Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | rely-20171130x8k.htm |

|

EXHIBIT 99.1 |

||||||||

|

|

||||||||

|

UNITED STATES BANKRUPTCY COURT |

||||||||

|

DISTRICT OF DELAWARE |

||||||||

|

|

|

|||||||

|

In re Real Industry, Inc., et al. |

|

Case No. 17-12464 (KJC) |

||||||

|

|

||||||||

|

|

|

|||||||

|

INITIAL MONTHLY OPERATING REPORT |

||||||||

|

File report and attachments with Court and submit copy to United States Trustee within 15 days after order for relief. |

||||||||

|

|

||||||||

|

Certificates of insurance must name United States Trustee as a party to be notified in the event of policy cancellation. |

||||||||

|

Bank accounts and checks must bear the name of the debtor, the case number, and the designation "Debtor in Possession." |

||||||||

|

Examples of acceptable evidence of Debtor in Possession Bank accounts include voided checks, copy of bank deposit agreement/certificate of authority, signature card, and/or corporate checking resolution. |

||||||||

|

|

||||||||

|

|

Document |

Explanation |

||||||

|

REQUIRED DOCUMENTS |

Attached |

Attached |

||||||

|

12-Month Cash Flow Projection (Form IR-1) |

Yes |

13 Week DIP Budget Attached |

||||||

|

Certificates of Insurance: |

|

|

||||||

|

Workers Compensation |

Yes |

|

||||||

|

Property |

Yes |

|

||||||

|

General Liability |

Yes |

|

||||||

|

Vehicle |

Yes |

|

||||||

|

Other: |

Yes |

|

||||||

|

Identify areas of self-insurance w/liability caps |

|

|

||||||

|

Evidence of Debtor in Possession Bank Accounts |

|

|

||||||

|

Tax Escrow Account |

Yes |

Cash Management Order and exhibits attached. |

||||||

|

General Operating Account |

|

|

||||||

|

Money Market Account pursuant to Local Rule 4001-3. Refer to http://www.deb.uscourts.gov/ |

|

|

||||||

|

Other: |

|

|

||||||

|

Retainers Paid (Form IR-2) |

Yes |

|

||||||

|

|

|

|

||||||

|

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the documents attached are true and correct to the best of my knowledge and belief. |

||||||||

|

|

|

|

|

|||||

|

|

|

|

||||||

|

Signature of Debtor |

|

Date |

|

|||||

|

|

|

|

||||||

|

|

|

|

||||||

|

Signature of Joint Debtor |

|

Date |

|

|||||

|

|

|

|

|

|||||

|

|

|

|

|

|||||

|

/s/ Michael J. Hobey |

|

12-4-2017 |

||||||

|

Signature of Authorized Individual* |

|

Date |

|

|||||

|

|

|

|

|

|||||

|

|

|

|

|

|||||

|

Michael J. Hobey |

|

Interim Chief Executive Officer |

||||||

|

Printed Name of Authorized Individual |

|

Title of Authorized Individual |

||||||

*Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

(4/07)

|

DIP Budget |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13- Week Total |

||||||||||||||

|

($Thousands) |

|

11/24/17 |

|

12/01/17 |

|

12/08/17 |

|

12/15/17 |

|

12/22/17 |

|

12/29/17 |

|

01/05/18 |

|

01/12/18 |

|

01/19/18 |

|

01/26/18 |

|

02/02/18 |

|

02/09/18 |

|

02/16/18 |

|

|

11/24 - 2/16 |

||||||||||||||

|

|

|

Week 1 |

|

Week 2 |

|

Week 3 |

|

Week 4 |

|

Week 5 |

|

Week 6 |

|

Week 7 |

|

Week 8 |

|

Week 9 |

|

Week 10 |

|

Week 11 |

|

Week 12 |

|

Week 13 |

|

|

|

||||||||||||||

|

Operating Receipts |

|

$ |

16,844 |

|

$ |

14,751 |

|

$ |

14,751 |

|

$ |

14,751 |

|

$ |

16,589 |

|

$ |

12,096 |

|

$ |

13,596 |

|

$ |

13,596 |

|

$ |

12,983 |

|

$ |

12,983 |

|

$ |

12,983 |

|

$ |

12,983 |

|

$ |

13,430 |

|

|

$ |

182,334 |

|

Canadian Receipts |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Additional Business Risk |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(190) |

|

|

(190) |

|

|

(190) |

|

|

(190) |

|

|

(190) |

|

|

(190) |

|

|

(190) |

|

|

|

(1,333) |

|

Receipts Timing |

|

|

(1,684) |

|

|

(1,475) |

|

|

(1,475) |

|

|

(1,475) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(6,110) |

|

Total Operating Receipts |

|

$ |

15,159 |

|

$ |

13,276 |

|

$ |

13,276 |

|

$ |

13,276 |

|

$ |

16,589 |

|

$ |

12,096 |

|

$ |

13,405 |

|

$ |

13,405 |

|

$ |

12,792 |

|

$ |

12,792 |

|

$ |

12,792 |

|

$ |

12,792 |

|

$ |

13,239 |

|

|

$ |

174,891 |

|

Operating Disbursements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll / Benefits |

|

|

(960) |

|

|

(2,060) |

|

|

(960) |

|

|

(2,060) |

|

|

(960) |

|

|

(2,060) |

|

|

(897) |

|

|

(897) |

|

|

(1,606) |

|

|

(1,606) |

|

|

(1,655) |

|

|

(1,719) |

|

|

(1,719) |

|

|

|

(19,158) |

|

Recycling / Scrap |

|

|

(17,131) |

|

|

(17,685) |

|

|

(11,175) |

|

|

(9,675) |

|

|

(9,675) |

|

|

(8,136) |

|

|

(7,951) |

|

|

(7,951) |

|

|

(7,554) |

|

|

(7,554) |

|

|

(7,626) |

|

|

(7,722) |

|

|

(7,722) |

|

|

|

(127,558) |

|

Capital Expenditures |

|

|

(424) |

|

|

(424) |

|

|

(423) |

|

|

(423) |

|

|

(423) |

|

|

(423) |

|

|

(323) |

|

|

(324) |

|

|

(357) |

|

|

(357) |

|

|

(315) |

|

|

(258) |

|

|

(258) |

|

|

|

(4,732) |

|

Health Savings Account |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,000) |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(1,000) |

|

Reduction in Accounts Payable |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Other |

