Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WIDEPOINT CORP | tv480758_8k.htm |

Exhibit 99.1

© 2017 WIDEPOINT CORPORATION. ALL RIGHTS RESERVED. NYSE MKT: WYY Serving the Mobile Needs of a Global Workforce Jin Kang, President & CEO December 6, 2017

This presentation may contain forward - looking information within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended (the Exchange Act), including all statements that are not statements of historical fact regarding the intent, belief or current expectations of the company, its directors or its officers with respect to, among other things : (i) the Company's financing plans ; (ii) trends affecting the Company's financial condition or results of operations ; (iii) the company's growth strategy and operating strategy ; (iv) the Company's ability to achieve profitability and positive cash flows ; (v) the Company's ability to raise additional capital on favorable terms or at all ; (vii) the Company's ability to gain market acceptance for its products and (viii) the risk factors disclosed in the Company's periodic reports filed with the SEC . The words "may," "would," "will," "expect," "estimate," "anticipate," "believe," "intend" and similar expressions and variations thereof are intended to identify forward - looking statements . Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond the company's ability to control, and that actual results may differ materially from those projected in the forward - looking statements as a result of various factors including the risk factors disclosed in the Company's Annual Report on Form 10 - K for the year ended December 31 , 2016 filed with the SEC on March 30 , 2017 . Safe Harbor Statement NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 2

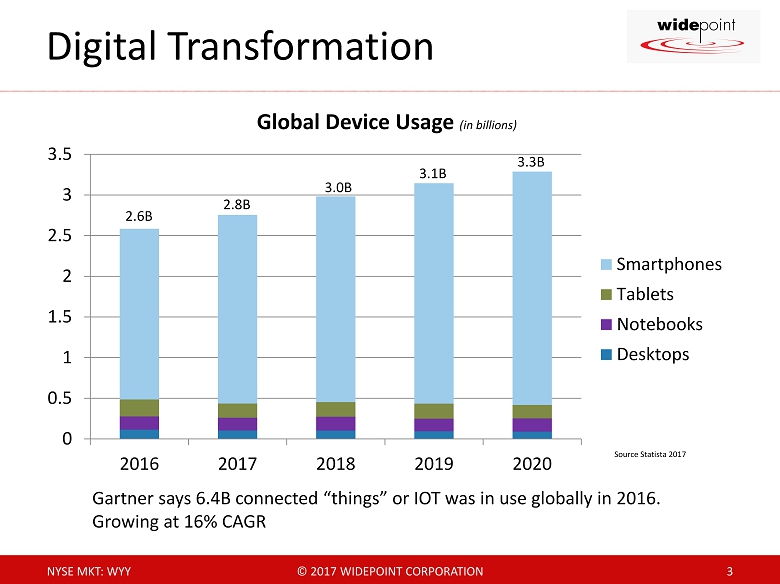

0 0.5 1 1.5 2 2.5 3 3.5 2016 2017 2018 2019 2020 Global Device Usage (in billions) Smartphones Tablets Notebooks Desktops 2.6B 3.1B 3.0B 2.8B 3.3B Digital Transformation NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 3 Source Statista 2017 Gartner says 6.4B connected “things” or IOT was in use globally in 2016. Growing at 16% CAGR

NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 4 Proliferation of devices and cloud - based systems is driving demand for secure mobile management and identity solutions. Digital transformation is accelerating Mobile devices are becoming the center of our IT universe Mobile Workforce Challenge

