Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | stbz-20171211x8k.htm |

State Bank Financial Corporation

Investor Presentation

December 2017

2

Cautionary Note Regarding Forward-Looking

Statements

This presentation contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies, and expectations, can generally be identified by the use of the words “will,” “expect,” “should,” “anticipate,” “forward

vision,” “may,” “opportunity,” “assume,” and “project,” as well as similar expressions. These forward-looking statements include, but are not limited to, statements regarding

our focus on improving efficiency, the expected future impact of the AloStar Bank of Commerce (“AloStar”) acquisition, including expected cost savings and the timing thereof,

our ability to achieve our target burden and target efficiency ratios, and other statements about expected developments or events, our future financial performance, and the

execution of our strategic goals including our ability to execute on growth opportunities in our markets. Forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood and degree. Therefore, actual results

and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. We undertake no obligation to update, amend or clarify

forward-looking statements, whether as a result of new information, future events or otherwise. Risk factors include, without limitation, the following:

• negative reactions to our recent or future acquisitions of each bank’s customers, employees, and counterparties or difficulties related to the transition of services;

• the integration of AloStar’s business into ours and the conversion of AloStar’s operating systems and procedures may take longer than anticipated or may be more costly than

anticipated or have unanticipated adverse results related to AloStar’s or our existing businesses;

• the transaction with AloStar may be more expensive to complete and the anticipated benefits, including anticipated cost savings and strategic gains, may be significantly

harder or take longer than expected or may not be achieved in the entirety or at all as a result of unexpected factors or events;

• our ability to achieve anticipated results from the transactions with AloStar, NBG Bancorp, and S Bankshares will depend on the state of the economic and financial markets

going forward;

• economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a

reduction in demand for credit and a decline in real estate values;

• a general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results;

• risk associated with income taxes including the potential for adverse adjustments and the inability to fully realize deferred tax benefits;

• increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses;

• restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals;

• legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us;

• competitive pressures among depository and other financial institutions may increase significantly;

• changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired;

• other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can;

• our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry;

• adverse changes may occur in the bond and equity markets;

• war or terrorist activities may cause deterioration in the economy or cause instability in credit markets; and

• economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which we operate.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A, Risk Factors, in our Annual Report on Form 10-K for the most recently ended fiscal

year. These and other risk factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a forward-

looking statement.

3

Headquartered in Atlanta, Georgia

State Bank operates 32 full-service banking

offices and 6 mortgage origination offices in 7 of

the 8 largest MSAs in Georgia

Completed merger with AloStar Bank of

Commerce on September 30, 2017

AloStar adds scalable asset-generating

lines of business and loan portfolio

diversification while efficiently leveraging

excess capital

Atlanta

Macon

Warner

Robins

Augusta

Savannah

Athens

Gainesville

State Bank Financial Corporation Profile

Source: SNL Financial

Note: Financial metrics as of 9/30/17; dividend yield and market cap as of 11/14/17