|

|

(2,664) |

|

|

(2,663) |

|

|

(2,775) |

|

|

(2,774) |

|

|

(2,773) |

|

|

(2,772) |

|

|

(2,771) |

|

|

(2,889) |

|

|

(1,953) |

|

|

(2,123) |

|

|

(1,979) |

|

|

(2,012) |

|

|

(2,012) |

|

|

|

(32,159) |

|

Total Operating Disbursements |

|

$ |

(21,179) |

|

$ |

(22,832) |

|

$ |

(15,333) |

|

$ |

(14,932) |

|

$ |

(13,831) |

|

$ |

(13,391) |

|

$ |

(11,942) |

|

$ |

(12,062) |

|

$ |

(11,470) |

|

$ |

(12,640) |

|

$ |

(11,574) |

|

$ |

(11,711) |

|

$ |

(11,711) |

|

|

$ |

(184,607) |

|

Total Net Operating Cash Flow |

|

$ |

(6,019) |

|

$ |

(9,556) |

|

$ |

(2,057) |

|

$ |

(1,656) |

|

$ |

2,758 |

|

$ |

(1,295) |

|

$ |

1,463 |

|

$ |

1,344 |

|

$ |

1,322 |

|

$ |

152 |

|

$ |

1,219 |

|

$ |

1,081 |

|

$ |

1,528 |

|

|

$ |

(9,716) |

|

Restructuring / Non-Op. Disbursements: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional Fees |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,708) |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,705) |

|

|

— |

|

|

— |

|

|

|

(7,413) |

|

KEIP / KERP |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Collateral Audit / Appraisal |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Margin |

|

|

(5,500) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(5,500) |

|

First Day Motion Items |

|

|

(2,331) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(2,331) |

|

Prepetition Roll-Up Interest |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Foreign Sub. Interest |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Foreign Sub. Ticking Fee |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

DIP Fees & Expenses |

|

|

(5,760) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(42) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(5,802) |

|

DIP Interest: ABL |

|

|

— |

|

|

(89) |

|

|

— |

|

|

— |

|

|

— |

|

|

(361) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(372) |

|

|

— |

|

|

— |

|

|

|

(823) |

|

DIP Interest: New Money |

|

|

— |

|

|

(166) |

|

|

— |

|

|

— |

|

|

— |

|

|

(333) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(333) |

|

|

— |

|

|

— |

|

|

|

(831) |

|

Total Restructuring / Non-Op. |

|

$ |

(13,591) |

|

$ |

(255) |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

(736) |

|

$ |

(2,708) |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

(5,410) |

|

$ |

— |

|

$ |

— |

|

|

$ |

(22,699) |

|

Total Net Cash Flow - After Restructuring Items |

|

$ |

(19,610) |

|

$ |

(9,811) |

|

$ |

(2,057) |

|

$ |

(1,656) |

|

$ |

2,758 |

|

$ |

(2,031) |

|

$ |

(1,245) |

|

$ |

1,344 |

|

$ |

1,322 |

|

$ |

152 |

|

$ |

(4,191) |

|

$ |

1,081 |

|

$ |

1,528 |

|

|

$ |

(32,416) |

|

DIP Financing: ABL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beg. Balance |

|

|

— |

|

|

81,964 |

|

|

91,774 |

|

|

93,831 |

|

|

95,487 |

|

|

92,729 |

|

|

94,760 |

|

|

96,005 |

|

|

94,661 |

|

|

93,339 |

|

|

93,187 |

|

|

97,378 |

|

|

96,298 |

|

|

|

— |

|

DIP Proceeds |

|

|

81,964 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

81,964 |

|

DIP Draw |

|

|

— |

|

|

9,811 |

|

|

2,057 |

|

|

1,656 |

|

|

— |

|

|

2,031 |

|

|

1,245 |

|

|

— |

|

|

— |

|

|

— |

|

|

4,191 |

|

|

— |

|

|

— |

|

|

|

20,990 |

|

DIP Paydown |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,758) |

|

|

— |

|

|

— |

|

|

(1,344) |

|

|

(1,322) |

|

|

(152) |

|

|

— |

|

|

(1,081) |

|

|

(1,528) |

|

|

|

(8,184) |

|

DIP Balance |

|

$ |

81,964 |

|

$ |

91,774 |

|

$ |

93,831 |

|

$ |

95,487 |

|

$ |

92,729 |

|

$ |

94,760 |

|

$ |

96,005 |

|

$ |

94,661 |

|

$ |

93,339 |

|

$ |

93,187 |

|

$ |

97,378 |

|

$ |

96,298 |

|

$ |

94,770 |

|

|

$ |

94,770 |

|

Effective Borrowing Base |

|

|

99,315 |

|

|

99,315 |

|

|

99,315 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

102,500 |

|

|

101,738 |

|

|

|

101,738 |

|

Availability |

|

|

17,351 |

|

|

7,540 |

|

|

5,483 |

|

|

7,013 |

|

|

9,771 |

|

|

7,740 |

|

|

6,495 |

|

|

7,839 |

|

|

9,161 |

|

|

9,313 |

|

|

5,122 |

|

|

6,202 |

|

|

6,968 |

|

|

|

6,968 |

|

Interim Availability Cap |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Interim Availability |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Money DIP Notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beg. Balance |

|

|

— |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

35,000 |

|

|

|

— |

|

DIP Proceeds |

|

|

35,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

35,000 |

|

DIP Draw |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

DIP Balance |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

$ |

35,000 |

|

|

$ |

35,000 |

|

Availability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

|

30,000 |

|

Interim Availability |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roll-Up Obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beg. Balance |

|

|

170,000 |

|

|

170,000 |

|

|

170,710 |

|

|

170,710 |

|

|

170,710 |

|

|

170,710 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

173,567 |

|

|

173,567 |

|

|

|

170,000 |

|

PIK Interest |

|

|

— |

|

|

710 |

|

|

— |

|

|

— |

|

|

— |

|

|

1,423 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,434 |

|

|

— |

|

|

— |

|

|

|

3,567 |

|

Ending Balance |

|

|

170,000 |

|

|

170,710 |

|

|

170,710 |

|

|

170,710 |

|

|

170,710 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

172,132 |

|

|

173,567 |

|

|

173,567 |

|

|

173,567 |

|

|

|

173,567 |

|

Foreign Sub. DIP Notes Facility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beg. Balance |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Draw / (Paydown) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Ending Balance |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

