Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HollyFrontier Corp | hfc-form8xkanalystday2017.htm |

HOLLYFRONTIER

2017 ANALYST DAY

December 7, 2017

Craig Biery

Director, Investor Relations

W E L C O M E

Disclosure Statement

Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that

may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may

differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and

uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products in

HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market

prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility

of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of

financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and

marketing strategies, HollyFrontier's and Holly Energy Partners’ efficiency in carrying out construction projects, HollyFrontier's ability to

acquire refined product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired

operations, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional

information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is

provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All

forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The

forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy Partners

undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise.

3

Agenda

4

OPENING REMARKS George Damiris

REFINING Jim Stump

Tom Creery

HOLLY ENERGY PARTNERS George Damiris

BREAK

LUBRICANTS & SPECIALTY PRODUCTS Mark Plake

Tony Weatherill

FINANCIALS & VALUATION Rich Voliva

Q&A

4

George Damiris

Chief Executive Officer

O P E N I N G R E M A R K S

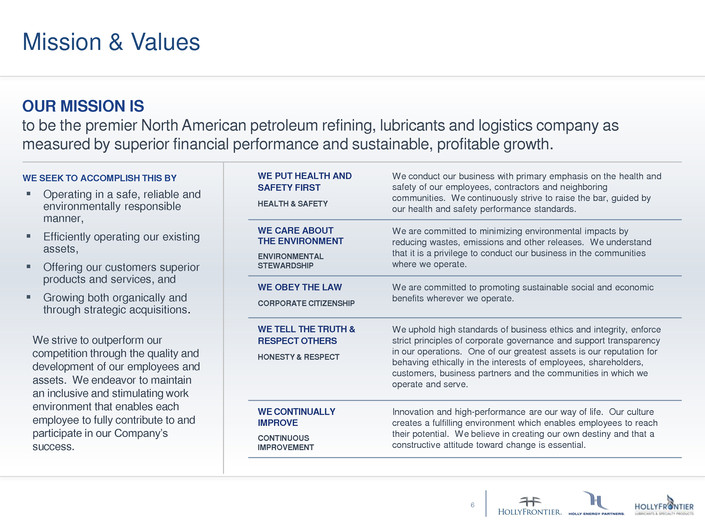

Mission & Values

OUR MISSION IS

to be the premier North American petroleum refining, lubricants and logistics company as

measured by superior financial performance and sustainable, profitable growth.

WE PUT HEALTH AND

SAFETY FIRST

HEALTH & SAFETY

We conduct our business with primary emphasis on the health and

safety of our employees, contractors and neighboring

communities. We continuously strive to raise the bar, guided by

our health and safety performance standards.

WE CARE ABOUT

THE ENVIRONMENT

ENVIRONMENTAL

STEWARDSHIP

We are committed to minimizing environmental impacts by

reducing wastes, emissions and other releases. We understand

that it is a privilege to conduct our business in the communities

where we operate.

WE OBEY THE LAW

CORPORATE CITIZENSHIP

We are committed to promoting sustainable social and economic

benefits wherever we operate.

WE TELL THE TRUTH &

RESPECT OTHERS

HONESTY & RESPECT

We uphold high standards of business ethics and integrity, enforce

strict principles of corporate governance and support transparency

in our operations. One of our greatest assets is our reputation for

behaving ethically in the interests of employees, shareholders,

customers, business partners and the communities in which we

operate and serve.

WE CONTINUALLY

IMPROVE

CONTINUOUS

IMPROVEMENT

Innovation and high-performance are our way of life. Our culture

creates a fulfilling environment which enables employees to reach

their potential. We believe in creating our own destiny and that a

constructive attitude toward change is essential.

WE SEEK TO ACCOMPLISH THIS BY

Operating in a safe, reliable and

environmentally responsible

manner,

Efficiently operating our existing

assets,

Offering our customers superior

products and services, and

Growing both organically and

through strategic acquisitions.

We strive to outperform our

competition through the quality and

development of our employees and

assets. We endeavor to maintain

an inclusive and stimulating work

environment that enables each

employee to fully contribute to and

participate in our Company’s

success.

