Amount $600,000,000 - Initial Shares Issued / Offer Price 600,000 shares / Offering Price: $1,000 per share - Liquidation Preference $1,000 per share - Dividend 3.00% cumulative cash dividend, paid quarterly 3.00% cumulative dividend, paid semi-annually in common stock with a floor of $.85 per share of WMIH’s common stock Conversion Price 20 trading day daily VWAP of WMIH common stock preceding announcement of an acquisition, with floor of $1.75 per share and a ceiling of $2.25 per share of WMIH’s common stock 20 trading day daily VWAP of WMIH common stock preceding announcement of an acquisition, with floor of $1.60 per share and a ceiling of $1.90 per share of WMIH’s common stock Mandatory Redemption Date and Price January 5, 2018, if an Acquisition has been announced prior to the Mandatory Redemption Date the date will be extended six months – Redemption is at a price equal to $1,000 per share of the Series B Preferred Stock, plus accrued and unpaid dividends Mandatory Redemption Date extension for 21 months Mandatory Conversion Events On each date an Acquisition is closed, the number of outstanding shares of Series B Preferred Stock having an aggregate liquidation preference equal to the net proceeds of this offering utilized in such Acquisition, on a pro rata basis will automatically convert into a number of shares of our Common Stock equal to the $1,000 liquidation preference amount divided by the conversion price No Change Put Event If a Change of Control event occurs before the consummation of a Qualified Acquisition, the Company shall repurchase the Series B at a price equal to $1,750 per share of Series B plus accrued and unpaid dividends No Change Investor Right to Elect Directors Upon a failure to pay 3 consecutive dividends, pay the mandatory redemption price in full on the Mandatory Redemption Date or repurchase shares of Series B Preferred Stock tendered for repurchase upon a Put Event, the holders of the Series B Preferred Stock may elect 2 additional directors to the Board of Directors No Change Voting The holders of the Series B Preferred Stock will vote on an as-converted basis with the Common Stock, such basis being determined assuming the then applicable Initial Conversion Price. Majority of Series B needed to amend or alter terms of Series B No Change Use of Proceeds Finance efforts to explore and fund, in whole or in part, acquisitions whether completed or not, including reasonable attorney fees and expenses, accounting expenses, due diligence and financial advisor fees and expenses No Change