STBZ Profile

Total Assets $5.1 billion TCE Ratio 10.8%

Total Loans $3.6 billion Cost of Funds .38%

Total Deposits $4.2 billion Dividend Yield 1.97%

Total Equity $643 million Market Cap $1.1 billion

Key Metrics

4

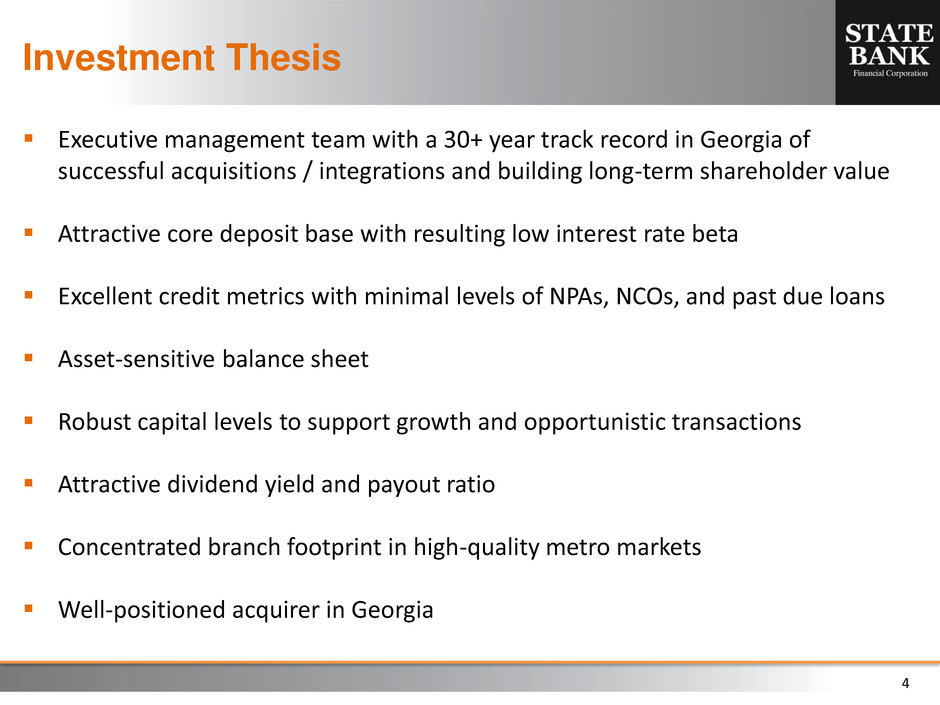

Investment Thesis

Executive management team with a 30+ year track record in Georgia of

successful acquisitions / integrations and building long-term shareholder value

Attractive core deposit base with resulting low interest rate beta

Excellent credit metrics with minimal levels of NPAs, NCOs, and past due loans

Asset-sensitive balance sheet

Robust capital levels to support growth and opportunistic transactions

Attractive dividend yield and payout ratio

Concentrated branch footprint in high-quality metro markets

Well-positioned acquirer in Georgia

5

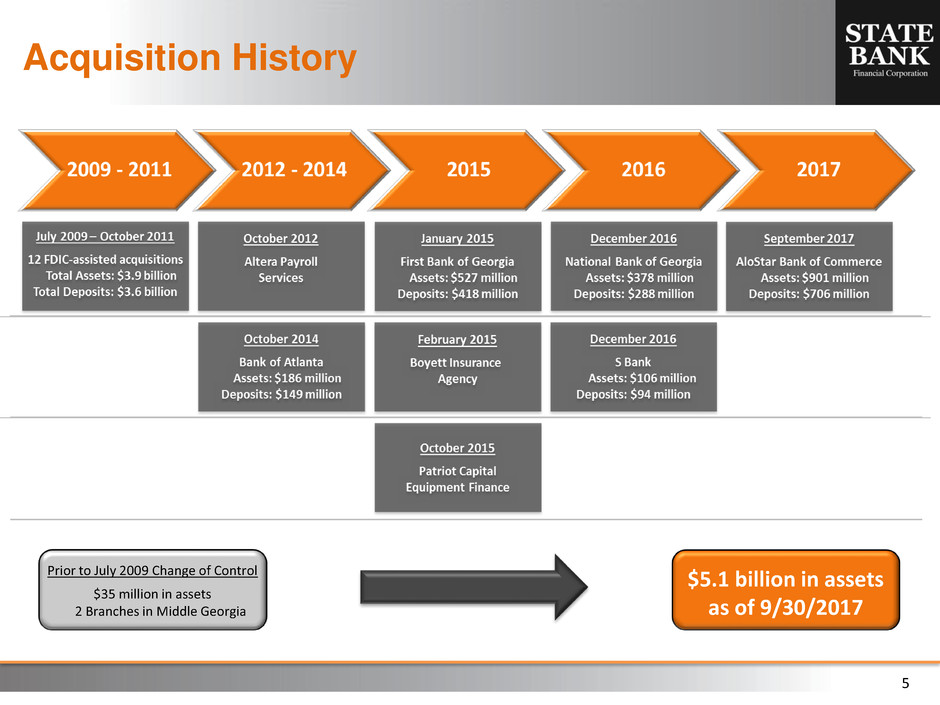

Acquisition History

Prior to July 2009 Change of Control

$35 million in assets

2 Branches in Middle Georgia

$5.1 billion in assets

as of 9/30/2017

6

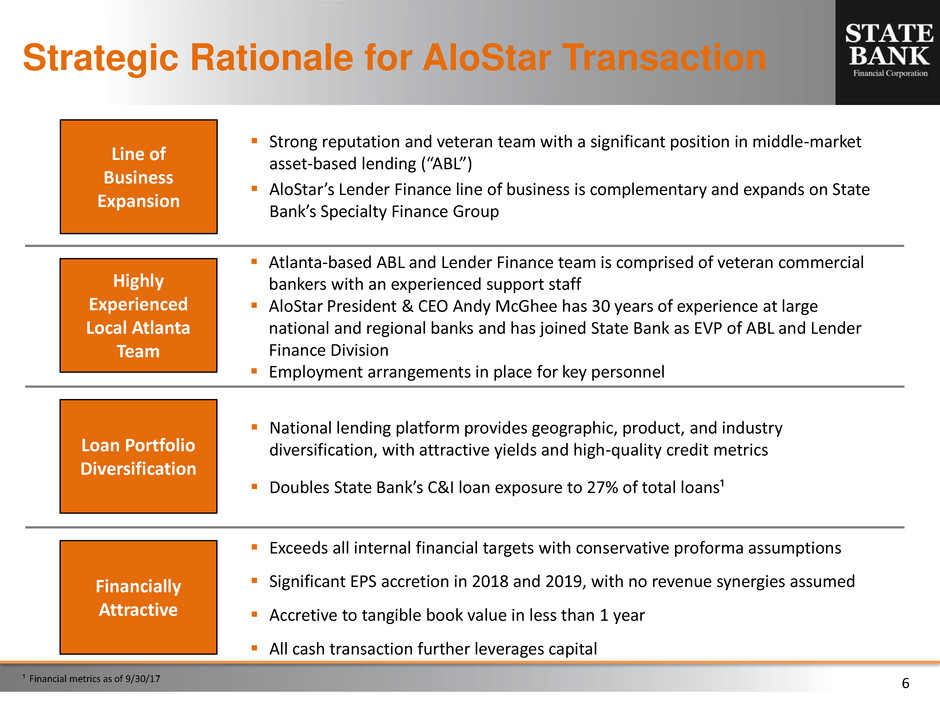

Strategic Rationale for AloStar Transaction

Financially

Attractive

Highly

Experienced

Local Atlanta

Team

Exceeds all internal financial targets with conservative proforma assumptions

Significant EPS accretion in 2018 and 2019, with no revenue synergies assumed

Accretive to tangible book value in less than 1 year

All cash transaction further leverages capital

Atlanta-based ABL and Lender Finance team is comprised of veteran commercial

bankers with an experienced support staff

AloStar President & CEO Andy McGhee has 30 years of experience at large

national and regional banks and has joined State Bank as EVP of ABL and Lender

Finance Division