ABL Loan Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning Balance |

|

|

99,993 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99,993 |

|

ABL (Paydown)/Draw |

|

|

(99,993) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(99,993) |

|

ABL Ending Balance |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

— |

|

Letters of Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total ABL Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Borrowing Base |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABL Availability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beg. Cash |

|

$ |

2,639 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

2,639 |

|

Net Cash Flow |

|

|

(19,610) |

|

|

(9,811) |

|

|

(2,057) |

|

|

(1,656) |

|

|

2,758 |

|

|

(2,031) |

|

|

(1,245) |

|

|

1,344 |

|

|

1,322 |

|

|

152 |

|

|

(4,191) |

|

|

1,081 |

|

|

1,528 |

|

|

|

(32,416) |

|

ABL Borrowing / (Repayment) |

|

|

(99,993) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

(99,993) |

|

DIP Term Loan |

|

|

35,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

35,000 |

|

DIP ABL Borrowing / (Repayment) |

|

|

81,964 |

|

|

9,811 |

|

|

2,057 |

|

|

1,656 |

|

|

(2,758) |

|

|

2,031 |

|

|

1,245 |

|

|

(1,344) |

|

|

(1,322) |

|

|

(152) |

|

|

4,191 |

|

|

(1,081) |

|

|

(1,528) |

|

|

|

94,770 |

|

Ending Cash Balance (US & Canada) |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

Minimum Cash Balance |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

$ |

— |

|

Total Liquidity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIP ABL |

|

|

17,351 |

|

|

7,540 |

|

|

5,483 |

|

|

7,013 |

|

|

9,771 |

|

|

7,740 |

|

|

6,495 |

|

|

7,839 |

|

|

9,161 |

|

|

9,313 |

|

|

5,122 |

|

|

6,202 |

|

|

6,968 |

|

|

|

6,968 |

|

New Money DIP Notes |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

30,000 |

|

|

|

30,000 |

|

Cash on Balance Sheet |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

Total Liquidity |

|

$ |

17,351 |

|

$ |

7,540 |

|

$ |

5,483 |

|

$ |

7,013 |

|

$ |

9,771 |

|

$ |

37,740 |

|

$ |

36,495 |

|

$ |

37,839 |

|

$ |

39,161 |

|

$ |

39,313 |

|

$ |

35,122 |

|

$ |

36,202 |

|

$ |

36,968 |

|

|

$ |

36,968 |

|

CERTIFICATE OF LIABILITY INSURANCE |

DATE (MM/DD/YYYY) 12/1/2017 |

|||||

|

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. |

||||||

|

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). |

||||||

|

PRODUCER Arthur J. Gallagher Risk Management Services, Inc. 500 First Street Suite 2700 Wausau WI 54403 |

CONTACT NAME: Dawn Linski |

|||||

|

PHONE (A/C, No, Ext): 920/380-2214 |

FAX (A/C, No): 920/734-3637 |

|||||

|

E-MAIL ADDRESS: Dawn_Linski@ajg.com |

||||||

|

INSURER(S) AFFORDING COVERAGE |

NAIC # |

|||||

|

INSURER A :Sentry Insurance a Mutual Company |

24988 |

|||||

|

INSURED Real Alloy Holding, Inc. 3700 Park East Drive, Suite 300 Beachwood, OH 44122 |

REALALL-01 |

INSURER B :Travelers Property Casualty Co of America |

25674 |

|||

|

INSURER C :Sentry Casualty Company |

28460 |

|||||

|

INSURER D :Great American Insurance Company |

16691 |

|||||

|

INSURER E :Federal Insurance Company |

20281 |

|||||

|

INSURER F : |

||||||

|

COVERAGES |

CERTIFICATE NUMBER: 201832320 |

REVISION NUMBER: |

||||

|

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. |

|||||||||||||||||||||

|

INSR LTR |

TYPE OF INSURANCE |

ADDL |

SUBR |

POLICY NUMBER |

POLICY EFF (MM/DD/YYYY) |

POLICY EXP (MM/DD/YYYY) |

LIMITS |

||||||||||||||

|

A |

X |

COMMERCIAL GENERAL LIABILITY |

902019902 |

2/27/2017 |

2/27/2018 |

EACH OCCURRENCE |

$ 2,000,000 |

||||||||||||||

|

CLAIMS-MADE |

X |

OCCUR |

DAMAGE TO RENTED PREMISES (Ea occurrence) |

$ 1,000,000 |

|||||||||||||||||

|

________________________________________ |

MED EXP (Any one person) |

$ 10,000 |

|||||||||||||||||||

|

________________________________________ |

PERSONAL & ADV INJURY |

$ 2,000,000 |

|||||||||||||||||||

|

GEN'L AGGREGATE LIMIT APPLIES PER: |

GENERAL AGGREGATE |

$ 4,000,000 |

|||||||||||||||||||

|

X |

POLICY |

PROJECT |

LOC |

PRODUCTS - COMP/OP AGG |

$ 4,000,000 |

||||||||||||||||

|

OTHER: |

$ |

||||||||||||||||||||

|

A |

AUTOMOBILE LIABILITY |

902019903 |

2/27/2017 |

2/27/2018 |

COMBINED SINGLE LIMIT (Ea accident) |

$ 2,000,000 |

|||||||||||||||

|

X |

ANY AUTO |

BODILY INJURY (Per person) |

$ |

||||||||||||||||||

|

OWNED |

SCHEDULED AUTOS |

BODILY INJURY (Per accident) |

$ |

||||||||||||||||||

|

HIRED |

NON-OWNED AUTOS ONLY |

PROPERTY DAMAGE (Per accident) |

$ |

||||||||||||||||||

|

$ |

|||||||||||||||||||||

|

B |

X |

UMBRELLA LIAB |

X |

OCCUR |

ZUP91M2640617NF |

2/27/2017 |

2/27/2018 |

EACH OCCURRENCE |

$ 25,000,000 |

||||||||||||

|

EXCESS LIAB |

CLAIMS-MADE |

AGGREGATE |

$ 25,000,000 |

||||||||||||||||||

|

DED |

X |

RETENTION $10,000 |

$ |

||||||||||||||||||

|

C |

WORKERS COMPENSATION AND EMPLOYERS' LIABILITY Y / N |

902019901 |

2/27/2017 |

2/27/2018 |

X |

PERSTATUTE |

OTHER |

||||||||||||||

|

ANY PROPRIETOR/PARTNER/EXECUTIVE OFFICER/MEMBER EXCLUDED? |

N / A |

E.L. EACH ACCIDENT |

$ 1,000,000 |

||||||||||||||||||

|

(Mandatory in NH) |

E.L. DISEASE - EA EMPLOYEE |

$ 1,000,000 |

|||||||||||||||||||

|

If yes, describe under DESCRIPTION OF OPERATIONS below |

E.L. DISEASE - POLICY LIMIT |

$ 1,000,000 |

|||||||||||||||||||

|

D E |

Excess Liability($50M x $25M) Excess Liability($25M x $50M) |

TUE461596300 79880457 |

2/27/2017 2/27/2017 |

2/27/2018 2/27/2018 |

Each Occurrence Limit Each Occurrence Limit |

$ 50,000,000 $ 25,000,000 |

|||||||||||||||

|

DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) Additional Named Insured applicable to the General Liability, Commercial Auto, Workers Compensation Polices: Real Alloy Holding, Inc. Real Alloy Recycling, Inc. The insured will notify the certificate holder in the event that any of the above policies are cancelled |

|||||||||||||||||||||

|

CERTIFICATE HOLDER |

CANCELLATION |

||||||||||||||||||||

|

Office of The United States Trustee 844 King Street Suite 2207 Lockbox 35 Wilmington DE 19801 |