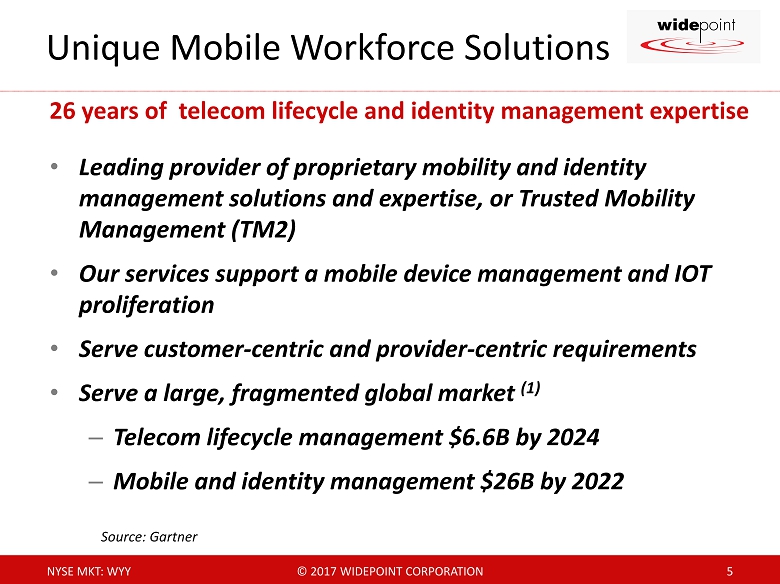

26 years of telecom lifecycle and identity management expertise • Leading provider of proprietary mobility and identity management solutions and expertise, or Trusted Mobility Management (TM2 ) • Our services support a mobile device management and IOT proliferation • Serve customer - centric and provider - centric requirements • Serve a large, fragmented global market (1) – Telecom lifecycle management $6.6B by 2024 – Mobile and identity management $26B by 2022 Unique Mobile Workforce Solutions NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 5 Source: Gartner

Supporting Diverse U.S. Federal & Commercial Organizations (“3” revenue lines, focused on expanding & broadening our solution sets) Serving Global Markets NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 6 Telecom Life Cycle Management 1 Identity Management 2 Bill Presentment & Analytics 3

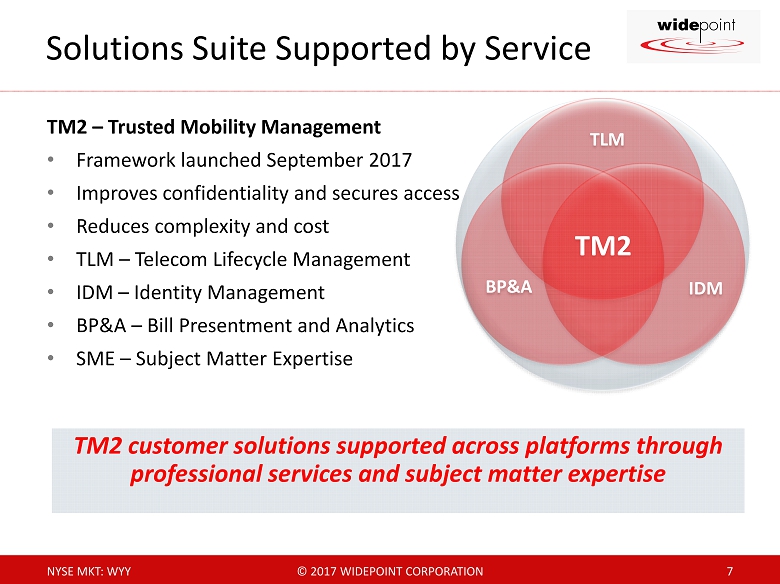

TM2 customer solutions supported across platforms through professional services and subject matter expertise TM2 – Trusted Mobility Management • Framework launched September 2017 • Improves confidentiality and secures access • Reduces complexity and cost • TLM – Telecom Lifecycle Management • IDM – Identity Management • BP&A – Bill Presentment and Analytics • SME – Subject Matter Expertise Solutions Suite Supported by Service NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 7 TLM IDM BP&A T M2

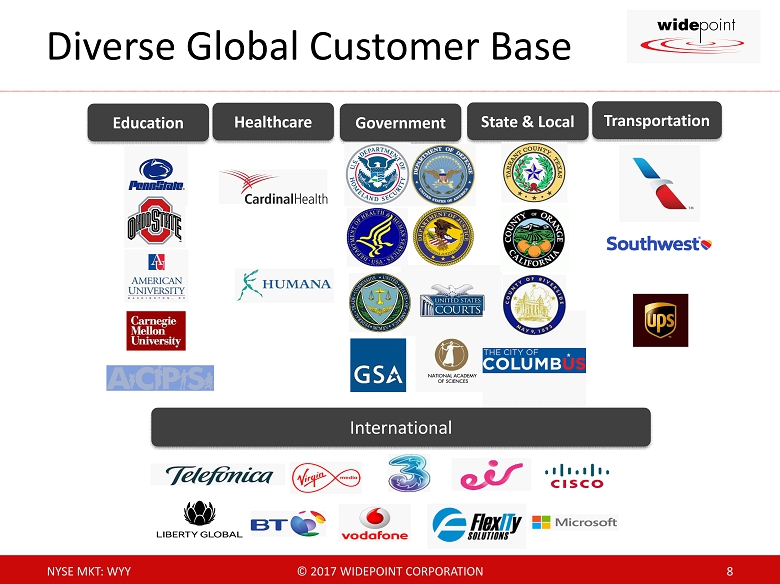

Diverse Global Customer Base NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 8 Education Government Transportation Healthcare State & Local International

NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 9 Growth Drivers for TM2 • Need to provide secure mobile access • Manage risings costs associated with connected devices • Increased complexity to support diverse platforms and devices • Added security risks from IoT, mobile apps, and cloud services Enterprise Solutions Federal Solutions State & Local Solutions Rapid growth of connected devices and an increasingly mobile workforce is straining IT resources and increasing risk

Track Record of Revenue Growth NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 10 $ in millions $46.8 $53.3 $70.8 $78.4 FY 2013 FY 2014 FY 2015 FY 2016 90% of revenue is recurring Near term growth impacted by timing delays Profitability has been lagging behind top line growth

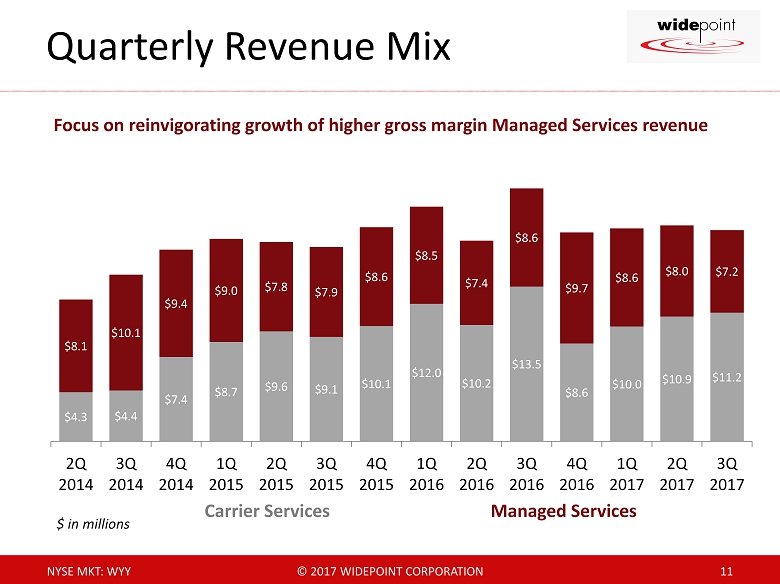

Quarterly Revenue Mix NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 11 $4.3 $4.4 $7.4 $8.7 $9.6 $9.1 $10.1 $12.0 $10.2 $13.5 $8.6 $10.0 $10.9 $11.2 $8.1 $10.1 $9.4 $9.0 $7.8 $7.9 $8.6 $8.5 $7.4 $8.6 $9.7 $8.6 $8.0 $7.2 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017 $ in millions Carrier Services Managed Services Focus on reinvigorating growth of higher gross margin Managed Services revenue