Employment arrangements in place for key personnel

Line of

Business

Expansion

Strong reputation and veteran team with a significant position in middle-market

asset-based lending (“ABL”)

AloStar’s Lender Finance line of business is complementary and expands on State

Bank’s Specialty Finance Group

Loan Portfolio

Diversification

National lending platform provides geographic, product, and industry

diversification, with attractive yields and high-quality credit metrics

Doubles State Bank’s C&I loan exposure to 27% of total loans¹

¹ Financial metrics as of 9/30/17

7

Strong Core Deposit Base with

Significant Opportunity for Growth

1 Region represents individual or combined MSAs; Savannah region includes Savannah and Hinesville MSAs and Tattnall County, GA 2 Excludes new branch opened on December 4, 2017

Atlanta – less than 1% market share of $163 billion in deposits; over 75% of the market is

dominated by large regional and national competitors

Savannah – new market where State Bank executive management has significant in-market

experience

Significant

Growth

Opportunities

Leading

Market Share

Top 10

Market Share

Augusta – remain well-positioned to take advantage of recent market disruption

Athens / Gainesville – strong local leadership team; opportunity to leverage State Bank’s

existing treasury and payroll capabilities in these new markets

Macon / Warner Robins – mature franchise with #1 market share since 2005 (including

predecessor bank)

2

Source: SNL Financial; FDIC deposit data as of June 30, 2017

3 Acquired in our acquisition of AloStar Bank of Commerce on September 30, 2017. Deposit data reflects deposits held by AloStar as of June 30,2017

($ in 000)