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. |

||||||||||||||||||||

|

AUTHORIZED REPRESENTATIVE |

|||||||||||||||||||||

|

|

© 1988-2015 ACORD CORPORATION. All rights reserved. |

|

|

ACORD 25 (2016/03) |

The ACORD name and logo are registered marks of ACORD. |

|

|

CERTIFICATE OF PROPERTY INSURANCE |

DATE (MM/DD/YYYY) 12/1/2017 |

|||||

|

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. |

||||||

|

PRODUCER Arthur J. Gallagher Risk Management Services, Inc. 245 South Executive Drive Suite 200 Brookfield WI 53005 |

CONTACT NAME: |

|||||

|

PHONE (A/C, No, Ext): 800-345-0275 |

FAX (A/C, No): 262-792-1712 |

|||||

|

E-MAIL ADDRESS: |

||||||

|

PRODUCER CUSTOMER ID: REALALL-01 |

||||||

|

INSURER(S) AFFORDING COVERAGE |

NAIC # |

|||||

|

INSURER A : American Home Assurance Company |

19380 |

|||||

|

INSURED Real Alloy Holding, Inc. 3700 Park East Drive, Suite 300 Beachwood, OH 44122 |

INSURER B : |

|||||

|

INSURER C : |

||||||

|

INSURER D : |

||||||

|

INSURER E : |

||||||

|

INSURER F : |

||||||

|

COVERAGES |

CERTIFICATE NUMBER: 2027016575 |

REVISION NUMBER: |

||||

|

LOCATION OF PREMISES / DESCRIPTION OF PROPERTY (Attach ACORD 101, Additional Remarks Schedule, if more space is required) |

|||||||||||

|

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. |

|||||||||||

|

INSR LTR |

TYPE OF INSURANCE |

POLICY NUMBER |

POLICY EFFECTIVE DATE (MM/DD/YYYY) |

POLICY EXPIRATION DATE (MM/DD/YYYY) |

COVERED PROPERTY |

LIMITS |

|||||

|

A |

X |

PROPERTY |

BUILDING |

$ |

|||||||

|

CAUSES OF LOSS |

DEDUCTIBLES |

016453927 |

11/1/2017 |

2/27/2019 |

PERSONAL PROPERTY |

$ |

|||||

|

BASIC |

BUILDING |

BUSINESS INCOME |

$ |

||||||||

|

BROAD |

X |

EXTRA EXPENSE |

$ 25,000,000 |

||||||||

|

X |

SPECIAL |

X |

RENTAL VALUE |

$ 150,000,000 |

|||||||

|

X |

EARTHQUAKE |

50,000,000 |

X |

BLANKET BUILDING |

$ 150,000,000 |

||||||

|

WIND |

BLANKET PERS PROP |

$ |

|||||||||

|

X |

FLOOD |

50,000,000 |

BLANKET BLDG & PP |

$ |

|||||||

|

X |

EB |

150,000,000 |

$ |

||||||||

|

$ |

|||||||||||

|

INLAND MARINE |

TYPE OF POLICY |

$ |

|||||||||

|

CAUSES OF LOSS |

$ |

||||||||||

|

NAMED PERILS |

POLICY NUMBER |

$ |

|||||||||

|

$ |

|||||||||||

|

CRIME |

$ |

||||||||||

|

TYPE OF POLICY |

$ |

||||||||||

|

$ |

|||||||||||

|

BOILER & MACHINERY / EQUIPMENT BREAKDOWN |

$ |

||||||||||

|

$ |

|||||||||||

|

$ |

|||||||||||

|

$ |

|||||||||||

|

SPECIAL CONDITIONS / OTHER COVERAGES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) The insured will notify the certificate holder in the event that any of the above policies are cancelled |

|||||||||||

|

CERTIFICATE HOLDER |

CANCELLATION |

||||||||||

|

Office of The United States Trustee 844 King Street Suite 2207 Lockbox 35 Wilmington DE 19801 |

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. |

||||||||||

|

AUTHORIZED REPRESENTATIVE |

|||||||||||

|

|

© 1988-2015 ACORD CORPORATION. All rights reserved. |

|

|

ACORD 25 (2016/03) |

The ACORD name and logo are registered marks of ACORD. |

|

|

CERTIFICATE OF LIABILITY INSURANCE |

DATE (MM/DD/YYYY) 12/1/2017 |

|||||

|

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. |

||||||

|

IMPORTANT: If the certificate holder is an ADDITIONAL INSURED, the policy(ies) must have ADDITIONAL INSURED provisions or be endorsed. If SUBROGATION IS WAIVED, subject to the terms and conditions of the policy, certain policies may require an endorsement. A statement on this certificate does not confer rights to the certificate holder in lieu of such endorsement(s). |

||||||

|

PRODUCER Arthur J. Gallagher Risk Management Services, Inc. 245 South Executive Drive Suite 200 Brookfield WI 53005 |