6

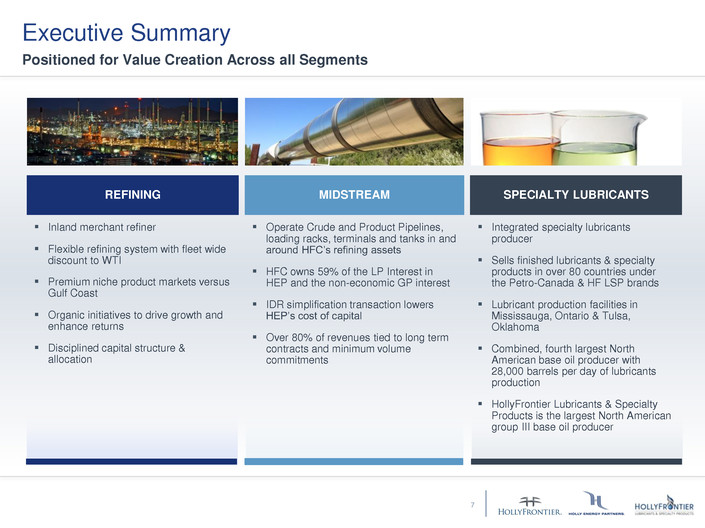

Executive Summary

Positioned for Value Creation Across all Segments

REFINING MIDSTREAM SPECIALTY LUBRICANTS

Inland merchant refiner

Flexible refining system with fleet wide

discount to WTI

Premium niche product markets versus

Gulf Coast

Organic initiatives to drive growth and

enhance returns

Disciplined capital structure &

allocation

Operate Crude and Product Pipelines,

loading racks, terminals and tanks in and

around HFC’s refining assets

HFC owns 59% of the LP Interest in

HEP and the non-economic GP interest

IDR simplification transaction lowers

HEP’s cost of capital

Over 80% of revenues tied to long term

contracts and minimum volume

commitments

Integrated specialty lubricants

producer

Sells finished lubricants & specialty

products in over 80 countries under

the Petro-Canada & HF LSP brands

Lubricant production facilities in

Mississauga, Ontario & Tulsa,

Oklahoma

Combined, fourth largest North

American base oil producer with

28,000 barrels per day of lubricants

production

HollyFrontier Lubricants & Specialty

Products is the largest North American

group III base oil producer

7

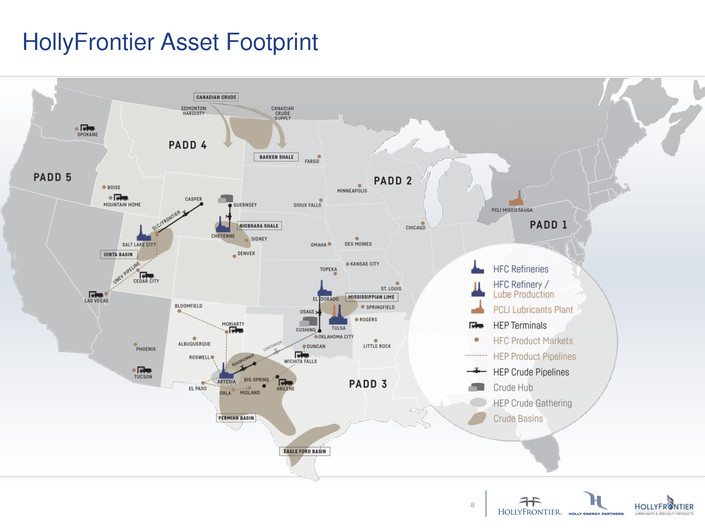

HollyFrontier Asset Footprint

8

Strategy

Safe & Reliable Operations

Value Creation Through Growth

Financial Strength & Discipline

9

R E F I N I N G : O P E R AT I O N S

Jim Stump

Senior Vice President, Refining

Health & Safety Top Priority

0.0

0.5

1.0

1.5

2012 2013 2014 2015 2016 YTD 2017

Employees Contractors

0

5

10

15

20

0.0

0.1

0.2

0.3

0.4

2012 2013 2014 2015 2016 YTD 2017

Incident Rate Incident Count

HollyFrontier Recordable Incident Rates Tier 1 Process Safety Incident Rate vs

Count

1. Total Recordable Incident Rate is the number of recordable injuries per 200,000 man hours worked

2. Tier 1 Incident Rate is the number of Tier 1 Process Safety Incidents for every 200,000 man hours worked

Total Recordable Incident Rate1 Tier 1 Incident Rate2

11

Tier 1 Incident Count

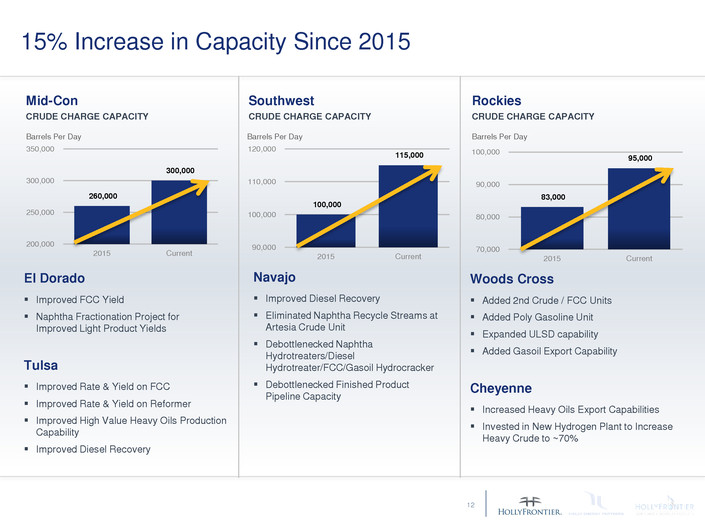

15% Increase in Capacity Since 2015

El Dorado

Improved FCC Yield

Naphtha Fractionation Project for

Improved Light Product Yields

Tulsa

Improved Rate & Yield on FCC

Improved Rate & Yield on Reformer

Improved High Value Heavy Oils Production

Capability

Improved Diesel Recovery

Navajo

Improved Diesel Recovery

Eliminated Naphtha Recycle Streams at

Artesia Crude Unit

Debottlenecked Naphtha

Hydrotreaters/Diesel

Hydrotreater/FCC/Gasoil Hydrocracker

Debottlenecked Finished Product

Pipeline Capacity

Woods Cross

Added 2nd Crude / FCC Units

Added Poly Gasoline Unit

Expanded ULSD capability

Added Gasoil Export Capability

Cheyenne

Increased Heavy Oils Export Capabilities

Invested in New Hydrogen Plant to Increase

Heavy Crude to ~70%

Mid-Con

CRUDE CHARGE CAPACITY

Rockies

CRUDE CHARGE CAPACITY

Southwest

CRUDE CHARGE CAPACITY

260,000

300,000

200,000

250,000

300,000

350,000

2015 Current

100,000

115,000

90,000

100,000

110,000

120,000

2015 Current

83,000

95,000

70,000

80,000

90,000

100,000

2015 Current

Barrels Per Day Barrels Per Day Barrels Per Day

12

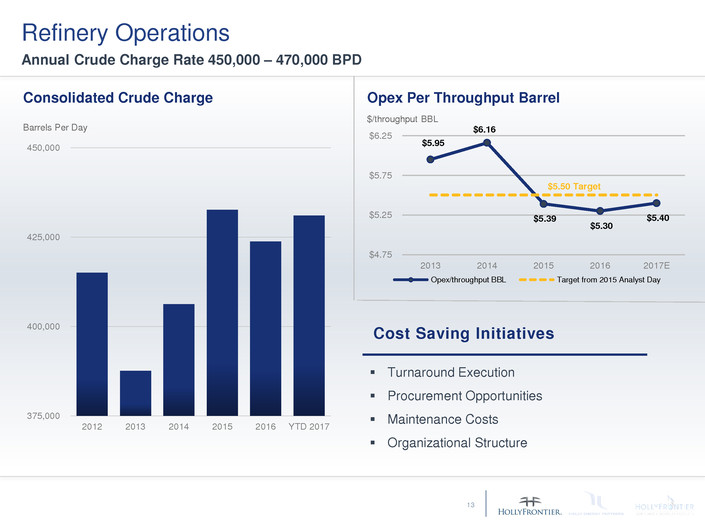

375,000

400,000

425,000

450,000

2012 2013 2014 2015 2016 YTD 2017

$5.95

$6.16

$5.39

$5.30

$5.40

$4.75

$5.25

$5.75

$6.25

2013 2014 2015 2016 2017E

Opex/throughput BBL Target from 2015 Analyst Day

Barrels Per Day

Opex Per Throughput Barrel Consolidated Crude Charge

$/throughput BBL

Cost Saving Initiatives

Turnaround Execution

Procurement Opportunities

Maintenance Costs

Organizational Structure

13

Refinery Operations

Annual Crude Charge Rate 450,000 – 470,000 BPD

$5.50 Target

R E F I N I N G : C O M M E R C I A L

Tom Creery

Senior Vice President, Commercial

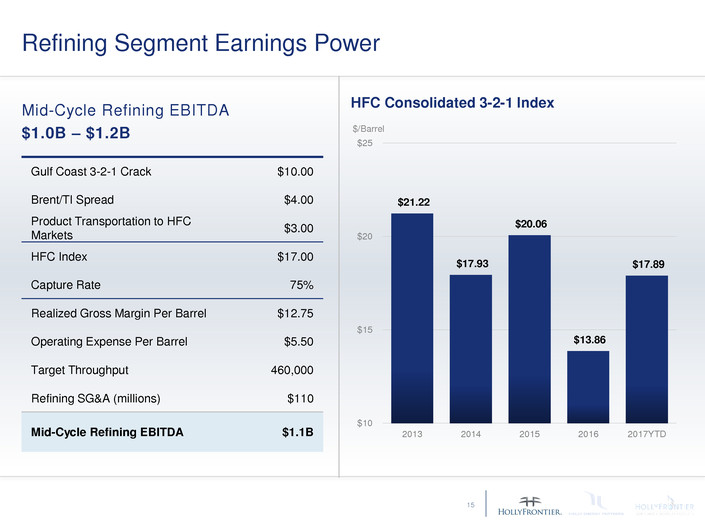

Refining Segment Earnings Power

$21.22

$17.93

$20.06

$13.86

$17.89

$10

$15

$20

$25

2013 2014 2015 2016 2017YTD

Mid-Cycle Refining EBITDA

$1.0B – $1.2B

Gulf Coast 3-2-1 Crack $10.00

Brent/TI Spread $4.00

Product Transportation to HFC

Markets

$3.00

HFC Index $17.00

Capture Rate 75%

Realized Gross Margin Per Barrel $12.75

Operating Expense Per Barrel $5.50

Target Throughput 460,000

Refining SG&A (millions) $110

Mid-Cycle Refining EBITDA $1.1B

HFC Consolidated 3-2-1 Index

$/Barrel

15

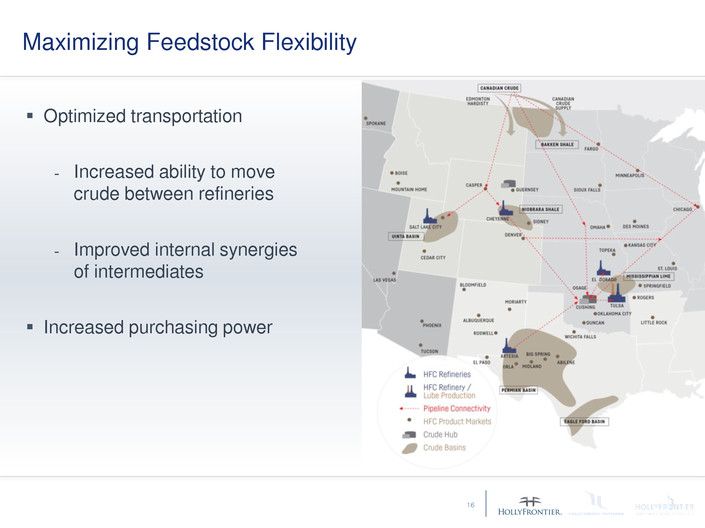

Maximizing Feedstock Flexibility

Optimized transportation

- Increased ability to move

crude between refineries

- Improved internal synergies

of intermediates

Increased purchasing power

16

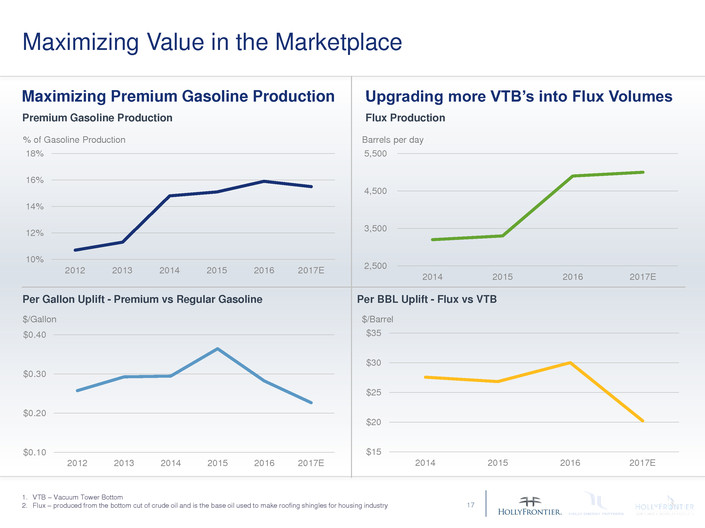

Maximizing Value in the Marketplace

17

10%

12%

14%

16%

18%

2012 2013 2014 2015 2016 2017E

Maximizing Premium Gasoline Production

$0.10

$0.20

$0.30

$0.40

2012 2013 2014 2015 2016 2017E

Upgrading more VTB’s into Flux Volumes

2,500

3,500

4,500

5,500

2014 2015 2016 2017E

$15

$20

$25

$30

$35

2014 2015 2016 2017E

Premium Gasoline Production Flux Production

Per BBL Uplift - Flux vs VTB Per Gallon Uplift - Premium vs Regular Gasoline

% of Gasoline Production Barrels per day

$/Barrel $/Gallon

1. VTB – Vacuum Tower Bottom

2. Flux – produced from the bottom cut of crude oil and is the base oil used to make roofing shingles for housing industry

H O L LY E N E R G Y

PA RT N E R S

George Damiris

Chief Executive Officer

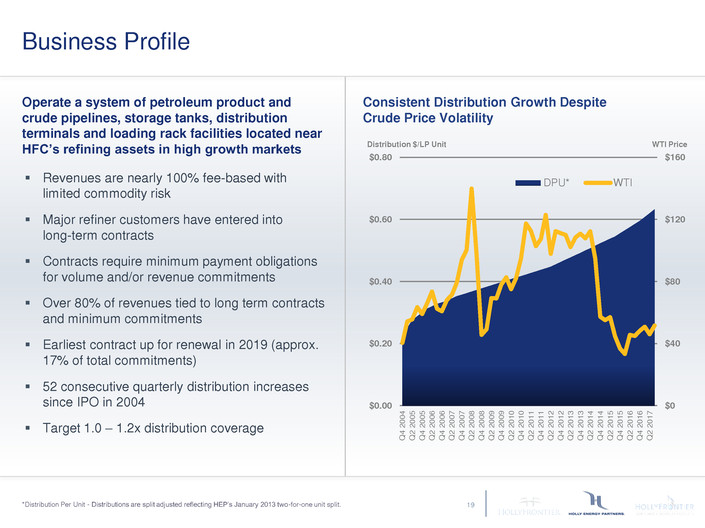

Operate a system of petroleum product and

crude pipelines, storage tanks, distribution

terminals and loading rack facilities located near

HFC’s refining assets in high growth markets

Revenues are nearly 100% fee-based with

limited commodity risk

Major refiner customers have entered into

long-term contracts

Contracts require minimum payment obligations

for volume and/or revenue commitments

Over 80% of revenues tied to long term contracts

and minimum commitments

Earliest contract up for renewal in 2019 (approx.

17% of total commitments)

52 consecutive quarterly distribution increases

since IPO in 2004

Target 1.0 – 1.2x distribution coverage

*Distribution Per Unit - Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split.

Business Profile

$0

$40

$80

$120

$160

$0.00

$0.20

$0.40

$0.60

$0.80

Q

4

2

0

0

4

Q

2

2

0

0

5

Q

4

2

0

0

5

Q

2

2

0

0

6

Q

4

2

0

0

6

Q

2

2

0

0

7

Q

4

2

0

0

7

Q

2

2

0

0

8

Q

4

2

0

0

8

Q

2

2

0

0

9

Q

4

2

0

0

9

Q

2

2

0

1

0

Q

4

2

0

1

0

Q

2

2

0

1

1

Q

4

2

0

1

1

Q

2

2

0

1

2

Q

4

2

0

1

2

Q

2

2

0

1

3

Q

4

2

0

1

3

Q

2

2

0

1

4

Q

4

2

0

1

4

Q

2

2

0

1

5

Q

4

2

0

1

5

Q

2

2

0

1

6

Q

4

2

0

1

6

Q

2

2

0

1

7

DPU* WTI

Consistent Distribution Growth Despite

Crude Price Volatility

WTI Price Distribution $/LP Unit

19

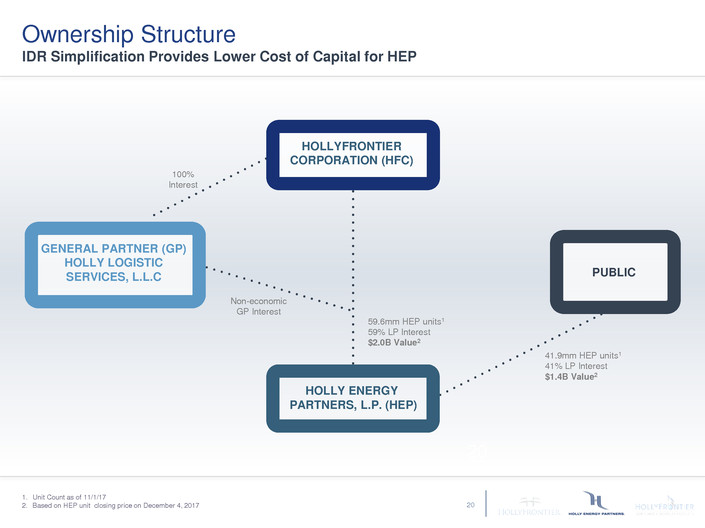

1. Unit Count as of 11/1/17

2. Based on HEP unit closing price on December 4, 2017

20

100%

Interest

41.9mm HEP units1

41% LP Interest

$1.4B Value2

59.6mm HEP units1

59% LP Interest

$2.0B Value2

HOLLYFRONTIER

CORPORATION (HFC)

GENERAL PARTNER (GP)

HOLLY LOGISTIC

SERVICES, L.L.C

HOLLY ENERGY

PARTNERS, L.P. (HEP)

PUBLIC

Non-economic

GP Interest

Ownership Structure

IDR Simplification Provides Lower Cost of Capital for HEP

20

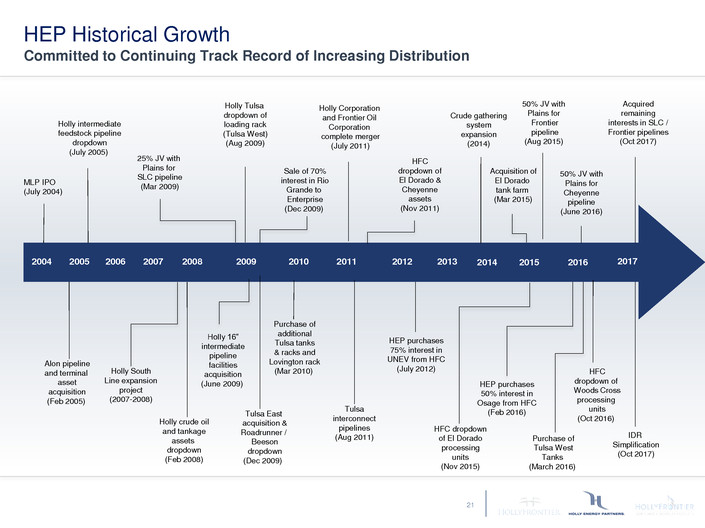

2004 2005 2006 2007 2008 2009

MLP IPO

(July 2004)

Holly intermediate

feedstock pipeline

dropdown

(July 2005)

25% JV with

Plains for

SLC pipeline

(Mar 2009)

Holly Tulsa

dropdown of

loading rack

(Tulsa West)

(Aug 2009)

Holly crude oil

and tankage

assets

dropdown

(Feb 2008)

Alon pipeline

and terminal

asset

acquisition

(Feb 2005)

Holly 16”

intermediate

pipeline

facilities

acquisition

(June 2009)

Tulsa East

acquisition &

Roadrunner /

Beeson

dropdown

(Dec 2009)

Sale of 70%

interest in Rio

Grande to

Enterprise

(Dec 2009)

2010

Purchase of

additional

Tulsa tanks

& racks and

Lovington rack

(Mar 2010)

2011

HFC

dropdown of

El Dorado &

Cheyenne

assets

(Nov 2011)

Holly South

Line expansion

project

(2007-2008)

Holly Corporation

and Frontier Oil

Corporation

complete merger

(July 2011)

2012

HEP purchases

75% interest in

UNEV from HFC

(July 2012)

Tulsa

interconnect

pipelines

(Aug 2011)

2013

Crude gathering

system

expansion

(2014)

2014 2015 2016 2017

Acquired

remaining

interests in SLC /

Frontier pipelines

(Oct 2017)

IDR

Simplification

(Oct 2017)

Purchase of

Tulsa West

Tanks

(March 2016)

HFC dropdown

of El Dorado

processing

units

(Nov 2015)

50% JV with

Plains for

Frontier

pipeline

(Aug 2015)

50% JV with

Plains for

Cheyenne

pipeline

(June 2016)

HFC

dropdown of

Woods Cross

processing

units

(Oct 2016)

Acquisition of

El Dorado

tank farm

(Mar 2015)

HEP Historical Growth

Committed to Continuing Track Record of Increasing Distribution

HEP purchases

50% interest in

Osage from HFC

(Feb 2016)

21

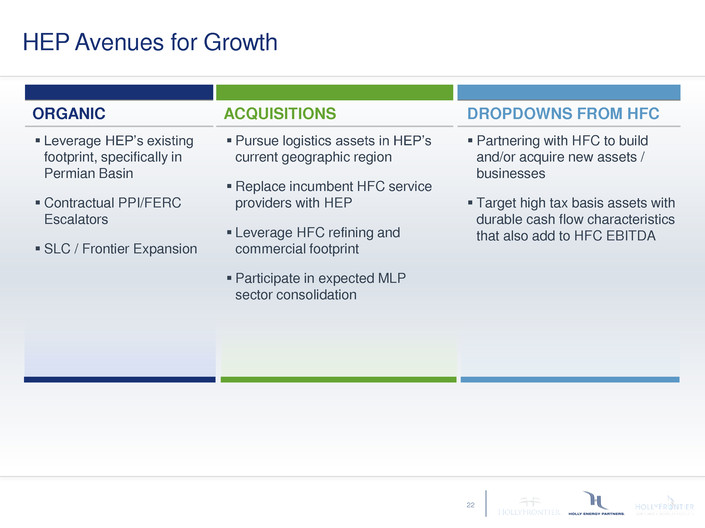

HEP Avenues for Growth

ORGANIC ACQUISITIONS DROPDOWNS FROM HFC

Leverage HEP’s existing

footprint, specifically in

Permian Basin

Contractual PPI/FERC

Escalators

SLC / Frontier Expansion

Pursue logistics assets in HEP’s

current geographic region

Replace incumbent HFC service

providers with HEP

Leverage HFC refining and

commercial footprint

Participate in expected MLP

sector consolidation

Partnering with HFC to build

and/or acquire new assets /

businesses

Target high tax basis assets with

durable cash flow characteristics

that also add to HFC EBITDA

22

B R E A K

H F L U B R I C A N T S &

S P E C I A LT Y P R O D U C T S

Mark Plake

President

Advanced lubricants are a crucial requirement in the drive

to develop more reliable, efficient and environmentally

compliant industrial machinery worldwide.