Region1 Deposits

% of

Deposits

Deposits /

Branch

# of Full

Service

Branches

Market

Share Deposits

Deposits /

Branch

Atlanta $1,271,128 30% $211,855 6 0.8% $163,045,564 $135,532

M c n / Warner Robins 1,356,873 32% 113,073 12 25.3% 5,370,409 59,671

Augusta 452,256 11% 64,608 7 5.5% 8,288,294 67,385

Athens / Gainesville 345,229 8% 172,615 2 4.2% 8,123,418 84,619

Savannah 88,574 2% 22,144 4 1.1% 7,978,201 68,778

Al Star 703,912 17% 703,912 N/A N/A N/A N/A

STBZ Total Region

3

8

Grow Commercial

Relationships by Targeting

Net Funding Segments

Provide Best In-Class Client

Experience

Scale Efficient Asset-

Generating Lines of

Business

Foster a Culture of

Efficiency

Maintain Focus on

Noninterest Income

Strategic Outlook

Management Depth

Disciplined and

Experienced Acquirer

Balance Sheet Strength

Strong Credit Quality

Metrics

Shareholder Focused

Management Team with

Significant Insider

Ownership

Solid Foundation Built on

Proven Performance

Forward Vision

9

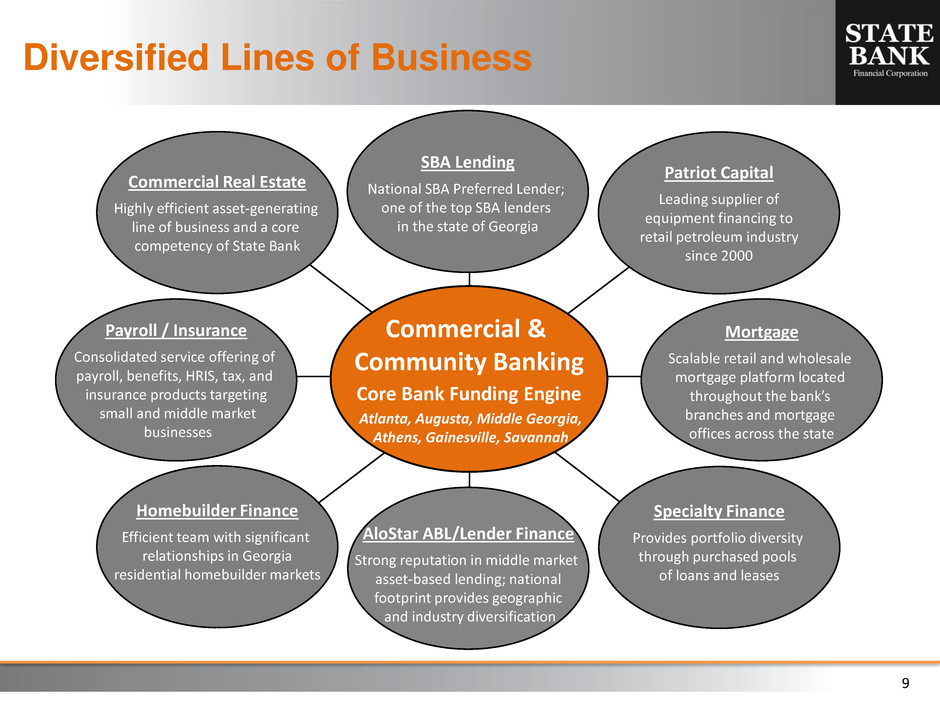

Diversified Lines of Business

Mortgage

Scalable retail and wholesale

mortgage platform located

throughout the bank’s

branches and mortgage

offices across the state

Patriot Capital

Leading supplier of

equipment financing to

retail petroleum industry

since 2000

SBA Lending

National SBA Preferred Lender;