CONTACT NAME: |

|||||

|

PHONE (A/C, No, Ext): 800-345-0275 |

FAX (A/C, No): 262-792-1712 |

|||||

|

E-MAIL ADDRESS: |

||||||

|

INSURER(S) AFFORDING COVERAGE |

NAIC # |

|||||

|

INSURER A : Federal Insurance Company |

20281 |

|||||

|

INSURED Real Industry, Inc. 17 State Street, Ste. 3811 New York NY 10004 |

REALIND-02 |

INSURER B : |

||||

|

INSURER C : |

||||||

|

INSURER D : |

||||||

|

INSURER E : |

||||||

|

INSURER F : |

||||||

|

COVERAGES |

CERTIFICATE NUMBER: 1135683199 |

REVISION NUMBER: |

||||

|

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. |

|||||||||||||||||||||

|

INSR LTR |

TYPE OF INSURANCE |

ADDL |

SUBR |

POLICY NUMBER |

POLICY EFF (MM/DD/YYYY) |

POLICY EXP (MM/DD/YYYY) |

LIMITS |

||||||||||||||

|

COMMERCIAL GENERAL LIABILITY |

EACH OCCURRENCE |

$ |

|||||||||||||||||||

|

CLAIMS-MADE |

OCCUR |

DAMAGE TO RENTED PREMISES (Ea occurrence) |

$ |

||||||||||||||||||

|

________________________________________ |

MED EXP (Any one person) |

$ |

|||||||||||||||||||

|

________________________________________ |

PERSONAL & ADV INJURY |

$ |

|||||||||||||||||||

|

GEN'L AGGREGATE LIMIT APPLIES PER: |

GENERAL AGGREGATE |

$ |

|||||||||||||||||||

|

POLICY |

PROJECT |

LOC |

PRODUCTS - COMP/OP AGG |

$ |

|||||||||||||||||

|

OTHER: |

$ |

||||||||||||||||||||

|

A |

AUTOMOBILE LIABILITY |

Y |

Y |

(17) 73253487 |

1/1/2017 |

1/1/2018 |

COMBINED SINGLE LIMIT (Ea accident) |

$ 1,000,000 |

|||||||||||||

|

ANY AUTO |

BODILY INJURY (Per person) |

$ |

|||||||||||||||||||

|

OWNED |

SCHEDULED AUTOS |

BODILY INJURY (Per accident) |

$ |

||||||||||||||||||

|

X |

HIRED |

NON-OWNED AUTOS ONLY |

PROPERTY DAMAGE (Per accident) |

$ |

|||||||||||||||||

|

$ |

|||||||||||||||||||||

|

A |

X |

UMBRELLA LIAB |

OCCUR |

Y |

Y |

79826594 |

1/1/2017 |

1/1/2018 |

EACH OCCURRENCE |

$ 5,000,000 |

|||||||||||

|

EXCESS LIAB |

CLAIMS-MADE |

AGGREGATE |

$ 5,000,000 |

||||||||||||||||||

|

DED |

RETENTION $ |

$ |

|||||||||||||||||||

|

WORKERS COMPENSATION AND EMPLOYERS' LIABILITY Y / N |

PERSTATUTE |

OTHER |

|||||||||||||||||||

|

ANY PROPRIETOR/PARTNER/EXECUTIVE OFFICER/MEMBER EXCLUDED? |

N / A |

E.L. EACH ACCIDENT |

$ |

||||||||||||||||||

|

(Mandatory in NH) |

E.L. DISEASE - EA EMPLOYEE |

$ |

|||||||||||||||||||

|

If yes, describe under DESCRIPTION OF OPERATIONS below |

E.L. DISEASE - POLICY LIMIT |

$ |

|||||||||||||||||||

|

A |

Crime |

82500819 |

7/11/2017 |

7/11/2018 |

Employee Theft Covera Retention |

10,000,000.00 250,000.00 |

|||||||||||||||

|

DESCRIPTION OF OPERATIONS / LOCATIONS / VEHICLES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) The insured will notify the certificate holder in the event that any of the above policies are cancelled. |

|||||||||||||||||||||

|

CERTIFICATE HOLDER |

CANCELLATION |

||||||||||||||||||||

|

Office of The United States Trustee 844 King Street Suite 2207 Lockbox 35 Wilmington DE 19801 |

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. |

||||||||||||||||||||

|

AUTHORIZED REPRESENTATIVE |

|||||||||||||||||||||

|

|

© 1988-2015 ACORD CORPORATION. All rights reserved. |

|

|

ACORD 25 (2016/03) |

The ACORD name and logo are registered marks of ACORD. |

|

|

CERTIFICATE OF PROPERTY INSURANCE |

DATE (MM/DD/YYYY) 12/1/2017 |

|||||

|

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER. |

||||||

|

PRODUCER Arthur J. Gallagher Risk Management Services, Inc. 500 1st Street, Suite 2700 Wausau WI 54403 |

CONTACT NAME: Dawn Linski |

|||||

|

PHONE (A/C, No, Ext): 920-380-2214 |

FAX (A/C, No): 920-734-3637 |

|||||

|

E-MAIL ADDRESS: Dawn_Linski@ajg.com |

||||||

|

PRODUCER CUSTOMER ID: SIGNGRO-05 |

||||||

|

INSURER(S) AFFORDING COVERAGE |

NAIC # |

|||||

|

INSURER A : Federal Insurance Company |

20281 |

|||||

|

INSURED REAL INDUSTRY, INC. 17 State Street, Ste. 3811 New York, NY 10004 |

INSURER B : |

|||||

|

INSURER C : |

||||||

|

INSURER D : |

||||||

|

INSURER E : |

||||||

|

INSURER F : |

||||||

|

COVERAGES |

CERTIFICATE NUMBER: 1479993599 |

REVISION NUMBER: |

||||

|

LOCATION OF PREMISES / DESCRIPTION OF PROPERTY (Attach ACORD 101, Additional Remarks Schedule, if more space is required) |

|||||||||||

|

THIS IS TO CERTIFY THAT THE POLICIES OF INSURANCE LISTED BELOW HAVE BEEN ISSUED TO THE INSURED NAMED ABOVE FOR THE POLICY PERIOD INDICATED. NOTWITHSTANDING ANY REQUIREMENT, TERM OR CONDITION OF ANY CONTRACT OR OTHER DOCUMENT WITH RESPECT TO WHICH THIS CERTIFICATE MAY BE ISSUED OR MAY PERTAIN, THE INSURANCE AFFORDED BY THE POLICIES DESCRIBED HEREIN IS SUBJECT TO ALL THE TERMS, EXCLUSIONS AND CONDITIONS OF SUCH POLICIES. LIMITS SHOWN MAY HAVE BEEN REDUCED BY PAID CLAIMS. |