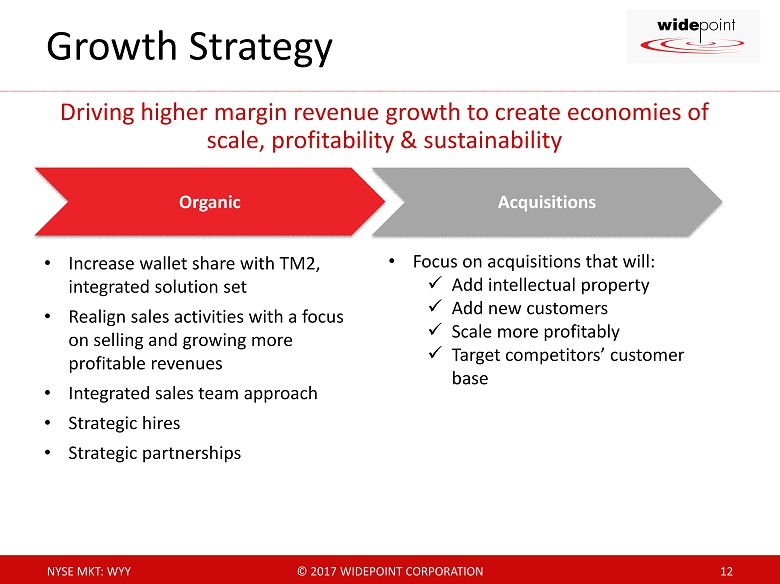

Driving higher margin revenue growth to create economies of scale, profitability & sustainability Growth Strategy NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 12 Organic Acquisitions • Increase wallet share with TM2, integrated solution set • Realign sales activities with a focus on selling and growing more profitable revenues • Integrated sales team approach • Strategic hires • Strategic partnerships • Focus on acquisitions that will: x Add intellectual property x Add new customers x Scale more profitably x Target competitors’ customer base

Targeting annual operating expense reductions of $2.5M to $3M heading into fiscal year 2018 Profitability Improvement Plan NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 13 Streamline Infrastructure & Reduce Expenses Reinvesting for Growth • Consolidate physical and logical IT infrastructure x Eliminate duplicate overhead x Consolidate help desk and IT environments • Reduce Expenses x Streamline operations to r educe c ost of revenues x Reduce headcount & redundancy x Consolidate facilities x Reduce overhead labor Sales and Marketing – targeted approach ↑ Add new p roducts and s olutions to our mix, TM2 ↑ Research & Development – enhanced solutions ↑ Technology & customer acquisitions ↑ Channel partners & strategic relationships

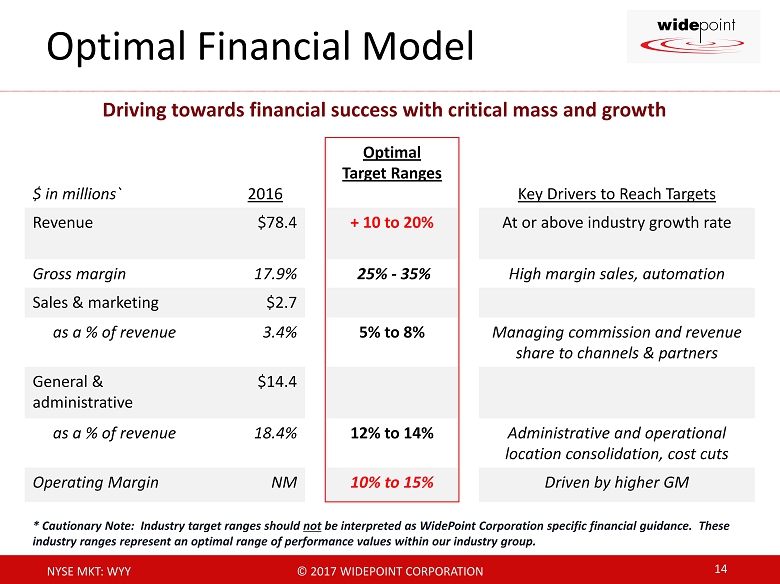

Driving towards financial success with critical mass and growth $ in millions` 2016 Optimal Target Ranges Key Drivers to Reach Targets Revenue $78.4 + 10 to 20% At or above industry growth rate Gross margin 17.9% 25% - 35% High margin sales, automation Sales & marketing $2.7 as a % of revenue 3.4% 5% to 8% Managing commission and revenue share to channels & partners General & administrative $14.4 as a % of revenue 18.4% 12% to 14% Administrative and operational location consolidation, cost cuts Operating Margin NM 10% to 15% Driven by higher GM Optimal Financial Model NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 14 * Cautionary Note: Industry target ranges should not be interpreted as WidePoint Corporation specific financial guidance. These industry ranges represent an optimal range of performance values within our industry group.

• New leadership team executing strategy to improve revenue and profitability • Launched TM2 solutions framework that addresses the growing needs of a global workforce while reducing complexity and cost. • Realigning sales team to drive top line growth • Realigning operations to reduce expenses by $2.5M - $3M by 2018 Poised for Future Growth and Profitability NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 15 Near - term milestones: • Adjusted EBITDA positive in 4Q 2017 • Continued EBITDA improvement in 2018 • Return top line growth rate in 2018

NYSE MKT: WYY © 2017 WIDEPOINT CORPORATION 16 Contacts Investor Relations Brett Maas , Managing Partner Hayden IR Tel 646.536.7331 | www.haydenir.com