These lubricants command higher margins by:

HF Lubricants & Specialty Products

The World’s Machinery is Driving Towards Greater Efficiency, Reliability and Longevity

Meeting more

exacting standards

of purity and

viscosity

Providing exceptional

wear protection over a

wider range of

temperatures and harsh

environments

Allowing for

extended

drain

intervals

HF LSP is a

leading producer

of high-margin

premium lubricants,

specialty products and

top-quality base oils.

25

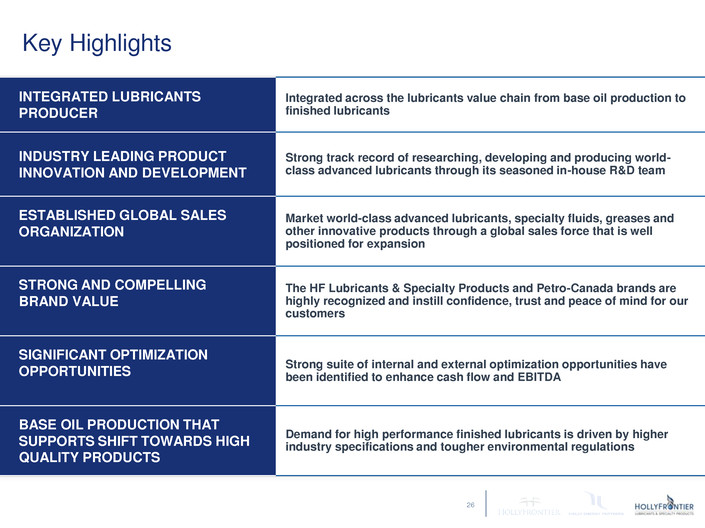

Key Highlights

INTEGRATED LUBRICANTS

PRODUCER

Integrated across the lubricants value chain from base oil production to

finished lubricants

INDUSTRY LEADING PRODUCT

INNOVATION AND DEVELOPMENT

Strong track record of researching, developing and producing world-

class advanced lubricants through its seasoned in-house R&D team

ESTABLISHED GLOBAL SALES

ORGANIZATION

Market world-class advanced lubricants, specialty fluids, greases and

other innovative products through a global sales force that is well

positioned for expansion

STRONG AND COMPELLING

BRAND VALUE

The HF Lubricants & Specialty Products and Petro-Canada brands are

highly recognized and instill confidence, trust and peace of mind for our

customers

SIGNIFICANT OPTIMIZATION

OPPORTUNITIES

Strong suite of internal and external optimization opportunities have

been identified to enhance cash flow and EBITDA

BASE OIL PRODUCTION THAT

SUPPORTS SHIFT TOWARDS HIGH

QUALITY PRODUCTS

Demand for high performance finished lubricants is driven by higher

industry specifications and tougher environmental regulations

26

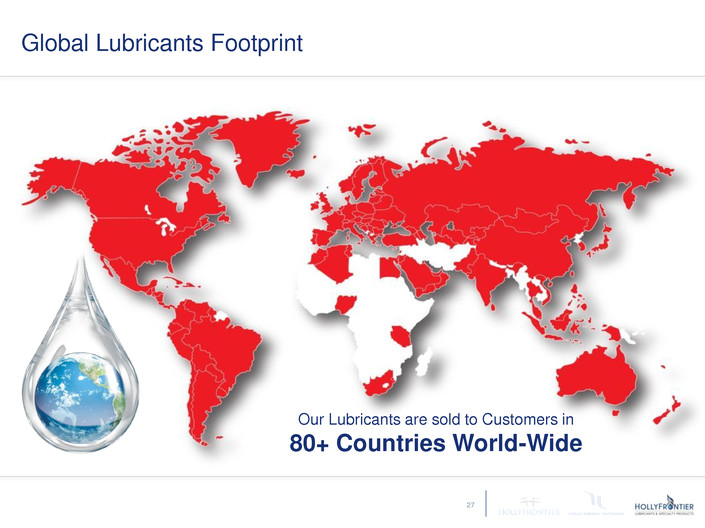

Global Lubricants Footprint

Our Lubricants are sold to Customers in

80+ Countries World-Wide

27

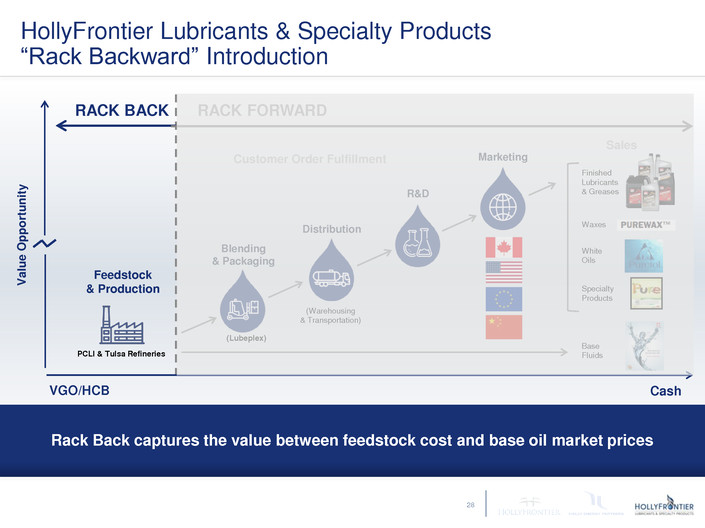

V

a

lu

e

O

p

p

ortu

n

it

y

PCLI & Tulsa Refineries

(Lubeplex)

(Warehousing

& Transportation)

Feedstock

& Production

Blending

& Packaging

RACK BACK

Marketing

Distribution

R&D

RACK FORWARD

VGO/HCB Cash

HollyFrontier Lubricants & Specialty Products

“Rack Backward” Introduction

Base

Fluids

White

Oils

Specialty

Products

Waxes

Finished

Lubricants

& Greases

Rack Back captures the value between feedstock cost and base oil market prices

Customer Order Fulfillment

Sales

28

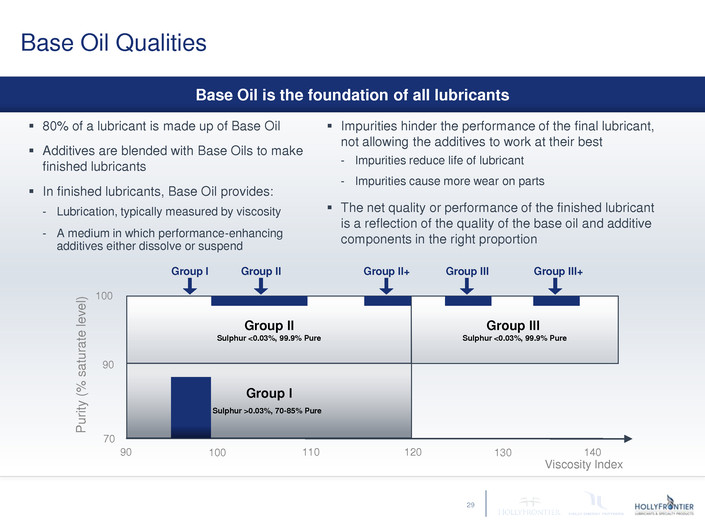

Base Oil Qualities

80% of a lubricant is made up of Base Oil

Additives are blended with Base Oils to make

finished lubricants

In finished lubricants, Base Oil provides:

- Lubrication, typically measured by viscosity

- A medium in which performance-enhancing

additives either dissolve or suspend

P

uri

ty

(

%

s

at

u

rat

e

le

v

e

l)

70

90

100

Viscosity Index

90 100 110 120 130

Group II

Sulphur <0.03%, 99.9% Pure

Group I

Sulphur >0.03%, 70-85% Pure

Group III

Sulphur <0.03%, 99.9% Pure

140

Group I Group II Group II+ Group III Group III+

Impurities hinder the performance of the final lubricant,

not allowing the additives to work at their best

- Impurities reduce life of lubricant

- Impurities cause more wear on parts

The net quality or performance of the finished lubricant

is a reflection of the quality of the base oil and additive

components in the right proportion

Base Oil is the foundation of all lubricants

29

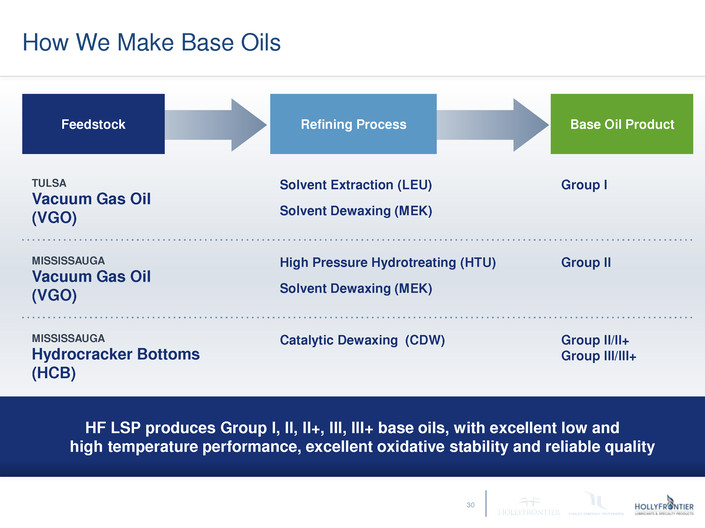

How We Make Base Oils

HF LSP produces Group I, II, II+, III, III+ base oils, with excellent low and

high temperature performance, excellent oxidative stability and reliable quality

Feedstock Refining Process Base Oil Product

TULSA

Vacuum Gas Oil

(VGO)

Solvent Extraction (LEU)

Solvent Dewaxing (MEK)

Group I

MISSISSAUGA

Vacuum Gas Oil

(VGO)

High Pressure Hydrotreating (HTU)

Solvent Dewaxing (MEK)

Group II

MISSISSAUGA

Hydrocracker Bottoms

(HCB)

Catalytic Dewaxing (CDW) Group II/II+

Group III/III+

30

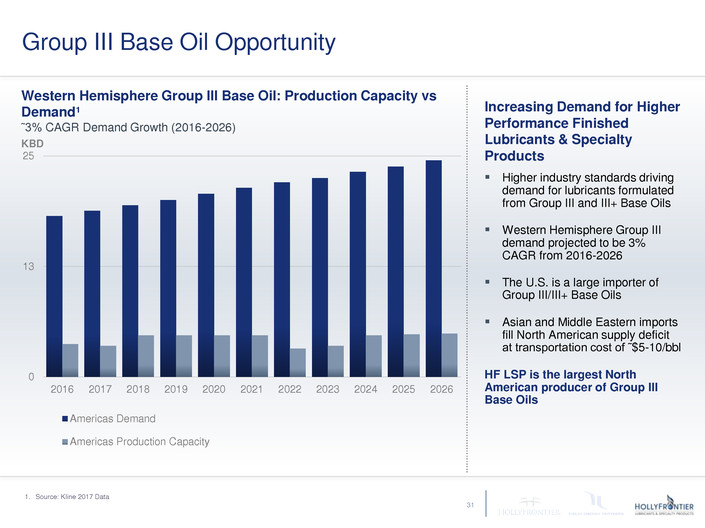

Group III Base Oil Opportunity

Increasing Demand for Higher

Performance Finished

Lubricants & Specialty

Products

Higher industry standards driving

demand for lubricants formulated

from Group III and III+ Base Oils

Western Hemisphere Group III

demand projected to be 3%

CAGR from 2016-2026

The U.S. is a large importer of

Group III/III+ Base Oils

Asian and Middle Eastern imports

fill North American supply deficit

at transportation cost of ˜$5-10/bbl

HF LSP is the largest North

American producer of Group III

Base Oils

Western Hemisphere Group III Base Oil: Production Capacity vs

Demand¹

˜3% CAGR Demand Growth (2016-2026)

1. Source: Kline 2017 Data

0

13

25

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

Americas Demand

Americas Production Capacity

31

KBD

F I N I S H E D L U B R I C A N T S

& S P E C I A LT Y P R O D U C T S

Tony Weatherill

Managing Director of Marketing, Research and Development

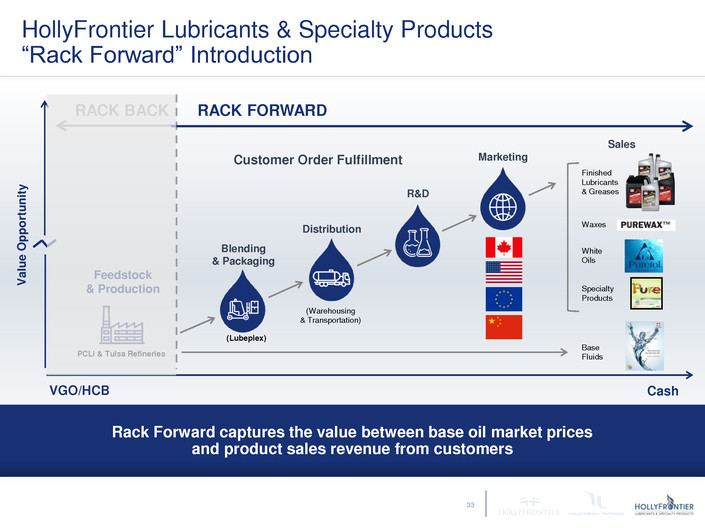

Rack Forward captures the value between base oil market prices

and product sales revenue from customers

V

a

lu

e

O

p

p

ortu

n

it

y

PCLI & Tulsa Refineries

(Lubeplex)