|||||||||||

|

INSR LTR |

TYPE OF INSURANCE |

POLICY NUMBER |

POLICY EFFECTIVE DATE (MM/DD/YYYY) |

POLICY EXPIRATION DATE (MM/DD/YYYY) |

COVERED PROPERTY |

LIMITS |

|||||

|

A |

X |

PROPERTY |

BUILDING |

$ |

|||||||

|

CAUSES OF LOSS |

DEDUCTIBLES |

35357851WCE |

1/1/2017 |

1/1/2018 |

X |

PERSONAL PROPERTY |

$ 174,250 |

||||

|

BASIC |

BUILDING |

X |

BUSINESS INCOME |

$ 512,500 |

|||||||

|

BROAD |

EXTRA EXPENSE |

$ |

|||||||||

|

X |

SPECIAL |

CONTENTS $10,000 |

RENTAL VALUE |

$ |

|||||||

|

EARTHQUAKE |

BLANKET BUILDING |

$ |

|||||||||

|

WIND |

BLANKET PERS PROP |

$ |

|||||||||

|

FLOOD |

BLANKET BLDG & PP |

$ |

|||||||||

|

X |

Fine Arts |

$ 2,892,000 |

|||||||||

|

$ |

|||||||||||

|

INLAND MARINE |

TYPE OF POLICY |

$ |

|||||||||

|

CAUSES OF LOSS |

$ |

||||||||||

|

NAMED PERILS |

POLICY NUMBER |

$ |

|||||||||

|

$ |

|||||||||||

|

CRIME |

$ |

||||||||||

|

TYPE OF POLICY |

$ |

||||||||||

|

$ |

|||||||||||

|

BOILER & MACHINERY / EQUIPMENT BREAKDOWN |

$ |

||||||||||

|

$ |

|||||||||||

|

$ |

|||||||||||

|

$ |

|||||||||||

|

SPECIAL CONDITIONS / OTHER COVERAGES (ACORD 101, Additional Remarks Schedule, may be attached if more space is required) The insured will notify the certificate holder in the event that any of the above policies are cancelled |

|||||||||||

|

CERTIFICATE HOLDER |

CANCELLATION |

||||||||||

|

Office of The United States Trustee 844 King Street Suite 2207 Lockbox 35 Wilmington DE 19801 |

SHOULD ANY OF THE ABOVE DESCRIBED POLICIES BE CANCELLED BEFORE THE EXPIRATION DATE THEREOF, NOTICE WILL BE DELIVERED IN ACCORDANCE WITH THE POLICY PROVISIONS. |

||||||||||

|

AUTHORIZED REPRESENTATIVE |

|||||||||||

|

|

© 1988-2015 ACORD CORPORATION. All rights reserved. |

|

|

ACORD 25 (2016/03) |

The ACORD name and logo are registered marks of ACORD. |

|

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

) |

|

|

|

In re: |

) |

|

Chapter 11 |

|

|

) |

|

|

|

REAL INDUSTRY, INC., et al.,1 |

) |

|

Case No. 17-12464 (KJC) |

|

|

) |

|

|

|

Debtors. |

) |

|

Jointly Administered |

|

|

) |

|

|

|

|

) |

|

Ref. Docket No. 14 |

INTERIM ORDER (I) AUTHORIZING, BUT NOT DIRECTING, THE DEBTORS TO (A) CONTINUE USING THEIR CASH MANAGEMENT SYSTEMs, (B) MAINTAIN EXISTING Bank ACCOUNTS AND BUSINESS FORMS, AND (C) CONTINUE CONDUCTING INTERCOMPANY TRANSACTIONS IN THE ORDINARY COURSE; (II) GRANTING ADMINISTRATIVE PRIORITY STATUS TO INTERCOMPANY CLAIMS; AND (III) GRANTING RELATED RELIEF

Upon the motion (the “Motion”)2 of Real Industry, Inc. (“Real Industry”) and its affiliated debtors and debtors-in-possession (the “Real Alloy Debtors,” and with Real Industry, collectively, the “Debtors”) in the above-captioned chapter 11 cases (the “Chapter 11 Cases”) for entry of interim and final orders, pursuant to sections 105, 345, 363, 364, and 503 of the Bankruptcy Code, Bankruptcy Rules 6003 and 6004, and Local Rules 2015-2 and 9013-1: (a) authorizing, but not directing, the Debtors to (i) maintain and continue using their cash management systems and honor certain prepetition obligations related thereto, (ii) maintain their Accounts and continue using existing checks, business forms, and records, and (iii) continue conducting intercompany transactions in the ordinary course; (b) granting administrative priority status to postpetition intercompany claims; and (c) granting related relief, all as more fully set

1The Debtors in the above-captioned chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, are Real Industry, Inc. (3818), Real Alloy Intermediate Holding, LLC (7447), Real Alloy Holding, Inc. (2396), Real Alloy Recycling, Inc. (9798), Real Alloy Bens Run, LLC (3083), Real Alloy Specialty Products, Inc. (9911), Real Alloy Specification, Inc. (9849), ETS Schaefer, LLC (9350), and RA Mexico Holding, LLC (4620). The principal place of business for the Real Alloy Debtors is 3700 Park East Drive, Suite 300, Beachwood, Ohio 44122.

2Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Motion.

forth in the Motion; and upon the First Day Declaration; and upon the record of the hearing on the Motion; and this Court having jurisdiction over this matter pursuant to 28 U.S.C. §§ 157 and 1334 and the Amended Standing Order of Reference from the United States District Court for the District of Delaware, dated February 29, 2012; and this Court having found that this is a core proceeding pursuant to 28 U.S.C. § 157(b)(2); and this Court having found that venue of this proceeding and the Motion in this District is proper pursuant to 28 U.S.C. §§ 1408 and 1409; and this Court having found that the Debtors’ notice of the Motion and opportunity for a hearing on the Motion were appropriate under the circumstances and no other notice need be provided; and this Court having found that good and sufficient cause exists for the relief granted by this Order, it is hereby

ORDERED, ADJUDGED, AND DECREED THAT:

1. The Motion is GRANTED on an interim basis, as set forth herein.

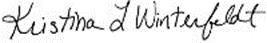

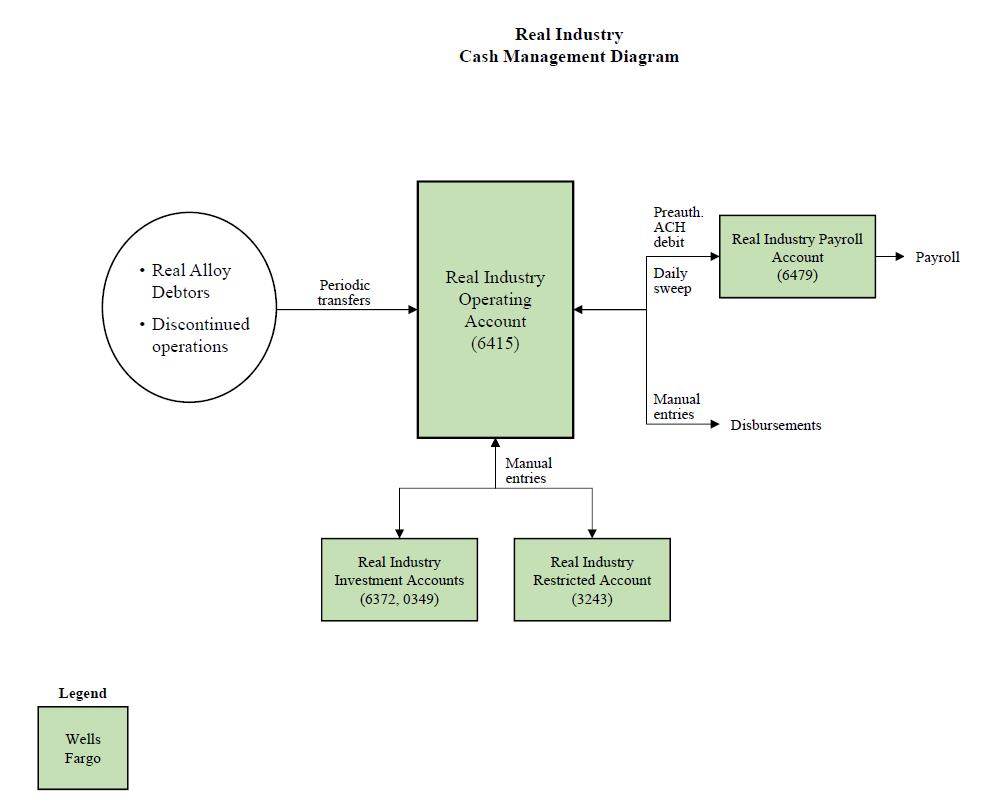

2. The Debtors are authorized to maintain the Cash Management Systems in accordance with their prepetition practices, as described in the Motion, except as otherwise set forth herein.

3. Except as otherwise set forth herein, the Debtors are authorized but not directed to: (a) continue using the Cash Management Systems and honor any prepetition obligations related to the use thereof; (b) designate, maintain, and continue to use on an interim basis any or all of their existing Accounts identified on Exhibit 1 and Exhibit 2 hereto, in the names and with the account numbers existing immediately before the Petition Date; (c) deposit funds in and withdraw funds from the Accounts by all usual means, including checks, wire transfers, ACH transfers, and other debits; and (d) treat their prepetition Accounts for all purposes as debtor in possession accounts.

4. The Debtors are authorized to open any new bank accounts or close any existing Bank Accounts as they may deem necessary and appropriate in their sole discretion; provided, however, that the Debtors give notice within fifteen (15) days to the Office of the United States Trustee for the District of Delaware and any statutory committees appointed in these chapter 11 cases; provided, further, however that the Debtors shall open any such new Bank Account only if such account is (i) insured with the FDIC, and (ii) at a bank that has executed a Uniform Depository Agreement with the Office of the United States Trustee for the District of Delaware, or is willing to immediately execute such an agreement; and provided further that the opening and closing of any bank account shall be in accordance with the terms of the Debtors’ postpetition financing facility (the “DIP Facility”) and the terms of any interim and/or final orders approving the DIP Facility and the use of cash collateral (collectively, the “DIP Orders”); and further, except for any utility deposit account, any bank accounts opened by any of the Debtors on or after the Petition Date shall be subject to the liens granted under the DIP Orders. All accounts opened by any of the Debtors on or after the Petition Date consistent with the terms of this paragraph shall, for purposes of this Interim Order, be deemed Bank Accounts as if they had been listed on Exhibit 1 or Exhibit 2 hereof.

5. The Debtors are authorized, but not directed, to continue using, in their present form, the Business Forms as well as checks and other documents related to the Accounts existing immediately before the Petition Date; provided, that the Debtors will use reasonable efforts during the pendency of these chapter 11 cases to include a stamp on invoices and checks to reference the Debtors’ status as debtors in possession and the main bankruptcy case number; and provided further that once the Debtors' existing checks have been used, the Debtors shall, when reordering checks, require the designation "Debtor in Possession" and the main bankruptcy case

number on all checks; and provided further that, with respect to checks which the Debtors or their agents print themselves, the Debtors shall begin printing the “Debtor in Possession” legend and the main bankruptcy case number on such items within ten (10) days of the date of entry of this Order.

6. Except as otherwise provided in this Interim Order and only to the extent sufficient funds are available in each applicable Account, all Banks at which the Accounts are maintained are directed to continue to service and administer the Accounts as accounts of the Debtors as debtors in possession, without interruption and in the ordinary course, and to receive, process, honor, and pay any and all checks, drafts, wire transfers, and ACH transfers issued, after the Petition Date, and drawn on the Accounts after the Petition Date by the holders or makers thereof, as the case may be and shall receive, process, honor, and pay any and all checks, drafts, wire transfers, and ACH transfers issued before the Petition Date but presented to such Bank for payment after the Petition Date to the extent instructed to do so by the Debtors.

7. Except for those checks, drafts, wires, or other ACH transfers that are authorized or required to be honored under an order of the Court, no Debtor shall instruct or request any Bank to pay or honor any check, draft, or other payment item issued on an Account prior to the Petition Date but presented to such Bank for payment after the Petition Date.

8. As soon as practicable after entry of this Interim Order, the Debtors shall serve a copy of this Interim Order on the Banks.

9. The requirement to establish separate accounts for tax payments is hereby waived.

10. The Debtors are authorized, but not directed to: (a) pay undisputed prepetition amounts outstanding as of the Petition Date, if any, owed in the ordinary course to the Banks as service charges for the maintenance of the Cash Management Systems; and (b) reimburse the

Banks for any charges arising before or after the Petition Date in connection with customer checks deposited with the Banks that have been dishonored or returned as a result of insufficient funds in the Accounts in the ordinary course of business, to the same extent the Debtors were responsible for such items prior to the Petition Date.

11. The Debtors are authorized, but not directed, to enter into, engage in and perform under the Intercompany Transactions in the ordinary course of business and in compliance with past practices by and amongst the Debtors and their Non-Debtor Affiliates., provided, however, that prior to the entry of the final order on the Motion, transfers from the Debtors to non-Debtor affiliates shall not exceed $5,060,000. The Debtors shall (a) continue to track Intercompany Transactions electronically through their accounting system in accordance with their prepetition practices, (b) provide reasonable access to such records and procedures to the U.S. Trustee and any official committee appointed in these chapter 11 cases, and (c) shall maintain accurate and detailed records of all transfers, including but not limited to intercompany transfers, so that all transactions may be readily ascertained, traced, recorded properly and distinguished between prepetition and post-petition transactions..

12. All Intercompany Claims based on net transfers from a Debtor to another Debtor, or based on net transfers from a non-debtor affiliate to a Debtor, arising after the Petition Date shall be accorded administrative expense status in accordance with sections 503(b) and 507(a)(2) of the Bankruptcy Code.