one of the top SBA lenders

in the state of Georgia

Specialty Finance

Provides portfolio diversity

through purchased pools

of loans and leases

Payroll / Insurance

Consolidated service offering of

payroll, benefits, HRIS, tax, and

insurance products targeting

small and middle market

businesses

Commercial Real Estate

Highly efficient asset-generating

line of business and a core

competency of State Bank

Homebuilder Finance

Efficient team with significant

relationships in Georgia

residential homebuilder markets

Commercial &

Community Banking

Core Bank Funding Engine

Atlanta, Augusta, Middle Georgia,

Athens, Gainesville, Savannah

AloStar ABL/Lender Finance

Strong reputation in middle market

asset-based lending; national

footprint provides geographic

and industry diversification

10

3Q 2017 Financial Results

11

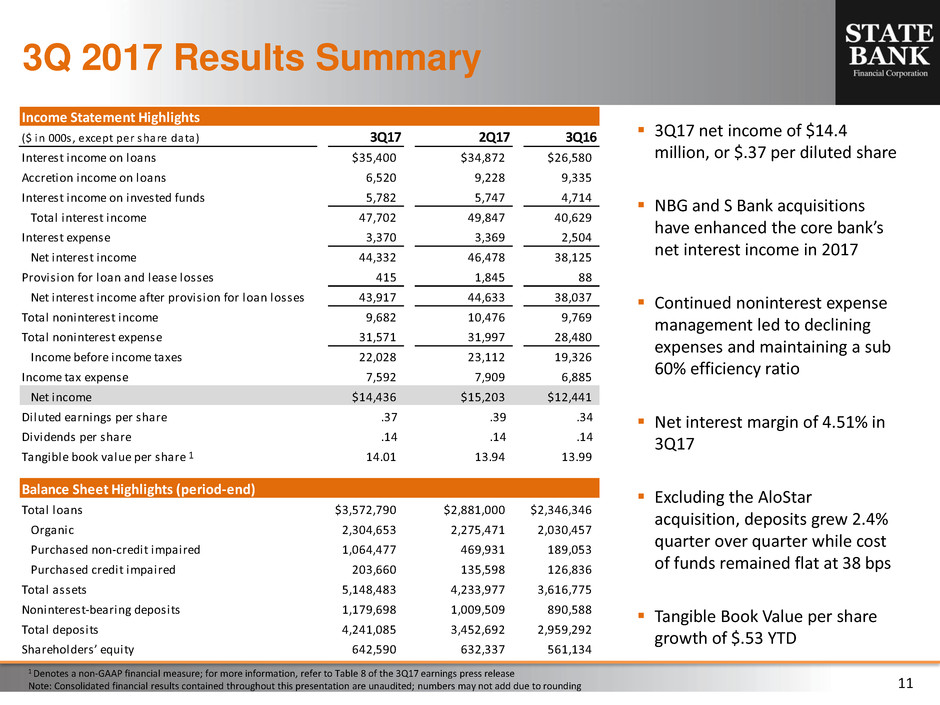

Income Statement Highlights

($ in 000s , except per share data) 3Q17 2Q17 3Q16

Interest income on loans $35,400 $34,872 $26,580

Accretion income on loans 6,520 9,228 9,335

Interest income on invested funds 5,782 5,747 4,714

Total interest income 47,702 49,847 40,629

Interest expense 3,370 3,369 2,504

Net interest income 44,332 46,478 38,125

Provision for loan and lease losses 415 1,845 88

Net interest income after provision for loan losses 43,917 44,633 38,037

Total noninterest income 9,682 10,476 9,769

Total noninterest expense 31,571 31,997 28,480

Income before income taxes 22,028 23,112 19,326

Income tax expense 7,592 7,909 6,885

Net income $14,436 $15,203 $12,441

Diluted earnings per share .37 .39 .34

Dividends per share .14 .14 .14

Tangible book value per share 14.01 13.94 13.99

Balance Sheet Highlights (period-end)

Total loans $3,572,790 $2,881,000 $2,346,346

Organic 2,304,653 2,275,471 2,030,457

Purchased non-credit impaired 1,064,477 469,931 189,053

Purchased credit impaired 203,660 135,598 126,836

Total assets 5,148,483 4,233,977 3,616,775

Noninterest-bearing deposits 1,179,698 1,009,509 890,588

Total deposits 4,241,085 3,452,692 2,959,292

Shareholders’ equity 642,590 632,337 561,134

3Q 2017 Results Summary

1 Denotes a non-GAAP financial measure; for more information, refer to Table 8 of the 3Q17 earnings press release

Note: Consolidated financial results contained throughout this presentation are unaudited; numbers may not add due to rounding

3Q17 net income of $14.4

million, or $.37 per diluted share

NBG and S Bank acquisitions

have enhanced the core bank’s

net interest income in 2017

Continued noninterest expense

management led to declining

expenses and maintaining a sub

60% efficiency ratio

Net interest margin of 4.51% in

3Q17

Excluding the AloStar

acquisition, deposits grew 2.4%

quarter over quarter while cost

of funds remained flat at 38 bps

Tangible Book Value per share

growth of $.53 YTD

1

12

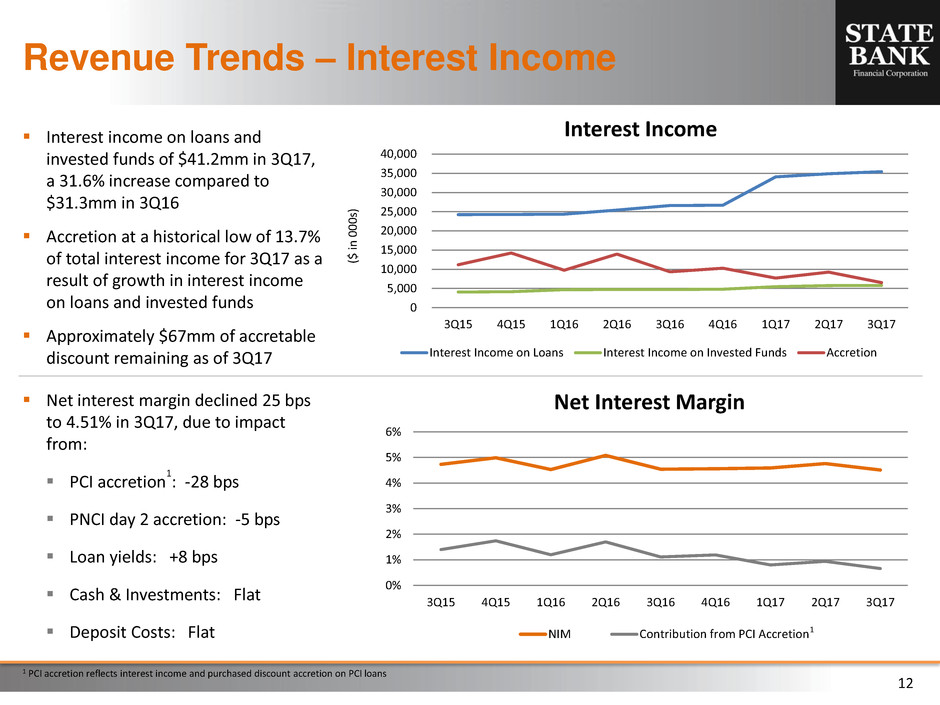

Revenue Trends – Interest Income

Interest income on loans and

invested funds of $41.2mm in 3Q17,

a 31.6% increase compared to

$31.3mm in 3Q16

Accretion at a historical low of 13.7%

of total interest income for 3Q17 as a

result of growth in interest income

on loans and invested funds

Approximately $67mm of accretable

discount remaining as of 3Q17

($ i

n

000

s)

Net interest margin declined 25 bps

to 4.51% in 3Q17, due to impact

from:

PCI accretion

1

: -28 bps

PNCI day 2 accretion: -5 bps

Loan yields: +8 bps

Cash & Investments: Flat

Deposit Costs: Flat 1

1 PCI accretion reflects interest income and purchased discount accretion on PCI loans

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Interest Income

Interest Income on Loans Interest Income on Invested Funds Accretion

0%

1%

2%

3%

4%

5%

6%

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Net Interest Margin

NIM Contribution from PCI Accretion

13

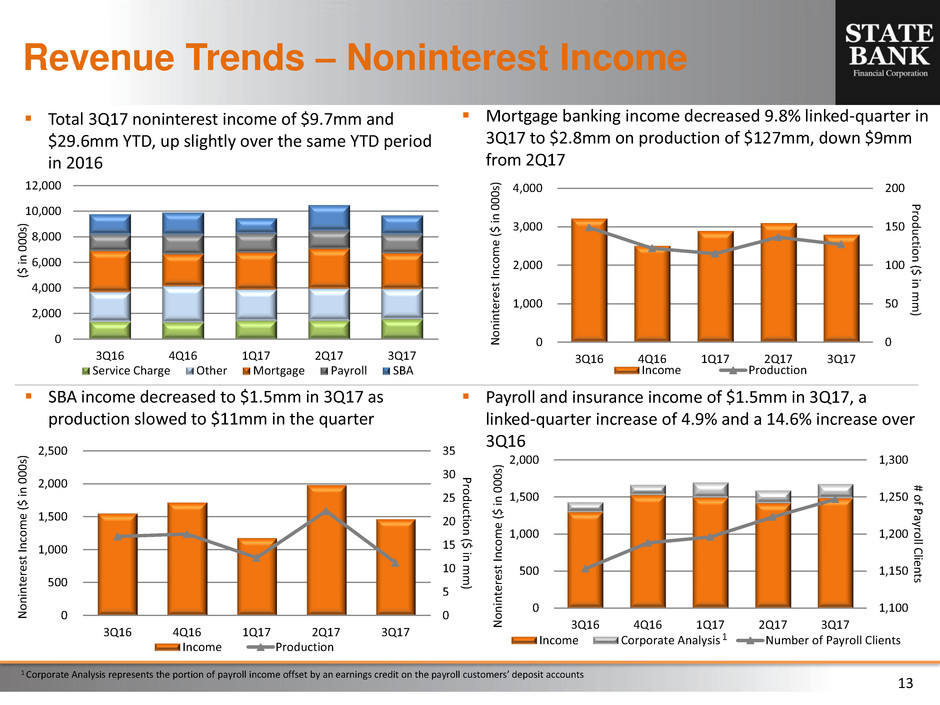

SBA income decreased to $1.5mm in 3Q17 as

production slowed to $11mm in the quarter

Payroll and insurance income of $1.5mm in 3Q17, a

linked-quarter increase of 4.9% and a 14.6% increase over

3Q16

Revenue Trends – Noninterest Income

Mortgage banking income decreased 9.8% linked-quarter in

3Q17 to $2.8mm on production of $127mm, down $9mm

from 2Q17

Total 3Q17 noninterest income of $9.7mm and

$29.6mm YTD, up slightly over the same YTD period

in 2016

($ i

n

000

s)

0

2,000

4,000

6,000

8,000

10,000

12,000

3Q16 4Q16 1Q17 2Q17 3Q17

Service Charge Other Mortgage Payroll SBA

0

50

100

150

200

0

1,000

2,000

3,000

4,000

3Q16 4Q16 1Q17 2Q17 3Q17

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

0

5

10

15

20

25

30

35

0

500

1,000

1,500

2,000

2,500

3Q16 4Q16 1Q17 2Q17 3Q17

Pr

o

d

u

cti

o

n

($

in

m

m

)

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Production

1,100

1,150

1,200

1,250

1,300

0

500

1,000

1,500

2,000

3Q16 4Q16 1Q17 2Q17 3Q17

# o

f P

ayro

ll C

lien

ts

N

o

n

in

ter

es

t

In

com

e

($ i

n

000

s)

Income Corporate Analysis Number of Payroll Clients1

1 Corporate Analysis represents the portion of payroll income offset by an earnings credit on the payroll customers’ deposit accounts