(Warehousing

& Transportation)

Feedstock

& Production

Blending

& Packaging

RACK BACK

Marketing

Distribution

R&D

Customer Order Fulfillment

RACK FORWARD

VGO/HCB Cash

Sales

Base

Fluids

White

Oils

Specialty

Products

Waxes

Finished

Lubricants

& Greases

HollyFrontier Lubricants & Specialty Products

“Rack Forward” Introduction

33

Better wear protection:

Longer engine and equipment

life

Superior resistance to high

temperature thermal

breakdown:

Lower maintenance costs

Outstanding low temperature

fluidity: Smoother engine and

equipment startups

Energy Efficiency:

Products stay in grade longer

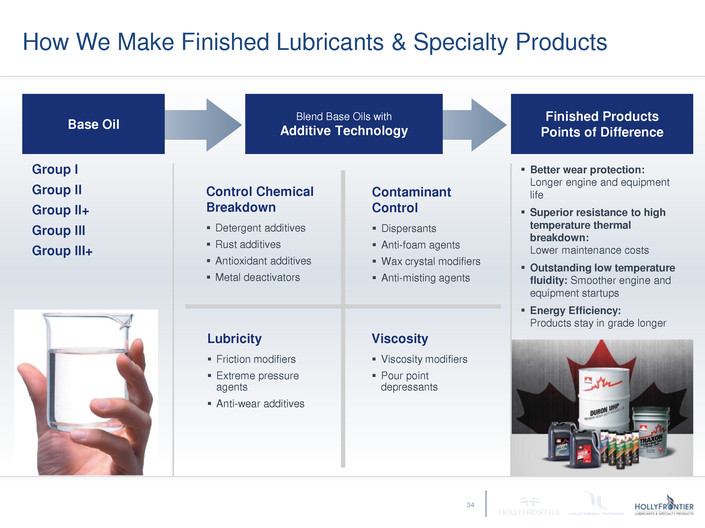

Group I

Group II

Group II+

Group III

Group III+

How We Make Finished Lubricants & Specialty Products

Base Oil

Blend Base Oils with

Additive Technology

Finished Products

Points of Difference

Control Chemical

Breakdown

Detergent additives

Rust additives

Antioxidant additives

Metal deactivators

Lubricity

Friction modifiers

Extreme pressure

agents

Anti-wear additives

Contaminant

Control

Dispersants

Anti-foam agents

Wax crystal modifiers

Anti-misting agents

Viscosity

Viscosity modifiers

Pour point

depressants

34

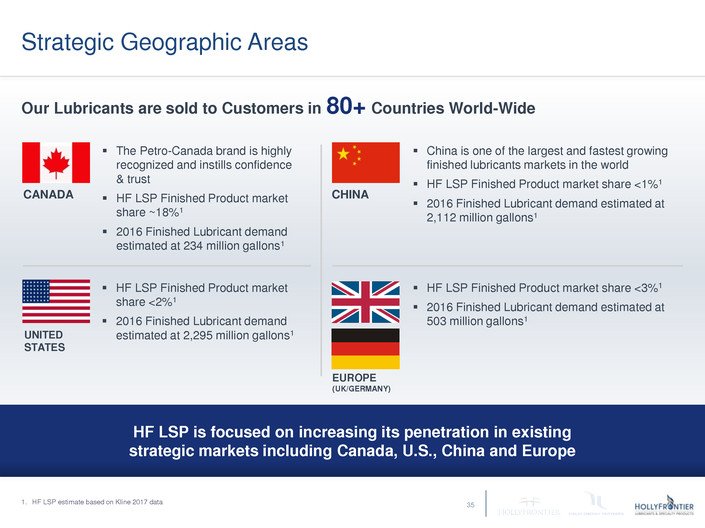

Our Lubricants are sold to Customers in 80+ Countries World-Wide

CANADA

HF LSP Finished Product market

share <2%1

2016 Finished Lubricant demand

estimated at 2,295 million gallons1

HF LSP Finished Product market share <3%1

2016 Finished Lubricant demand estimated at

503 million gallons1

China is one of the largest and fastest growing

finished lubricants markets in the world

HF LSP Finished Product market share <1%1

2016 Finished Lubricant demand estimated at

2,112 million gallons1

The Petro-Canada brand is highly

recognized and instills confidence

& trust

HF LSP Finished Product market

share ~18%1

2016 Finished Lubricant demand

estimated at 234 million gallons1

Strategic Geographic Areas

UNITED

STATES

EUROPE

(UK/GERMANY)

CHINA

HF LSP is focused on increasing its penetration in existing

strategic markets including Canada, U.S., China and Europe

1. HF LSP estimate based on Kline 2017 data 35

SUNSPRAY® ULTRA-FINE®

SPRAY OIL horticultural spray

oil for insect and mite pest

management

Sunspray ® MLOTM larvicide

oil used to control mosquito

larvae

SUNDEX® 8000 EU,

SUNPAR®, and CIRCOSOL®

oils designed for the rubber

and chemical industries.

HYDROLENE® asphalt

performance products

DCA® dust control oils for

mines and construction sites

PUREDRILL™ drilling mud

base fluids

Specialty Products

PURETOL™ white mineral

oils (USP, NF, NSF, EP,

DABX) used in personal care

products

PURITYTM FG food grade

white oils (NSF HI & 3H)

KRYSTOL™ technical

white oils used in nonfood

applications

White Oils

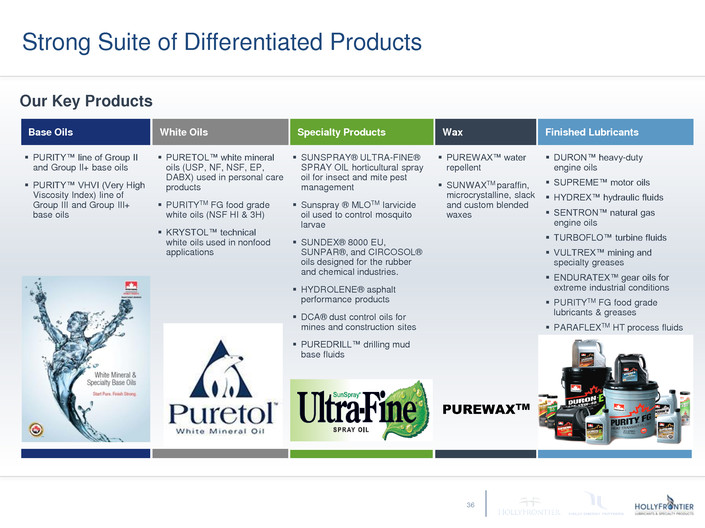

PURITY™ line of Group II

and Group II+ base oils

PURITY™ VHVI (Very High

Viscosity Index) line of

Group III and Group III+

base oils

Base Oils

Strong Suite of Differentiated Products

Our Key Products

PUREWAX™ water

repellent

SUNWAXTM paraffin,

microcrystalline, slack

and custom blended

waxes

DURON™ heavy-duty

engine oils

SUPREME™ motor oils

HYDREX™ hydraulic fluids

SENTRON™ natural gas

engine oils

TURBOFLO™ turbine fluids

VULTREX™ mining and

specialty greases

ENDURATEX™ gear oils for

extreme industrial conditions

PURITYTM FG food grade

lubricants & greases

PARAFLEXTM HT process fluids

Finished Lubricants Wax

36

PUREWAXTM

Automotive Gear Fluid

Automatic Transmission

Fluids

Passenger Car Motor Oils

Heavy Duty Diesel

Engine Oils

Small Engine Oils

Hydraulic Fluids

Greases

Tire Formulation Oils

Food Grade

Lubricants

White Oils

Compressor Fluids

Greases

Industrial Gear Oils

Compressor Fluids

Heat Transfer Fluids

Metal Working Fluids

Process Oils

Slideway Lubricants

Natural Gas Engine Oils

Turbine Fluids

Electrical Insulating Fluid

Providing Solutions Across Diverse Industries

Automotive Food & Beverage Industrial

Gas Plants, Pipelines

& Power Generation

37

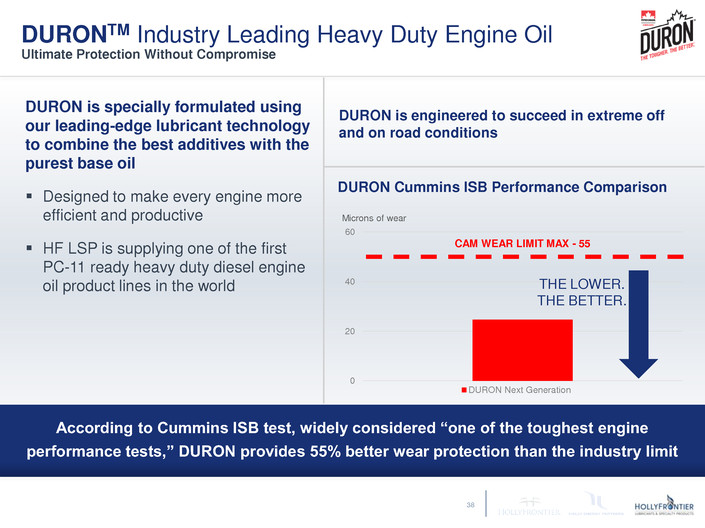

According to Cummins ISB test, widely considered “one of the toughest engine

performance tests,” DURON provides 55% better wear protection than the industry limit

DURON is specially formulated using

our leading-edge lubricant technology

to combine the best additives with the

purest base oil

Designed to make every engine more

efficient and productive

HF LSP is supplying one of the first

PC-11 ready heavy duty diesel engine

oil product lines in the world

DURON is engineered to succeed in extreme off

and on road conditions

DURONTM Industry Leading Heavy Duty Engine Oil

Ultimate Protection Without Compromise

38

0

20

40

60

DURON Next Generation

CAM WEAR LIMIT MAX - 55

THE LOWER.

THE BETTER.

Microns of wear

DURON Cummins ISB Performance Comparison

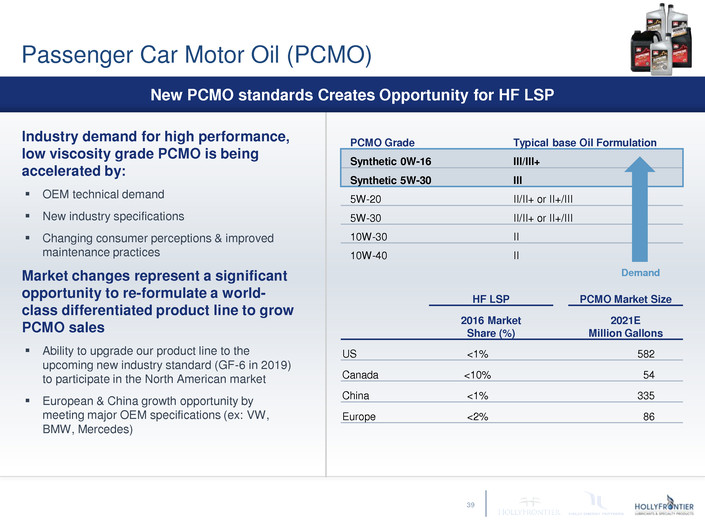

PCMO Grade Typical base Oil Formulation

Synthetic 0W-16 III/III+

Synthetic 5W-30 III

5W-20 II/II+ or II+/III

5W-30 II/II+ or II+/III

10W-30 II

10W-40 II

Passenger Car Motor Oil (PCMO)

Industry demand for high performance,

low viscosity grade PCMO is being

accelerated by:

OEM technical demand

New industry specifications

Changing consumer perceptions & improved

maintenance practices

Market changes represent a significant

opportunity to re-formulate a world-

class differentiated product line to grow

PCMO sales

Ability to upgrade our product line to the

upcoming new industry standard (GF-6 in 2019)

to participate in the North American market

European & China growth opportunity by

meeting major OEM specifications (ex: VW,

BMW, Mercedes)

Demand

HF LSP PCMO Market Size

2016 Market

Share (%)