13. The Debtors are authorized, but not directed, to set off mutual postpetition obligations relating to intercompany receivables and payables through the Cash Management Systems.

14. Notwithstanding anything to the contrary contained in this Interim Order or the Motion, any payment, obligation or other relief authorized by this Interim Order shall be subject to and limited by the requirements imposed on the Debtors under the terms of the DIP Orders and any budget in connection therewith, entered by this Court in these chapter 11 cases.

15. Subject to applicable bankruptcy or other law, those certain deposit agreements existing between the Debtors and the Banks shall continue to govern the postpetition cash management relationship between the Debtors and the Banks and, subject to applicable bankruptcy or other law, all of the provisions of such agreements, including the termination, fee provisions, rights, benefits, offset rights and remedies afforded under such agreements shall remain in full force and effect absent further order of the Court or, with respect to any such agreement with any Bank, unless the Debtors and such Bank agree otherwise.

16. Except as otherwise set forth herein, the Debtors and the Banks may, without further order of the Court, agree and implement non-material changes to the Cash Management Systems and procedures in the ordinary course of business as set forth in this Interim Order and to facilitate and effectuate the terms of the Debtors’ postpetition financing and the use of cash collateral upon entry of the DIP Orders.

17. The Banks are authorized to debit the Debtors’ accounts in the ordinary course of business and without further order of the Court on account of all checks drawn on the Debtors’ accounts that were cashed at the Banks’ counters or exchanged for cashier’s or official checks by the payees thereof prior to the Petition Date.

18. Notwithstanding any other provision of this Interim Order, should a Bank honor a prepetition check or other item drawn on any account that is the subject of this Interim Order (a) at the direction of the Debtors to honor such prepetition check or item, (b) in a good faith

belief that the Court has authorized such prepetition check or item to be honored, or (c) as the result of an innocent mistake made despite implementation of customary item handling procedures, the Bank shall not be deemed to be nor shall be liable to the Debtors or their estates or otherwise be in violation of this Interim Order.

19. Except as otherwise provided in this Interim Order, the Banks are authorized to charge, and the Debtors are authorized to pay, honor, or allow prepetition and postpetition fees, costs, charges, and expenses, including the Bank Fees, and charge back returned items to the Accounts in the ordinary course.

20. For banks at which the Debtors hold bank accounts that are party to a Uniform Depository agreement with the Office of the United States Trustee for the District of Delaware, within fifteen (15) days of the date of entry of this Order the Debtors shall (a) contact each bank, (b) provide the bank with each of the Debtors’ employer identification numbers and (c) identify each of their bank accounts held at such banks as being held by a debtor in possession in a bankruptcy case, and provide the case number.

21. Notwithstanding anything contained in the Motion or this Order, any payment authorized to be made by the Debtors herein shall be subject to the terms and conditions contained in any interim or final order authorizing the Debtors to obtain postpetition financing and to use cash collateral (the “DIP Order”), including any budgets in connection therewith.

22. For banks at which the Debtors hold bank accounts that are not party to a Uniform Depository Agreement with the U.S. Trustee, the Debtors shall use their good-faith efforts to cause the banks to execute a Uniform Depository Agreement in a form prescribed by the U.S. Trustee within thirty (30) days of the date of this Interim Order. The U.S. Trustee’s rights to seek further relief from this Court on notice in the event that the aforementioned banks are

unwilling to execute a Uniform Depository Agreement in a form prescribed by the U.S. Trustee are fully reserved.

23. Despite use of a consolidated cash management system, the Debtors shall calculate quarterly fees under 28 U.S.C. § 1930(a)(6) based on the disbursements of each debtor, regardless of who pays those disbursements.

24. The Final Hearing shall be held on December 19, 2017 at 1:00 p.m. (prevailing Eastern Time). Any objections or responses to entry of the proposed Final Order shall be filed with the Clerk of this Court on or before 4:00 p.m. on December 12, 2017, and served on the following parties: (a) the Office of the United States Trustee, 844 King Street, Suite 2207, Wilmington, DE 19801, Attn: Juliet Sarkessian (Juliet.M.Sarkessian@usdoj.gov); (b) co-counsel to the Debtors, Morrison & Foerster LLP, 250 West 55th Street, New York, New York 10019, Attn: Mark A. Lightner (mlightner@mofo.com) and Benjamin W. Butterfield (bbutterfield@mofo.com); (c) co-counsel to the Debtors, Saul Ewing Arnstein & Lehr LLP, 1201 N. Market Street, Suite 2300, Wilmington, Delaware 19801, Attn. Monique B. DiSabatino (monique.disabatino@saul.com); (d) counsel to the DIP Noteholders, Latham & Watkins LLP, 330 North Wabash Avenue, Suite 2800, Chicago, Illinois 60611, Attn: Rick Levy (richard.levy@lw.com), Ted Dillman (ted.dillman@lw.com), and Jason Gott (jason.gott@lw.com); (e) counsel to the ABL Lenders, Goldberg Kohn Ltd., 55 East Monroe Street, Suite 3300, Chicago, Illinois 60603, Attn: Randall L. Klein (randall.klein@goldbergkohn.com), Jeremy M. Downs (jeremy.downs@goldbergkohn.com), Eva D. Gadzheva (eva.gadzheva@goldbergkohn.com), and (f) counsel to any official committee appointed in these cases.

25. Notwithstanding the relief granted in this Interim Order and any actions taken pursuant to such relief, nothing in this Interim Order shall be deemed: (a) an admission regarding the validity or amount of any claim against the Debtors; (b) a waiver of the Debtors’ rights to dispute any claim on any grounds; (c) a promise or requirement to pay any claim; (d) an implication or admission that any particular claim is of a type specified or defined in this Interim Order or in the Motion; (e) a request or authorization to assume any agreement, contract, or lease pursuant to section 365 of the Bankruptcy Code; or (f) a waiver or limitation of the Debtors’ rights under the Bankruptcy Code or any other applicable law.

26. If no objections to the relief granted herein on a permanent basis are timely served and filed in accordance with this Interim Order, the Court may enter a final order granting the relief herein without further notice or hearing.

27. The Court finds and determines that the requirements of Bankruptcy Rule 6003 are satisfied and that the relief requested is necessary to avoid immediate and irreparable harm.

28. The notice of the relief requested in the Motion satisfies Bankruptcy Rule 6004(a) and, pursuant to Bankruptcy Rule 6004(h), the terms and provisions of this Interim Order shall be immediately effective and enforceable upon its entry.