14

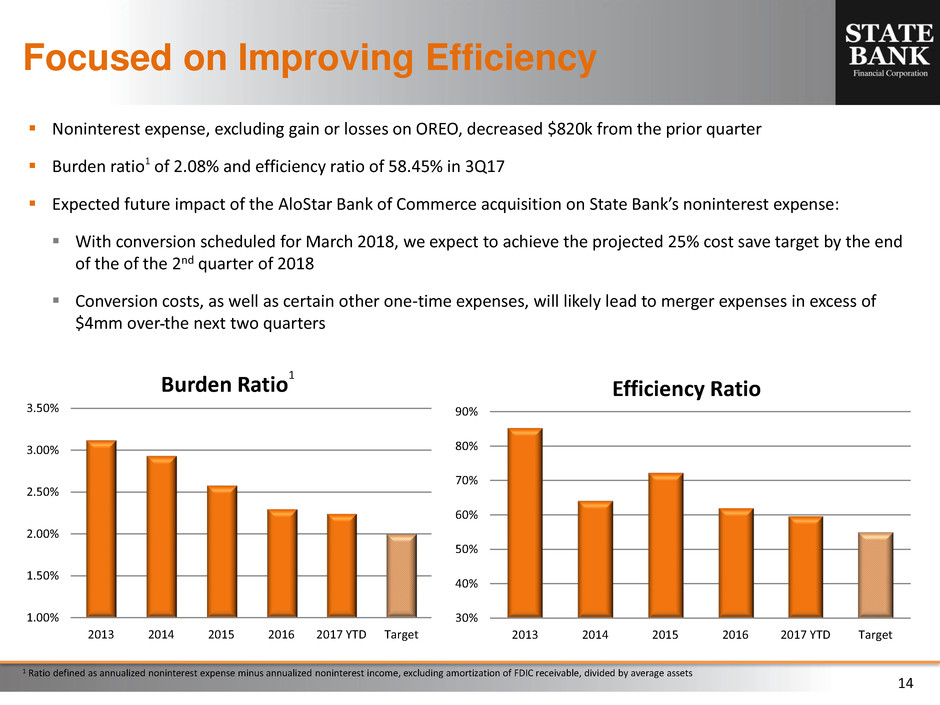

Focused on Improving Efficiency

Noninterest expense, excluding gain or losses on OREO, decreased $820k from the prior quarter

Burden ratio1 of 2.08% and efficiency ratio of 58.45% in 3Q17

Expected future impact of the AloStar Bank of Commerce acquisition on State Bank’s noninterest expense:

With conversion scheduled for March 2018, we expect to achieve the projected 25% cost save target by the end

of the of the 2nd quarter of 2018

Conversion costs, as well as certain other one-time expenses, will likely lead to merger expenses in excess of

$4mm over the next two quarters

1 Ratio defined as annualized noninterest expense minus annualized noninterest income, excluding amortization of FDIC receivable, divided by average assets

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

2013 2014 2015 2016 2017 YTD Target

Burden Ratio

1

30%

40%

50%

60%

70%

80%

90%

2013 2014 2015 2016 2017 YTD Target

Efficiency Ratio

15

Core Deposit Funding

Average noninterest-bearing

deposits increased $32mm in 3Q17

and represent 29.2% of average

total deposits

Low cost of funds of 38 bps as of

3Q17 is up just 4 bps since 3Q16, as

compared to the 75 bps rise in the

Fed Funds target over the same

period

Cost of interest-bearing transaction

accounts of 13 bps has remained

relatively steady since 3Q14

($ i

n

m

m

)

.00%

.10%

.20%

.30%

.40%

.50%

0

200

400

600

800

1,000

1,200

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Average Transaction Deposits

Interest- Bearing Non-Interest Bearing Cost of Funds Cost of IB Transaction Accts

Deposit Region

($ in mm)

2013 % 2014 % 2015 % 2016 % 2017 YTD %

Atlanta 798 38% 869 40% 1,080 39% 1,134 39% 1,140 33%

Middle Georgia 1,309 62% 1,297 60% 1,271 46% 1,337 46% 1,393 41%

Au usta - - - - 422 15% 422 15% 449 13%

Athens / Gainesville - - - - - - - - - - 354 10%

Greater Savannah - - - - - - - - - - 89 3%

Total Average Deposits $2,107 $2,166 $2,773 $2,893 $3,425

AloStar Deposits as of Period-End 3Q17 $706

16

Loan Portfolio

To

ta

l L

o

an

s

($

in

m

m

)

1 New loan fundings include new loans funded and net loan advances on existing commitments

2 3rd quarter 2017 loan balances include AloStar’s loan portfolio net of the fair value mark

1

New loan originations in

excess of $420mm in 3Q17; in

line with the trailing eight

quarter average

Acquisition of AloStar

materially impacts State

Bank’s loan portfolio as

Organic & PNCI loans grew

$624mm in 3Q17, including a

$529mm, or 47.9%, increase

in non CRE loans

N

ew

Lo

an

Fu

n

d

in

gs ($ i

n

m

m

)

Loan Composition (period-end)

($ in mm)