2021E

Million Gallons

US <1% 582

Canada <10% 54

China <1% 335

Europe <2% 86

39

New PCMO standards Creates Opportunity for HF LSP

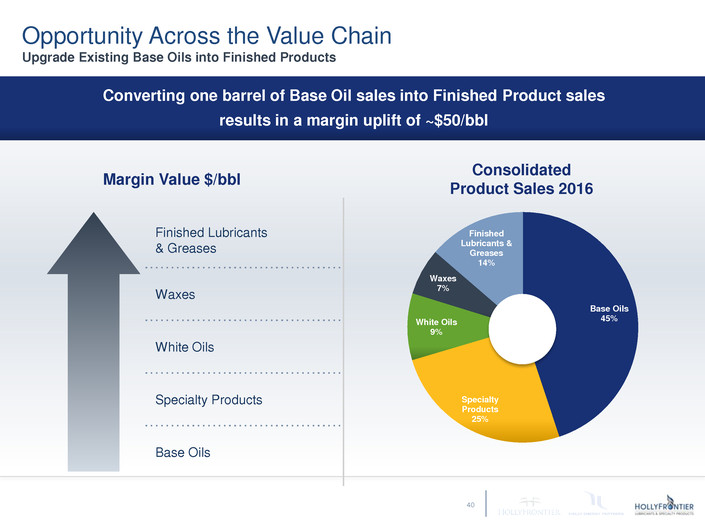

Base Oils

45%

Specialty

Products

25%

White Oils

9%

Waxes

7%

Finished

Lubricants &

Greases

14%

Consolidated

Product Sales 2016

Finished Lubricants

& Greases

Waxes

White Oils

Specialty Products

Base Oils

Margin Value $/bbl

Converting one barrel of Base Oil sales into Finished Product sales

results in a margin uplift of ~$50/bbl

40

Opportunity Across the Value Chain

Upgrade Existing Base Oils into Finished Products

F I N A N C I A L S &

VA L U AT I O N

Rich Voliva

Chief Financial Officer

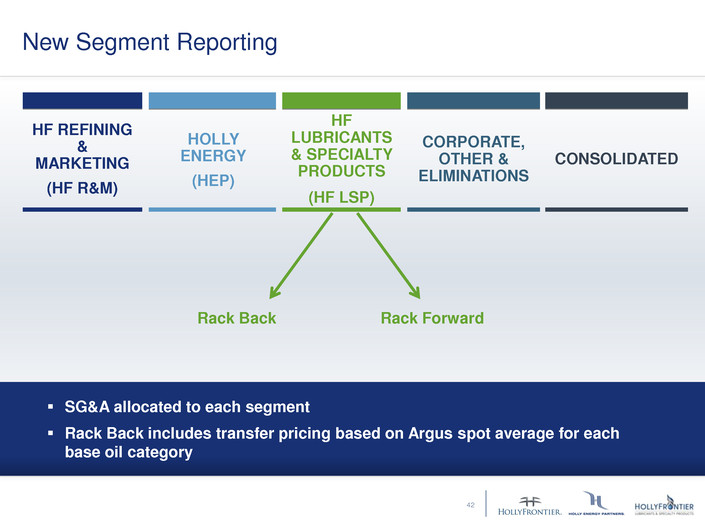

New Segment Reporting

Rack Back Rack Forward

HF REFINING

&

MARKETING

(HF R&M)

HOLLY

ENERGY

(HEP)

HF

LUBRICANTS

& SPECIALTY

PRODUCTS

(HF LSP)

CORPORATE,

OTHER &

ELIMINATIONS

CONSOLIDATED

SG&A allocated to each segment

Rack Back includes transfer pricing based on Argus spot average for each

base oil category

42

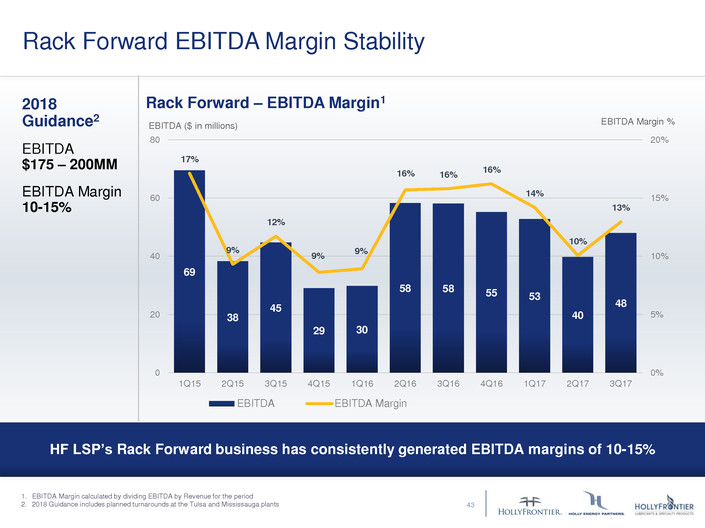

Rack Forward EBITDA Margin Stability

69

38

45

29 30

58 58 55 53

40

48

17%

9%

12%

9%

9%

16% 16%

16%

14%

10%

13%

0%

5%

10%

15%

20%

0

20

40

60

80

1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17

EBITDA EBITDA Margin

Rack Forward – EBITDA Margin1 2018

Guidance2

EBITDA

$175 – 200MM

EBITDA Margin

10-15%

1. EBITDA Margin calculated by dividing EBITDA by Revenue for the period

2. 2018 Guidance includes planned turnarounds at the Tulsa and Mississauga plants

HF LSP’s Rack Forward business has consistently generated EBITDA margins of 10-15%

EBITDA Margin % EBITDA ($ in millions)

43

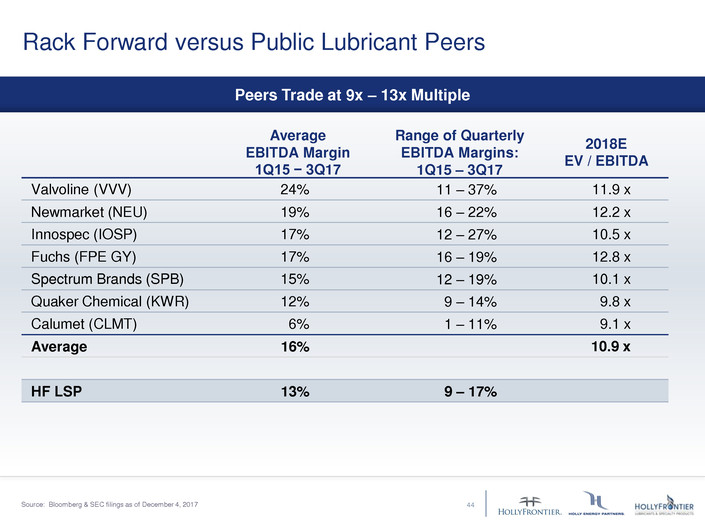

Rack Forward versus Public Lubricant Peers

Average

EBITDA Margin

1Q15 − 3Q17

Range of Quarterly

EBITDA Margins:

1Q15 – 3Q17

2018E

EV / EBITDA

Valvoline (VVV) 24% 11 – 37% 11.9 x

Newmarket (NEU) 19% 16 – 22% 12.2 x

Innospec (IOSP) 17% 12 – 27% 10.5 x

Fuchs (FPE GY) 17% 16 – 19% 12.8 x

Spectrum Brands (SPB) 15% 12 – 19% 10.1 x

Quaker Chemical (KWR) 12% 9 – 14% 9.8 x

Calumet (CLMT) 6% 1 – 11% 9.1 x

Average 16% 10.9 x

HF LSP 13% 9 – 17%

Source: Bloomberg & SEC filings as of December 4, 2017 44

Peers Trade at 9x – 13x Multiple

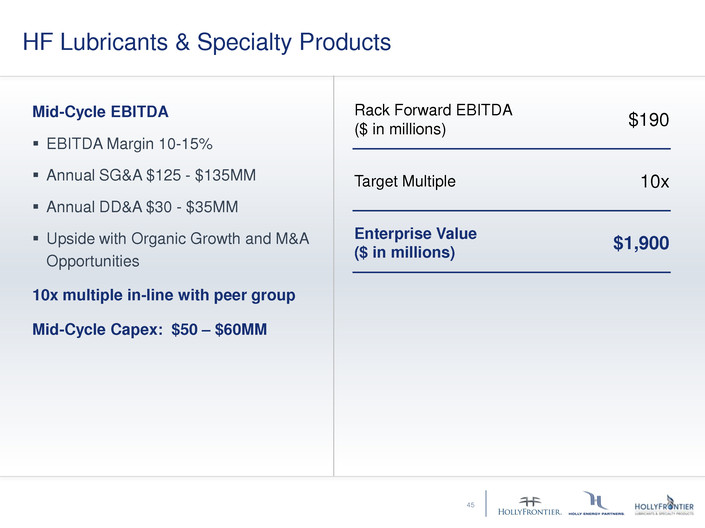

HF Lubricants & Specialty Products

Mid-Cycle EBITDA

EBITDA Margin 10-15%

Annual SG&A $125 - $135MM

Annual DD&A $30 - $35MM

Upside with Organic Growth and M&A

Opportunities

10x multiple in-line with peer group

Mid-Cycle Capex: $50 – $60MM

Rack Forward EBITDA

($ in millions)

$190

Target Multiple 10x

Enterprise Value

($ in millions)

$1,900

45

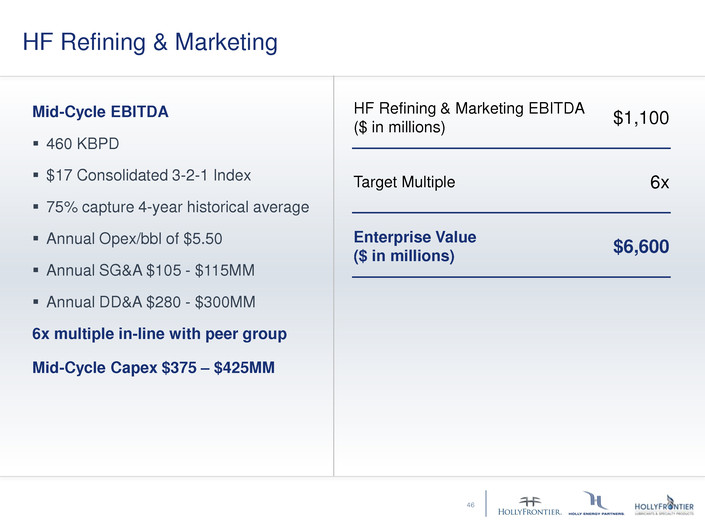

HF Refining & Marketing

HF Refining & Marketing EBITDA

($ in millions)

$1,100

Target Multiple 6x

Enterprise Value

($ in millions)

$6,600

Mid-Cycle EBITDA

460 KBPD

$17 Consolidated 3-2-1 Index

75% capture 4-year historical average

Annual Opex/bbl of $5.50

Annual SG&A $105 - $115MM

Annual DD&A $280 - $300MM

6x multiple in-line with peer group

Mid-Cycle Capex $375 – $425MM

46

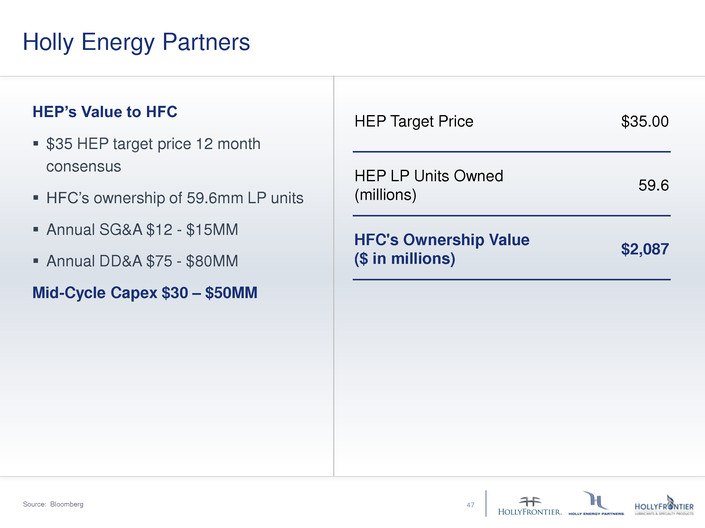

Holly Energy Partners

HEP’s Value to HFC

$35 HEP target price 12 month

consensus

HFC’s ownership of 59.6mm LP units

Annual SG&A $12 - $15MM

Annual DD&A $75 - $80MM

Mid-Cycle Capex $30 – $50MM

Source: Bloomberg

HEP Target Price $35.00

HEP LP Units Owned

(millions)

59.6

HFC's Ownership Value

($ in millions)

$2,087

47

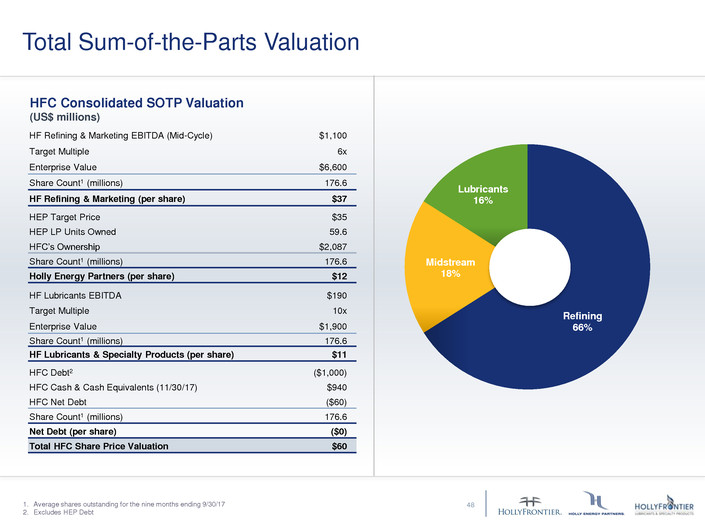

Total Sum-of-the-Parts Valuation

HF Refining & Marketing EBITDA (Mid-Cycle) $1,100

Target Multiple 6x

Enterprise Value $6,600

Share Count1 (millions) 176.6

HF Refining & Marketing (per share) $37

HEP Target Price $35

HEP LP Units Owned 59.6

HFC’s Ownership $2,087

Share Count1 (millions) 176.6

Holly Energy Partners (per share) $12

HF Lubricants EBITDA $190

Target Multiple 10x

Enterprise Value $1,900

Share Count1 (millions) 176.6

HF Lubricants & Specialty Products (per share) $11

HFC Debt2 ($1,000)

HFC Cash & Cash Equivalents (11/30/17) $940

HFC Net Debt ($60)

Share Count1 (millions) 176.6

Net Debt (per share) ($0)

Total HFC Share Price Valuation $60

HFC Consolidated SOTP Valuation

(US$ millions)

Refining

66%

Midstream

18%

Lubricants

16%

48 1. Average shares outstanding for the nine months ending 9/30/17

2. Excludes HEP Debt

Summary

REFINING MIDSTREAM SPECIALTY LUBRICANTS

450 – 470 KBPD crude rate

$1.0 – $1.2 billion mid-cycle

EBITDA per year

Upside through reliability, cost

saving, and commercial initiatives

HFC owns 59.6 million HEP units

IDR simplification transaction lowers

HEP’s cost of capital

Demonstrated track record of growth

Rack Forward business generates

$175 - $200 million of annual

EBITDA

Specialty lubricants multiple

Significant growth potential

49

A P P E N D I X

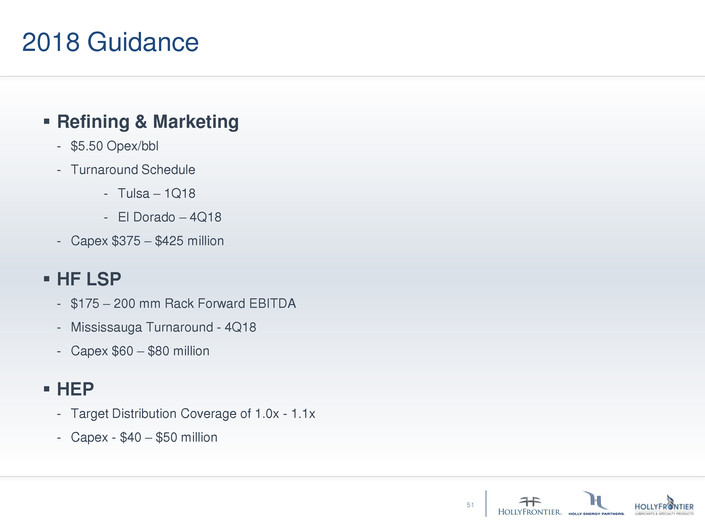

2018 Guidance

Refining & Marketing

- $5.50 Opex/bbl

- Turnaround Schedule

- Tulsa – 1Q18

- El Dorado – 4Q18

- Capex $375 – $425 million

HF LSP

- $175 – 200 mm Rack Forward EBITDA

- Mississauga Turnaround - 4Q18

- Capex $60 – $80 million

HEP

- Target Distribution Coverage of 1.0x - 1.1x

- Capex - $40 – $50 million

51

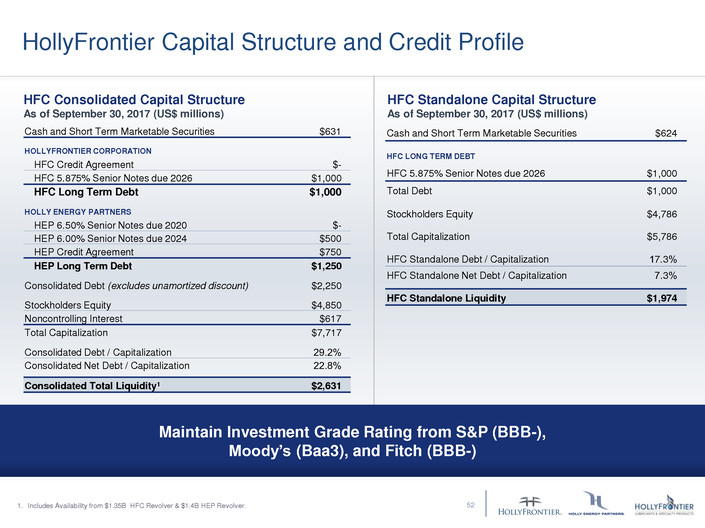

HollyFrontier Capital Structure and Credit Profile

52

52

Maintain Investment Grade Rating from S&P (BBB-),

Moody’s (Baa3), and Fitch (BBB-)

Cash and Short Term Marketable Securities $631

HOLLYFRONTIER CORPORATION

HFC Credit Agreement $-

HFC 5.875% Senior Notes due 2026 $1,000

HFC Long Term Debt $1,000

HOLLY ENERGY PARTNERS

HEP 6.50% Senior Notes due 2020 $-

HEP 6.00% Senior Notes due 2024 $500

HEP Credit Agreement $750

HEP Long Term Debt $1,250

Consolidated Debt (excludes unamortized discount) $2,250

Stockholders Equity $4,850

Noncontrolling Interest $617

Total Capitalization $7,717

Consolidated Debt / Capitalization 29.2%

Consolidated Net Debt / Capitalization 22.8%

Consolidated Total Liquidity1 $2,631

HFC Consolidated Capital Structure

As of September 30, 2017 (US$ millions)

Cash and Short Term Marketable Securities $624

HFC LONG TERM DEBT

HFC 5.875% Senior Notes due 2026 $1,000

Total Debt $1,000

Stockholders Equity $4,786

Total Capitalization $5,786

HFC Standalone Debt / Capitalization 17.3%

HFC Standalone Net Debt / Capitalization 7.3%

HFC Standalone Liquidity $1,974

HFC Standalone Capital Structure

As of September 30, 2017 (US$ millions)

1. Includes Availability from $1.35B HFC Revolver & $1.4B HEP Revolver.

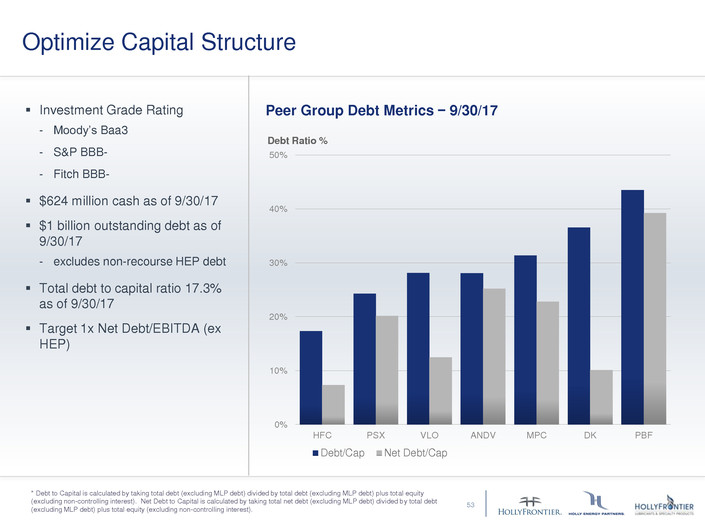

Investment Grade Rating

- Moody’s Baa3

- S&P BBB-

- Fitch BBB-

$624 million cash as of 9/30/17

$1 billion outstanding debt as of

9/30/17

- excludes non-recourse HEP debt

Total debt to capital ratio 17.3%

as of 9/30/17

Target 1x Net Debt/EBITDA (ex

HEP)

* Debt to Capital is calculated by taking total debt (excluding MLP debt) divided by total debt (excluding MLP debt) plus total equity

(excluding non-controlling interest). Net Debt to Capital is calculated by taking total net debt (excluding MLP debt) divided by total debt

(excluding MLP debt) plus total equity (excluding non-controlling interest).

0%

10%

20%

30%

40%

50%

HFC PSX VLO ANDV MPC DK PBF

Debt/Cap Net Debt/Cap

Debt Ratio %

Peer Group Debt Metrics − 9/30/17

Optimize Capital Structure

53

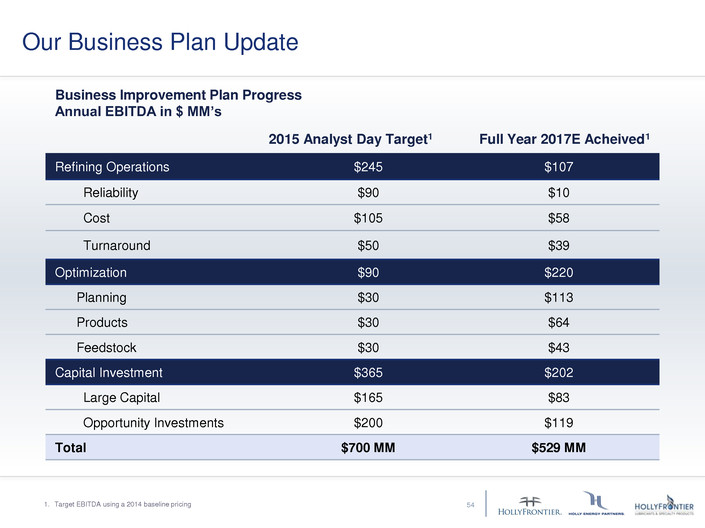

Our Business Plan Update

54 1. Target EBITDA using a 2014 baseline pricing

Business Improvement Plan Progress

Annual EBITDA in $ MM’s

2015 Analyst Day Target1 Full Year 2017E Acheived1

Refining Operations $245 $107

Reliability $90 $10

Cost $105 $58

Turnaround $50 $39

Optimization $90 $220

Planning $30 $113

Products $30 $64

Feedstock $30 $43

Capital Investment $365 $202

Large Capital $165 $83

Opportunity Investments $200 $119

Total $700 MM $529 MM

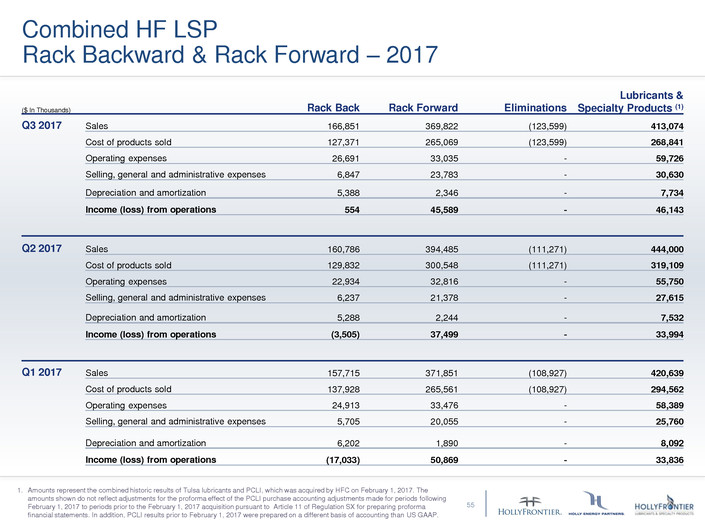

Combined HF LSP

Rack Backward & Rack Forward – 2017

55

($ In Thousands) Rack Back Rack Forward Eliminations

Lubricants &

Specialty Products (1)

Q3 2017 Sales 166,851 369,822 (123,599) 413,074

Cost of products sold 127,371 265,069 (123,599) 268,841

Operating expenses 26,691 33,035 - 59,726

Selling, general and administrative expenses 6,847 23,783 - 30,630

Depreciation and amortization 5,388 2,346 - 7,734

Income (loss) from operations 554 45,589 - 46,143

Q2 2017 Sales 160,786 394,485 (111,271) 444,000

Cost of products sold 129,832 300,548 (111,271) 319,109

Operating expenses 22,934 32,816 - 55,750

Selling, general and administrative expenses 6,237 21,378 - 27,615

Depreciation and amortization 5,288 2,244 - 7,532

Income (loss) from operations (3,505) 37,499 - 33,994

Q1 2017 Sales 157,715 371,851 (108,927) 420,639

Cost of products sold 137,928 265,561 (108,927) 294,562

Operating expenses 24,913 33,476 - 58,389

Selling, general and administrative expenses 5,705 20,055 - 25,760

Depreciation and amortization 6,202 1,890 - 8,092

Income (loss) from operations (17,033) 50,869 - 33,836

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

Lubricants &

($ In Thousands) Rack Back Rack Forward Eliminations Specialty Products(1)

Q4 2016 Sales 150,885 339,765 (105,885) 384,765

Cost of products sold 120,809 234,151 (105,885) 249,075

Operating expenses 25,716 32,271 - 57,987

Selling, general and administrative expenses 5,172 18,223 - 23,395

Depreciation and amortization 7,209 1,382 - 8,591

Income (loss) from operations (8,021) 53,738 - 45,717

Q3 2016 Sales 168,689 367,526 (115,710) 420,505

Cost of products sold 135,181 257,573 (115,710) 277,044

Operating expenses 23,576 32,646 - 56,222

Selling, general and administrative expenses 5,459 19,223 - 24,682

Depreciation and amortization 7,209 1,293 - 8,502

Income (loss) from operations (2,736) 56,791 - 54,055

Q2 2016 Sales 158,914 370,837 (110,950) 418,801

Cost of products sold 120,344 258,848 (110,950) 268,242

Operating expenses 23,146 34,054 - 57,200

Selling, general and administrative expenses 5,639 19,724 - 25,363

Depreciation and amortization 7,218 1,301 - 8,519

Income (loss) from operations 2,567 56,910 - 59,477

Q1 2016 Sales 129,713 333,294 (97,395) 365,612

Cost of products sold 100,367 247,727 (97,395) 250,699

Operating expenses 23,231 32,350 - 55,581

Selling, general and administrative expenses 6,783 23,453 - 30,236

Depreciation and amortization 6,692 1,237 - 7,929

Income (loss) from operations (7,360) 28,527 - 21,167

Combined HF LSP

Rack Backward & Rack Forward – 2016

56

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

($ in Thousands) Rack Back Rack Forward Eliminations

Lubricants &

Specialty Products(1)