2013 2014 2015 2016 3Q172

Construction, land & land development $251 $313 $501 $551 $491

Other commercial real estate 550 636 736 964 1,150

Total commercial real estate 802 949 1,236 1,516 1,641

Residential real estate 67 135 210 289 288

Owner-occupied real estate 175 212 281 372 387

C&I and Leases 71 123 267 435 989

Consumer 9 9 21 42 64

Total Organic & PNCI Loans 1,123 1,428 2,015 2,654 3,369

PCI Loans 257 206 146 161 204

Total Loans $1,381 $1,635 $2,160 $2,815 $3,573

0

125

250

375

500

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

Total Loan Portfolio

Organic PNCI PCI New Loan Fundings

17

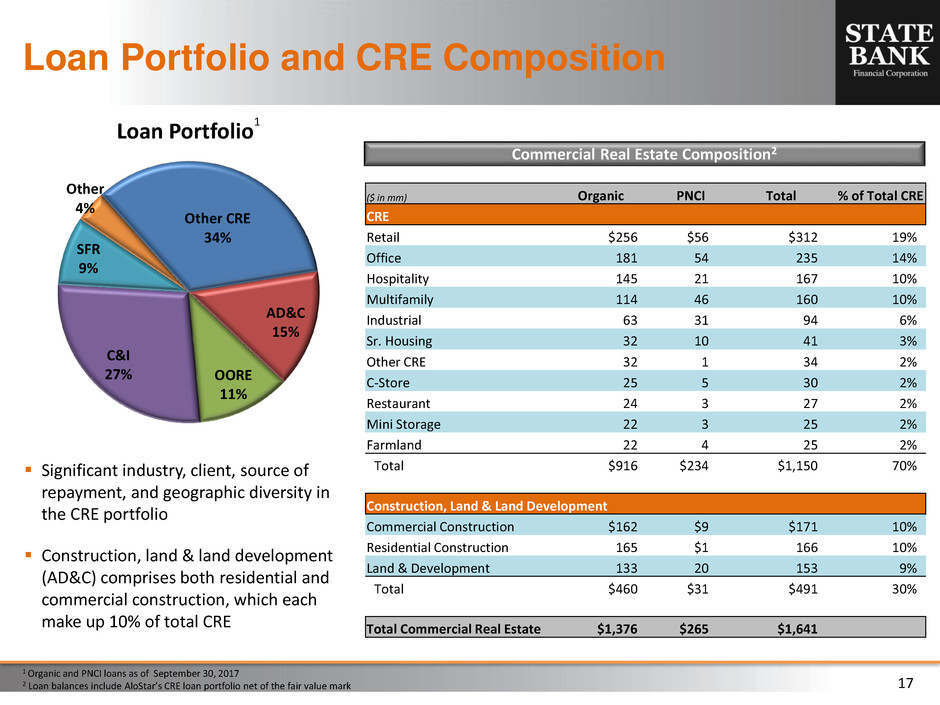

Loan Portfolio and CRE Composition

1 Organic and PNCI loans as of September 30, 2017

2 Loan balances include AloStar’s CRE loan portfolio net of the fair value mark

Commercial Real Estate Composition2

Significant industry, client, source of

repayment, and geographic diversity in

the CRE portfolio

Construction, land & land development

(AD&C) comprises both residential and

commercial construction, which each

make up 10% of total CRE

($ in mm) Organic PNCI Total % of Total CRE

CRE

Retail $256 $56 $312 19%

Office 181 54 235 14%

Hospitality 145 21 167 10%

Multifamily 114 46 160 10%

Industrial 63 31 94 6%

Sr. Housing 32 10 41 3%

Other CRE 32 1 34 2%

C-Store 25 5 30 2%

Restaurant 24 3 27 2%

Mini Storage 22 3 25 2%

Farmland 22 4 25 2%

Total $916 $234 $1,150 70%

Construction, Land & Land Development

Commercial Construction $162 $9 $171 10%

Residential Construction 165 $1 166 10%

Land & Development 133 20 153 9%

Total $460 $31 $491 30%

Total Commercial Real Estate $1,376 $265 $1,641

Other CRE

34%

AD&C

15%

OORE

11%

C&I

27%

SFR

9%

Other

4%

Loan Portfolio

1

18

PCI loans decreased $9.5mm

quarter over quarter excluding the

impact of the AloStar acquisition

Over 90% of PCI loans are current

as of 3Q17

OREO balances of $1.3mm as of

3Q17, down from $2.4mm at 2Q17

and $10.6mm at 3Q16

Asset Quality

($ i

n

m

m

)

Total organic NPAs of $5.5mm at

3Q17, up from last quarter but in line

with historical levels, representing

just .24% of organic loans and OREO

Past due organic loans remain low at

.12% at 3Q17

Annualized net charge-offs were

.14% in 3Q17

Allowance for organic loans is .99%

0

5

10

15

20

0

50

100

150

200

250

3Q16 4Q16 1Q17 2Q17 3Q17

OR

EO

($ i

n

m

m

)

PCI

Lo

an

s ($

in

m

m

)

PCI Loans & OREO

PCI Loans OREO

0.00%

0.25%

0.50%

0.75%

1.00%

0

5

10

15

20

3Q16 4Q16 1Q17 2Q17 3Q17

Nonperforming Loans

Organic PNCI NPLs / Organic Loans