Q4 2015 Sales 135,561 337,120 (99,363) 373,318

Cost of products sold 120,018 246,599 (99,363) 267,254

Operating expenses 13,994 32,530 - 46,524

Selling, general and administrative expenses 8,024 28,940 - 36,964

Depreciation and amortization 7,670 1,216 - 8,886

Income (loss) from operations (14,145) 27,835 - 13,690

Q3 2015 Sales 194,340 381,549 (134,226) 441,663

Cost of products sold 167,769 284,321 (134,226) 317,864

Operating expenses 22,018 32,990 - 55,008

Selling, general and administrative expenses 5,376 19,524 - 24,900

Depreciation and amortization 8,905 1,243 - 10,148

Income (loss) from operations (9,728) 43,471 - 33,743

Q2 2015 Sales 204,126 410,308 (138,582) 475,852

Cost of products sold 171,001 316,312 (138,582) 348,731

Operating expenses 26,315 35,312 - 61,627

Selling, general and administrative expenses 5,671 20,458 - 26,129

Depreciation and amortization 9,328 1,277 - 10,605

Income (loss) from operations (8,189) 36,949 - 28,760

Q1 2015 Sales 153,076 405,732 (111,118) 447,690

Cost of products sold 136,935 283,550 (111,118) 309,367

Operating expenses 31,854 34,358 - 66,212

Selling, general and administrative expenses 5,051 18,362 - 23,413

Depreciation and amortization 9,282 1,164 - 10,446

Income (loss) from operations (30,046) 68,298 - 38,252

Combined HF LSP

Rack Backward & Rack Forward – 2015

57

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

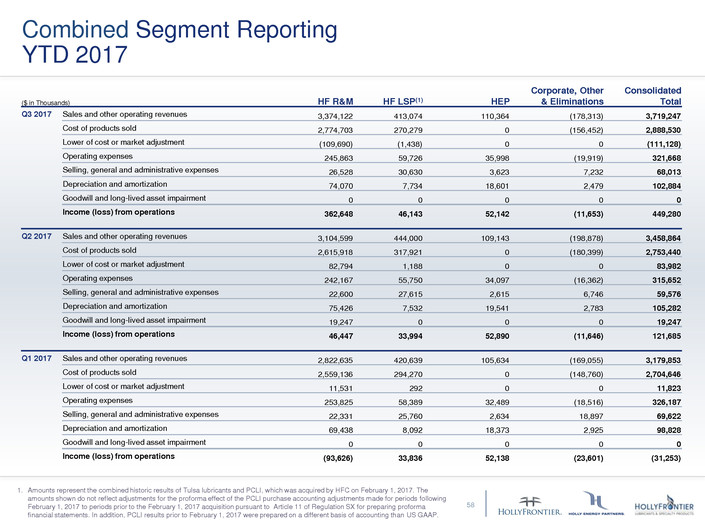

Combined Segment Reporting

YTD 2017

58

($ in Thousands) HF R&M HF LSP(1) HEP

Corporate, Other

& Eliminations

Consolidated

Total

Q3 2017 Sales and other operating revenues 3,374,122 413,074 110,364 (178,313) 3,719,247

Cost of products sold 2,774,703 270,279 0 (156,452) 2,888,530

Lower of cost or market adjustment (109,690) (1,438) 0 0 (111,128)

Operating expenses 245,863 59,726 35,998 (19,919) 321,668

Selling, general and administrative expenses 26,528 30,630 3,623 7,232 68,013

Depreciation and amortization 74,070 7,734 18,601 2,479 102,884

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 362,648 46,143 52,142 (11,653) 449,280

Q2 2017 Sales and other operating revenues 3,104,599 444,000 109,143 (198,878) 3,458,864

Cost of products sold 2,615,918 317,921 0 (180,399) 2,753,440

Lower of cost or market adjustment 82,794 1,188 0 0 83,982

Operating expenses 242,167 55,750 34,097 (16,362) 315,652

Selling, general and administrative expenses 22,600 27,615 2,615 6,746 59,576

Depreciation and amortization 75,426 7,532 19,541 2,783 105,282

Goodwill and long-lived asset impairment 19,247 0 0 0 19,247

Income (loss) from operations 46,447 33,994 52,890 (11,646) 121,685

Q1 2017 Sales and other operating revenues 2,822,635 420,639 105,634 (169,055) 3,179,853

Cost of products sold 2,559,136 294,270 0 (148,760) 2,704,646

Lower of cost or market adjustment 11,531 292 0 0 11,823

Operating expenses 253,825 58,389 32,489 (18,516) 326,187

Selling, general and administrative expenses 22,331 25,760 2,634 18,897 69,622

Depreciation and amortization 69,438 8,092 18,373 2,925 98,828

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations (93,626) 33,836 52,138 (23,601) (31,253)

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

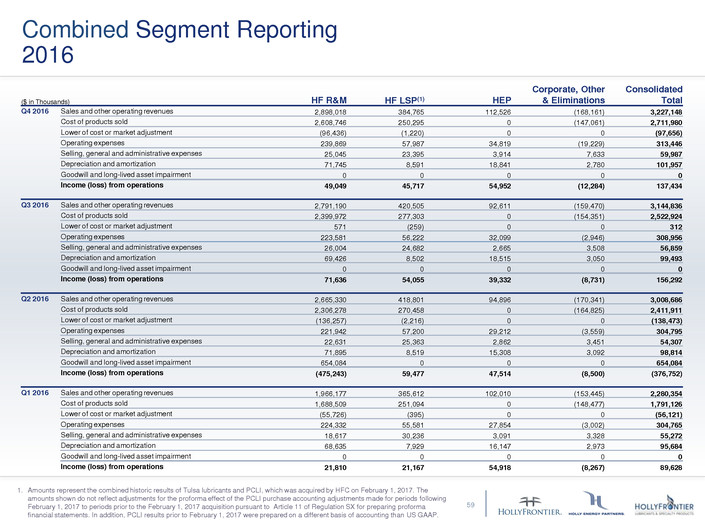

Combined Segment Reporting

2016

59

($ in Thousands) HF R&M HF LSP(1) HEP

Corporate, Other

& Eliminations

Consolidated

Total

Q4 2016 Sales and other operating revenues 2,898,018 384,765 112,526 (168,161) 3,227,148

Cost of products sold 2,608,746 250,295 0 (147,061) 2,711,980

Lower of cost or market adjustment (96,436) (1,220) 0 0 (97,656)

Operating expenses 239,869 57,987 34,819 (19,229) 313,446

Selling, general and administrative expenses 25,045 23,395 3,914 7,633 59,987

Depreciation and amortization 71,745 8,591 18,841 2,780 101,957

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 49,049 45,717 54,952 (12,284) 137,434

Q3 2016 Sales and other operating revenues 2,791,190 420,505 92,611 (159,470) 3,144,836

Cost of products sold 2,399,972 277,303 0 (154,351) 2,522,924

Lower of cost or market adjustment 571 (259) 0 0 312

Operating expenses 223,581 56,222 32,099 (2,946) 308,956

Selling, general and administrative expenses 26,004 24,682 2,665 3,508 56,859

Depreciation and amortization 69,426 8,502 18,515 3,050 99,493

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 71,636 54,055 39,332 (8,731) 156,292

Q2 2016 Sales and other operating revenues 2,665,330 418,801 94,896 (170,341) 3,008,686

Cost of products sold 2,306,278 270,458 0 (164,825) 2,411,911

Lower of cost or market adjustment (136,257) (2,216) 0 0 (138,473)

Operating expenses 221,942 57,200 29,212 (3,559) 304,795

Selling, general and administrative expenses 22,631 25,363 2,862 3,451 54,307

Depreciation and amortization 71,895 8,519 15,308 3,092 98,814

Goodwill and long-lived asset impairment 654,084 0 0 0 654,084

Income (loss) from operations (475,243) 59,477 47,514 (8,500) (376,752)

Q1 2016 Sales and other operating revenues 1,966,177 365,612 102,010 (153,445) 2,280,354

Cost of products sold 1,688,509 251,094 0 (148,477) 1,791,126

Lower of cost or market adjustment (55,726) (395) 0 0 (56,121)

Operating expenses 224,332 55,581 27,854 (3,002) 304,765

Selling, general and administrative expenses 18,617 30,236 3,091 3,328 55,272

Depreciation and amortization 68,635 7,929 16,147 2,973 95,684

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 21,810 21,167 54,918 (8,267) 89,628

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

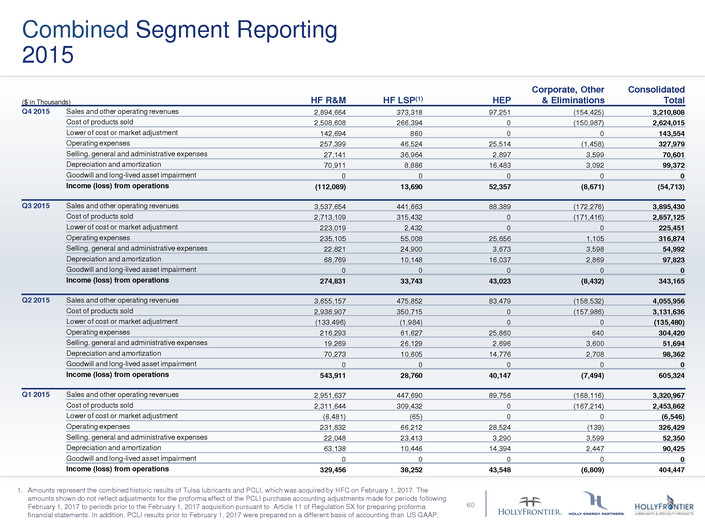

Combined Segment Reporting

2015

60

($ in Thousands) HF R&M HF LSP(1) HEP

Corporate, Other

& Eliminations

Consolidated

Total

Q4 2015 Sales and other operating revenues 2,894,664 373,318 97,251 (154,425) 3,210,808

Cost of products sold 2,508,608 266,394 0 (150,987) 2,624,015

Lower of cost or market adjustment 142,694 860 0 0 143,554

Operating expenses 257,399 46,524 25,514 (1,458) 327,979

Selling, general and administrative expenses 27,141 36,964 2,897 3,599 70,601

Depreciation and amortization 70,911 8,886 16,483 3,092 99,372

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations (112,089) 13,690 52,357 (8,671) (54,713)

Q3 2015 Sales and other operating revenues 3,537,654 441,663 88,389 (172,276) 3,895,430

Cost of products sold 2,713,109 315,432 0 (171,416) 2,857,125

Lower of cost or market adjustment 223,019 2,432 0 0 225,451

Operating expenses 235,105 55,008 25,656 1,105 316,874

Selling, general and administrative expenses 22,821 24,900 3,673 3,598 54,992

Depreciation and amortization 68,769 10,148 16,037 2,869 97,823

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 274,831 33,743 43,023 (8,432) 343,165

Q2 2015 Sales and other operating revenues 3,655,157 475,852 83,479 (158,532) 4,055,956

Cost of products sold 2,938,907 350,715 0 (157,986) 3,131,636

Lower of cost or market adjustment (133,496) (1,984) 0 0 (135,480)

Operating expenses 216,293 61,627 25,860 640 304,420

Selling, general and administrative expenses 19,269 26,129 2,696 3,600 51,694

Depreciation and amortization 70,273 10,605 14,776 2,708 98,362

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 543,911 28,760 40,147 (7,494) 605,324

Q1 2015 Sales and other operating revenues 2,951,637 447,690 89,756 (168,116) 3,320,967

Cost of products sold 2,311,644 309,432 0 (167,214) 2,453,862

Lower of cost or market adjustment (6,481) (65) 0 0 (6,546)

Operating expenses 231,832 66,212 28,524 (139) 326,429

Selling, general and administrative expenses 22,048 23,413 3,290 3,599 52,350

Depreciation and amortization 63,138 10,446 14,394 2,447 90,425

Goodwill and long-lived asset impairment 0 0 0 0 0

Income (loss) from operations 329,456 38,252 43,548 (6,809) 404,447

1. Amounts represent the combined historic results of Tulsa lubricants and PCLI, which was acquired by HFC on February 1, 2017. The

amounts shown do not reflect adjustments for the proforma effect of the PCLI purchase accounting adjustments made for periods following

February 1, 2017 to periods prior to the February 1, 2017 acquisition pursuant to Article 11 of Regulation SX for preparing proforma

financial statements. In addition, PCLI results prior to February 1, 2017 were prepared on a different basis of accounting than US GAAP.

Speaker Biographies

61

George Damiris

CEO, PRESIDENT

Mr. Damiris has served as Chief Executive Officer and President since

January 2016. He previously served as Executive Vice President and

Chief Operating Officer from September 2014 to January 2016 and as

Senior Vice President, Supply and Marketing from January 2008 until

September 2014. Mr. Damiris has served as Chief Executive Officer of

HLS since November 2016 and as President of HLS since February 2017.

Mr. Damiris joined Holly Corporation in 2007 as Vice President, Corporate

Development after an 18-year career with Koch Industries, where he was

responsible for managing various refining, chemical, trading, and financial

businesses. Mr. Damiris has both a B.S. and M.B.A. from Case Western

Reserve University.

Richard Voliva

CFO, EXECUTIVE VICE PRESIDENT

Mr. Voliva has served as Executive Vice President and Chief Financial Officer of

HollyFrontier since March, 2017. Since joining the HollyFrontier Companies in

2014, he served in roles of increasing responsibility including Senior Vice

President, Strategy for HollyFrontier and Chief Financial Officer of Holly Energy

Partners. Prior to joining the HollyFrontier Companies, Mr. Voliva worked as a

financial analyst at firms including Millennium Management LLC, Partner Fund

Management, LP and Deutsche Bank. Mr. Voliva holds a B.A. from Harvard

University, an M.A. from Johns Hopkins University, and is a CFA Charterholder.

Thomas Creery

SENIOR VICE PRESIDENT, COMMERCIAL

Mr. Creery was appointed Senior Vice President, Commercial of

HollyFrontier Corporation in January 2016 and President of HollyFrontier

Refining and Marketing in February 2017. He previously served as Vice

President, Crude Supply from October 2008 to January 2016 and Vice

President, Crude Supply and Planning from January 2006 to October

2008. Prior to joining HollyFrontier, Mr. Creery served at Unocal

Corporation for 25 years in a variety of locations based in Calgary, Los

Angeles, Singapore and Houston. Mr. Creery graduated from the

University of Calgary’s Haskayne School of Business.

Jim Stump

SENIOR VICE PRESIDENT, REFINING

Mr. Stump has served as Senior Vice President, Refining (formerly called Senior

Vice President, Refinery Operations) since the merger in July 2011. During his 21

years at Frontier, Mr. Stump held various positions, including serving as Vice

President – Refining Operations for Frontier Refining and Marketing from 2009

until July 2011, and as Vice President and Refining Manager from 2002 to 2009.

Mr. Stump holds a B.S. in Chemical Engineering from the Colorado School of

Mines.

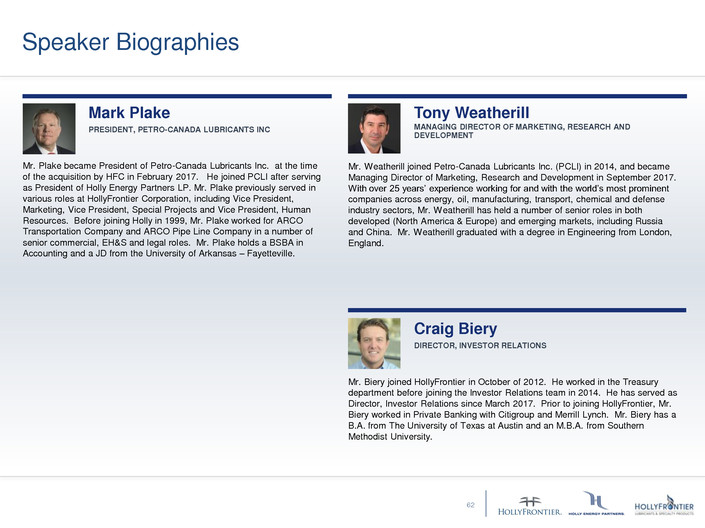

Speaker Biographies

62

Mark Plake

PRESIDENT, PETRO-CANADA LUBRICANTS INC

Mr. Plake became President of Petro-Canada Lubricants Inc. at the time

of the acquisition by HFC in February 2017. He joined PCLI after serving

as President of Holly Energy Partners LP. Mr. Plake previously served in

various roles at HollyFrontier Corporation, including Vice President,

Marketing, Vice President, Special Projects and Vice President, Human

Resources. Before joining Holly in 1999, Mr. Plake worked for ARCO

Transportation Company and ARCO Pipe Line Company in a number of

senior commercial, EH&S and legal roles. Mr. Plake holds a BSBA in

Accounting and a JD from the University of Arkansas – Fayetteville.

Tony Weatherill

MANAGING DIRECTOR OF MARKETING, RESEARCH AND

DEVELOPMENT

Mr. Weatherill joined Petro-Canada Lubricants Inc. (PCLI) in 2014, and became

Managing Director of Marketing, Research and Development in September 2017.

With over 25 years’ experience working for and with the world’s most prominent

companies across energy, oil, manufacturing, transport, chemical and defense

industry sectors, Mr. Weatherill has held a number of senior roles in both

developed (North America & Europe) and emerging markets, including Russia

and China. Mr. Weatherill graduated with a degree in Engineering from London,

England.

Craig Biery

DIRECTOR, INVESTOR RELATIONS

Mr. Biery joined HollyFrontier in October of 2012. He worked in the Treasury

department before joining the Investor Relations team in 2014. He has served as

Director, Investor Relations since March 2017. Prior to joining HollyFrontier, Mr.

Biery worked in Private Banking with Citigroup and Merrill Lynch. Mr. Biery has a

B.A. from The University of Texas at Austin and an M.B.A. from Southern

Methodist University.

62

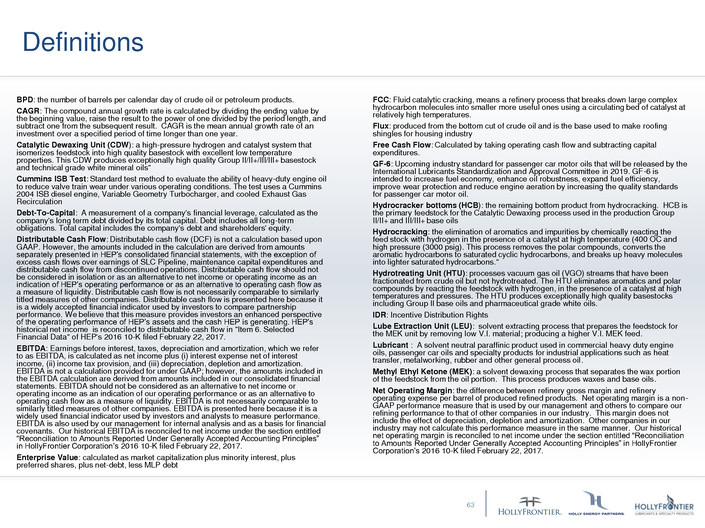

Definitions

63

FCC: Fluid catalytic cracking, means a refinery process that breaks down large complex

hydrocarbon molecules into smaller more useful ones using a circulating bed of catalyst at

relatively high temperatures.

Flux: produced from the bottom cut of crude oil and is the base used to make roofing

shingles for housing industry

Free Cash Flow: Calculated by taking operating cash flow and subtracting capital

expenditures.

GF-6: Upcoming industry standard for passenger car motor oils that will be released by the

International Lubricants Standardization and Approval Committee in 2019. GF-6 is

intended to increase fuel economy, enhance oil robustness, expand fuel efficiency,

improve wear protection and reduce engine aeration by increasing the quality standards

for passenger car motor oil.

Hydrocracker bottoms (HCB): the remaining bottom product from hydrocracking. HCB is

the primary feedstock for the Catalytic Dewaxing process used in the production Group

II/II+ and III/III+ base oils

Hydrocracking: the elimination of aromatics and impurities by chemically reacting the

feed stock with hydrogen in the presence of a catalyst at high temperature (400 OC and

high pressure (3000 psig). This process removes the polar compounds, converts the

aromatic hydrocarbons to saturated cyclic hydrocarbons, and breaks up heavy molecules

into lighter saturated hydrocarbons."

Hydrotreating Unit (HTU): processes vacuum gas oil (VGO) streams that have been

fractionated from crude oil but not hydrotreated. The HTU eliminates aromatics and polar

compounds by reacting the feedstock with hydrogen, in the presence of a catalyst at high

temperatures and pressures. The HTU produces exceptionally high quality basestocks

including Group II base oils and pharmaceutical grade white oils.

IDR: Incentive Distribution Rights

Lube Extraction Unit (LEU): solvent extracting process that prepares the feedstock for

the MEK unit by removing low V.I. material; producing a higher V.I. MEK feed.

Lubricant : A solvent neutral paraffinic product used in commercial heavy duty engine

oils, passenger car oils and specialty products for industrial applications such as heat

transfer, metalworking, rubber and other general process oil.

Methyl Ethyl Ketone (MEK): a solvent dewaxing process that separates the wax portion

of the feedstock from the oil portion. This process produces waxes and base oils.

Net Operating Margin: the difference between refinery gross margin and refinery

operating expense per barrel of produced refined products. Net operating margin is a non-

GAAP performance measure that is used by our management and others to compare our

refining performance to that of other companies in our industry. This margin does not

include the effect of depreciation, depletion and amortization. Other companies in our

industry may not calculate this performance measure in the same manner. Our historical

net operating margin is reconciled to net income under the section entitled “Reconciliation

to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier

Corporation’s 2016 10-K filed February 22, 2017.

BPD: the number of barrels per calendar day of crude oil or petroleum products.

CAGR: The compound annual growth rate is calculated by dividing the ending value by

the beginning value, raise the result to the power of one divided by the period length, and

subtract one from the subsequent result. CAGR is the mean annual growth rate of an

investment over a specified period of time longer than one year.

Catalytic Dewaxing Unit (CDW): a high-pressure hydrogen and catalyst system that

isomerizes feedstock into high quality basestock with excellent low temperature

properties. This CDW produces exceptionally high quality Group II/II+/III/III+ basestock

and technical grade white mineral oils"

Cummins ISB Test: Standard test method to evaluate the ability of heavy-duty engine oil

to reduce valve train wear under various operating conditions. The test uses a Cummins

2004 ISB diesel engine, Variable Geometry Turbocharger, and cooled Exhaust Gas

Recirculation

Debt-To-Capital: A measurement of a company's financial leverage, calculated as the

company's long term debt divided by its total capital. Debt includes all long-term

obligations. Total capital includes the company's debt and shareholders' equity.

Distributable Cash Flow: Distributable cash flow (DCF) is not a calculation based upon

GAAP. However, the amounts included in the calculation are derived from amounts

separately presented in HEP’s consolidated financial statements, with the exception of

excess cash flows over earnings of SLC Pipeline, maintenance capital expenditures and

distributable cash flow from discontinued operations. Distributable cash flow should not

be considered in isolation or as an alternative to net income or operating income as an

indication of HEP’s operating performance or as an alternative to operating cash flow as

a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly

titled measures of other companies. Distributable cash flow is presented here because it

is a widely accepted financial indicator used by investors to compare partnership

performance. We believe that this measure provides investors an enhanced perspective

of the operating performance of HEP’s assets and the cash HEP is generating. HEP’s

historical net income is reconciled to distributable cash flow in "Item 6. Selected

Financial Data" of HEP's 2016 10-K filed February 22, 2017.

EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer

to as EBITDA, is calculated as net income plus (i) interest expense net of interest

income, (ii) income tax provision, and (iii) depreciation, depletion and amortization.

EBITDA is not a calculation provided for under GAAP; however, the amounts included in

the EBITDA calculation are derived from amounts included in our consolidated financial

statements. EBITDA should not be considered as an alternative to net income or

operating income as an indication of our operating performance or as an alternative to

operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to

similarly titled measures of other companies. EBITDA is presented here because it is a

widely used financial indicator used by investors and analysts to measure performance.

EBITDA is also used by our management for internal analysis and as a basis for financial

covenants. Our historical EBITDA is reconciled to net income under the section entitled

“Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles”

in HollyFrontier Corporation’s 2016 10-K filed February 22, 2017.

Enterprise Value: calculated as market capitalization plus minority interest, plus

preferred shares, plus net-debt, less MLP debt

Definitions

64

Reforming: The process of converting gasoline type molecules into aromatic, higher

octane gasoline blend stocks while producing hydrogen in the process.

Solvent Dewaxing: base oil refining process which lowers the pour point (freezing point)

of base oil product by introducing dewaxing solvents such as methyl-ethyl ketone (MEK).

Wax is removed from the base oil to prevent base oil from crystallizing in engines at low

temperatures.

Solvent Extraction: base oil refining process which removes aromatic components in

vacuum gas oil to improve the lubricating quality of the base oil product.

Sour Crude: Crude oil containing quantities of sulfur greater than 0.4 percent by weight,

while “sweet crude oil” means crude oil containing quantities of sulfur equal to or less

than 0.4 percent by weight.

Vacuum Distillation: The process of distilling vapor from liquid crudes, usually by

heating, and condensing the vapor below atmospheric pressure turning it back to a liquid

in order to purify, fractionate or form the desired products.

Viscosity: measure of a fluid’s resistance to flow. It is ordinarily expressed in terms of

the time required for a standard quantity of the fluid at a certain temperature to flow

through a standard orifice. The higher the value, the more viscous the fluid. Since

viscosity varies inversely with temperature, its value is meaningless unless accompanied

by the temperature at which it is determined. With petroleum oils, viscosity is now

commonly reported in CENTISTOKES (cSt), measured at either 40°C or 100°C."

VTB: Vacuum Tower Bottoms are the left over bottom product of vacuum distillation,

which can be processed in cokers and used for upgrading into gasoline, diesel and gas

oil.

WCS: Western Canada Select crude oil, made up of Canadian heavy conventional and

bitumen crude oils blended with sweet synthetic and condensate diluents.

WTI: West Texas Intermediate, a grade of crude oil used as a common benchmark in oil

pricing. WTI is a sweet crude oil and has a relatively low density.

WTS: West Texas Sour, a medium sour crude oil.

Non GAAP measurements: We report certain financial measures that are not prescribed

or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss

management's reasons for reporting these non-GAAP measures below. Although

management evaluates and presents these non-GAAP measures for the reasons

described below, please be aware that these non-GAAP measures are not alternatives to

revenue, operating income, income from continuing operations, net income, or any other

comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial

measures may be calculated and/or presented differently than measures with the same or

similar names that are reported by other companies, and as a result, the non-GAAP

measures we report may not be comparable to those reported by others.

OEM: Original Equipment Manufacturer, or company whose goods are used as

components in the products of another company.

Paraffinic oil: A high paraffinic, high gravity oil produced by extracting aromatic oils and

waxes from gas oil and is used in producing high-grade lubricating oils.

PC-11: Proposed Category 11 is a new performance category for heavy-duty engine oils

released by the American Petroleum Institute in December 2016. PC-11 is designed to

help reduce emissions and boost fuel economy by increasing the quality standards for

heavy-duty engine oils. PC-11 engine oils can withstand higher temperatures for longer

periods of time without breaking down.

Rack Backward: business segment of HF LSP that captures the value between feedstock

cost and base oil market prices (transfer prices to rack forward).

Rack Forward: business segment of HF LSP that captures the value between bas oil

market prices and product sales revenue from customers.

RBOB: Reformulated Gasoline Blendstock for Oxygen Blending

Refining gross margin or refinery gross margin: the difference between average net

sales price and average product costs per produced barrel of refined products sold.

Refining gross margin or refinery gross margin is a non-GAAP performance measure that

is used by our management and others to compare our refining performance to that of

other companies in our industry. This margin does not include the effect of depreciation,

depletion and amortization. Other companies in our industry may not calculate this

performance measure in the same manner. Our historical refining gross margin or refinery

gross margin is reconciled to net income under the section entitled “Reconciliation to

Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier

Corporation’s 2016 10-K filed February 22, 2017.

HollyFrontier Corporation

(NYSE: HFC)

2828 N. Harwood, Suite 1300

Dallas, Texas 75201

(214) 954-6510

www.hollyfrontier.com

Craig Biery | Director, Investor Relations

investors@hollyfrontier.com

214-954-6510

Jared Harding | Investor Relations

investors@hollyfrontier.com

214-954-6510